According to incomplete statistics from Odaily, a total of 31 domestic and overseas blockchain financing incidents were announced from March 25 to March 31, which was a decrease from last week’s data (40 cases). The total amount of financing disclosed was approximately US$278 million, an increase from last weeks figure (US$266 million).

Last week, the project that received the largest amount of investment was the NFT card chain game Parallel (USD 35 million); the modular AI chain data availability protocol 0G also followed closely (USD 35 million).

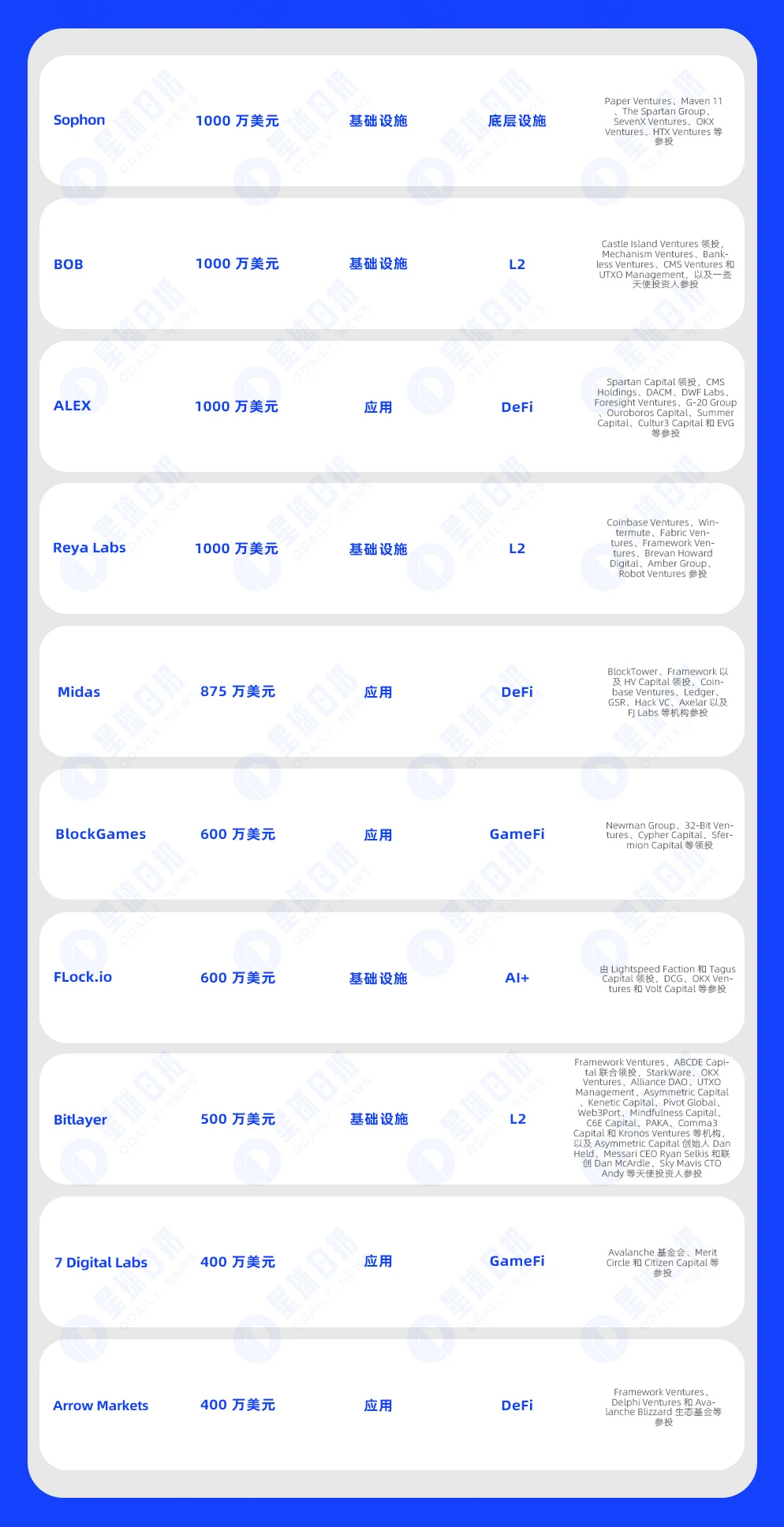

The following are specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fund raising and mergers and acquisitions; 3. *Represents companies in the traditional field where some of the business involves blockchain):

Chain game Parallel completes US$35 million in financing, Solana Ventures and others participated

On March 28, according to official news, NFT card chain game Parallel announced the completion of US$35 million in financing, with participation from Solana Ventures, Amber Group, Distributed Global, Big Brain Holdings, OSS Capital, VanEck, Focus Labs, etc.

