Original author: Danny Sursock

Original compilation: Block unicorn

The best part of ETHDenver 2024 was seeing the two opposing groups collide in the classic Left Curve/Right Curve debate.

One of them carriesDare to take risks and go all outcame to the scene with a mentality of looking forward to the upcoming big cycle.

The other one is inTry to find fundamentalsto explain today’s market frenzy.

In the short term, I think both are probably correct. Although public and private markets have almost certainly lost their fundamentals in the current situation, cryptocurrencies are still looking quite poised for massive, long-term gains.

But a closer look reveals that something different may be happening this time.

Previous bull markets have driven users, but these cycles often look less like true adoption and more like the beta of macro leverage.

Currently, volatile liquidity waves will be replaced by sustained ones due to three major favorable factors:

Macrox Crypto Mainnet

The explosive growth of public and private markets has masked some of the mundane changes taking place, thanks to a combination of AI hype and economic optimism.

In fact, rather than a return to pre-pandemic norms, a radically different geopolitical paradigm is emerging: one centered on fragmentation and cross-border competition.

While these new developments will pose significant challenges to existing businesses, they provide a generational opportunity for cryptocurrencies to leap to levels of global adoption.

Cryptocurrency’s first decade was a remarkable testnet, marked by grassroots growth, prosperous highs, and difficult lows. Now entering its second decade, cryptocurrencies are ready to mainnet as the world’s interoperability layer: as a neutral home for economic exchange and technological innovation in an era that desperately needs it.

Why?

For cryptocurrencies, worldly changes are a positive impetus before the perfect time arrives.

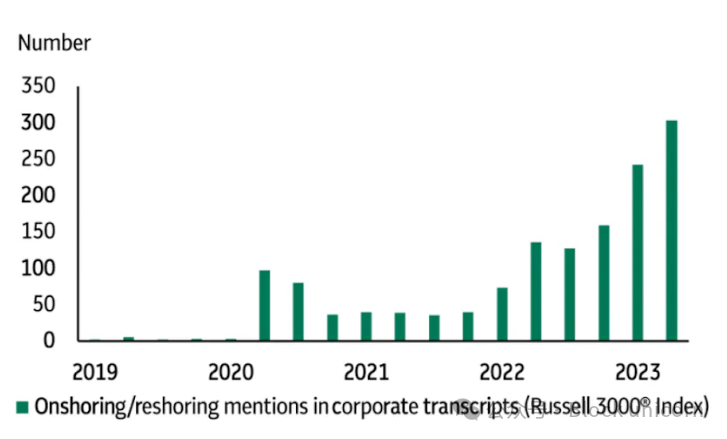

In fact, the basic architecture that has underpinned global trade over the past two decades is being accelerated by deep fissures in international relations. In 2023, the reorganization of global supply chains and trade trajectories accelerated and became a core concern for businesses and governments.

Businesses are increasingly paying attention to reshoring:

Source: Macrobond/Macquarie

At the same time, more than 54% of the worlds population and nearly 60% of global GDP are going through election cycles, and protectionism has become a major focus as several major military conflicts play out in real time.

Equally relevant to cryptocurrencies is the evolution of international competition, with countries no longer relying solely on rockets and bullets.

The United States weaponized international finance in response to Russias invasion of Ukraine, while OPEC and Russia said they would be happy to do the same by manipulating energy supplies.

Meanwhile, techno-nationalism around semiconductors and other critical inputs has shifted from rhetorical warnings to real action such as sanctions and subsidies.

This fragmentation of global commerce is hurting profits in developed countries, but the impact is even more significant for the 40% of the worlds population living in low- and middle-income (LMI) countries.

Particularly for individuals in low- and middle-income countries, cryptocurrencies offer important solutions to everyday problems, and their importance will only grow alongside systemic challenges. The data bears this out: when geopolitical tensions rise, grassroots cryptocurrency adoption is not only strengthened, but accelerated.

Source: Chainalysis

Likewise, for private companies, the convergence of these factors creates significantly higher costs and limits access to new consumer markets, all in a world where the cost of capital is no longer zero.

