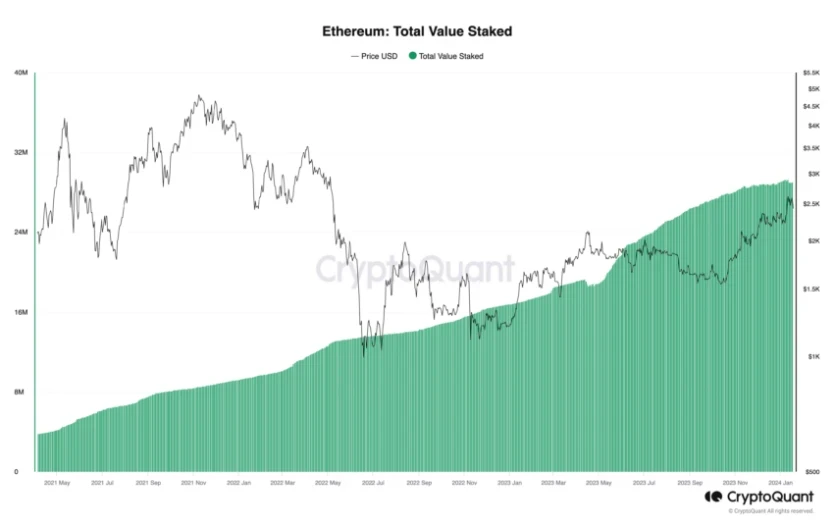

Ethereum pledge volume is growing rapidly

Although the pledge withdrawal function was opened after the Ethereum Shapella upgrade, the total amount of pledges did not decrease. Currently, the Ethereum network has 898,110 active validators with 28.8 million coins staked, accounting for 24% of the total Ethereum supply, reflecting the widespread adoption and trust of the PoS verification mechanism.

According to Ebunker, the annual inflation rate of Ethereum is -0.03%, while the annual staking return rate in the past 7 days is approximately 5.04%. The deflationary trend and more attractive staking rewards make ETH holders full of long-term value for the Ethereum network. Confidence, prefer to earn passive income through staking. This trend also coincides with the growth in stability and maturity of the Ethereum ecosystem.

Ethereum Staking aims to increase the security and stability of the network while reducing its environmental footprint, putting Ethereum blockchain development at the forefront of decentralized applications, enabling secure and transparent transactions in the digital realm. However, the impact of the surge in staking volume was previously unforeseen during development and has posed a potential risk to the Ethereum network. As a result, Ethereum developers are considering EIP-7514, a proposal that would change the landscape of Ethereum staking.

The risk of over-collateralization in Ethereum

The big problem with over-collateralization stems from the pressure a massive increase in validators puts on the Ethereum network. As more participants participate in staking, the number of validators and their corresponding responsibilities will continue to grow. This leads to issues such as increased communication, stakeholder ledger (beacon chain) growth, traffic surges, network congestion, and longer transaction processing times.

As the amount of pledges increases, the pressure on the consensus layer responsible for confirming transactions will increase exponentially. While a high staking level can enhance network security, its benefits to the network are diminished when staking volumes surge in the short term.

As more ETH is staked, the rewards obtained by validators will be distributed to more participants, and the staking revenue will also decrease, but the high profit of miner extractable value (MEV) and the liquidity of the staking token The appeal will continue to spur additional staking growth. If this trend continues unchecked, a higher percentage of ETH will be staked. Therefore, Ethereum itself must carefully evaluate this to ensure the durability and stability of the Ethereum network.

How will EIP-7514 solve Ethereum’s staking issues?

EIP-7514 proposes to alleviate the rapid surge in ETH staking volume by changing the growth rate of validators. It proposes to convert it from the current exponential growth model to a controlled linear growth model by limiting the epoch churn limit.

Epoch churn limit is a setting that limits the number of validators that can join or leave the Ethereum network during a specific period (epoch). Currently, the number of nodes joining or exiting each epoch is 12, and will slowly increase as the total number of validators increases.

