Crypto Market Secondary Fund Metrics Ventures Market Watch

1/ BTC exceeded $40,000, and our previous expectations have been realized. BTC and ETH have entered a bull market structure at the chip level, which can determine the newThe bull market cycle has begun。

2/There will definitely be adjustments to clean up profit floating chips and high leverage. Aim for replacement cost above $30,000. A reasonable retracement level is around $35,000.

3/ The key time points for major adjustments are the ETF decision in January, the halving in April, and the possible adoption of ETF in June.Especially in January, the market is likely to fall regardless of the ETF results.。

4/ The real bull market won’t start until after the April halving and June ETF decision.We should be watching for a late-December retracement of the pullback window.

This article is MVC’s comments on the crypto asset market trends in December.

In MVC’s November monthly report, we believe that BTC breaking 3 means 4. As BTC breaks through 40,000 US dollars, the expectation has been realized. ETH has stood at the bull-bear dividing line of the upper MA 120. BTC and ETH have both entered a bull market structure at the chip level. , we can consider that a new bull market cycle has started.

For positions that have already been purchased at BTC below $28,000 and ETH below $1,700 and are intended to be held for a long time, I suggest that you move this part of the position to a cold wallet now, choose to close your eyes, and wait until 2025 before switching back to trading. .

As for the question that everyone is most concerned about now is, will there be a callback and when will it be called back? I think this is not an appropriate question. There will definitely be a correction, but the real question is, when a 20-30% correction comes, do you dare to bet with a full position?

The development of the market must be tortuous in the early stages. We believe that the monthly mid-line market from the beginning of October to the present has been loaded to 85% of the progress. BTC and ETH are obviously entering an accelerating trend, and it is not difficult to accelerate to any price. Importantly, if the 20% acceleration at the tail end can reach 45,000 US dollars, it is no problem. If it cannot reach 42,000 US dollars, it is not surprising that the wings suddenly break. It is meaningless to predict this particularly specific top.

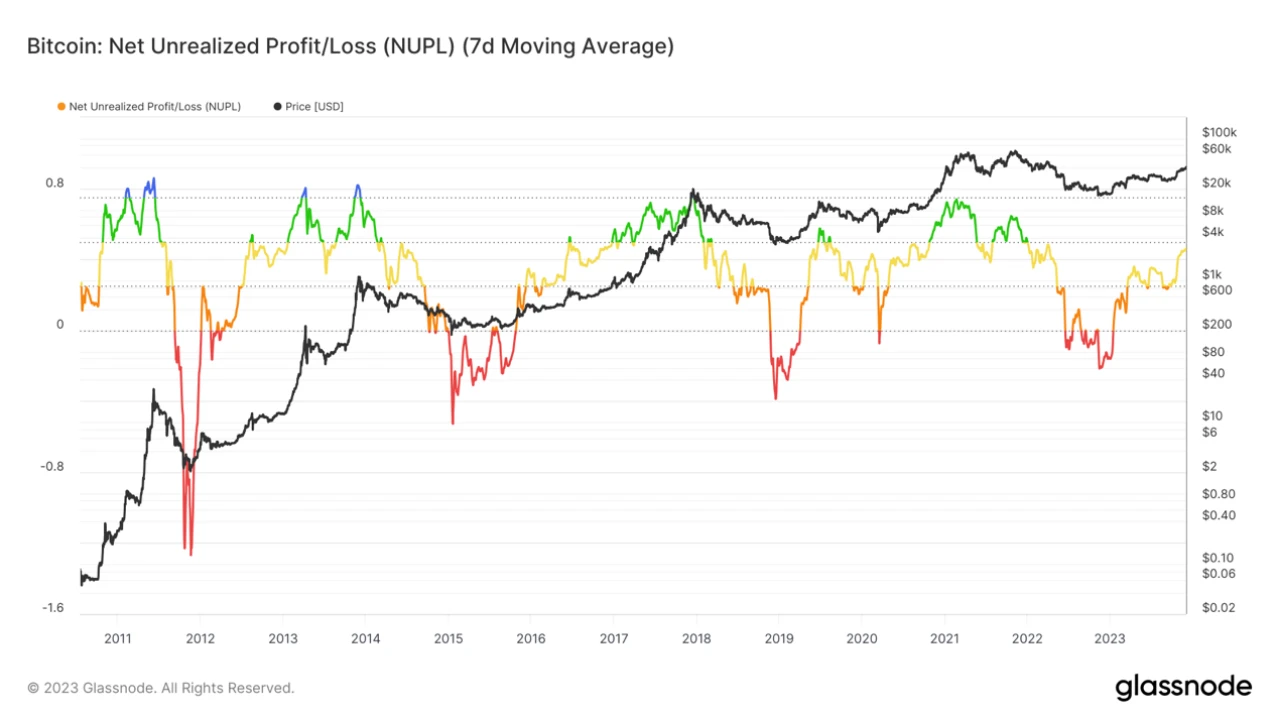

As for adjustments, there will definitely be adjustments. The market excitement is already boiling. BitMEX funding and premium are close to the emotional peak. Judging from the chip profit ratio, the current profit level of BTC on the chain is close to July and October 2020. Short-term profit taking The level of enrichment is already high, so we need to clearly understand that there will definitely be adjustments, and we also need to understand what the main purpose of this adjustment is.The main purpose of future adjustments is to clean up profit floating chips and high leverage, and further accumulate chips before the main rise of the bull market.

