Original author:stella@footprint.network

Data Sources:NFT Research

December saw a significant upward trend in the cryptocurrency and NFT space, with sharp increases in the prices of Bitcoin and Ethereum signaling a recovery in the market. At the same time, the transaction volume in the NFT field has soared, and the number of independent users (wallets) has also increased, which shows that the NFT industry is continuing to grow and mature.

This report is based on Footprint AnalyticsNFT research pageData provided. This page is a comprehensive and easy-to-use dashboard that provides the latest statistics and indicators necessary to understand the pulse of the NFT industry, including transactions, projects, financings, and more.

Key points overview

Crypto Market Overview

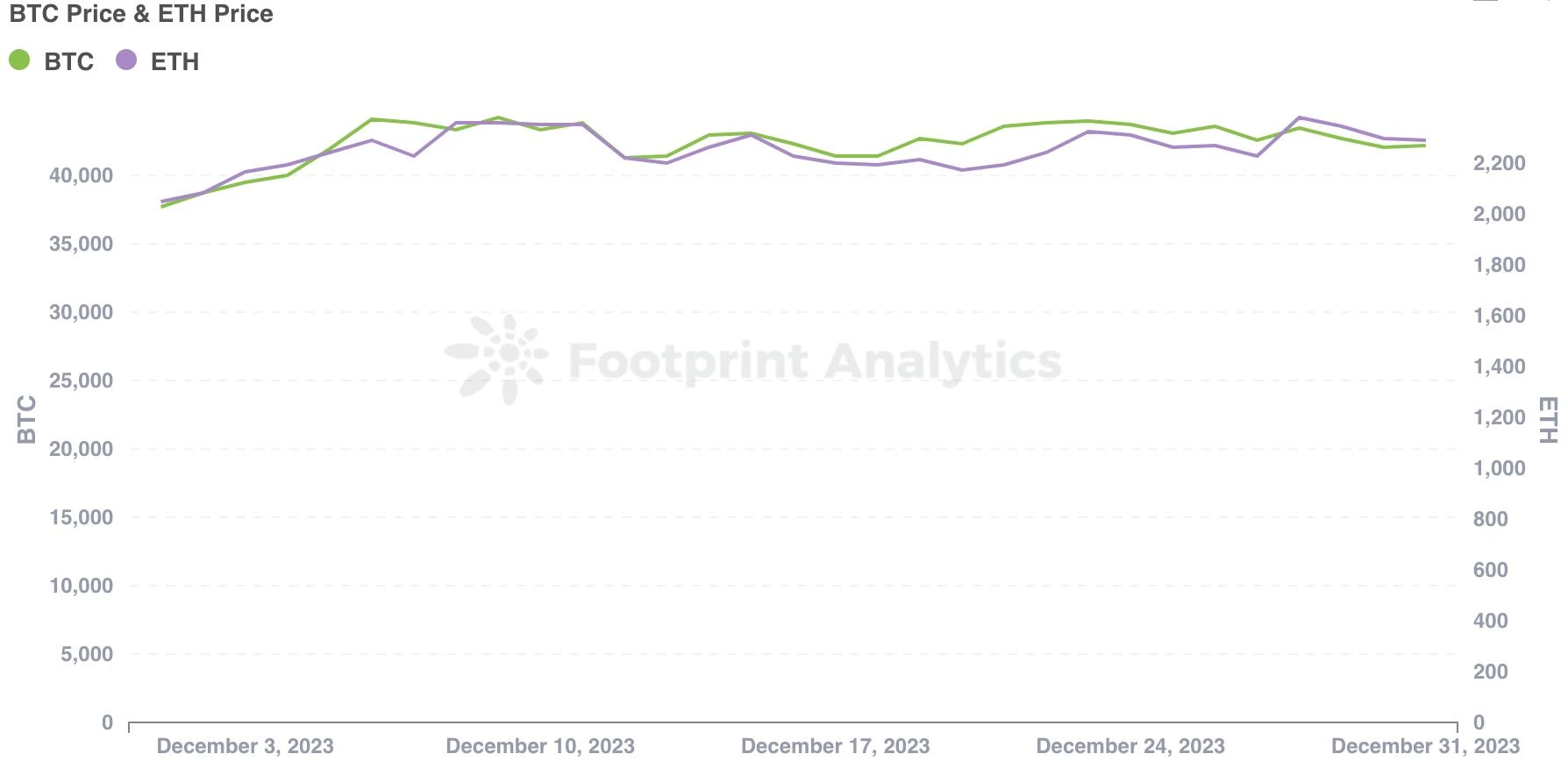

Bitcoins performance in December was very impressive. The price at the beginning of the month was US$37,729 and closed at US$42,171 at the end of the month, an increase of 11.8%.

Optimism in global stock markets and expected interest rate cuts by the Federal Reserve have boosted investor confidence, having a positive impact on the cryptocurrency industry.

NFT Market Overview

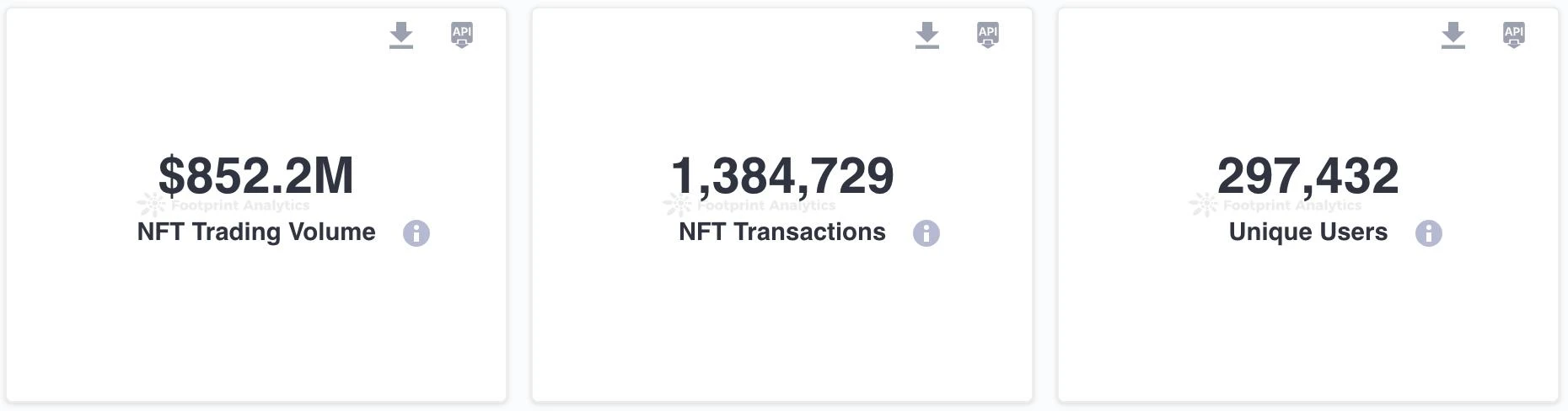

In December, the NFT market transaction volume increased significantly by 32.3%, reaching US$850 million.

