The market in December was surprisingly good, and both the stock market and the currency circle were performing a cheerful money-making effect. The market is relatively optimistic about the Federal Reserves interest rate cut, the U.S. economy has cooled significantly, and South Koreas export indicators hint at global economic recovery; the stock markets of the United States, India, Japan, France, and Germany have successively hit record highs; the price of Bitcoin has exceeded $44,000, and the United States and Hong Kong Virtual asset ETFs are on the verge of development, and everything seems to be moving in a brighter direction.

In the early morning of December 14th, Beijing time, according to the minutes of the Federal Reserve’s latest Federal Open Market Committee (FOMC) monetary policy meeting, the Federal Reserve decided to slow down the pace of interest rate increases in December and continue to maintain the target range of the federal funds rate at 5.25% to 5.50%. between. As soon as the news came out, the market cheered, with all three major U.S. stock indexes rising sharply.

In fact, judging from the new economic data released by the United States in December, it is very necessary to suspend interest rate increases. The United States released a number of important economic data on December 21, including third-quarter GDP growth of 4.9% (expected 5.2%) and the Philadelphia Fed Manufacturing Index -10.5 (expected -3.0), both of which fell short of expectations. Judging from the two major household sector inflation indicators, CPI and PCE, in November, CPI increased by 3.1% year-on-year, and core CPI increased by 4.0% year-on-year, both in line with market expectations; the core PCE price index increased by 3.2% year-on-year, the smallest increase since April 2021 , lower than the 3.3% estimate. GDP and manufacturing were affected to a certain extent and were lower than expected. At the same time, the inflation data were in line with or slightly lower than expected. Therefore, no matter from any aspect, there is no need to continue to raise interest rates.

