Welcome to this week’s Crypto Market Watch! Here, we dig deep into the crypto space to provide you with detailed analysis of key events and emerging trends. BTC and ETH are experiencing significant gains, while Polygon is rapidly rising in the gaming space. On-chain activity is gradually increasing, and savvy investors are strategically adjusting their positions, indicating a renewed appetite for risk. Next comes the climax: the imminent confirmation of ETFs, can it be realized this year? There seems to be only one final piece of the puzzle left to place.

This is just a preview, be sure to check out the full version of the report.

Get our crypto-native industry insights and research reports, pleaseSubscribe here。

This week’s Alpha focus

If youre reading this, please be aware of your early position.

This week’s topic: Market surge and the latest developments in the gaming and NFT fields

Market overview

First, BlackRock registered the iShares Ethereum Trust in Delaware, a move that brought institutional-level attention to Ethereum. The price of Ethereum surged, surpassing the $2,000 mark for the first time since July. This development demonstrates growing institutional interest in Ethereum and its potential as a valuable asset class. In addition, Bloomberg analysts said that multiple spot Bitcoin ETFs are likely to be approved within the 8-day time window starting on November 9.

However, it is important to note that the U.S. Securities and Exchange Commission (SEC) has not explicitly approved it, and opening this window does not guarantee approval of the ETF. Investors were hopeful as the SEC requested comments on the application and asked the applicant to address concerns, including market manipulation safeguards and surveillance-sharing agreements. The outcome remains uncertain, but the possibility of multiple ETFs being approved in this time frame is noteworthy.

Meanwhile, MicroStrategy has made significant profits from its Bitcoin holdings, with its Bitcoin price rising to yearly highs of over $37,000 per coin. As of September 30, MicroStrategy had purchased 158,400 Bitcoins for $46.8 billion, with their investment showing an impressive unrealized gain of $1.2 billion. Bitcoin itself has experienced significant price swings, reaching yearly highs and pushing its market cap past Tesla.

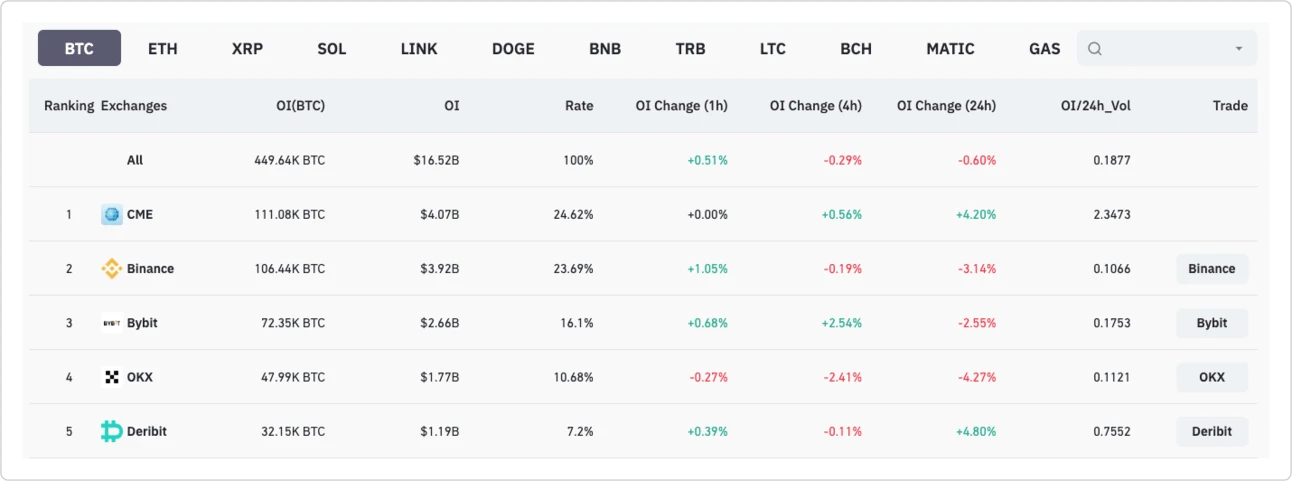

The increase in Bitcoin’s market capitalization is largely attributed to optimism over the approval of a spot Bitcoin ETF. This increase in market capitalization marks a significant percentage change in one day and is a testament to Bitcoin’s resilience and appeal as a digital asset. Additionally, open interest in the Bitcoin futures market has surged, indicating growing interest in Bitcoin trading contracts. Additionally, open interest in Bitcoin futures contracts fell by more than 5%, with CME now surpassing Binance to become the largest exchange in this regard. Finally, short-term Bitcoin holders made substantial profits within 48 hours, indicating that this group of investors is in a volatile market.

