As Bitcoin strongly breaks through the $40,000 mark, the market seems to be starting a new cycle.

Looking back on the past two years, the brutal bear market has left a deep imprint on the cryptocurrency industry. Countless projects failed to survive the cold winter due to various problems such as funding and operations, leaving hundreds of prices along the way. Oversold coins heading lower.

If we follow the elimination rules of the cryptocurrency market that we are used to, these non-performing assets that have been falling will eventually gradually fade out of the sight of investors, and the remaining value scattered in the hands of different currency holders will gradually dissipate. However, what few people notice is thatThese scattered residual values still have a value of hundreds of millions after they are accumulated into large amounts. If an effective activation measure can be found, the disposal of non-performing assets has the opportunity to become a very valuable asset within the DeFi track. A cutting-edge segment with growth potential.

Noahswap is a representative project that has keenly captured this opportunity. As the first DeFi protocol on the market focusing on the disposal of non-performing assets, Noahswap’s sermon during Token 2049 this year left a deep impression on many participants, including us. impression.

Noahswap: the industry’s first non-performing asset disposal platform

as described above,Noahswap is positioned as the world’s first disposal platform focusing on non-performing assets, this project allows users to package their non-performing assets and USDT for mortgage, and then mint Noahswaps stable currency NUSD. The amount of NUSD that can be minted will achieve a value amplification of up to 2-10 times based on different release cycles, thereby activating And amplify the value of non-performing assets originally held by users.

The idea of Noahswap sprouted in 2020. After witnessing the blind hype and rapid collapse of the industry, the team began to cooperate with the non-performing asset processing platform of traditional finance (TradeFi) to explore the application in the cryptocurrency market that has proven effective in TradeFi. Distressed asset solutions.

Early 2022,Noahswap has completed the product prototype design and completed Pre-A round of financing; in the past October, Noahswap received another US$3 million investment from Coinstore Labs.

Friends who are familiar with the disposal of non-performing assets may understand that this business requires extremely complex model calculations. Considering the inherent risks of non-performing assets themselves, how to achieve a balance between profitability and sustainability is a difficult problem that Noahswap must overcome. .

In this regard, Noahswap Chief Marketing Officer (CMO) Amanda Tan told us that Noahswap has formed a core team of actuaries. The team members all have several years of experience in financial market research and analysis and have participated in over 10 billion U.S. dollars of non-performing transactions. Asset disposal cases, and in the process accumulated rich experience and industry resources in handling non-performing assets. For various potential risks, Noahswaps actuary team has developed as many as 167 evaluation models, trying to find the best balance between risk and return.

Amanda Tan also has more than 8 years of experience in the disposal of non-performing assets. She has held senior positions in well-known financial institutions in the United States, responsible for managing and solving various complex non-performing asset problems, and is familiar with the classification, evaluation, disposal, monitoring, and auditing of non-performing assets. Through other processes and methods, we have handled a total of US$260 million in non-performing asset projects.

Asset value amplification? How Noahswap turns bad things into magic

In the previous article, we outlined the business operation model of Noahswap, but there may still be many readers who fail to understand exactly how Noahswap activates and amplifies the value of non-performing assets. Next, we will take you through a step-by-step tutorial to take a closer look at the magic details of Noahswap.

