Original title: Will ETFs Boost Bitcoins Liquidity?

Original author: Dessislava Aubert, Clara Medalie

Original compilation: Block unicorn

We have been keeping a close eye on cryptocurrency liquidity since the FTX collapse. Let’s make no secret of the fact: trading volume and order book depth are generally down across all assets and across all exchanges, and even the latest market rally has failed to return depth or volume to pre-FTX levels.

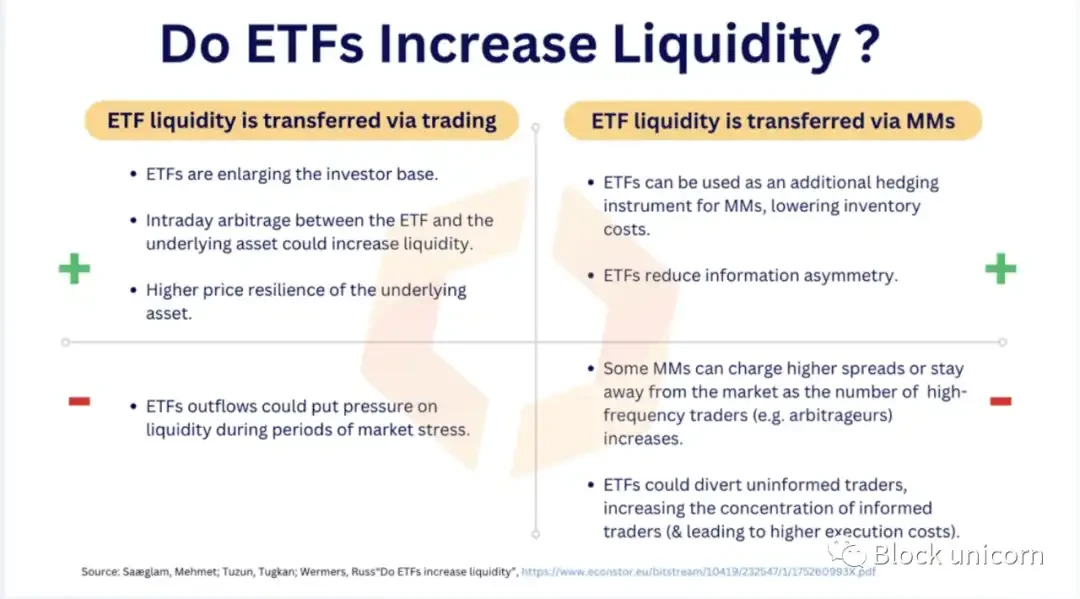

However, with the hope of possible approval of spot exchange-traded funds (ETFs) in January, expect to see liquidity really return soon (albeit with the risk of some negative impact). This can be achieved in two ways:

1. Liquidity is transferred through transactions

2. Liquidity is transferred through the market maker (MM)

On the “ETFs will increase liquidity” side, there is a compelling argument that ETFs will expand the number of cryptocurrency traders, leading to greater trading volumes and more efficient markets. Market makers will also benefit from ETFs, which may expand the scope of their activities as a hedge.

On the ETFs will harm liquidity side, the real concern is that large ETF redemptions may exert selling pressure on the underlying market. On the market maker side, they may charge higher spreads due to more informed traders. Let’s take a look at the current state of Bitcoin liquidity to understand the impact.

Bitcoin order book

The collapse of FTX caused a significant drop in Bitcoin market depth. Not only did FTXs sudden disappearance essentially reduce liquidity, but market makers also closed positions on many exchanges due to huge losses and difficult market conditions. 1% market depth, the number of buys and sells on the order book within 1% of the price, has fallen from about $58 billion across all exchanges and trading pairs to only about $23 billion.

The latest market rally has had a minimal impact on liquidity, with the slight increase observed primarily due to price effects.

In the context of ETFs, why does market depth matter? ETF issuers will need to buy and sell the underlying assets. While it’s unclear where they will do this – whether on spot exchanges, OTC, or buying from miners – it’s possible that at some point, liquidity will increase on centralized spot exchanges, Especially since many ETFs are expected to be approved in one go.

Liquidity is also important from an arbitrageurs perspective. ETF prices will need to track the underlying assets, doing so by buying and selling when premiums or discounts occur. Illiquid markets complicate the job of arbitrageurs through more frequent price dislocations, so liquidity is critical to market efficiency.

In particular, crypto exchanges available in the United States, which currently account for approximately 45% of global Bitcoin market depth, may play an important role in spot ETFs.

In 2023, Kraken had the largest average Bitcoin order book depth at $32.9 million, followed by Coinbase at $24.3 million. To provide context, Binance’s average daily market depth is shown in red.

