Original author: Fu Shaoqing, SatoshiLab, All Things Island BTC Studio

Preface

As the price of Bitcoin continues to rise, our technical developers in the Bitcoin ecosystem feel constant pressure. Every time a new function based on the Bitcoin ecosystem is designed, every time an operation on the Bitcoin chain is performed, an increasing economic price (handling fee) will be paid. However, other roles in the Bitcoin ecosystem, such as investors and miners, generally do not have such troubles and expect the price of Bitcoin to continue to rise.

Is there a way to prevent the price of Bitcoin from rising wildly? Let’s analyze the factors that affect Bitcoin price and see if we can find the answer.

1. What can curb Bitcoin’s price rise?

It is very difficult to predict how high the price of Bitcoin will rise. There are many factors that affect price changes. Let’s first look at the factors that influence Bitcoin’s price from two perspectives, one is an economic perspective and the other is a technical perspective.

1.1. Economic perspective

In economics, there is a conclusion: the price of a commodity will not rise or fall indefinitely. There are several relevant economics knowledge: price elasticity, market supply and demand, marginal utility and price adjustment mechanism and other theories.

Price elasticity theory:Price elasticity is a measure of how sensitive demand for a good or service is to changes in price. When price changes, the elasticity of demand determines the relationship between price and quantity. If the elasticity of demand approaches infinity (perfect elasticity), small changes in price will result in large changes in quantity, preventing unlimited price increases or decreases.

The role of substitutes in price elasticity is to influence how consumers respond to changes in commodity prices. When price elasticity is high, consumers are more likely to look for substitutes to replace the original product and are therefore more sensitive to price changes. If the existence and availability of substitutes is high, consumers may be more inclined to switch to substitutes, thereby reducing demand for the original good. Therefore, the existence of substitutes can reduce the price elasticity of the original commodity. On the other hand, if the availability of substitutes is low, consumers may have more difficulty finding substitutes and thus be less responsive to price changes and have lower price elasticity. therefore,The availability and degree of substitution of substitutes play an important role in price elasticity.(This article mainly thinks from the perspective of alternatives)

Market supply and demand:Market supply and demand refers to the relationship between supply and demand for goods or services. When market supply and demand are imbalanced, prices will be adjusted to achieve a balance between supply and demand. When prices rise, supply will increase and demand will decrease, thus limiting further price increases. vice versa. (This factor has a small impact. The big aspect is that the total number of Bitcoins is fixed, and the number of new Bitcoins generated every year is limited. On the other hand, even if people who hold Bitcoins are willing to sell, the total number of Bitcoins will not be as large as the number of people in the world. In terms of supply, it is also a relatively small amount, and it is difficult for the supply side to make major changes.)

Marginal utility theory:Marginal utility theory holds that consumers have diminishing marginal utility for goods or services. In other words, as consumption increases, the satisfaction brought by each unit of consumption gradually decreases. This means that the price consumers are willing to pay per unit of a good or service will also decrease, thereby limiting unlimited price increases. (Marginal utility has an obvious impact on people who use Bitcoin, and is more attractive to investors.)

Price adjustment mechanism:The price adjustment mechanism in the market can ensure that prices fluctuate within a certain range. A price increase creates an incentive for suppliers to provide more goods or services while reducing consumer demand. Falling prices will reduce supplier supply and increase consumer demand. Through the feedback mechanism of supply and demand, prices in the market will adjust accordingly to avoid unlimited increases or decreases. (When there is no way to increase supply, consumption can only be reduced. If consumption cannot be reduced, substitutes are looked for.)

These theories help us use economic knowledge to understand the formation and changes of commodity prices, and provide some guiding principles for market participants. However, the price in the market is affected by many factors, especially for Bitcoin, a new thing, which is not a simple ordinary commodity. One cannot simply draw conclusions based on a single factor or several factors.

But economic knowledge gives us an important thought. As long as substitutes can be found, the rise in the price of the commodity (Bitcoin) can be suppressed.

