Original - Odaily

Author - Nan Zhi

recently,BCH took advantage of the approaching halving date to start a strong rise, and Bitcoin is also expected to halve on April 20.

Are there any traces of the market trends before and after the halving event? Odaily will review and analyze the halving data over the years in this article.

Bitcoin Halving

Currently, Bitcoin has undergone three halvings, namely on November 28, 2012, July 9, 2016, and May 11, 20. Since the market for the first halving was not mature enough, it was not included in the statistics.

In terms of currencies, most of the current mainstream currencies have not yet been born during the second and third halvings. Therefore, some leading currencies that have survived to this day are selected, including BTC, ETH, LTC, XRP, and BCH. The prices are sinceCoinGeckoHistorical Data.

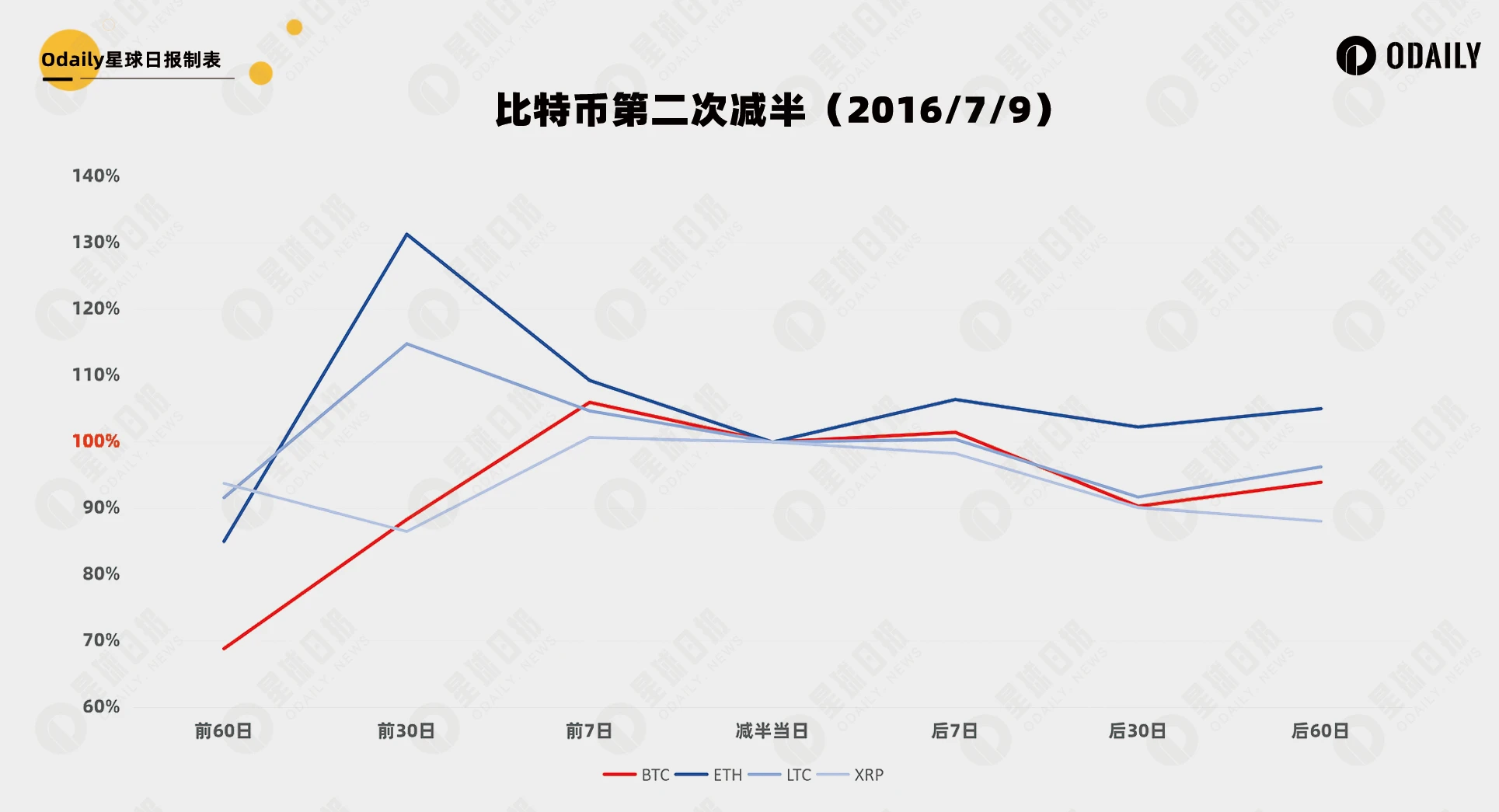

Taking the price on the day of the halving as the base point, the relative prices of the above tokens in the 60 days, 30 days and 7 days before and after the halving are calculated.Bitcoin’s second halvingThe trend is shown in the figure below. It can be seen that before the halving cycle,As time approaches, all currencies have risen to a certain extent.. After the halving, most prices started to fall.

