LD Capital: 4.1 Macro Weekly Report, a Key Week for Adjusting Positions at the End of the Quarter

U.S. stocks had their best start to the year in five years in the first quarter

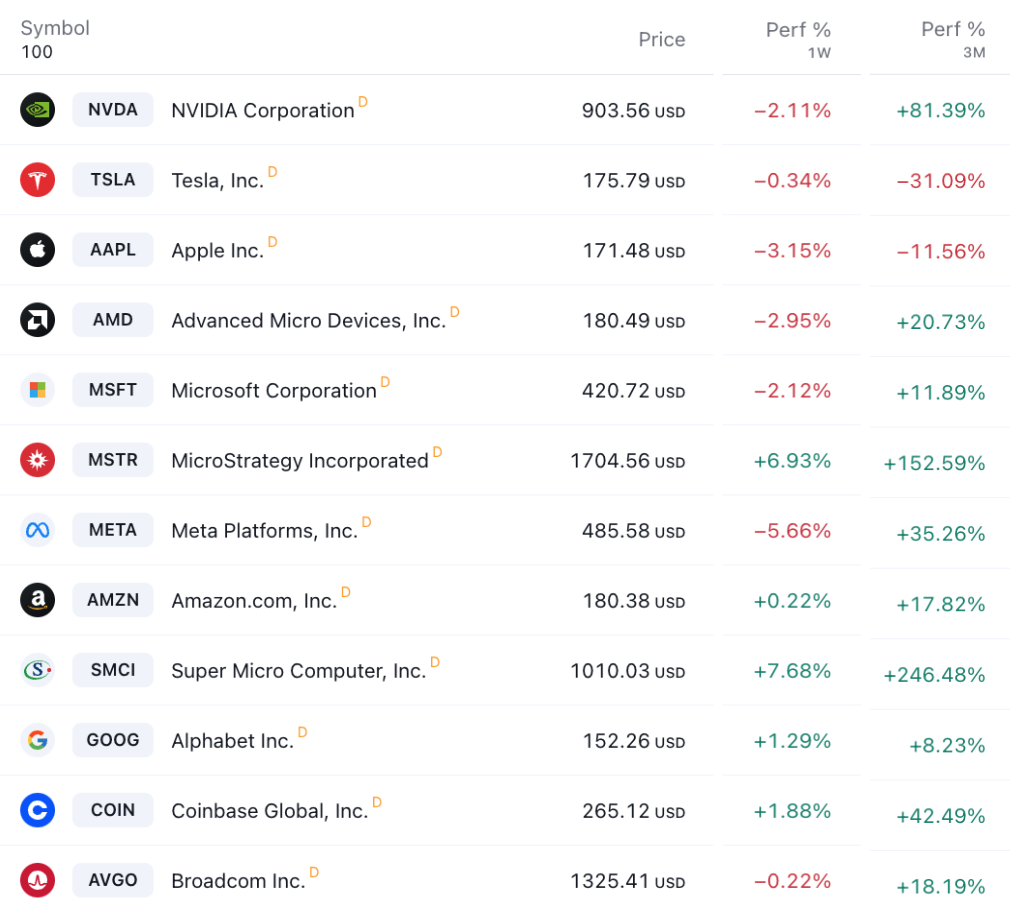

Technology stocks were generally under pressure last week, digital currencies rebounded to a certain extent, and related stocks also performed positively:

But as of the end of March, European and American stock markets have risen for five consecutive months for the first time in ten years. The SP has risen by more than 10% for two consecutive quarters. The Nasdaq lagged slightly behind in the first quarter of this year, but it also rose by more than 9%, mainly due to the rise of more than 9%. The performance of some big technology companies was dragged down. Tesla fell nearly 30% in the first quarter, Nvidia rose 80%, and Apple fell 10%.

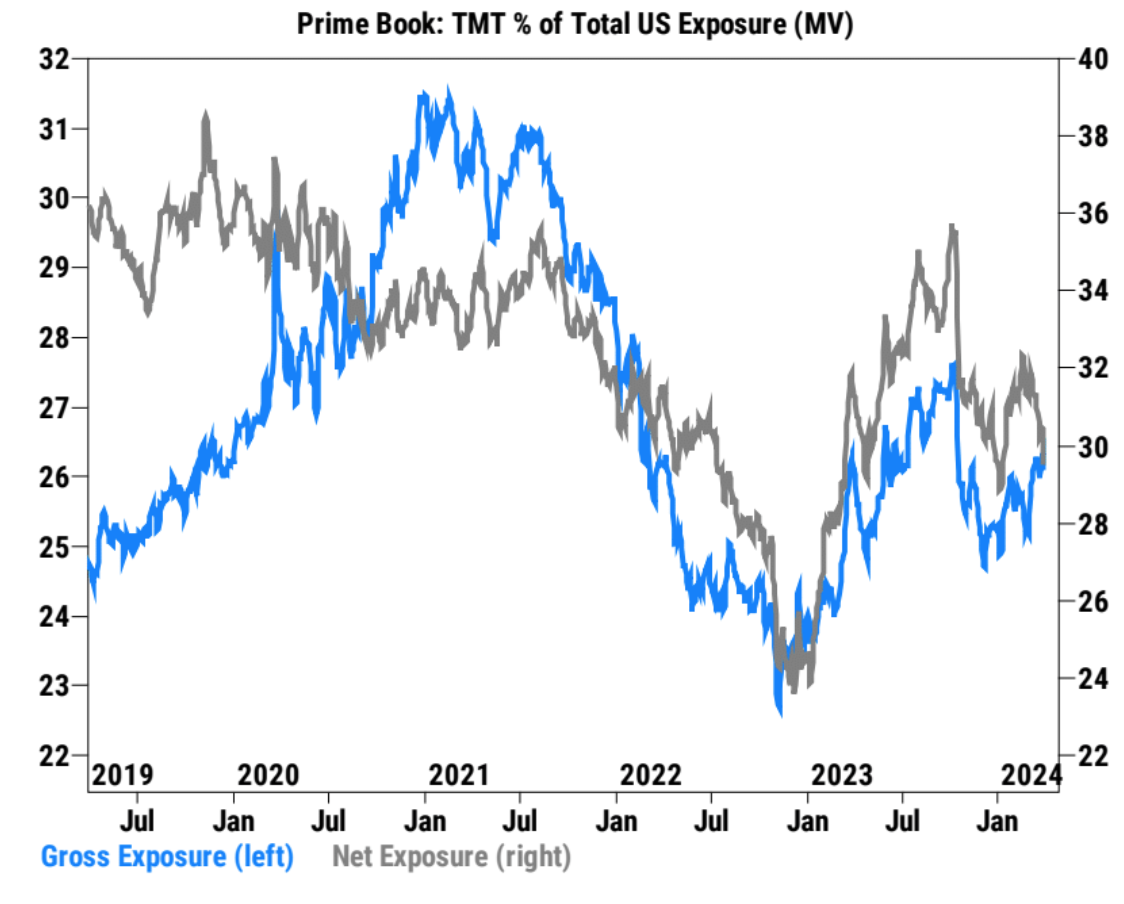

According to Goldman Sachs PB data, TMT stocks (information technology + communication services) were continuously net sold in the last three trading days before the end of the quarter, accounting for approximately 75% of the total net sales of single stocks in the United States last week. It currently accounts for 29.1% of the total net exposure to U.S. stocks, which is down from the peak of 32.5% in mid-February and the levels in the past one and five years.

