Original author: 0x Weilan

*The information, opinions, and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

Like a war to achieve publicity, the fifth round of the crypto asset bull market has gradually begun.

In April, we released the report “The overall situation has changed, looking for clues to start the bull market, emphasizing that the bear market has ended and the market has entered a recovery period;

In July, we released the report “The short-handed whale failed to rebound prematurely, and on-chain data supports the resumption of the upward trend.》, pointed out that box suppression does not change the essence of recovery;

In September, we released the report “BTC Q4 may once again challenge the year’s high of $32,000》, a desperate counterattack with accurate prediction of 10 in the bleak market;

In October, we released the report “As expected, BTC is likely to fluctuate upward along the channel in the market outlook., clearly stated that stablecoins are entering a bull market, and after counterattack, the market will continue to rise;

In November, we released the report “Due to internal and external factors, the fifth round of crypto asset bull market is about to begin.》, pointed out that the market began to transform from a repair period to an upward period (bull market).

No matter in the spring of April or the bleak autumn of August and September, EMC Labs is firmly bullish on the market and predicts that BTC will break through the years high during the difficult time of September.

Finally, the market broke out of the haze of interest rate hikes, got rid of the fear of another collapse, and sailed towards the starry sea of the fifth crypto asset bull market!

This is the promotion of industrial thinking, this is the victory of will.

2024 will be a magnificent year, a year for blockchain technology to expand its application, a year for crypto assets to take on a bigger stage, and a year for builders to reap the rewards of their hard work.

At the beginning of the new year, I wish you all to aim high and follow nature.

macro market

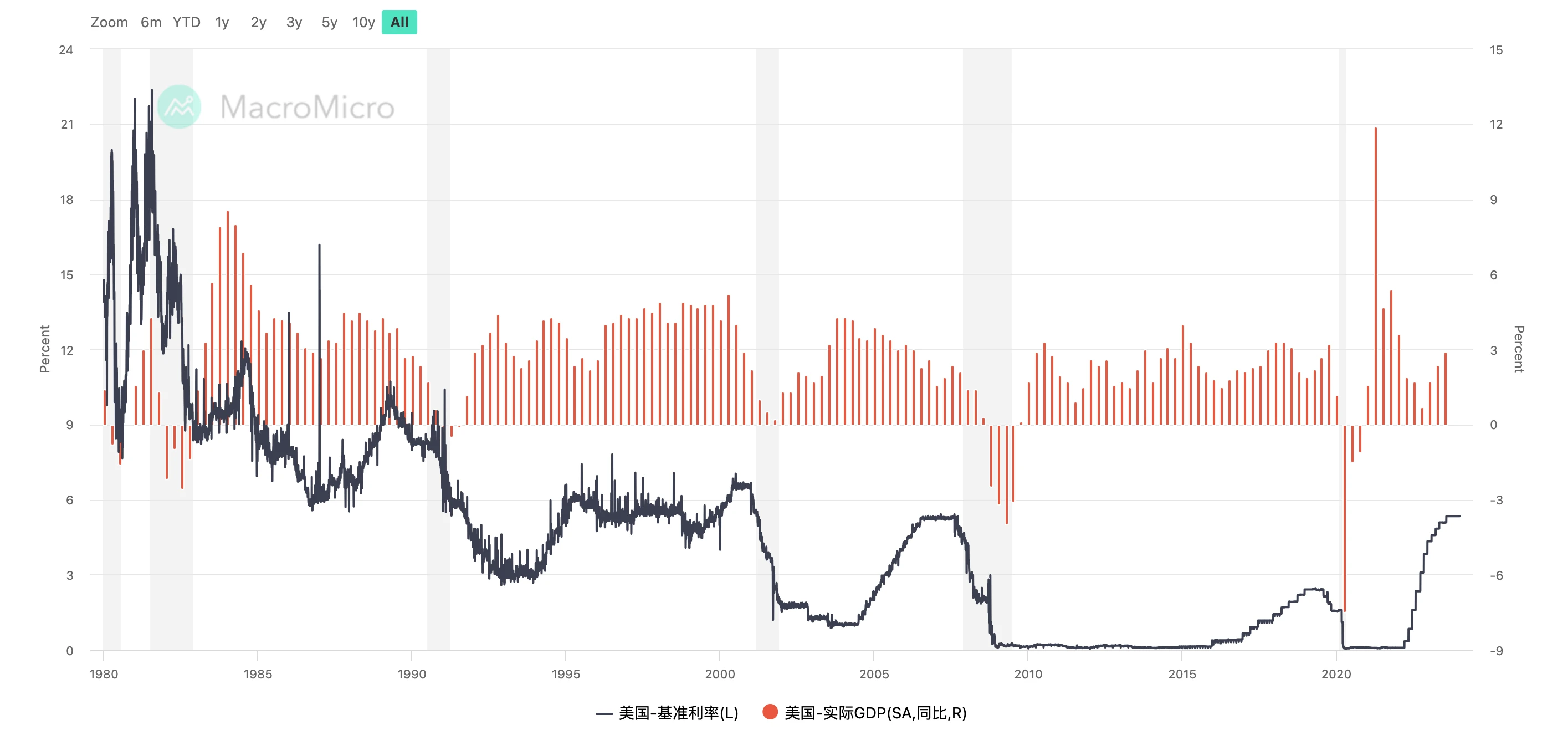

In December, the Federal Reserve ended raising interest rates as scheduled. This round of interest rate hikes started in April 2022 and ended in October 2023, lasting 19 months, with an interest rate increase of 5.25%.