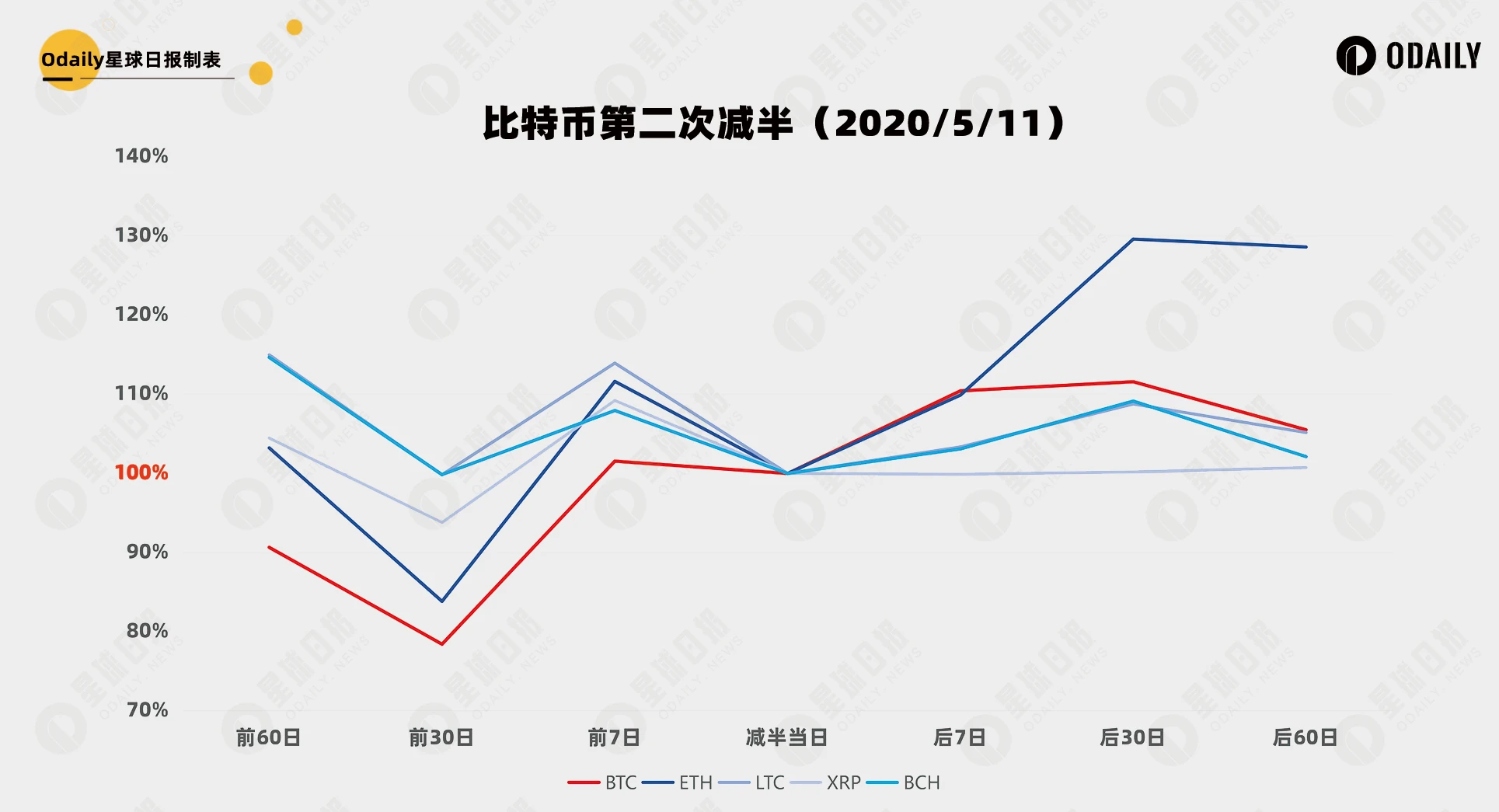

The trend of Bitcoin’s third halving is shown in the figure below. It is worth noting that the 60 days before the halving was actually the day of the 312 plunge. In fact, the price of this node can be considered to be much lower than shown in the figure. Considering the standard consistency issue, the CoinGecko data caliber will not be modified.

