Original author: 0x Weilan

*The information, opinions, and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

The problem has been solved and the bull market has begun.

After settling on historically profitable GBTC, the BTC ETF channel pulsed with huge amounts of funds in February—more than $6 billion according to relevant statistics. As we pointed out in our January report - The approval of the BTC ETF is a major event in the history of BTC asset issuance. The short-term impact of the violent fluctuations in the price of BTC in January has basically come to an end, but the changes in the market structure it caused have These long-term effects will gradually appear in the future.

In February, BTC’s price performance initially confirmed this. BTC rose 43.79% in a single month, totaling $18,631, the largest single-month increase since the market entered the repair period in 2023.

The driving force for the violent rise mainly comes from ETF channel funds. EMC Labs believes that the market structure of BTC is undergoing historic changes, and its pricing power will gradually be transferred from on-site industrial capital to financial institutions from Wall Street. This months strong price gains are just one symptom of this transfer of power.

Wall Street is jumping in to snap up BTC, and Coinbase’s inventory is starting to run low…

On-market funds began to flow from BTC to ETH and other high-alpha projects. All sectors rose broadly, and stagflation targets with fundamentals began to rise crazily.

In our November briefing, we said that “the fifth round of the crypto asset bull market is about to begin.”

Today, we can judge that the fifth wave of crypto bull market has started.

Macro market: The global capital market has entered a new cycle of bull market

In February, global capital continued to flow into the United States, pushing the U.S. dollar index to continue to fluctuate upward. Gold prices rebounded, with the Dow Jones Industrial Average rising 2.22% to hit a record high and the Nasdaq rising 6.12% to 16091.92, just one step away from its all-time high of 16212.23.

In February, news that the New Zealand Central Bank hinted at raising interest rates once triggered short-term fluctuations in the market. Subsequently, Nvidias excellent financial report eliminated the doubts of long funds, and the market rekindled its enthusiasm for rising prices. In the next few months, U.S. stocks will enter the earnings season. If expectations for interest rate cuts do not change, the performance of technology companies is expected to push the index to continue to rise.

U.S. stocks are in a relatively stable bull market. Potential risks are the expansion of regional conflicts and wars, as well as the unexpected deterioration of the U.S. economy and the U.S. bond market.

BTC vs NASDAQ trend (weekly)

Since 2020, BTC price and NASDAQ trends have been highly positively correlated most of the time. The peak time in 2021 is 8 days apart, and the bottom time in November 2022 is only 18 days apart. Now, both BTC and the NASDAQ index are trading near previous highs. The only difference between the two is that BTC is more price elastic.

From a macro-financial perspective, after the outbreak of the COVID-19 epidemic in 2020, the fiat currency liquidity released by global financial easing pushed NASDAQ and BTC into a monetary easing bull market, while the interest rate hike cycle starting in November 2021 caused the two markets to enter a downward stage at the same time. That is, a bear market. During the 12 months of the bear market, the crypto market completed a major clearing, and then began to form a bottom in November before the interest rate hikes stopped. In January 2023, when the market began to speculate on the Feds interest rate cut timetable, it began to bottom out and enter a recovery period. Expect.

The market value of the crypto market has exceeded US$2.5 trillion, and the market value of BTC has exceeded US$1.2 trillion. The positive correlation between BTC and NASDAQ shows that the logic and behavior of the two main funds are converging, and the long-term crypto market of US stocks is not in danger.

There are bound to be twists and turns in the middle, but as the world gradually enters an interest rate cut cycle, we judge that the worlds major financial markets will continue the bull market pace in 2024 and continue to hit new highs. With the support of macro-financial easing, the crypto market, led by BTC, has stepped out of the repair period and entered a vigorous up period, which is the fifth round of the crypto asset bull market.

Industry Narrative: Ethereum becomes the application center, and the battle for expansion develops in depth

At the darkest moment of the bear market in 2022, adventurers and speculators such as FTX, Luna, Three Arrows Capital, Celsius, and Voyager were cleared by the market. Many assets issued with inflated FDV and superficial project teams also suffered heavy losses, losing market value and community trust, and even disappeared. As part of the end, Binance, the worlds largest offshore exchange, received major fines twice in 2023, settling with U.S. law enforcement agencies in exchange for $7.15 billion and the departure of its CEO.

