Organize - Odaily

Edit - 0xAyA

1. Market transactions

1. Spot market

Last week, BTC price experienced a daily level correction. As of press time, BTC was temporarily trading at $41,049, a drop of 5.52% in the past week.

It can be seen that the BTC price has once again stepped back to the 41,000 level within the 4-h level window. If this support can be firmly established, the rising market can still continue.

It can be seen that the BTC price has once again stepped back to the 41,000 level within the 4-h level window. If this support can be firmly established, the rising market can still continue.

2. GBTC performance

2. GBTC performance

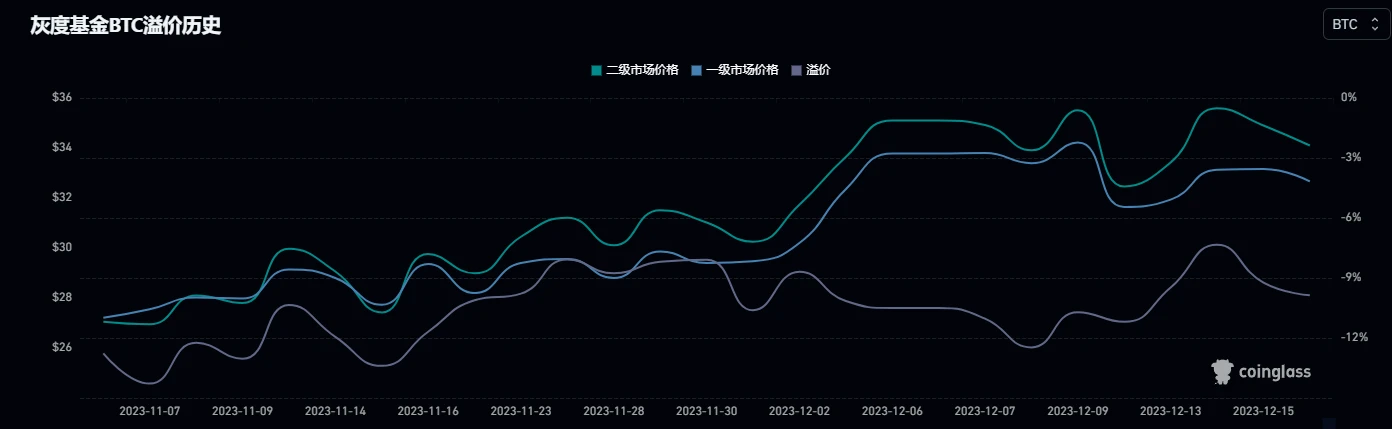

this weekGBTCThe discount range continued to expand, with the primary market price at 37.83 per share and the secondary market price at 34.1 per share, with a discount rate of -9.86%.

3. Futures

3. Futures

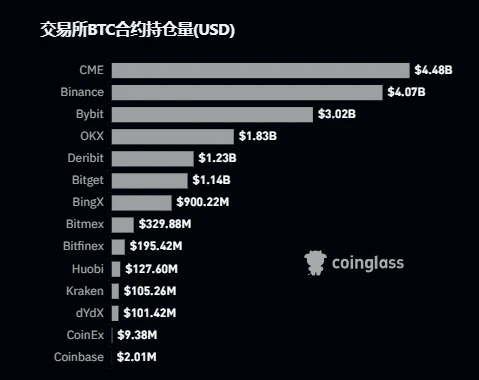

BTC Perpetual Contract Funding RateIn terms of funding, the USD contract funding rate on HTX is the highest at 0.0905%, and the USD contract rate on dYdX is the lowest at -0.0010%. Quarterly delivery prices range from US$41,000 to US$43,000. In terms of BTC contract holdings, CME continues to rank first with a holding of $4.48 billion; followed by Binance with a holding of $4.07 billion; Bybit ranks third with a holding of $3.02 billion.

4. Options

Total BTC holdings this weekto US$136.725 billion. The option holding ratio has not changed significantly compared with last week, with call options accounting for 64.46% and put options accounting for 35.54%. In terms of specific positions, the total position of call options is 259,493.66 BTC, while the total position of put options is 143,066.16 BTC. The dominant position of call options in the market remains unchanged. As the overall market correction, most of the positions in the market Still bullish on Bitcoin, positions will continue to expand.

