WealthBee Macro Monthly Report: U.S. inflation pressures rise beyond expectations, and the crypto market’s “Spring Festival market” arrives as expected

The U.S. manufacturing industry has recovered for two consecutive months, causing U.S. inflation to heat up again and triggering market concerns;OpenAIThe release of the Demo of Vincents video model Sora triggered a new round of discussions about the AI revolution. NVIDIAs financial report far exceeded expectations, and its market value once became the third largest in the US stock market (after Microsoft and Apple); the encryption market gave out a big red envelope during the Spring Festival , Bitcoin topped $61,000, and the blood supply function of ETFs on the crypto market has begun to show results.

In early February, the U.S. Department of Labor took the lead in announcing the first important data: U.S. non-farm employment increased by 353,000 in January, the largest increase since January 2023. The estimate was for an increase of 185,000, compared with the previous estimate of 216,000.

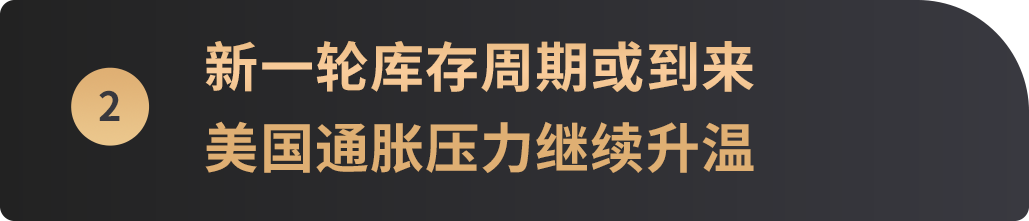

The jobs data raised concerns about higher inflation. Sure enough, data released on February 13 showed that the U.S. CPI increased by 3.1% year-on-year in January (expected to increase by 2.9%); the CPI in January increased by 0.3% month-on-month (expected to increase by 0.2%). United States JanuaryCore CPIYear-on-year growth was 3.9% (3.7% growth expected); core CPI in January increased 0.4% month-on-month (0.3% growth expected). The market voted with real money that day: the Nasdaq fell 1.8% on the day, while the 10-yearU.S. Treasury yieldsGet out of the big Yang line.