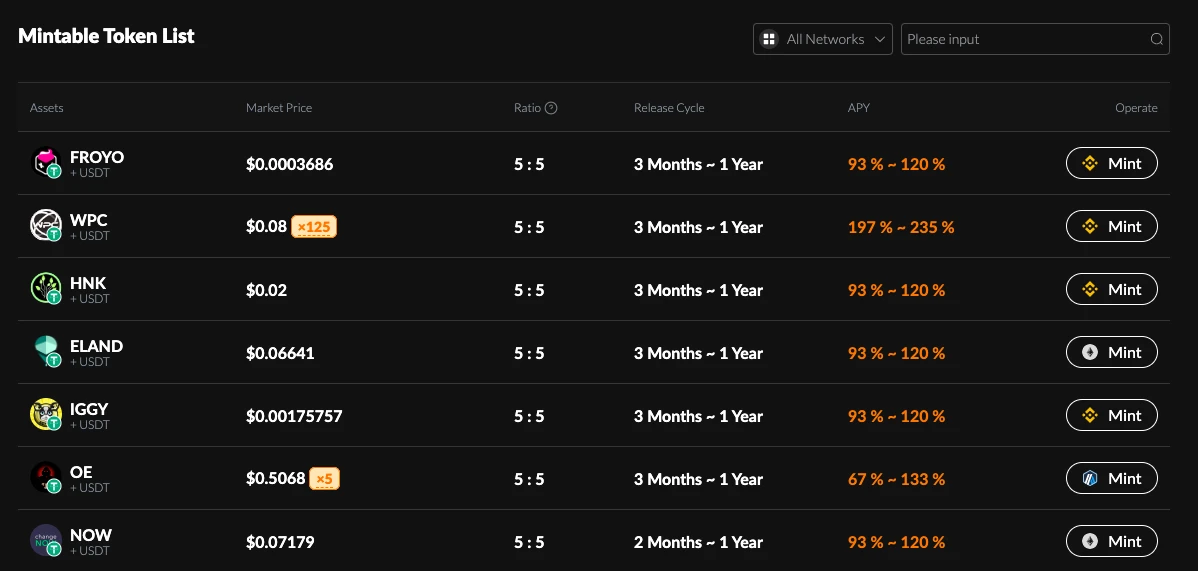

First we enter Noahswap’s official website (https://noahswap.io). On the Markets page we can see a large number of Mintable Tokens. It should be noted that the mintable tokens here refer to non-performing assets that can be used as collateral to mint NUSD. Currently, Noahswap has supported the above in multiple ecosystems such as Ethereum, Polygon, BSC, and Arbitrum. Thousands of mintable tokens.

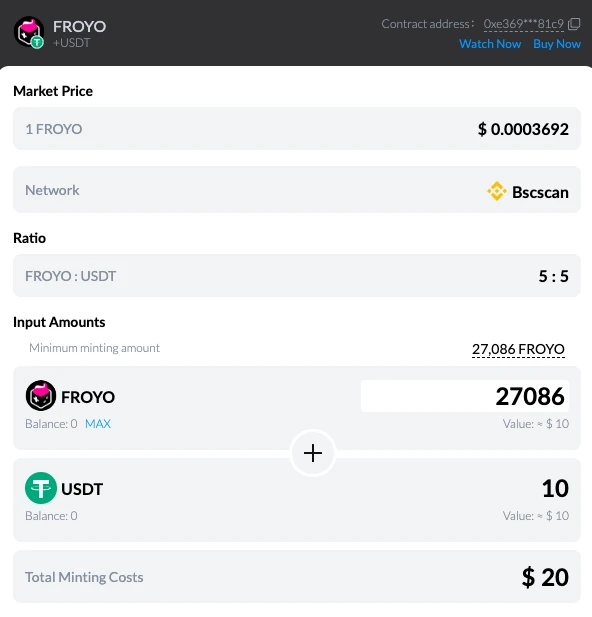

Next, we randomly select a token (such as FROYO at the top) for subsequent creation. After clicking the Mint button, we will see that Noahswap requires users to package and mortgage FROYO and USDT in an equal ratio (5:5, the combination ratio of each currency is different), and then mint NUSD.

It should be noted that in the previous article, we put all the words mortgage in quotation marks.The reason for this is that minting NUSD on Noahswap is a one-way operation and does not support reverse redemption., in other words, users are more like using non-performing assets plus USDT to exchange for NUSD. We will continue to explain the effectiveness of this design below.

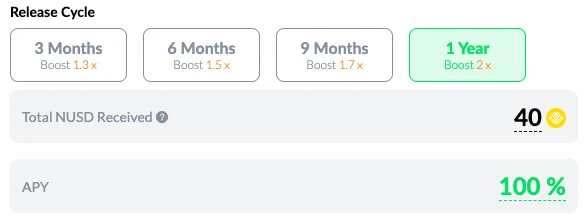

Next is the moment to witness the miracle,As shown in the picture above, the value of the FROYO + USDT asset package deposited by the user is US$20, but as shown in the picture below, the amount of NUSD that Noahswap allows users to mint exceeds 20.Specifically, depending on the unlocking time of NUSD, Noahswap allows users to mint 1.3 times to 2 times NUSD, up to 40 NUSD, doubling the nominal value.

Some readers may be confused here. Doesn’t NUSD mean that it is not fully mortgaged? Can its price maintain an effective anchor? The answer is no, because NUSD is only the denominated stablecoin used for the internal operation of the Noahswap system. Its main function is to record and determine the real-time value when users deposit assets.

