Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday, and provide those in the crypto world with data analysis, industry judgment, opinion output, etc. You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

Glassnode: An in-depth interpretation of the true impact of halving and ETFs on Bitcoin

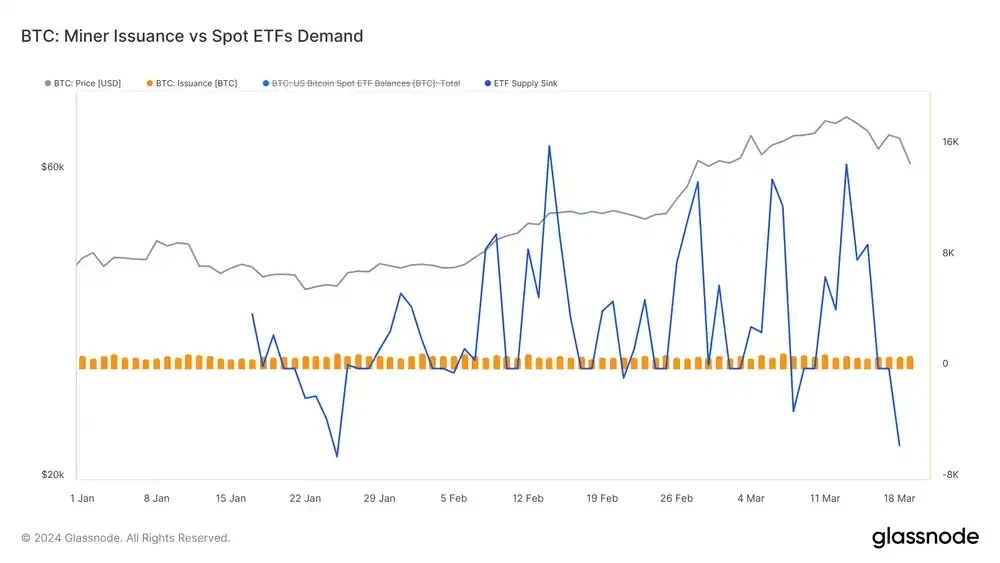

Current market conditions differ from historical norms. As the Bitcoin halving approaches, the impact of newly mined Bitcoins being put into circulation is becoming smaller and smaller compared to surging demand for ETFs. The amount of Bitcoin that the ETF removes from the market is multiple times the number of Bitcoins that are minted every day. The supply crunch typically expected from a halving may occur due to massive Bitcoin acquisitions by ETFs. These funds currently exert significant influence over Bitcoin’s availability, which may obscure the halving’s impact on the market in the short to medium term. Therefore, keeping a close eye on ETF activity, including purchases and potential sales, is critical to predicting market movements as the halving approaches.

Therefore, keeping a close eye on ETF activity, including purchases and potential sales, is critical to predicting market movements as the halving approaches.

Historical patterns suggest that as the peak of the distribution of long-term holders approaches, the market may tend to balance and possibly peak. Currently, the trend in LTH market inflation rates shows that we are in the early stages of the distribution cycle, which is approximately 30% complete. This suggests there will be plenty of activity in the current cycle before reaching a market equilibrium point and potential price top from a supply and demand perspective.

The direct impact of the halving on the market will be influenced by psychological factors and the dynamics of institutional participation. Traders should prepare for possible volatility during the halving.

Despite breaking out of the previous ATH before the halving, the bull run may still last longer.

Bankless: A look at 12 trending narratives to watch in 2024

Decentralized AI: Bittensor (TAO), The Render Network (RNDR), Grass;

Re-pledge: EigenLayer;

Bitcoin L2: Lightning Labs, Stacks, BitVM;

Modular: Celestia;

DA:Celestia、EigenDA、Avail;

DePIN:Helium、Hivemapper、Filecoin;

Alt L1s:Solana、Avalanche;

Intents:Anoma、Essential、PropellerHeads;

Interoperability: LayerZero Labs, Axelar Network, Wormhole;

Ordinals:NodeMonkes、Quantum Cats;

Parallel EVM: Monad, Sei;

RWA:Ondo Finance、Parcl、Mattereum。

200 Smart Money Addresses Analysis: What Low-Cap Memes Are They Accumulating on Base?

The market has shifted from a PVP model, where cryptocurrency Degens compete with each other to maximize profits, to a PVE model, where almost every opportunity can lead to abnormal profits.

More than 200 smart wallet addresses on the Base chain are buying FOMO ON BASE ($FOMO), ponchoBASE ($PONCHO), bloo ($BLOO), Earn Finance ($EARNFI), MYSTCL ($MYST), BriunArmstrung ($BRIUN) ), Pepebutblue ($PBB), ElonRWA ($ELONRWA), Based Buttman ($BUTT).