CME currently leads by open interest (OI). Source: Coinglass

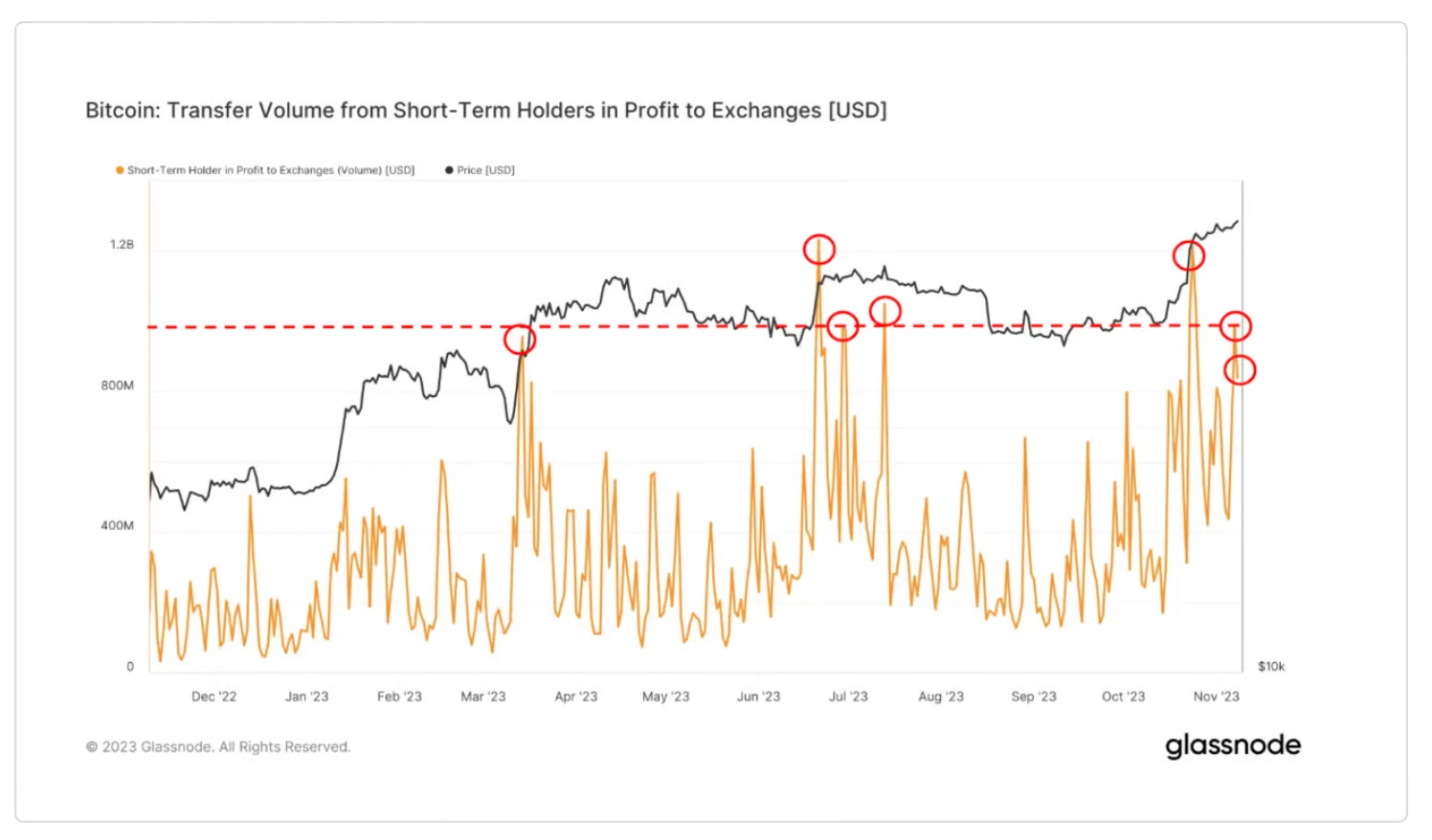

Finally, short-term Bitcoin holders made considerable profits within 48 hours, indicating that this group of investors made significant profit-making operations. These short-term holders withdrew a total of $1.8 billion in profits during the period, demonstrating their prudent strategy in volatile markets.

Transfer the profits of short-term holders to the exchange. Source: Glassnode

NFTs

*All data below comes from Footprint Analytics unless otherwise stated

Unveiling:Gaming and NFTs have experienced significant surges in activity recently, making it clear that both markets are here to stay. They are set to play a key role in the crypto space and the overall landscape of the Internet. Why, you ask? Well, internet culture continues to evolve, and one of the most notable innovations driving this evolution in recent years has been the widespread use of NFTs in various forms.

It’s important to note that NFTs are not limited to avatars and games; their utility spans countless areas. In a world where most assets are non-fungible, NFTs offer a breakthrough solution that enables these unique assets to be represented on the blockchain. While some still view NFTs as trivial, those of us who remain involved in the crypto space know better. We can see the trajectory of the world.

Looking ahead to the next 10 to 15 years, when artificial intelligence, encryption, virtual reality and augmented reality merge seamlessly into a nearly indistinguishable real life experience, when most human activities in all fields tend to converge, it will also be Who could remain skeptical?

In conclusion, it is crucial to keep an eye on these developments as this is where we expect to see the most significant progress, even if the current state of activity for many games and NFT collections is disappointing. But enough preamble, let’s dive into the data!