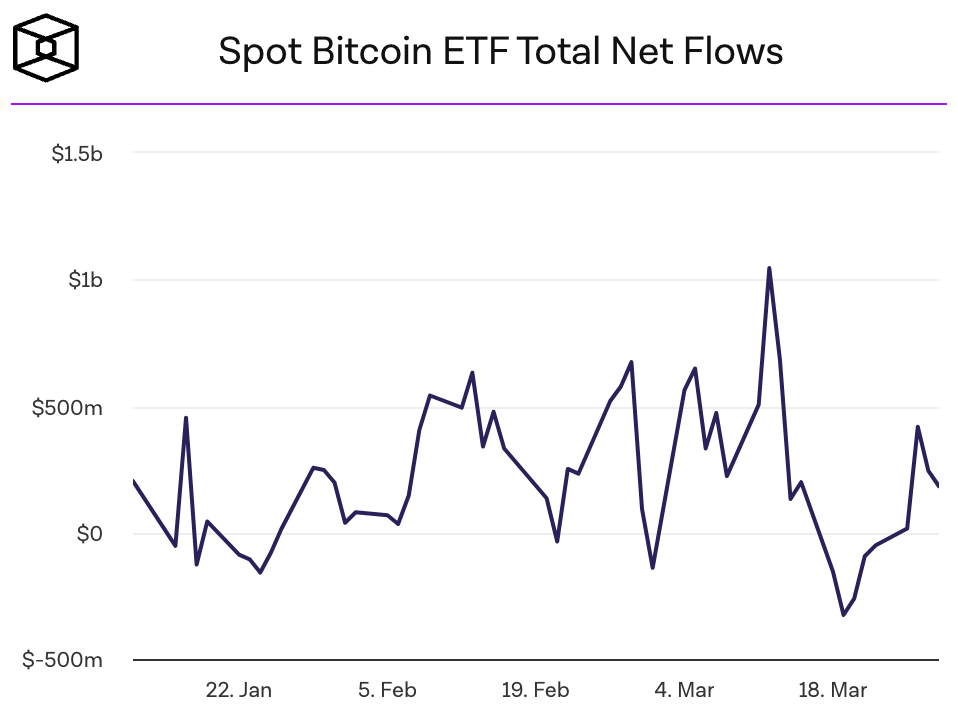

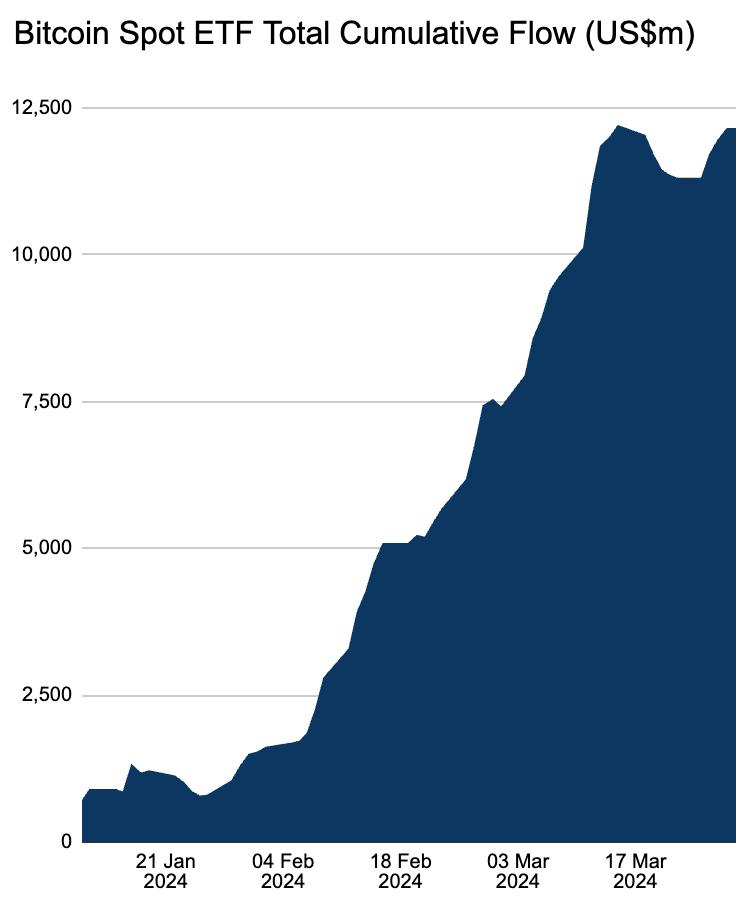

It can be seen that the rebalance of large funds at the end of the quarter has a significant impact (generally sell those who have risen and cover those who have fallen, and the actual rebalancing transactions are usually arranged from the end of March to the beginning of April). Stocks with large gains in the early period face selling pressure. According to Goldman Sachs’ calculation of pension Funds may sell an estimated $32 billion in shares to rebalance their positions. Theoretically, end-of-quarter rebalancing should see a lot of demand for Bitcoin ETFs (because they were only launched in January, funds that intend to allocate have not had time to add them to the investment portfolio). Next week may be a week of strong inflows.

Gold surged 3.12% last week, setting a new all-time high again, demonstrating the markets demand for diversified allocations and the expectations of central banks of various factions. During the same period, the price of WTI crude oil rose by 3% to US$83.1, setting a new high since November last year. Since entering 2024, crude oil has risen every month and has rebounded by more than 10%, implying that inflationary stickiness will exist, which theoretically puts pressure on non-interest-bearing assets. But the current market focus is still on diversified allocation.

Tech giants face regulatory pressure

U.S. and EU regulators are launching a series of antitrust lawsuits and investigations against technology giants such as Apple, Amazon, Google, and Microsoft. The seven companies, with annual revenues of up to $2 trillion, are an attractive target for financially strapped regulators and governments.

The seven largest technology companies by market capitalization, which account for 30% of the SP 500, have contributed to 60% of the SP 500s gains over the past 12 months. Investors like them because they have monopoly advantages in their respective fields and can maintain high profit margins.

The average tax rate for the seven largest tech giants over the past year was only 15%, significantly lower than the 21% for the rest of the SP 500. Tightening regulations and rising tax rates may affect stock price expectations.

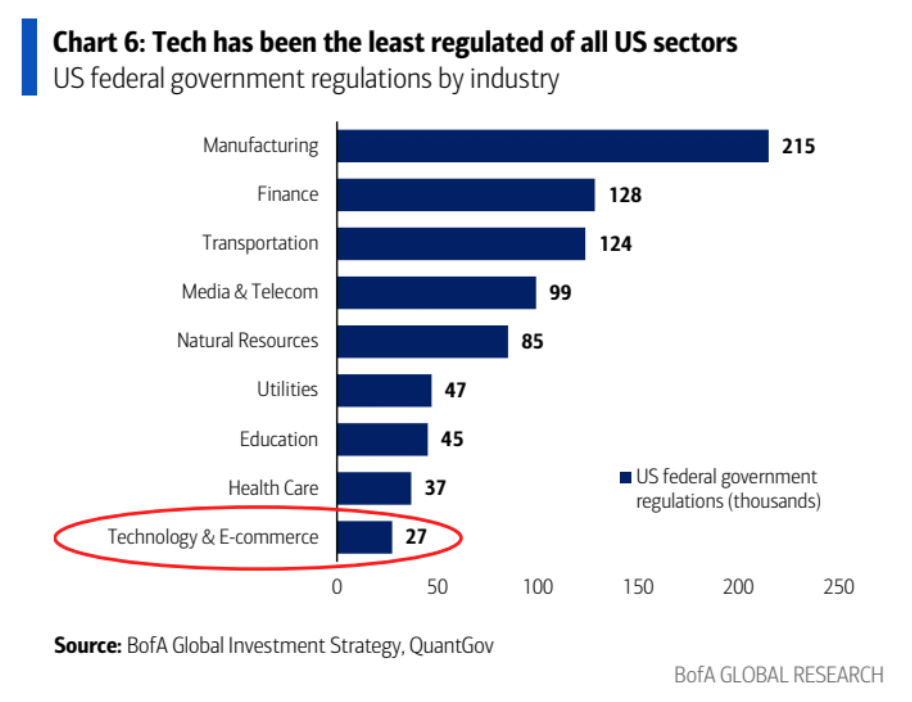

The technology Internet industry has historically been the most lightly regulated industry. This may be because they are relatively new industries and regulatory rules are not yet sound enough, or it may be because the government intends to give these industries more freedom to encourage innovation. But as the influence of technology giants increases, this regulatory environment may change.

The chart below shows the degree to which the U.S. federal government regulates various industries, as measured by the number of regulations:

Domestic substitution of science and technology

Gradually remove American chips from government computers and servers and replace them with domestically produced products. The biggest impact here is Intel and AMD. In addition, the Chinese governments procurement guidance also stated that Microsofts window system will be marginalized and foreign database software will also be replaced by domestic products. In order to counter U.S. restrictions on chip exports to China, China has been trying to reduce its dependence on foreign companies by building a local semiconductor industry.

Yes, the new measures may have a significant impact on the profits of the chip companies involved. In 2023, China will be Intels largest market, accounting for 27% of revenue, while AMD will account for 15%.

Chinese version of QE?