On March 26, the modular AI chain data availability protocol 0G announced the completion of a $35 million Pre-Seed round of financing, led by Hack VC, with participation from Alliance, Animoca Brands, Delphi Digital, Stanford Builders Fund, Symbolic Capital and OKX Ventures. , specific valuation information has not been disclosed for this round of financing. The new funds will be used to hire engineers and establish 0G market functions, communities and ecosystems.

On March 26, crypto game development company Gunzilla Games announced the completion of US$30 million in financing, led by Avalanches Blizzard Fund and CoinFund. The new funds will support the development and release of its upcoming free-to-play battle royale video game Off the Grid. The game is planned to launch on PlayStation, Xbox, and PC.

On March 28, the intention execution network dappOS completed a US$15.3 million Series A financing, with a valuation reaching US$300 million. It was led by Polychain Capital, Nomad Capital, IDG Capital Vietnam, Flow Traders, IOBC Capital, NGC Ventures, Amber Group, UpHonest Capital, Taihill Venture, Waterdrip Capital, Bing Ventures, Spark Capital and Metalpha participated in the investment.

Peaq raises $15 million led by Generative Ventures and Borderless Capital

On March 27, DePIN Layer 1 protocol Peaq completed US$15 million in financing, led by Generative Ventures and Borderless Capital, Spartan Group, HV Capital, CMCC Global, Animoca Brands, Moonrock Capital, Fundamental Labs, TRGC, DWF Labs, Crit Ventures, Cogitent Ventures, NGC Ventures, Agnostic Fund, Altana Wealth and others participated in the investment.

On March 28, Web3 game company Elixir Games announced the completion of a $14 million seed round of financing, with participation from Shima Capital and Solana Foundation, as well as gaming giant Square Enix. The companys total financing so far has reached $20 million. Elixir Games will use the funds to develop its gaming ecosystem, which will be launched in the second quarter of 2024, and will also launch ELIX tokens to support the companys gaming products.

On March 27, decentralized cloud infrastructure provider Hive announced the completion of a $13 million Series A round of financing, led by SC Ventures and participated by OneRagtime and others. Hive built a centralized model of cloud computing that aims to aggregate unused hard drives and computing power from personal devices. This decentralized reorganization should help enterprises plan cloud-related expenses more effectively, promoting server autonomy rather than dependence. Fewer cloud providers and reduce energy usage.

MyPrize completed two rounds of financing totaling US$13 million, valuing it at US$140 million

On March 26, Web3 gambling game platform MyPrize completed two rounds of financing totaling US$13 million, with its valuation reaching US$140 million. Its first round of financing was US$5 million, completed in October last year; its second round of financing was US$8 million, completed this month.

These two rounds of financing were led by Dragonfly and Boxcars Ventures respectively, with participation from a16z Scout, Mechanism Capital, Arrington Capital, Breed VC, JST Capital, 2 Punks Capital and others. Pudgy Penguins CEO Luca Netz, Blockchain.com co-founder Peter Smith, Sei Labs co-founder Jeff Feng, Jack Entertainment’s Steve Rosenthal, Spencer Noon and other angel investors participated in the investment.

On March 27, according to official news, blockchain game Illuvium announced the completion of a $12 million Series A financing, led by King River Capital, Animoca Brands, Arrington Capital, and Spartan Capital, and GoldenChain, Arca, Selini Capital, Laser Digital, Polygon Ventures, 32-Bit Ventures, Yield Guild Games, N 8. Capital, Seven Capital and others participated in the investment.

The new financing will be used to develop new game projects within the Illuvium ecosystem.