The airdrop trilemma: How to balance capital efficiency, decentralization and retention?

Stop doing one-off airdrops, youre shooting yourself in the foot. Deploy incentives like A/B testing. Iterate heavily and use past experiences to guide future goals.

Having standards built on past airdrops will increase your efficiency. In effect, more tokens are given to people who hold them in the same wallet. Make it clear to users that they should stick with one wallet and only change wallets when absolutely necessary.

Get better data to ensure smarter and higher quality airdrop segmentation. Bad data = bad results. The lower the “predictability” of the criteria, the better the retention results.

Airdrop opportunities and interactive guide

Interactive tutorial: How to obtain potential airdrops from the Scroll ecosystem?

Meme

A comprehensive interpretation of 10,000 words on the Meme track: How to become a golden dog hunter?

Meme’s communication mechanisms include social media and community interaction, viral marketing, the use of celebrity effects, KOL and community influence, wealth effects, incentive mechanisms, unique concepts and designs, innovative and easy-to-spread topics.

To mine thousands of coins in advance, you need to look at the ease of spreading of the projects culture, as well as the initial and core seed users (coin holders). Its early community culture, its pictures, and names must be impressive.

An active community is key to the success of Meme coins. Research the team and developers behind the project to learn about their experience and background. Identify good narratives. Check if the project has reputable partners or backers. Use on-chain bots to monitor data. Whether to turn to practical applications to sustain growth after the market is saturated.

The author specifically recommends diversifying your portfolio when faced with memes and not investing all your money in a single asset.

Bitcoin Ecology

Comprehensive interpretation of Stacks: Ten years of hard work

Stacks has stable and upward fundamentals, a team that continues to build through cycles, and combined with strong catalysts such as the Nakomoto upgrade, it is a presence that cannot be ignored in Bitcoin L2. If you are optimistic about the overall development of L2 and believe that Bitcoin will have more uses besides being a SOV (becoming a productive asset), you can use $STX as a beta configuration of the Bitcoin ecosystem at a suitable price.

Multiple ecology and cross-chain

Learn about the latest developments in the Filecoin DeFi ecosystem in one article