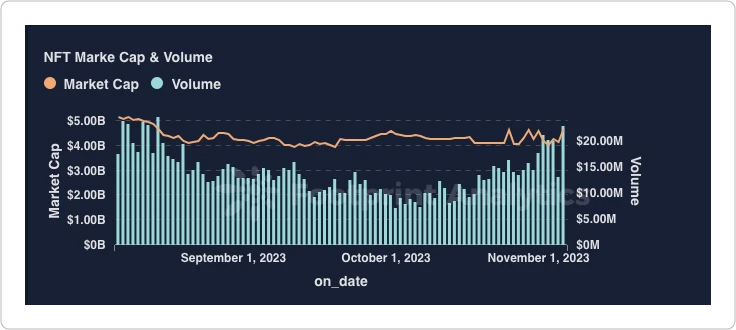

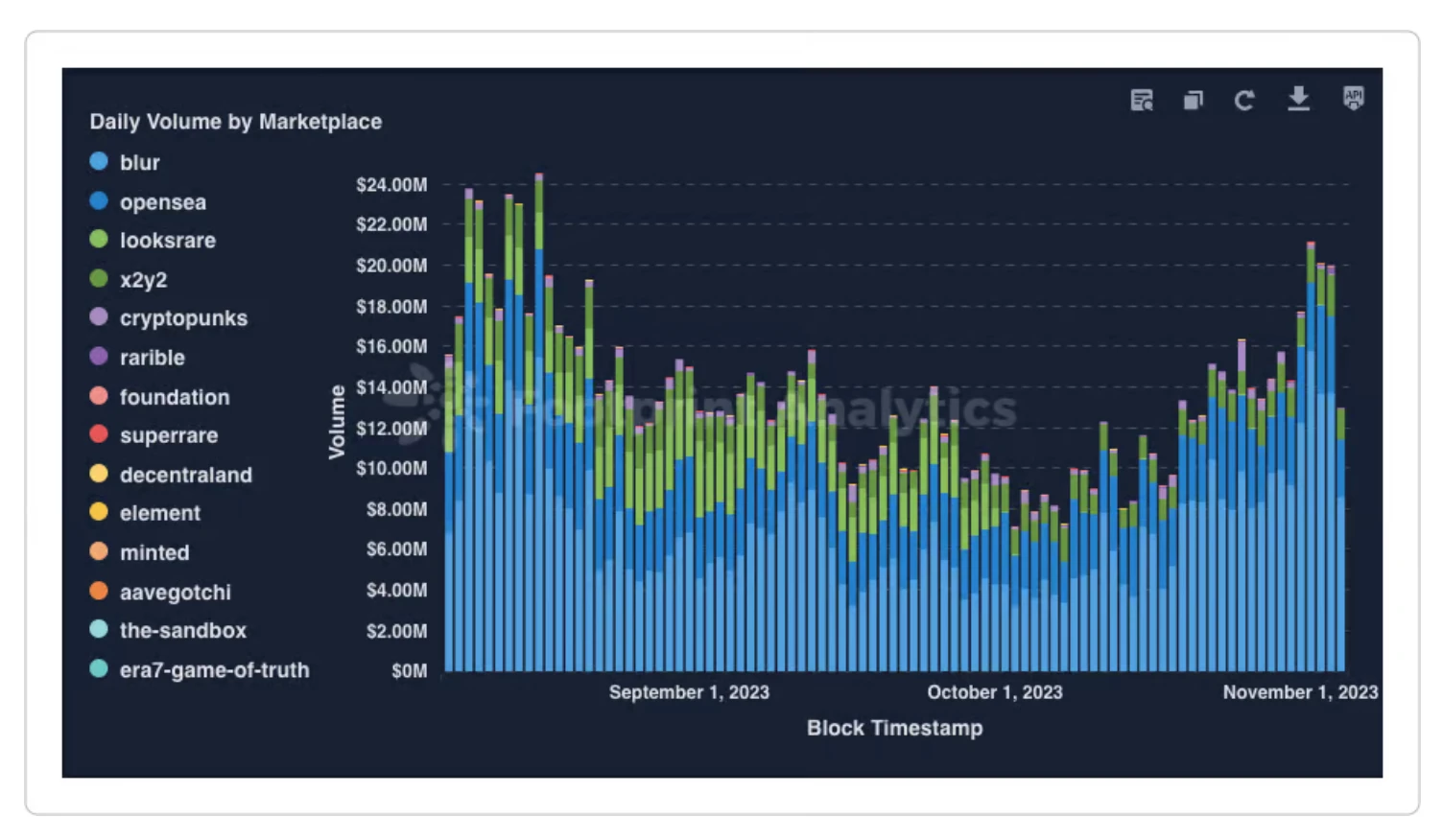

Trading volume and market capitalization have grown significantly since the lows in early October.