Web3 AI platform MyShell completed $11 million in Pre-A financing, led by Dragonfly

On March 27, MyShell, a Web3 artificial intelligence platform focused on creators, announced the completion of $11 million in Pre-A financing, led by Dragonfly, Delphi Ventures, Bankless Ventures, Maven 11 Capital, Nascent, Foresight Ventures, GSR, Animoca Ventures, Nomad Capital and OKX Ventures, as well as many well-known angel investors such as Balaji Srinivasan, Illia Polosukhin, Casey K. Caruso, Santiago Santos, etc. participated in the investment.

On March 30, according to official news, the modular blockchain Sophon completed US$10 million in financing, with participation from Paper Ventures, Maven 11, The Spartan Group, SevenX Ventures, OKX Ventures, HTX Ventures, etc.

On March 28, the Bitcoin second-layer network BOB (Build on Bitcoin) announced the completion of a US$10 million seed round of financing, led by Castle Island Ventures, with participation from Mechanism Ventures, Bankless Ventures, CMS Ventures and UTXO Management, as well as some angel investors. BOB is a hybrid layer 2 network that sits on top of the Bitcoin blockchain but is compatible with Ethereum.

Bitcoin DeFi platform ALEX completes $10 million in new round of financing

On March 26, Bitcoin DeFi platform ALEX announced the completion of a new round of US$10 million in financing, led by Spartan Capital, CMS Holdings, DACM, DWF Labs, Foresight Ventures, G-20 Group, Ouroboros Capital, Summer Capital, Cultur 3 Capital and EVG participated in the investment. As of now, the total locked value of ALEX is nearly US$200 million, and the total transaction volume of 52,892 wallets exceeds US$1.3 billion.

On March 26, modular L2 Reya Network development company Reya Labs announced the completion of US$10 million in financing, with participation from Coinbase Ventures, Wintermute, Fabric Ventures, Framework Ventures, Brevan Howard Digital, Amber Group, and Robot Ventures. Reya Network focuses on creating liquidity, capital efficiency and performance for DeFi traders and liquidity providers, and the new funds will be used to fuel the launch of its Liquidity Generation Activity (LGE) in April.

RWA project Midas completes US$8.75 million in seed round financing

On March 29, according to official news, RWA project Midas completed a seed round of financing of US$8.75 million, led by BlockTower, Framework and HV Capital, with participation from institutions such as Coinbase Ventures, Ledger, GSR, Hack VC, Axelar and FJ Labs.

It is reported that Midas is an asset tokenization project. mTBILL, the first product launched by Midas, will track short-term U.S. Treasury bonds. Each mTBILL token represents one share of the BlackRock German Bond ETF.

On March 26, BlockGames revealed that it had completed a new round of financing of US$6 million, led by Newman Group, 32-Bit Ventures, Cypher Capital, Sfermion Capital and others.

On March 28, the Web3 AI project FLock.io completed a $6 million seed round of financing. This round of financing was led by Lightspeed Faction and Tagus Capital, with participation from DCG, OKX Ventures and Volt Capital. So far, the company’s total financing has reached $800 It is reported that FLock will use the funds to grow its team and develop an artificial intelligence training platform powered by federated learning.

On March 27, Bitcoin Layer 2 infrastructure Bitlayer announced the completion of a US$5 million seed round of financing on the Institutions such as Pivot Global, Web3Port, Mindfulness Capital, C 6 E Capital, PAKA, Comma 3 Capital and Kronos Ventures, as well as angel investors such as Asymmetric Capital founder Dan Held, Messari CEO Ryan Selkis and Lianchuang Dan McArdle, Sky Mavis CTO Andy, etc. cast.

On March 28, BloodLoop game developer and Swiss game studio 7 Digital Labs announced the completion of a US$4 million seed round of financing, with participation from the Avalanche Foundation, Merit Circle and Citizen Capital. The new financing will be used for game development and publishing.

BloodLoop is a shooting game based on the Avalanche subnet and the first game from 7 Digital Labs. Players can collect NFTs and earn BLS rewards in every game.

On March 31, Arrow Markets, an AMM option protocol based on Avalanche, completed a $4 million Series A financing, with participation from Framework Ventures, Delphi Ventures and Avalanche Blizzard Ecological Fund.