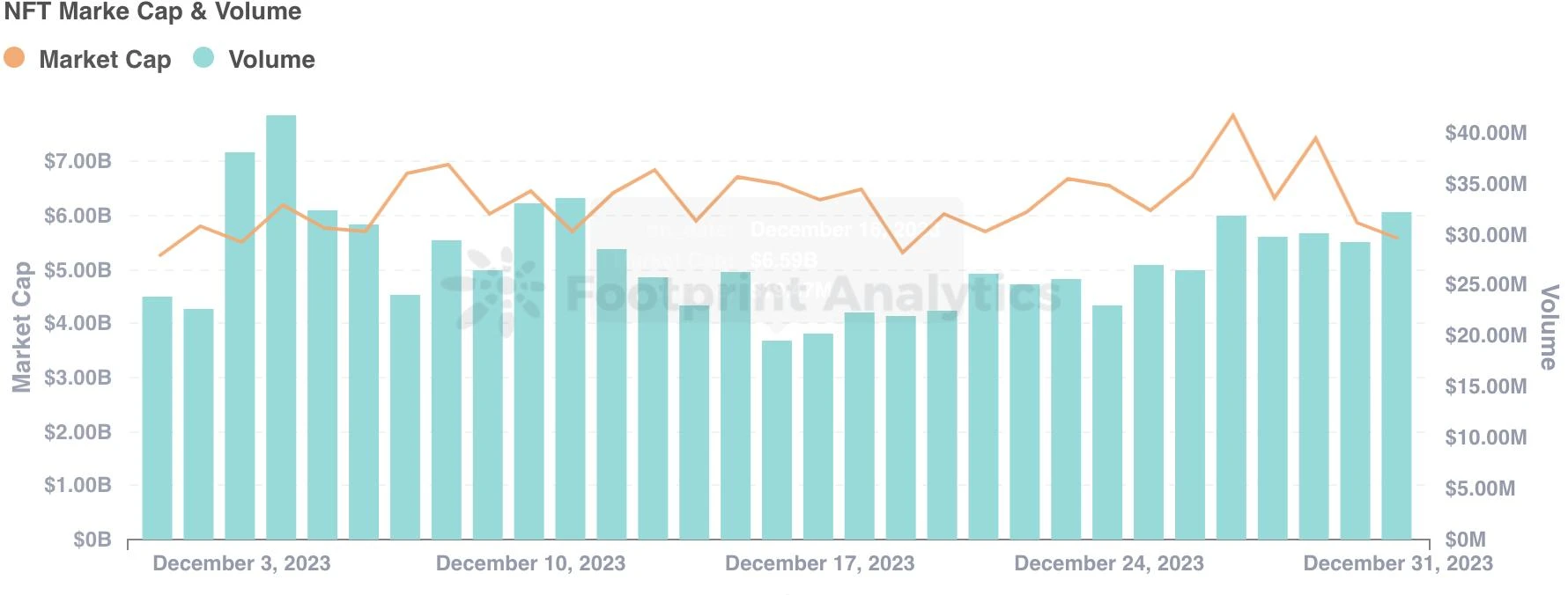

The market capitalization of the NFT market started at $5.24 billion and eventually grew 6.5% to $5.58 billion.

The blue-chip index also rose, rising 4.6%.

Public chain and NFT trading market

In December, different public chains showed diversified trends in user participation.