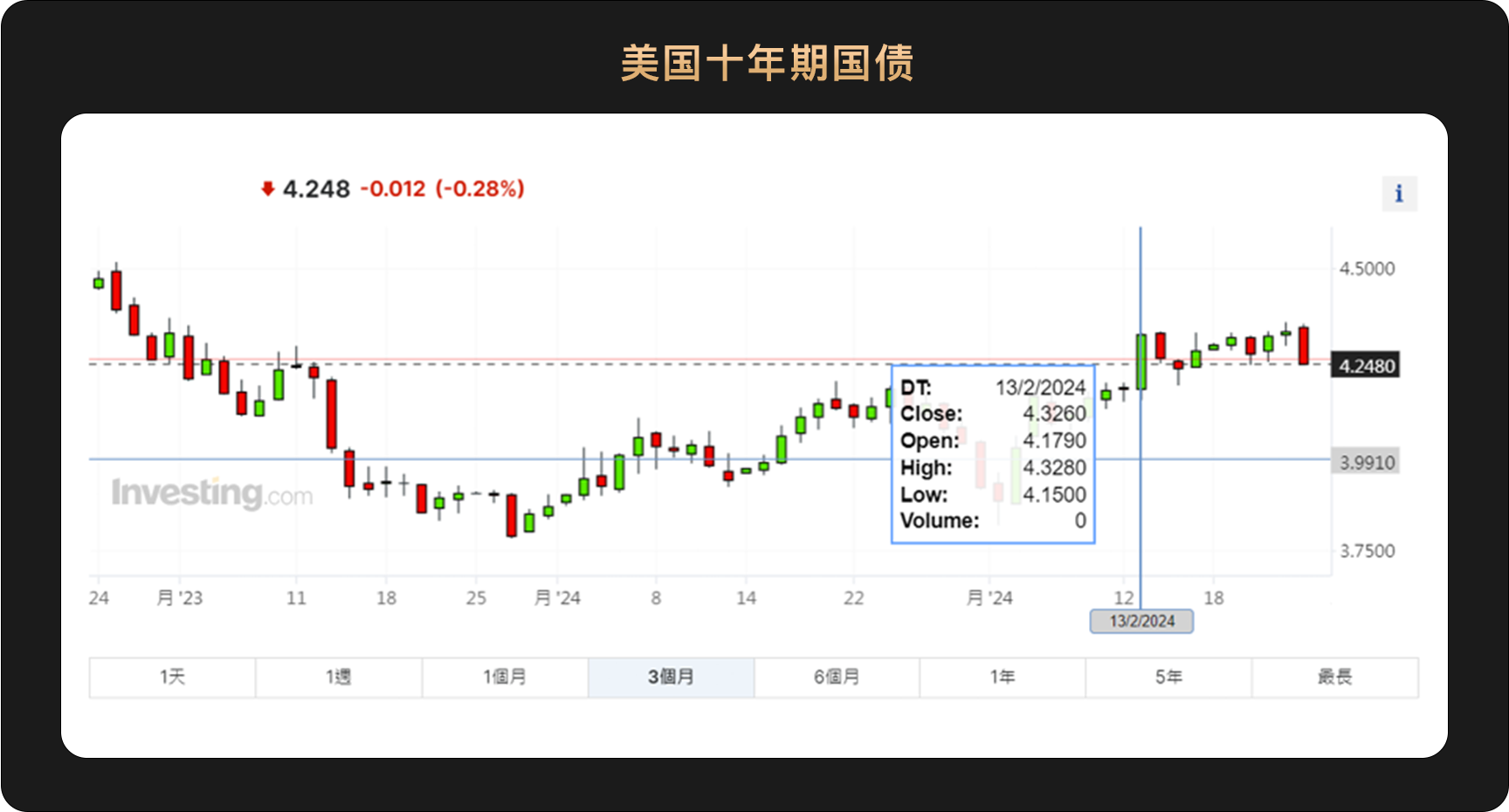

The trend of U.S. debt has actually started to rise slowly since the end of January. This is related to the performance of various economic data at the end of last year and the beginning of this year. Smart money has long expected the possible inflation. Currently, according to FedWatch, the market generally expects the first rate cut to be made in June, and Goldman Sachs no longer expects a rate cut in the United States in May, but instead expects only four rate cuts this year, compared with the previous expectation of five.