Trade wars and tariffs over the past few years have proven to be damaging to businesses and the domestic economy, and these negative impacts are likely to intensify as businesses adapt to new realities.

As a result, companies and individuals increasingly need to make choices:

This intersection reminds me of an interesting historical parallel:

When Constantinople fell to the Ottoman Empire in the 15th century, the new conquerors inherited a geographical hub that controlled global commerce connected across the Silk Road.

As we all know, the Ottoman Empire soon began to restrict the overland trade routes that had flourished for centuries. The result prompted European powers to set sail to find new trade routes, igniting the Age of Exploration that shaped the modern world.

And this time, it will be the blockchain, where those who bravely set sail will find the wealth and dangers of the new world.

Reach enterprise scale

There’s another important point to note: cryptocurrencies have historically been an arena for large companies to experiment with new technologies.

Due to the factors covered in this article, traditional enterprise exploration of cryptocurrency is now moving from the RD level to the production level.

Enterprises will accelerate their exploration of digital assets and on-chain ecosystems as key sources of opening up new markets. What was once a vanity project will increasingly become an existential mission.

Capital allocators will expand cryptocurrency native deployment and participation to protect against “beta” exposure to global risks and uncertainties. Because in the old world, people wouldnt have many places to hide.

Systemic challenges in different regions (inflation, capital controls, hot/cold conflicts) will drive greater relevance and demand for digital assets. Permissionless blockchain infrastructure will start at the grassroots and then go global.

To be sure, economic and geopolitical challenges are always driving users toward cryptocurrencies, especially in developing markets.

However, the scale and scope of the challenges the world must face in the coming years provide a unique opportunity for cryptocurrencies to become a de facto free business and cultural system.

Institutional Fund Flows

Of course, all of this hinges on one final piece of the puzzle: bringing institutional capital on-chain.

The approval of a Bitcoin spot ETF marks a major turning point in this regard, and Ethereum appears to be on the verge of a similar outcome.

Source: Bloomberg

Bitcoin ETFs have attracted more than $7.5 billion in net inflows so far, with the ETF launched by BlackRock and Fidelity the most for any ETF in the past 30 years

record for the largest first-month circulation.

This incredible momentum will eventually enable the largest institutions to join the on-chain economy, with more than 52 million Americans and another 500 million people worldwide (a previous report by Crypto.com calculated that by the end of 2023, the world’s Cryptocurrency owners reached 580 million) participated in the grand event.

If macroeconomic structural changes are providing the spark, institutional capital flows represent the fuel that ignited crypto’s golden age.

Middleware and infrastructure upgrades drive growth

The external environment is set up brilliantly, are we ready to seize this opportunity?

I believe the answer is yes.

After the 2022 crash sent investors fleeing, crypto natives began to reflect on the excesses and flaws that led to the bubble in the first place.

Tremendous progress has been made across all layers of the stack as capital and talent coalesce around comprehensive system upgrades, setting the stage for the mass adoption cycle to come.

Private money flows throughout the year reflected this. The year started with financial infrastructure accounting for the largest share of funding, followed by wallets, and finally financial infrastructure dominated again, with L2/interoperability projects not far behind.

Amidst all this, what is particularly striking is that the forward cycle of infrastructure applications is beginning to be more focused and purposeful than ever before.

Source: USV (The Myth of the Infrastructure Phase)

Increasing demand from crypto-native consumers is driving directed and focused improvements to the technology stack, which in turn is giving rise to new use cases and applications.

Great UI/UX is driving adoption

Block unicorn Note: UI/UX refers to User Interface Design and User Experience Design.

The ERC-4337 standard was released in the first quarter of 2023, aiming to transform external accounts (EOA) into smart contract wallets to enable customizability, better private key recovery mechanisms, and a more streamlined user experience.

Even more impactful, teams like Privy* are making huge strides by simplifying the onboarding process for embedded wallets, minimizing user friction while allowing developers to design more contextual experiences.