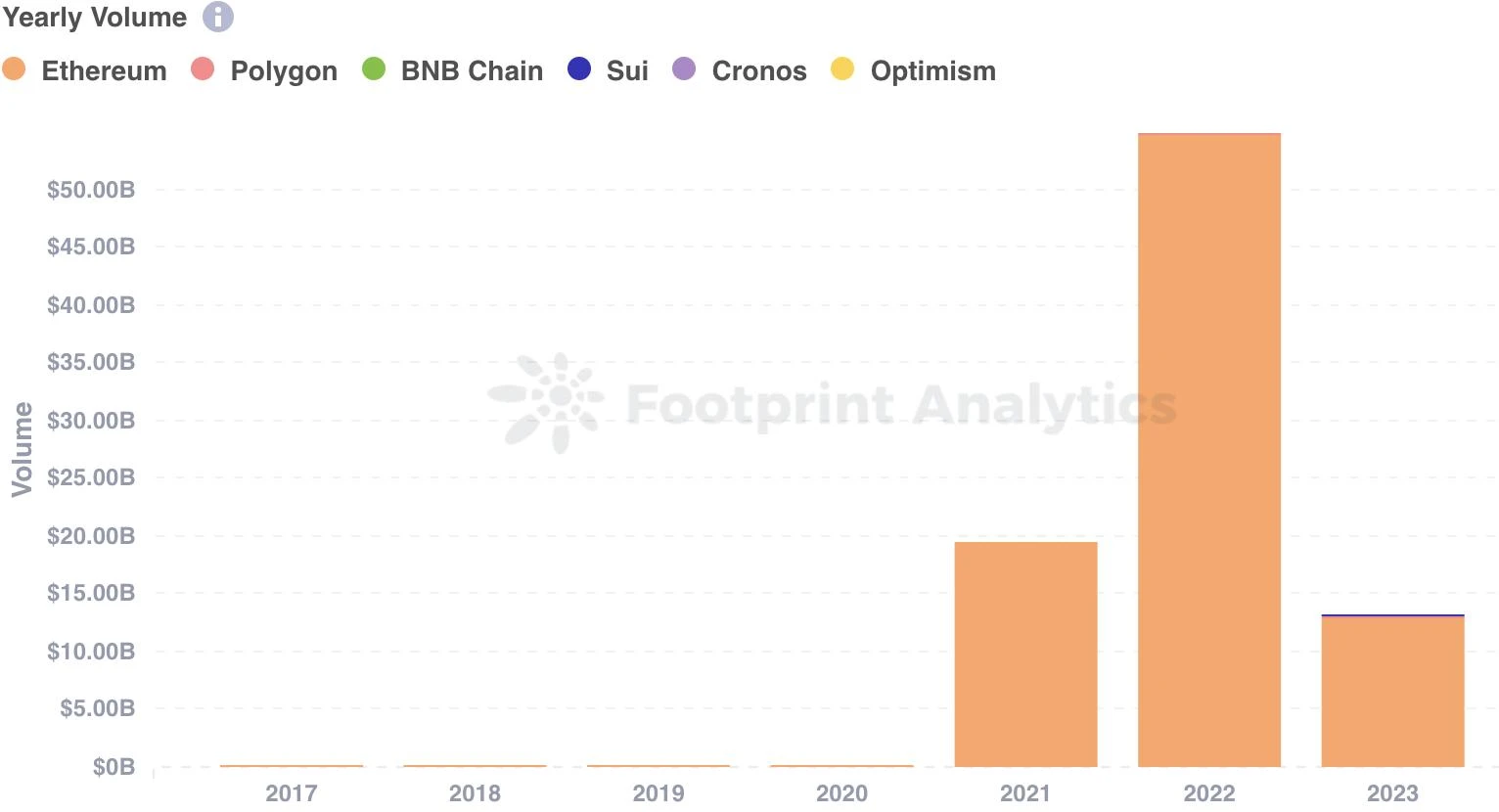

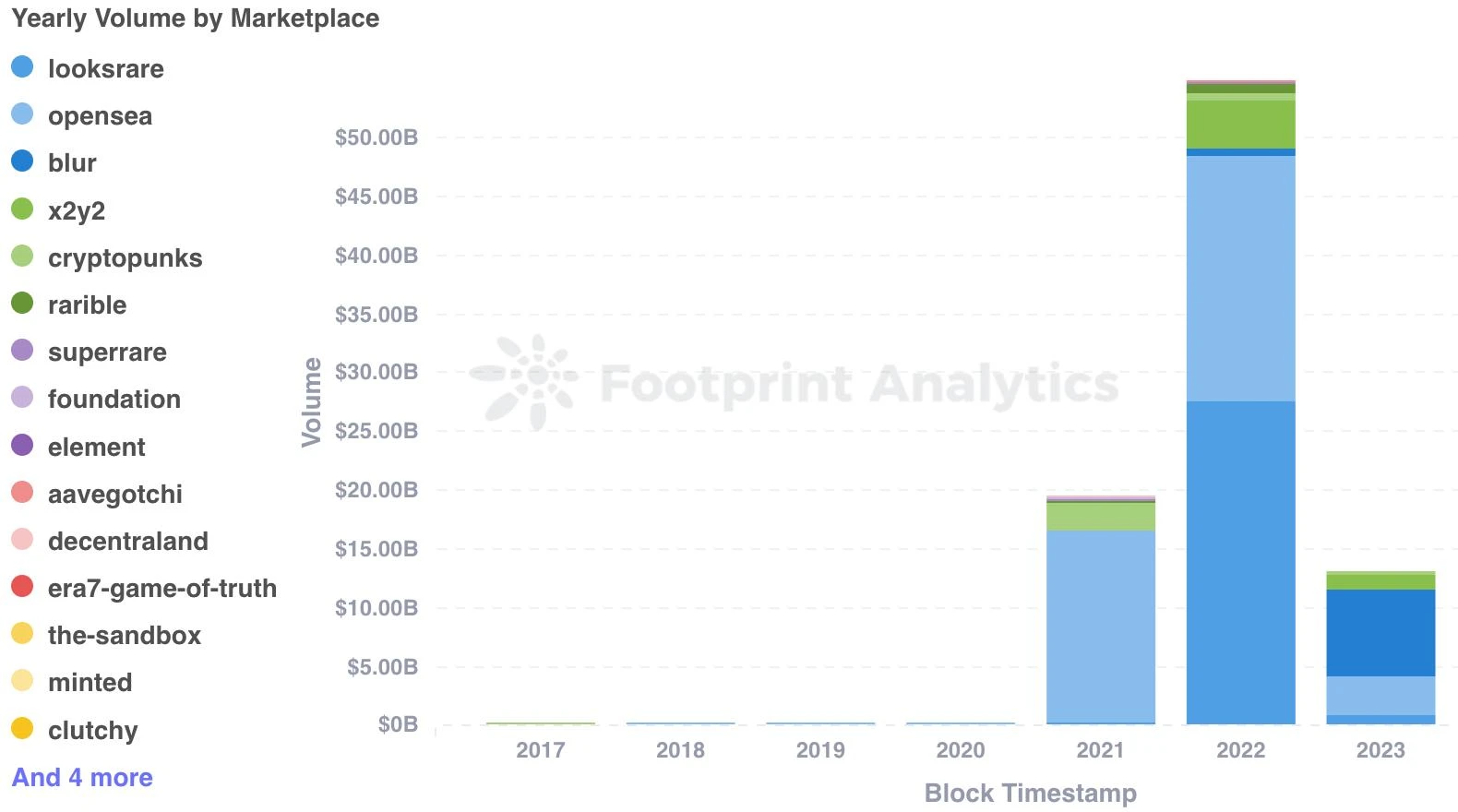

NFT market trading volume in 2023 was $13.12 billion, down from the previous years high. Ethereum’s market share fell slightly to 97.8%, down from 99.8% in 2022, indicating that the market is gradually diversifying.

In 2023, the annual trading volume performance of the NFT trading market showed significant changes compared with the previous year. Blur achieved a staggering annual transaction volume of $7.26 billion, far exceeding the $650 million in 2022.

NFT investment and financing situation

Compared with November, investment and financing activities in the NFT field were more active this month, with a total of five rounds of financing and a total of US$160 million raised.

LINE NEXT received US$140 million in investment led by Crescendo Equity Partners.

Highlights this month

The NFT of Ubisofts Champions Tactics: Grimoria Chronicles game was released before the game.

Forbes Web3 Community Center Forbes Web3 has created a wallet specifically for the long-term collection of NFTs.

Animoca Brands NFT series Mocaverse completed nearly $11.89 million in financing.

Magic Eden integrates its NFT market into the blockchain game Honeyland.

Crypto Market Overview

Bitcoins performance in December was very impressive. The price at the beginning of the month was US$37,729 and closed at US$42,171 at the end of the month, an increase of 11.8%. Ethereum also showed a similar upward trend, starting from $2,052 and finally closing at $2,293, an increase of 11.7%.

Data Sources:BTC Price & ETH Price

At the same time, global stock markets generally show optimism, which is particularly evident in countries such as the United States, India, Japan, France and Germany. This optimism, along with expected interest rate cuts from the Federal Reserve, has boosted investor confidence and had a positive impact on the cryptocurrency industry. Additionally, the United States is expected to soon approve a spot Bitcoin ETF, while Hong Kong is also ready to accept applications for a spot cryptocurrency ETF. These factors further boosted bullish sentiment in the market. The synergies between traditional financial markets and the crypto ecosystem are increasingly evident.

NFT Market Overview

In December, the transaction volume of the NFT market increased significantly by 32.3%, reaching 850 million US dollars, the number of transactions increased by 29.4% to 1,384,729, and the number of independent user wallets also increased by 21.4% to 297,432.

Data Sources:NFT Market Overview

The market capitalization of the NFT market started at $5.24 billion and eventually grew 6.5% to $5.58 billion.