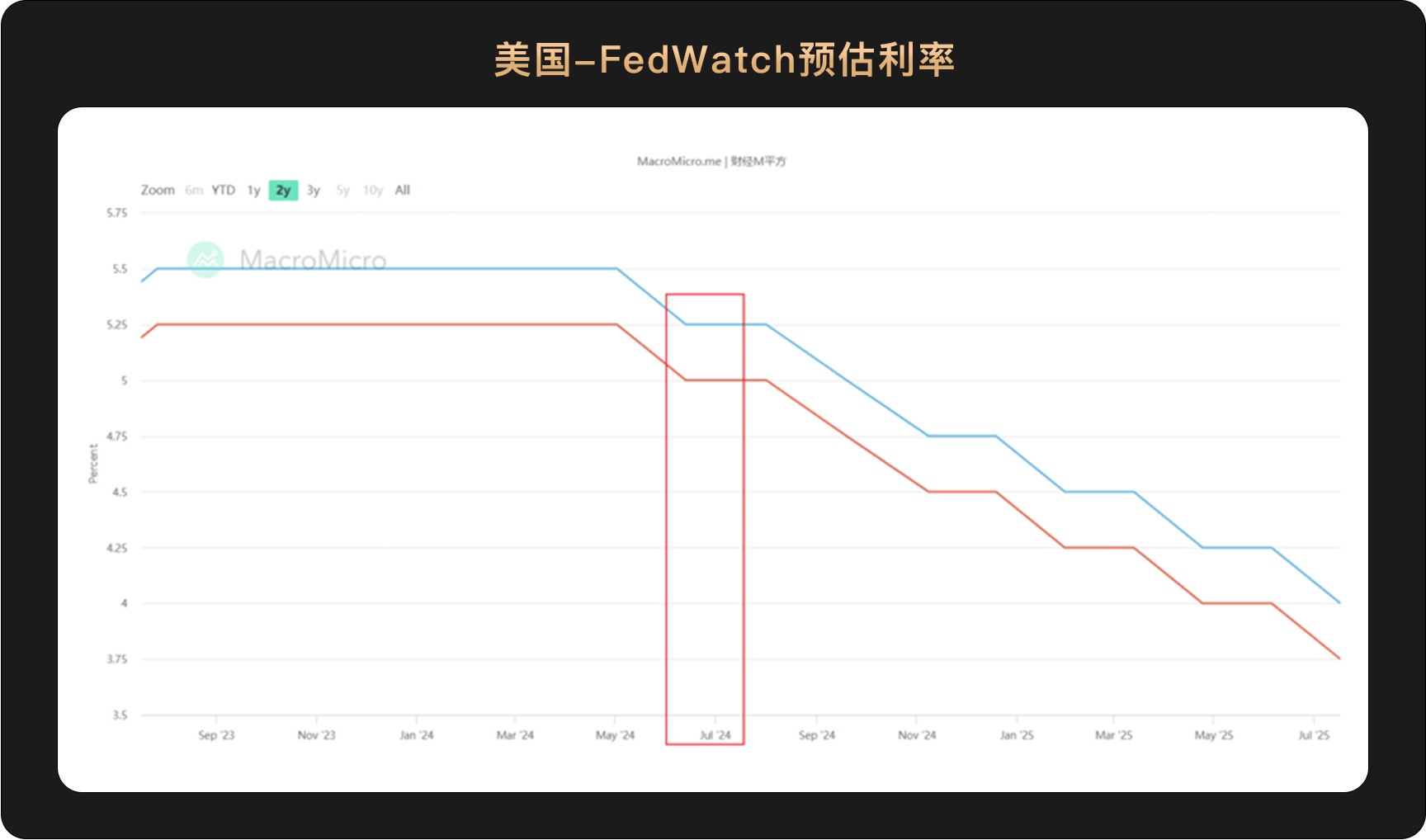

In fact, the performance of the U.S. economy is related to the manufacturing cycle. The recently announced MarkitManufacturing PMIThe preliminary value shows that the initial value of the Markit manufacturing PMI in the United States in February was 51.5, which was expected to be 50.5 and the previous value of 50.7. This is the first time since September 2022 that the initial value of the Markit manufacturing PMI in the United States has been above the boom-and-bust line for two consecutive months.

Judging from the number of manufacturing orders, the latest number of manufacturing orders in the United States hit a new high since June 2022. The strong recovery of the manufacturing industry means that the United States may be entering a new round of inventory cycle, thereby driving employment data and inflation.

However, in terms of continuing to raise interest rates, the market generally believes that this is unlikely to happen. Judging from the FedWatch probability of interest rate hikes and cuts, although the probability of interest rate cuts has dropped sharply, the probability of interest rate hikes has remained at a low level, indicating that the market generally does not believe that continued interest rate hikes will occur. The current development trend of the U.S. economy is accompanied by a certain amount of inflation. From the perspective of asset prices, inflation has not suppressed the rise of stocks and crypto assets at this stage. Asset prices reflect changes in the economic situation, and the market is still optimistic about subsequent interest rate cuts. .

The hottest event in the tech world this month is the release of Sora, a Vincent video tool by OpenAI. Multiple one-minute videos generated by this tool are widely circulated on the Internet, and their image quality, smoothness and logical coherence between frames are no less than those of human-produced videos. Most opinions believe that the emergence of the Sora model heralds the coming of industry changes. In the field of content creation and media, it will completely change the traditional way of video production, helping creators create high-quality videos in a more efficient and lower-cost way, thus promoting the improvement of work efficiency in the entire industry.

When ChatGPT was created, there was speculation that video-generating AI tools might be 5 to 10 years away. But just over a year after the release of ChatGPT, Sora emerged and produced shocking results. Although there may be some partial flaws in the video, it does not affect the overall effect, and these problems can be gradually solved through technical iteration. In other words, AI technology is developing far faster than people expected.

At the same time, Nvidia’s latest financial report data also proves the speed of AI development. Many of its financial report data exceeded market expectations: NVIDIAs fourth-quarter revenue was US$22.1 billion, a 22% increase from the previous quarter and a year-on-year surge of 265%, higher than analysts expectations of US$20.41 billion. The single-quarter revenue was even higher than that of the whole of 2021. Net profit in the fourth quarter was US$12.3 billion, a year-on-year increase of 769%, and adjusted earnings per share were US$5.16, higher than market expectations of US$4.59. Adjusted profit margin in the fourth quarter was 76.7%, exceeding market expectations of 75.4%. Throughout fiscal 2024, Nvidias revenue increased 126% year-over-year to $60.9 billion. In addition, Nvidia expects first-quarter revenue of US$24 billion, with a fluctuation range of no more than 2%, which is much higher than market expectations of US$21.9 billion. After the financial report data came out, Nvidias stock soared by more than 16% on February 22, and even became the third largest market capitalization company in the US stock market after Microsoft and Apple. On that day, NVIDIA drove the three major U.S. stock indexes to jump short and open higher. The Dow and SP 500 continued to hit record highs. The Nasdaq reached a maximum of 16,134.22 points, less than 100 points away from the record high.