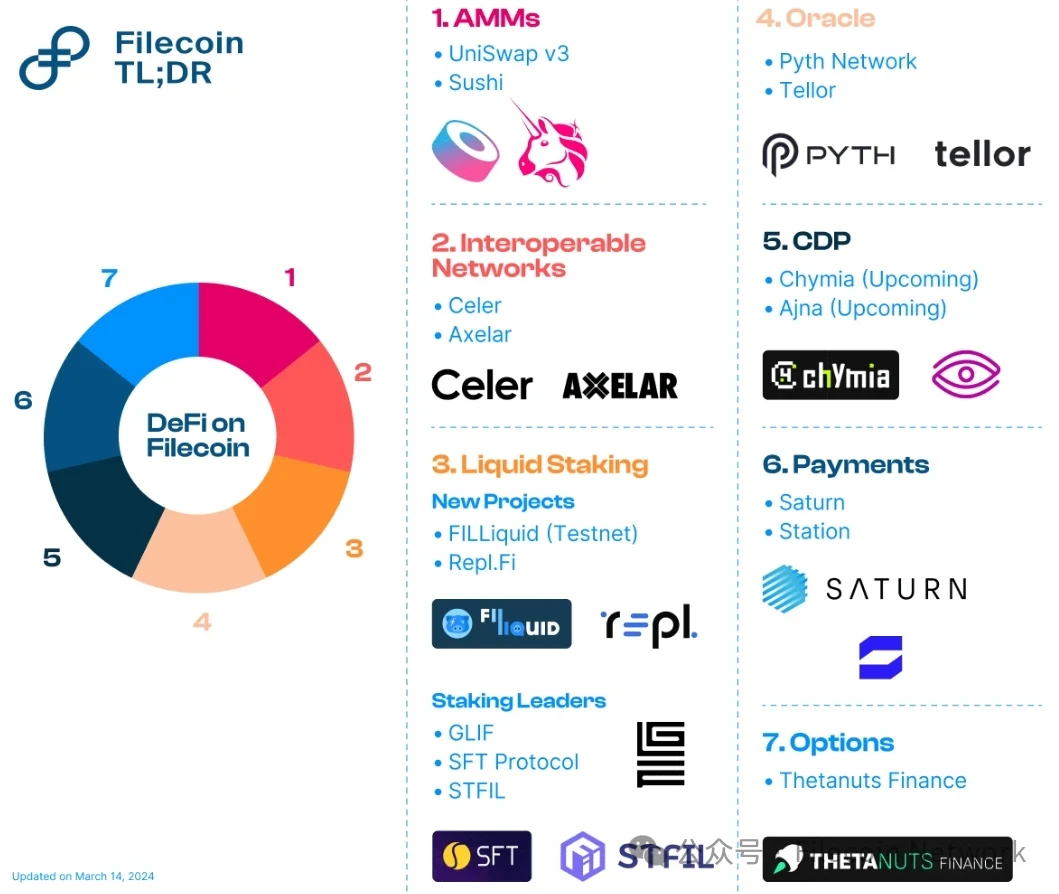

FVM brings programmability to Filecoin’s verifiable storage and opens up a unique DeFi ecosystem around improving on-chain capital markets. For example, liquidity staking is an important component of Filecoin DeFi, and its TVL has exceeded US$500 million. As the network develops, multiple key infrastructures such as AMM, Bridge, Oracle and Collateralized Debt Position (CDP) will jointly promote the development of DeFi in 2024.

As the number and diversity of DeFi protocols on Filecoin increases, it will bring deeper liquidity. The continued growth of the DeFi economy, coupled with the addition of more services to the chain and the use of FVM for payments, will comprehensively increase network revenue and utility. It is expected that the strong traction of DeFi will expand the scale of Filecoin as an L1 ecosystem, and core services such as storage and computing will become the pillars of the decentralized Internet.

Frax announces Singularity roadmap: launching 23 L3s in one year, what’s the purpose?

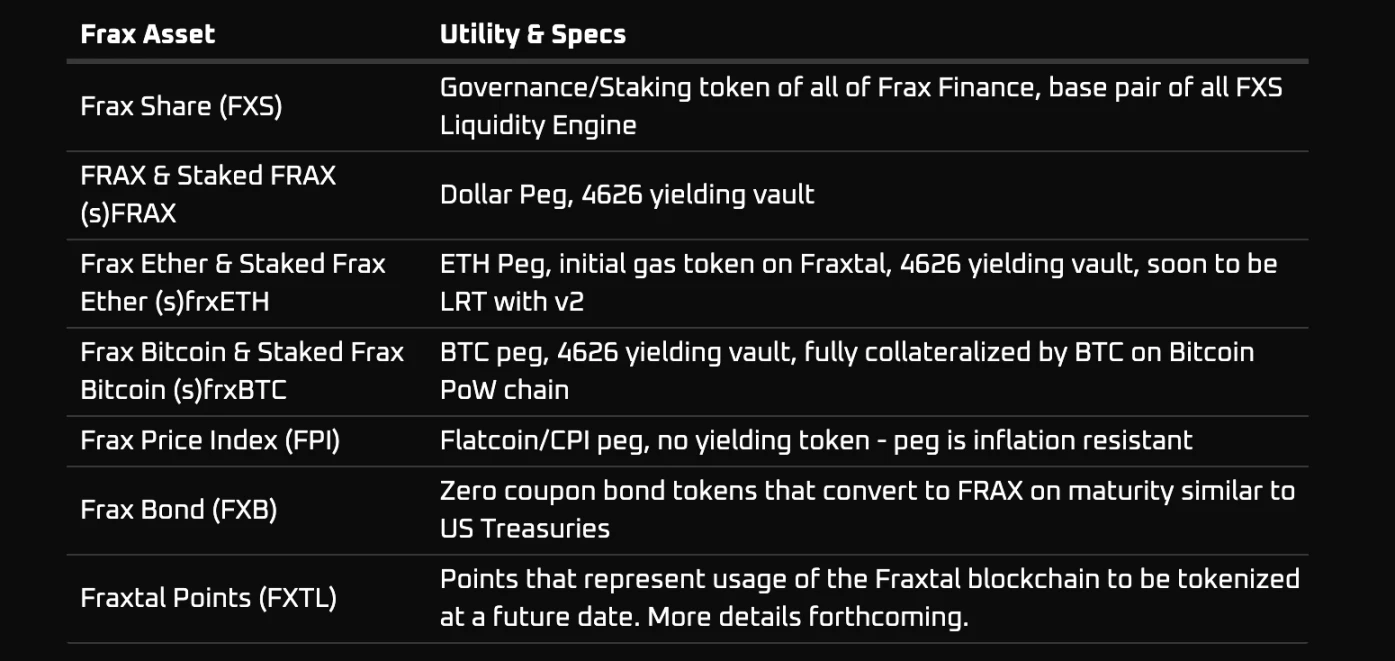

The launch of the modular L2 blockchain Fraxtal and the effective realization of full collateralization means the beginning of a new era for Frax. Across the entire stack, Frax can introduce features such as account abstraction, new precompilation, privacy features, aggregated DA, and hyperchain interop.

