Original author: Loki, ABCDE researcher

1 Overview

This article introduces the Surf Protocol, which aims to provide an unlimited number of tradable assets, low fees, and transparent settlement, enabling permissionless derivatives trading on almost any asset.

2. When will decentralized derivatives have their “Uniswap moment”?

2.1 Question

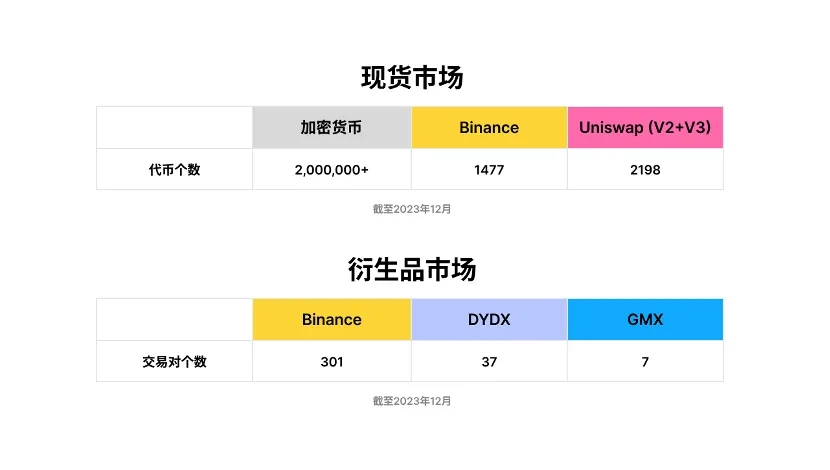

The potential of decentralized derivatives remains untapped.According to Coinmarketcap data, as of December 2023, there have been more than 2 million issued cryptocurrencies. Among them, Binance, the largest, has opened a total of 1,477 trading pairs of 394 tokens, while Uniswap, the largest decentralized exchange, provides at least 2198 active trading pairs (v2+v3).

However, in the field of derivatives, there is still a huge gap between the richness of the decentralized market and the centralized market. Currently, Binance provides 301 derivatives trading pairs, while dYdX and GMX only provide 37 and 7 trading pairs respectively.

Since the FTX incident, the market has paid particular attention to the decentralization of asset custody in the derivatives trading market, and both CEX and DEX are exploring various possible asset decentralization solutions. But just like when people talk about Uniswap, it is easy to think of “Decentralization” and ignore “Permissionless”. “Permissionless” is also underestimated in the field of derivatives. The “Uniswap moment” of decentralized derivatives must be permissionless.

2.2 Solution

The problem with the underdevelopment of the derivatives market, especially some long-tail assets, NFTs, and emerging assets, is not that there is insufficient buying/selling demand in the market, but that there are insufficient liquidity providers and an effective supply and demand matching mechanism.

Surf Protocol enables permissionless derivatives trading through voluntary liquidity provision and a risk-adjusted fee structure. Simply put, a liquidity provider (LP) voluntarily provides liquidity and bears the profits or losses of another trader on any specific asset position. The price of the contract is determined by a combination of Oracle and TWAP prices. The risk structures of currencies with different liquidity, market capitalization, and volatility are also different, so LPs can choose their own fee structures. With enough LP providers, market competition will eventually lead to an optimal allocation.

3. Surf Protocol design plan

3.1 Transaction structure

Let’s first review the design of Spot DEX. Whether it is Uni V2, V3 or Curve, they are all implemented through LP. The essence of providing liquidity is to place a certain number of pending orders in different ranges. The collection of these pending orders forms liquidity for traders to use. LP is a passive transaction. LP provides the service of unconditionally becoming the counterparty of the trader and charges a certain fee as consideration. From the perspective of risk structure, providing liquidity is equivalent to shorting volatility, and impermanent losses are the realization of volatility gains and losses. In contract trading, LP is not necessarily equivalent to shorting volatility; due to the existence of leverage, it is easier for users to stop losses and liquidate positions when volatility is high, so LP may gain additional income; described in another way , LP will not only not suffer impermanent losses, but will even obtain impermanent profits, which is the opposite of what is commonly known as the price does not change, the position is gone. Based on this point, LPs leveraging behavior is actually beneficial to LP, just like the banker in a casino does not use the principal to gamble 1:1 but runs this kind of business with no capital and huge profits.

It can be seen that if we hope to realize a trading market, the most important thing is to pay a reasonable consideration to obtain an unconditional counterparty. Surf Protocol is designed to build on this. On Surf, Liquidity Providers (LPs) provide liquidity and take the opposite side of a traders position on any given trading pair. The model is based on the following assumptions:

① Without considering transaction friction, when there are enough trading activities, the trader’s overall mathematical expectation of profit approaches 0. itself tends to be negative. Of course, this is a consensus based on the stock market and the foreign exchange market.

② Considering transaction wear (handling fees, wear, slippage, liquidation), when there are enough trading activities, the limit of the traders overall mathematical expectation of profit is < 0.