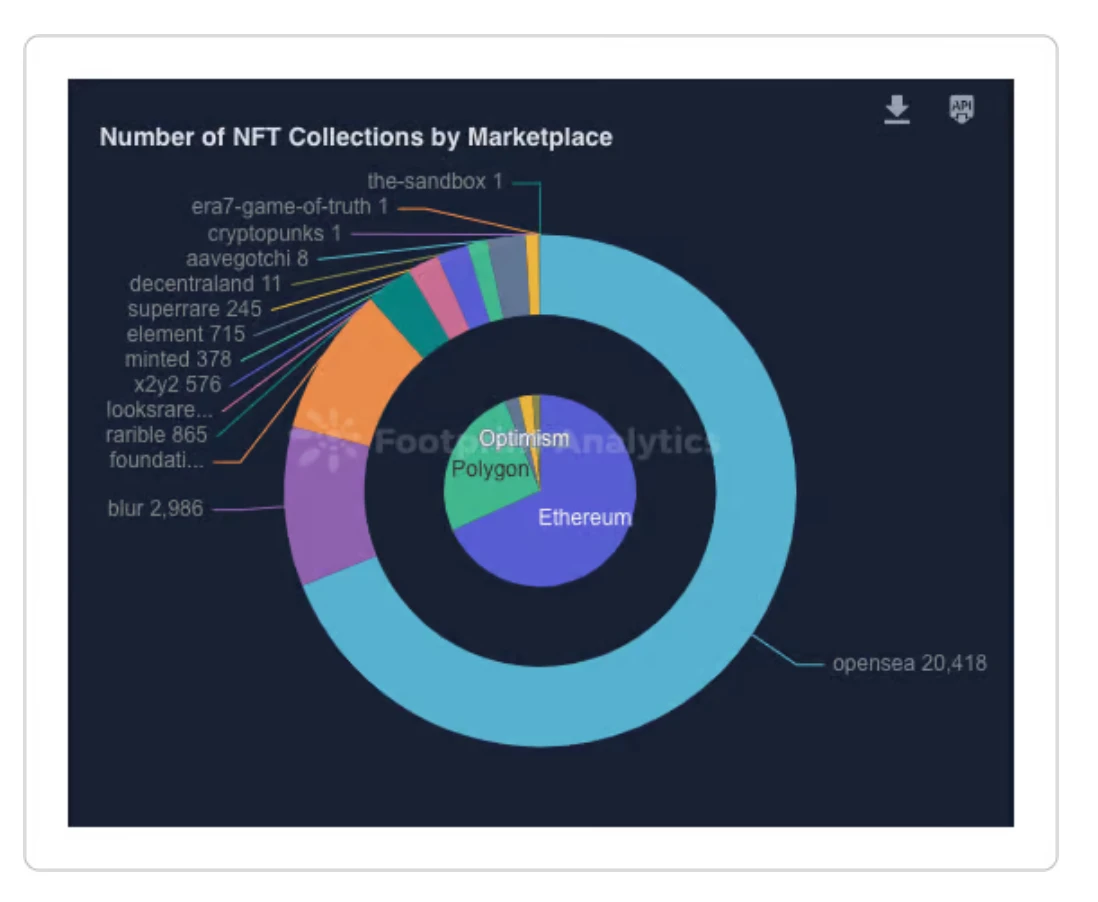

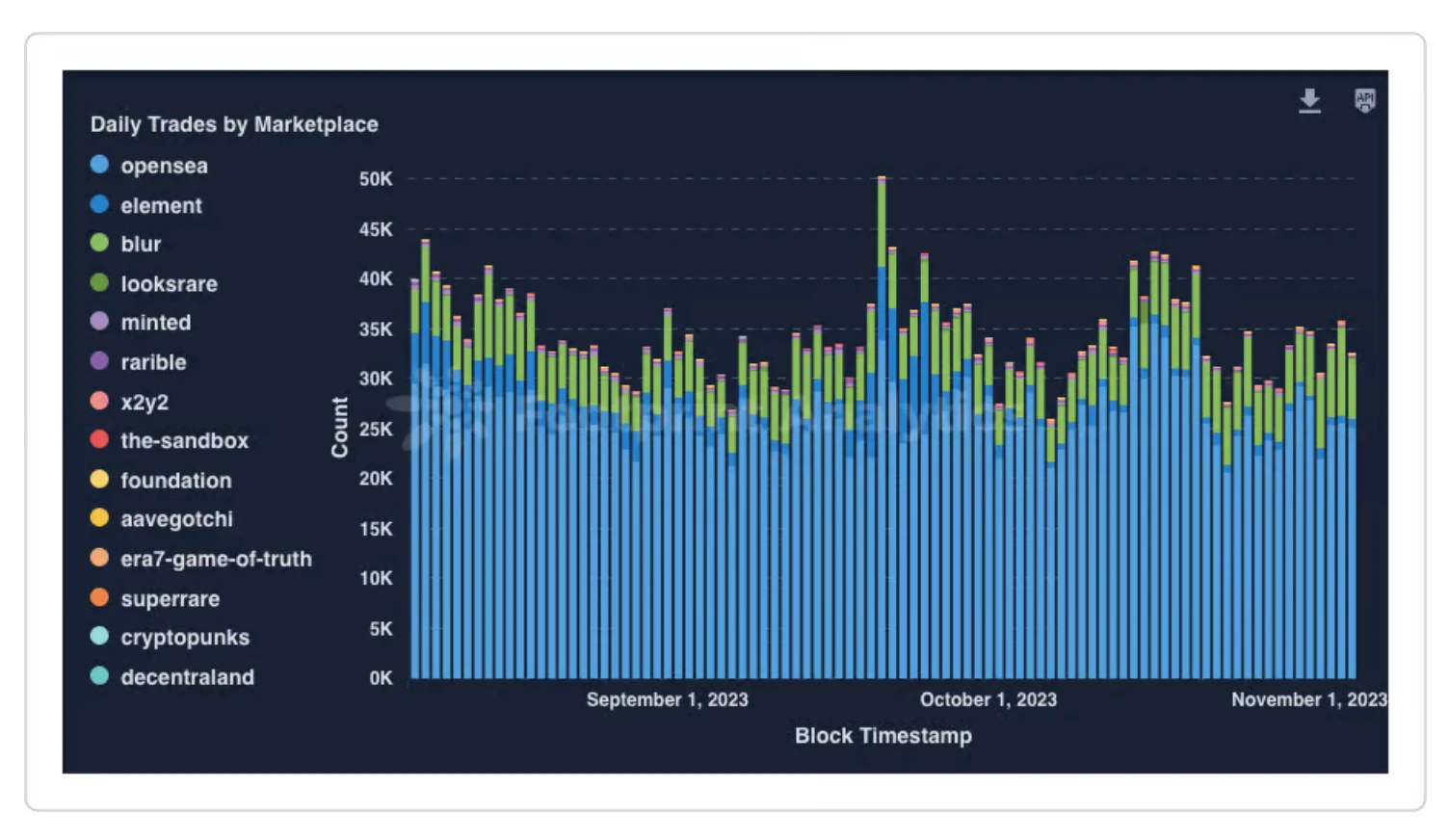

In the NFT market, OpenSea maintains its dominance in terms of number of collections, leaving Blur far behind. Its worth noting that Blur attracted considerable attention, especially considering that its launch came after the peak of the bull market. Unlike older platforms that launched and even offered airdrops at the peak of the bull market, they were unable to generate the same level of interest.

