Original author: Meta Era guest author Metaer

For the crypto industry, a tumultuous week has finally come to an end with the U.S. Securities and Exchange Commission finalizing approval for the listing of a spot Bitcoin ETF, and now investors are turning their attention to another market full of potential, Hong Kong.

In fact, as early as December 22, 2023, the Hong Kong Securities Regulatory Commission published the Circular on Securities Regulatory Commission-authorized funds to invest in virtual assets, officially announcing its preparations to accept applications for spot virtual asset ETFs, and clearly stated that for those who are allowed to hold virtual assets, For virtual assets (such as Bitcoin, Ethereum) traded on licensed trading platforms, licensed institutions can issue and manage corresponding spot ETFs, and subscribe and subscribe in kind and in cash on licensed trading platforms or recognized financial institutions. redemption.

Previously, many investors have been wandering outside the virtual asset market. The main reason is that in addition to not adapting to this emerging investment method, they are also worried about something happening to the investment platform. Spot virtual asset ETFs allow traditional investors to invest through channels they are familiar with. For virtual asset spot ETFs issued in Hong Kong, the Hong Kong Securities and Futures Commission will require them to use a locally licensed platform.

So the question is, what licenses does the Hong Kong Securities Regulatory Commission have? How to identify it? Meta Era will be analyzed in depth in this article.

Full analysis of licenses issued by the Hong Kong Securities and Futures Commission

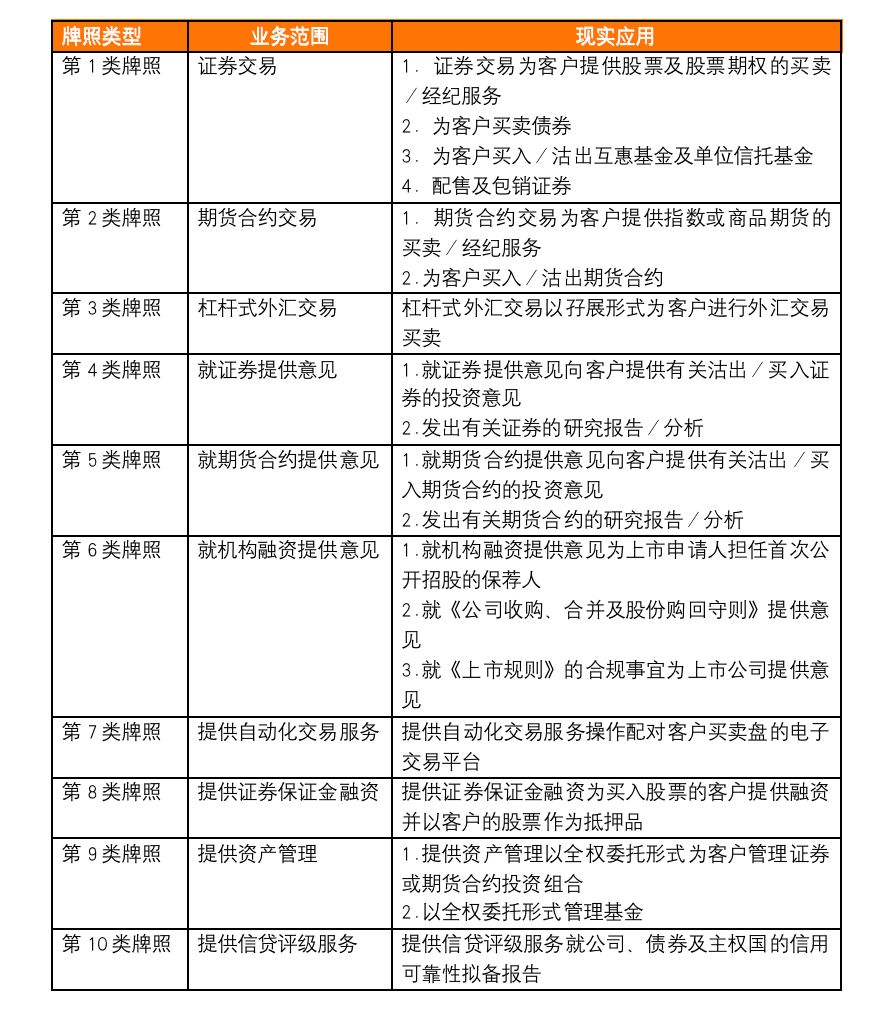

As a major offshore and non-offshore center in the Asian financial market, Hong Kong is at the forefront of the international financial market in terms of the maturity of its regulatory structure, the perfection of its public trading market and the richness of its financial products. The Hong Kong Securities Regulatory Commission manages There are 10 types of licenses, each type of license corresponds to a business. To engage in corresponding business, you must obtain the corresponding license. For details, please refer to the following:

In terms of virtual asset trading platforms, the Hong Kong Securities and Futures Commission has only granted licenses to two companies, namely Hash Blockchain Limited (HashKey Exchange) and OSL Digital Securities Limited (OSL Exchange). The licenses obtained by these two companies are both Type 1 and Category 7, that is, they can provide securities trading services and automated trading services in Hong Kong.

For institutions that want to issue spot virtual asset ETFs, they may need to pay more attention to the 149 license often referred to in the industry. As mentioned in the table above, if a financial institution wants to conduct securities trading activities in Hong Kong, the most basic condition is to hold Type 1 license, so Type 1 license is also the most common among the ten major types of licenses, and the number of individuals and institutions holding licenses is also the largest among all licenses. Hong Kong Type 4 license is a license that companies that want to provide securities advisory services in Hong Kong need to apply for. Generally, companies will choose to apply for a Type 1 license and a Type 4 license at the same time. Companies holding a Type 1 license can conduct securities trading activities, and companies holding a Type 4 license can provide advice to customers. The main service of Hong Kongs Type 4 license is to provide securities advice. If it misleads investors, the Hong Kong Securities and Futures Commission will impose fines, and Hong Kongs Type 4 license will be revoked at any time.

According to public information, it is not easy to apply for a “149” license in Hong Kong——

First of all, the applicant must be a limited company incorporated in Hong Kong or a non-Hong Kong company registered at the Registry and have an actual office address in Hong Kong (must be Class A);

Secondly, there must be an experienced management team to assist in operating the company, business framework, internal control system and qualified responsible person (risk control officer). At the same time, there must be two licensees, the nationality of the licensed individual and the responsible person In this regard, the Securities and Futures Commission does not have any restrictions or special regulations, but it requires that at least one responsible officer must be based in Hong Kong to directly supervise the relevant business, and at least one responsible officer in the company must be a member of the board of directors.

More importantly, the Hong Kong Securities Regulatory Commission requires companies applying for a license to have a registered capital of up to HK$5 million and must maintain paid-in share capital and liquid capital of no less than HK$3 million, and open an account in a bank in Hong Kong.

After understanding these backgrounds, the next thing the applicant needs to do is submit an application form. Whether it is a corporate applicant or an individual applicant, if you intend to apply for a license or registration, you need to use the common electronic form and submission service of the Hong Kong Securities and Futures Commission. Submit an online application to the China Securities Regulatory Commission through the personal account or sub-account under the consulting company account on the WINGS platform. If the application relates to a licensed corporation, registered institution or responsible officer, the applicant needs to declare on the application form that the relevant board of directors has passed a resolution approving the application. It is acceptable to the SFC if the board of directors has, by passing a resolution, authorized a specified committee or person to approve the application and the committee or person has so approved the application.

In terms of application time, for applications by new industry participants, the general waiting time is approximately: seven business days (applicable to applications for temporary licensed representatives); eight weeks (applicable to applications for ordinary licensed representatives) ; ten weeks (for applications by responsible officers); or fifteen weeks (for applications by licensed corporations).

If the statutory licensing requirements are not met, or the applicant cannot satisfy the SFC that it is a fit and proper person to be licensed or registered, the relevant license application will be rejected. However, the SFC will give the applicant an opportunity to make submissions before rejecting the application and will carefully consider any representations made by the applicant before making a final decision. If the application is still rejected later, the applicant can also lodge a review of the rejection decision with the Hong Kong Securities and Futures Appeals Tribunal within 21 days.

What do industry insiders think about when the Hong Kong spot virtual asset ETF will be launched?

With the approval of a spot Bitcoin ETF by the SEC, there is likely to be stimulus.