U.S. benchmark interest rate

2023 ended with gains in all major global financial markets except China. The Nasdaq Composite Index, which is often used to compare crypto markets, continued to rise 5.52% in December to close at 15011.35, recording a gain of 43.42% for the year.

NASDAQ index annual line

It shows that after experiencing deflation and fear in 2022, global capital will actively do long in 2023 under the expectation of the end of deflation, in order to welcome the expected return to the interest rate cutting cycle in 2024.

During the same period, the price of gold also continued to rise, closing at $2,062.94, indicating that some capital lacking confidence in economic recovery chose safe havens amid expectations of interest rate cuts and rising stock markets.

Correspondingly, the U.S. dollar index consolidated throughout the year, and began to accelerate its decline after expectations of interest rate hikes, stoppages, and interest rate cuts were initiated in November and December. The decline is expected to continue in the future.

dollar index

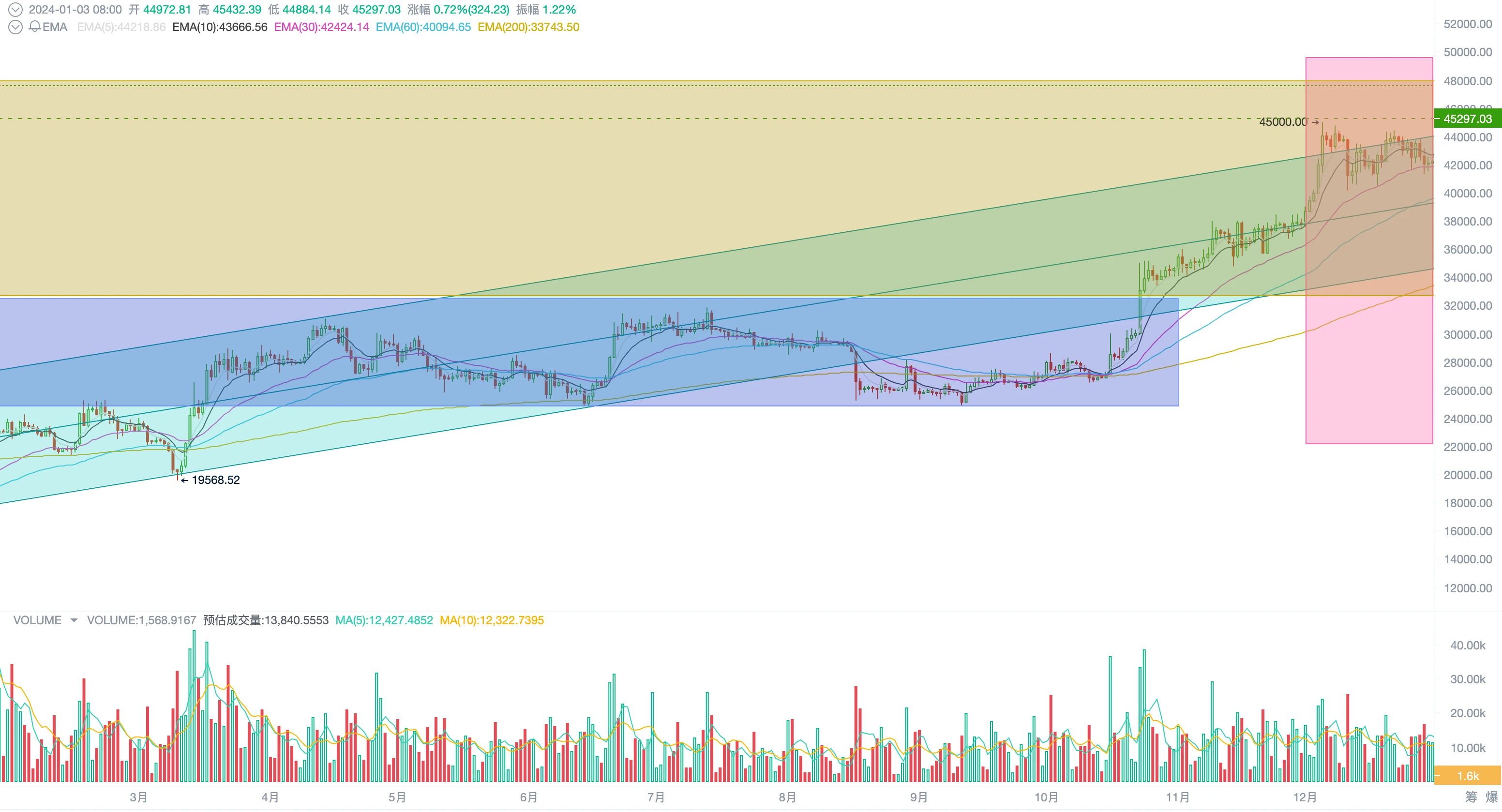

Compared with the global financial market, BTC achieved a sharp increase of 155.82% throughout the year and recovered 87% of the decline in 2022, showing great resilience and resilience.

BTC price monthly trend

Judging from the Emergence Engine, BTC will soon move out of the repair period and enter the rising period (that is, the bull market stage).

crypto market

For BTC, December was a month of solid upward movement and annual breakthrough. It opened at US$37,732 and closed at US$42,288, rising by US$4,556 for the whole month, or 12.07%, with an amplitude of 19.56%, achieving consecutive gains in April.

A new round of rise started in mid-October brought BTC back to the repair period ascending channel (green part in the figure below), and tested the middle rail of the ascending channel. It broke through the middle rail in November and gained momentum, and in December it broke through the ascending channel with great momentum. upper edge.