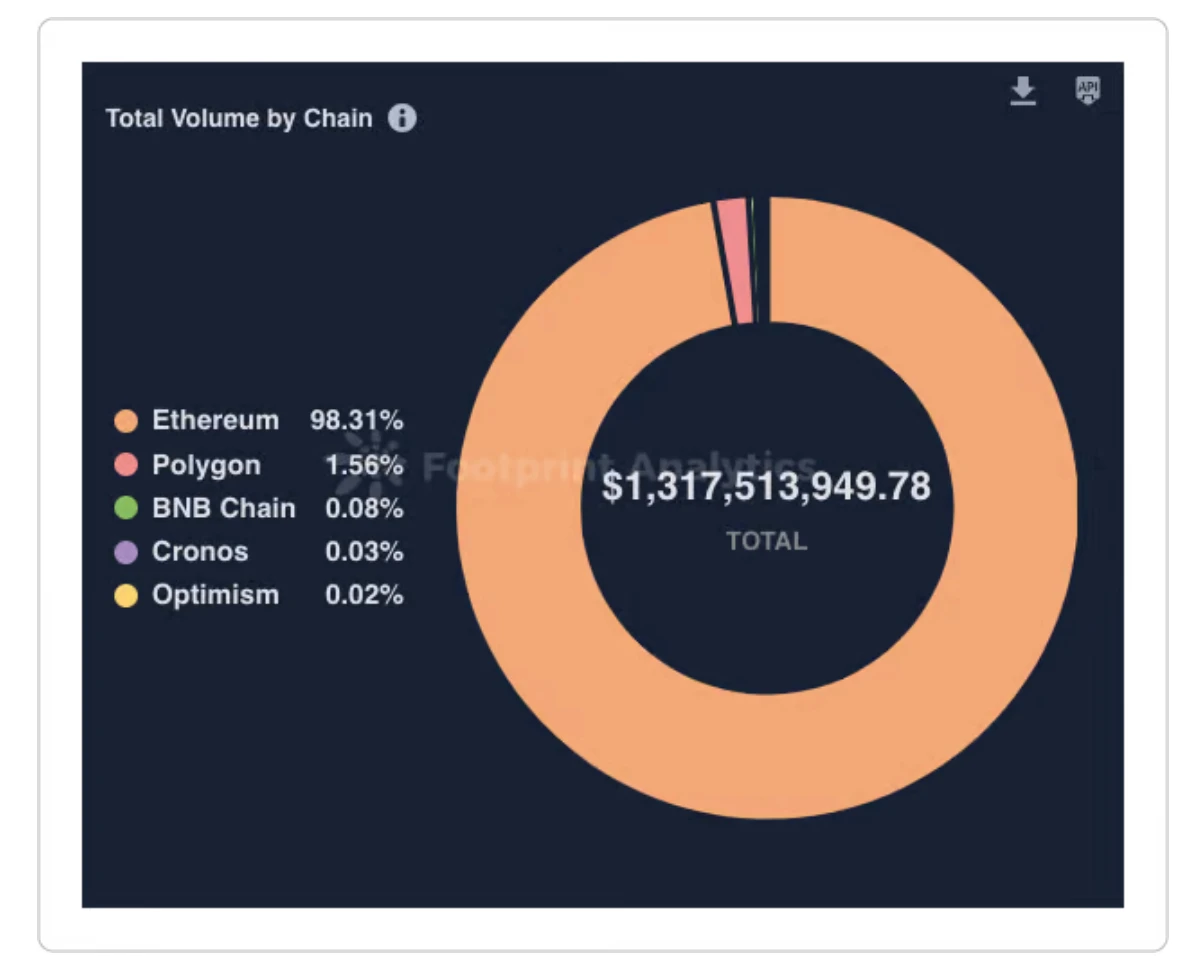

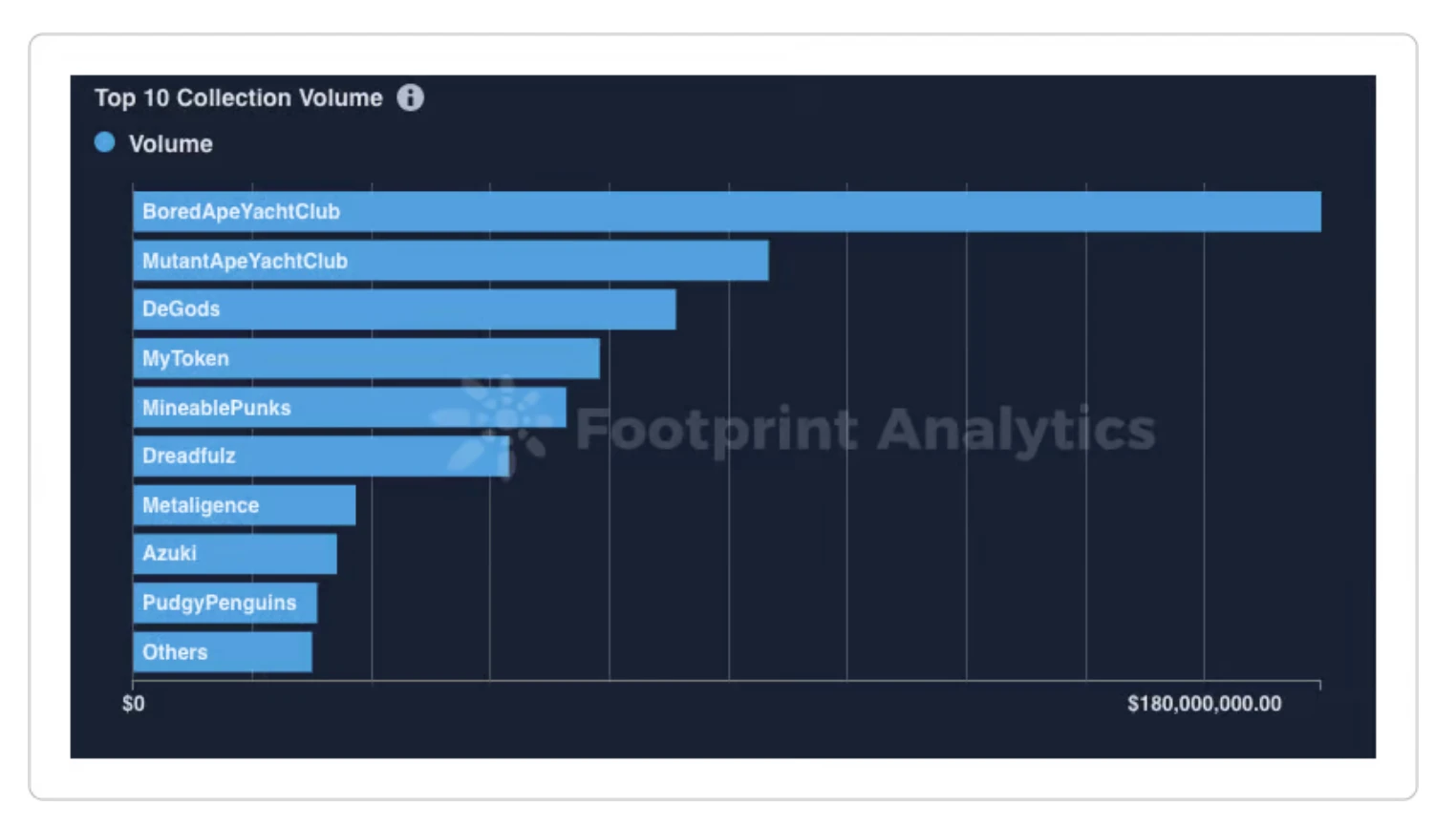

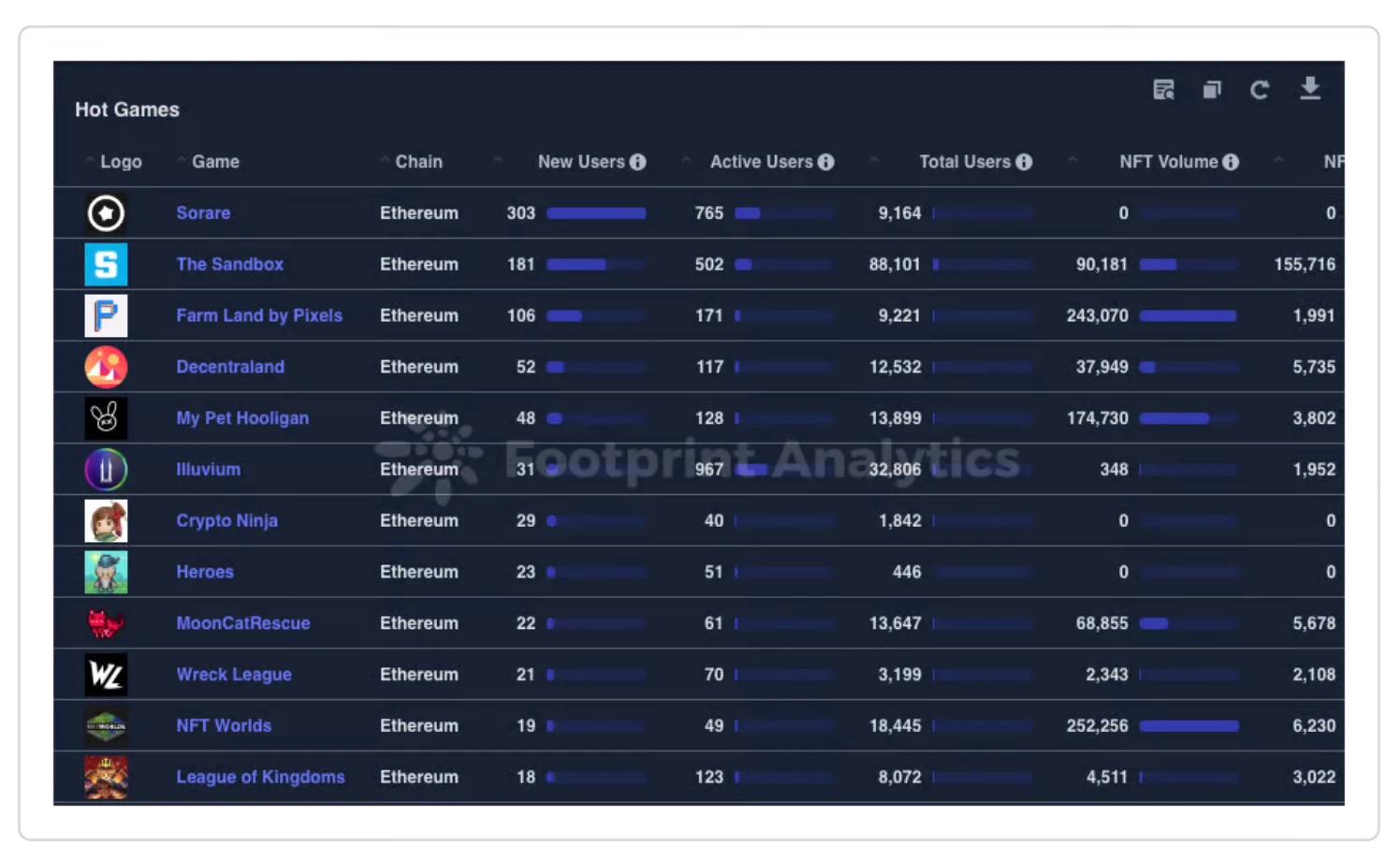

Ethereum still dominates most NFT transaction volumes. When it comes to traditional NFTs and the top 10, those established projects still continue to generate the most interest, although there have been a few new collections entering the top 10 recently.

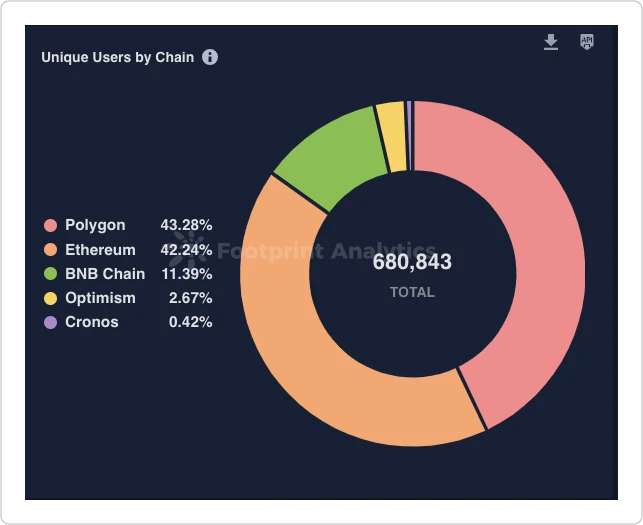

Polygon has become the dominant blockchain for NFT activity. This is likely due to the surge in gaming activity on the chain.