From the perspective of the time for adjusting expectations, we believe that there are only three time points that need to be focused on in the next six months.The first is the passing node of BTC ETF in mid-January, the second is the halving around April, and the third is the passing node of BTC ETF around June.Simply deducing from the time dimension, if the ETF passes in January, then the expectations will be realized, and there will definitely be a larger correction. If the ETF continues to delay in January, then the expectations will not be realized, and it will trigger profit-taking flight, and the outcome will still be a correction.Therefore, purely from the point of view of January, regardless of whether ETFs pass or fail, we believe that the market must fall.

If we look a little further ahead, when the January ETF results appear and the market correction materializes, it will slowly climb to the halving, and then there will be a second systematic adjustment in June. Based on our belief that the ETF will definitely pass Based on the premise, there is a high probability that June will finally pass the node, and then there will be the last opportunity to get on the bus before the bull market starts in June. But June is too far away,We still need to pay more attention to the callback window after the current midline market accelerates to the top at the end of December, which is also the most important layout window.

From the perspective of the adjustment target space, the main costs of long-term chips on the chain are currently concentrated at the 28,000-30,000 line. The current price has been far away from the main cost area, so the correction is likely to be completed through the escape of profit taking. The repair of costs and the nature of the callback are similar to those from 3-12 in 2020. They are both a washout of Nius initial profits and a cleaning of leverage, allowing the long-term cost of chips to settle above 30,000. Therefore, the most extreme correction space is to step back on the weekly WMA 120 to around 32,000 US dollars (you should wake up laughing even if you dream),A reasonable retracement level is around $35,000.This is also the chip cost range for all chasing after BTC breaks through on false news.

Looking back at the market situation for more than two months from October to now, the biggest feeling of many people is that the market seems to lack a particularly clear absolute main line. The tokens that rebounded more in the market throughout early November were mainly based on the logic of the chip structure. Many tokens will be in the market at the end of 2022. Due to the collapse of FTX and the violent and smooth decline, a huge chip vacuum was formed, such as matic, etc. This rebound has recovered the chip vacuum range at the end of 2022. Many tokens have completed 10 months of sideways accumulation, such as sol/link/dydx, etc., and have made a very solid bottom; or they are new coins that have just been listed on the major exchanges, such as Tia/Pyth, etc. Many investors who have experienced the cycle often feel at this stage that they are stuck in a state of rush and rush, as if nothing really new has emerged. This is also in line with the characteristics of the bottom rebound theme rotation.

However, in mid-to-late November, market funds rushed to find three themes that can be called main lines, namely BTC ecology represented by ordi, games and AI. These three themes began to take shape as the main track. background color.

Although many tokens have experienced huge gains, we believe that these three themes‘still early’, it is still in a relatively chaotic state. If you buy it, you will make money. If you don’t buy it, there is no need to worry at all.The current market hype for this type of subject is more like meme logic. Different IQ groups like to hype memes of different subjects., iq10 and iq150 are hyping ordi (DePin can also be counted), iq100 is hyping AI, iq50 is hyping the game, and there are even many elites with hedge fund backgrounds holding on to Perp Dex and old DeFi with their calculators. Chinese people speculate on inscriptions, Europeans and Americans speculate on POW and Sol ecology, and Koreans speculate on lunc. Each has its own meme (no offense intended, I consider myself to be in the IQ 50 group).

Thousands of words can be combined into one sentence, still early. Let us enjoy the joy of the accelerating wave first. No matter how it goes up or down now, it is the stage when the bulls early chips are changing hands. There are still many opportunities behind, and we will wait until January-February. , let us make a finer net to catch the big fish. As for the complex impacts of macroeconomics, interest rate cuts, and the U.S. stock market, we have repeatedly emphasized since January 2023 that these are not important and are not the main contradiction.The endogenous encryption cycle always requires the most attention to the natural innovation of the industry, and funds will naturally follow it.

about Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund led by a team of experienced crypto professionals. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC cooperates with senior influential figures in the encryption community to provide long-term enabling capabilities for projects, such as media and KOL resources, ecological collaboration resources, project strategies, economic model consulting capabilities, etc.

Welcome everyone to DM to share and discuss insights and ideas about the market and investment of crypto assets.

We are recruiting, if you are good at crypto asset investment, please contact us, Email: ops@metrics.ventures.

Our research content will be published simultaneously on Twitter and Notion, please follow:

Twitter: https://twitter.com/MetricsVentures

Notion: https://www.notion.so/metricsventures/Metrics-Ventures-475803b4407946b1ae6e0eeaa8708fa2?pvs=4