Last Friday, news spread in the market that the Peoples Bank of China may purchase government bonds to expand its balance sheet (Chinese version of QE), which once affected the stock market, commodities, and bond markets. The original report was that the South China Morning Post quoted Xi Jinpings speech at the Central Financial Work Conference on October 30 last year, saying, We must enrich the monetary policy toolbox and gradually increase the buying and selling of government bonds in the central banks open market operations. This is a high-level financial meeting held every five years. , but the relevant content of the speech did not appear in the official press release at the time, until China published an excerpt of Excerpts of Xi Jinpings Discourse on Financial Work published publicly in March and was reported by the South China Morning Post. This content attracted the attention of financial market traders. Partly affected by optimism that Chinas monetary stimulus may increase, China and Hong Kong stock markets rose, the RMB exchange rate and the bond market also strengthened for a time, before giving up gains in late trading.

Because various analyzes were soon released, it is generally believed that China is unlikely to implement Fed-style quantitative easing. Compared with the total amount of credit, recent policies still emphasize the structure and effectiveness of credit expansion. The Peoples Bank of China Law clearly stipulates that the central bank shall not purchase treasury bonds in the primary market in order to prevent government departments from directly increasing leverage and increasing the risk of fiscal overdrafts. Secondary market operations are feasible, but one of the previous ways for the central bank to purchase bonds from the secondary market was through pledged repurchase, rather than direct purchase, as it can easily lead to price and expected fluctuations. Another is that central banks generally start QE only after they have no room to cut interest rates. This is not the case yet.

Treasury bonds have become an international practice as a way for the central bank to invest base currency, but the central banks purchase of treasury bonds does not equal QE. QE refers to planned, long-term, large-scale bond purchases. The current ratio of national debt to the balance sheet of the central banks of the United States, Europe and Japan is 61% (USD 4.62 trillion), 58% (EUR 4 trillion), and 78% (JPY 602 trillion) respectively.

Over the years, my countrys central bank has injected liquidity into the market, usually by re-lending to commercial banks and reducing the deposit reserve ratio of commercial banks. The central bank rarely directly purchases government bonds in the secondary market. So only 3.4% of the Chinese central bank’s balance sheet is in government bonds. The last time PBOC increased its holdings of government bonds was in 2007, and it was to provide capital to China Investment Corporation.

We believe that it is still too early for Chinas QE, and the PBOC still has a lot of ammunition to fire, so it will not rush to use unconventional means. Central Bank Governor Pan Gongsheng and other major leaders have released multiple interest rate cuts and RRR cuts in March. Space information (there has been an unconventional interest rate cut of 50 BP in February 2024). However, PBOC is fully qualified to try to purchase some Chinese government bonds in the secondary market. Since the market had no expectations for this before, the marginal change from 0 to 1 cannot be ignored, and in case this news is authorized by the central government to test the market reaction Yes, it is not a bad thing to stimulate positive market sentiment. It can be understood as a benefit for A-shares, ChinaBond, gold, and Bitcoin, but expectations do not need to be too high.

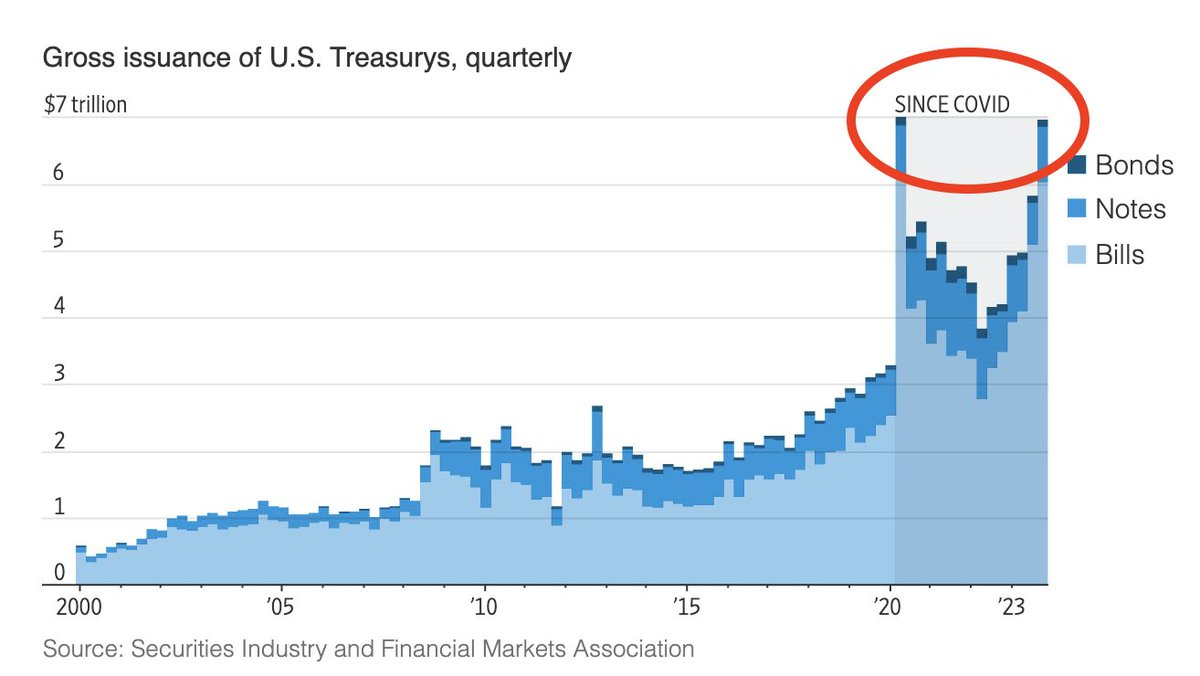

Lack of fiscal discipline is a plus

The U.S. Treasury Department issued a total of 23 trillion in national debt throughout 2023, which is the same as the peak during the COVID-19 period, even though the economy is recovering. This number will only continue to grow in the future. No one thinks that the U.S. government can tighten spending. It is now expected that 27 trillion will be issued in 2024, which is 60% larger than in 2019 and about 6 times that before the financial crisis. Meanwhile, the fiscal deficit last year was nearly $2 trillion, and U.S. debt is rising by $1 trillion almost every 90 days. Just days ago, another $1.2 trillion budget was passed. In the words of Federal Reserve Chairman Powell, the United States is on an unsustainable fiscal path.

The issuance of huge debt will trigger fiscal concerns and further strengthen the markets confidence that the Federal Reserve will cut interest rates or introduce other easing measures in the coming months. From this point on, it is good for stocks, commodities, digital currencies and gold.

