Original author: Steven, E2MResearcher

Preface

Previous Aave articles have more business data comparisons with Compound. Here we mainly introduce some of Compound’s development status, project background, token incentives, etc., and there is relatively little data measurement introduction. Compound itself is interesting.

This article involves some discussions of the E2M team on the decentralized lending track.

Writing a separate article is also about Compound’s innovation Respect.

What innovations has Compound made? (This is similar to the innovation of Curve’s Ve token economics, whether good or bad)

The structure of cToken

Fund pool (peer-to-pool) lending

dynamic interest rate

Asset segregation

An important promoter of liquidity mining

The concept of governance tokens

............

As the development of Web 3.0 becomes more and more mature, is it because of the open source nature of Web 3.0 that every innovation can easily become a wedding dress for others, and it is the capital that ultimately benefits? At the same time, the vicious cycle ultimately leads to less and less creativity?

For example:

Recently, when I was chatting with a friend who is working on a payment + wallet project, I found that everyone is using the same open source code. However, wallet project developers with a Silicon Valley background can obtain investment from a16z and the best resources, but in fact there is no breakthrough in the underlying technology. ; The same goes for hardware wallets. After Trezor is open sourced, most hardware wallets can directly use its source code for commercialization without paying any price. On this basis, we can make up for the problem that Trezor does not have a security chip; decentralization The user groups of derivatives exchanges are essentially the same, but MYX, led by Sequoia China, is able to achieve high financing and high valuation.

As the development of Web 3.0 becomes more and more mature, is it because of the open source nature of Web 3.0 that every innovation can easily become a wedding dress for others, and it is the capital that ultimately benefits? At the same time, the vicious cycle ultimately leads to less and less creativity?

Better loans will still appear, but how exactly will they appear is still unclear? So besides waiting for better lending methods to appear, what can we do that has a longer half-life?

For example: What factors does a good decentralized lending need to contain? High capital efficiency, you can borrow without collateral; the liquidation threshold is low, even highly volatile assets or extreme markets can protect user assets (CrvUSD’s Llama algorithm)

Dongzhen: Is the game similar? The gameplay can be easily copied. In the categories of chess and card games and early simple games, Tencent, which has a monopoly on social networks and traffic, can make huge profits. However, it is not completely ruled out that companies such as Blizzard, MiHoYo and NetEase can break through through products and IP. In fact, there are not fewer and fewer fun and creative games. Yuanshen and Chicken are both favorable refutations, and game stagnation will self-defeat.

What do you think of decentralized governance?

CM-Marco: The Curve framework is better. Governance is focused on functionality and decentralized on the chain. The advantage is that the underlying layer is simple, so the probability of security risks is relatively low. Buterin advocates minimal governance. If you can’t govern, don’t govern. Centralized governance does not matter in the initial stage of the project. Regardless of whether it is decentralized or not, the ultimate goal is to minimize governance. Without governance modules and governance tokens, the protocol relies entirely on its own Operation promotion is not friendly to investors, but it is an ideal idea.

Dongzhen: The first principle is the bottom line of the agreement: The bottom line problem of Compound is very poor. It takes 7 days for a problem to occur and there is not enough hedging strategy. The second principle is that if something goes wrong, you need to be able to correct it. Setting up a framework requires the freedom to maintain the basics, and the second is to be able to adjust. V God is very interesting.

1 Introduction

1.1 Development history

Compound is one of the earliest DeFi projects and made a huge contribution to the early form of decentralized lending. At the same time, Compound pioneered many of DeFi’s popular business models, token economics, and gameplay.

Compound was founded in 2017 by two University of Pennsylvania alumni, Robert Leshner and Geoffrey Hayes, and launched in September 2018. Among them, Robert Leshner graduated in economics, worked as a web designer and financial services, and worked at Postmates* (Postmates provides food delivery service, aiming to provide a last-mile delivery service platform to connect local people with stores, in other words, takeout Delivery Company) * as a product manager, and later founded Robot Ventures. Geoffrey Hayes also worked at Postmates as an engineer and is the founder of Safe Shepherd. Subsequently, many people were attracted to join, including senior development engineer Antonina Norair, design director Jayson Hobby, strategic subject Calvin Liu, legal counsel Jake Chervinsky, and more.

The famous Ethereum lending protocol in 2019CompoundFinance v2 is officially launched, and the concept of cToken-interest-bearing assets is born.

Compound was officially launched in June 2020COMP Token, and transfer the governance authority of the Compound protocol to the DAO organization, and use COMP currency as the core governance token. When COMP Token was launched, the main purpose was actually to encourage lenders and borrowers to use the Compound protocol. Such behavior was greatly welcomed at the time, and a large number of users used the protocol in order to obtain COMP Token. The liquidity mining craze started through the method of loan is mining.

The COMP token is the first governance token that allows anyone to own a stake in Compound and have voting rights on protocol proposals. By design, COMP tokens are distributed directly to their most important stakeholders, such as users of the protocol. This distributed delegation and incentive protocol allows the community to jointly manage the future of the protocol through good governance. The core purpose of users starting to use Compound is to mine, so the term liquidity mining has been popularized.

Compound has also experienced multiple security incidents during its operation. For example, on November 26, 2020, the price of DAI on Coinbase Pro rose to $1.34, causing abnormal price fluctuations in the Compound oracle, causing more than $80 million in crypto assets to be forced liquidation. On September 30, 2021, after Proposition 62 was passed and executed, there was an error in the contract, which caused COMP tokens that should be distributed slowly to be issued incorrectly. About 280,000 COMP were affected, worth $80 million at the time.

These events paved the way for Compounds future development strategy. On August 25, 2022, Compound Labs launched Compound III, which removed the concept of interest-earning assets, and even the collateral for each loan will be stored in the corresponding smart contract. It can be lent out again, and it cannot be re-interested.

1.2 Team situation

According to the number of employees displayed on the official website, there are currently 17 employees. Many employees left with Lianchuang to work on Superstate.

Image Source:https://compoundlabs.xyz/#hiring

1.3 Financing situation

2. Business situation

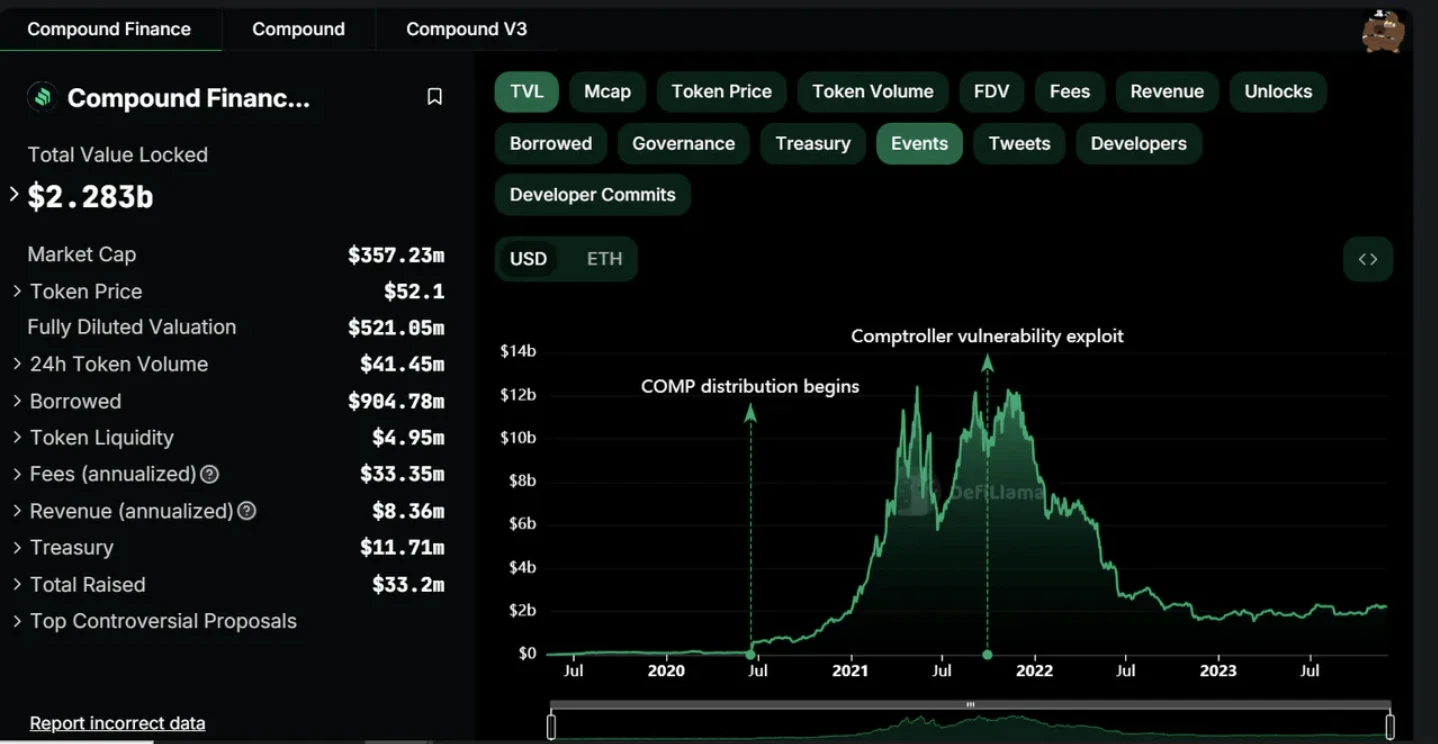

2.1 Overall TVL

After Compound TVL pioneered the concept of “liquidity mining”, its fluctuations increased significantly, which basically coincided with the time period of Defi Summer. The subsequent major security incident at the end of September 2021 with the arrival of Deep Bear led to Compounds continued decline and also changed its strategic direction.