There is another interesting news this month: Charles Schwab’s total number of U.S. teenagers (13-19 years old) custody accounts is approaching 200,000 in 2022, up from 120,000 in 2019, and will further benefit from acquisitions in 2023 TD Ameritrade has expanded to more than 300,000 households. Among them, technology stocks represented by Big 7 are the most popular among teenagers. Each generation has its own investment habits and financial management logic. The old money represented by Buffett prefers traditional blue chips with high dividends, while the new generation of young people prefers the high-growth technology industry. Therefore, we have reason to believe that with the support of AI, new assets such as technology giants and even crypto assets will most likely be accepted by more and more people and become mainstream investments in the long term in the future.

During the Spring Festival, the price of Bitcoin has been soaring. It started to surge around the price of 43,000 US dollars at 0:00 (UTC+ 8) on February 8, rising for a week to the 15th. Then it began to enter a period of sideways consolidation, with the price reaching a maximum of 53,000 US dollars. Up to 23.3%. On the 28th, Bitcoin continued to break through, reaching a maximum of around $61,000.

Bitcoins Spring Festival market seems to have become a new custom - in the past 9 years, if you buy Bitcoin 3 days before the start of the Lunar New Year and sell it 10 days after the start of the Lunar New Year, you will get varying degrees of gains. According to rough statistics, in the past nine years, 2021 has had the highest increase, with the highest increase of 24.3%. Even the worst-performing Spring Festival period in 2019 had an increase of about 3%.