1.2. Technical perspective

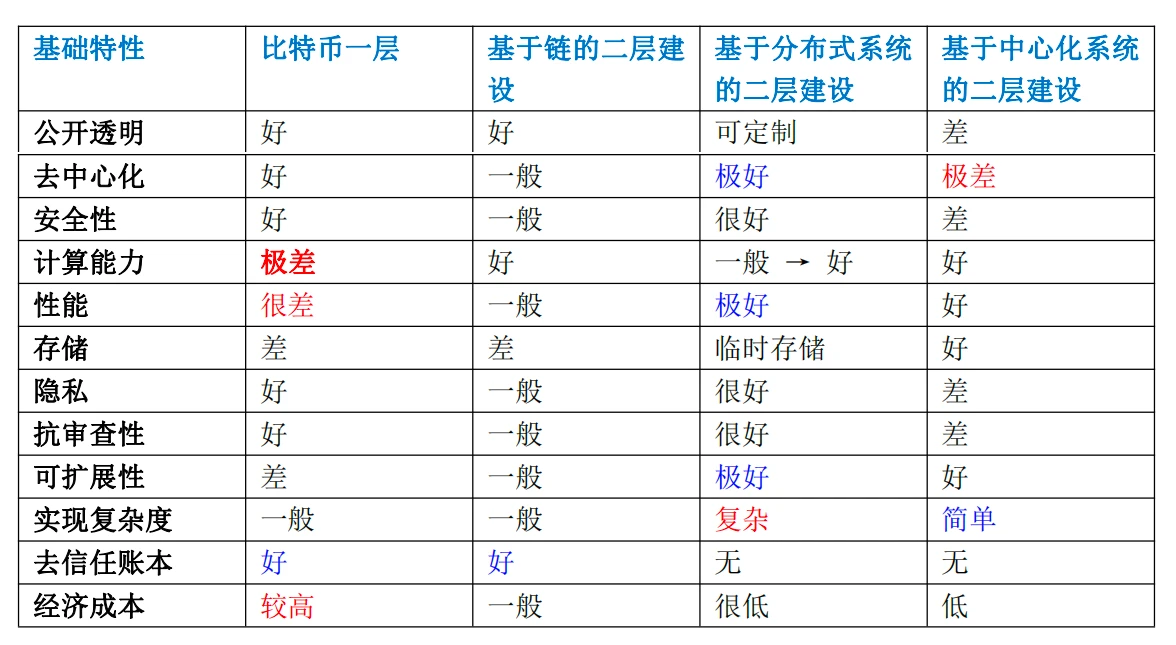

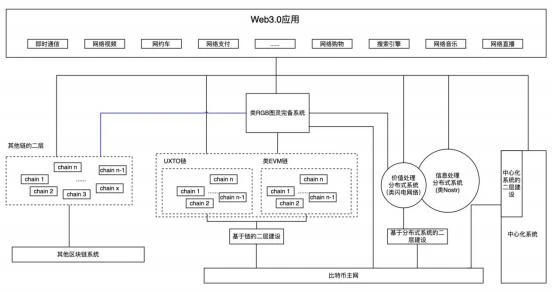

Can a replacement be found? Let’s first look at the characteristics of Bitcoin. The picture below is my summary of the systems related to Bitcoin and the second-layer construction in the article Observing the second layer of Bitcoin from the perspective of a state machine, you can see the architecture and construction path of future Web3.0 applications.

First of all, from the three perspectives of blockchain system, distributed system, and centralized system, the blockchain systems ability to serve as a trustless ledger is something that the other two systems do not have. If there are alternatives to Bitcoin, they should also emerge from the blockchain system.

Secondly, when we compare the Bitcoin system with other blockchain systems, we will find that the Bitcoin systemDecentralization, security, privacy, censorship resistanceThey are all very strong, and there is currently no blockchain that can compete with them on these points. If a blockchain system can be found that can replace Bitcoin on these basic characteristics, it can technically replace the Bitcoin system.