Data Sources:NFT Market Cap & Volume

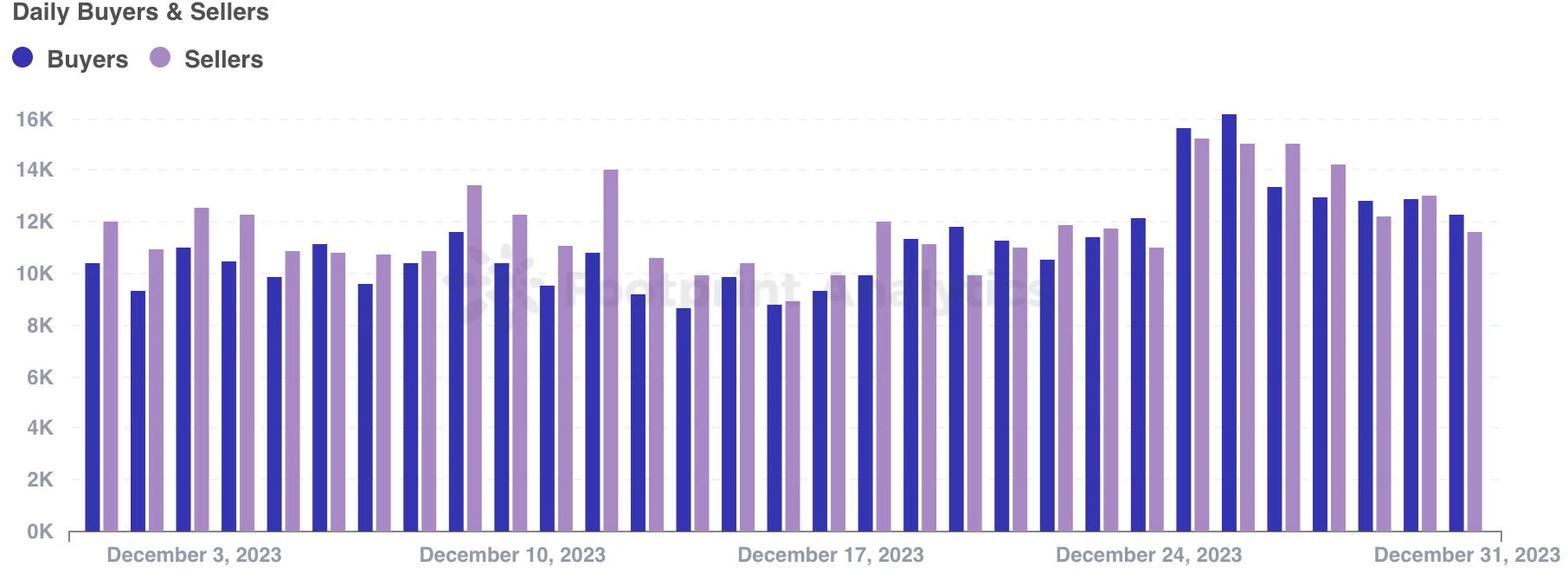

The ratio of buyers to sellers was 102.1%, an increase of 1.45% from November. Specifically, there were 180,232 buyers (a 22.7% increase) and 176,607 sellers (a 21.0% increase).

Data Sources:Daily Buyers & Sellers

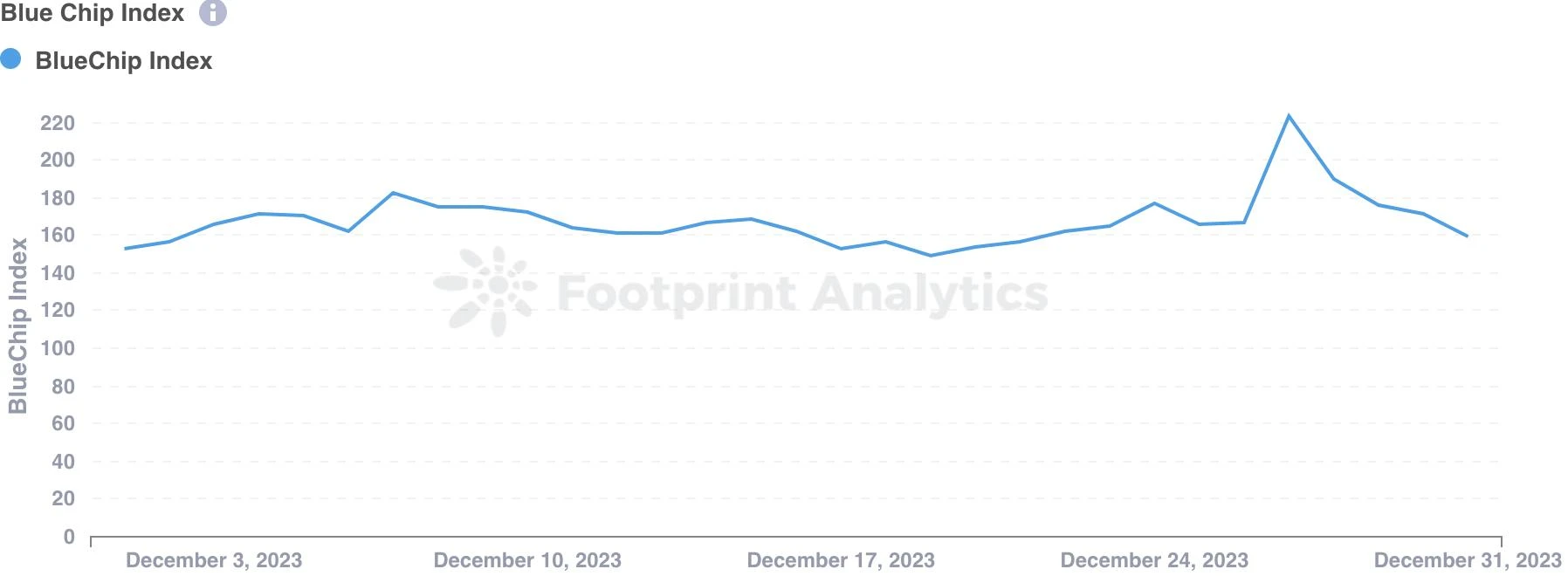

The blue-chip index also rose, rising 4.6%.