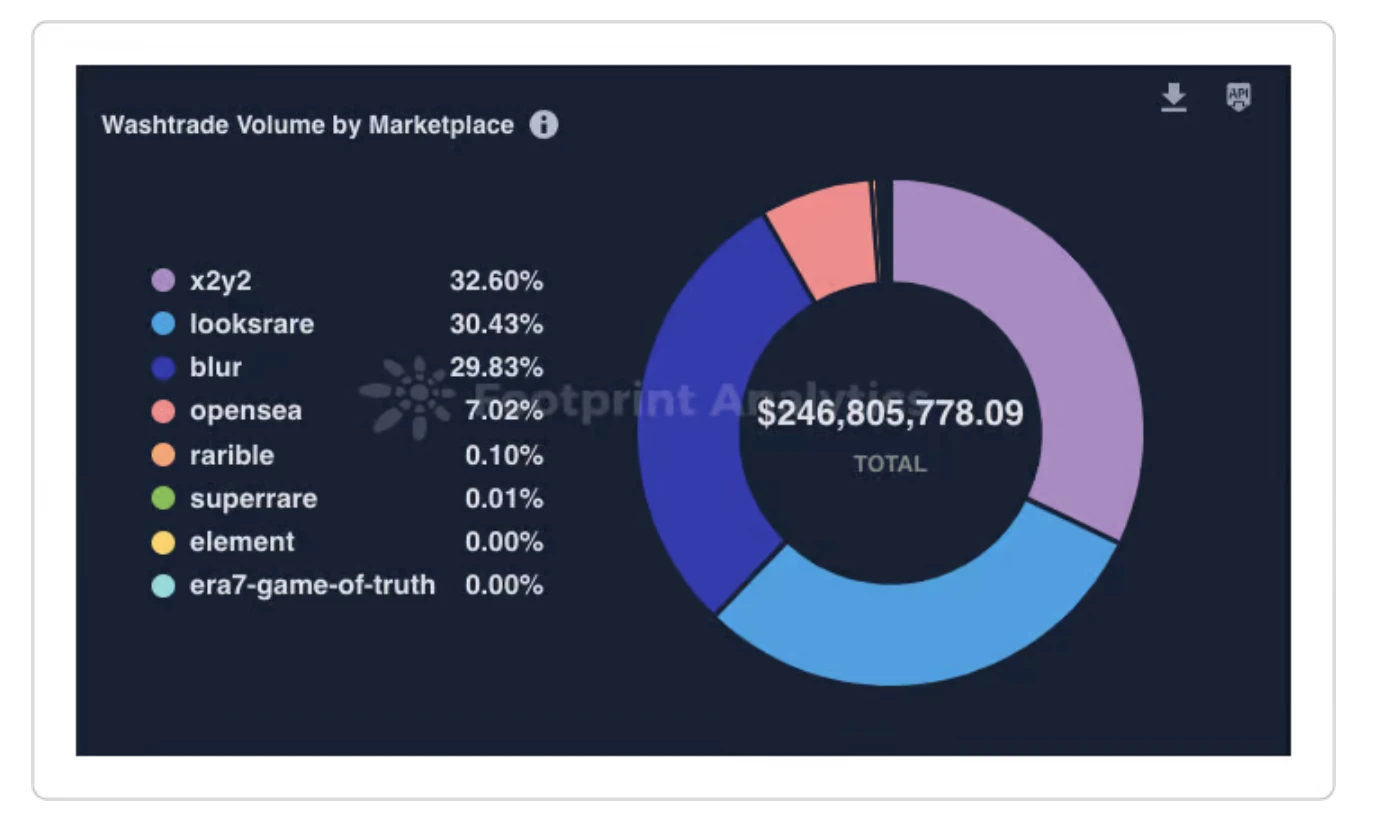

Blur currently leads in NFT transaction volume, while Opensea leads in daily transactions. However, it is worth noting that Blur has been accused of more wash trading than Opensea. This increased trading volume may be related to Blur’s upcoming airdrop in anticipation. It will be fascinating to see if Blur is able to sustain these metrics post-airdrop. Additionally, users should keep in mind that rumors about the OS token have been circulating since the 2021 bull run, which could be an important factor for OS in the upcoming bull run.