BTC price daily trend

From the perspective of boxes, November effectively broke through the 25,000 ~ 32,000 boxes (purple part in the picture above). This box suppressed the price of BTC for eight months in 2023, and was also the main range for washouts during the repair period. During this period, millions of chips changed hands.

At present, the BTC price has entered the 32000 ~ 48000 box space. The breakthrough of this box will mean the opening of the bull market and the establishment of an upward channel.

capital supply

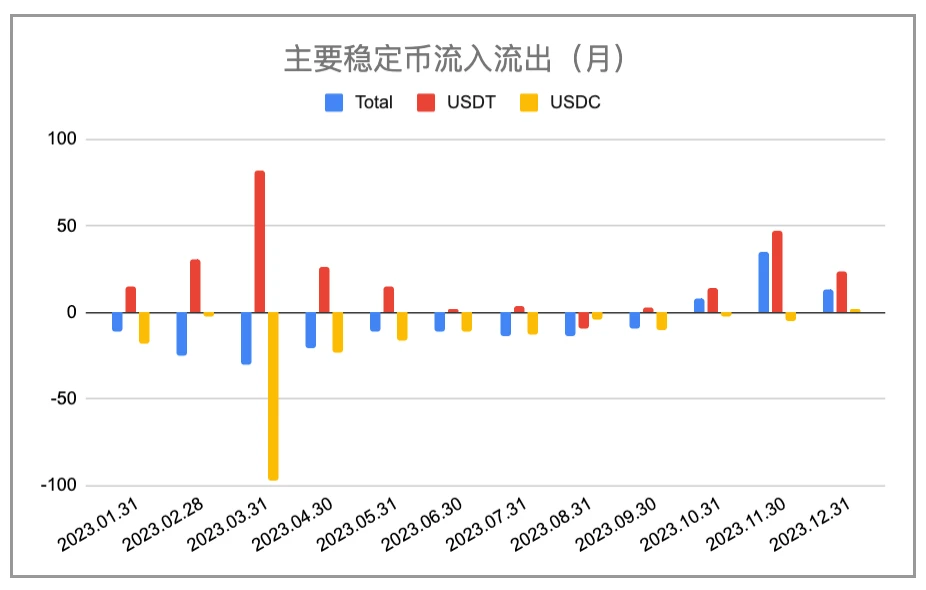

Stablecoins provide a channel to monitor the overall inflow and outflow of funds in the market.

In 2023, stablecoin outflows will reach as high as US$9 billion. Among them, USDT received 11 net inflow months in 12 months, with an overall inflow of US$25.4 billion. USDC saw an outflow of US$19.9 billion throughout the year, with an inflow of US$200 million in December only in 12 months. , the remaining 11 months all recorded net outflows. The rest of the outflow gap mainly comes from BUSD, which is about to cease circulation.

Statistics on the inflow and outflow of major stablecoins

The turning point for stablecoin inflows occurred in October. The large inflow of USDT that month directly prompted BTC to break away from the box suppression and return to the upward channel during the repair period. Afterwards, under the continuous inflow in November and December, BTC finally broke through the upper edge of the upward channel during the repair period, showing a trend of breaking the trend during the repair period.

Throughout the year, USDT was the main channel for capital inflows, reaching 254 throughout the year, which was highly sustainable and accelerated in Q4, especially in November. It can be inferred from this that the Asian community, which mainly uses USDT, is the promoter and beneficiary. Of course, there is massive adoption of USD into the market by US communities and institutions. This part of the funds is currently difficult to count.

supply trends

Stablecoins provide a channel to monitor the overall inflow and outflow of funds in the market.