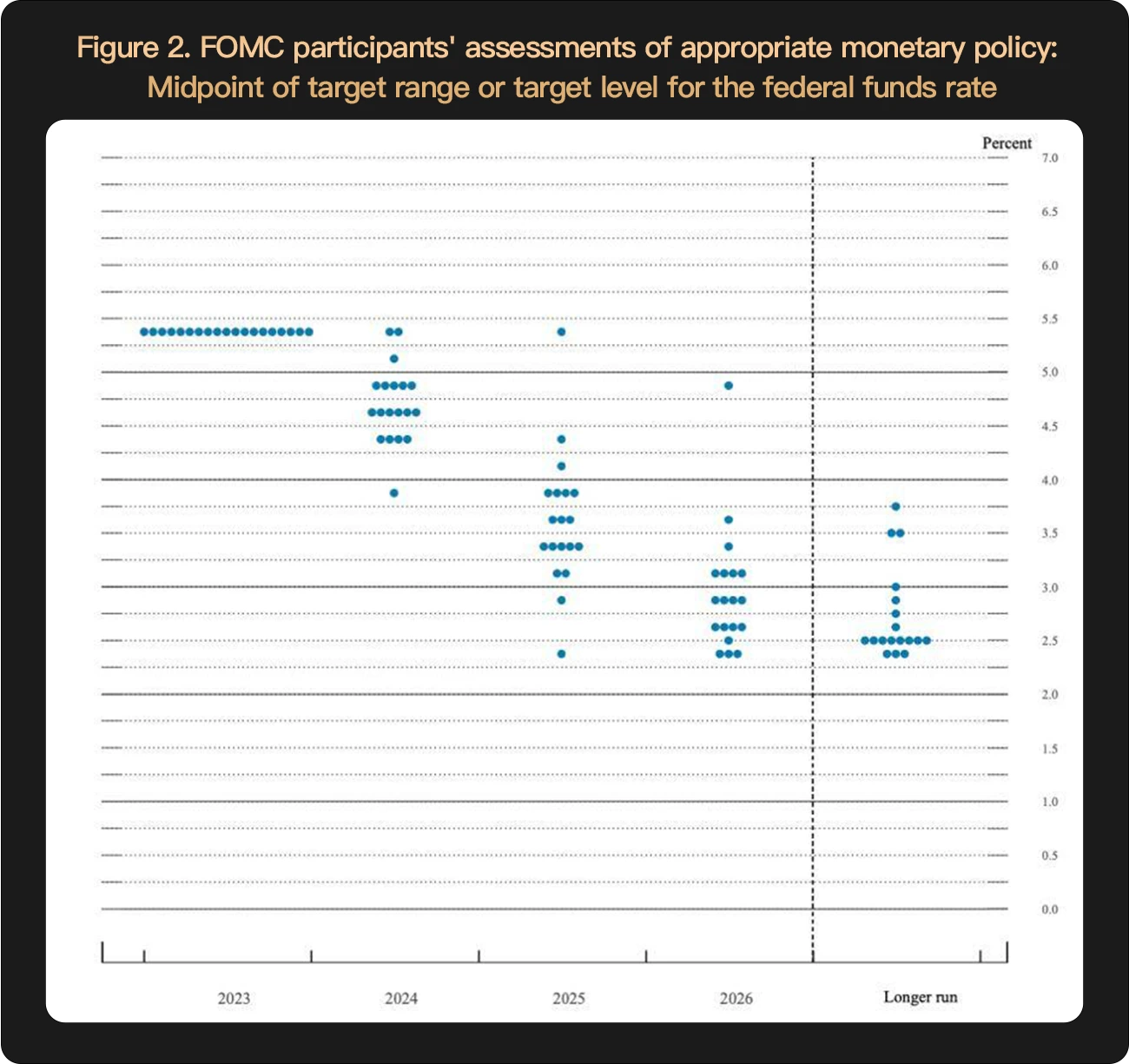

The data in December once again solidified the obvious attribute of suspending interest rate hikes. How much and when to cut interest rates has become the most concerned thing in the market. Judging from the current dot plot, the average interest rate expectation in 2024 is around 4.6%, which is still a considerable decrease compared to the current 5.25% to 5.5%.

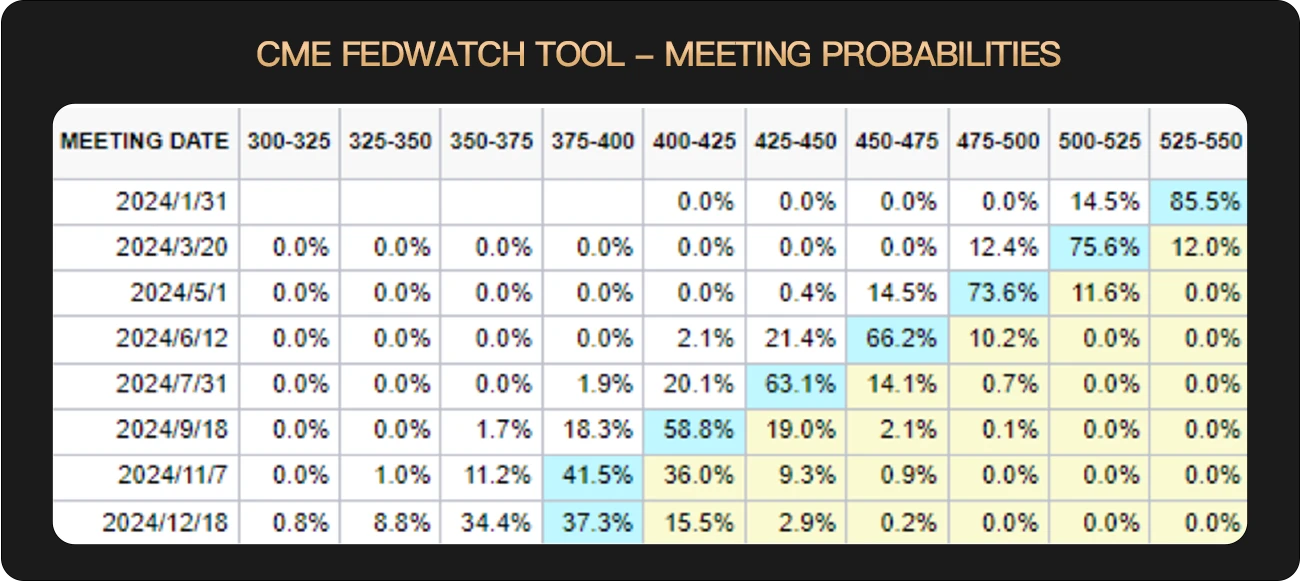

As for when to cut interest rates, according to CME FedWatch, the probability of cutting interest rates to below 5.25% in March 2024 is 75.6%, the probability of interest rates returning to below 5 in May is 73.6%, and there is a 66.2% probability of reaching 4.5 in the first half of the year. interest rates around %. Therefore, the market is still relatively optimistic at present and believes that a significant interest rate cut may be achieved in the first half of the year.

