BTC Weekly Report - Atomics Market will announce the investigation report and compensation plan; the currency price range continues to fluctuate (11.20-11.26)

Organize - Odaily

Edit - 0xAyA

1. Market transactions

1. Spot market

Last week, the price of BTC still fluctuated greatly, and the market was generally in the adjustment stage, fluctuating between US$37,800 and US$35,500. As of press time, BTC was temporarily trading at $37,500, with an increase of 0.21% in the past week.

It can be seen that the BTC price has also formed a range-bound fluctuation pattern within the 4-h level window. It is recommended to wait patiently for the range to break through before entering the market.

Last week, the price of BTC fluctuated greatly, and there was a correction and consolidation on the market to increase leverage. In such a market environment, investors need to remain cautious, control risks, and pay close attention to market dynamics and technical indicators in order to adjust their trading strategies in a timely manner, reasonably control positions, and avoid risks.

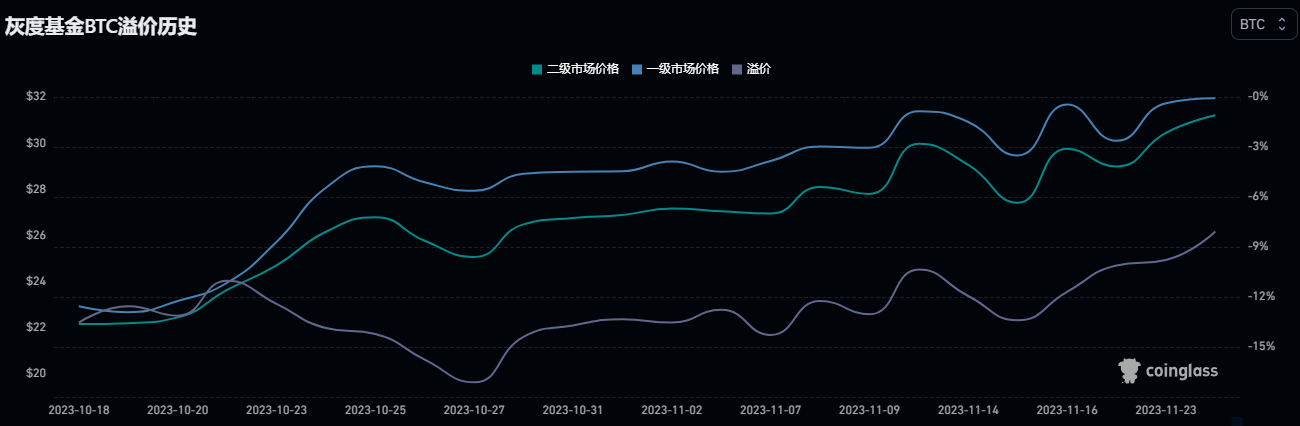

2. GBTC performance

this weekGBTCThe discount range continued to decrease, with the primary market price at 33.95 per share and the secondary market price at 31.21 per share. The discount level narrowed from 10.11% last week (November 19) to 8.07% (November 25).

3. Futures

BTC Perpetual Contract Funding RateIn terms of funding, the USDT contract funding rate on Bitget is the highest, reaching 0.0230%, and HTX is the lowest, reporting -0.0116%. Quarterly delivery prices have not changed significantly compared to last week, with prices ranging from US$37,600 to US$38,000. In terms of BTC contract holdings, CME continues to rank first with a holding of $4.44 billion; followed by Binance with a holding of $3.87 billion; Bybit ranks third with a holding of $2.81 billion.

4. Options

Total BTC holdings this weekwas US$122.603 billion, a year-on-year decrease of approximately 2.01%. Compared with last week, the number of options positions has increased, with call options accounting for 69.45% and put options accounting for 30.55%. In terms of specific positions, the total position of call options is 246,331.07 BTC, while the total position of put options is 108,382.05 BTC. The dominance of call options in the market remains unchanged, and the number of option positions this week has decreased significantly compared with last week. , which may mean that the market has reservations about the market situation in the next period of time.