The continuous builders who are brave in innovation and full of determination continue to expand their territory. In the last bull market, Ethereum, which faced the crisis of high-performance public chain competition, successfully transformed its POS system, effectively promoted second-layer construction, gas burning and multiple technological innovations, and broke away from the melee to become the undisputed application center of the blockchain world. On the basis of maintaining decentralization and security, Layer 2 undertakes a large number of main chain activities on behalf of Arbitrum One and OP Mainnet, significantly reducing the cost of using the Ethereum network for millions of users. Challengers in the last bull market, Avalanche, Fantom, and Polygon, gave back most of their users. Only Solana is reborn with heterogeneous design, a resilient community, and lower costs.

Layer 1, Layer 2 bridge out ETH proportion

The victory of Ethereum directly led to the prosperity of LST, Restaking and other tracks. Developers who joined after being unable to win returned to the Ethereum system to find room for development. Since the Shanghai upgrade, the Ethereum pledge rate has steadily climbed to 26%, and the total pledge value has exceeded US$100 billion. Competition for ETH, and even ETH’s LST, has become the core goal of these tracks.

As users and use cases increase, scalability remains the core issue of the blockchain infrastructure layer. In the context of Ethereums sharding that has been unable to break through, modular public chains have begun to emerge as an alternative solution. Its popularity may exceed that of a single high-performance public chain.

Modular public chains try to separate functions that were previously carried by a single public chain, such as transaction processing, consensus mechanisms, and data storage, into different layers or modules. Each layer or module focuses on completing specific tasks, thereby improving reliability. Scalability, enhanced flexibility and customization, reduced development difficulty and improved security. In addition to the layering and sharding of Ethereum, the cross-chain of Cosmos, and the parallel chain of Polkadot, the modular public chain brings a brand new solution with more blockchain temperament.

The proposal of the Ordinals protocol received a huge response, and the transaction volume of BTC NFT once exceeded that of Ethereum. The BTC ecosystem, which has been dormant for a long time, has attracted huge attention. BTC, the core crypto asset, is worth trillions of dollars. How to realize the flow of this huge asset is the most ignored issue in the DeFi field. Whether and how to implement programming and run smart contracts on the Bit Network has triggered controversy at the fundamental level, but it has also attracted the entry of large-scale funds. BTC ecological innovation will attract much attention in this bull market.

EMC Labs believes that ETHs return to the application center, the expansion brought about by Layer 2, RaaS (Rollup as a Service), and the development of innovative application projects have provided a solid foundation for the introduction of large-scale users and provided a relatively solid foundation for the expansion of the bull market. Industry fundamentals.

New Frontier: Blockchain Technology Opens Up a New Track

EMC Labs believes that the last bull market cycle completed the blockchain technology verification. The competition for blocks in the public chain field, transactions in the DeFi field, lending and borrowing entering normal use, the decentralized storage market being adopted by Web2 service providers, etc., all prove the usability of decentralized technology in the real world. Since then, it has become more than a speculative attribute. Speculative value is increasing day by day.

After the successful breakthrough of DeFi, using blockchain technology to expand new application frontiers has become an investment hotspot beyond infrastructure. Over the past few years, eye-catching cases have been initially cultivated in many fields.

DePIN (Decentralized Physical Infrastructure Networks), which was born from the integration of the Internet of Things and blockchain technologies, is one of the areas that has attracted the most attention. Its paradigm is to use blockchain technology and tokens to incentivize individuals and small businesses to deploy and operate infrastructure networks, making the laying of digital-centric infrastructure on a global scale more efficient, democratic, and cost-effective (resilient). Users can access the network without permission and utilize network resources in a more cost-effective way. Current practice areas include telecommunications, data warehouses, data sensors, AI computing power and models, etc. The DePIN track has the potential to become another broad application area for blockchain technology in addition to DeFi. The potential market is as high as trillions of dollars, with huge room for imagination.

After DeFi Summer, people realized the huge value of providing liquidity for assets in a trustless form, and then started practicing in the field of RWA (Real World Assets). Traditional physical assets such as real estate, art, precious metals, etc. have poor liquidity, poor divisibility, and low transaction efficiency. Using the transparency, security, and decentralization of blocks can improve the accessibility, liquidity, and transaction efficiency of these physical assets. . Like DePIN, the RWA circuit is in its early stages and also has plenty of room for growth.

In addition, in the fields of Game, Social, Derivatives and other fields, industrial capital has made tens of billions of dollars in primary investment, and many projects are under continuous construction. They will appear one after another in the coming time and undergo market testing.