All Frax assets including FRAX, sFRAX, frxETH (and new Frax assets) will be issued on Fraxtal first.

Frax core developers are issuing Frax assets on Fraxtal, including native 4626 yield vaults, minting and redemption. When the Frax asset reaches its all-time high supply, Fraxtal TVL will also reach new highs. This is a unique synergy of the Frax full-stack system.

Frax Asset Overview

FXS is the ultimate beneficiary of the Frax ecosystem.

DeFi

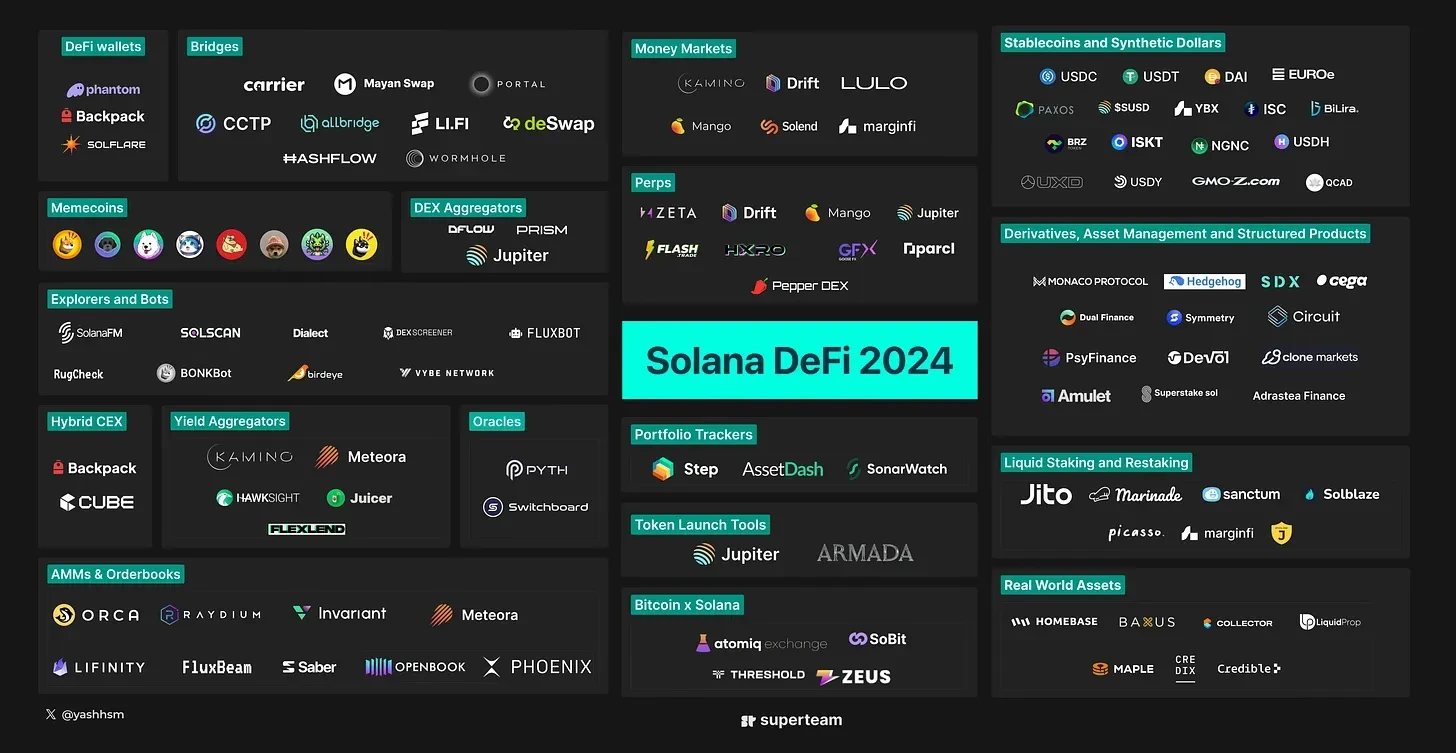

Taking stock of Solana’s top 10 DeFi themes worth paying attention to in 2024

DeFi stablecoin mechanisms will become more diverse; (re)staking and LST - the currency of SOL; the next generation of money markets; interest rate derivatives - unknown territory; making RWA and DeFi composable; the era of derivatives is coming; for DeFi protocols build infrastructure and tools; MemeFi and Making DEX become more vertical; protocols tend to become platforms; interfaces (UX aggregators) will become more powerful. The author also makes alpha recommendations for Builder on each topic.