Data Sources:https://defillama.com/protocol/compound-finance

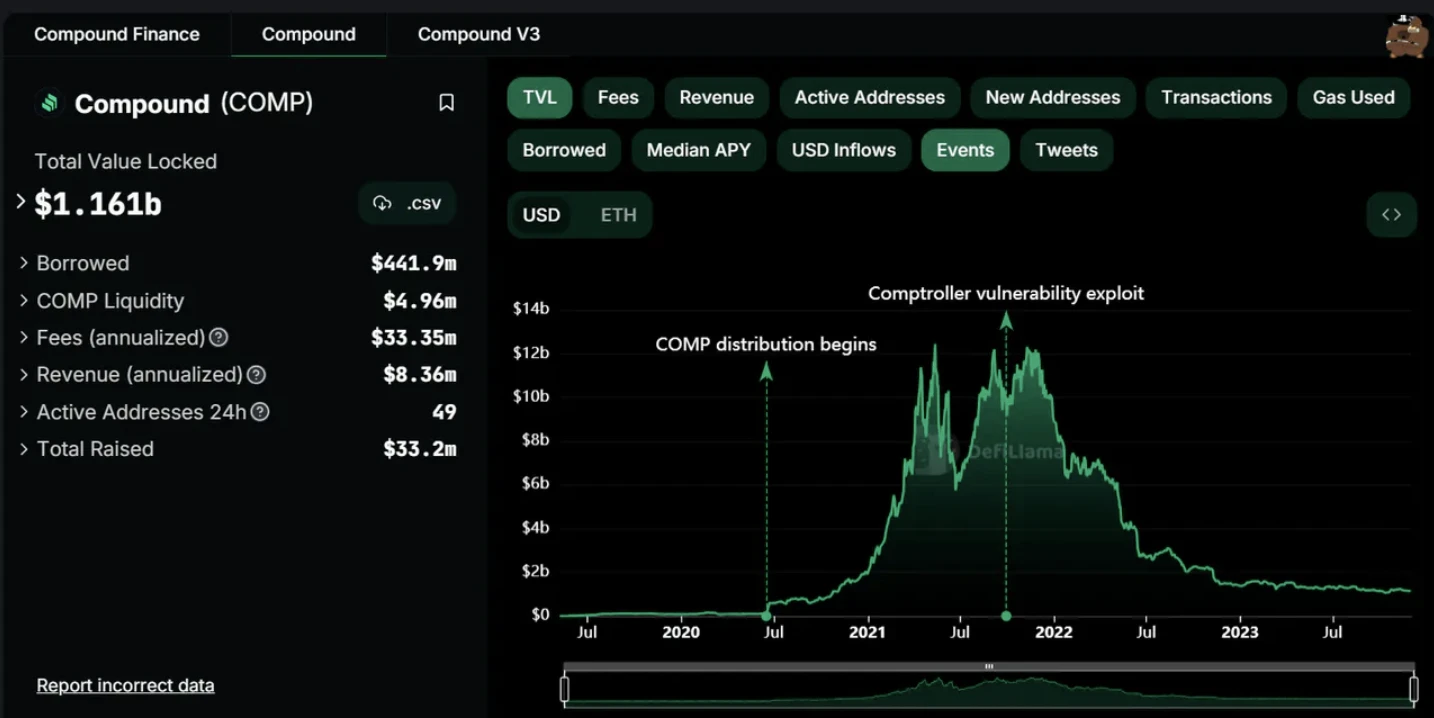

2.2 Compound V2

TVL

After the launch of liquid mining, TVL began to skyrocket, coinciding with Defi Summer and the crypto market bull market, reaching its peak.

Data Sources:https://defillama.com/protocol/compound

Lending analysis

The more important update of V2 is relatively close to Aave V2. The two core functions are cToken and Comptroller (auditor)

Similar to Aave, each asset is integrated through a cToken contract, which is a conformance to the balance provided to the protocol.Representation of EIP-20.By minting cTokens, users (1) earn interest on the cTokens exchange rate, which increases in value relative to the underlying asset; and (2) gain the ability to use cTokens as collateral.