It should be noted that the Bitcoin system has accumulated a large amount of funds, which is often referred to as OldMoney. Even if it can technically replace Bitcoin, it will be difficult to shake Bitcoin’s dominance in the field of digital currency in a short period of time.

Summary: From an economic perspective, if we conclude that as long as we find alternatives to Bitcoin, the price increase of Bitcoin can be suppressed. From a technical perspective, if we want to find a substitute for Bitcoin, we need to look for it from the system structure of the chain, and the basic characteristics must be on par with Bitcoin. We have not yet seen the emergence of such a system. Even Ethereum, currently the second largest digital currency in terms of market capitalization, cannot replace Bitcoin in terms of basic characteristics. This is part of the reason why Bitcoin is so dominant, and also the reason why the Bitcoin ecology has become a center of popularity again after having some achievements (Inscription, Bitcoin second layer).

Why are decentralization, security, privacy, and censorship resistance among the basic characteristics of blockchain so important? Teacher Hong Shuning gave relevant explanations from the perspective of currency, that is, if it can become a digital currency acceptable worldwide, it needs to have security, privacy, and censorship resistance. A higher level requires analysis from a sociological perspective, which is beyond the scope of this article and the authors abilities. But it does matter, and many people pursue the benefits of these features.

2. Revisiting Bitcoin

In order to find alternatives to Bitcoin, we need to take a fresh look at Bitcoin. Let’s first look at the basic characteristics of Bitcoin and its main problems. From the perspective of layered design, let’s look at Bitcoin’s positioning in the web3.0 application architecture (one layer of network).

Before discussing the basic features of Bitcoin, we need some basic knowledge of consensus protocols.

2.1. Basic knowledge of consensus algorithm (or protocol)

Here, we mainly use PoW and PoS as case introductions. In the introduction, we will compare the differences between PoW and PoS. This makes it easier to understand the characteristics of the consensus algorithm required by alternative chains.

(1) The difference between synchronous algorithm and asynchronous algorithm

PoW is an asynchronous algorithm. In the PoW world, all nodes are in a competitive relationship, and the node with the fastest speed will produce blocks. It improves the robustness of the entire system by sacrificing the overall efficiency of the system. As long as there is one node in the system, the system can continue to run. Therefore, PoW is freely scalable, and theoretically there is no upper limit on the number of nodes it can support.

All PoS algorithms are synchronous algorithms. The PoS algorithm emphasizes collaboration between nodes. In terms of efficiency, or its block production speed, it will be higher than PoW. But what it sacrifices is the degree of decentralization. Because it requires collaboration, it needs to attract enough nodes to vote for candidate blocks. As long as enough node votes are not collected, this block cannot be issued, so it is a synchronous algorithm. In the PoS system, the efficiency of block production is determined by the slowest node among the nodes that participate in and successfully vote in the entire system.

(2) Algorithm complexity and communication complexity

PoW is widely criticized for its high power consumption. From an algorithm theory perspective, it reduces communication complexity by sacrificing computational complexity. Hash calculation complexity is relatively high (and repeated hash calculations consume a lot of power). However, the communication complexity of PoW can be said to be the lowest among all consensus algorithms. PoS algorithm, because the nodes are in a cooperative relationship, it does not need to consume a lot of electricity to calculate Hash, so the computational complexity is relatively low. However, due to the need for PoS voting communication collaboration, its communication complexity is often proportional to the square of the number of nodes. For example, the communication complexity of the traditional PBFT algorithm is O(N^ 2).

PoW has the lowest communication complexity and the highest degree of decentralization. This feature is well adapted to the current situation of restricted Internet network environment. This is why Bitcoin has been able to survive and develop for so many years. In fact, there have been hundreds of different attempts before this, and only Bitcoin has developed with the help of the PoW algorithm.