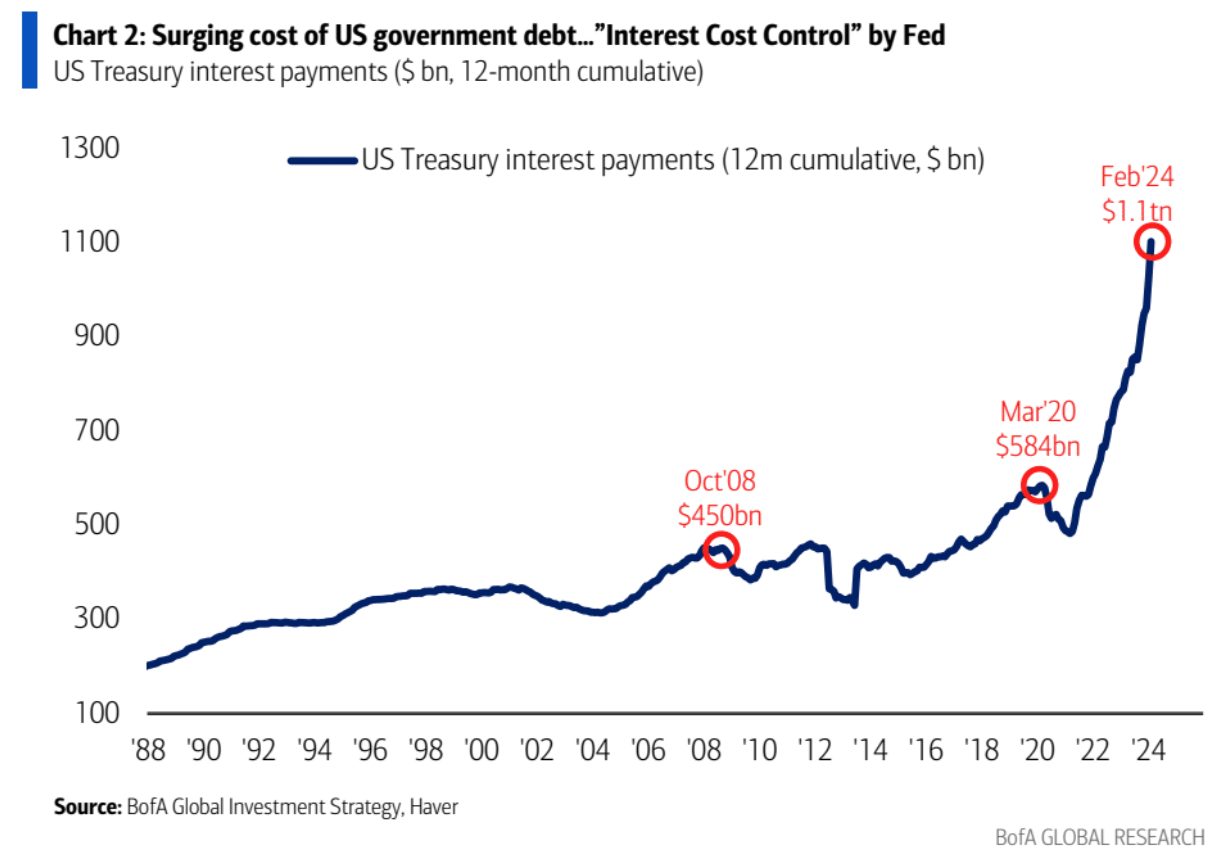

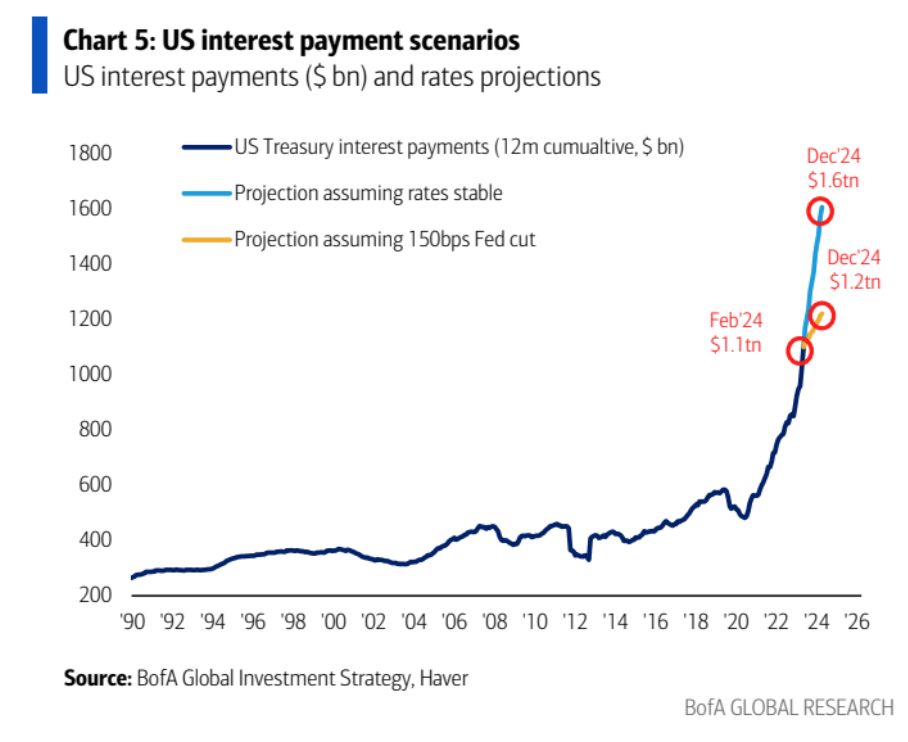

The U.S. governments interest payments in the past year have reached $1.1 trillion, twice as much as before the COVID-19 pandemic. Government spending and debt continue to rise, giving the Federal Reserve an incentive to cut interest rates in order to control the rapid growth of interest costs. If the Fed keeps interest rates unchanged over the next 12 months, the U.S. governments annual interest payments will increase from $1.1 trillion to $1.6 trillion. It would take a 150 basis point Fed cut to keep interest payments essentially flat

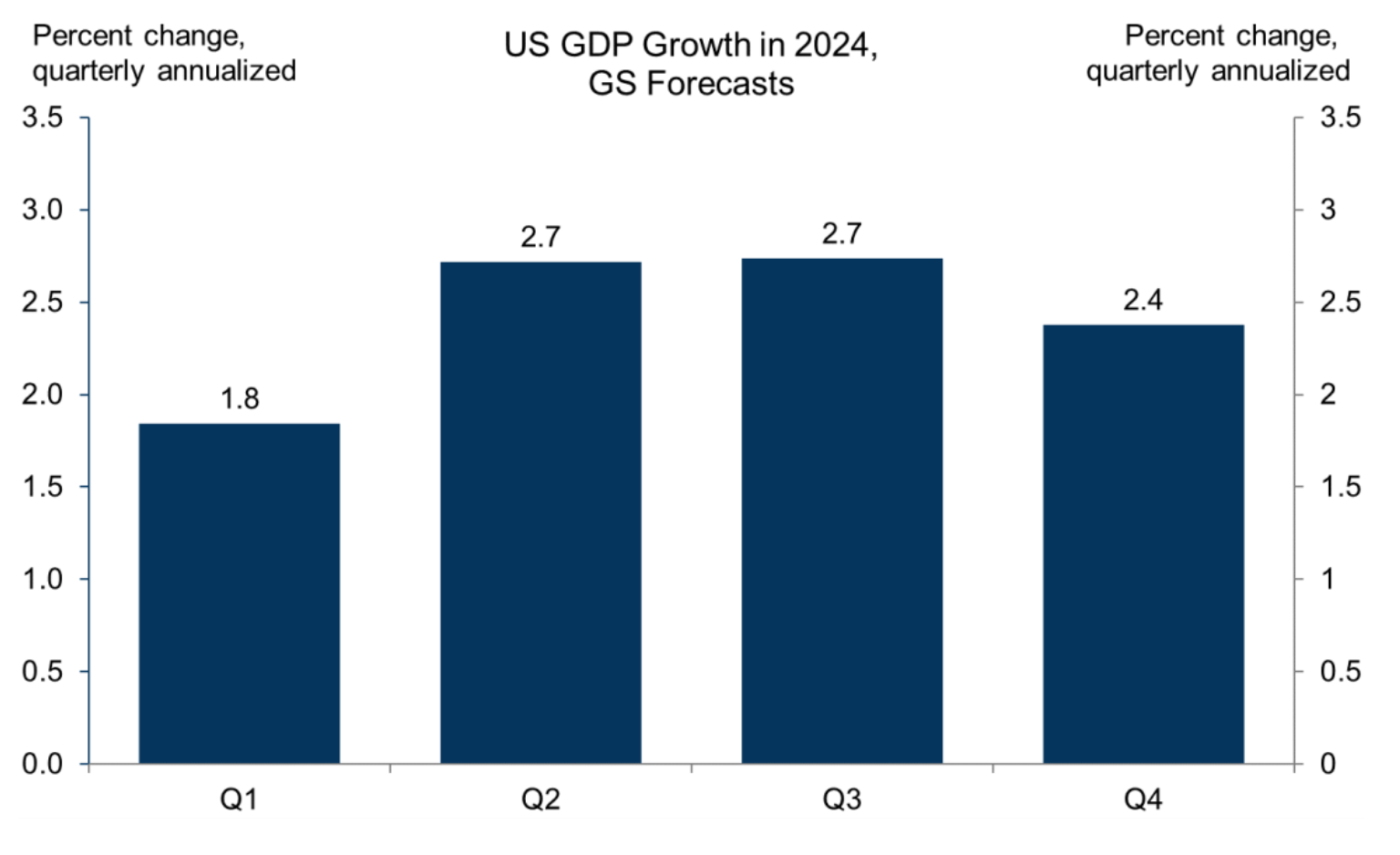

U.S. GDP expected to rebound quarter by quarter

According to Goldman Sachs’ forecast, U.S. GDP growth is expected to rebound quarter by quarter in 2024:

If the Fed cuts interest rates three times starting in June, as Goldman Sachs expects, it would be an easing of monetary policy while economic growth picks up. This is the opposite of what happened in 2022, when the Fed tightened policy against the backdrop of a slowing economy. So while a forward P/E ratio of 21 is historically high, the combination of Fed policy easing and accelerating economic growth should still provide support for stocks.

