Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

invest

The driving factors for this round of bull market are still lacking in new asset models and business model innovation.

The relatively new species that have emerged in this cycle are mainly the BTC ecosystem and the Web3 AI project (barely considered new).

It is more difficult to win Alpha in this bull market, and the return-to-risk ratio of BTC+ETH in the main position will be better than in the previous round.

The bull market cycle has obviously moved forward: it is best to increase positions in 24 years and reduce positions in 25 years to harvest.

Coinbase: An in-depth interpretation of Bitcoin’s trend after this halving

Studies of previous cycles should be interpreted with caution, as small sample sizes make it difficult to generalize their patterns to the immediate future.

The U.S. Spot Bitcoin ETF has also reshaped Bitcoin’s market dynamics by establishing a new anchor for BTC demand, making this cycle unique.

The current price trend is just the beginning of a long-term bull market, and the upward trend in prices will need to go further to push supply and demand dynamics into balance.

Multicoin: Consumer Applications and Value Attention Theory

News = prices, information = money. Money and attention increasingly share similar characteristics.

In the crypto space, exchanges have a similar position to major publishers in the consumer internet (such as X, Instagram, and the New York Times): publishers control the flow of attention on the consumer internet, while exchanges control the crypto space capital flows in.

“We’re excited about tokenizing intangible quantities in content networks: accuracy, reputation, humor.”

Bankless: Riding the Meme Wave, These 5 Tools Are Worth Knowing

From the real-time tracking of Dexscreener and the market insights of Coinglass, to the sharp analysis of Arkham, the data aggregation of DefiLlama and the familiar format of Zapper, each tool adds unique capabilities to your cryptocurrency arsenal.

One article to sort out 20 Dune analysis boards: quickly capture trends on the chain

A collection of Dune common tool pages.

Start a business

Review of 14 popular projects: From 0 to 1, what did they do right?

The team background of most projects is good; what the team needs to do at the beginning is most likely to be unique; it must obtain financing from leading institutions; for lnfra projects, it must have core competitiveness across cycles; it must solve the market problem A pain point on the Internet, and its own solution is unique.