More brokerages are applying to the China Securities Regulatory Commission for virtual asset trading licenses. On the other hand, the number of virtual asset spot ETFs has increased. When investors trade related virtual assets, it will also increase the business of Hong Kong virtual asset brokers, which can increase the size of the entire market and also benefit Hong Kong’s local virtual asset trading platforms and brokers. development of. Regarding the question of when Hong Kong spot virtual asset ETFs will be launched, Meta Era also sorted out the opinions of some industry insiders.

According to Weng Xiaoqi, CEO of HashKey Exchange, one of Hong Kongs licensed virtual asset trading platforms, about 10 fund companies are currently preparing to launch virtual asset spot ETFs in Hong Kong, and about 7 to 8 are already in the actual advancement stage. It is reported that issuers may need to use licensed exchanges to manage underlying assets and provide trading, clearing and other services. Several issuers have chosen Hashkey to provide them with infrastructure. Hashkey will even work with issuers to apply for spot Bitcoin ETF licenses. .

OKX Global Chief Commercial Officer Jimmy Lai said that the approval of the issuance of Bitcoin ETFs in the United States means that different types of traditional investment instruments, such as large-scale funds such as pensions and retirement funds, can now directly invest in Bitcoin, including retail and institutional representatives. Investors with a wider range of backgrounds can participate in the Bitcoin market. In addition, Bitcoin ETFs are settled in kind. The capital invested in such ETFs will have a more direct impact on the spot price of Bitcoin, bring positive attention to the virtual asset market and a large amount of capital inflow, and play a key role in the long-term development of the industry. effect.

Wang Yi, director of the quantitative investment department of CSOP, one of the issuers of virtual asset futures ETFs in Hong Kong, also said that after the US SEC approves spot ETFs, traditional financial institutions can buy Bitcoin through spot ETFs, further increasing market demand for Bitcoin. Since the total supply of Bitcoin is limited, increased demand may push up the price of Bitcoin. Although Hong Kong allowed the issuance of spot ETFs before the United States, judging from the markets overall product issuance expectations, the actual product launch time will be slightly behind the United States.

Chen Peiquan, executive director of Victory Securities, a licensed virtual asset brokerage in Hong Kong, pointed out that U.S. regulatory agencies allow the listing of spot Bitcoin ETFs, which is regarded by the currency circle as the key to connecting virtual currencies with physical exchanges, and will inevitably lead to more investors participating. . Although Hong Kongs fund companies have not yet submitted applications, they are already intensively preparing for the application. It is expected that as soon as the first quarter of this year, many fund companies will express their willingness to apply, or even successfully apply.

Zhong Jun, an investment strategist at Samsung Asset Management (Hong Kong), believes that with the listing of wholesale spot ETFs in the United States, more markets are expected to follow suit and approve the issuance of spot ETFs, thereby attracting more funds to flow into the virtual asset field. After the approval of Bitcoin spot ETF, it will be easier for institutional investors and retail investors to allocate assets, but relevant investor education still needs to be strengthened.

Luo Boren, head of securities product development at the Hong Kong Stock Exchange, said that the Hong Kong Stock Exchange is ready to seize the opportunities brought by thematic investment and will work closely with issuers and various stakeholders to smoothly introduce this new product into the Hong Kong ETF market. He said that he welcomes the announcement of relevant circulars and policy guidance by the Hong Kong Securities and Futures Commission, making Hong Kong the first market in Asia to allow the listing of virtual asset spot ETFs, strengthening Hong Kongs position as the leading digital asset center in the region, and supporting Hong Kongs position as Asias preferred ETF market. Continuous development.

Summarize

We know that the AUM of many large asset management institutions in Hong Kong has reached hundreds of billions of dollars. Under the background of the Hong Kong Securities Regulatory Commission’s efforts to develop Web 3.0, investing in Bitcoin spot ETFs will become an important step for financial entities such as asset management institutions and fund companies. options, or tens of billions of dollars of funds may gradually pour into it.

Now that the system has been implemented, and the Hong Kong Securities and Futures Commission has provided clear license application information and procedures, it can be said that everything is ready but the east wind is needed. The virtual asset spot ETF will undoubtedly strengthen Hong Kong’s position as the leading virtual asset center in the region and support Hong Kong’s role as a leading virtual asset center. Asias premier ETF market continues to grow and further improve

Its attractiveness and competitiveness as an international financial center bring more diversified choices to the market and investors.