It is reported that the core of Arrow Markets is to use the Request-for-Execution (RFE) mechanism to provide quotes for option contracts in the Avalanche C chain.

On March 26, according to official news, Nubit, a native Bitcoin DA layer project, completed a $3 million Pre-Seed round of financing, with participation from dao 5, OKX Ventures, Primitive Ventures, ArkStream Capital and others.

OrdinalsBot completed over US$3 million in seed round financing, led by DACM

On March 26, OrdinalsBot, an infrastructure platform focusing on Bitcoin Ordinals, announced the completion of over $3 million in seed round financing, led by DACM, Eden Block, natural Capital, WWVentures, Lightning Ventures, Oak Grove Ventures, UTXO Management (Bitcoin Magazine Fund managers), Kenetic Capital, CMS Holdings, Kestre l0 x 1, Sora Ventures, London Real Ventures, Crypto Zombie and MDX Crypto participated. After this round of financing, OrdinalsBot’s cumulative financing amount exceeds US$4.5 million.

On March 28, DeFi protocol Unstable Protocol announced the completion of a US$2.5 million seed round of financing from Lattice, Laser Digital (a digital asset subsidiary of Nomura Group), Blockchain Founders Fund, Assouline Ventures, Agnostic Fund, Artichoke Capital, Black Edge Capital, NewTribe Capital and NxGen, as well as multiple angel investors participated in the investment. It is reported that Unstable Protocol mainly provides ETH re-pledge services, allowing users to use liquidity to pledge and re-pledge tokens to achieve innovative income strategies.

On March 27, Bitcoin Lightning Network company Neutronpay announced the completion of $1.5 million in bridge financing, led by Axiom Capital. The financing is intended to help Neutronpay leverage Bitcoin to provide instant and cost-effective payment solutions in Southeast Asia’s digital economy.

On March 31, the artificial intelligence security platform Rug.AI announced the completion of a $1.1 million Pre-Seed round of financing, led by No Limit Holdings, Mask Network, Builder Capital, Formless Capital, Prismatic Capital, Roshun Patel, Pentoshi, Avi Felman, Institutional and angel investors such as MacnBTC and Andrej Radonjic participated in the investment.

On March 25, BTC Layer 2 project BEVM announced the completion of seed round financing and part of Series A financing on the Nearly 20 institutions including MH Ventues, Mapleblock, Electrum Capital, Zephyrus Capital, Lotus Capital, 7 UPDAO, and TimeTells participated in the investment, with a post-money valuation of US$200 million. The new financing will be used to build a more decentralized Bitcoin ecosystem based on Taproot Consensus.

No-code ecosystem GraphLinq completes strategic round of financing, with participation from DWF Labs

On March 25, the code-free ecosystem GraphLinq announced on the X platform that it had completed a strategic round of financing, with DWF Labs participating in the investment. The specific amount has not yet been disclosed. DWF Labs will serve as GraphLinq’s primary liquidity provider on various CEX and DEX and provide support for OTC trading. The new funds will be used to enhance the liquidity of the GLQ token, optimize its seamless supply in the global market, and Bring tangible benefits to market participants.

On March 26, according to official news, BEVM ecological CDP stablecoin protocol Satoshi Protocol completed a seed round of financing, jointly led by Web3Port Foundation and Waterdrip Capital, with GPs from BEVM Foundation, Cogient Ventures, Satoshi Lab, MH Venture and co-founders of BSCN , MoveBit, Supremacy, etc. participated in the investment.

On March 26, Blast ecological derivatives trading platform DTX announced the completion of angel round financing. Blast angel investors hype.eth, dingaling, FreeLunchCapital, Mr. Block, HongKongDoll and others participated in the investment. The specific financing amount has not yet been disclosed.

On March 28, according to official news, multi-chain infrastructure developer Biconomy announced the completion of strategic financing. Jump Capital, Borderless Capital, Consensys Ventures, Taisu Ventures, Manifold Trading, Side Door Ventures and Blockchain Founders Fund participated in the investment. The specific amount is temporarily Not disclosed.

Web3 base layer Mystiko.Network: seed round valuation valued at $400 million

On March 30, Mystiko.Network, the basic layer of Web3, issued an announcement on the X platform. The latest seed round financing was valued at US$400 million.