Data Sources:BlueChip Index

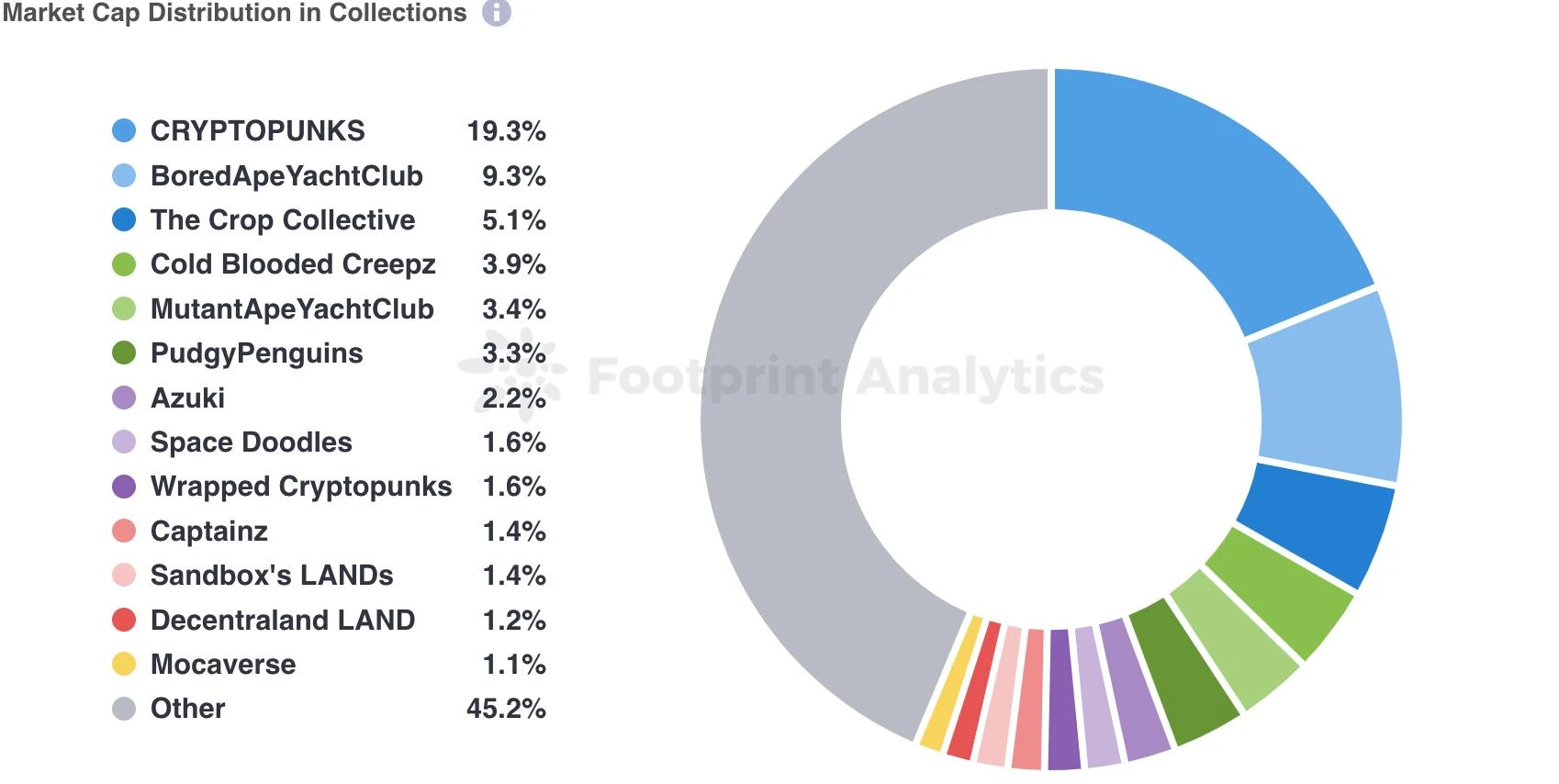

Pudgy Penguins and Mocaverse saw significant growth this month, according to Footprint Analytics.Pudgy PenguinsThe floor price increased by 64.4%, from 6.46 ETH to 10.62 ETH, whileMocaverseThe floor price increased by 51.6%, from 2.23 ETH to 3.38 ETH. Additionally, following an investment of US$20 million in September 2023,Animoca Brands raised an additional $11.88 million for Mocaverse this month.

Data Sources:Market Cap Distribution in December

Public chain and NFT trading market

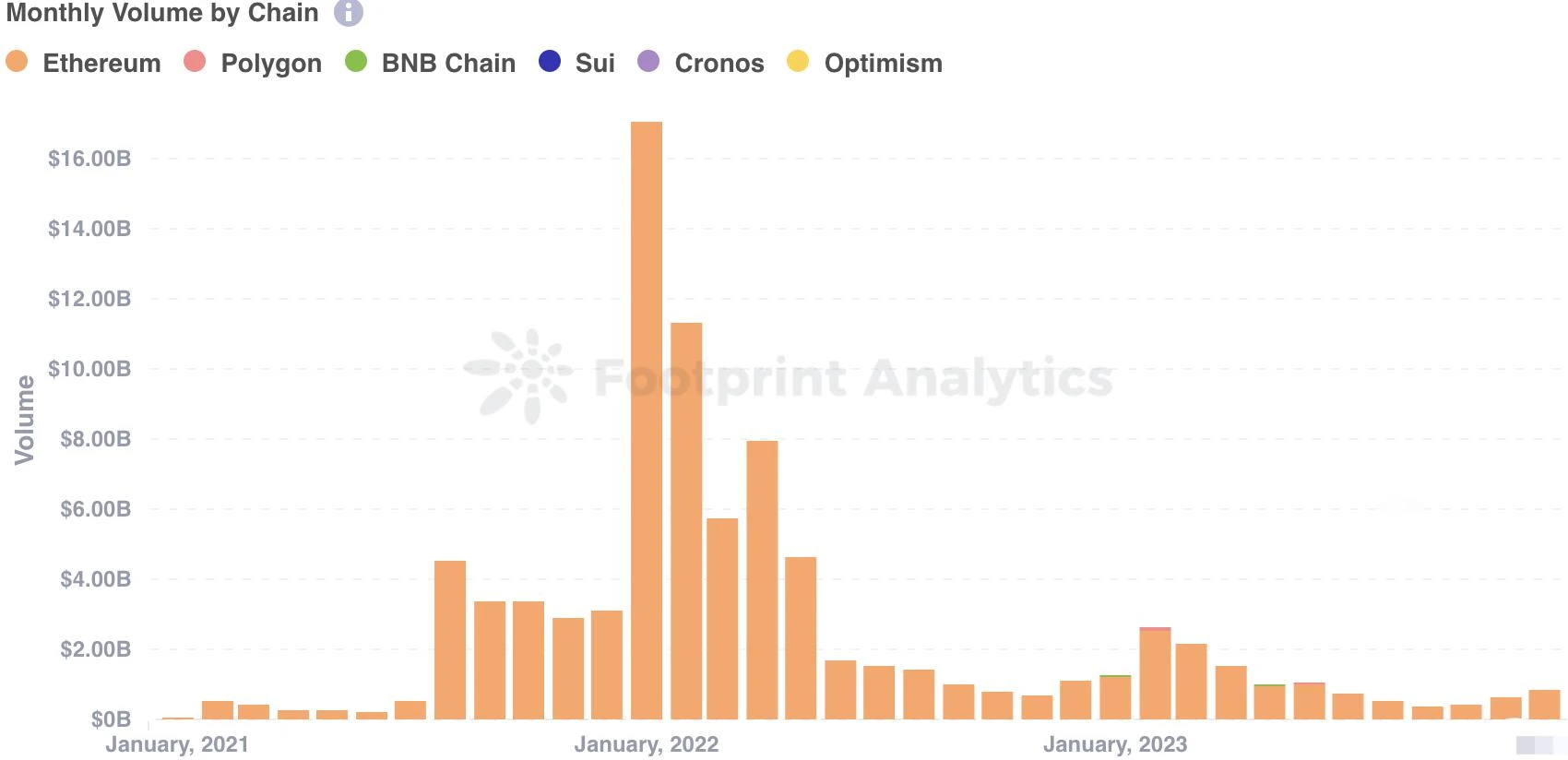

In December, Ethereum continued to maintain its market leadership, with transaction volume reaching $840 million, accounting for 98.1%. The transaction volume increased significantly by 31.8% compared with November.