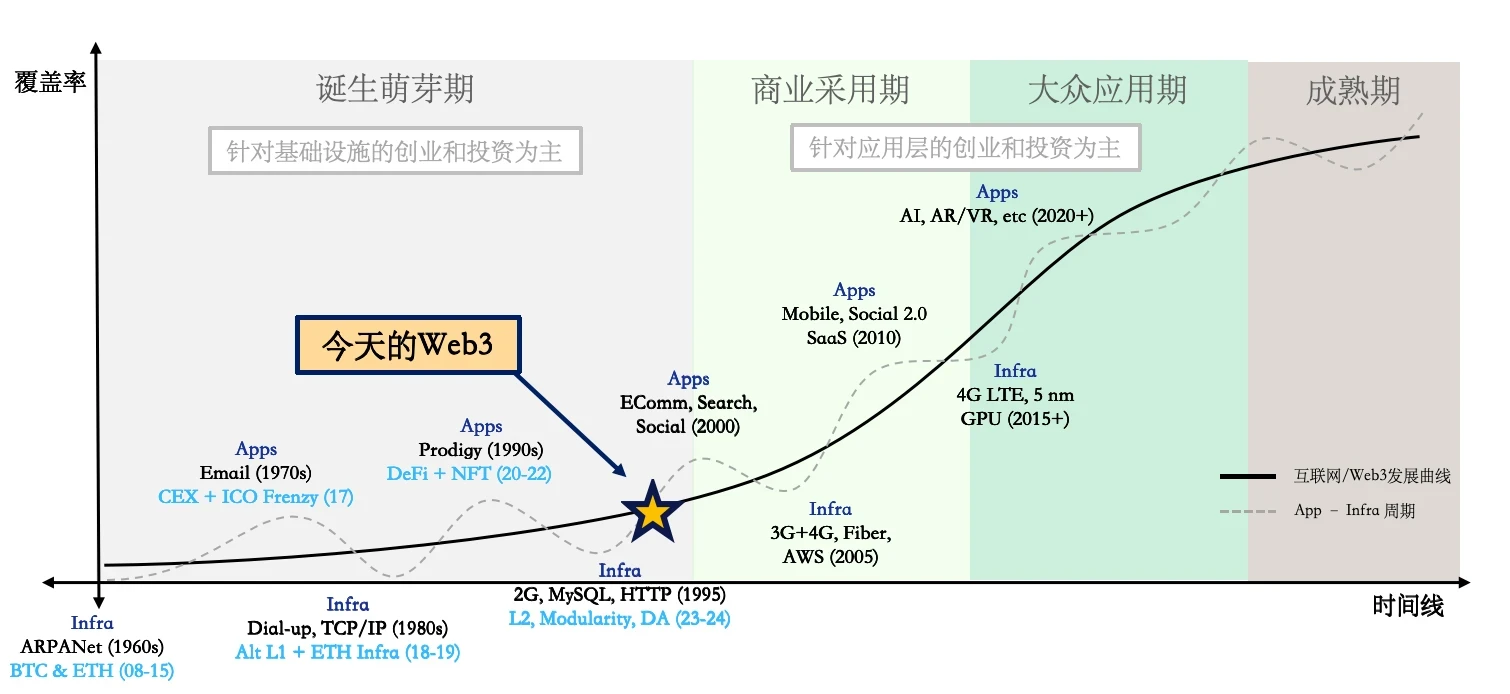

Folius Ventures: Special report on Web3 Chinese developers

At least 200-300 potential top projects with Chinese background will appear on the market at a rate of 1-2 per week in the next three years. Web3 is currently on the eve of its application dividend period, and the turning point will come in the next 12-18 months.

Chinese Internet entrepreneurs should make good use of the Web2 methodology to form differentiated advantages, focus on the scenario of migration from Web2 to Web3, and expand the incremental market. The advantages of Chinese developers are in the large DAU base, creator economy, strong operational platform economic system, and business model that has been verified in Web2.

Airdrop opportunities and interactive guide

With investment from Arthur Hayes, what interactions can Elixir currently do?

Elixir was founded in 2022. It has launched two versions of testnet and is about to launch v3 testnet. This is also the last testnet before the mainnet goes online in August.

Currently, users can interact by running nodes, earning points on Apothecary, and providing liquidity for DEX integrated with Elixir.

Bitcoin Ecology

The past and present of Bitcoin infrastructure: indexers, oracles, and DeFi

The Bitcoin ecosystem has always lacked infrastructure. Alex and other teams are asking for advice in the Bitcoin ecosystem.

It is clear from the development path of Ethereum that the truly successful Layer 2 is mostly driven by funding - developing Layer 2 is one thing, but whether it can form an ecosystem is another.

The development of BTC Layer 2 requires the continuous support of chain abstraction capabilities. MerlinChain can quickly and methodically absorb nearly 4 billion US dollars of TVL assets, which is directly related to the mature chain abstraction services such as BTC Connect, AA account abstraction, and Paymaster provided by Particle Network behind the scenes.

On the eve of the explosion of Bitcoin applications? Merlin Chain ecological project inventory

DeFi:MerlinSwap (iZUMI)、BitSmiley、Surf Protocol、KiloEx、Ethena、BendDAO、Solv Protocol;

Games: Dragonverse Neo (MOBOX), Cellula, Bitmap War, Elfin;

Infrastructure: LayerZero, Pyth, Cobo, Particle Network, Lumoz, Meson;

On-chain tools Marketplace: UniCross, GeniiData, Element, Ordinal Hive;

Meme:$VOYA、$HUHU。

Merlin Chains ecological map has its own complete logic and provides solutions to Bitcoins native problems.

Ethereum and Scaling

8 pictures to understand the new L2 battle situation opened after Dencun upgrade

The article introduces the Dencun upgrade special page launched by OKLink, including L2 handling fee, daily transaction number, daily transaction volume, TPS, address overview, TVB, TVL, and currency price board.