③The limit of the traders overall mathematical expectation of profit < 0 means that the limit of the mathematical expectation limit of his counterpartys profit > 0 .

This gives it a positive expected value in the long run. The pools are separate for each asset as we believe each asset carries special risks that should not be contagious to other trading pairs. This structure not only isolates the risks between different assets and ensures the independence of assets, but also expands the opportunities for liquidity guidance for newly issued assets.

3.2 Effectiveness of economic incentives

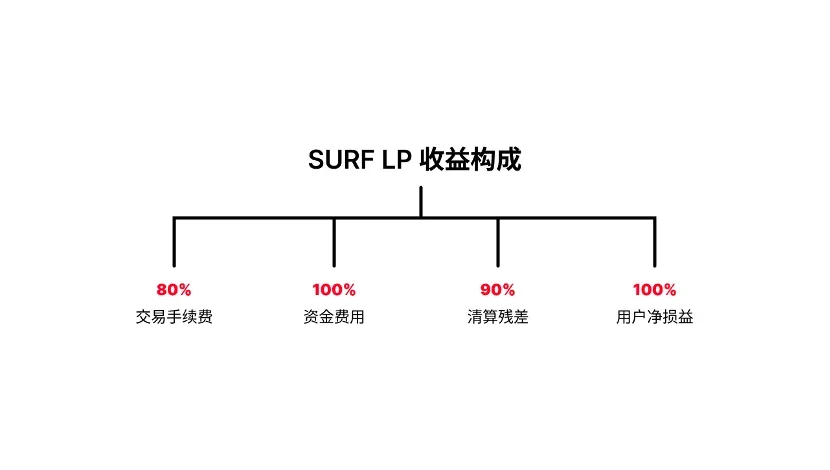

The essence of providing liquidity is to become a counterparty to traders, so the key issue is how to ensure the effectiveness of economic incentives. On Surf, LP can obtain at least 80% of transaction fees, 100% of funding rates, 90% of liquidation residuals and 100% of user net profits and losses. These benefits ensure that LP has a positive mathematical expectation in the long term. to compensate for the risks you take. At the same time, due to the huge benefits of operating LP, the LP of each new asset has the incentive to attract more users to join the trading pairs of the pool created by them to maximize benefits.

In addition, Surf provides two additional designs:

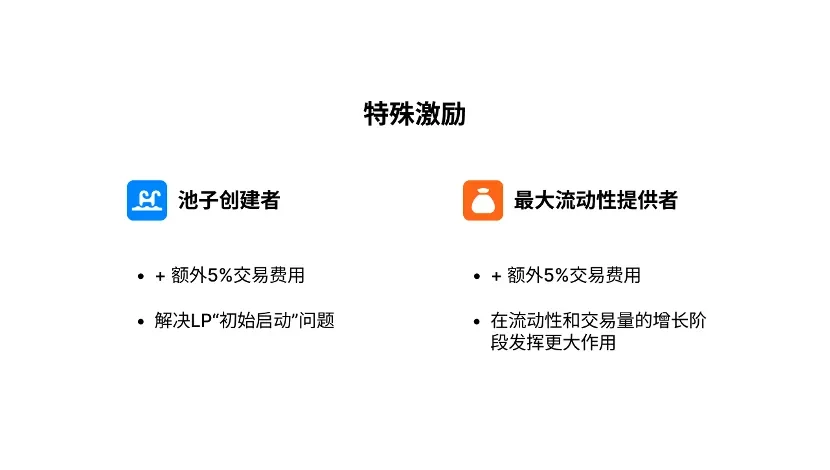

(1) Special incentives.The creator of each pool on Surf is able to receive an additional 5% in transaction fees, and the largest LP in each pool also receives 5% in transaction fees. A common problem in the DeFi field is whether there is transaction demand or liquidity first. The 5% start-up reward can well solve the initial startup problem, while the 5% reward for the largest LP will be divided between liquidity and liquidity. The growth phase of transaction volume plays a greater role.