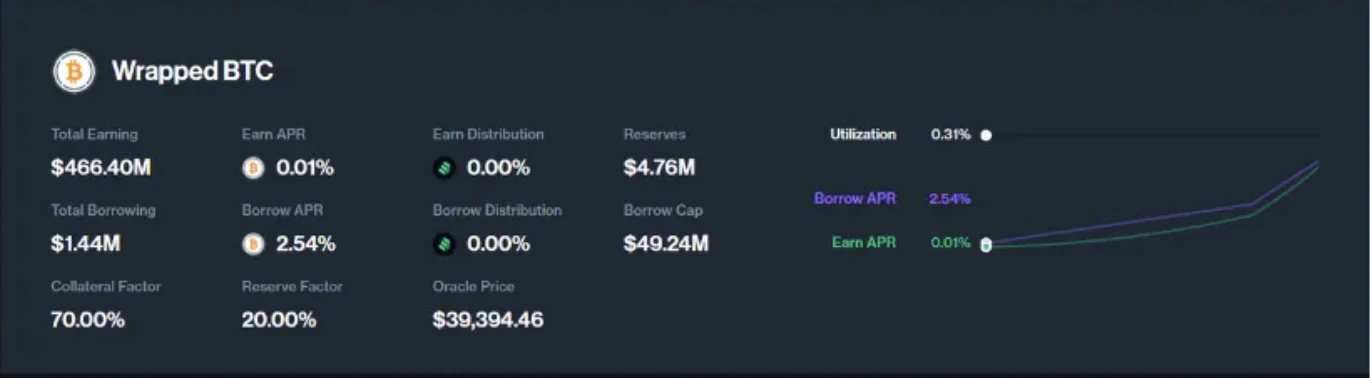

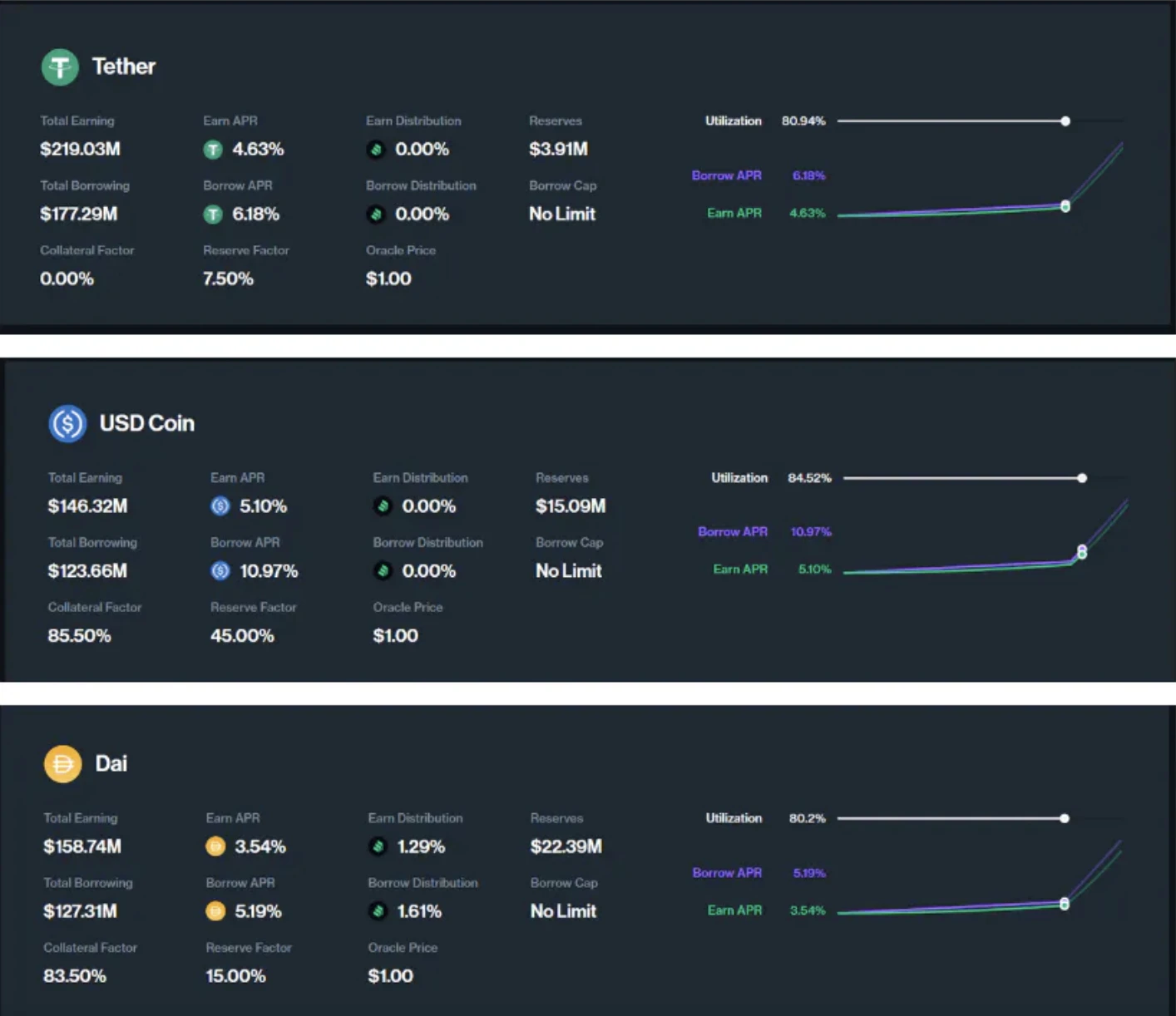

The Compound V2 Market is very misleading, making it seem like every asset is a pool. At first glance, I thought there were many people depositing large amounts of Eth in the protocol, but very few people were borrowing it. . .

You can see that Earn Distribution is 0% except for DAI. That is to say, Compound’s token incentive promotion TVL has been completely focused on Compound III.

Eth, WBTC, Chainlink, including some blue-chip Defi, etc., have high Total Earning, extremely low Total Borrowing, and low Utilization assets, which to a certain extent means that most users are long BTC and ETH on Compound.

https://app.compound.finance/markets/v2

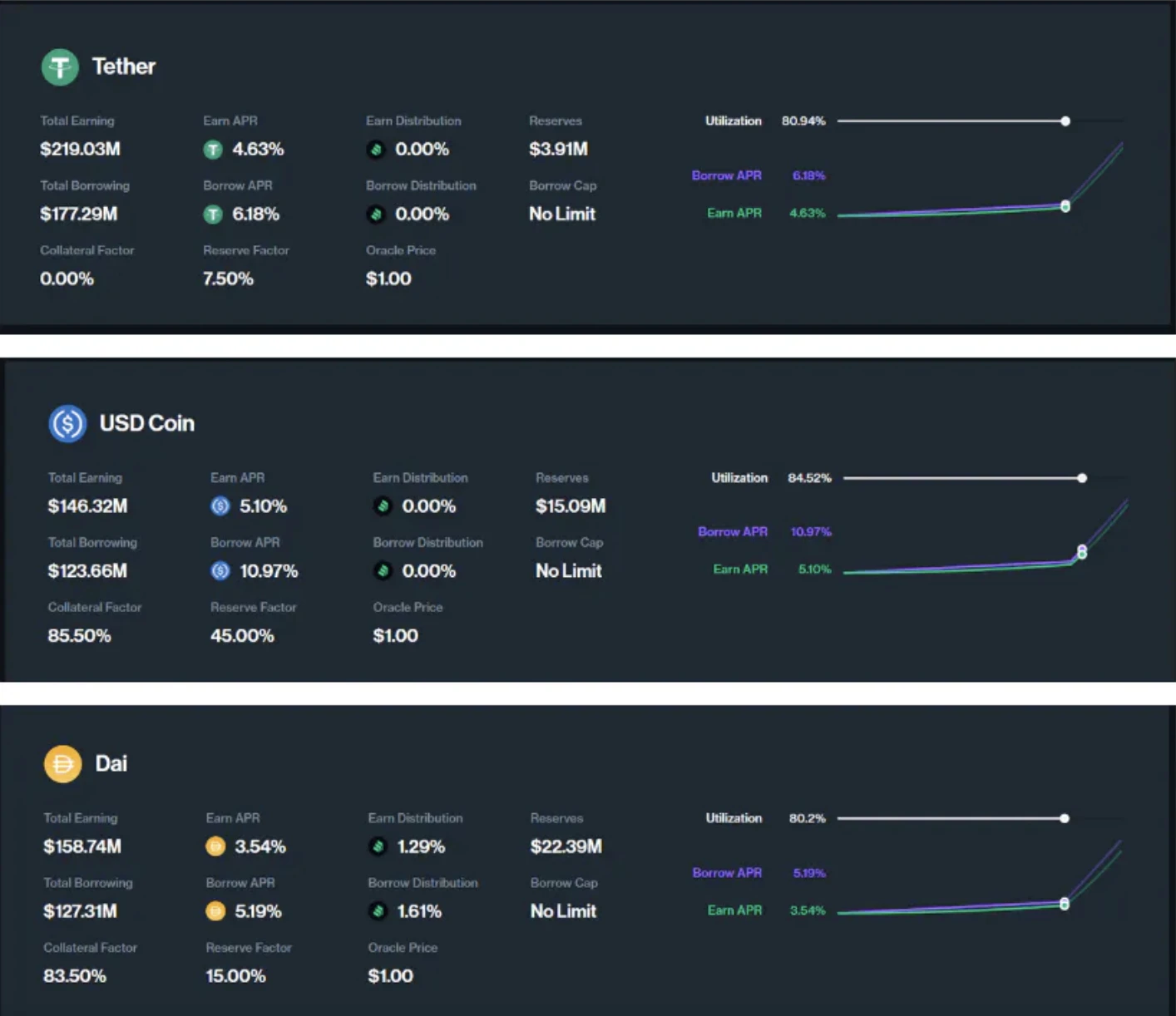

On the other hand, it can be judged to a certain extent that the Utilization of UDSC, USDT, and DAI is close to the optimal utilization rate.Users exchange Eth, BTC and other collateral into stable coins.

https://app.compound.finance/markets/v2

2.3 Compound III

For large-amount loan users, there is a demand for absolute security. In addition, the collaterals are basically long assets.

TVL

Compound III’s TVL has been in a state of increasing TVL since its launch, surpassing $1b around November.

Data Sources:https://defillama.com/protocol/compound-v3

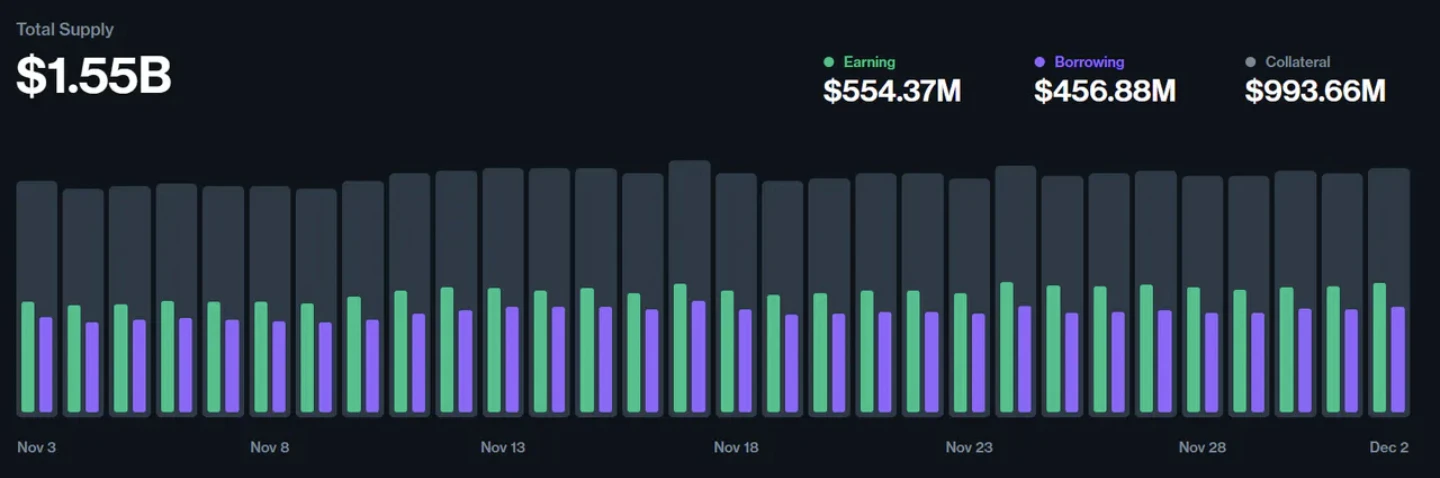

Overall lending situation

Because of the particularity of Compound III, the concepts of lender (Lending/Earning) and collateral (Collateral) are distinguished.