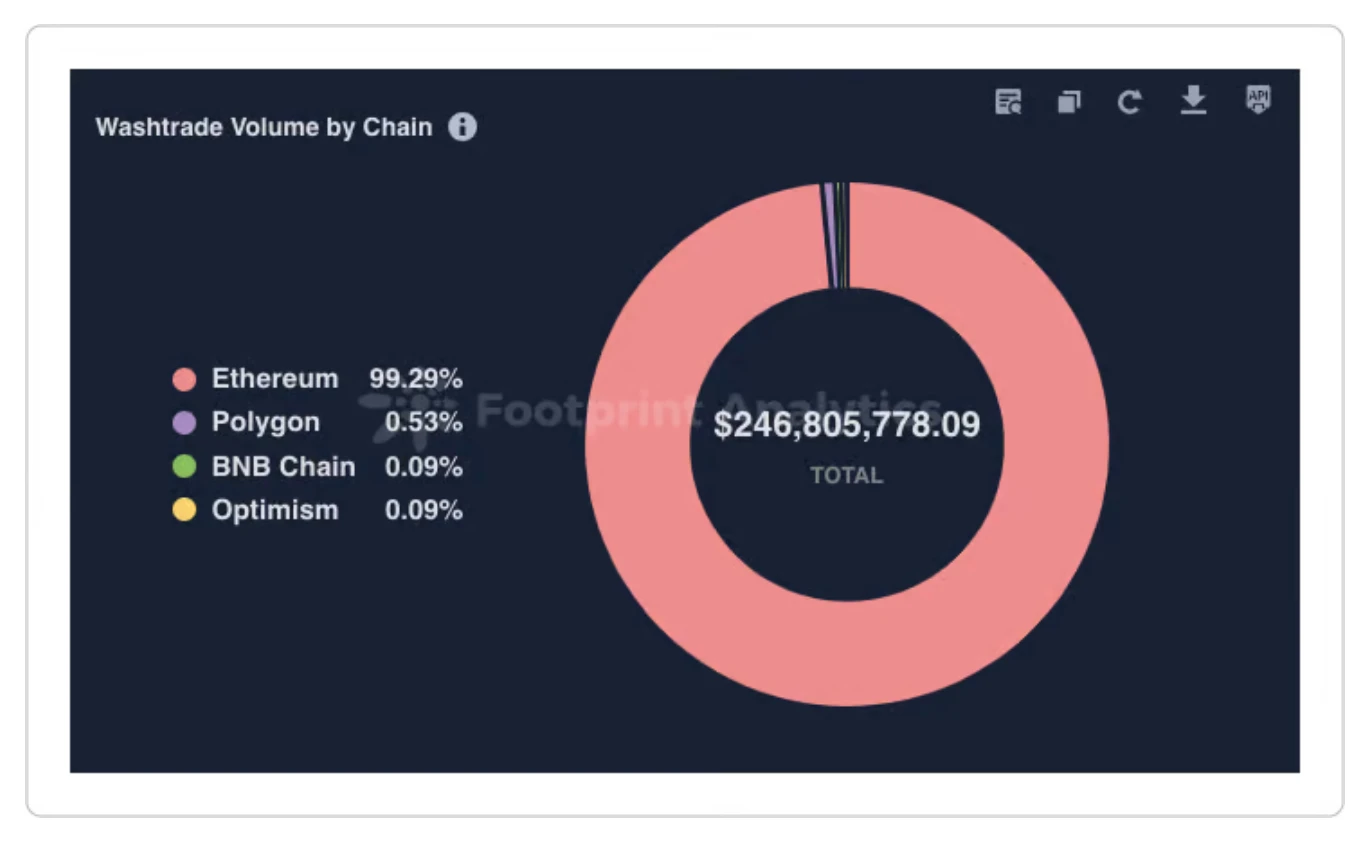

It is worth noting that the majority of wash trades occur on Ethereum. This is interesting because it suggests that the growth observed on blockchains like BNB and Polygon may be more organic and reflect actual user activity.

game

Although the crypto gaming space has yet to gain mainstream recognition, keen observers believe that the tokens associated with these projects have astronomical growth potential. Given the relatively limited participation in this emerging field, opportunities for early participation and substantial returns are abundant.

A recent report from Dapp Radar found that the GameFi market currently has a staggering $9.9 billion market capitalization. In the GameFi space, there are a staggering 650,000 active users, 16% of whom actively participate in the AlienWorlds ecosystem. The proliferation of innovative protocols in this space heralds the impending explosion of the emerging green market, indicating significant growth and potential.

Blockchain games maintain a strong presence in the blockchain space. In the latest month, Unique Active Wallets (UAW) interacting with the game increased by a significant 17% compared to September, reaching a total of 1.7 million unique active wallets. The rise also cemented the games dominance in the market, marking a 10% increase. It is worth noting that in October, about 62% of Dapp activity came from gaming projects. In the field of NFT game collections, Sorare, Axie Infinity, and Gods Unchained have maintained their position as some of the most actively traded NFT collections.