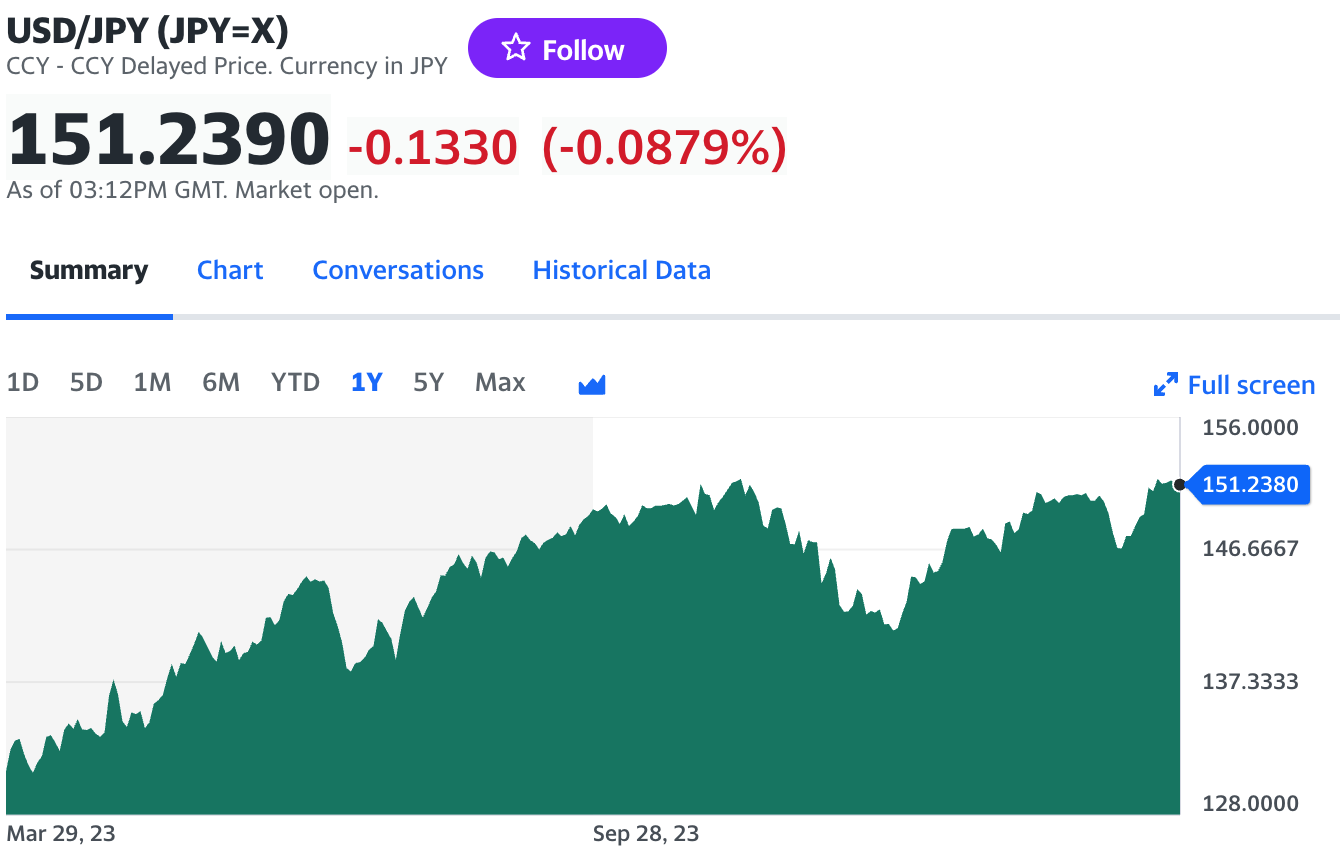

BOJ Yen approaches 152 after dovish rate hike

The Bank of Japan ended eight years of negative interest rate policy on March 19 and canceled purchases of Japanese stock ETFs and REITS, but it will continue to purchase government bonds, and several officials said it will continue to maintain loose monetary conditions.

Because giving up YCC and raising interest rates slightly is different from giving up QE. As long as the purchase of government bonds continues, the Japanese yens liquidity will still increase, and the status of the major central bank as a major central bank in issuing additional legal currency to global assets will not change much.

Therefore, the yen has recently returned to weakness, falling to its lowest level in a year. Moreover, the stable macro risk environment is expected to continue to be unfavorable to the Japanese yen. Japanese yen financing is going overseas but transactions will continue. At present, even if the interest rate rises by another 25 bp, it will not be enough to trigger a large-scale return of capital.

Although the exchange rate breaking through the 152 mark may trigger intervention by the Japanese Ministry of Finance, it may not be able to change the general trend, and the foreign exchange market will see greater volatility by then.

A U-turn for Global Central Banks

The recent U-turn by global central banks has made headlines in the media. However, due to the different circumstances of each country, some beginning to cut interest rates does not mean that we will see a continuous decline, while some raising interest rates is actually a dovish signal.

First of all, the Swiss National Bank was the first central bank in a developed country to start cutting interest rates. Its action was initially interpreted as a milestone event. Subsequent market reports mainly focused on the dovish signal of the Swiss National Banks sudden action and its impact on the Federal Reserve and the European Central Bank. guiding role. Articles in major newspapers also focused on discussing who the next central bank might cut interest rates. But then everyone focused on Switzerlands inflation and exchange rate issues. It was indeed necessary to cut interest rates, and the markets joyful mood declined.

European Central Bank President Christine Lagarde said officials were not guaranteeing possible future actions after a rate cut in June is likely. In other words, it is also reminding the market not to think that interest rate cuts will continue after they begin.

The Fed actually wants to cut interest rates, but recent data doesnt provide a good starting point. Powell said at the March press conference that we typically see inflation be a little stronger in the first half of the year and then not as strong in the second half, and we have to let the data tell us, and I dont know if thats a small bump in the road or more.

The small bump he is talking about here refers to the hot inflation data in January and February (the March data is also likely to be hot). It can be seen here that he wants to lower the inflation rate, but needs to wait for sufficient reasons. And if the global economy is particularly strong compared to the United States, it means that the possibility of cutting interest rates is lower than that of Europe and the United Kingdom.

In his speech on Friday, Powell said the just-released PCE inflation rate was broadly in line with the Feds expectations. But in fact, this is a report that slightly exceeds market expectations. This shows that he does not want to over-interpret the price data now.

Of course, the key point is that he mentioned that the U.S. economy is performing strongly and there is no need to rush to cut interest rates at the moment. If inflation does not decline, the Fed can maintain interest rates for a longer period of time. That triggered a pullback of more than 3% Friday night.

However, he did not mention the possibility of returning to raising interest rates in his speech. In addition, if the job market weakens unexpectedly, the Fed will respond promptly (the subtext is that as long as employment is loose and prices do not reach the target, interest rates will be cut). Overall, Fridays speech was slightly hawkish, but not very hawkish. It is unlikely to affect expectations for a rate cut in June, and the correction is expected to be limited.