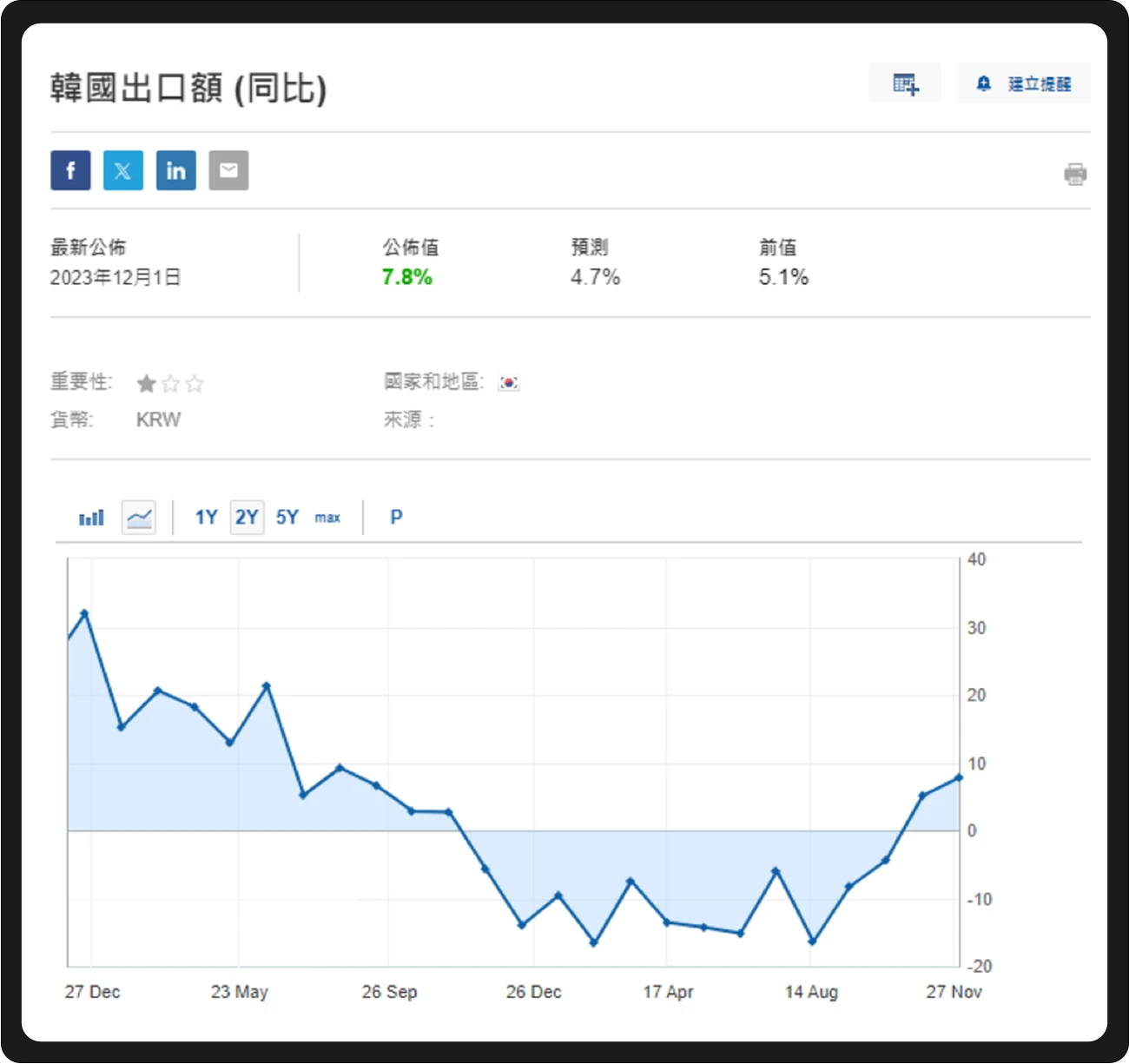

In fact, looking around the world, the economies of many countries are showing signs of improvement: Japans economy is regaining its lost 30 years, and both inflation and hourly wages have overcome the previous unchanged predicament; and South Korea, as a global economy The canary of the economy has reversed the downward trend of exports as early as October. The latest export data for the first 20 days of December reached 13% year-on-year growth. The growth trend is becoming more and more fierce, reflecting the recovery trend of the global market. .