EMC Labs believes that breakthrough innovation in the technology field, continuous construction of new applications and large-scale user adoption are the foundation of the bull market for high-quality crypto assets. With the successful expansion of the first phase of Ethereum, the low threshold for entry brought by modular public chains and RaaS is significantly reducing the cost of using block space, which allows developers to develop new applications in new fields to make it more convenient , lower-cost services attract large-scale users.

Fund supply: Stablecoin supply has already entered a bull market, and BTC ETF channel funds are endless

The growth in capital supply is the direct reason for the price increase, and the continued growth in capital supply is the direct reason for the start of the bull market.

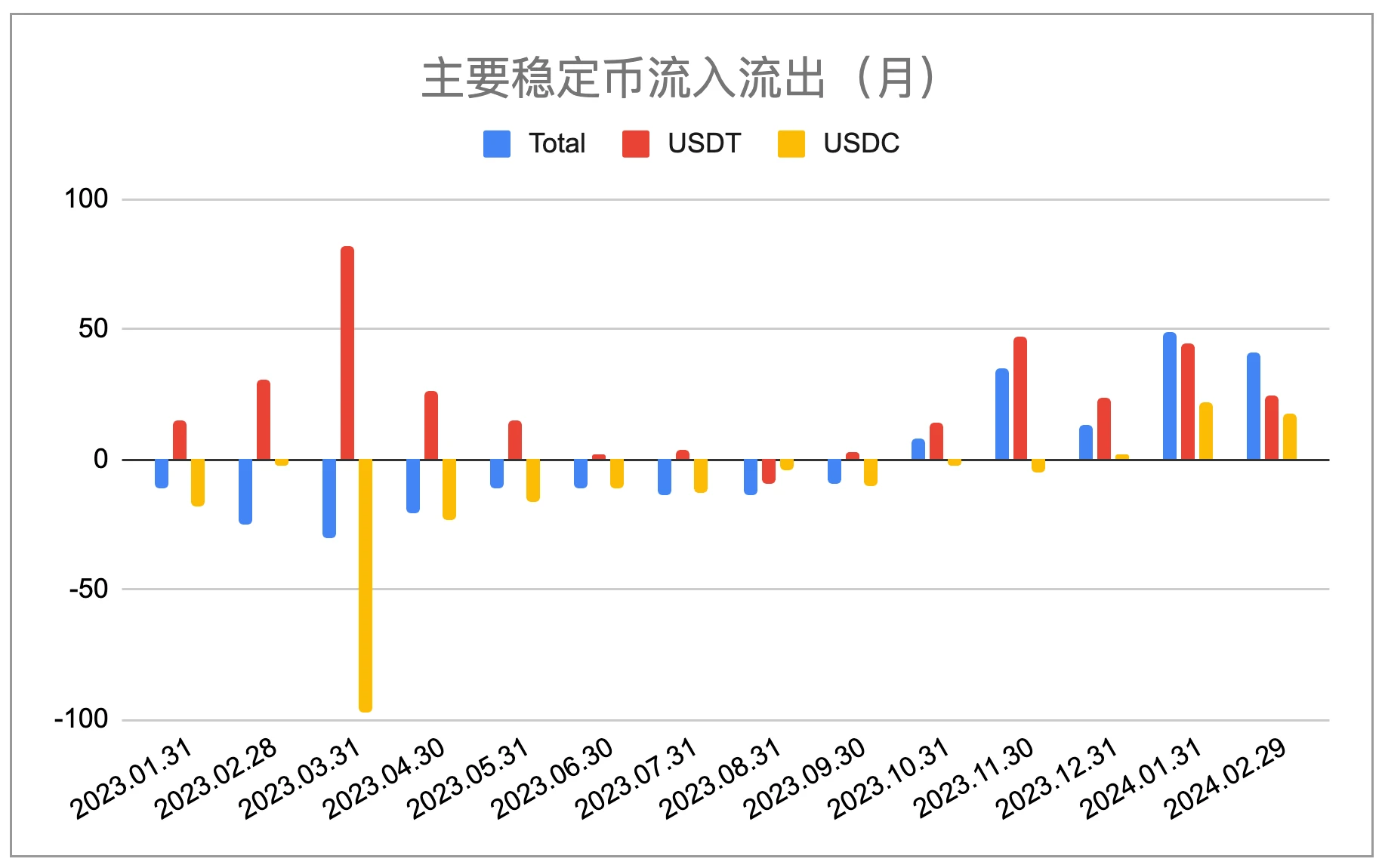

existOctober report, we observed that “the outflow of stablecoins stagnated in the first half of October, and on the 15th stablecoins began to show positive inflows, and BTC immediately started to rise.” October was the first time in 2023 that there was a static inflow of funds in a single month. existDecember report, we judge that “Q4 stablecoins have recorded positive inflows for three consecutive months, indicating that stablecoins have entered a bull market.”