Privys efforts helped Friend.Tech quickly attract 100,000 addresses in a matter of weeks, and they have supported onboarding processes for platforms such as OpenSea, Zora, Blackbird and more over the past 13 months, attracting 200+ addresses from over 150 countries. More than 10,000 users.

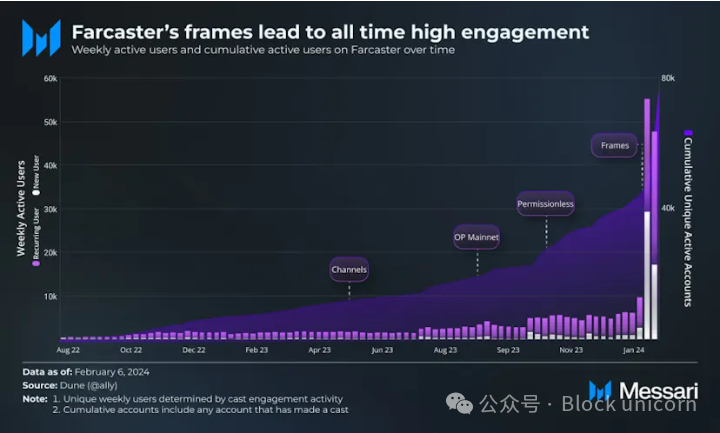

Meanwhile, Farcaster*’s launch of Frames, a new primitive that allows people to embed interactive experiences directly in Casts, is a transformative initiative that has significantly boosted activity on the platform.

Farcaster garnered over 8 million responses out of over 4 million Casts, which is likely an early sign that crypto-native consumer applications are about to reach escape velocity.

Source: Messari (Farcaster Framework)

The new design space becomes broader and better

Just as Ethereum sought to transcend Bitcoin’s functional limitations, a new generation of projects is now targeting Ethereum’s own structural flaws and solving them through modularity.

Alternative L1s and sidechains have been a feature of previous cycles, but none have successfully disrupted Ethereum (mainnet) dominance in terms of users, TVL, developers, and activity.

This has changed with the launch of Rollups such as Arbitrum and Optimism, projects that aim to achieve higher throughput and lower fees by offloading computation outside of Ethereum.

Source: TokenTerminal

While the scale of these new layers already rivals, or in some cases exceeds, Ethereum itself, builders have bigger dreams as they seek to further optimize the L1 stack.

Thats because, even though the number of daily active users on L2 has grown 8x in the last year, much of what users actually do looks very similar to historical L1 activity. Therefore, the emerging consensus is that offloading transactions to cheaper execution environments is not enough to enable a truly novel on-chain experience.

We actually need to re-architect the components that underpin blockchain, from data availability (DA) to state access bottlenecks and parallel execution.

Standalone Data Availability (DA) tiers built to scale to Web2 performance parity (i.e. EigenDA, Celestia, Avail) will come to market along with upgraded VMs, some based on EVM, others using Moves (Movement Labs* ) or Solana virtual machine (Eclipse). Still others are building L2 and just for optimized execution (MegaETH), while others are launching entirely new L1 from the ground up (Monad).

At the same time, EigenLayers mission is to provide a shared security layer through re-collateralization, allowing a new generation of projects to launch in a minimal way, thereby reducing the need for local liquidity to launch, and therefore not deviating from Ethereums core security model .

All of this means that the underlying infrastructure, tooling, and design options available to Web3 builders are approaching unprecedented levels of maturity and performance.