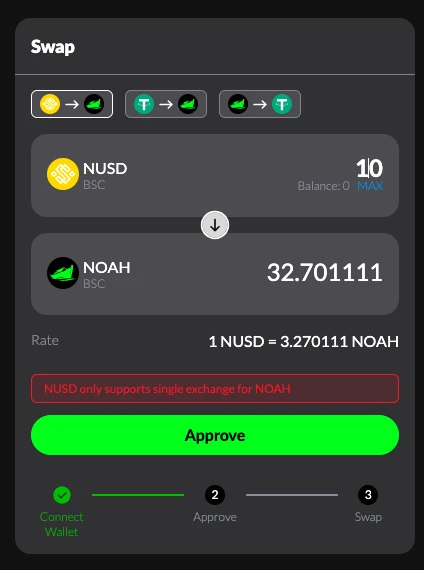

If you want to continue withdrawing earnings, users need to one-way exchange NUSD for the protocol governance token NOAH through Noahswaps built-in transaction window. In this transaction, NUSD will be fixed at 1 US dollar.

After users exchange for NOAH, if they are not worried about the fluctuation of currency prices, they can choose to sell and cash it out directly on major DEX; but if they are optimistic about the future development of Noahswap, they can also choose to continue to hold and carry out protocol governance, staking and interest-earning, etc. financial operations to gain greater returns.

It is worth mentioning that Noahswap has launched a half-month interactive airdrop event on December 15. Before December 31, all users participating in Noahswap interactions are expected to share the airdrop of 1,000,000 NOAH. As of the time of publication, the total number of participants has reached 219,000.

in summary,The uniqueness of Noahswap lies in providing a practical value activation and amplification channel for holders of distressed assets.Through this channel, users can recover certain investment losses through the value amplification of the NUSD casting process, and can use NOAH to obtain more income possibilities; in turn, project parties will also receive more sufficient liquidity support through Noahswap, unlocking more Application scenarios.

Using subsidy for traffic, how does Noahswap build a growth flywheel?

Looking at the design of Noahswaps entire business, its biggest ingenuity is to use a pure Web3 economic model to achieve a similar effect to Web2s commercial subsidies - using a clear NUSD value-added multiple to attract more potential users to mint.

From the perspective of non-performing asset holders, the long-term decline of tokens is undoubtedly an extremely emotionally draining process. If there is a window of opportunity that can help them free themselves from torture and even recover certain losses, The appeal is obviously self-evident.

As we mentioned before, Noahswap requires that the combination deposited by users (non-performing assets plus USDT) cannot be redeemed during the NUSD minting process. So what role will this part of the deposited assets play?According to the design of Noahswap, 70% of the USDT deposited by users will be used for continuous NOAH repurchase and destruction.

At the same time, in order to slow down the selling pressure caused by users exchanging NUSD for NOAH and then selling it directly, Noahswap first introduced an unlocking time limit in the NUSD minting process, and secondly, adopted a series of pledge and incentive measures to further stabilize the currency price. ,for example:

Governance participation incentives: Provide additional rewards, voting rights and other governance rights to encourage users to participate in governance instead of selling immediately.

NOAH staking function: The staking function is launched to provide additional income or rights, encourage users to lock NOAH for a long time, and reduce selling pressure.

Liquidity mining: Launch liquidity mining to reward users who provide liquidity of NOAH and other tokens, increase market depth, decentralize NOAH circulation, and balance supply and demand.

In this way,As more and more users flock to Noahswap, more and more assets will be deposited, and NOAH’s repurchase efforts will continue to increase. Coupled with a series of mechanism designs aimed at alleviating selling pressure, NOAH itself is a The mother currency of all non-performing assets will usher in better appreciation expectations, which in turn will further improve users income status, thus attracting more new users to settle in...A growth flywheel with great expansion potential has begun to take shape.

Fill the market gap and promote healthy development of the industry

Overall, the most surprising thing about Noahswap as a cutting-edge DeFi project is that it does not just fork a piece of code like the cookie-cutter DEX, lending, and derivatives on the market, and then randomly find a narrative to cover it and disguise it as a so-called Innovation, but found a new way to find the blue ocean market of non-performing assets, and found a scalable business model between the revenue needs of users and the continued growth of the platform.

The tides come and go, and new winners will be born in each cycle, but more losers will also be left behind. Today, the non-performing asset market has accumulated considerable value and is destined to grow. As the first innovative project focusing on this market, we hope that Noahswap can become the winner of the new cycle with the support of countless losers. .

After several years of precipitation, the Web3 industry has achieved considerable development, but objectively speaking, there are still many market gaps compared to the traditional world, especially in niche areas such as the disposal of non-performing assets.As believers in the Web3 revolution, we are happy to see more projects similar to Noahswap continue to emerge. Based on the real pain points of users, we propose effective solutions to fill the market gaps and help the healthy development of the industry.