Data Sources:Monthly Volume by Chain./a>

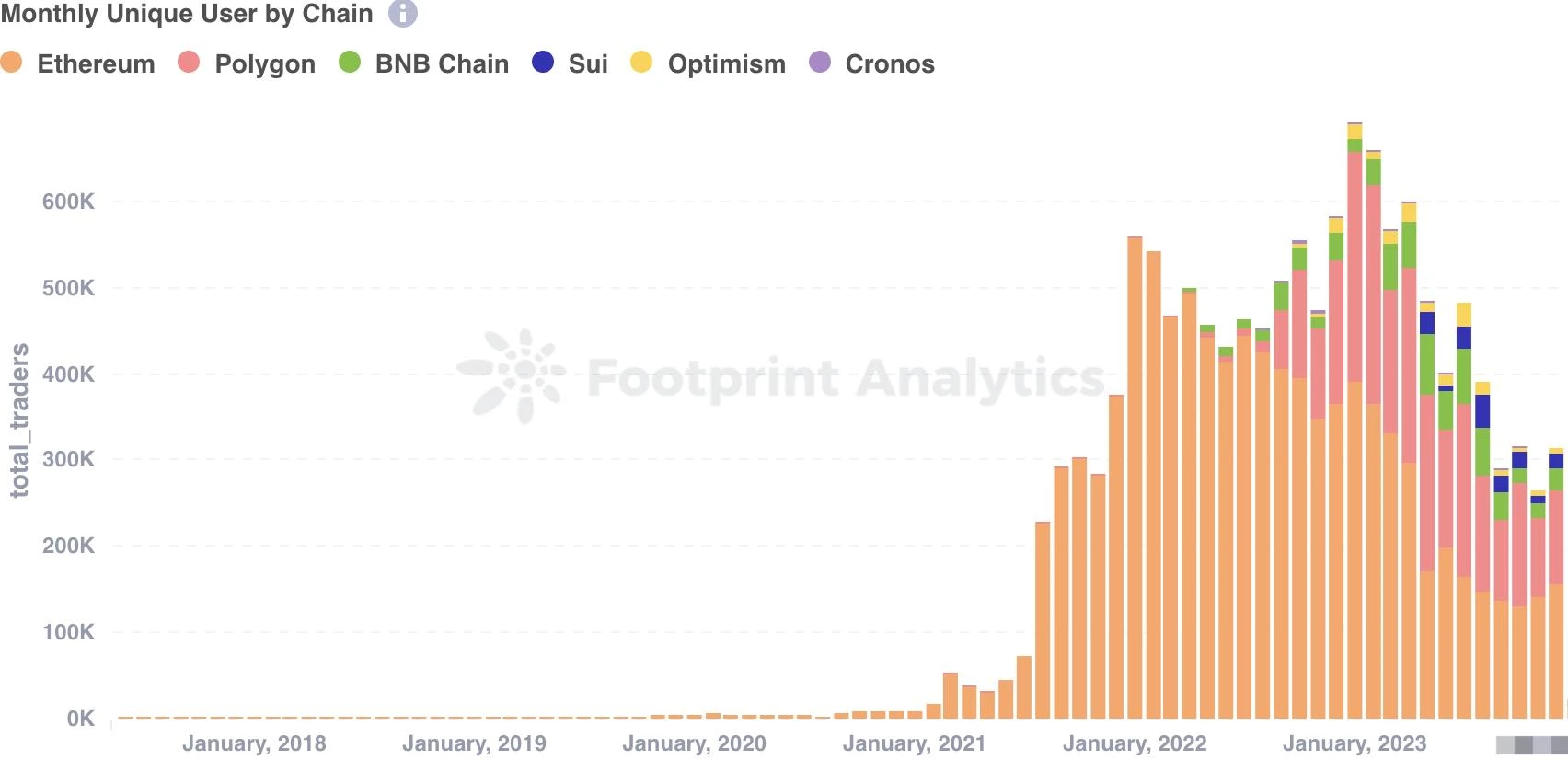

Different public chains show diversified trends in user participation. Ethereum continues its upward trend, with 156,000 unique users, an increase of 10.9% from November. The number of Polygon users increased by 19.2% to 110,000, reversing the previous downward trend. BNB Chain also rebounded, with the number of users reaching 24,000, an increase of 41.8%, but still lower than the peak in July. Suis user base has doubled to 18,000.

Data Sources:Monthly Unique User by Chain

Looking at macro trends, the NFT market trading volume in 2023 was US$13.12 billion, down from the previous years high. Ethereum’s market share fell slightly to 97.8%, down from 99.8% in 2022, indicating that the market is gradually diversifying.