2. Mining

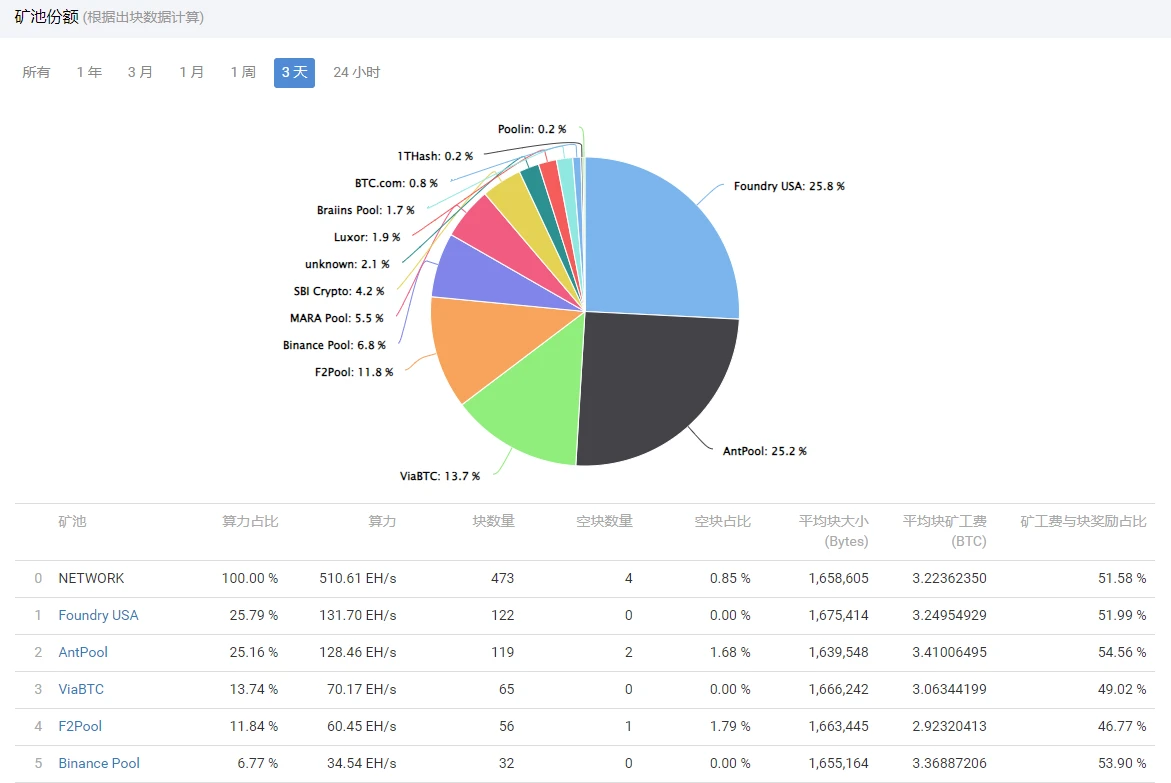

according toBTC.comAccording to data, the BTC network computing power this week is 510.61 EH/s. Seven days ago, the difficulty of the entire BTC network decreased by 0.96%. Six days later, the difficulty of the entire network is expected to increase by 1.31%, as shown below:

The top three mining pools are still Foundry USA, AntPool and F 2 Pool, accounting for 29.81%, 26.35% and 11.23% respectively. As follows:

The top three mining pools are still Foundry USA, AntPool and F 2 Pool, accounting for 29.81%, 26.35% and 11.23% respectively. As follows:

Iris Energy announces spending $22.3 million to purchase 8,380 Bitmain mining machines

Bitcoin mining company Iris Energy announced that it will spend $22.3 million to purchase 8,380 Bitmain T 21 mining machines. Scheduled to ship in the second quarter of 2024, it will increase the company’s self-mining capacity from 5.6 EH/s to 10 EH/s.