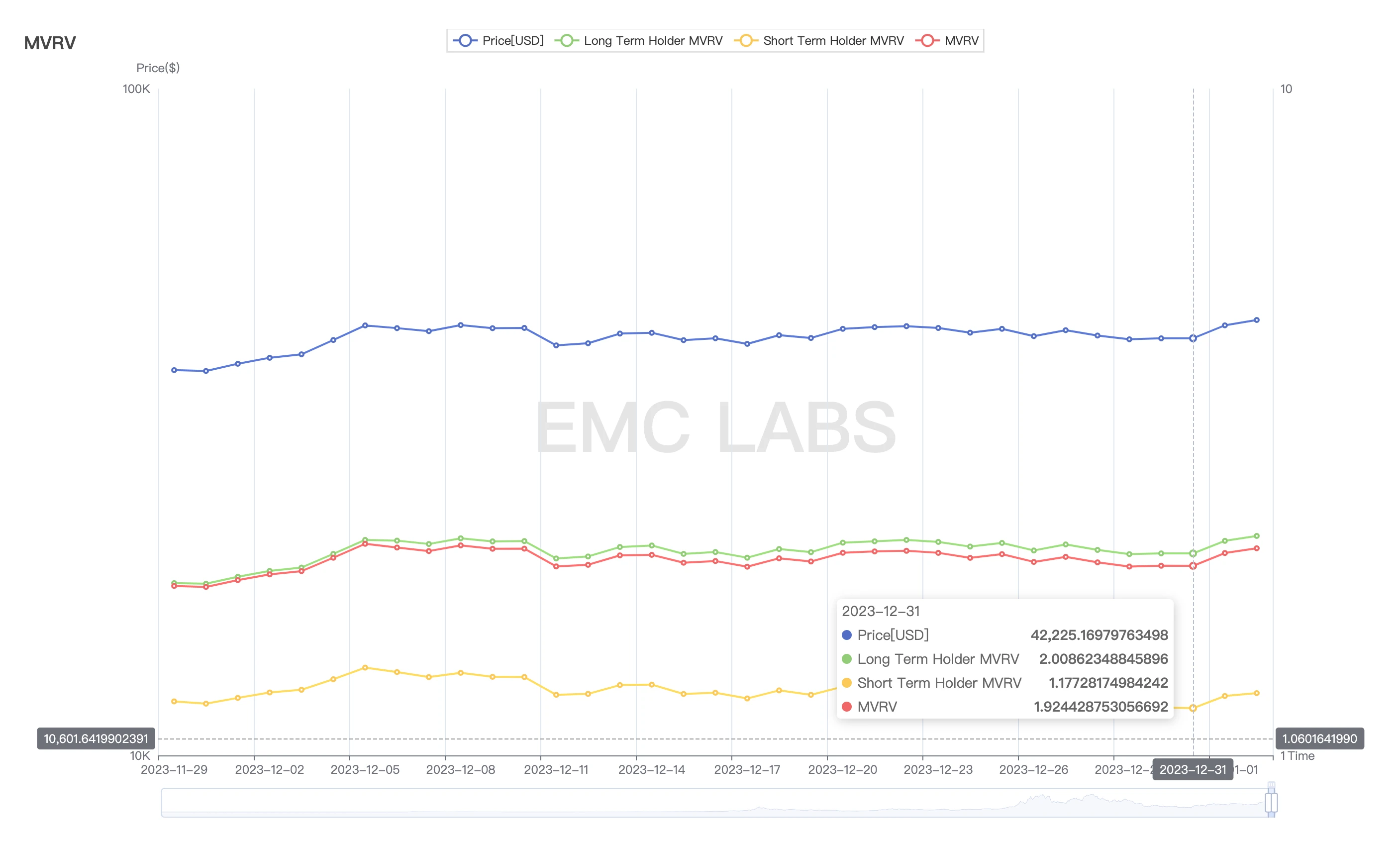

With the rapid rise in BTC prices in early December, the market-wide profitability ratio rose from 1.79 at the end of November to 1.92. Among them, the long-term investor group (long-term investor group) increased from 1.8 to 2.0, and the short-term investor group dropped from 1.2 to 1.18.

Long-term, short-term and total market profit ratios

These figures show the typical characteristics of the recovery period group: long-term investors continue to accumulate floating profits, while short-term investors are keen to continuously cash in profits. The constantly revised floating profits of short-term investors have actually cleared the market of the impetus for short-term sharp declines. EMC Labs believes that although the price of BTC has experienced a sharp rise in terms of position structure and profit pressure, there is not much downward momentum within the market.

