Author of the article: Meta Era guest author Metaer

At the beginning of the new year, just as the crypto industry was eagerly anticipating the approval of spot Bitcoin ETFs, the U.S. Securities and Exchange Commission caused an own incident. In the early morning of January 10, Hong Kong time, the U.S. Securities and Exchange Commission official The original Twitter) account announced that it has approved the spot Bitcoin ETF and allowed it to be listed on all registered stock exchanges in the United States. However, shortly after the news was released, U.S. Securities and Exchange Commission Chairman Gary Gensler issued a statement saying that the agency’s Twitter account had been compromised and unauthorized tweets had been posted, and that the U.S. Securities and Exchange Commission had not yet approved spot Bitcoin exchange-traded products. Listed and traded.

However, this incident does not seem to have affected the confidence of spot Bitcoin ETF issuers and the approval progress. In the early morning of January 11, the boots finally landed, and the spot Bitcoin ETF was finally approved by the U.S. Securities and Exchange Commission.

However, after experiencing a series of torsions, the encryption industry seemed to have lost its initial enthusiasm. Once the news was released, the overall market performance was still stable, and shocks did not appear. Bitcoin was still fluctuating in the range of the previous high of $47,000, which may be an early benefit. has been released. In fact, crabs have already been tried on the other side of the ocean, and this place is: Hong Kong.

On the day when the US SEC approved the first spot Bitcoin ETF, Wu Jiezhuang, a member of the National Committee of the Chinese Peoples Political Consultative Conference and a member of the Hong Kong Legislative Council, promptly posted on social media that the Hong Kong SAR government should promote the implementation of spot ETFs as soon as possible. The Hong Kong Securities Regulatory Commission has already expressed its readiness. Applications for Spot Bitcoin ETF are accepted.

In the field of virtual asset ETFs, why does Hong Kong have an advantage over the United States?

In fact, Hong Kong has listed Asias first crypto-asset ETFs, CSOP Bitcoin Futures ETF and CSOP Ethereum Futures ETF, as early as the end of 2023, providing Hong Kong and international investors with more choices. The two ETFs, managed by CSOP Asset Management Ltd., track standardized, cash-settled Bitcoin futures contracts and Ethereum futures contracts traded on the Chicago Mercantile Exchange (CME Group), respectively.

Overall, it seems that U.S. regulatory agencies have been adopting a easy in and strict out virtual asset supervision model, that is, they do not provide detailed system explanations before market access, but first open the pockets and then use their law enforcement powers to Violations and agency penalties. In contrast, Hong Kong regulators have provided a relatively complete ETF access mechanism, and the regulatory model is clearer and more transparent.

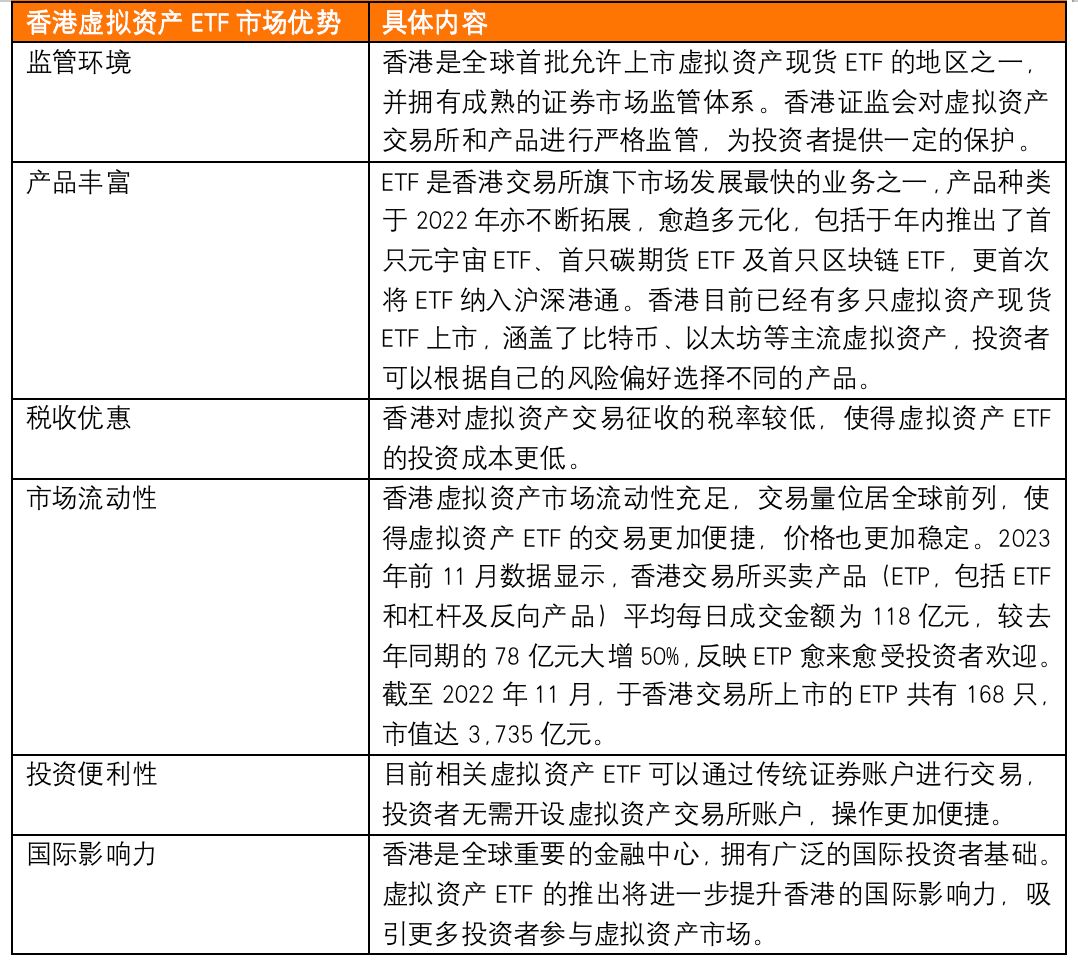

At this stage, the advantages of Hong Kong’s virtual asset ETF market are mainly reflected in the following aspects:

Although the Chicago Mercantile Exchange has long listed Bitcoin futures ETF, and Hong Kong also has a futures ETF launched by CSOP, at this stage, the spot Bitcoin ETF is the product that attracts the most attention in the entire cryptocurrency market, because it is absolutely Most public funds are not very involved in futures, and they cannot add high-risk assets such as Bitcoin to their investment list. However, spot ETFs are different. Whether they are public or private funds, spot ETFs are regular investment targets.

In order to make up for this shortcoming, on December 22, 2023, the official website of the Hong Kong Securities Regulatory Commission published the Notice on Funds Involving Virtual Assets Recognized by the Securities Regulatory Commission, officially announcing its preparations to accept applications for spot virtual asset ETFs, and clearly stated that for the For virtual assets (such as Bitcoin, Ethereum) that are allowed to be traded on licensed trading platforms, licensed institutions can issue and manage corresponding spot ETFs, and exchange them in kind and in cash on licensed trading platforms or recognized financial institutions. Make subscriptions and redemptions.

On the same day, the Joint Circular on Virtual Asset Related Activities of Intermediaries was updated to clarify the distribution regulations including virtual asset spot ETFs. The Hong Kong Securities and Futures Commission confirmed that licensed virtual asset trading platforms have been allowed to provide retail investors with services and has approved a number of virtual asset futures exchange-traded funds (virtual asset futures ETFs) for public offering in Hong Kong. The current policies of the Hong Kong Securities and Futures Commission and the Hong Kong Monetary Authority on intermediaries interested in engaging in virtual asset-related activities Upon review, as the China Securities Regulatory Commission has recognized virtual asset futures ETFs and is ready to accept authorization applications for other funds involving virtual assets, including virtual asset spot exchange-traded funds (virtual asset spot ETFs), the two regulatory agencies have In response to the latest market developments mentioned above, relevant policies have been updated.

As shown in the table above, the Hong Kong virtual asset ETF market has low investment thresholds (investors do not need to purchase the entire virtual asset to participate in investment) and convenient transactions (trading can be conducted through traditional securities accounts, and investors do not need to open a virtual asset exchange) Account), relatively low risk (usually managed by a professional investment team, relatively low risk) and other advantages, provide investors with a convenient and safe way to invest in virtual assets.

The Hong Kong market has strong support for virtual asset ETFs

Just after the Hong Kong Securities and Futures Commission made it clear that it would accept applications for spot virtual asset ETFs, the Hong Kong Exchange also expressed its support for this regulatory measure. Luo Boren, head of securities product development at the Hong Kong Stock Exchange, said that the SFC’s announcement means that Hong Kong will become the first market in Asia to allow the listing of virtual asset spot ETFs, strengthening Hong Kong’s position as the leading digital asset center in the region and supporting Hong Kong as Asia’s first choice The ETF market continues to evolve. HKEx is ready to seize the opportunities brought by thematic investment, and will work closely with issuers and stakeholders to smoothly introduce this new product into the Hong Kong ETF market, and is committed to further enhancing Hong Kong’s attractiveness as an international financial center. strength and competitiveness, bringing more diversified choices to the market and investors.

In addition, just this week when the U.S. Securities and Exchange Commission announced its approval of spot Bitcoin ETFs, the three virtual currency ETFs listed on the Hong Kong Stock Exchange all outperformed other asset classes. Data disclosed by Ming Pao shows that three virtual currency ETF products issued by CSOP and Samsung Assets hit a 21-month high this week, and simultaneously entered the top three ETF gainers, among which CSOP Bitcoin Futures ETF and Samsung Bitcoin Futures ETFs rose more than 7%. The data also shows that the three virtual currency ETF products all use margin to participate in the trading of Bitcoin and Ethereum futures listed on the CME Group. They also allow the holding of cash and related assets. Among them, the value of the assets under management of Southern Bitcoin is the largest (scale exceeds 2.5 billion), Samsung’s Bitcoin futures ETF has the highest margin ratio, accounting for no less than 80% of the net asset value from time to time, which is the most aggressive.

It is worth mentioning that Livio Weng, chief operating officer of HashKey Group, revealed in an exclusive interview with Caixin that about ten fund companies are preparing to launch virtual asset spot ETFs in Hong Kong, and seven or eight of them are already in the process of actual advancement. stage. The preparation phase has ended, and Hong Kong is becoming the first market in Asia to allow the listing of virtual asset spot ETFs.

Summarize

Following the U.S. Securities and Exchange Commission’s major decision to approve a spot Bitcoin ETF, it heralds the growing role of Bitcoin and other virtual assets in mainstream financial markets. The approval of the ETF not only marks policymakers’ recognition of the potential of cryptocurrency as an investment tool, but also provides a new and convenient channel for the broader investment community to participate in Bitcoin investment.

In addition to the US market, Hong Kong is undoubtedly another excellent choice for the launch of spot virtual asset ETFs. We know that the market size of the Hong Kong Stock Exchange is nearly US$5 trillion, and the asset management scale of many large asset management institutions in Hong Kong has reached hundreds of billions of US dollars. In the context of the Hong Kong Securities Regulatory Commissions efforts to develop Web 3.0, virtual asset ETFs are bound to become an important option for asset management institutions in the future, and tens of billions of dollars of funds may gradually pour into them.