(3) Comparison of economic capabilities

PoS secures the blockchain without consuming large amounts of electricity (it is estimated that both Bitcoin and Ethereum 1.0 consume over $1 million per day in electricity and hardware costs as part of the PoW consensus mechanism.)

Due to the lack of high power consumption requirements, there is no need to issue too many tokens to incentivize participants to continue participating in the network. Theoretically, it is even possible to have negative net issuance, where a portion of transaction fees are consumed as fuel, reducing the money supply over time.

PoS Proof-of-Stake opens the door to a variety of technologies designed using competition theory mechanisms to more effectively prevent the formation of centralized giants that would otherwise be harmful to the network if a cartel-like phenomenon in the economic field were formed (e.g., based on PoW Private mining behavior).

PoS reduces the risk of centralization because economies of scale do not arise. $10 million in digital currency will bring you $1 million, and $100 will bring you $10 in return, both 10% returns without any other disproportionate benefits. Unlike PoW, participants with more financial advantages can purchase or produce better equipment and obtain generous returns. Ordinary participants are basically unable to obtain returns due to their weakness.

Various forms of 51% attacks can be prevented using economic penalties, and this ability of PoS is much more expensive than proof-of-work PoW. To paraphrase Vlad Zamfir: “If you participate in a 51% attack, it’s like your ASIC farm was burned.” PoW will only produce no profits, and will not have the effect of burning down mining machines and mines.

2.2. Basic characteristics of Bitcoin

We will not describe the general blockchain characteristics of Bitcoin. Those characteristics are characteristics that all blockchain systems will have, and they are also the characteristics of the blockchain system in the three system structures (blockchain system, distributed system, and centralized system). Reasons for irreplaceability.

(1) Remarkable capabilities brought by consensus protocols

We pointed out in Section 1.2 that the Bitcoin system is strong in decentralization, security, privacy, and censorship resistance. Currently, there is no blockchain that can compete with it on these points. These features are basically due to the consensus protocol. Because the consensus protocol of Bitcoin POW is an asynchronous algorithm and has low communication complexity, any node can join and exit. In this way, the Bitcoin network can accommodate countless nodes. The large number of nodes makes Bitcoin unique Strong decentralization, security, privacy, and censorship resistance. As can be seen from the table in Section 1.2, if the limitations of the system structure are put aside, the distributed system can easily have such capabilities, but it is a pity that the distributed system does not have the ledger capability of the blockchain.

Why haven’t other PoW blockchain systems achieved Bitcoin’s status? Although there are many reasons, Pow has an important Matthew effect, that is, the higher the value of the blockchain system, the greater the computing power it attracts. This causes the lack of sufficient computing power to affect the security of other blockchain systems. No guarantees.

(2) Looking at the imperfections of Bitcoin now, we can understand that it is the need for layered design.

From Vitaliks imperfect summary of Bitcoin in Ethereums white paper (UTXOs accountless system, non-Turing completeness of the execution language, poor scalability, etc.), we can see several other notable features of Bitcoin. :

1) Bitcoin account system UTXO

In current blockchain projects, there are two main record keeping methods, one is the account/balance model and the other is the UTXO model. Bitcoin uses the UTXO model, while Ethereum, EOS, etc. use the account/balance model.

In a Bitcoin wallet, we can usually see the account balance. However, in the Bitcoin system designed by Satoshi Nakamoto, there is no concept of balance. Bitcoin Balance is a product derived from the Bitcoin Wallet application. UTXO (Unspent Transaction Outputs) is an unspent transaction output, which is a core concept in Bitcoin transaction generation and verification. Transactions form a set of chain structures. All legal Bitcoin transactions can be traced back to the output of one or more previous transactions. The source of these chains is mining rewards, and the end is the current unspent transaction output.

So there is no Bitcoin in the real world, only UTXO. Bitcoin transactions are composed of transaction inputs and transaction outputs. Each transaction spends an input and produces an output, and the output it generates is the unspent transaction output. , which is UTXO.