2. Mining

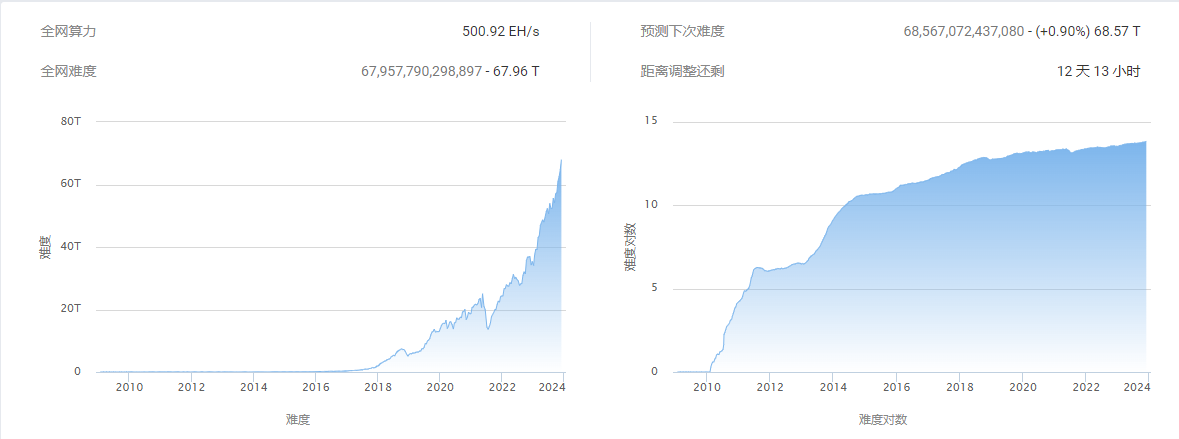

according toBTC.comAccording to data, the BTC network computing power this week was 500.92 EH/s, a year-on-year increase of 6.45%. 7 days ago, the difficulty of the entire BTC network increased by 5.07%. In 6 days, the difficulty of the entire network is expected to increase by 0.90%, as shown below:

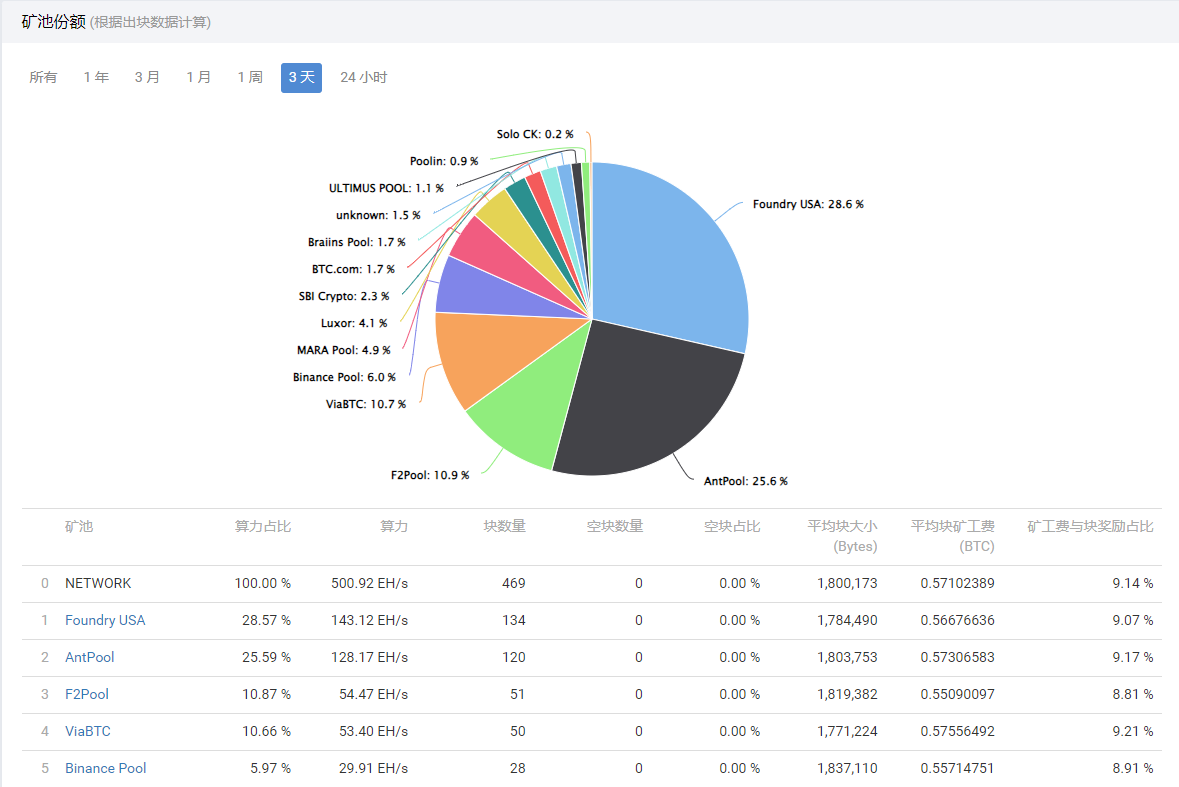

The top three mining pools are still Foundry USA, AntPool and F 2 Pool, accounting for 28.57%, 25.59% and 10.87% respectively. As follows:

Bitcoin developer @0x B 10 C posted that according to its Bitcoin mining pool transaction review monitoring service miningpool-observer, in the past few weeks, F2 Pool is likely to have deliberately filtered four transactions involving OFAC (U.S. Treasury Department Foreign Assets Control). office) sanctions transactions to the address. The author pointed out that there are usually many reasons why transactions are not included in the block. It may be because transactions propagate in the network at different speeds. Each node has its own set of valid transactions. Mining pools may also prioritize transactions based on different reasons. Processing, including special payments received, etc. But for these four transactions that were not included in the block by F 2 Pool, the author analyzed the rate distribution of the missing transactions and the included alternative transactions (for example, the former can provide more mining fees), combined with the block space situation (space sufficiently accommodated but not actually included), concluding that this was a case of intentional filtering.

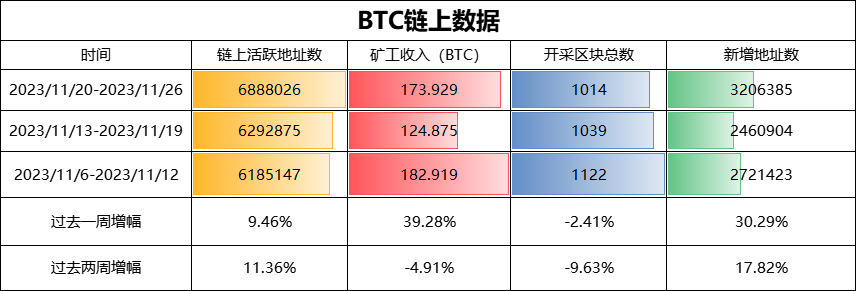

glassnodeData shows that the number of active addresses on the BTC chain in the past week was 6,888,026, a year-on-year increase of 9.46%; miners income was 173.929 BTC, a year-on-year increase of 39.28%; the total number of mined blocks was 1,014, a year-on-year decrease of 2.41%; the number of new addresses was 3,206,385 , a year-on-year increase of 30.29%. Although the popularity of inscriptions has subsided, the data on the chain still rebounded overall this week, as shown below:

3. Ecological Progress

(1)Ordinals

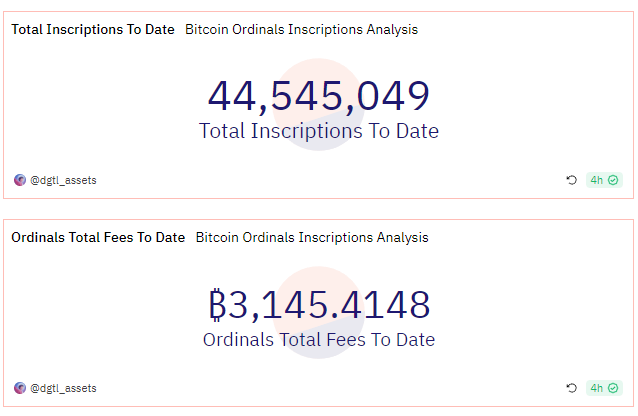

Data Display, the total number of inscriptions minted by Ordinals has reached 44.545 million, and the total cost incurred so far has reached 3145.4 BTC, equivalent to approximately US$117 million.