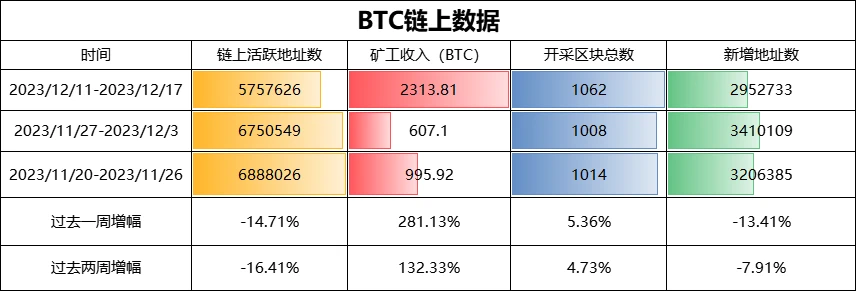

glassnodeData shows that the number of active addresses on the BTC chain in the past week was 5,757,626. The income of miners has increased significantly due to the surge in gas fees, reporting 2,313.81 BTC. The total number of mined blocks was 1,062, and the number of new addresses was 2,952,733.

3. Ecological Progress

(1)Ordinals

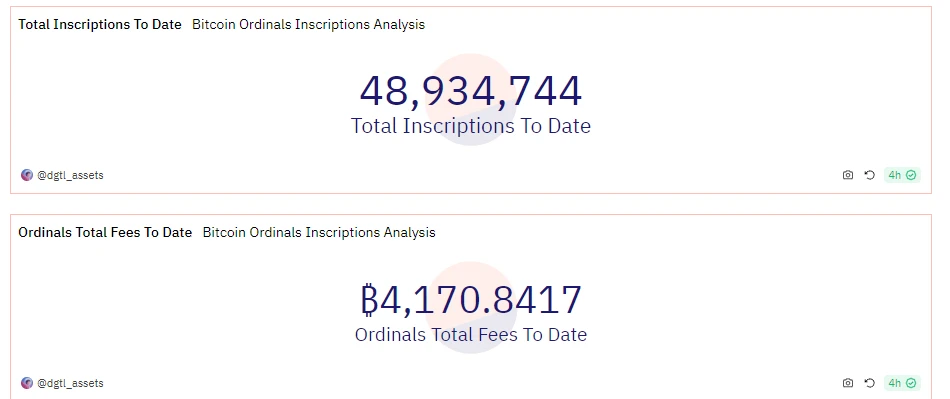

Data Display, the total number of inscriptions minted by Ordinals has reached 48.934 million, and the total cost incurred so far has reached 4170.8 BTC, equivalent to approximately US$172 million.

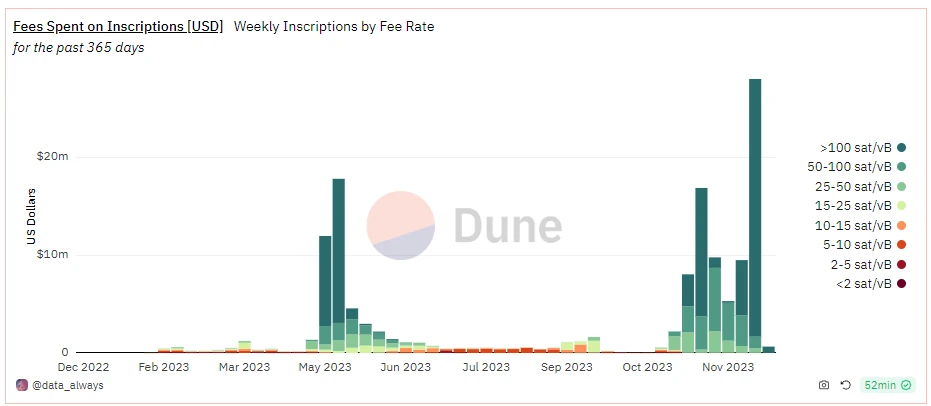

inscriptionIn terms of revenue, Inscriptions revenue and expenses reached a new high this week, reported at US$28.06 million.

Cosine: Maliciously stuck inscription transactions are possible with low transaction fees

X platform user @BTW 0205 posted a message stating that there is a malicious behavior: Buyers initiate ultra-low gas transactions to purchase inscriptions, making it impossible to complete the transaction in the short term. After the price rises, the transaction is accelerated, and after the price falls, the transaction is canceled.