Total Supply = Lending/Earning + Collateral

Earning = $ 554.37 M

Borrowing = $ 456.88 M

Collateral = $ 993.66 M

Data Sources:https://app.compound.finance/markets

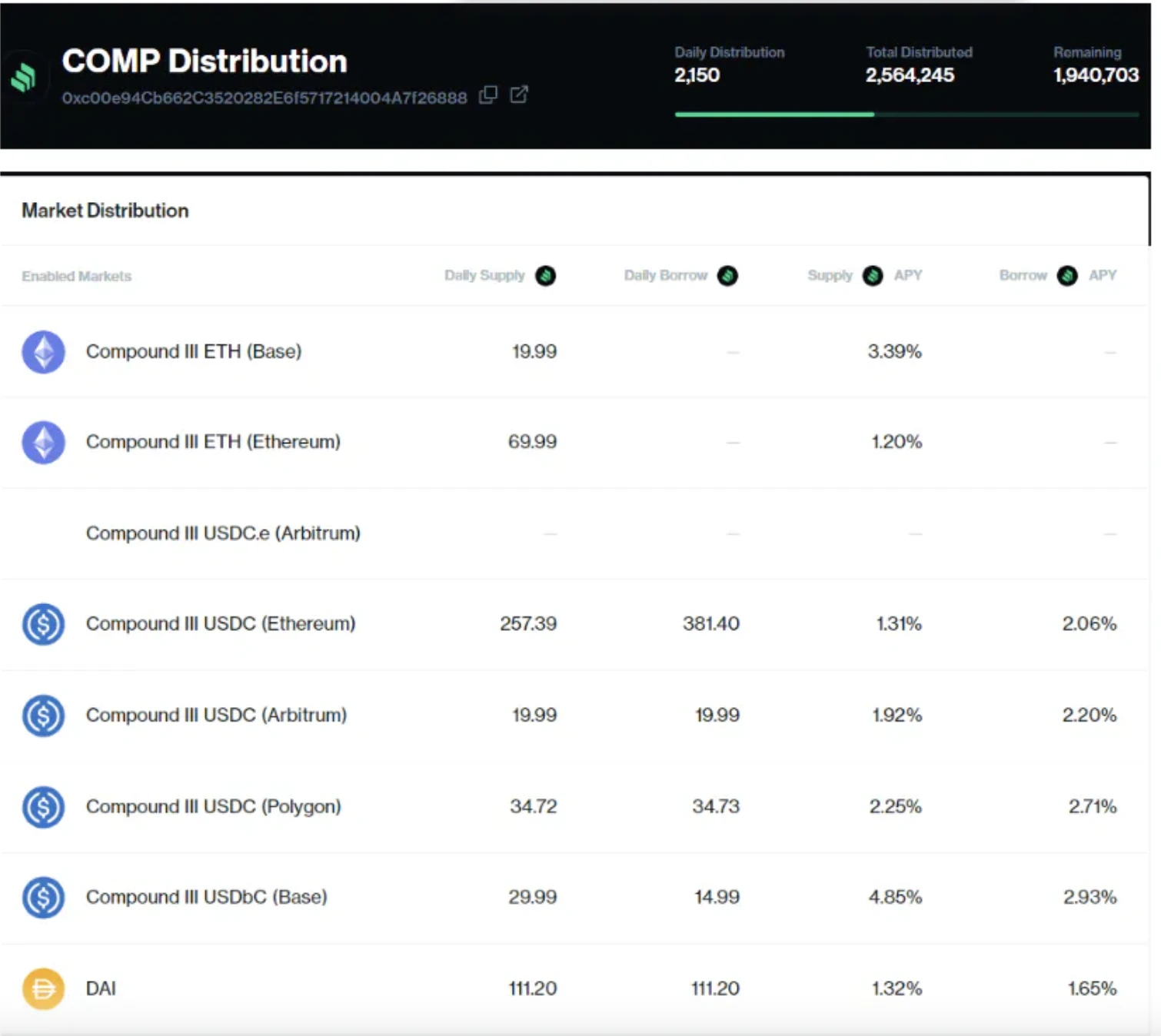

Incentive situation

The currency-based incentive is 2,150. The Compound team is relatively traditional and conservative as a whole. It started liquidity mining in 2020 to stimulate V2 TVL. Now the incentive has been gradually transferred from V2 to III. It can be seen that the team does not have much desire for innovation. To stabilize TVL by resting on our laurels.

Data Sources:https://compound.finance/governance/comp

Lending status

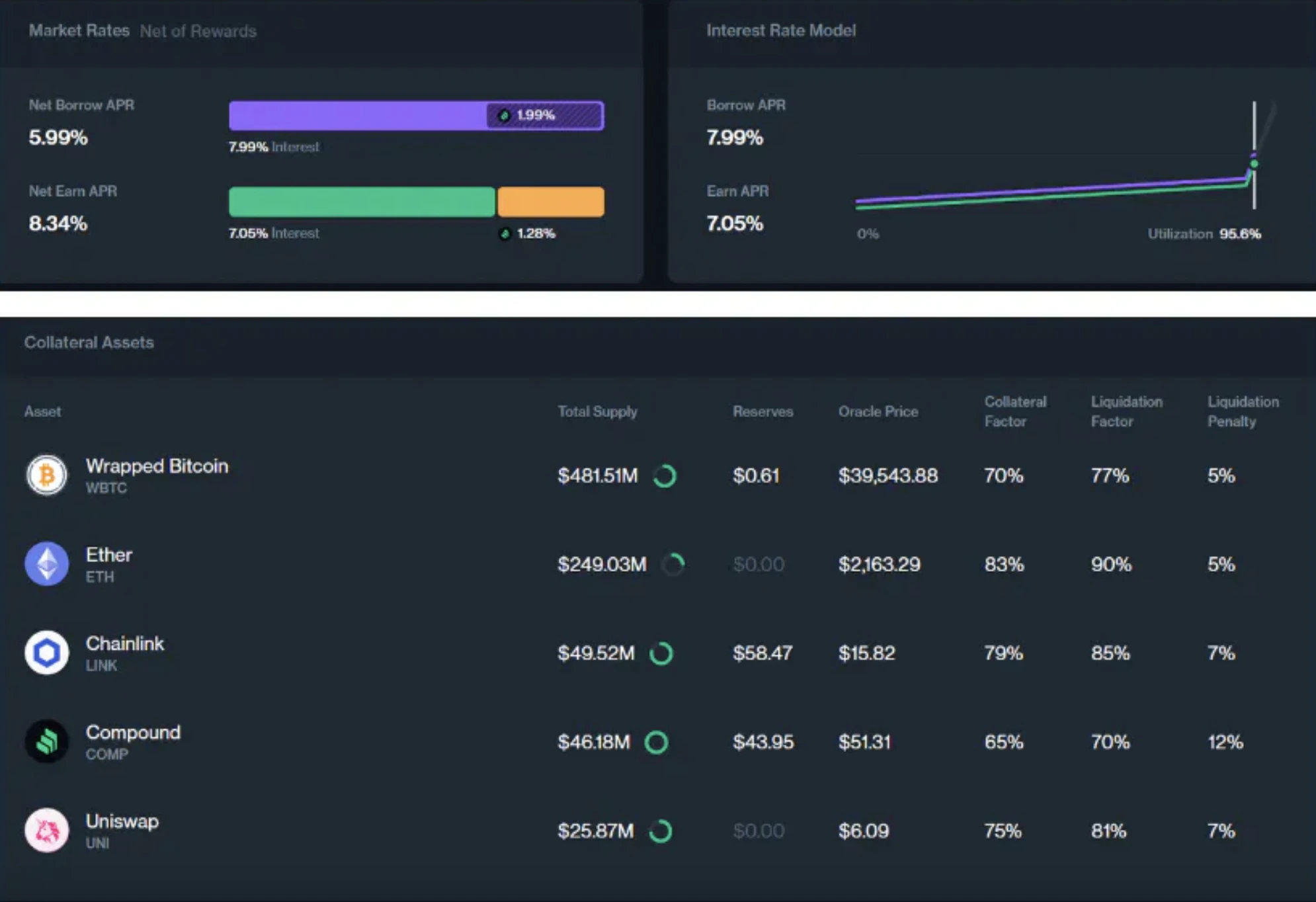

Incentivized by COMP tokens, Net Earn APR is great.

USDC V3

Taking a single USDC V3 pool as an example, there is a rate of return of up to 8.34% under incentives. At the same time, since the most incentives are distributed, the lender pool is also currently the highest, reaching $850M.