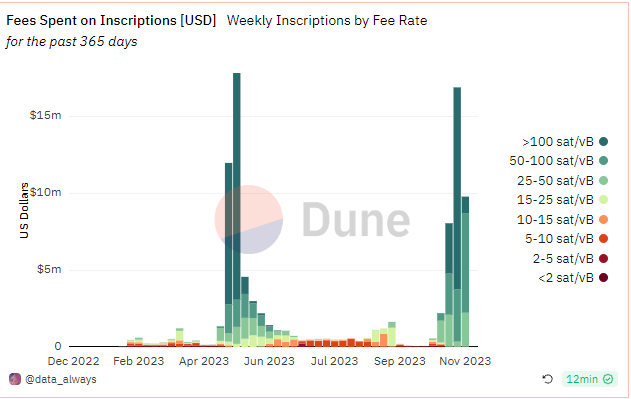

inscriptionIn terms of revenue, Inscriptions revenue and expenses have declined this week, reporting at US$9.79 million.

According to 0x Scope researcher Bobie’s monitoring, the cross-chain Ordinals market TeleportDAO is suspected to be under attack, and the protocol’s Bitcoin-anchored token TELEBTC has become unanchored.

REVS initial deposit reaches 10.9755 BTCThe initial deposit amount of REVS has reached 10.9755 BTC. It is reported that REVS is an inscription with anonymous characteristics built on BRC-20, which introduces a resonance mechanism for token stability and system efficiency.

(2) Lightning Network

Lightspark Lianchuang Marcus: Institutional-grade hosted Lightning Network is ready

David Marcus, co-founder and CEO of Lightspark, a provider of Lightning Network payment solutions, said that the Lightning Network based on institutional-grade hosting is ready, but the use of non-custodial still means compromising on some features. At the same time, Marcus also said that if you want to fully support the unmanaged Lightning Network with offline reception capabilities, and want to make it economically viable, you must accept some form of compromise on the trustless level of the solution.

Wallet of Satoshi posted on the The team hopes that future developments will allow it to revisit and possibly resume operations in the United States. Existing users in the United States have full access to their Bitcoin funds, making withdrawals and transfers to another wallet. Earlier news, according to feedback from community members, the Lightning Network wallet Wallet of Satoshi was removed from Google Play and Apple App Store in the United States.

(3) Other projects:

Atomics Market: Investigation report and compensation plan will be announced as soon as possible

Atomics Market posted on the X platform that the team is still investigating the cause of the recent user $ATOM loss and will release a detailed incident report and compensation plan later. According to previous news, on November 24, according to shep.eth, an early participating community member of Atomics, Atomics Market founder Erik (@BRC 20 Coins) will no longer hold a management position, having suffered losses in the previous two 0 yuan purchase events. All 33, 000 $ATOM will be paid in full by the new team within one week after the handover is completed. The day before yesterday, Atomics Market issued a message on the

4. Other news

Argentine President’s Office: Central bank closure is imperative

The Office of the President-elect of the Argentine Republic announced on the X platform that closing the Central Bank of the Republic of Argentina (BCRA) is non-negotiable. According to previous news, the exchange rate of BTC against ARS (Argentine peso) once reached 13,565,218, a record high; the price of 1 BTC was 13,466,487.62 ARS, an increase of 358.89% during the year.

Arthur Hayes: USD liquidity is increasing and BTC will also rise

BitMEX co-founder Arthur Hayes posted on the X platform that charts on changes in net RRP and TGA balances show that USD liquidity is increasing and BTC will also rise.