In this regard, Cosine issued an article on the X platform stating that due to the PSBT signature mechanism used by the trading platform, the transaction can indeed be maliciously occupied for a certain period of time. RBF can be used to accelerate transaction success, but will not accelerate transaction cancellation (the cancellation is actually the low-fee transaction before the success, but in theory there will eventually be a successful transaction as agreed by the sellers PSBT).

OKX Web3 Wallet Ordinals market total transaction volume exceeds US$500 million

Dune data shows that the total transaction volume of the OKX Web3 wallet Ordinals market has now exceeded US$500 million, reaching US$503,361,400, accounting for approximately 58% of the total transaction volume of the Ordinals protocol, which is close to US$865 million. In addition, the total number of transactions in the OKX Ordinals market is 329,019, and the number of independent addresses is 76,927.

It is reported that the OKX Web3 Wallet Ordinals market is the largest BRC 20 inscription and BTC NFT trading market. The OKX Ordinals market is completely decentralized, with no platform service fees for interactions, and supports multiple functions such as one-stop transfer, trading, and engraving of BRC-20 and BTC NFT.

(2) Lightning Network

Lightning Network DEX BitTrust went online and the number of addresses exceeded 3,000 in 24 hours

According to official news, the number of addresses on BitTrust has exceeded 3,000 in less than 24 hours since it went online.

BitTrust is a decentralized trading platform running entirely on the Lightning Network, providing trading services for INSCRIPTION and BRC-20 tokens. In the future, BitTrust will also enable seamless interoperability between other assets (such as NFTs) and BRC-20 tokens.

Nostr Assets has opened TREAT/TRICK airdrop applications for ORDI holders

The Bitcoin Lightning Network Nostr Assets Protocol announced on the

In addition, users holding ORDI will receive an additional 10% airdrop in their OKX wallet, for a total of 110 TRICK or TREAT tokens. The application period is from 11am on December 11, 2023 to 8am on December 31, 2023.

According to previous news, Nostr Assets Protocol announced the Fair Mint details. The total number of NOSTR tokens is 21, 000, 000, and 18, 900, 000 will be allocated for the Fair Mint event. The first phase will start on December 11, and subsequent phases will be announced separately. announced. In addition, Nostr Assets Protocol stated that it will airdrop to ORDI holders, and the snapshot will be completed at 05:00 (UTC+ 8) on December 5.

(3) Other projects:

Bitcoin ecological project Tap Protocol completed US$4.2 million in financing, led by Sora Ventures

Tap Protocol has completed US$4.2 million in financing. This financing was led by Sora Ventures, LD Capital, Cypher Capital, Rw 3, Oak Grove Capital, Perock Capital, Kosmos Ventures, New Tribe Capital, Cogitent Ventures, Compute Ventures, MSA Novo, etc. Institutions and angel investors such as Animoca Brands executives and Quantstamp executives participated in the investment.

Tap Protocol is a product of German company Trac Systems, and the financing will be used to support the company’s growth. Tap Protocol offers a range of features, including the segmentation of Inscriptions and enabling DeFi applications on Inscriptions. The protocol is designed to discover and track ordinal numbers, facilitating OrdFi applications without the need for complex Layer 2 layers.

4. Other news

Ordinals Opponent, PoW Inventor Adam Back: You Can’t Stop JPEG on Bitcoin

Ordinals opponent and PoW inventor Adam Back posted on the X platform: You cant stop JPEG on Bitcoin, complaining will only make them do more. Try to stop them, and they will do it in a worse way. .High fees drive Layer 2 adoption and drive innovation. So relax and develop.”

As Odaily reported in January, an NFT protocol emerged on the Bitcoin mainnet, and the crypto community was divided over whether it would be beneficial to the Bitcoin ecosystem. The protocol is called Ordinals and was created by software engineer Casey Rodarmor. Blockstream CEO and Bitcoin Core developer Adam Back is not happy with Bitcoin being introduced into meme culture, suggesting developers bring silliness to other places.

Bloomberg ETF analyst James Seyffart said on The Scoop podcast that a Bitcoin spot ETF is likely to be approved before 1/10/24. That’s because by this time Ark and 21 Shares’ ETF applications, which were first filed in April, have reached their final deadlines. The SEC has been strategically delaying to avoid giving one company a first-mover advantage. However, Grayscale’s ETF application is currently different from others and may not be approved at the same time.