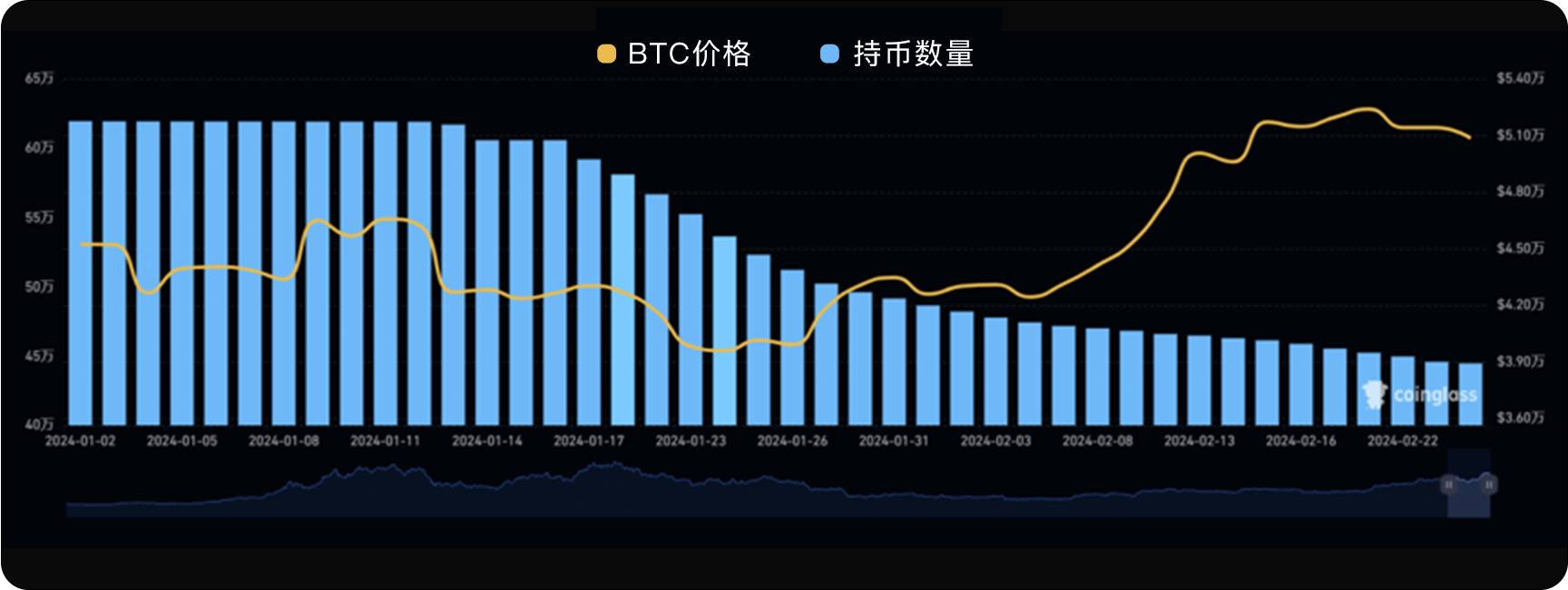

Of course, aside from these metaphysical factors, the driving force behind this wave of Bitcoin’s rise actually comes from the reduction in Grayscale’s selling pressure and the continued inflow of Bitcoin spot ETF funds: As can be seen from the figure below, although Grayscale’s positions are still decreasing, However, the extent of reduction is diminishing at the margin.