An in-depth interpretation of modularity and the endgame of Ethereum

Solanas single architecture provides a fast, low-cost transaction experience, but its high requirements for hardware may lead to a trend of centralization, while modular designs, such as the latest trends in Celestia and Ethereum, reduce costs by separating data availability layers. , improve security and flexibility, and support a wider range of applications and innovation.

Rollups are key to enabling scaling and lowering transaction fees, and now the battle for the data availability layer (and the rest of the modular stack) has begun.

Celestia chose the fastest path to market, using fraud proof (which is also what Optimism rollups use). The trade-off is that in its current configuration, Celestia will not be able to support ZK rollups.

Avail (formerly Polygon Avail), as an independent blockchain, provides a fast and secure data and consensus layer, giving developers what they need to start a rollup (either ZK or Optimistic).

EigenDA is probably the most aligned with Ethereum, as it is a DA module, not a blockchain. Additionally, ETH re-staked in EigenLayer will be available to secure rollups using EigenDA. Its weakness is that it does not use data sampling or data availability proof.

NearDA helps rollups save on data availability costs by storing data on Nears sharded blockchain. NearDA leverages an important part of the Near consensus mechanism, which parallelizes the network into multiple shards.

Modular technology greatly simplifies the complexity of technology implementation by providing multiple combination possibilities, which is a major advancement in technology development. But many people have reservations about outsourcing DA.

CeFi

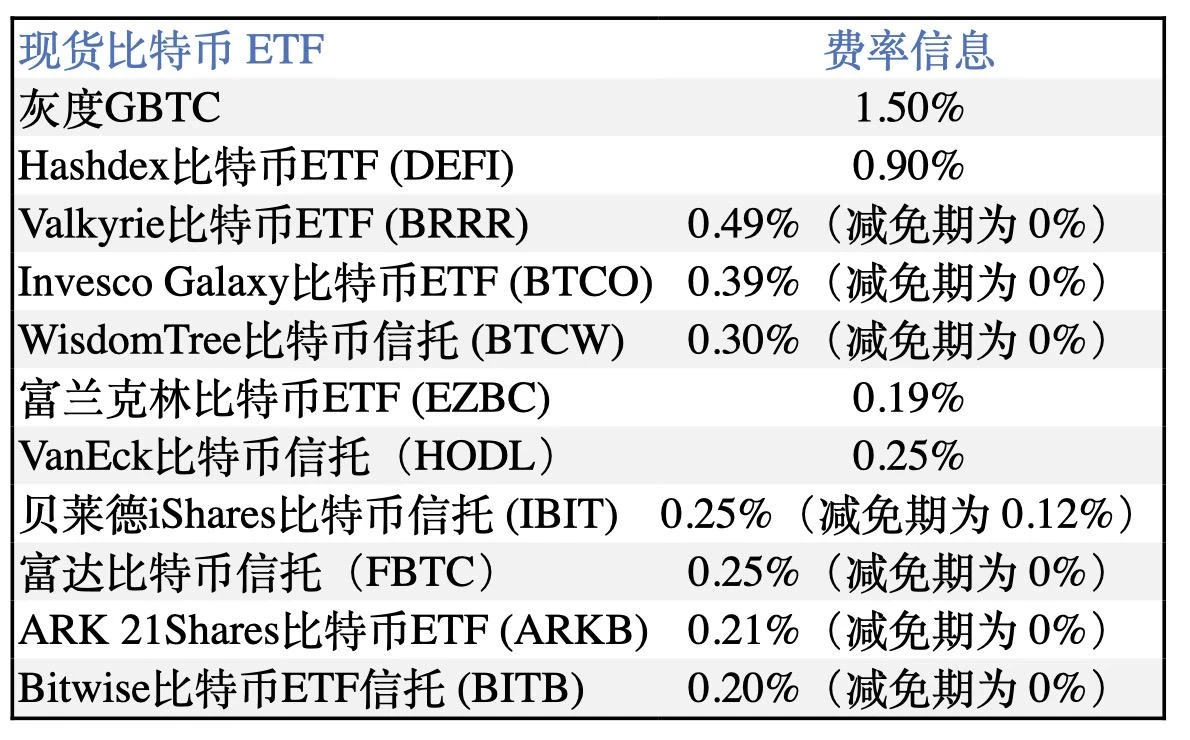

Can Grayscale’s application for “Bitcoin Mini Trust” curb the outflow of GBTC funds?