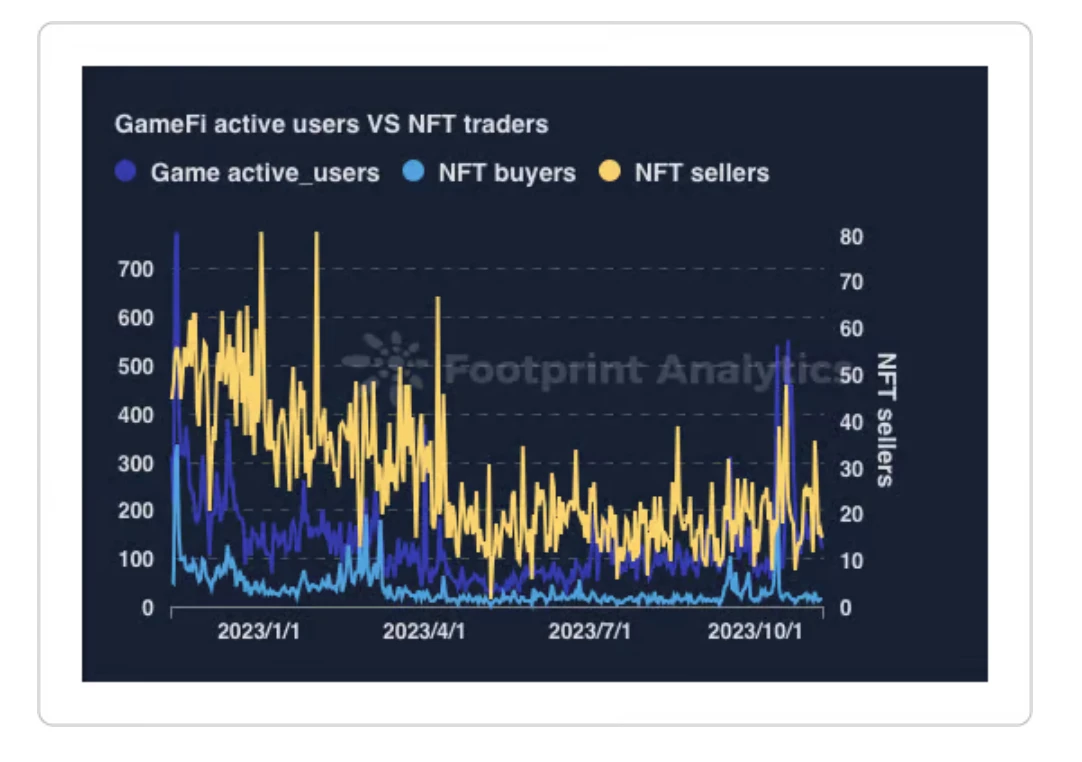

NFT buyers and sellers account for the vast majority of activity across all blockchains. This metric shows how undervalued the GameFi ecosystem actually is.

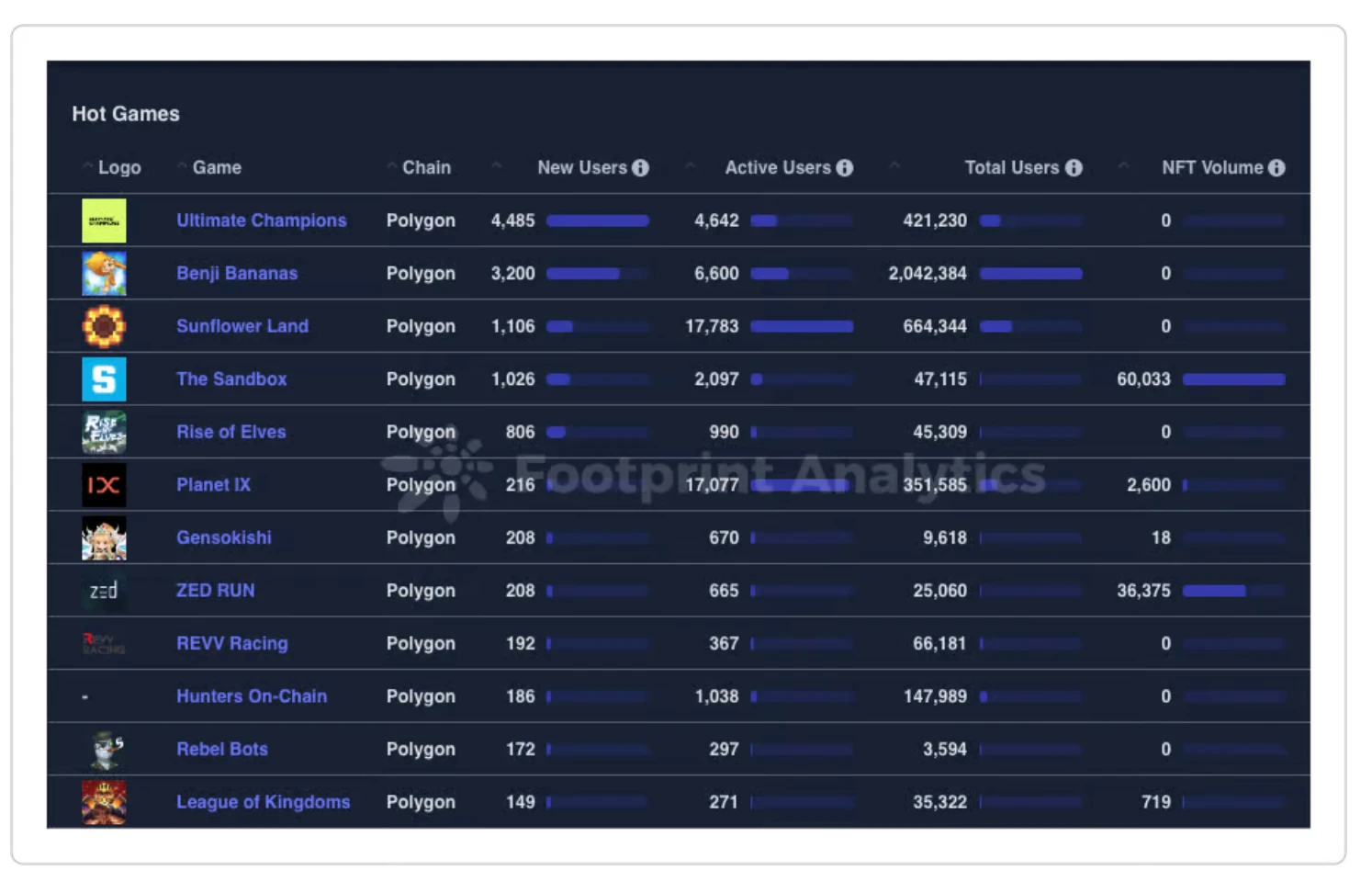

The following three charts compare gaming activity on Ethereum, BNB, and Polygon. Polygon is prominent in gaming, with games like Ultimate Champions, Benji Bananas, and Sunflower Land enjoying impressive user numbers. In the future games may move to other L1 or L2 solutions and may stop entirely on Ethereum due to high costs and fees for users.

Overall, the gaming and NFT markets are witnessing growth and are expected to remain influential in the crypto space and broader internet culture.

Although mainstream participation has yet to materialize, crypto gaming tokens offer significant growth potential for early adopters. GameFi has demonstrated an impressive market capitalization and gaming projects continue to occupy a significant position in the blockchain space. Looking ahead, the market leaders from the last bull market remain dominant, but that may change. It would be wise to keep a close eye on this space, especially on Polygon where gaming and NFTs are booming, as this space continues to evolve.