If you want to implement smart contracts, the UTXO account model has very big problems. Gavin Wood, the designer of the Ethereum Yellow Paper, has a very deep understanding of UTXO. The biggest new feature of Ethereum is smart contracts. Because of smart contract considerations, it is difficult for Gavin Wood to implement Turing-complete smart contracts based on UTXO. The account model is naturally object-oriented, and each transaction will be recorded on the corresponding account (nonce++). In order to make it easier to manage accounts, a global state is introduced, and each transaction will change this global state. This corresponds to the real world. Every small change will change the world. Therefore, Ethereum uses an account system, and later public chains are basically implemented based on various types of account systems.

Another serious flaw of UTXO is that it cannot provide fine control over the withdrawal limit of the account. This is explained in the Ethereum white paper.

2) Bitcoin’s scripting language is not Turing complete

Although Bitcoins scripting language can support many calculations, it cannot support all calculations. The main lack is Bitcoin’s scripting language, which has no loop statements and conditional control statements. Therefore, we say: the Bitcoin scripting language is not Turing complete. This results in certain limitations of the Bitcoin scripting language. Of course, due to these limitations, hackers cannot use this scripting language to write some endless loops (which will cause network paralysis), or some malicious code that can cause DOS attacks, thereby avoiding DOS attacks on the Bitcoin network. Bitcoin developers also believe that the core blockchain should not have Turing completeness to avoid some attacks and network congestion. However, it is precisely because of these limitations that the Bitcoin network cannot run more complex programs. The purpose of not supporting loop statements is to avoid infinite loops during transaction confirmation.

Without layered design theory, the reasons for not supporting Turing completeness for security purposes are insufficient. Moreover, non-Turing complete languages can do very limited things, which will limit the development and growth of blockchain.

3) Other imperfections of Bitcoin, security and scalability

The centralization problem of mining. The Bitcoin mining algorithm basically allows miners to slightly change the block header tens of millions of times until the hash of the modified version of a certain node is smaller than the target value. However, this mining algorithm is susceptible to two forms of centralization attacks. First, for the special task of Bitcoin mining, the mining ecosystem is controlled by specially designed ASICs (Application Specific Integrated Circuits) and computer chips that are thousands of times more efficient. This means that Bitcoin mining is no longer highly decentralized and egalitarian, but requires the effective participation of huge capital. Second, most Bitcoin miners actually no longer complete block verification locally, but rely on centralized mining pools to provide block headers. This problem can be said to be serious. The top three mining pools currently indirectly control about 50% of the processing power in the Bitcoin network.

Scalability issues are an important issue for Bitcoin. With Bitcoin, it grows about 1 MB per hour. If the Bitcoin network processed 2,000 Visa transactions per second, it would grow by 1 MB every three seconds (1 GB per hour, 8 TB per year). The low number of transactions has also caused controversy in the Bitcoin community. Although large blockchains can improve performance, the problem is centralization risk.

From the perspective of the product life cycle, some small imperfections of Bitcoin can be improved in its own system, but the improvement methods are limited by the current system. If these problems can be solved in a new system, there is no need to consider the limitations of the old system. Since a new blockchain system is to be built, when designing a new system, these small functional improvements can also be designed and upgraded together.

Most of the imperfections of Bitcoin described in the Ethereum white paper are reasonable if viewed from a layered design perspective. These imperfections will be completed in the second-layer construction of Bitcoin.

2.3. Bitcoin’s Achilles Heel

Here, we rely on teacher Hong Shuning’s definition of Bitcoin’s ecological problem as the “Achilles’ Heel”: that is, when Bitcoin is halved every four years, the block reward will gradually decrease until it is zero, which will cause the Bitcoin network to There will be big problems and threats to the security.