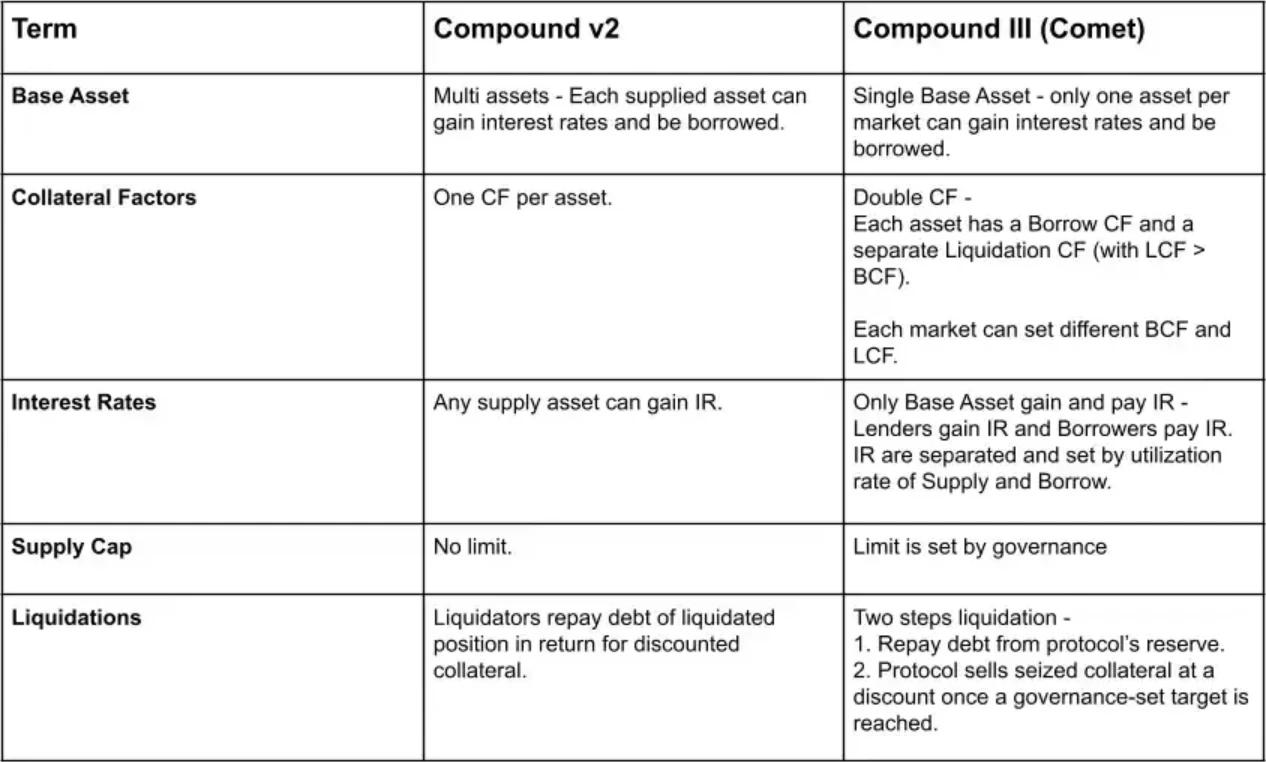

2.4 v2 VS III

COMP V2 returned the liquidity of interest-earning assets to users, and III took it back. The initial feature was the creation of a peer-to-peer pool to pursue capital efficiency, but III ultimately isolated assets and chose safety first. Thinking of what Brother Mo said about decentralized lending, the order book may still be one of the potential optimal solutions.

3. Token Economics

COMP itself basically does not have much utility other than its governance role.

3.1 Token distribution

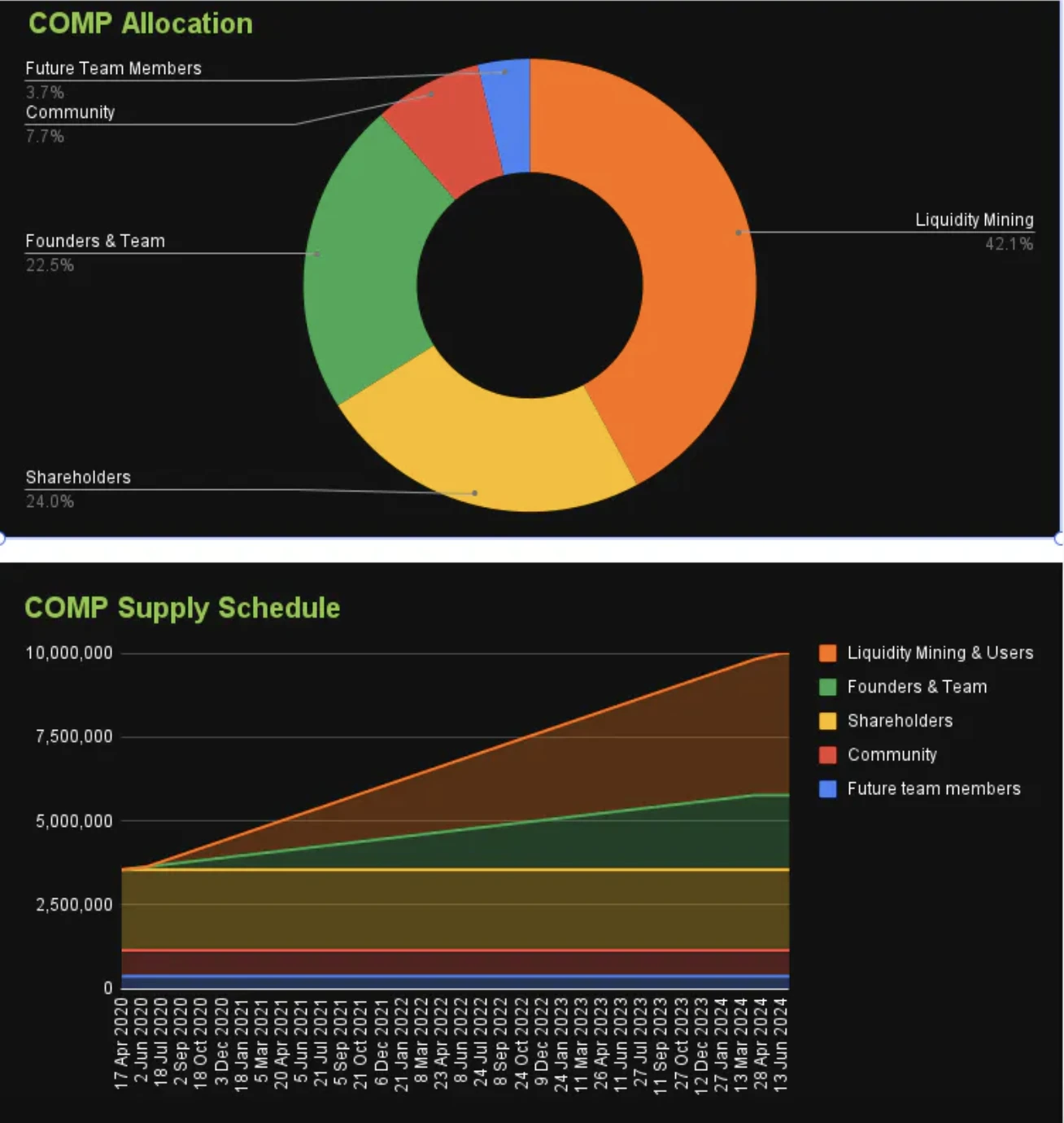

Released on June 15, 2020. The maximum supply of this token is capped at 1,000,000,000, and it is expected that all will be released in July 2024. The initial token distribution is as follows:

42.15% allocated to liquidity mining

23.95% distributed to shareholders

22.46% allocated to founders and team

7.73% allocated to the community

3.71% allocated to future team members

Data Sources:https://www.coingecko.com/en/coins/compound/tokenomics

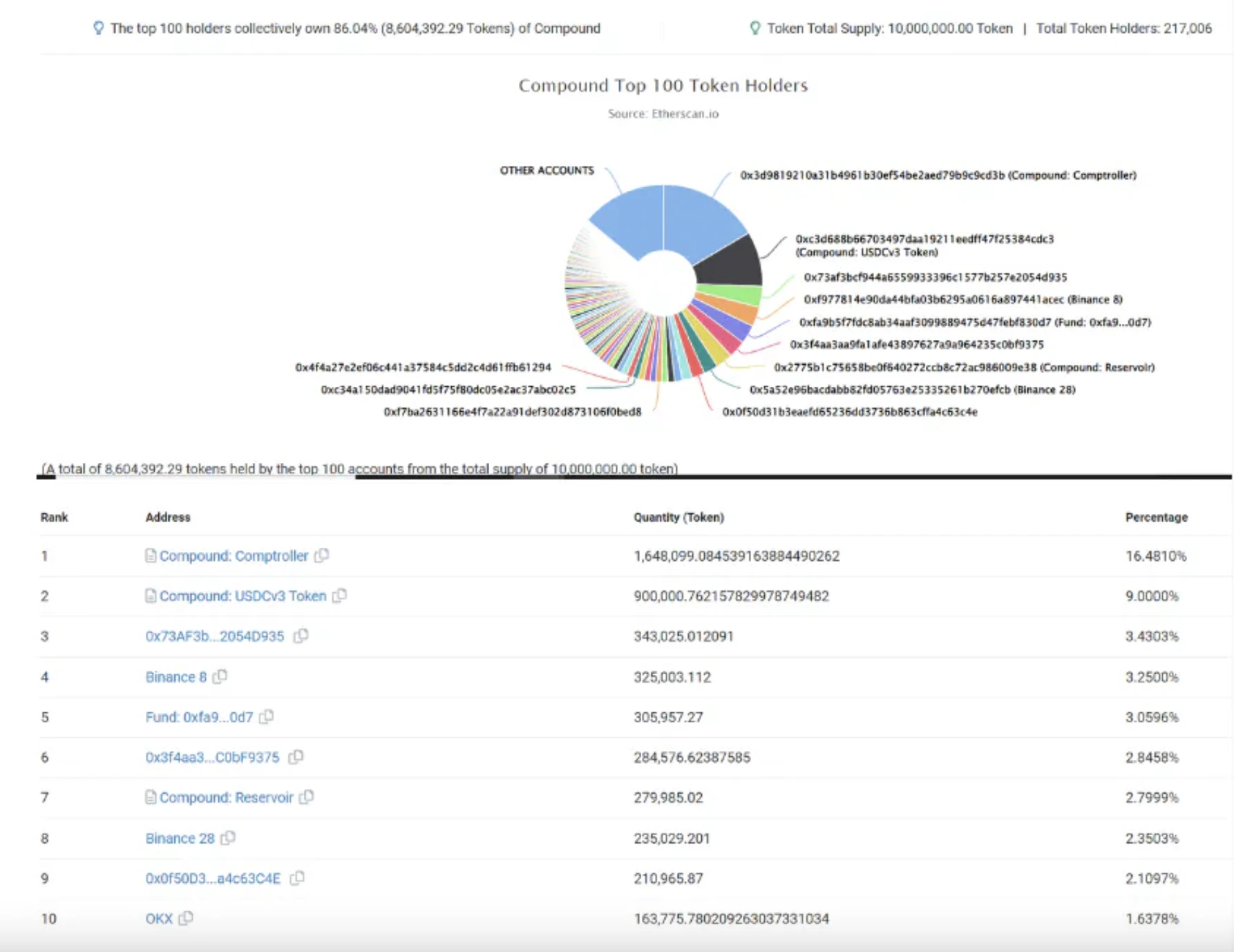

3.2 Token holdings

The overall distribution is relatively healthy, with 210,000 Holders, and the largest holder is less than 4%.

Data source: https://etherscan.io/token/tokenholderchart/0xc00e94cb662c3520282e6f5717214004a7f26888

3.3 Governance

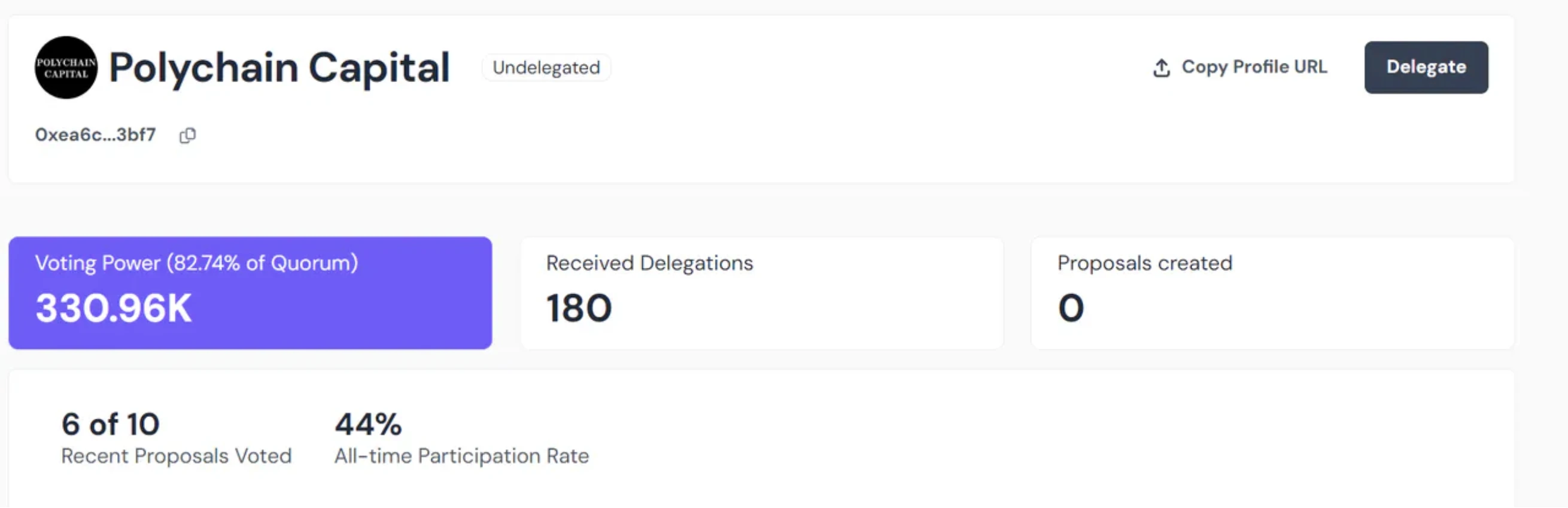

In terms of governance, Polychain Capital’s token holdings do not have a monopoly, but with a large number of entrustments, Voting Power is basically the only one, even a bit like the “veto power” of traditional Web2.0 investment institutions.

Whats interesting is that essentially delegating voting rights to others is not like Convex or the like where you can make more money, but it is just transferring voting rights.

Governance process

Refer to the official release:docs.compound.finance

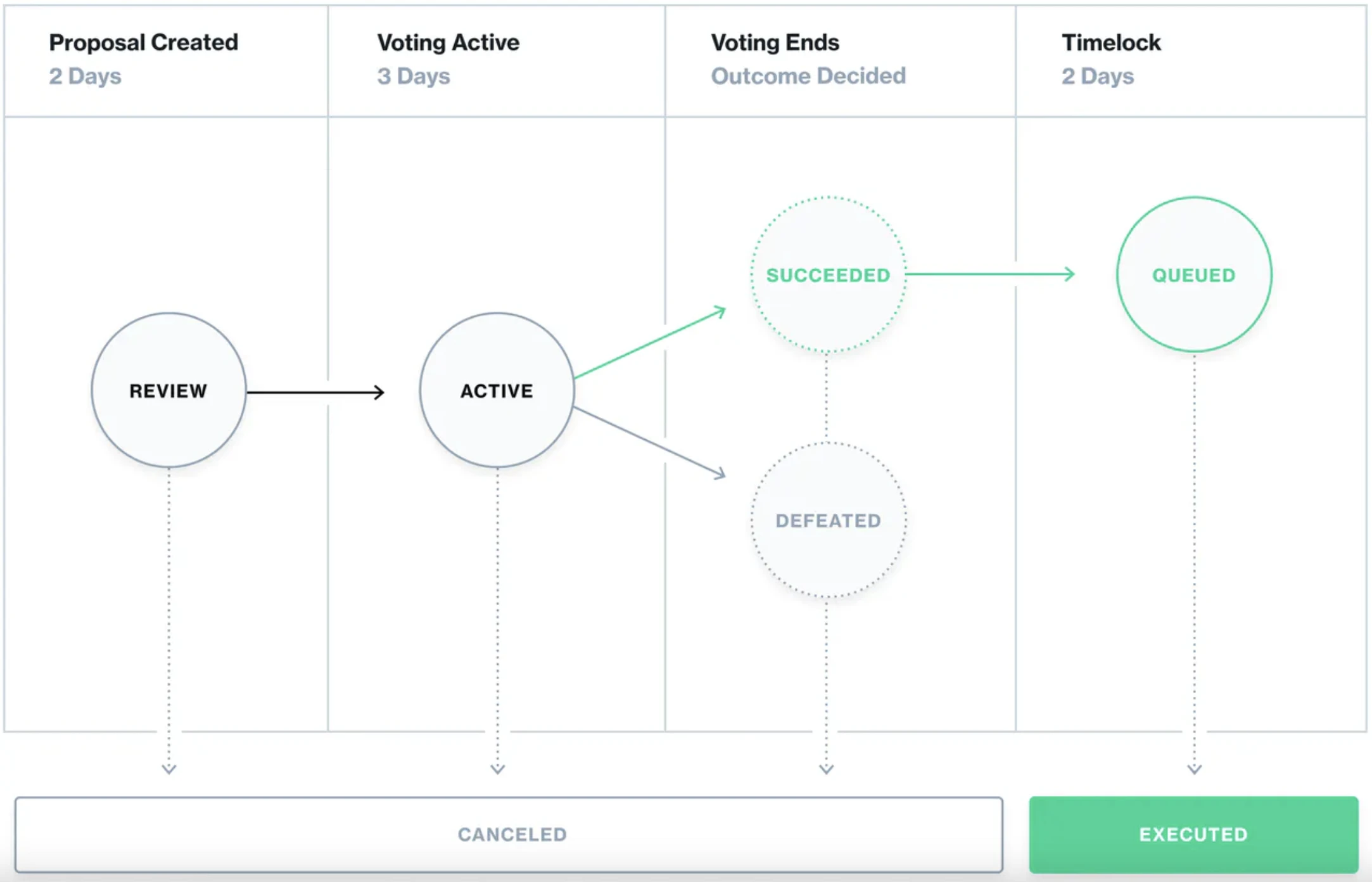

COMP token holders use three different components for management and upgrades; COMP token, governance module (Governor Bravo) andTimelock. Together, these contracts allow the community to propose, vote, and implement changes through the governance functions of cTokens or auditors. Proposals can modify system parameters, support new markets, or add entirely new functionality to the protocol.

