The number of validators has soared, and the issue of staking centralization has once again attracted attention

Recently, the number of active validators on the Ethereum network exceeded 1 million, and since validators are the core of Ethereum’s PoS mechanism, their development is crucial. The huge increase in the number of Ethereum validators, especially after the Shapella upgrade, has caused excitement and attention in the market. At the same time, there are also concerns about the technical and centralization challenges that may arise from a rapidly expanding number of validators.

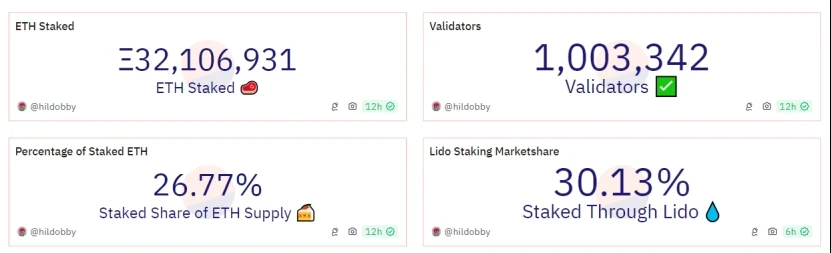

On March 28, Ethereum reached the important milestone of 1 million validators, according to Dune data. Discussion points in the community revolve around the growth of the validator set, especially after the Shapella upgrade made Ethereum staking flexible to withdraw, which is key to Ethereums development towards a more scalable and energy-efficient network. However, as the number of validators increases, each validator must independently download the latest data and verify state changes within a constrained time frame. This means they require more computing power to implement larger chunks of data.

According to statistics, there are currently at least 850,000 validators in which users entrust ETH to centralized platforms for pledge, because most ETH holders do not have more than 32 ETH, or cannot handle complex pledge operations on their own. This raises another concern – the potential risk of increasing centralization. This could happen if the growing bandwidth of the network allows validators with significant computing resources to continue to participate in validation efficiently. This would put institutional-owned data centers over individual self-hosted nodes. Furthermore, it would push the Ethereum network towards centralization, which is contradictory to its basic ethos.

It is important to note that validators do not represent a single entity. To run the validator, the entity must have 32 ETH. However, multiple validators can be run on a single server. Ethereum’s transition to a PoS verification mechanism is critical to improve efficiency, but how to balance the growth of the number of validators with the network’s fundamental principles of decentralization and availability remains a crucial challenge.

“Anti-correlated incentives” proposal

While Vitalik Buterin acknowledges the advantages that large validators provide to the Ethereum network, he is still trying to balance large validators with the requirements of a decentralized and resilient network. On March 27, he proposed an innovative plan of anti-correlated incentives, aiming to deal with the problem of centralization among validators, increase the penalty for failure of large validators, and enhance the decentralization and fairness of the Ethereum staking mechanism. sex.

Correlation failures in the Ethereum network could be due to the control of multiple validators from a single location, thereby undermining the decentralized nature of the system. To solve this problem, the “Anti-Correlation Incentive” scheme will penalize validators for correlated failures, thereby incentivizing them to expand the scope of their validator activities.

Vitalik Buterin believes that if multiple validators controlled by the same entity fail together, they will be subject to higher penalties than individual validators failing because any mistakes made by a large validator will be replicated across all identities they control. For example, validators in the same cluster (such as a Staking Pool) are more likely to experience related failures, possibly due to shared infrastructure.

The proposal proposes penalizing validators that deviate from the average failure rate accordingly. If many validators fail in a given slot, the penalty for each failure will be higher.

Simulations show that this approach can reduce the advantage of large Ethereum staking platforms, as large entities are more likely to cause spikes in failure rates due to related failures. Potential benefits of the proposal include incentivizing decentralization by establishing separate infrastructure for each validator and making solo staking more economically competitive relative to staking pools.

In addition to this, Vitalik Buterin also proposed other options such as different penalty schemes to minimize the advantage of large validators and examined the impact on geographical and customer decentralization.

Although Ethereum has penalty mechanisms such as slashing to deal with serious violations, these mechanisms are generally used to deal with extremely malicious or serious behavior. The proposal integrates penalties into regular network operations, with an emphasis on promoting true diversity among validators. The purpose of this strategy is to ensure that efforts to increase decentralization promote substantive transformation rather than mere superficial compliance.

Rainbow staking

At the 2024 Eth Taipei conference, Vitalik Buterin also analyzed the idea of “Rainbow staking”, a method that encourages service provider diversity and can be used as a means to solve the centralization problem faced by Ethereum. He highlighted the focus on staking platforms with significant Ethereum holdings, specifically Lido Finance (which has two-thirds of liquidity staking Ethereum, accounting for 7% of total ETH circulating supply).

Currently, there are not enough solo stakers (individual validators) in the Ethereum network, mainly due to technical challenges (such as running their own nodes) and financial constraints (owning less than 32 ETH). As a result, many people looking to stake their ETH can only earn returns through liquidity staking solutions.

Rainbow staking can be divided into heavy staking and light staking, in this particular case heavy staking is slashable and has signatures in every slot. In contrast, light staking is non-slashable and is signed via a lottery system. Now trying to clearly separate the two, and potentially require both to sign on a block in order for the block to be final, is to try and add the security of both approaches together.

Todd, a partner at Ethereum non-custodial staking service provider Ebunker, said that in the past, small stakers basically had a missing role in the verification work of the ETH network. The core purpose of Rainbow Staking is to allow small ETH pledgers to participate in network verification in a very lightweight way. Then, with the increase in the number of participants, it can partially offset the centralization effect of leading institutions and protocols holding a large amount of Staking ETH.

Rainbow staking’s framework responds to the emergence of dominant liquidity tokens that could replace ETH as the primary currency on the Ethereum network. It also aims to provide competitive participation by enhancing the economic value of solo stakers.

Vitalik Buterin noted that more research and development is still needed before rainbow staking becomes a viable design for Ethereum in the long term. The biggest problem, he believes, isnt even technical but philosophical.