The Grayscale Bitcoin Mini Trust could allow Grayscale to become more competitive on fees. Another potential reason is tax issues.

Grayscale’s market dominance has begun to show signs of weakening. The launch of Grayscale Bitcoin Mini Trust may be able to slow down the outflow of GBTC funds to a certain extent, but the effect may be limited.

DeFi

An overview of the six major liquidity re-pledge protocols

Puffer Finance and Ether.fi are the two largest liquid staking protocols by market cap of liquid staking tokens. Both focus on native re-staking, which has fewer risk levels than LST re-staking. Additionally, both protocols work to promote decentralization among Ethereum validators. Ether.fi has the largest number of DeFi integrations.

Kelp and Renzo protocols support native re-staking and LST re-staking. They accept major LSTs such as stETH, ETHx, and wBETH. It is worth mentioning that Renzo has extended the re-staking service to the second layer of Ethereum, providing users with the benefit of lower gas fees.

Swell was originally a liquid staking protocol, and its liquid staking token is swETH. The swETH market size is approximately US$950 million. Swell launched the re-pledge service and launched the liquid re-pledge token rswETH. It provides native re-staking and swETH re-staking.

Eigenpie is a sub-DAO of Magpie, focusing on LST re-pledge. It accepts 12 different LSTs and issues corresponding 12 different LRTs, providing a unique isolated LST re-pledge model.

Emergency rate adjustment, Maker starts DAI defense war?

MakerDAOs anchored stable module (PSM) saw a large outflow of DAI funds last week. The reason is that MakerDAO and Spark’s lending rates are lower than their peers. MakerDAOs system interest rate ultimately depends on the 3-month US Treasury bond interest rate. As the overall DeFi market interest rate rises relative to traditional finance (TradFi), MakerDAOs DAI interest rate has not reflected the increase in borrowing costs in a timely manner.

Against this background, the BA Labs team proposed an emergency rate adjustment.

The logic behind it is:

Increase interest rates to encourage repayment of DAI - preferably by exchanging USDC for DAI;

Increase the DSR (DAI Savings Rate) to encourage holding of DAI - again preferably letting users do this on PSM.