Therefore, each currency still maintained the upward trend before the halving cycle, but because 312 has significantly released risks and the macro environment has changed, the upward trend continued after the halving.

LTC halving

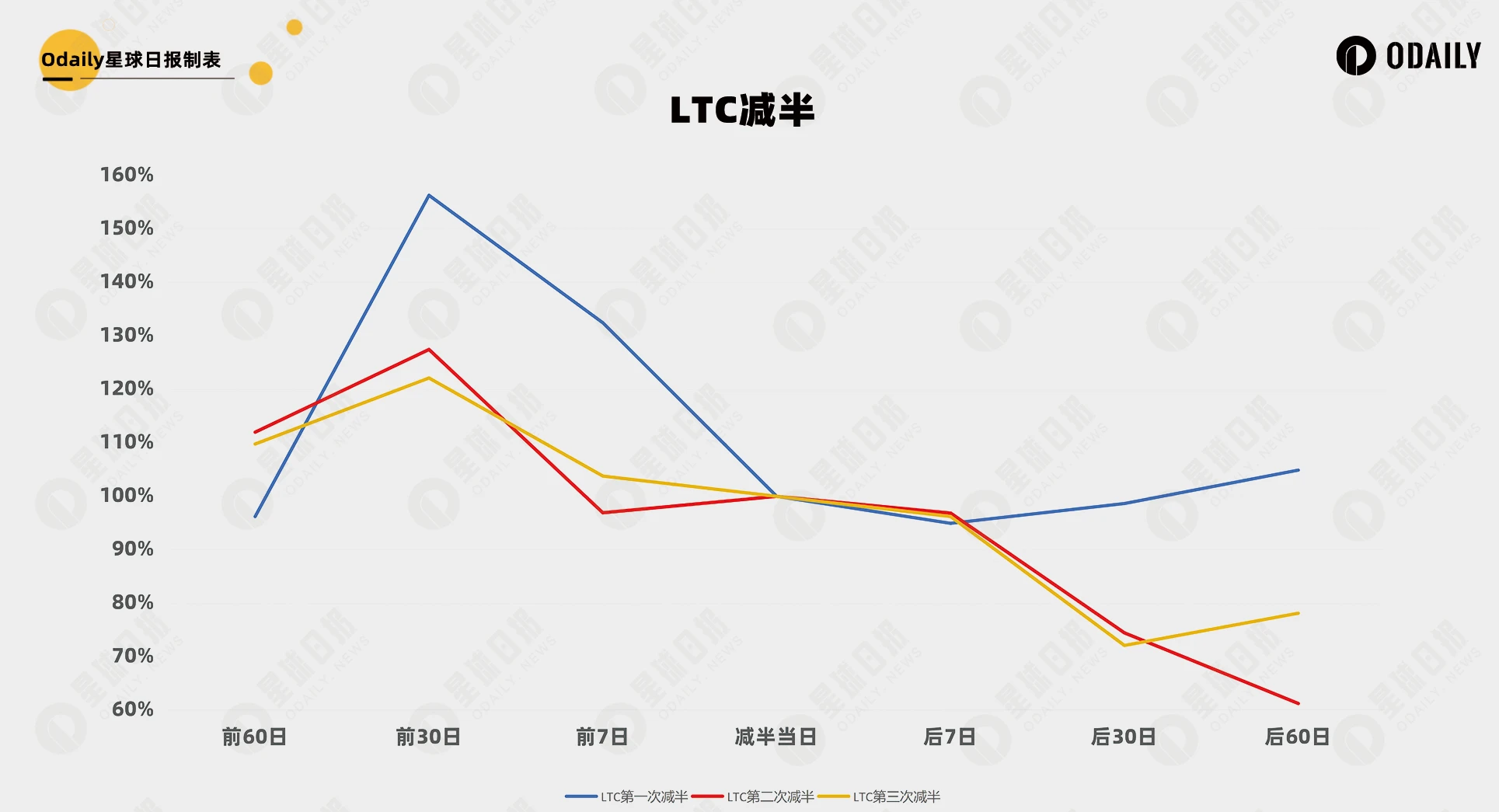

This section includes three rounds of LTC halvings as reference, namely August 25, 2015, August 5, 2019, and August 23, 23. The results are shown in the figure below.