The solution to Bitcoins Achilles heel is to develop a large number of applications on Bitcoin and re-inject continued value into the network, so that the substantial increase in handling fees can offset the reduction in block rewards, allowing miners who maintain the network to earn more than The rewards from blocks will gradually make more of the miners’ income come from handling fee rewards. This will not only benefit miners, but also project parties and application users who use Bitcoin ecological technology, creating a win-win situation for various actors in the ecosystem. This win-win situation can solve Bitcoin’s Achilles’ heel problem.

Because important contributors in the Bitcoin community are relatively conservative (some people call it Bitcoin fundamentalism), in the early days, some people had strong resistance to the application of Bitcoin. However, with the development of technology and application, after asset issuance functions such as inscriptions are used by more people on Bitcoin, more and more people begin to accept the idea of developing applications on Bitcoin, and will This idea was further improved to form the systematic thinking and construction path of Bitcoins second-layer network construction or off-chain construction.

2.4. Let’s talk about layered design and Bitcoin’s suitability for layered network construction

In order to better understand the basic characteristics of Bitcoin and the application construction of Bitcoin in Section 2.2, we also need to use the theory of layered design. As for why layered design is needed, I have a more detailed introduction in Section 1.3 of the article An article reviewing the basic knowledge system of Bitcoin Layer 2 construction. Here we only briefly quote the relevant content: Layered design is a means and methodology for humans to deal with complex systems. By dividing the system into multiple hierarchical structures and defining the relationships and functions between each layer, the system is modularized and Maintainability and scalability, thereby improving system design efficiency and reliability.

From the perspective of layered design, the imperfections of Bitcoin (UTXOs accountless system, non-Turing completeness of the execution language, and poor scalability) are no longer problems. Instead, they are designed as necessary features of a layered network. Those blockchain systems that are overly designed are more suitable to survive as Bitcoins second-layer construction technology or other test chain technologies.

From the application architecture level of Web3.0, we can also see the status of layered design and Bitcoin’s first-layer network. I have a more detailed introduction to this content in the article Observing the second layer of Bitcoin from the perspective of a state machine, you can see the architecture and construction path of future Web3.0 applications. Here we quote the system architecture diagram of large-scale applications in the Web3.0 era to briefly explain.

From the above structure diagram, we can see the first layer, second layer, third layer, ... of Web3.0, and even the system structure of upper-layer applications. The other blockchain systems on the far left in the figure can be considered layer 1.5 because they do not have the characteristics of the Bitcoin main network, but they can independently complete certain system functions.

This picture gives us a thought. Is the replacement chain we are looking for at one level? Or is it replaced at a higher level? I personally think that it is very difficult to replace Bitcoin on the first layer. If we look at the existing second layer of Bitcoin, it can meet the requirements on several important characteristics, and it is unlikely to become a replacement chain. There can be a 1.5-layer alternative chain between the first and second layers of Bitcoin, but the characteristics of this alternative chain are required to be stronger than other blockchain systems and need to be in decentralization, security, privacy, and resistance. The censorship capabilities are almost on par with Bitcoin’s capabilities. Having found this positioning, lets describe the other contents of this substitution chain in more detail.

