Original - Odaily

Author - Nan Zhi

Interpretation Project

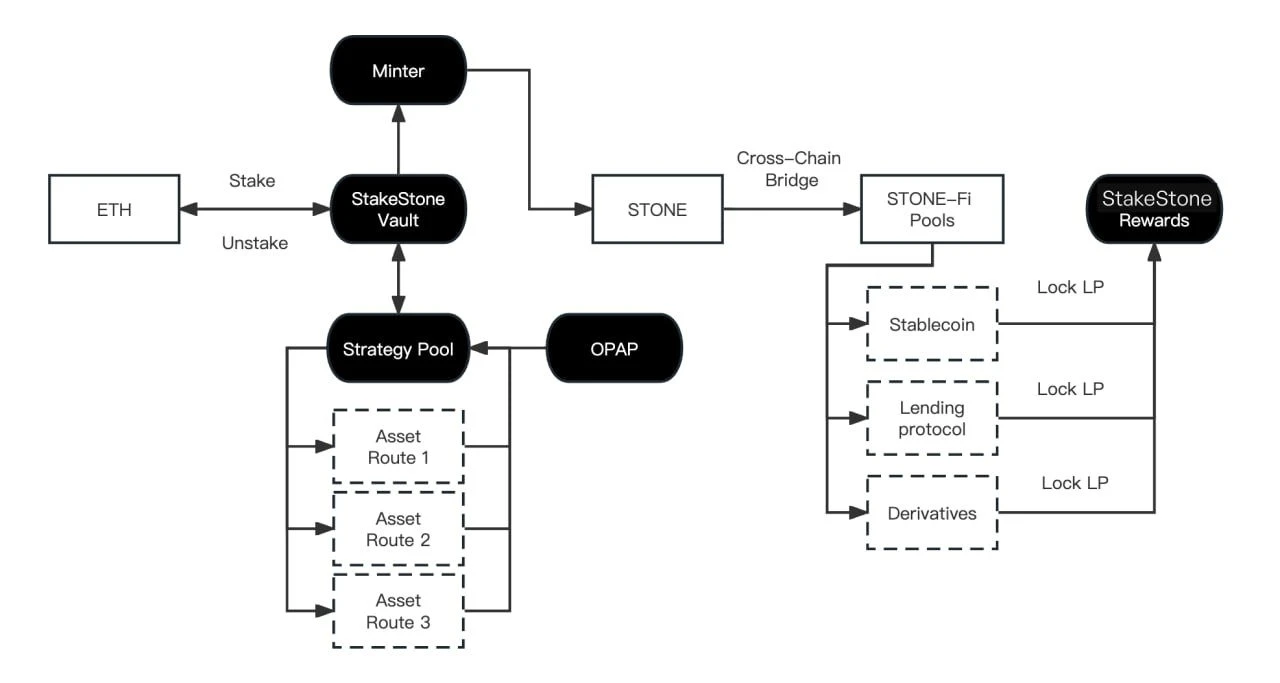

StakeStone is a full-chain LST (Liquid Stake Token, Liquid Staking Token) liquidity protocol that aims to bring native staking income and liquidity to Layer 2 in a decentralized manner. StakeStone is highly scalable, supports various staking pools, and is compatible with upcoming Restaking. At the same time, it established a multi-chain liquidity market based on StakeStones native LST STONE, providing more use cases and revenue opportunities for STONE users.

Market pain points

As Ethereum enters the PoS era, the pledge ratio and volume continue to increase. ETH and its LST have become the first choice for stable asset allocation for many users, and are also one of the bottom assets of many protocols. On the other hand, various Layer 2 and emerging networks continue to emerge, and liquidity and assets are separated between the main network and other networks. For users, it is impossible to achieve stable returns by staking ETH and seeking Alpha returns on Layer 2 at the same time, and the efficiency of asset utilization is limited. The emergence of Restaking has created ETH liquidity demand for some small networks and also provided users with opportunities for advanced income.

StakeStone Analysis

StakeStone is building a decentralized all-in-one staking protocol, establishing an LST liquidity cross-chain market, and connecting Ethereum and other blockchains to solve the above problems.

StakeStone has launched the OPAP (Optimized Portfolio and Allocation Advice) mechanism, pioneering a decentralized solution for liquid staking. Specifically, users will receive STONE tokens when they deposit ETH into the protocol. As the protocol increases, the value of STONE (the exchange rate against ETH) will continue to rise, and STONE can also be used as the equivalent asset of ETH in various DeFi, GameFi or Used in NFTfi. The assets deposited by users will be strategically allocated by the protocol, including allocation in the ETH pledge pool, Restaking protocol or other Yield protocols. OPAP can optimize the basic assets of STONE, ensuring that STONE holders can obtain optimized staking benefits without any operation, in a diverse and efficient manner.

For inter-network liquidity issues, STONE is designed based on LayerZero to support seamless transfer and alignment of assets and prices between multiple blockchains. Layer 2 ecosystem developers can easily integrate STONE, which is suitable for large-scale adoption. Currently supported public chains include Ethereum, Manta, Base, BNB Chain, Mantle, Linea, etc.

StakeStone core contributor Chrisexpress, Modularization is the future and an inevitable trend. StakeStone noticed that each chain has its own strengths and weaknesses, some focus on the community, and some build a solid technical foundation; some focus on games, some focus on social networking, and some focus on DeFi. Chris further said: “From our perspective, they have the same needs and pain points for liquidity in terms of cost in their application layer, so they need liquidity to build their ecosystem, and that’s where StakeStone comes in .”

Financing situation

March 25, Binance LabsAnnounced investment in StakeStone, the specific amount was not disclosed. March 26, OKX VenturesAnnouncing StakeStone, and establish strategic partnerships with them. Other financing conditions have not been disclosed yet.

protocol data

Since December ’23, StakeStone TVL has experienced a rapid rise, peaking at $1.38 billion and currently sitting at $900 million.

On March 30, StakeStone launched an event called omnichain carnival. During the 4-day early access period, recharging users will receive 3% of the total number of protocol tokens. Over 14,000 were deposited within 5 minutes of the opening. STONE, with a single-day deposit amount of approximately US$100 million.