COMP token holders can delegate voting rights to themselves or an address of their choice. Addresses authorized with at least 25,000 COMP can create governance proposals; any address can lock 100 COMP to create an autonomous proposal, which becomes a governance proposal after being delegated 25,000 COMP. Once a governance proposal is created, it will enter a 2-day review period, after which voting weights are recorded and voting begins. Voting lasts for 3 days; if the proposal receives a majority with at least 400,000 votes, the proposal will be queued in the Timelock and can be implemented 2 days later. In general, any changes to the protocol will take at least a week.

Decentralized governance: Brother Mo mentioned the Buddha during the previous discussion. In fact, if you think about it the other way around, a strong team can actually become stronger and bigger through centralization. Looking back at the decentralized governance of Compound and Aave, not only are they inefficient, but the proposals are essentially small changes that may make the protocol better, but to a very limited extent.

4. Limitations of Defi - Introduced by Compound Founder’s re-starting a business

Defi is more like a derivative of cryptocurrency. In the previous bull markets, it was closely related to the trend of the crypto market, and it has not yet reached the stage of actually solving a certain application scenario.

4.1 Turning Point – September 30, 2021 – Compound Error Distribution

The following content is quoted and modified from:Compound upgrade vulnerability: sending an extra 4 billion to users, weakness of decentralized governance

Aave has not had a major security incident so far, but the major security incident in Compound on September 30, 2021 showed the fragile side of decentralized governance, and it feels like one of the motivations for Robert Leshners departure.

Beginning of Liquid Mining in July 2020

In July 2020, Compound took the lead in issuing the governance token COMP that symbolizes voting rights. Users who use Compound to lend or borrow can receive additional COMP coin rewards. When prices soar, the COMP coin rewards obtained from borrowing may be more than the interest paid. It means you can still make money by borrowing money.

Proposition 62 September 22, 2021

According to the protocol operating rules, Compound will distribute 2,880 COMP tokens to all liquidity providers every day. Half of these tokens will be allocated to borrowers and half to lenders. However, in daily operations, Compound found that this half-and-half distribution method did not fully take into account market demand conditions, resulting in some distortions in the market (such as negative interest rates).

According to No. 62, a developer proposed to adjust the rules for issuance of COMP coins so that rewards can be adjusted freely. For example, rewards will only be given to people who lend money to attract more deposits; or conversely, to attract more deposits. Borrow more. According to Proposal No. 62, the proposal states:

The current COMP coin reward is that regardless of lending or borrowing, you can get the same interest rate. This can create adverse market conditions, such as negative interest rates. One example is the WBTC lending market. We want to provide more COMP coin rewards to lenders, but because the current rule is that the interest rates for lending and borrowing must be the same, people can end up borrowing WBTC with negative interest rates.

Simply put, Proposal No. 62 is to make the COMP coin rewards that can be obtained from lending and borrowing in the future no longer only 50/50, but can be adjusted to 70/30 or 20/80 at any time according to market demand.

The Compound community began discussing the proposal in July and formally voted on it at the end of September. In the end, nearly 730,000 COMP coins were in favor and 0 COMP coins were against, and this feature upgrade was approved without objection. After the vote is passed on September 28, according to the rules, there will be a 2-day waiting period (timelock) before the smart contract function will be truly changed.

Vulnerability appeared on September 30, 2021

Unexpectedly, the new feature was just launched on September 30, and someone immediately reported abnormal reward distribution. Some netizens posted screenshots, saying that they had tens of thousands of extra COMP coins to claim for no reason. According to Compound founder Robert Leshner, the total amount of COMP in the Compound: Comptroller contract is limited, and more COMP tokens used for mining distribution are actually stored in another contract Compound: Reservoir (0x2775b1c75658Be0F640272CCb8c72ac986009e38). The contract is still distributed normally at a rate of 0.5 COMP per block. In the most extreme case, when the tokens in the Compound: Comptroller contract are withdrawn, approximately 280,000 COMP will be affected, with a total value of approximately US$80 million. Compound may issue an additional 280,000 COMP coins, accounting for 2.8% of the total issuance.

In theory, emergency patching of program vulnerabilities is enough, but according to Compounds governance rules, each new proposal must have a 2-day review period, a 3-day voting period, and a 2-day waiting period, making the process as long as 7 days. In other words, even if a new smart contract is proposed immediately, it will not take effect until 7 days at the earliest. Distant water cannot save near fire. Program vulnerabilities are a common occurrence in software development and should be patched urgently. However, according to Compounds governance rules, each new proposal must have a 2-day review period, a 3-day voting period plus a 2-day waiting period, and the procedure can take up to 7 days. In other words, even if a new smart contract is proposed immediately, it will take 7 days at the earliest to take effect.

Therefore, the development community has to start from areas unrelated to smart contracts. They started by removing the COMP rewards screen on the Compound website. Although the wrong rewards have been sent out and the functions cannot be updated for the time being, at least users do not have a screen, so it is difficult to take screenshots and spread them widely.

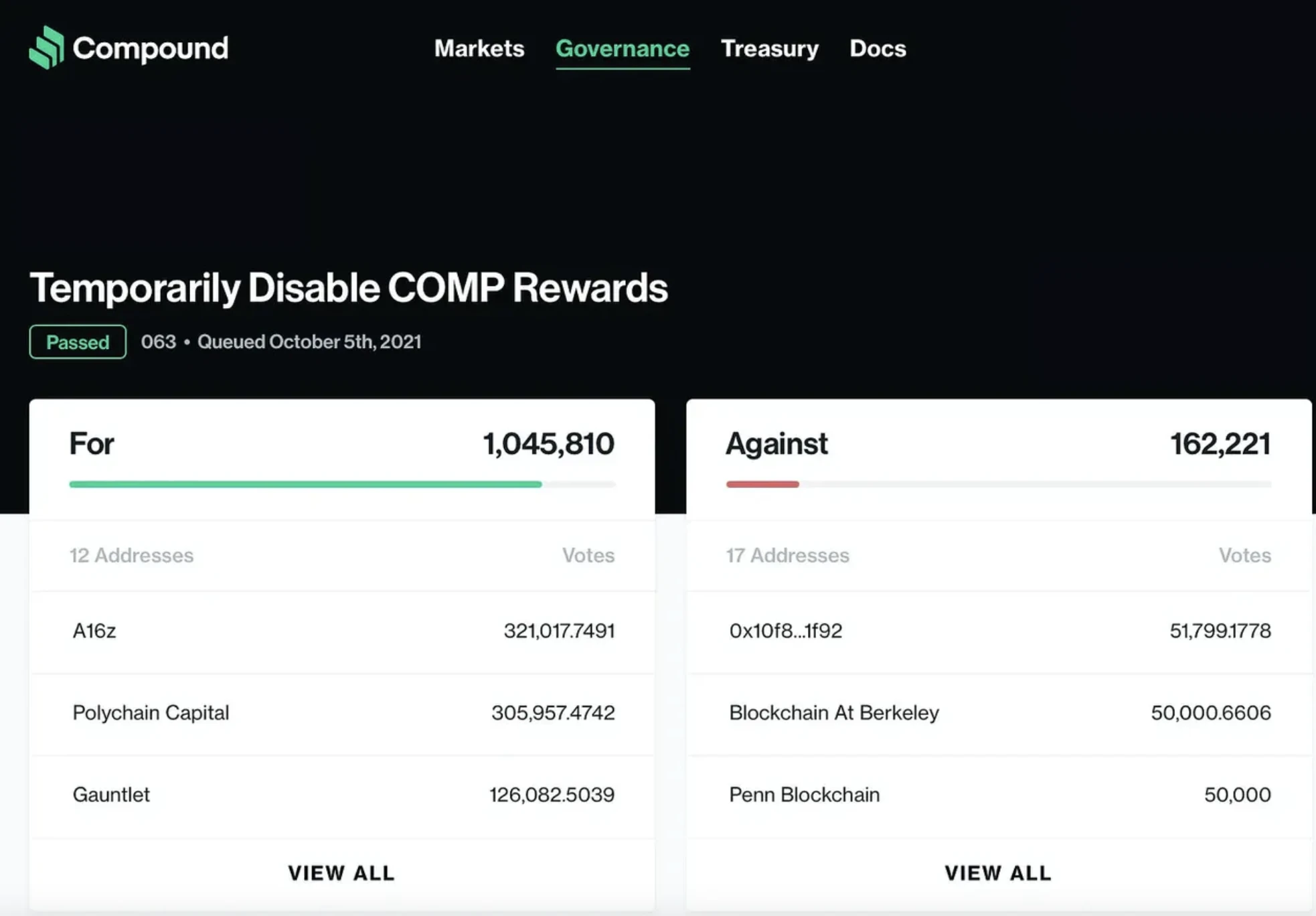

Within 2 hours after the incident, the community immediately drafted Proposal No. 63 to urgently stop the issuance of COMP coin rewards. According to the proposal description:

This proposal will temporarily stop the issuance of COMP rewards. Because there is an error in the distribution mechanism of Proposal No. 62, users can borrow certain assets and obtain excessive COMP coin returns. This proposal will temporarily halt the issuance of COMP coins until the correct mechanism is restored.

Twelve public representatives voted in favor and 17 against. Its just that decentralized governance counts not the number of people, but the votes of COMP coins. In the end, the proposal was passed with 1 million votes in favor and 160,000 votes against.

What is the reason for voting no?

The answer is hidden in Compounds forum. Developers of the automated financial management robot Yearn and idle.finance have come forward to say that this emergency proposal will undermine integration with other DeFi. Therefore, it is recommended that everyone vote against it.

As a veteran lending service, Compound has many DeFi applications built on Compounds lending market, creating more diverse financial innovation services based on its lending rates and COMP coin rewards.

If we use Lego as an analogy, Compound is like the lowest basic brick, while Yearn and idle.finance are other building blocks built on top.

Proposition No. 63 is an emergency braking measure that may disrupt the integration of services such as Yearn and idle.finance with Compound, affecting the normal operation of other DeFi applications. Thats why the community is divided into two factions. Some people think that the bleeding of Compound should be stopped first to prevent the currency price from falling. But some people think that DeFi applications built on Compound should be taken into account.

In the past, everyone always said that DeFi is like Lego bricks, but in times of crisis, it looks a bit like a house of cards made of stacked cards.

In addition, Compound developers are also on Twitter. In addition, Compound developers are also calling on users who have received unexpected rewards on Twitter to return 90% of the extra rewards to the smart contract, and they can keep 10% as White hat hacker rewards.

Robert Leshner, the founder of Compound, threatened on Twitter that users who received overpaid COMP coins would hand over their information to the IRS if they did not pay back, implying that they would be subject to tax audits and doxxing.

October 8, 2021

On October 8, the decentralized lending protocol Compound Finance announced the adoption of Proposal 064 to fix the COMP Accrual Bug. The purpose of this proposal is to fix the previous bug in the abnormal allocation of COMP for liquidity mining. The proposal states that this update will attempt to fix the token distribution vulnerability caused by the implementation of proposal 062. Until the problem is completely resolved, the exchange rate of the 6 affected trading markets (cTUSD, cMKR, cSUSHI, cYFI, cAAVE and cSAI) will be affected. Users will not be able to receive rewards from their staked COMP.

The proposal was mainly drafted by community members who originally proposed the upgrade, with 1037, 107 votes in favor (voters included 27 key addresses such as Compound CEO Robert Leshner, a16z, Gauntlet and Pantera Capital) and 0 votes against.

4.2 Robert Leshner left Compound and started his own business again

On June 28, 2023, Blockworks reported that it received $4 million in equity financing. Investors participating in this round include ParaFi Capital, 1kx, Cumberland Ventures, Coinfund, and Distributed Global. On June 29, 2023, Compound founder and CEO Robert Leshner announced the establishment of a new company, Superstate. The company is targeting the current hot field of RWA. They are committed to purchasing short-term U.S. Treasury bonds and putting them on the chain, making secondary records through the blockchain, and directly The ownership share of the circulating fund is traded on the chain.

At the same time, Compound announced the appointment of a new CEO-Jayson Hobby, who works for well-known companies such as Coinbase and Uber. If compared to many other projects, CEO starting a business is considered a negative behavior, but the optimistic market sentiment is considered to be a message for Compound to explore RWA. In the six days from June 25 to June 30, the maximum increase was about 100%.

Superstate is focused on developing regulated, compliant investment vehicles using public blockchains that are accessible to U.S. investors. The company, led by Robert Leshner, founder of DeFi lending platform Compound, has earmarked funds for team expansion, creating private equity funds for institutional investors, and developing a framework for tokenized public funds.

Robert Leshner said about DeFi at the Permissionless conference in Austin, Texas (September 11-September 13, 2023): “I have a strong opinion on this, institutions are not coming. These institutions are not interested in trading. Or borrowing Ethereum, or Chainlink tokens, or some random shitcoin that someone made last night at 2 a.m. isn’t that exciting**. “They (financial institutions in this case) like the idea of DeFi — they like to use it as a more powerful, more The idea of a transparent, more efficient, cheaper, better way to build financial products,** but they are more inclined to use it to trade traditional assets like stocks, bonds and currencies rather than cryptocurrencies. He believes that TradFi institutions Want to use DeFi technology without buying into the token economy that the ecosystem relies on. In his view, traditional financial companies joining DeFi will need to tokenize traditional financial assets and abandon crypto-native assets. Leshner said: “This is A huge divide that will define DeFi for the next decade.

Leshner believes that the first wave of DeFi protocols showed institutional investors what was possible with tokenized assets, and that these tools were perfect as proof-of-concepts about what smart contracts or distributed technologies could do.

On November 15, according to Coindesk, the blockchain-based asset management company Superstate completed US$14 million in financing. This round of financing was led by CoinFund and Distributed Global, and included Arrington Capital, Breyer Capital, CMT Digital, Department of XYZ, Folius Ventures , Galaxy Digital, HackVC, Modular Capital, Nascent and Road Capital Management participated in the investment.

So looking back, the interpretation of market distortion in June was entirely due to the rise of RWA narrative at that time and the obvious market FOMO sentiment. Whether judging from Robert Leshner’s speech and Twitter title, or judging from the official websites of Compound Labs and Superstate, the core members of Compound Labs should have differences in strategic development.

4.3 Thinking

In fact, the small case above is a microcosm of the development trend of Web 3.0 - a simple summary is what many people have been discussing recently, the currency circle and the chain circle. One group believes that Web 3.0 will lose its meaning without currency, so it requires waves of new narratives, and then on top of economic models and Ponzi innovations, such as: Friendtech and Blast; the other group believes that the important process of Mass Adoption is Give up Token and bring the technical advantages of blockchain directly into traditional industries, such as: RWA advocates (of course, there are also those who choose to weigh between the two, such as MakerDAO, EndGame mining + treasury become RWA).

Regarding the extremely slow iteration speed of the Compound team and the TVL accumulated by relying on the first-mover advantage, Leshner realized that Defi has no barriers, and decentralization cannot be a barrier. He believes that a group of really rich people will not be interested in even Chainlink or Eth. You don’t have to be interested. What you are interested in is how blockchain can revolutionize the financial system.

After the last discussion, I am thinking about some questions: What problems does decentralized lending solve? Perhaps Compound’s option could one day seamlessly plug into RWA, introducing a “giant pump”? But if Compound had this idea, would Robert Leshner still leave? Isn’t it enough to directly combine Compound IV with RWA?

references

Interpretation of the DeFi industry: Compound, a lending platform based on Ethereum - Weiyang.com

Bisheng Capital: Compound Finance Investment Analysis Report-ODAILY

Learn about Compound, a star project in the lending industry, in one article.

Compound Labs founders developing regulated financial products for the blockchain

Superstate is moving real-world assets to the digital space

Data related

IntoTheBlock - On-Chain Crypto, DeFi & NFT Analytics

IntoTheBlock provides real-time on-chain analytics and market intelligence on crypto assets.

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

About E2MResearch

From the Earth to the Moon

E2MResearch focuses on research and learning in the fields of investment and digital currency.

Article collection:

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

nft://undefined/undefined/undefined? showBuying=true&showMeta=true

Follow on Twitter :https://twitter.com/E2mResearch

️Audio Podcast:https://e2m-research.castos.com/

Small universe link:https://www.xiaoyuzhoufm.com/podcast/6499969a932f350aae20ec6d

DC link:https://discord.gg/WSQBFmP772