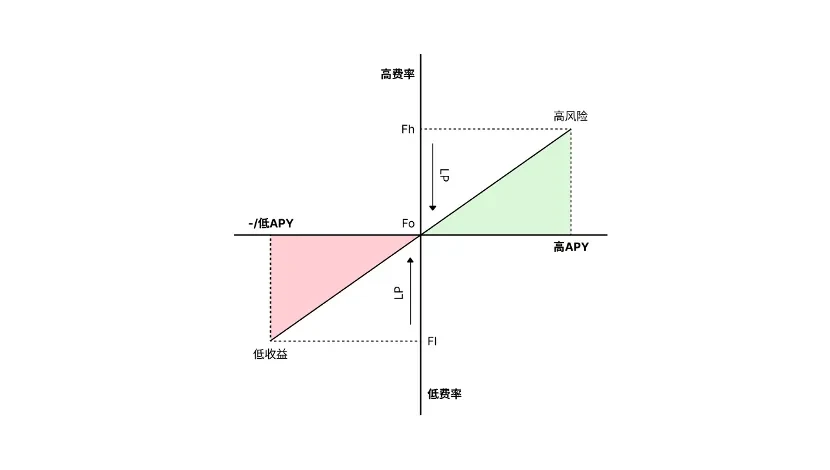

(2) Gradient handling fees.Surf currently has five fee options set up: 0.05%, 0.1%, 0.3%, 1%, and 3%. Liquidity pools are used as counterparties to all trader positions, executing orders in order from lowest to highest fee tier. The purpose of this design is to be compatible with as many asset types as possible and promote the market to form effective resource allocation. If the fees currently offered by LPs are too high, other LPs will have an incentive to offer lower rates if they can profitably do so, and the involution will continue until market equilibrium is reached. The same LP can also allocate its funds among different fee levels.

3.3 Oracle and liquidation

No derivatives solution can circumvent oracles and liquidation issues, which also exist in Sur Protocl. In terms of mainstream assets, Surf adopts a common weighted average calculation method to ensure that prices are relatively fair and safe; for Uniswap assets, Surf innovatively proposes a price comparison plan of 30-block TWMP average price + spot price to ensure that the oracle machine is lightning-friendly. Common languages such as loans and cross-block attacks and the stability of attacks also prevent the arbitrage risk to LP caused by price delays caused by the introduction of average prices.

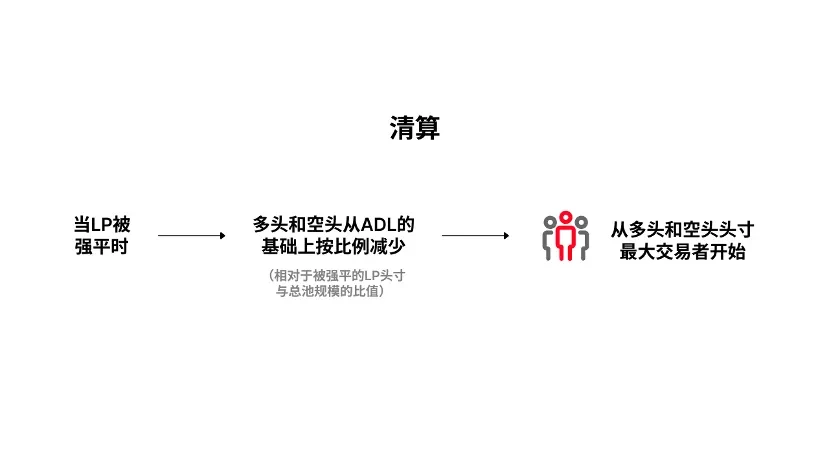

In addition, Surf Protocol introduces the concept of Leveraged LPs, which means that LP can achieve several times the capital efficiency, but it also brings corresponding risk amplification. Think of the LP and the trader as two sides of the transaction. The profit of either side is close to the other partys principal, which means a potential short position. In this case long and short positions will be reduced proportionally from the ADL (relative to the ratio of liquidated LP positions to the total pool size), starting with traders with the largest long and short positions.

4. Towards a future of decentralized derivatives

In addition to the protocol itself, we also see some interesting directions:

4.1 Unmanaged and unlicensed

Looking back at history, after the competitive landscape of the top centralized exchanges has been basically established, we can still see many medium-sized exchanges flourishing from 2018 to 2020, and after that, permissionless exchanges such as Uniswap and Curve emerged. With centralized exchanges, this pattern is likely to be repeated in the derivatives circuit. Since 2023, NFT, Brc-20, and Socialfi have brought us a large number of new assets, and the needs of these new assets and long-tail assets urgently need to be met.

4.2 Transaction/Counterparty Netting

The starting value of LP tokens for each specific pool in Surf is 1 . All subsequent activity and accrued value is returned to the pool and will be reflected in the price of the token. This includes transaction fees, profit and loss for traders, borrowing fees and liquidation fees. This feature provides us with an idea - whether it is possible to net/tokenize both sides of the counterparty. One of the simplest examples is tokenization, buying tokenization Its equivalent to buying a fund operated by a trader. Another example is LP ETFs, which reduce single point risk by spreading funds across different LP pools and provide the possibility for more professional liquidity management.

4.3 Competitive market brings optimal allocation

The market may not need to reinvent Binance or GMX, but a Perp version of Uniswap that is compatible with as many new assets as possible is necessary. Providing derivatives liquidity for different assets carries different levels of risk, so different rates need to be charged to meet the needs of risk compensation. In the same case, NFT once charged high transaction fees + high royalties, and some MEME tokens charged 5% -10% transaction tax. Although we cannot determine the most efficient mechanism arrangement, it is possible for the market to gradually approach the highest efficiency through continuous trial and error and selection.

With the support of new assets and new paradigms, the Uniswap moment of permissionless derivatives trading is coming.