The author also makes alpha recommendations for Builder on each topic.

NFT

An article taking stock of noteworthy Blast and Base NFT projects

Blast:Plutocats、Crypto Valley、Munchables;

Base: XCOPY and Jack Butchers Open Edition series, Based Fellas, Primitives, tiny based frogs.

Web3×AI

Trustless Labs: AI+Crypto, new tracks and new opportunities

Trustless Labs has traversed more than 60 projects in the primary and secondary markets, ranging from computing power cloud (Akash Network, Ritual, Render Network, NetMind.AI, CUDOS, Nuco.cloud, Dynex, OctaSpace, AIOZ Network, Phoenix, Aethir, lagon, OpFlow, OpSec), computing power market (Clore.ai, Nosana, io.net, Gensyn, Nimble, Morpheus AI, Kuzco, Golem, Node AI, GPU.Net, GamerHash, NodeSynapse), model assetization and training (Saharalabs, Bittensor, iExec RLC, Allora, lPAAL AI, MyShell, Qubic), AI Agent (Morpheus, QnA3.AI, Autonolas, SingularityNet, Fetch.AI, Humans.ai, Metatrust, AgentLayer, DAIN, ChainGPT), Data Capitalization (Synesis One, Grass.io, GagaNode, Ocean), ZKML (WorldCoin, EZKL, Giza, RiscZero, Modulus, Pi Squared), AI application [DeFi class (inSure DeFi, Hera Finance, SingularityDAO, Arc, AQTIS, Jarvis Network, LeverFi, Mozaic, Gaming (Sleepless AI, Phantasma, Delysium, Mars 4.me, GamerHash, Gaimin, Cerebrum Tech, Ultiverse), NFT (NFPrompt, Vertex Labs), Education (Hooked Protocol), System (Terminus OS)] 7 The modules are expanded horizontally to explore the future development of AI and cryptocurrency and explore investment opportunities.

A look at 10 AI projects worth watching

Bittensor($Tao)、PAAL AI($PAAL)、AIOZ Network($AIOZ)、LayerAI($LAI)、0x 0 ($0X 0)、RSS3($RSS3)、Oraichain($ORAI)、Autonolas($OLAS)、Numbers Protocol($NUM)、AIT Protocol($AIT)。

Hot Topics of the Week

In the past week,SBFSentenced to 25 years in prison,U.S. courtsDenying Most of Coinbase’s Motions, U.S. Department of Justice:KuCoinand two founders were charged with violating the Bank Secrecy Act and unauthorized funds transmission,SEC postponedResolved on Grayscale Ethereum Futures Trust ETF application,MicroStrategy share priceA record high,MunchablesAfter being stolen, it was reversed and called all usersFinancial security, Blast related rewards will be distributed normally;

In addition, in terms of policy and macro market,Fed bellwether Waller: There is no rush to cut interest rates, interest rates should be cut later or less, asset management companyVSFG and Value PartnersApply to the Hong Kong Securities and Futures Commission for a Bitcoin spot ETF;

In terms of opinions and voices,BlackRock CEO: The response of retail investors to IBIT is surprising, and they are surprised by the rise of Bitcoin. Even if the US SEC determines that Ethereum is a security, it may still be launchedEthereum ETF,Valkyrie Chief Investment Officer: BTC can reach US$150,000 within the year, but ETH may be recognized as a security.1 0x Research: April is usually a relatively strong month for Bitcoin,Su Zhu: April is structurally bullish, Bitcoin halving is coming,VC gives up friend.tech allocationHeralding a paradigm shift toward better token economics, Bloomberg analysts:GenesisSuspected of selling GBTC shares this week to buy spot BTC, Vitalik:User participation in Meme coinsBecause of its potentially rising prices and interesting, would like to see projects that are high quality and good for the ecology and the world, currentlyL2There are four key areas where the protocol can be improved, Vitalik posted: through more anti-correlated incentivesSupport decentralized staking,Ordinals Developer: Runestone is not an NFT collectible, but a Meme coin;

In terms of institutions, large companies and leading projects, Ordinals founder Casey announcedRunes documentation,AltLayerLaunched the ALT token staking function,Near FoundationLaunched Chain Signatures, allowing users to sign transactions on third-party chains through a single wallet,ether.fi: The second quarter point activity StakeRank has been launched and will allocate 5% of the total supply of ETHFI. SingularityNET, Fetch.ai and Ocean Protocol propose toToken mergerfor ASI,TON FoundationMeme project airdrops approximately 200,000 TON tokens to some DEX tradersLADYSLaunch of DEPIN mobile project Meme Phone…well, another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~