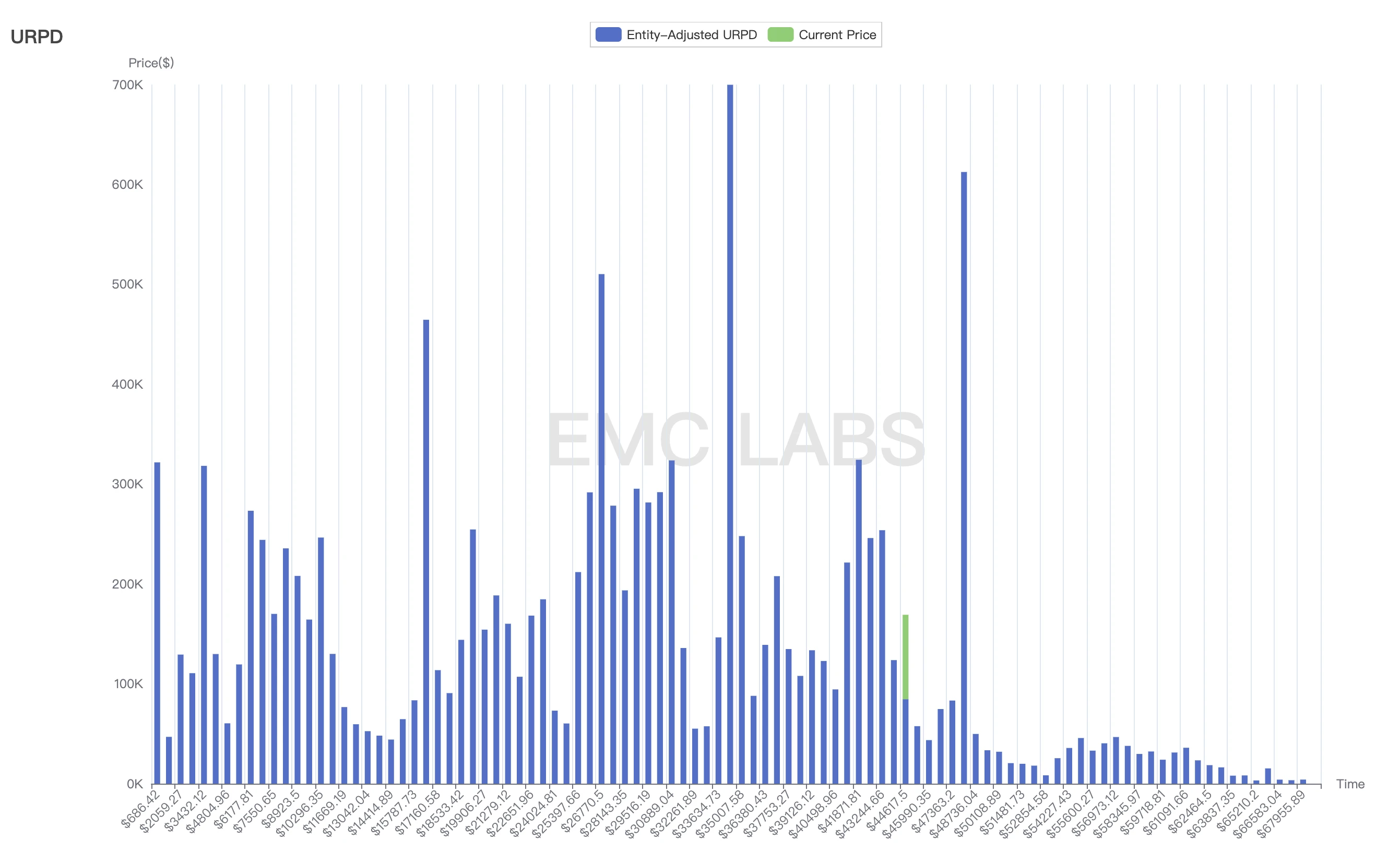

Let’s look at the BTC cost distribution——

BTC cost distribution

Compared with November, the market’s largest line of defense has risen to the $34,000 level, and above that, up to 1.05 million chips have been accumulated at the $4.1 to $44,000 level. EMC Labs believes that there is only one real threatening pressure level ahead, which is the turning point of the repair period and the rise at $48,000. Once it crosses $48,000, it will be the magnificent fifth round of the crypto asset bull market.

Long and short game

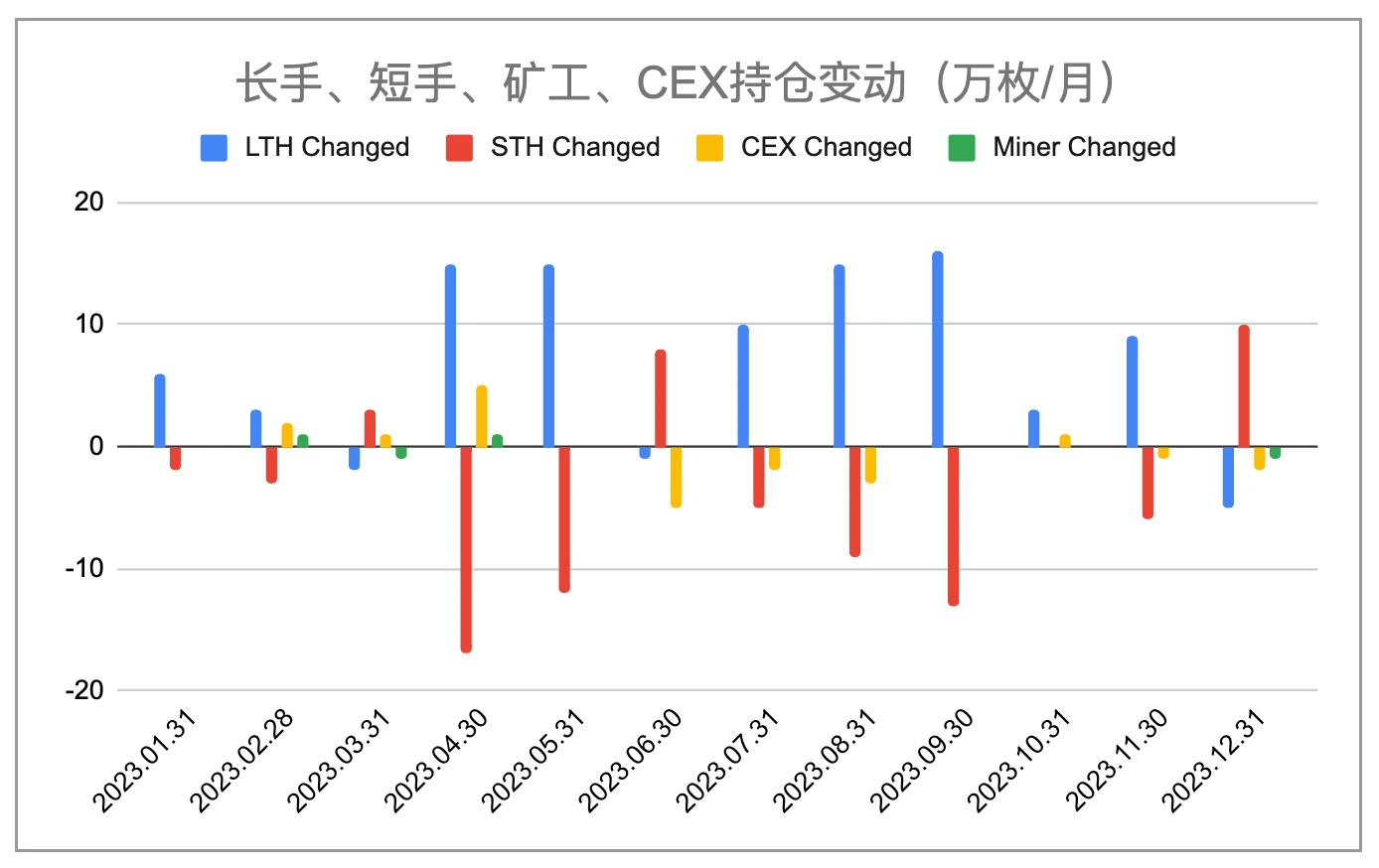

We believe that market cycles are formed by changes in the trading behavior of long-term investors (long hands) and short-term investors (short hands). After data analysis, EMC Labs found that long and short positions were undergoing historic changes in December——

Long-hand, short-hand, miners, CEX BTC position changes (monthly)

From January to November, long hands were accumulating, while short hands were selling consistently. In these 11 months, long hands collected 800,000 BTC, while short hands reduced their holdings by 560,000, CEX had outflows of 20,000, and miners increased their holdings by 10,000.