NFT

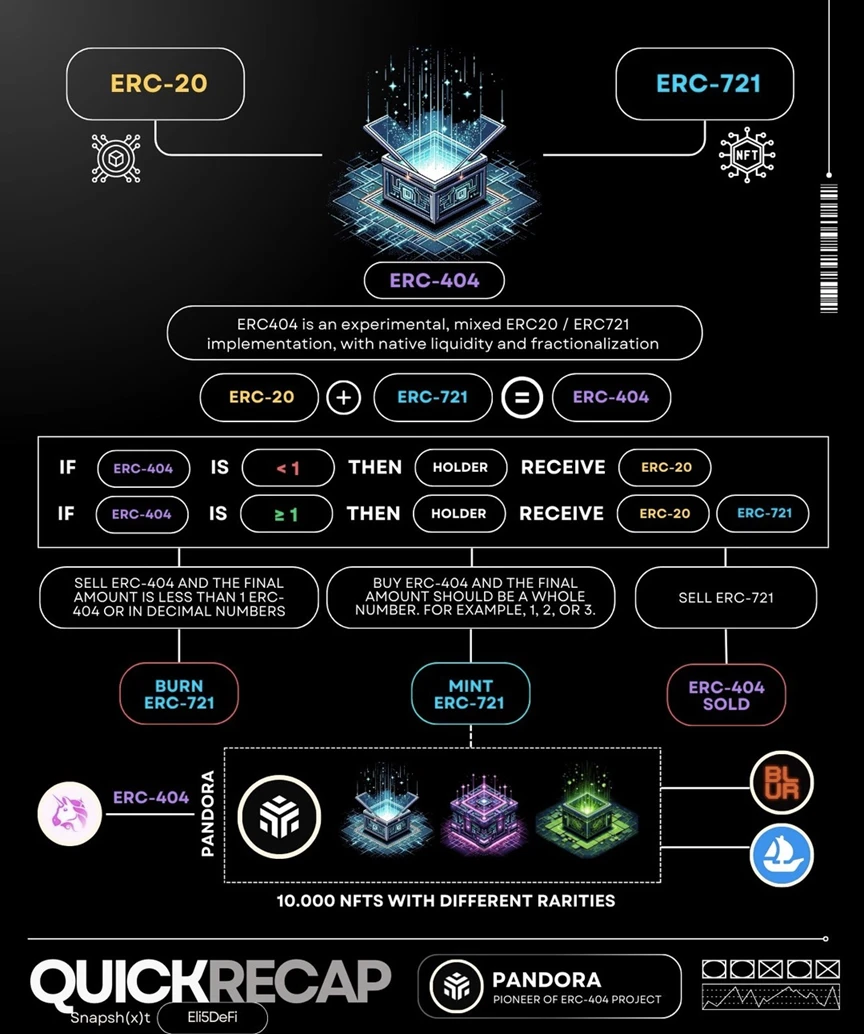

Behind Pandora’s surge, is ERC 404 a flash in the pan, or an innovation in the NFT paradigm?

ERC-404 is designed to enable native fragmentation and liquidity in NFT projects that implement the standard. This provides new ways to experiment and trade NFTs.

ERC-404 is an unofficial standard. The combination of graphics and currency model itself does little to help the liquidity of NFT, and it will also face competitive pressure from more rising stars.

Representatives of 404 protocol projects include Pandora, DeFrogs, and Monkees.

Hot Topics of the Week

In the past week, BTC continued to set new historical highs, and then retreated slightly.Cancun upgradestart, eachL2 gasbegin descending,WIFskyrocketing,BOMEburst into flames;

In addition, in terms of policy and macro market,Hong Kong Monetary AuthorityLaunch of stablecoin issuer sandbox;

In terms of opinions and voices,trump:Bitcoin has been used a lot. Not sure if it is banned, but the dollar is not allowed to get rid of,MicroStrategy CEO: BTC will become a more valuable asset than gold in the future, judge rulesCraig WrightNot Satoshi Nakamoto, nor the author of the Bitcoin white paper;

In terms of institutions, large companies and leading projects,GrayscaleApply to the US SEC for Grayscale Bitcoin Mini Trust,TelegramIt is close to making a profit and is planning to IPO in the United States. It had previously planned to go public in 2025.BakktTether will be delisted from the New York Stock Exchange after receiving a delisting warning from the New York Stock Exchange after its stock price continued to fall below $1.Celo onIssuing USDT,BNB ChainLaunched RaaS solution to expand its Layer 2 ecosystem,Uniswapv4 coming soon,MakerThe first phase of Endgame will be launched in the summer, and new tokens, Lockstake engine and other functions will be released.Lido: A network expansion working group has been established, and wstETH will be deployed to more L2 in the next few months.WormholeAnnouncement of airdrop details and witch detection rules, Polyhedra NetworkComplete ZK airdrop snapshot,Manta NetworkIntroducing Renew Paradigm,Polyhedra Network: User assets are safe. The attack is caused by human theft rather than contract loopholes.zkBridge securityand operate normally,ether.fi(ETHFI) releases economic model,Aevo(AEVO) Open airdrop application, Blast ecological Meme projectPacmoon airdropPAC;

NFT and GameFi areas,Magic EdenDiamond claims have been opened for ETH OG, Solana ecological NFT marketTensorPlans to issue governance token TNSR, classic game Adventure IslandA Web3 version based on Avalanche will be launched... Well, its another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~