On December 13, U.S. time, U.S. stocks surged, with the Dow Jones Industrial Average hitting a record high. This month, U.S. stocks continued their mad bull trend in November and continued to sell short. It is worth noting that after the United States released third-quarter GDP on the 21st, although it was lower than expected, US stocks still rose that day. Obviously, the current core factor affecting U.S. stocks is not economic fundamentals, but expectations of interest rate cuts. The slightly weaker-than-expected economy has greatly contributed to expectations of interest rate cuts, which in turn has prompted U.S. stock investors expectations for increased liquidity in the future.

Abundant liquidity is a direct factor in the rise of any market. A Bank of America survey showed that expectations of an interest rate cut in December drove a massive inflow of funds into the U.S. stock market, with the cash allocation ratio falling to a two-year low. The optimistic expectations of global investors have brought extremely abundant liquidity to U.S. stocks, which is why U.S. stocks continue to soar.

In addition to U.S. stocks, the Indian stock market can be said to be a rising star in the market in recent times. Indias Mumbai Sensex 30 index exceeded 70,000 points on December 11. It has now stood at 70,000 and exceeded 71,000, making it the seventh largest stock market in the world.

In recent days, India has become the premier location for global investors to invest in emerging markets. Indias economic growth this year leads the worlds major economies, and strong economic fundamentals provide investors with full confidence. In addition, the Nikkei 225 has reached a record high in November, and the German DAX and French CAC 40 have also reached record highs this month.

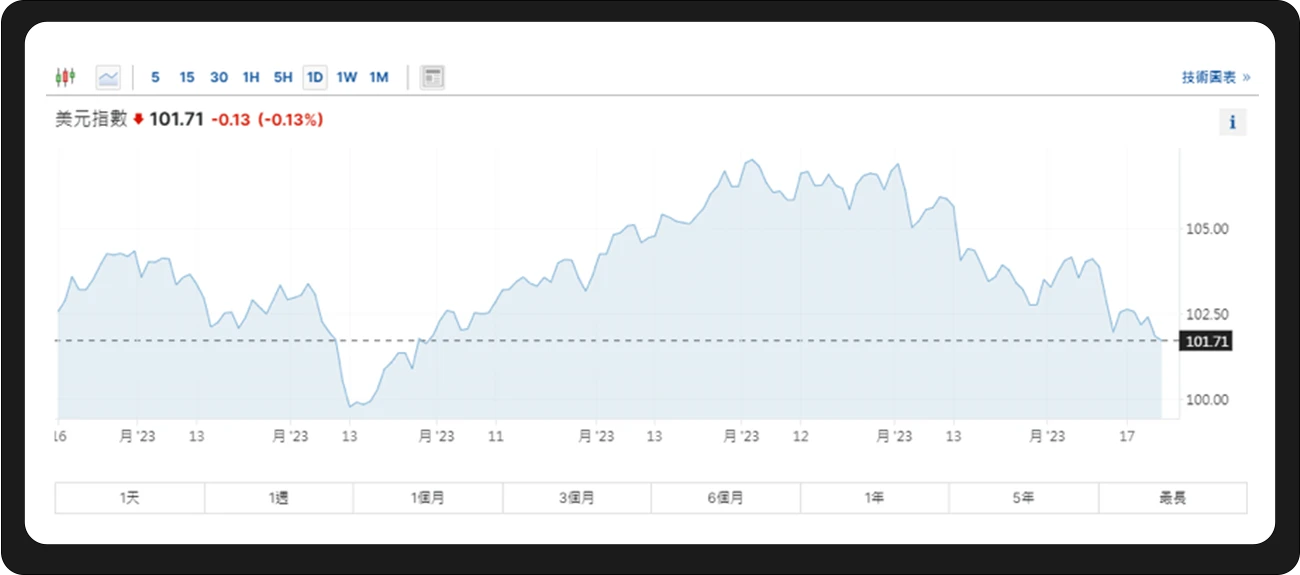

However, although market sentiment is currently high, one should not be overly optimistic. Currently, the U.S. dollar index continues to weaken due to expectations of interest rate cuts. When the U.S. dollar weakens from a strong currency, the attractiveness of U.S. dollar assets will also decline. In the future, attention should be paid to the dynamic game between the strength of the U.S. dollar and liquidity.