When the epoch limit is introduced, Ethereum will limit the rate at which new validators can join the Ethereum network, reducing it from a floating value (currently 12) to a fixed value of 8, thereby slowing down the surge in ETH pledge volume. However, the total amount exiting the network in each Epoch is not affected by this EIP and is still linked to the total number of validators (currently 12 per Epoch).

The reason is not complicated. According to the prediction of Ethereum core developer Dankrad Feist, the amount of ETH pledged may reach 50% of the total amount by May 2024, and may even reach close to 100% by December 2024. While high staking levels can theoretically improve network security, reaching high staking levels in the short term could disrupt the network balance and increase the burden on the consensus layer, while also risking depleting the available ETH supply on the chain. And if EIP-7514 is implemented, it will effectively prevent the amount of Ethereum pledged from growing too fast.

EIP-7514 is intended to hinder the expansion of the active validator set. Limiting the size of the validator set buys the Ethereum team some buffer time to develop a long-term solution to the problem. For the future, such as single-socket endpoints (SSF) and P2P network traffic, it will be crucial to effectively control the size of the validator set. This will ensure that the Ethereum network remains healthy and continues to run as planned, and there will be no impact on those already running validators.

The impact of EIP-7514 on Ethereum

EIP-7514 does not immediately address the technical and financial issues posed by the surge in Ethereum staking. A fixed maximum churn limit limits the number of validators that can enter or leave the network during an epoch, thereby temporarily mitigating staking increases and buying time to research long-term solutions. Since the churn limit for validators leaving the network is still dynamic, it is not affected by this limit. This ensures efficient reward management and prevents long staking withdrawal queues.

Because the impact of staking growth was not fully anticipated when the staking mechanism was first introduced to the Ethereum network, the EIP-7514 proposal is only a temporary response. If a hard cap is placed on the validator churn limit, it will become more difficult for new validators to join each epoch, so it will take longer for the pledge amount to increase to a higher proportion. If the validator activation queue remains saturated and this setting does not affect staking demand, staking volume will still rise to very high levels in the long term.

However, EIP-7514 could give the Ethereum development team enough time to explore long-term solutions to the staking problem. At present, some potential long-term alternatives mainly include: appropriately reducing staking returns, implementing MEV destruction, weakening Lidos monopoly by promoting the participation of more liquidity staking providers, and increasing the ETH required by each validator. Quantity etc. However, given that these solutions have not yet been tried and that blockchain technology is constantly changing and raising new questions, executing on these options without a thorough understanding of their implications could cause unpredictable second-order impacts.

Community reaction and discussion

EIP-7514 was one of the topics of community discussion during Ethereum’s 2024 Dencun upgrade. Currently, the Ethereum community has a mixed attitude towards EIP-7514.

On the one hand, supporters believe that EIP-7514 is seen as a practical step to control the rapid growth of staking and reduce network load. Therefore, implementing EIP-7514 before a long-term solution is proposed can alleviate the problem and make later related technology updates more efficient. Smooth; on the other hand, opponents believe that EIP-7514 was launched hastily without sufficient consideration, and the urgency of limiting validator growth does not match the steadily shrinking activation queue. They question that the proposal may harm Ethereum. The company’s commitment to net neutrality.

Nonetheless, the coming together of diverse perspectives in the community means the community is committed to addressing challenges and ensuring Ethereum remains resilient and adaptable in an evolving ecosystem. Community discussions will also facilitate more detailed research and development by the Ethereum development team on solving staking issues without harming other network components.

summary

The discussion surrounding EIP-7514 demonstrates the dynamic nature of Ethereum’s governance and how the community proactively addresses new issues. EIP-7514 seeks to strike a delicate balance between promoting staking growth, ensuring network efficiency, and maintaining Ethereum’s long-term sustainability, setting a precedent for handling unforeseen issues. EIP-7514 will play an important role in controlling the excessive growth of ETH pledges and gain buffer time for the Ethereum community to develop viable alternatives. It is an important step to ensure the long-term stability and prosperity of Ethereum.