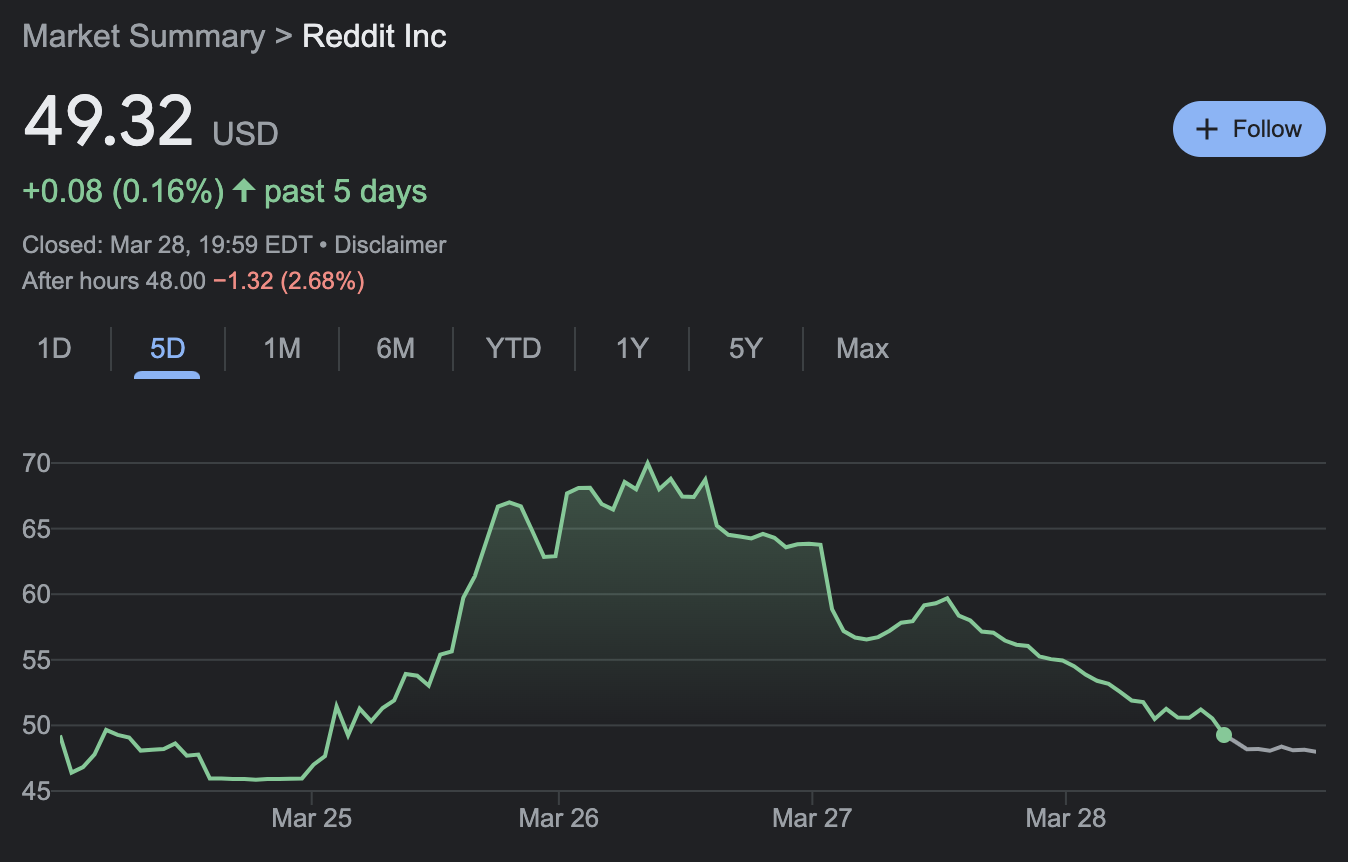

US Stocks MEME Craze

The meme stock craze is back, with both Reddit and DJT stocks surging on the frenzy of retail investors, with stock price movements driven primarily by market sentiment and capital flows, and unrelated to fundamentals.

Retail investors in the U.S. stock market this week are betting on Reddit and Trumps social media company Trump Media Technology Group Corp. (ticker DJT).

After DJT closed up more than 16% on its first day of listing, U.S. stocks rose another 14% overnight to $66.22, with a market value of approximately $8 billion. It is the most discussed stock on WallStreetBets and ranks among the top 15 stocks by trading volume on Interactive Brokers. stock.

According to financial documents, DJT has 9 million registered users. Its revenue in the first three quarters of last year was only US$3.4 million, while its losses reached US$49 million. Obviously, the increase was not driven by fundamentals.

Reddit is the fourth most traded company on Interactive Brokers. The company was listed on the New York Stock Exchange last Thursday with an issue price of US$34. It then rose to a maximum of US$70 that day and is now back to US$49.3 but is still lower than the issue price. 45% higher.

Reddit has never been profitable in its nearly 20 years of existence. In 2023, the companys revenue was US$808 million, a year-on-year increase of about 21%, and its net loss narrowed to US$90.8 million from US$158.6 million in 2022.