This is a typical feature of the repair period - from short to long, forcing short-term investors to hand over their chips through price fluctuations, draining liquidity, thereby pushing the increasingly dry market out of the repair period and into a bull market.

In December, a historic turning point occurred - long-term investors reduced their holdings by 50,000 coins, while short-term investors increased their holdings by 100,000 coins. Although from long to short also occurred in March, the significant increase in scale in December may mean a trend change in the behavior of market participants. EMC Labs believes that from long to short is a signal that the market is transitioning from a repair period to an up period. Once the market enters a rising period, long-term investors will enter a new round of historic selling.

Data on the chain

The behavior of the currency holders behind the on-chain data is not only the basic support for the BTC bull market, but also an important symptom of the bull market.

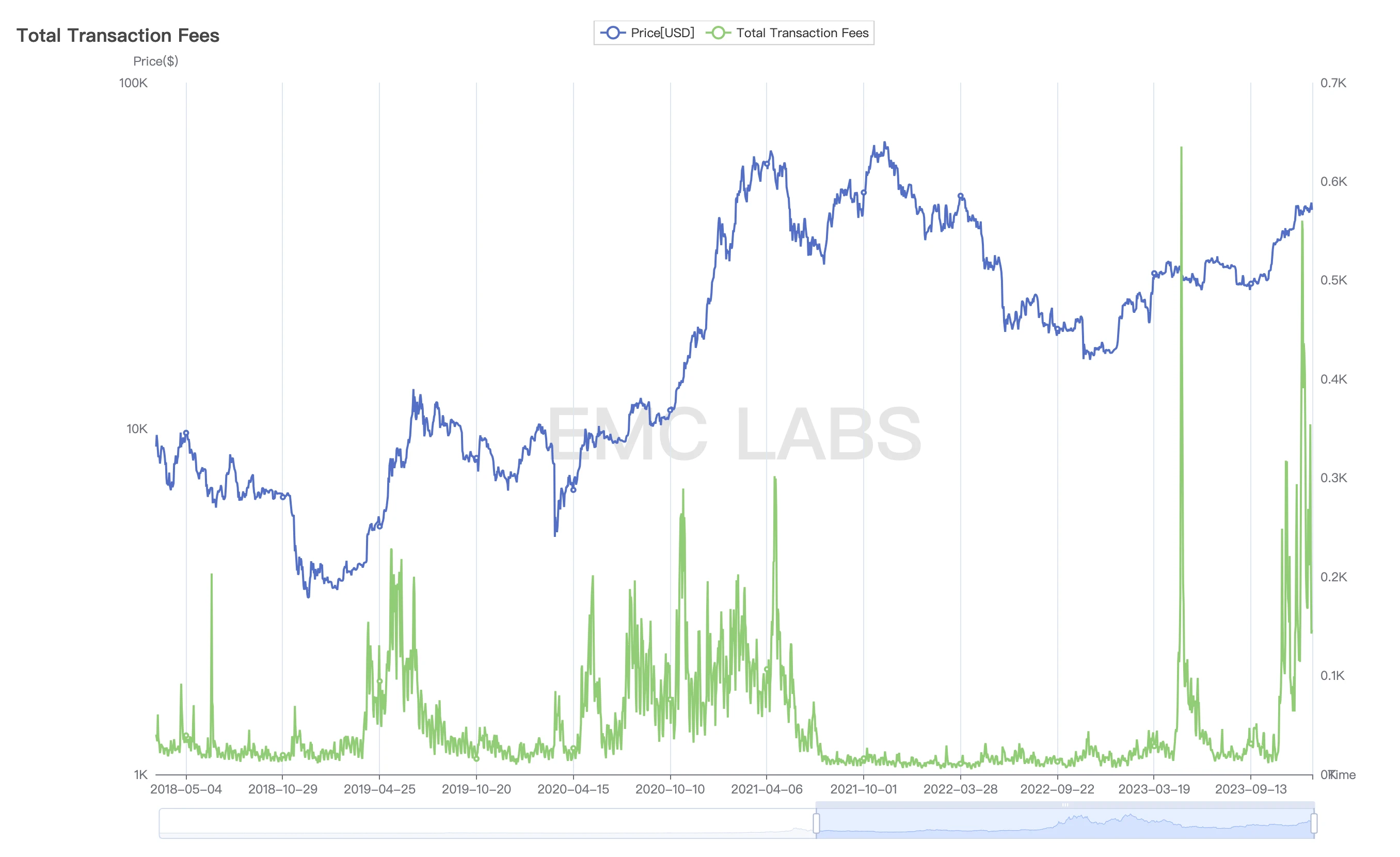

In 2023, the rise of the Ordinals protocol brought a wave of irrational trading to the long-dormant Bitcoin ecosystem.

This craze, which is mainly stirring in China, reached its climax twice in May and December respectively with the intervention of OKX and Binance, two centralized exchanges with huge influence among the Chinese trader community.

The irrational competition for block space by Ordinals (mainly BRC 20 MEME tokens) has made the data on the Bitcoin network chaotic.

Bitcoin Network Daily Fees Income

Judging from the income of Bitcoin network miners, the income in December was much higher than that during the previous repair period.

May 8 and December 16 became the third and fourth largest revenue days in the history of the Bitcoin network. The first and second largest revenue days occurred during the 2017 ICO craze.