It can be seen that the expected hype of LTCs halving came earlier, and then continued to fall from around the 30th.

BCH Halved

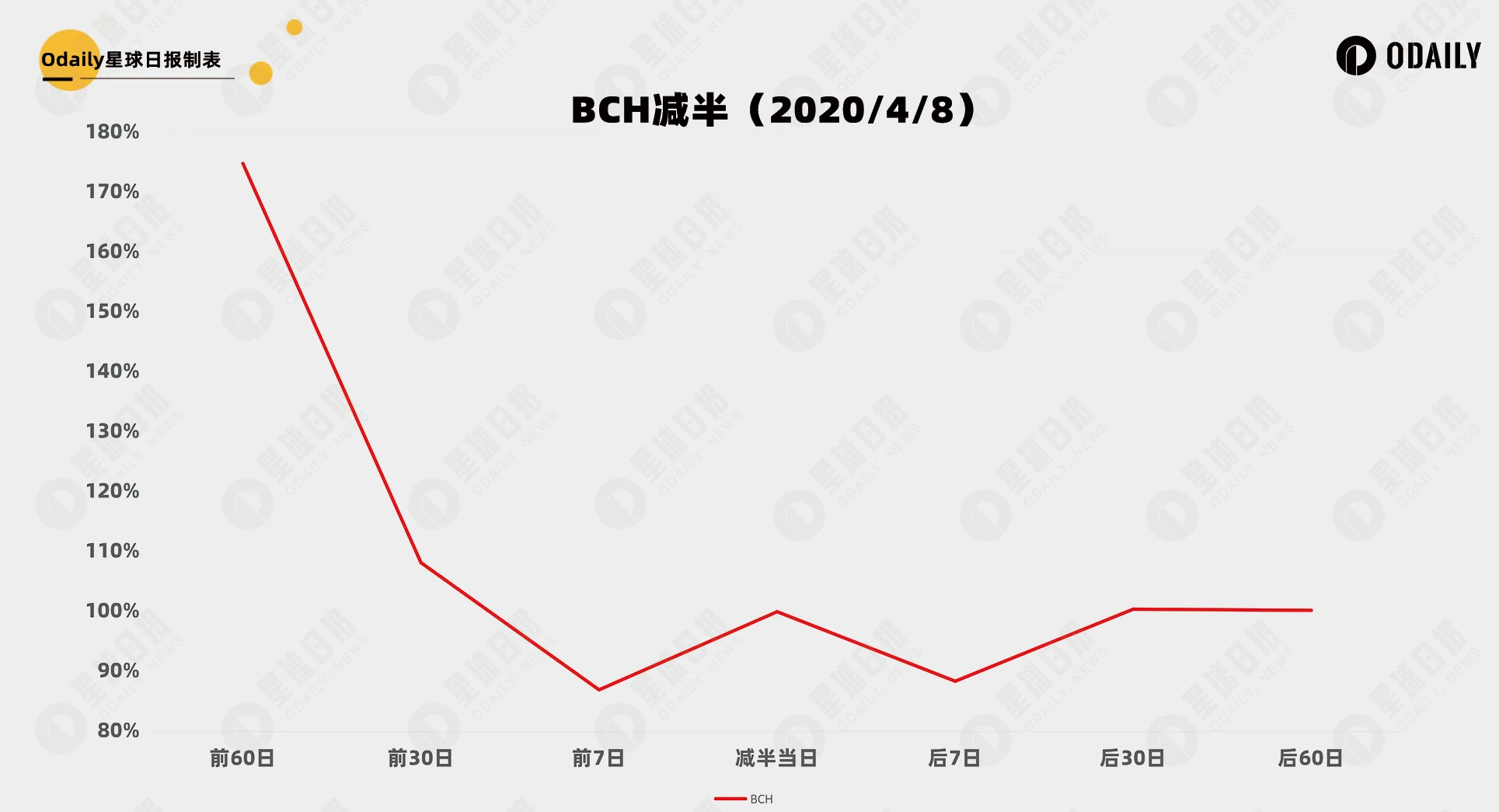

Looking back at the BCH halving market in 2020, we can see that the BCH hype came earlier and more rapidly. In fact, the rise before the halving started in early 2020 (about 100 days before the halving), rising from a minimum of about 200 USDT to 500 USDT. During the same period, Bitcoin rose by about 25%.

in conclusion

Based on the above data, it can be seen that the market hype of halving often starts 2-3 months or even earlier than the halving itself. After the event actually comes into effect, it will not become the driving force for short-term rise, but more of a sell the news.