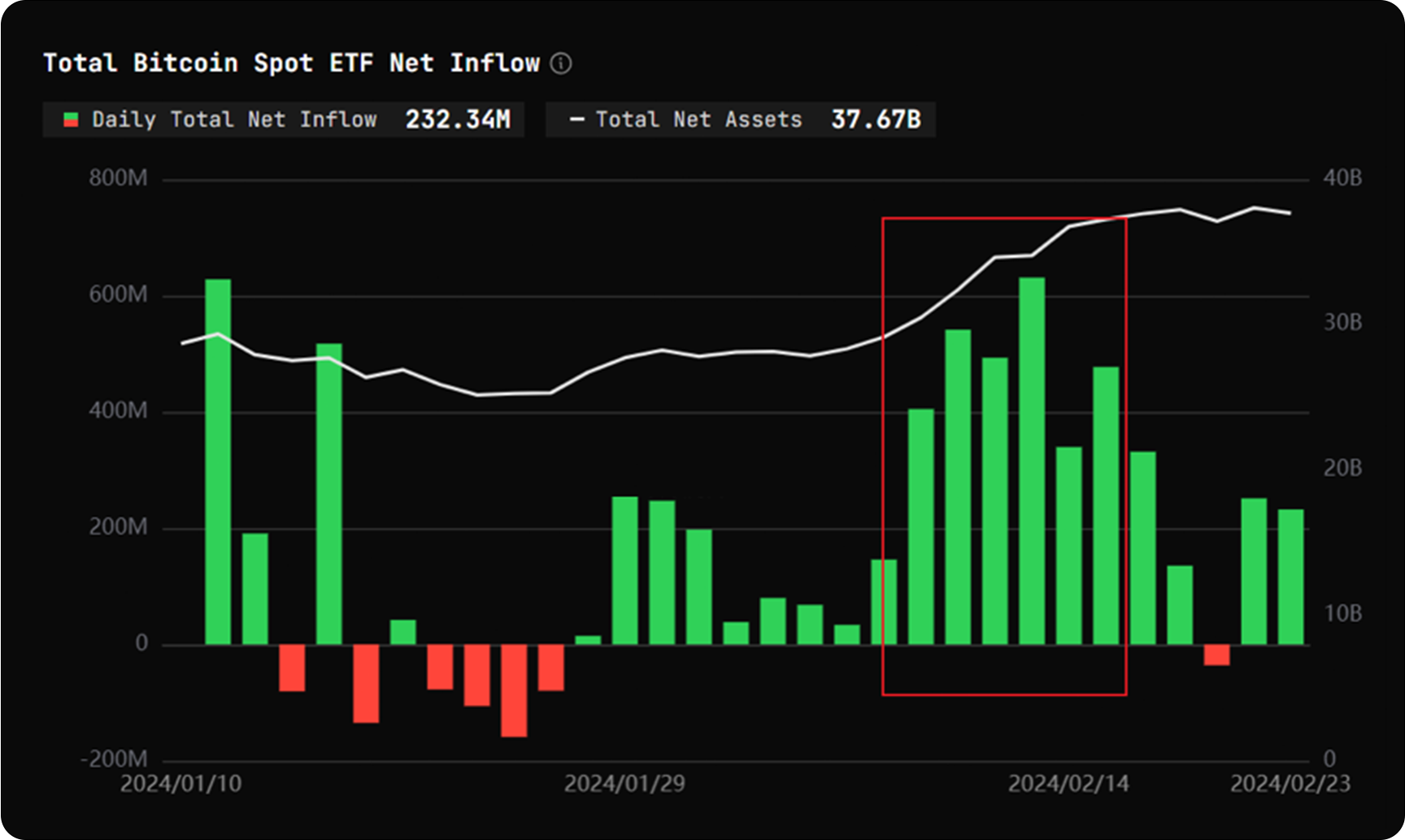

From the perspective of ETF inflows, we can see that around the Spring Festival is the time when ETFs continue to flow into Bitcoin on a large scale. The impact of ETFs on Bitcoin prices is gradually emerging. As of the 26th, 11 ETFs had accumulated net inflows of US$6.15 billion, and the market value of their currency holdings accounted for 3.81% of the total market value of Bitcoin. This data exceeds the number of Bitcoins held by the Binance exchange wallet address.

Bitcoin ETFThe speed of development is astonishing. The trading volume of BlackRocks IBTI actually exceeded US$1.3 billion on the 26th. Bloomberg ETF analyst Eric Balchunas posted on social media: This is definitely a breakthrough for a newly listed ETF. Crazy numbers.

In addition to ETFs, MicroStrategy is also a large source of inflows into the Bitcoin market. MicroStrategy has always been known for hoarding coins. On the 26th, MicroStrategy founder Michael Saylor stated on his social platform that MicroStrategy bought 3,000 Bitcoins from February 15 to 25, with an average purchase price of US$51,813. At this point, MicroStrategy holds a total of 193,000 Bitcoins, with an average holding price of approximately US$31,544.

The adoption of the Bitcoin spot ETF has injected great confidence into the market, so when the Ethereum spot ETF will be launched has become one of the current focuses of the market. Bloomberg analysts Eric Balchunas and James Seyffart tweeted on February 17 that VanEck submitted a revised S-1A filing for its spot Ethereum ETF, and ARK/21 Shares also filed for its spot Ethereum ETF. A new 19 b-4 document and a new set of analysis instructions have been included. The most important date right now is May 23 – the date when the SEC makes its final decision on VanEck’s Ethereum ETF. If the subsequent Ethereum ETF can also pass, it will represent another great victory for the crypto market. More traditional investors can participate in the Ethereum market through ETFs, a traditional investment tool, and introduce new funds into the crypto market. This could have a positive impact on the market, especially if some investors who were originally skeptical of crypto assets become incremental funds.

In the last month, the market value of the U.S. Bitcoin ETF has surpassed that of silver, becoming the second-largest ETF commodity asset class in the United States, but many analysts believe that this is not the end of Bitcoin. Michael Saylor believes that Bitcoin, with a market cap of just over a trillion dollars now, is competing with asset classes such as gold, real estate and even the SP Index, all of which have market caps many times greater than Bitcoin, which he believes is itself As an asset superior to all of the above, there is no reason to sell in this case.

Finally, in recent months, the market has been optimizing the Bitcoin network to enable Bitcoin to perform more functions, such as adopting technologies such as Bitcoin Layer 2 and Inscription. However, many investors are worried that this will destroy the value attribute of Bitcoins electronic gold and make Bitcoin no longer pure. Bitcoin Magazine recently released the Bitcoin L2 standard, which stipulates some key requirements, including that Bitcoin must be used as a native asset, L2 users can trace back the control of the layer asset (Bitcoin), and the control of the Bitcoin system. Strong dependence, etc. These standards ensure the control of Bitcoin in these extended networks, and at the same time make it clear that Bitcoin is still the final settlement tool, so it will not have an adverse impact on the value attributes of Bitcoin, and investors do not need to worry too much.

Even as inflation picks up, markets are still on a path to new highs, driven by the AI revolution. At present, the market is not worried about continuing to raise interest rates, but is more concerned about when the first interest rate cut will be postponed. Inflation has not suppressed asset gains. The impact of Grayscale selling pressure is ending. Let us wait and see when Bitcoin can break through $69,000.

Copyright statement: If you need to reprint, please contact our assistant WeChat (WeChat ID: hir 3 po). If you reprint or clean the manuscript without permission, we will reserve the right to pursue legal responsibility.

Disclaimer: The market is risky, so investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, views or conclusions in this article. The above content does not constitute any investment advice.