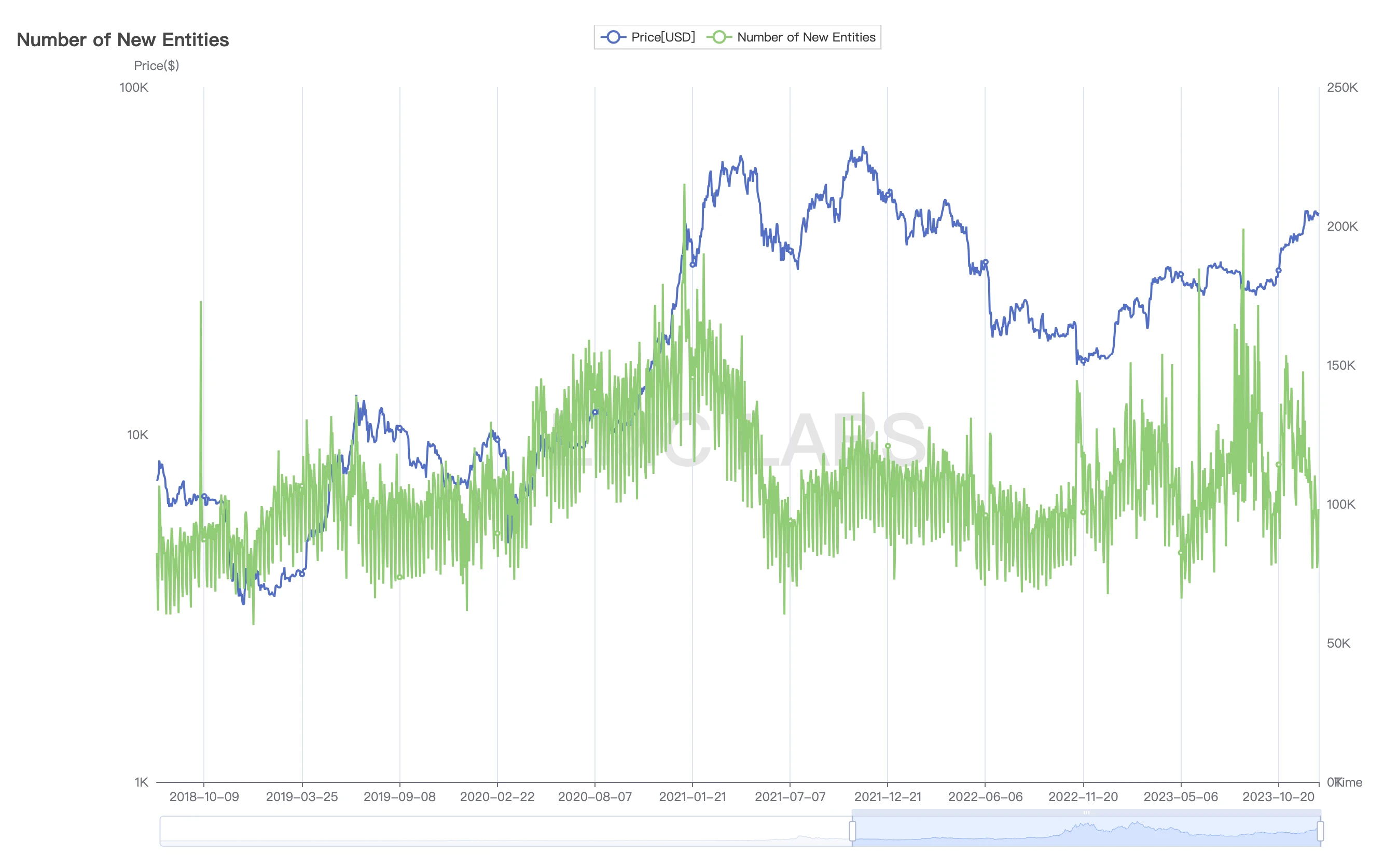

This surge in miner consumption revenue is poorly sustainable and has disrupted the normal functioning of the Bitcoin network for payments and value transfers. This is concretely reflected in the data of daily new entities and daily active entities——