Data Sources:Yearly Volume by Chain

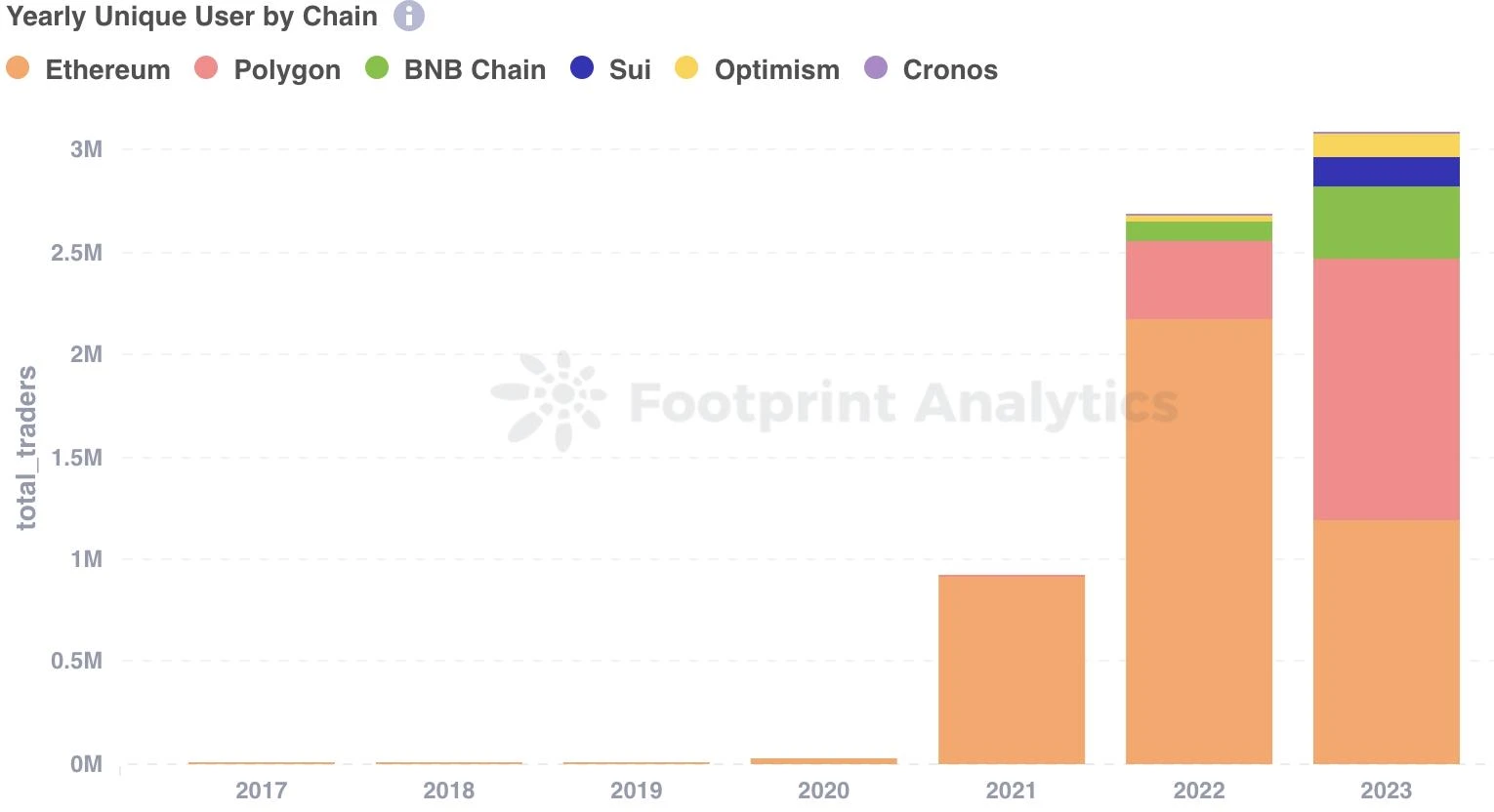

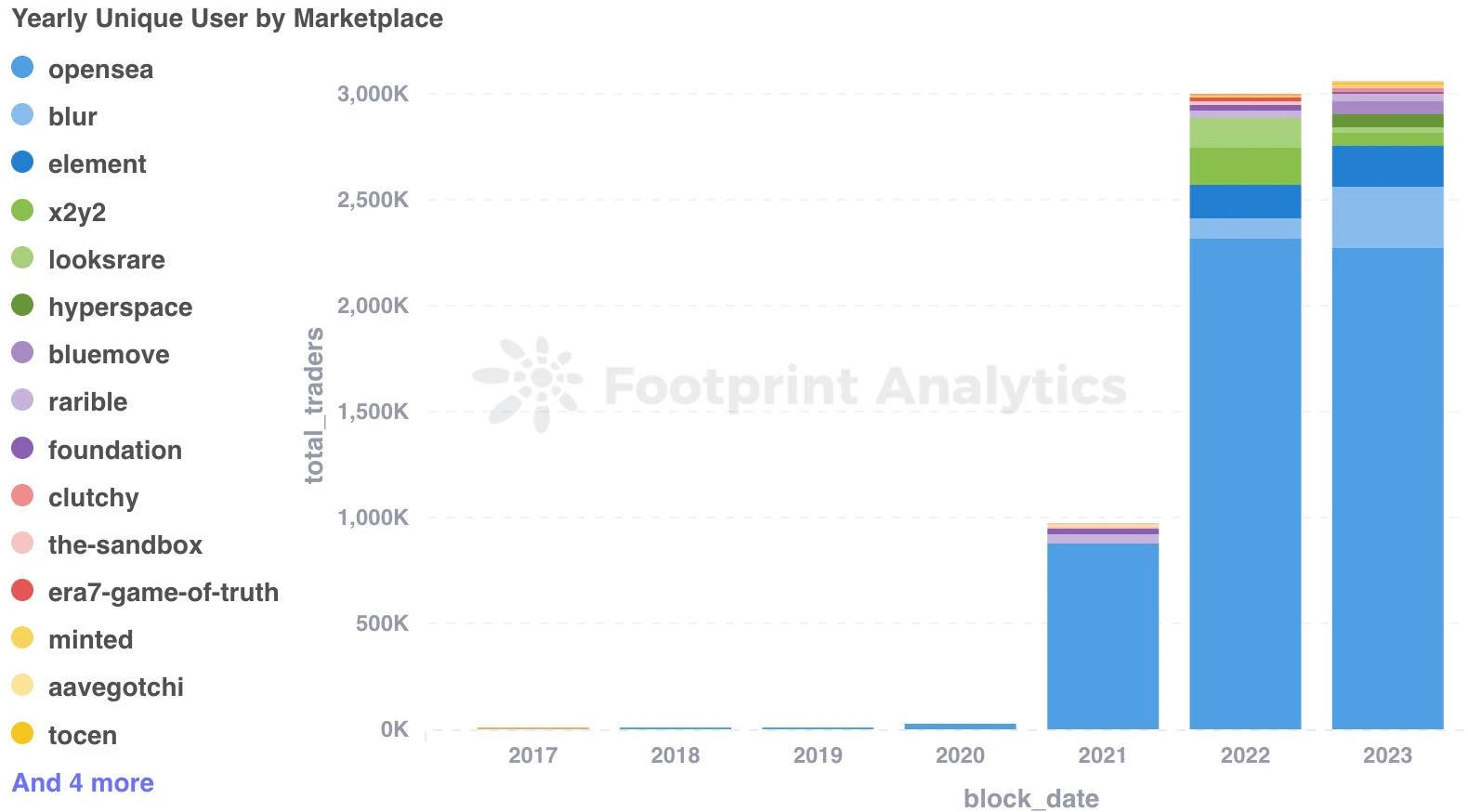

In 2023, Polygon led the way in terms of number of unique users, growing a staggering 231.0% to reach 1.28 million users. However, the number of Ethereum users fell by 45.2% to 1.19 million users, reflecting changes in user preferences between different public chains. BNB Chains user base has expanded to 350,000, an increase of 280.7% compared to 2022.

Data Sources:Yearly Unique User by Chain

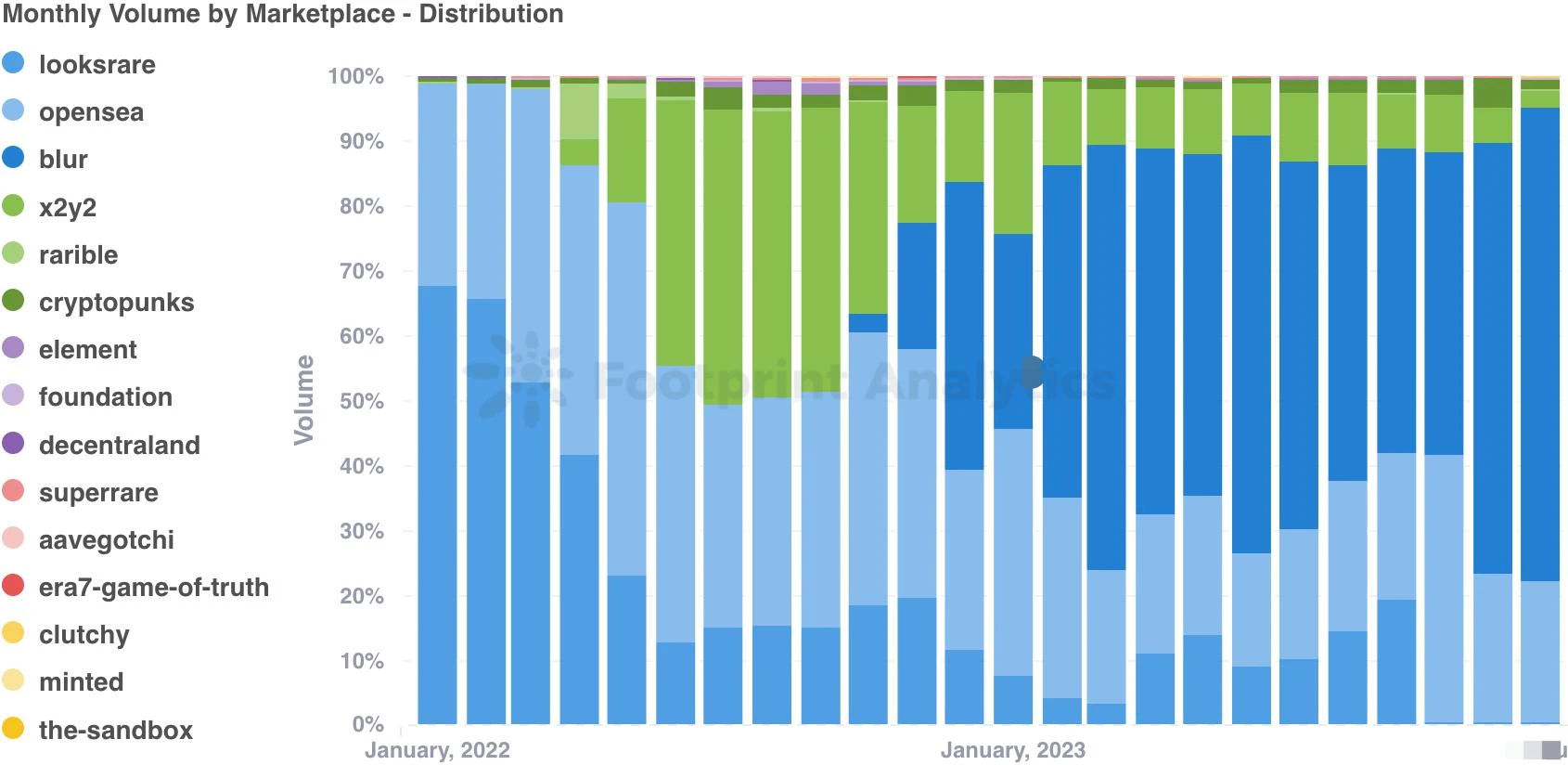

In the NFT trading market dynamics in December, we can see some major changes. Blurs trading volume increased by 45.4% to $620 million, while OpenSeas trading volume rose by 25.2% to $190 million. However, X2Y2s trading volume fell by 32.0%.