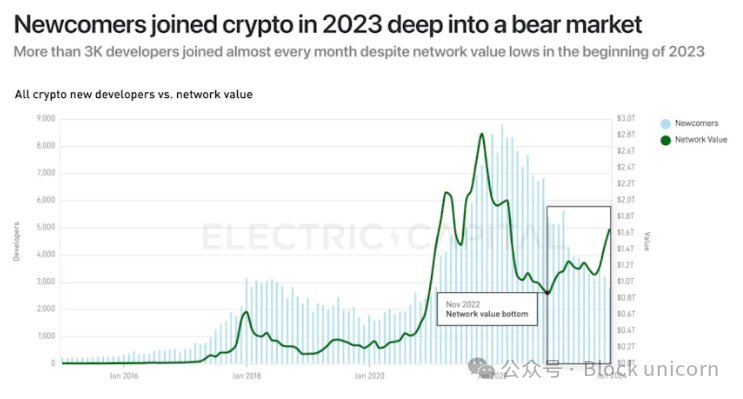

As the values of cryptocurrencies increasingly resonate with upgrades to infrastructure, tools, and middleware, we’re seeing data underpin cryptocurrencies’ all-important leading indicator: developer traffic. We see a promising story in the data supporting a vital leading indicator for cryptocurrencies: developer traffic.

Source: Power Capital Developer Report

Building on blockchain should not only be a more meaningful exercise, but a more technically performant one, effectively empowering developers to design the open internet of the future. Significantly improving retention rates for existing developers and getting new developers onboard in difficult market conditions speaks volumes for the work being done in this area.

Open Source Artificial Intelligence and Crypto Infrastructure

Ultimately, we believe the intersection of crypto and artificial intelligence—two individually disruptive paradigm shifts—represents one of the most transformative moments in modern history.

Blockchain’s infrastructure system has been successfully designed over years of stress testing to be a permissionless system fit for the digital age, especially one shaped by generative artificial intelligence.

Cryptocurrency’s solution toolkit addresses a variety of important issues, including resource and liquidity coordination, asset ownership, data provenance, attestation, and more. Crucially, the maturity of ecosystems and technology stacks is catching up in time to meet the demands of the AI revolution.

While there is ample room for blockchain to optimize existing machine learning (ML) processes, the most exciting opportunities will arise where crypto and AI combine to achieve completely novel results.

The most exciting new design spaces will cover the following areas:

Decentralized storage serves as the foundation for a shared, permissionless data warehouse designed to enable better training or higher-performing models through Retrieval Augmented Generation (RAG) technology.

Zero-knowledge proofs are used for model or content validation, training or user data privacy, or to enable edge and local (client-side) inference.

Novel information markets and better mechanisms for collecting higher quality data, as the underlying models require more specialized data inputs to continue to evolve.

Autonomous agents conduct transactions through smart contracts, allowing them to accumulate resources, knowledge, and assets using machine-operated private keys.

As crypto infrastructure impacts the supply of computing resources, data markets, and the collective creation and monetization of powerful underlying models, open source AI/ML will be strongly fueled by cryptocurrencies, driving human productivity and open collaboration in the coming years. of revival.

Cryptocurrencies will become the best way to gain exposure to the rise of artificial intelligence, either through proxies for blue-chip assets such as Ethereum (ETH), or through direct holdings or speculation on proxies, models, networks, and data sets.

whats next?

We are at an inflection point in this industry. After years of pushing forward despite resistance from the market, incumbents and regulation, the tide is finally starting to turn.

Cryptocurrency’s moment has arrived, thanks to the confluence of several important tailwinds that are ultimately ushering in a decentralized future. In the context of this renaissance of infrastructure and middleware, which has evolved by leaps and bounds in terms of on-chain experiences, we should remember an important point.

In a perfect world, modularity not only enables specialization but also spreads control and points of failure among multiple contributors. However, each new component involves different technical and security assumptions, incentives, token diffusion roadmaps, venture capital, foundation setup, and internal politics.

I don’t want to belittle the efforts of builders across the industry space over the last year, especially in the face of a brutal economic recession. But as activity and buzz picks up again, we need to move away from a narrow environment that just regurgitates the same ideas over and over again, as well as misinformation that misleads us, with signals like the ones that might lead people to believe that token issuance is a true partnership that works. Advocacy is community recognition, or incentivizing behavior in place of the organic adoption process.

In the coming years, we have a responsibility to ensure that this growing number of projects are responsible in terms of technical design choices, token distribution, value dissemination, ideology and governance.

This is how cryptocurrencies ultimately win.