3. Alternative chains to Bitcoin

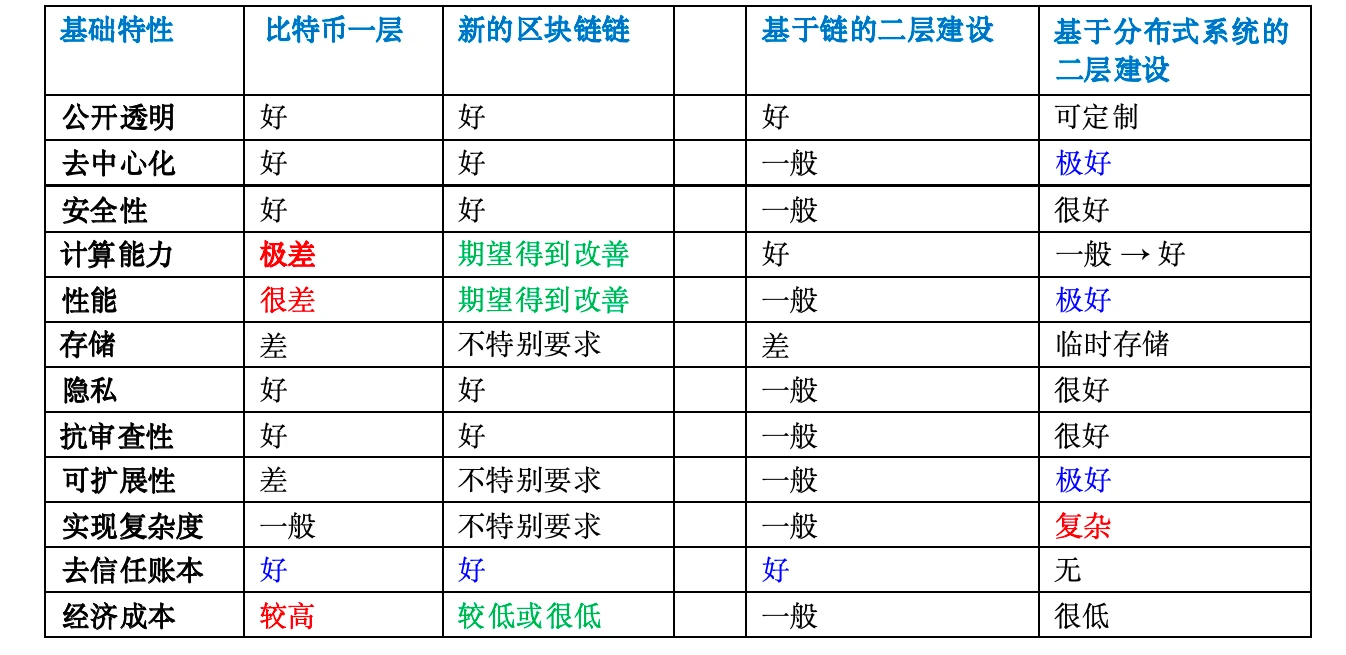

3.1. If an alternative chain is bound to be born, what are its characteristics?

In Section 1.2 we quoted a diagram of the basic characteristics of the first layer of Bitcoin and the characteristics of the second layer construction. We want to find a blockchain system that has similar characteristics to Bitcoin and can improve the poor performance of Bitcoin (this must be a blockchain, because the ledger function needs to be trusted). A brief summary of Chens sentence: I hope that this new chain will have these excellent characteristics of Bitcoin (public transparency, decentralization capabilities, security, censorship resistance), and will be improved in terms of computing power, performance, and economic costs, especially Economic costs can be reduced. If the computing power and performance cannot be improved, it is completely acceptable to only reduce the economic cost.

Then the desired new blockchain will have the following characteristics:

If we want to get the characteristics of the new chain in the above table, what will the technical implementation elements of this new chain look like? A rough summary is as follows:

(1) Encryption algorithm: Keeping Bitcoin’s encryption algorithm can meet the needs. It may be better if Shnorr signature is used directly.

(2) Consensus protocol: In order to maintain sufficient decentralization and accommodate more nodes to join, it can only be an asynchronous algorithm with low communication complexity. What are such consensus algorithms? Is it some kind of PoW algorithm? Or other PoW-like algorithms?

(3) Block time: not too fast, refer to the design considerations of Bitcoin block time. This involves the issue of algorithm difficulty adjustment.

(4) Blockchain size: This can take into account the design factors of Bitcoin and the experience factors that have been formed, as well as the development factors of software and hardware after the development of technology. You can refer to the storage size of 4 M.

(5) Account type: Should the UTXO model or the Account model be used? Because it needs to support high-level construction and support distributed systems (similar to Lightning Network), using the UTXO model will be more referential and reduce the difficulty of engineering implementation. Because the Raiden Network on Ethereum (Account model) may be a case where things are not going well.