At the beginning of December, Bitcoin soared again and successfully exceeded US$44,000; MicroStrategy purchased more than 14,000 Bitcoins this month, increasing the total holdings of Bitcoin to more than US$8 billion. Ethereum’s highest price also exceeded $2,400. Subsequently, the two major currencies entered sideways trading, with Bitcoin prices oscillating sideways between 40,000 USD and 44,000 USD, and Ethereum oscillating sideways between 2,100 USD and 2,400 USD.

Although the market first rose and then went sideways, investors confidence in the future market has not diminished. Judging from the BTC negative premium of Grayscale Fund, the negative premium shrank to less than 10% in late November and continues to shrink, currently between -6% and -5%.

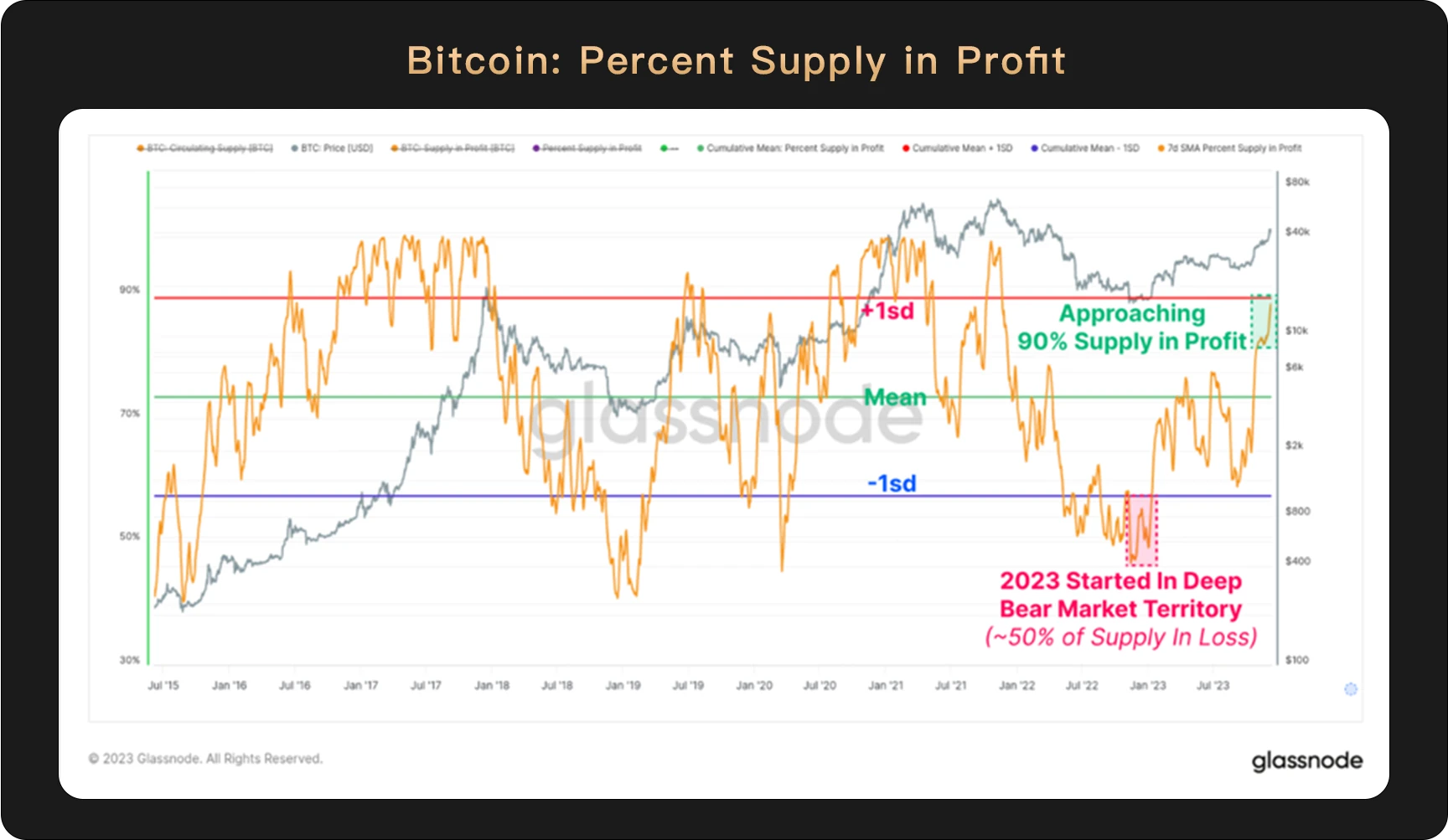

Although 90% of Bitcoins are currently in profit, investors are still confident due to the continuous stimulation of good news.