New entities added on Bit Network Day

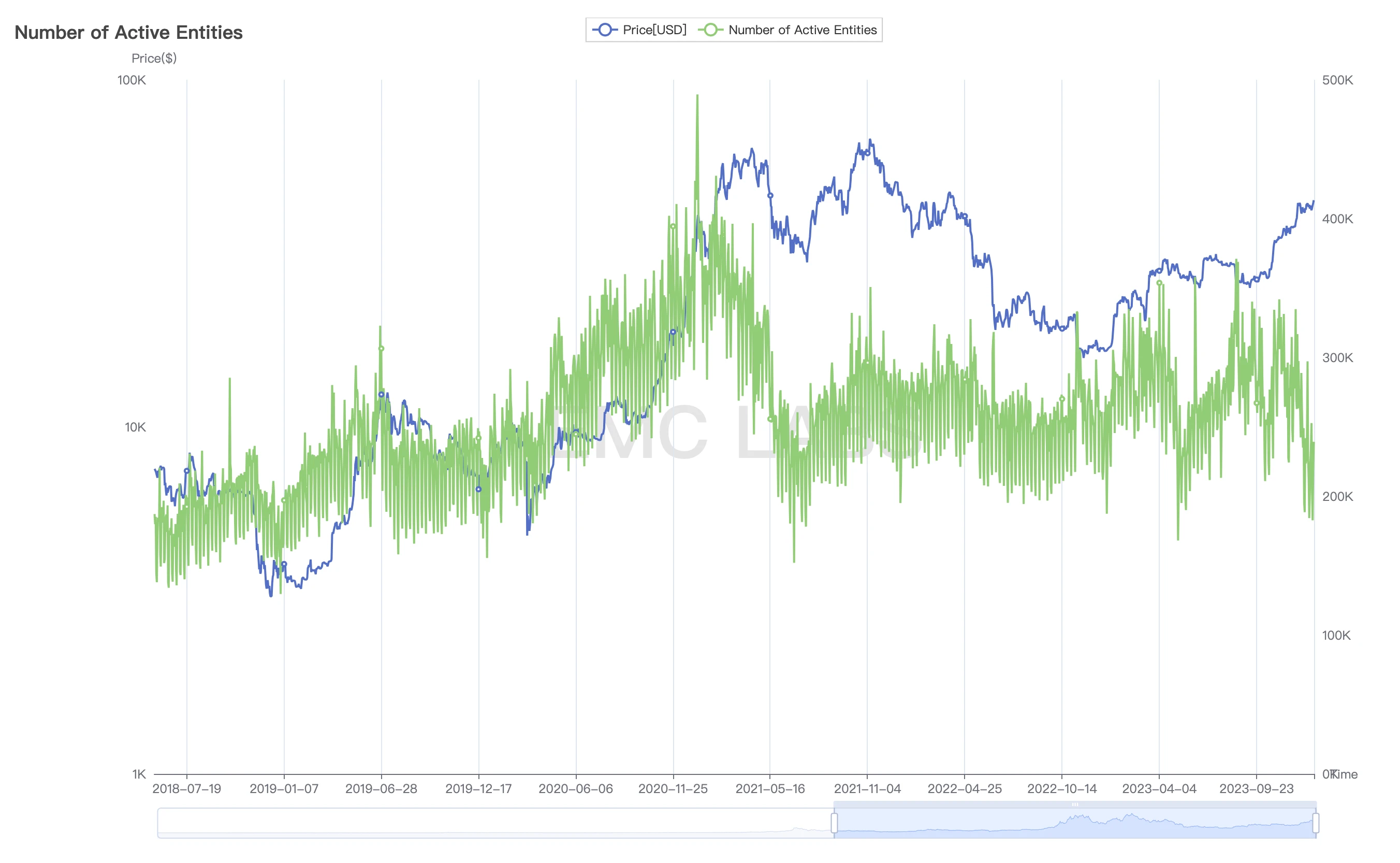

Bit Network Daily Active Entities

During the BRC 20 MEME frenzy in December, irrational traders were eager to engrave Ordinals, which pushed up the cost of using the Bit network and inhibited the creation and activity of new users (entities).

This is why the Bitcoin Core team came out to criticize Ordinals participants for consuming the BTC brand and abusing network space, and proposed developing a new version of the client to expel the Ordinals group from abusing block space.

According to historical data, the transition from the repair period to the upswing period will inevitably be accompanied by the growth of users of the Bit network and the prosperity of on-chain behavior. Because of the Ordinals BRC 20 MEME coin craze, the data was contaminated and user behavior was affected, making our observation more difficult.

In 2023, the overall on-chain data is improving, but there was indeed a huge retracement in December, which makes BTCs rise this month seem less confident. Going forward, we will continue to pay attention to the evolution of on-chain behavior through data, which is the foundation for the start of the bull market. The market cannot bear the decline in data in this dimension.

BTC ETF

As a new type of digital asset, BTC has gradually attracted the attention and involvement of mainstream financial institutions around the world, especially the United States, since the last bull market.

Since the approval of BTC futures ETF in 2017, applications for BTC spot ETF have gradually been in full swing. Because the participation cost and participation scale of spot ETFs are both better than futures ETFs, the application and approval status of BTC ETFs has received deep attention from the crypto asset market. Whether passed or not, every move will have a direct impact on the price of BTC.

Current applicants include traditional asset management giants such as BlackRock and FTSE, as well as new Crypto investment management institutions such as Valkyrie Investments. The market generally believes that these approved BTC ETFs will bring tens of billions of dollars in capital inflows to the market in the next few years.

The impending approval of these BTC ETFs (the latest expected point is mid-January) is also one of the driving forces behind the recent rise in BTC prices.

EMC Labs believes that the current gradual unfolding of BTC or the entire Crypto bull market is a high-probability event driven by industry and cyclical changes, rather than the expectation of BTC ETF. In 2023, the application and approval of BTC ETF are expected to attract a certain amount of speculative funds to enter the market, and the current BTC price has also reflected this. In January, whether the BTC ETF is approved or not, it will cause severe fluctuations in the price of BTC. The reason may be that old speculators leave the market, new speculators enter the market, or the contract controller controls the market.

EMC Labs believes that the transition from the repair period to the upward period is already taking place. The inflow and outflow of speculative funds caused by the passage of the BTC ETF may prolong this transition process, but it cannot change the trend of the bull market starting.

Conclusion

Stablecoins have experienced net inflows for three consecutive months, and the currency holding structure has begun to change from long to short. BTC has left the upward channel during the repair period and is trying to establish a new channel during the upward period.

These signs indicate that the development of the bull market has been written into the script. The switch is just a matter of time and will be completed as soon as January and no later than June.

In January, whether the BTC ETF is approved or not, it will cause severe fluctuations in the price of BTC.

If you believe in long-termism like us, then you can give up worries and wait patiently for the fifth round of the crypto asset bull market!

EMC Labs (Emergence Labs) was founded in April 2023 by crypto asset investors and data scientists. Focusing on blockchain industry research and Crypto secondary market investment, with industry foresight, insight and data mining as its core competitiveness, it is committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and encrypted assets as Blessings to humanity.

For more information please visit: https://www.emc.fund