Data Sources:Monthly Volume by Marketplace - Distribution

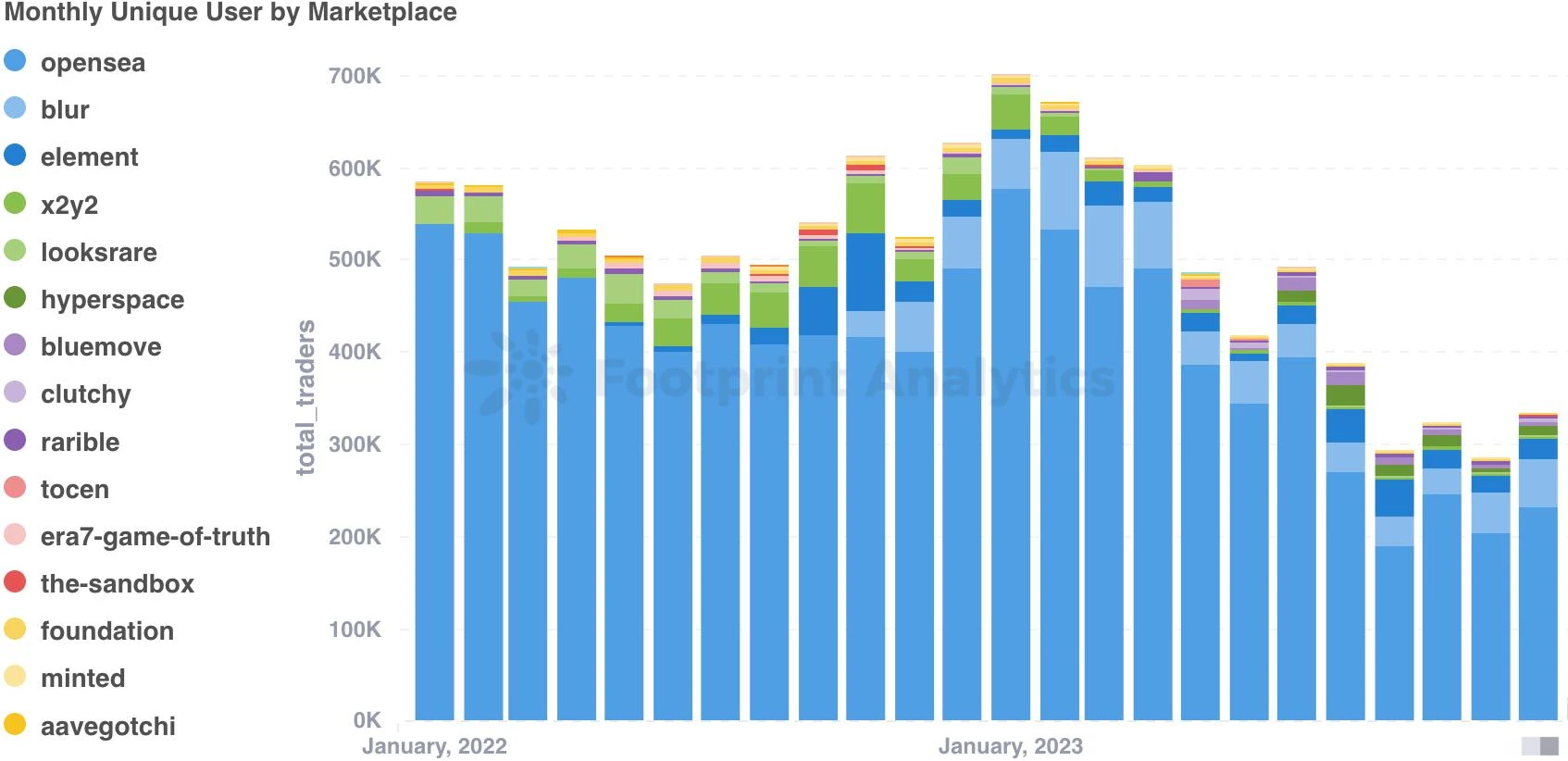

In addition, OpenSeas unique users increased by 14.0% in December to 232,702, further solidifying its market leadership. Unique users of Blur and Element also increased by 19.0% and 18.6% respectively.

Data Sources:Monthly Unique Users by Marketplace

In 2023, the annual trading volume performance of the NFT trading market showed significant changes compared with the previous year. Blur achieved a staggering annual transaction volume of $7.26 billion, far exceeding the $650 million in 2022. Although OpenSeas trading volume fell from $20.91 billion to $3.31 billion, it still has some influence in the market.

Data Sources:Yearly Volume by Marketplace

Meanwhile, Blurs user base grew 189.8% to 291,579 people, marking its rapid rise in the NFT market.

NFT investment and financing situation

Compared with November, investment and financing activities in the NFT field were more active this month, with a total of five rounds of financing and a total of US$160 million raised.

NFT project financing situation in December 2023

Among them, LINE NEXT, as a subsidiary of LINE that focuses on NFT development, received a US$140 million investment led by Crescendo Equity Partners. This is the largest financing in Asias Web3 field in 2023. This round of financing will support LINE NEXT’s launch of its global NFT platform DOSI in January 2024.

source:DOSI Citizen

As we bid farewell to 2023, the steady momentum and continuous changes in the NFT market indicate that 2024 will be an epoch-making year. NFTs are rapidly transcending their role as traditional digital collectibles to become a medium that represents users’ personalities, perfectly combines digital and reality, and facilitates user co-creation. This shift marks a clear progression toward wider mainstream adoption. As the diversity of user participation continues to expand, the emergence of more platforms is building a multi-dimensional and rich NFT ecosystem, laying a solid foundation for continued innovation and growth in the future.

________________

The above research report data includes:

Public chains: Ethereum, Polygon, BNB Chain, Cronos, Optimism, Sui

Markets: OpenSea, LooksRare, Blur, X2Y2, Cryptopunks, Rarible, SuperRare, Foundation, Decentraland, Aavegotchi, Element, Era 7, the Sandbox, Minted, Clutchy, BlueMove, Hyperspace, Tocen, and Keepsake.

The content of this article is for industry research and communication only and does not constitute any investment advice. Market risk, the investment need to be cautious.

This article was contributed by the Footprint Analytics community.

Footprint AnalyticsIs a blockchain data solutions provider. With the help of cutting-edge artificial intelligence technology, we provide the first code-free data analysis platform and unified data API in the Crypto field, allowing users to quickly retrieve NFT, Game and wallet address fund flow tracking data of more than 30 public chain ecosystems.

Product Highlights:

For developersData API

for GameFi projectFootprint Growth Analytics (FGA)

Big data batch download functionBatch download

All provided by Footprintdata set

Check out our Twitter (Footprint_Data) Learn more about product updates