News about spot ETFs is even more frequent. On the 21st of this month, Grayscale, BlackRock, Valkyrie, ARK Invest/21 Shares, Franklin, and Fidelity all met with the SEC to discuss Bitcoin spot ETF matters.

Currently, issuers of various Bitcoin spot ETFs have held more than 30 meetings with the U.S. Securities and Exchange Commission (SEC). Previous discussions focused on Bitcoin custody issues, but now the focus has shifted to the generation and redemption of ETF shares. way. The SEC requires ETF applicants to update AP information and change the redemption method in the application to cash redemption before December 31, because in this way only the issuer will handle Bitcoin, avoiding unregistered brokers Subsidiary handling of Bitcoin.

Although institutions generally hope to adopt the method of physical redemption, in the face of the SECs requirements, they have chosen to compromise. At present, Pando Asset, BlackRock, Valkyrie, Grayscale, Galaxy and other institutions have almost all modified their documents to cash only. It seems that the giants are cant wait to issue ETFs. As long as they can be issued, no matter what the conditions are. Can agree.

As institutional giants choose to compromise, the market is also very optimistic about the date of approval of the first batch of ETFs: Bloomberg ETF analyst Eric Balchunas also mentioned that AP agreement + cash creation = approval. In other words, these two steps should be the last steps before approval, so many people speculate that the first batch of applicants will be approved around January 10. But no matter what, things have come to this point. The arrow is on the string and has to be launched. It only takes a final kick to get approval. It is only a matter of time.

While there is good news from the United States, there is also good news from Hong Kong: On December 22, the Hong Kong Securities and Futures Commission issued the Joint Circular on Virtual Asset-Related Activities of Intermediaries and the Joint Circular on Virtual Asset-Related Activities of Securities and Futures Commission-Authorized Funds Circular and stated that it is ready to accept applications for recognition of virtual asset spot ETFs.

The two circulars released this time explain in detail the Hong Kong government’s requirements for virtual asset spot ETFs. From issuer qualifications to underlying asset requirements, from transactions, subscriptions and redemptions, custody to investment strategies, the circular has detailed regulations, which fully demonstrates that the Hong Kong government is fully prepared for the arrival of virtual asset ETFs. “Everything is ready, all we need is east wind”, the regulatory attitude has been clear, and the rest is mainly about some technical details.

The two circulars released this time explain in detail the Hong Kong government’s requirements for virtual asset spot ETFs. From issuer qualifications to underlying asset requirements, from transactions, subscriptions and redemptions, custody to investment strategies, the circular has detailed regulations, which fully demonstrates that the Hong Kong government is fully prepared for the arrival of virtual asset ETFs. “Everything is ready, all we need is east wind”, the regulatory attitude has been clear, and the rest is mainly about some technical details.

It is worth noting that unlike the United States, which only allows “cash redemptions”, Hong Kong allows both cash and physical goods, which gives Hong Kong’s virtual asset ETFs an advantage over those in the United States.

The market continues to perform well in November. The world has experienced the impact of the epidemic and is now on the track of recovery. It is not surprising that such a money-making effect occurs. However, there is no market in the world that only rises but never falls. Whether there will be an economic recession during the U.S. interest rate cut next year and whether the U.S. dollar will continue to weaken is also worthy of attention and consideration; crypto market sentiment is still high, and spot ETFs in the United States and Hong Kong are both “Everything is ready, all we need is the east wind”, and the era of large-scale institutional entry into virtual assets is quietly coming.

Copyright statement: If you need to reprint, please contact our assistant WeChat (WeChat ID: hir3po). If you reprint or clean the manuscript without permission, we will reserve the right to pursue legal responsibility.

Disclaimer: The market is risky, so investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, views or conclusions in this article. The above content does not constitute any investment advice.