Cryptocurrency recovery

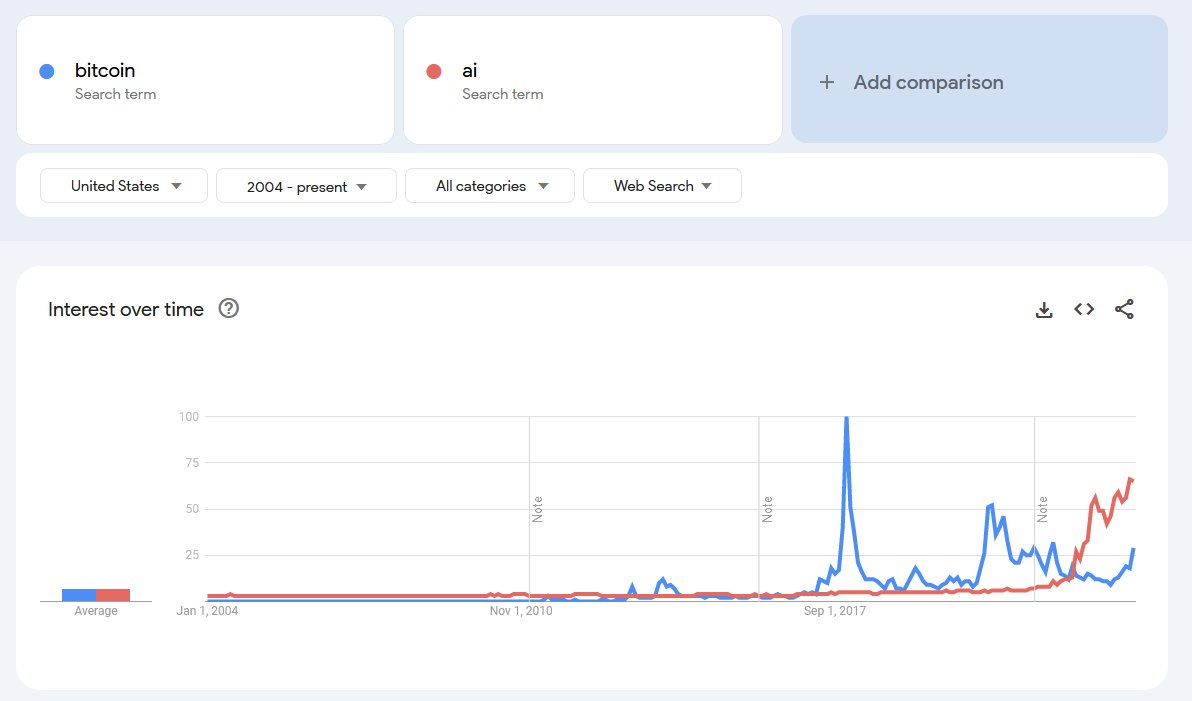

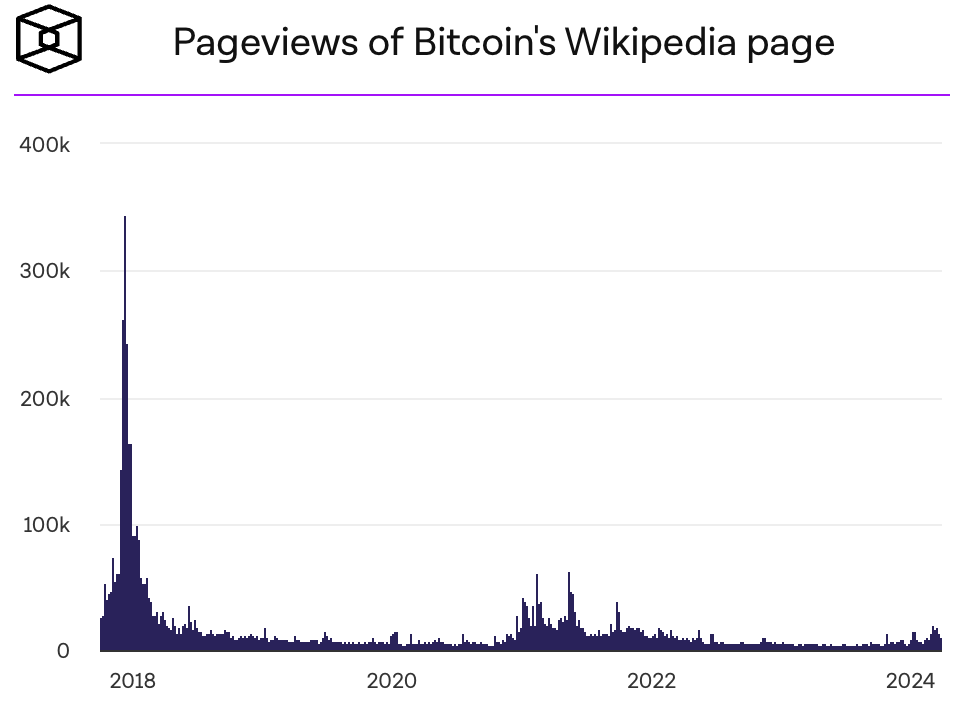

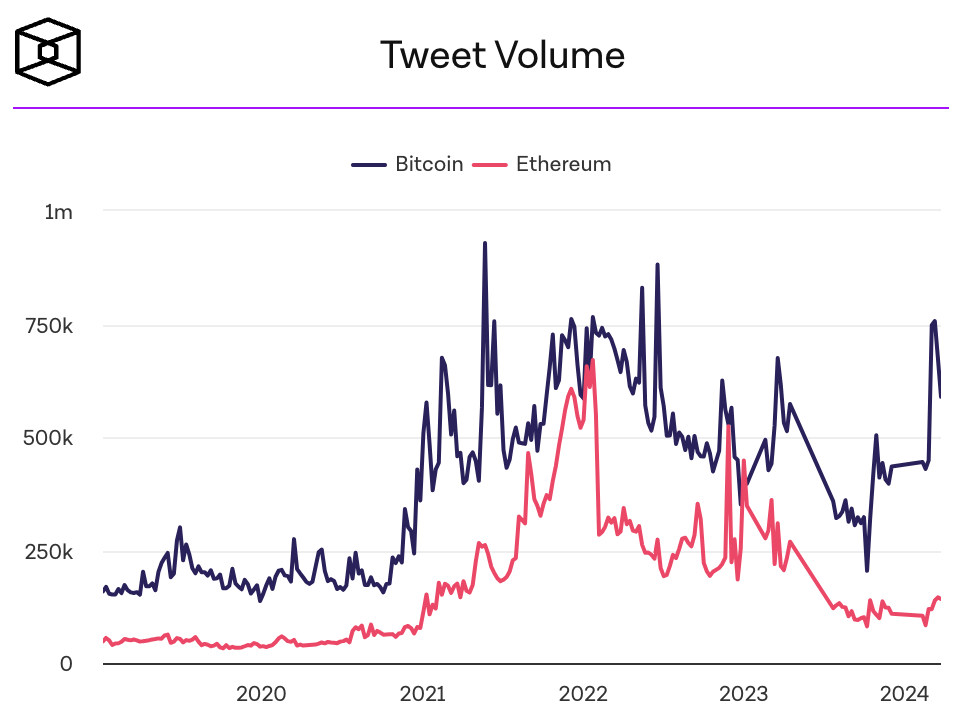

Cryptocurrency search popularity, social media popularity

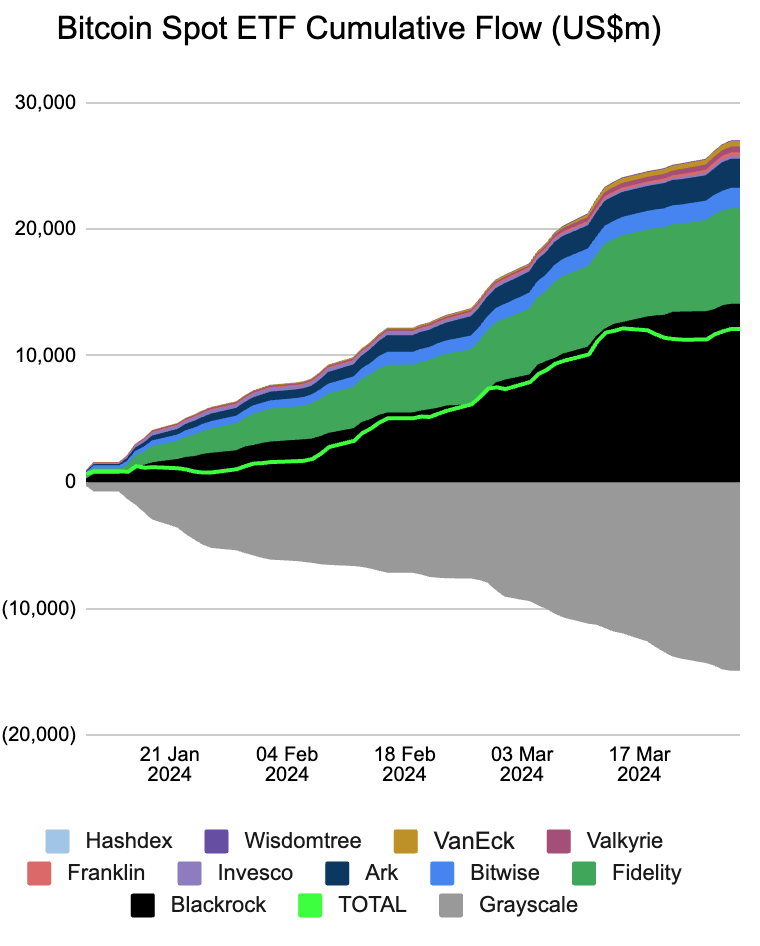

Bitcoin spot ETFs resumed net inflows, with net inflows of $845 million for the week, nearly offsetting net outflows of $890 million the week before. FBTC became the second spot Bitcoin ETF to exceed $10 billion after BlackRocks IBIT reached the $10 billion asset management mark for the first time on March 1. IBIT currently holds 250,000 BTC and FBTC holds 143,000.

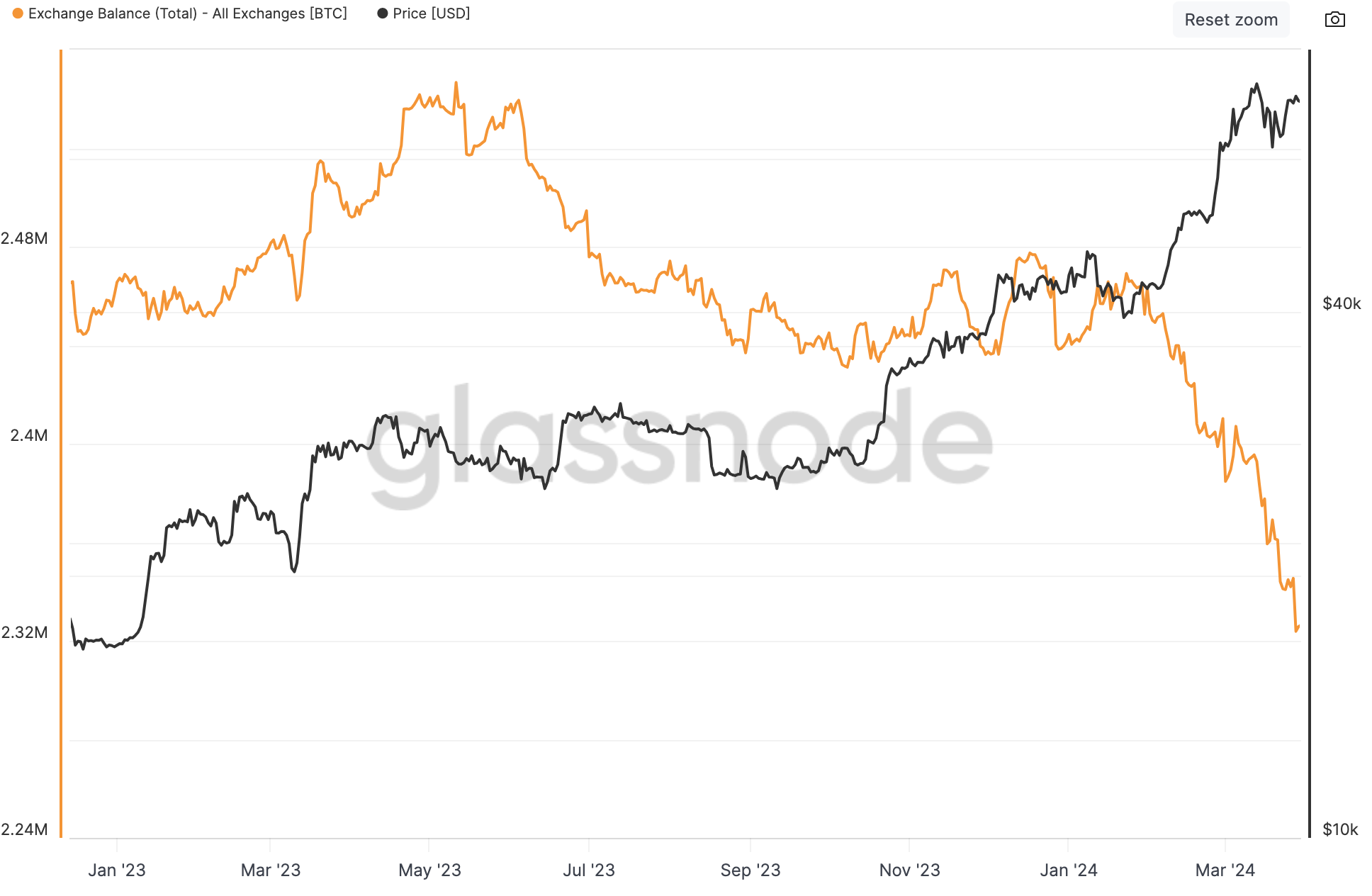

The number of Bitcoins deposited on exchanges has dropped significantly by 8% to 2.326 million since May 2023, indicating tight supply, in part due to the Bitcoin Spot ETF moving BTC to custodial cold wallets for long-term storage. According to Glassnode statistics, the total amount of BTC held by exchanges has shrunk to about 12% of the total BTC circulation, reaching the lowest level in five years. This kind of movement away from exchanges is traditionally seen as a bullish indicator, suggesting that people are more interested in holding than selling:

Unknowingly, the long rate of BTC perpetual contracts has almost returned to its historical high. The current annualized rate is about 80%, and the low on March 22 was only 11%:

Notable Cryptocurrency News

BlackRock’s new tokenized fund brings TradFi and crypto closer (Coindesk )

BlackRock Will Still Pursue Spot Ethereum ETF If Ethereum Is Designated As A Security (The Defiant )

Fidelity submitted an S-1 application to the U.S. SEC, requesting a pledged spot ETH EFT

WIF is now the third largest meme coin, and whales are clinging to it

Major cryptocurrency exchange KuCoin faces U.S. criminal charges(The Defiant )

SEC faces lawsuit seeking to exempt airdrops from securities classification (The Defiant)

Fetch.ai, SingularityNET and Ocean Protocol Tokens Surge Amid Proposed Merger Plans (The Block )

Grayscale launches pledge-based income fund for qualified investors

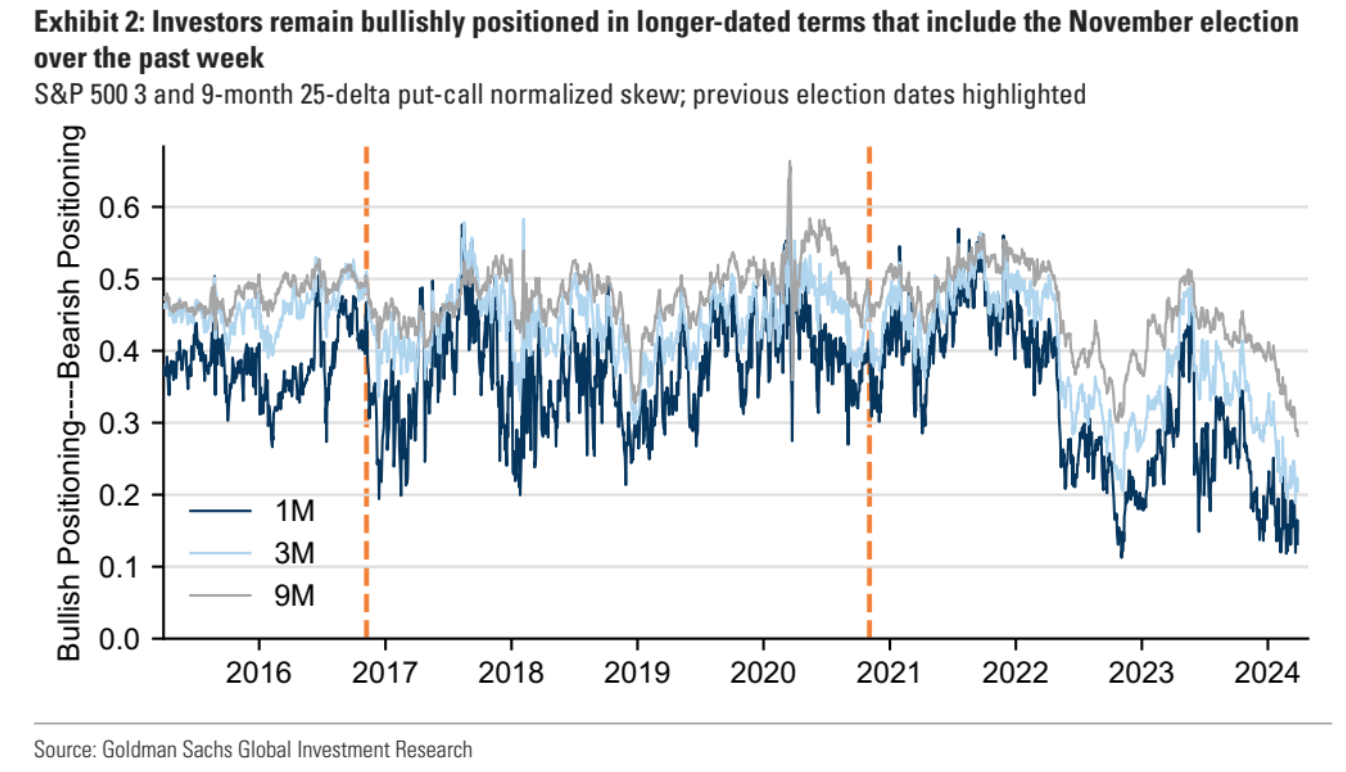

Options market optimistic about U.S. election

Assess investor expectations for the November 2024 U.S. presidential election by analyzing pricing in the SP 500 options market. Overall, the current options markets attention to the general election has increased compared with previous election years, but it is still at a normal level.

Expected election-day volatility implied by SPX index options is around plus or minus 3.3%. The SPX has moved more than 3.3% on Election Day only once in the past 60 years.

Investors seem to expect that the election results will be positive for the stock market, and the price level of SPX call options relative to put options has further increased recently:

liquidity

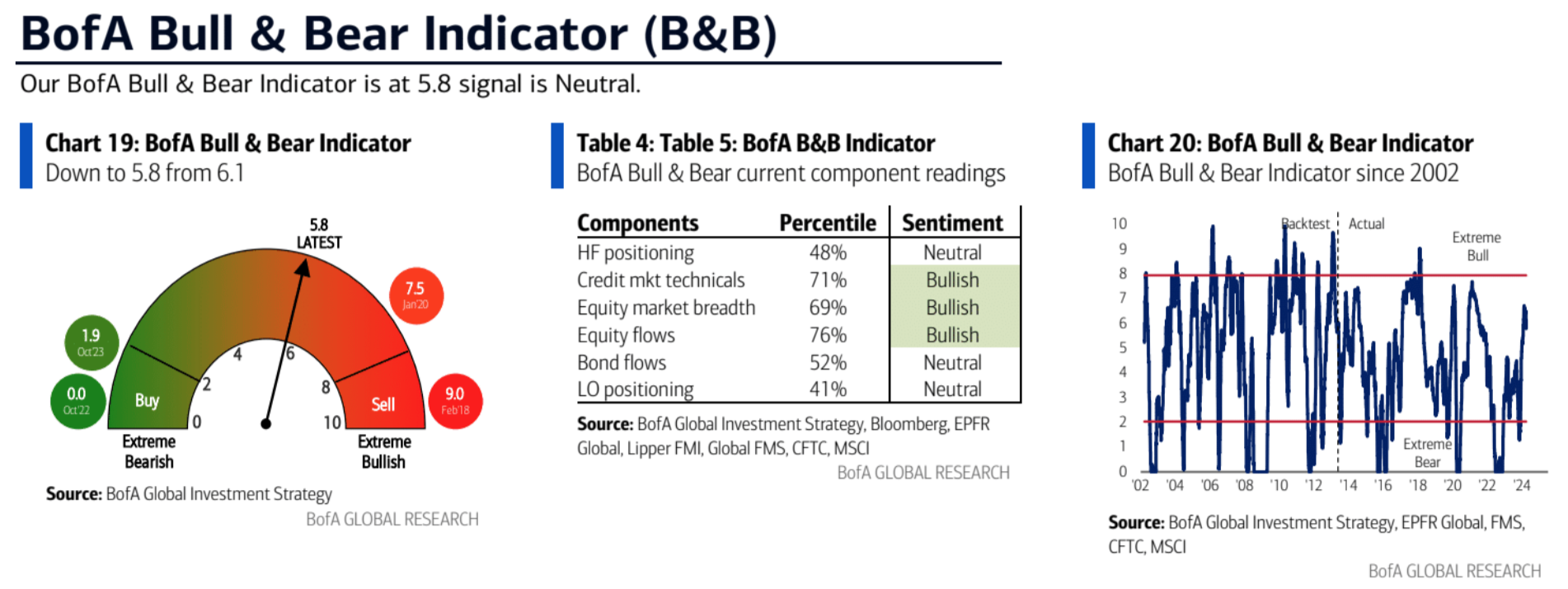

sentiment indicator