(6) Computing power: Because the substitution chain functions at the bottom level, it is very likely that Turing completeness is not required. Because the current technological development of Taproot, MAST, and Tapscript in the Bitcoin field has been seen to be able to meet the needs of the underlying chain. And if security is guaranteed to the maximum extent, Turing completeness may be abandoned.

(7) Economic model design: This is a relatively complex issue. If the consensus agreement can be determined and the relevant stakeholders are confirmed, clearer design requirements can be obtained.

Issues such as other programming languages and transaction structures are relatively detailed issues and can be considered at the implementation stage without affecting the judgment of the main features of the alternative chain.

3.2. Where will the alternative chain be born?

Will such a system be completely new? It is difficult for me to judge personally, and it may not be necessary.

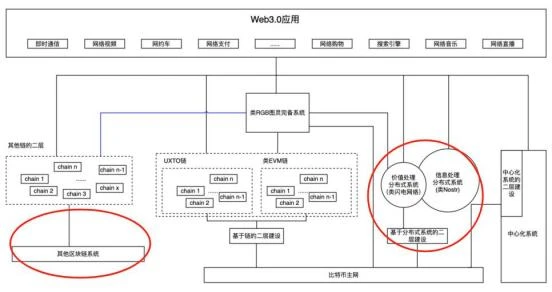

Referring to the application architecture diagram of Web3.0, there is a high probability that it will be born in other blockchain systems or distributed systems. The birth in a distributed system mentioned here is to use the existing architecture of the distributed system to create a blockchain system based on this architecture. Would it be easier to use Lightning Network or Nostr? Because the structure of these networks already has many nodes, would it be easier to complete it if some kind of consensus protocol could be generated to allow these nodes to do some things and complete ledger-related work? Will there be more win-win situations? The two areas shown in the red circles below:

3.3. What kind of team is suitable to make this alternative chain?

If the two birth areas we described in the previous section are feasible, then project teams with experience in these two areas are likely to be builders.

On the one hand, we look for similar systems from other blockchain systems. We can currently see that some chains meet the characteristics in Section 3.1. One thing that needs to be explained is that the consensus algorithm of such a chain cannot be the PoW algorithm that competes with the Bitcoin main network for computing power. Otherwise, it will be difficult for such a chain to ensure security due to the Matthew Effect. It is suggested that asynchronous algorithms also have proof algorithms based on space and time, and their communication complexity is not high. Therefore, the asynchronous consensus algorithm based on UTXO, with block time and block size similar to Bitcoin, may become a potential candidate. Such a blockchain system already exists, and to avoid suspicion, the name of the project will not be cited. If we could take advantage of certain features of the Bitcoin mainnet, would it be easier for such an alternative blockchain system to emerge?

On the other hand, if you consider using the current Lightning Network nodes or Nostr nodes to re-develop an alternative chain that satisfies the UTXO asynchronous consensus algorithm, it will also be a feasible idea. There are no explorers in this regard, but there should be theoretical feasibility.

If there is a team that can start from first principles like Elon Mask, it does not need to rely on original experience and traditional concepts at all. To use first principles to do things, you can follow the relevant steps: define the problem, decompose the problem, determine the basic principles, practice, and verify the results. It is also very possible to become the builder of this alternative chain.

4. Summary

This article is a reflection on the continued rise in Bitcoin prices when our project team is developing Bitcoin ecological technology. The description and content in the article are not complete enough. It is more about contributing some ideological materials to those who pay attention to this field.

I try to analyze the possibility of creating an alternative chain to Bitcoin from an economic perspective and a technical perspective. Then, from the perspective of Bitcoin’s basic characteristics and layered design, we summarize the characteristics of Bitcoin that can be used as a layer of network infrastructure. Finally, the characteristics and possible birth areas of the alternative chain are described, as well as possible construction teams. It is hoped that it can promote the emergence of a blockchain system that can replace Bitcoin to a certain extent, or attract more people to pay attention to this direction.