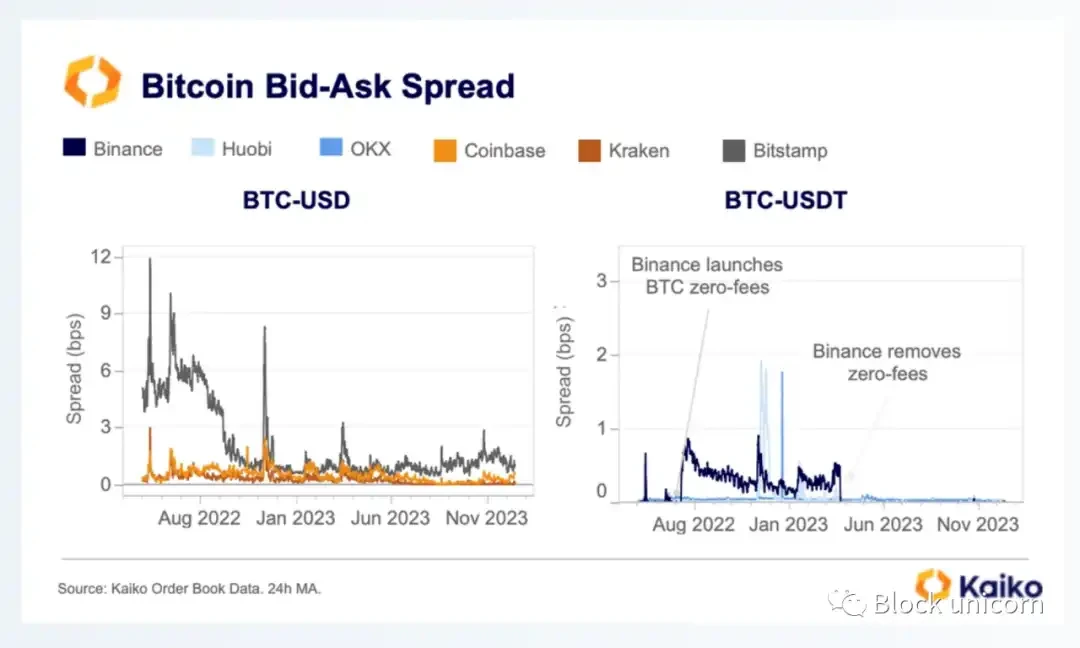

ETF approval could also impact transaction costs as more informed investors enter the Bitcoin market. Over the past year, traders costs, in the form of spreads, have mostly improved since last year, likely due to lower price volatility.

To summarize, Bitcoin market depth has remained flat most of the time (no change in liquidity), while spreads have tightened most of the time (lower costs for traders), but ETF approval may change this.

Bitcoin transaction volume

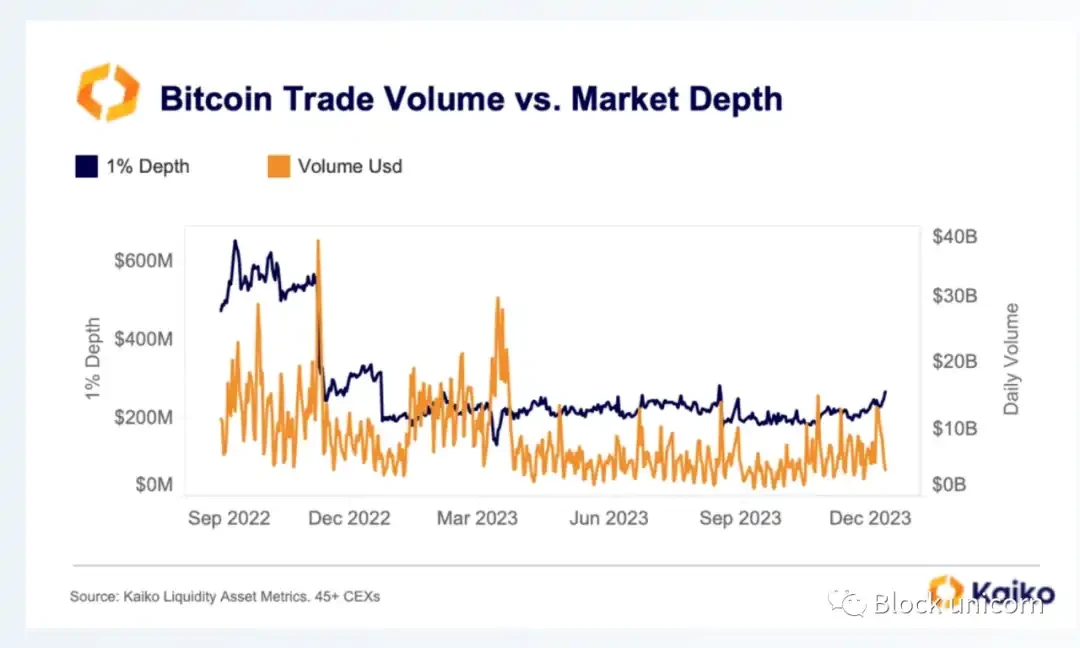

Compared with market depth, FTX has a much smaller impact on trading volume, accounting for less than 7% of global trading volume. There have been considerable fluctuations in trading volumes since November. Volumes remained elevated during the first three months of 2023 before plummeting following the March banking crisis, reaching multi-year lows over the summer.

Weve seen some slight recovery over the past few months, especially during the recent market rally, but overall, trading volumes are still well below FTXs pre-existing levels.

Therefore, when comparing trading volume to market depth, we can observe that the decline in depth since November 2022 has been more extreme, but much less volatile than trading volume throughout the year. This indicates that the level of market-making activity in the market remains unchanged, with no new entrants (or exits).

Bitcoin Dominates

Bitcoin remains by far the most liquid crypto asset and has shown the most resilience during difficult market conditions. The ETF is likely to further strengthen its dominance.

In the transaction volume distribution over the past year, we can see that Bitcoin’s transaction volume is on average about 3 times more than Ethereum and more than 10 times more than the top 10 altcoins. Notably, this trend was exacerbated by the Binance zero-fee Bitcoin trading promotion that ended in the spring.

Bitcoin’s average daily market depth is more similar to Ethereum’s, although it’s still much larger than most altcoins.

in conclusion

Bitcoin is by far the most liquid crypto asset. However, both measures of liquidity have declined sharply since the FTX collapse, with only a slight recovery over the past few months. Therefore, ETF approval is the biggest catalyst in the crypto market right now, promising huge potential upside and limited downside risk. Although there is some liquidity risk, ETFs are expected to improve market conditions overall if investor demand significantly increases.