In October, the overall net inflow of stablecoins directly pushed BTC to start a violent upward trend in late October, allowing BTC to escape from the $25,000 to $32,000 box that had been troubled for half a year. Since then, continued inflows in November and December pushed BTC to reach the $37,000 level.

By January and February 2024, stablecoin inflows continued to rise, and the BTC price had been pushed to more than $60,000.

Main stablecoin inflow and outflow statistics (monthly)

We view the issuance of stablecoins as a long-term trend indicator for market capital. This means that it takes enough time for supply to start growing once it starts to decrease, and enough time for it to start to decrease once it starts to increase.

Issuance scale of major stablecoins

In the last round of bear market, the maximum supply of stablecoins reached 162.9 billion US dollars. Net outflows began in April 2022 and ended in October 2023, with an overall outflow of 43.2 billion US dollars in 17 months. As of February 29, the overall inflow of stablecoins in the past five months was close to 14.6 billion, and the total issuance reached 134 billion, which has not yet returned to its previous highs. As the adoption of crypto-assets increases and global investment enthusiasm rises, it is expected that the influx of funds in this bull market will far exceed that of the previous bull market.

In January, 11 BTC ETFs were approved in the United States, opening up another larger capital entrance for crypto assets. After experiencing violent shocks after the approval (to solve the historical problem of GBTC precipitating BTC), a huge amount of funds began to violently purchase BTC through the ETF channel. After its issuance, 144,689 BTC ETFs were purchased, bringing the total holdings to 766,542, accounting for 3.9% of the total BTC issuance.

Position details of 11 BTC ETFs

There is reason to believe that as the bull market in U.S. stocks continues, funds through the BTC ETF channel will continue to flow in, and have become the main force dominating short-term price discovery of BTC.

In February, ETF channel funds, together with stablecoin channel funds, pushed BTC up 43.79%. The BTC stock of Coinbase, the main BTC purchase platform for 11 ETFs, continues to decline, with only 393,241 pieces remaining. If this continues, we will soon encounter a liquidity crisis.

Coinbase BTC Stock

Currently, only 900 BTC are dug out by miners every day, which is far lower than the purchase volume of the ETF channel. After the halving in April, the daily new supply will drop to 450. This year, BTC may face a serious supply crisis.

Conclusion

As discussed in this report, there are 4 prerequisites for the start of a bull market -

First of all, before the new cycle starts, the necessary liquidation of speculative institutions, redundant production capacity and junk assets from the previous cycle must be completed. In this way, high-quality projects gain vacated market share and expand their scale, while innovative projects also gain room to thrive.

Secondly, the industry must achieve sufficient innovation accumulation in the two dimensions of technology and application. Only new technologies and applications can effectively attract large-scale users and funds to enter the market.

Thirdly, macro-finance is in a period of expansion, at least not a period of contraction. Sustained large-scale capital inflows are a necessary condition for the market to enter a rising period (bull market).

Finally, the sentiment of community users and investors continues to be active. The activeness of community users indicates the restoration and prosperity of industry fundamentals; while the continued active or even rising investor sentiment indicates the impulse of funds to reprice assets. After this impulse deviates from the rational framework, it will push the market to a crazy stage (top).

The bull market is a stage in the market cycle. EMC Labs believes that after 14 months from January 2023 to February 2024, the crypto asset market has exited the repair zone and is entering an upward period, that is, a bull market. At this stage, various targets in the market will undergo a trilogy of value revaluation, value growth, and value realization, manifested by rising prices in turn until the market is exhausted.

Everything has just begun.

EMC Labs (Emergence Labs) was founded in April 2023 by crypto asset investors and data scientists. Focusing on blockchain industry research and Crypto secondary market investment, with industry foresight, insight and data mining as its core competitiveness, it is committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and encrypted assets as Blessings to humanity.

For more information please visit: https://www.emc.fund