introduction

The two major centers of the crypto market in Asia are Hong Kong and Singapore. Because of its inseparable relationship with China and its relatively independent governance environment, Hong Kong is not only the center of the Chinese community in the crypto market, but also a benchmark for regulatory standardization and information. The strongest hub for interaction.

With the prosperity of the crypto market in the last cycle, more and more people in the Asia-Pacific region radiated by Hong Kong have set their sights on the cryptocurrency field. Many institutional and individual investors are eager to try it. Hong Kongs policies around 2021 are not clear. , which has also led to a large amount of capital and institutions migrating to cryptocurrency-friendly areas such as Singapore, Dubai and the United States. As the Hong Kong government officially announced its openness and tolerance to the Crypto market in 2022, many capitals began to return one after another, and the entire market situation became increasingly prosperous.

Rather than talking about the Hong Kong market, it is actually more like the market of the Chinese axis. From the perspective of cultural relations, Hong Kong is closely connected with Macau and Taiwan; but in fact, Southeast Asia, South Asia and even the entire Asia are within the radiation range of Hong Kong, so Hong Kong’s connections Capacity and reach play an extremely important role in the crypto market.

1. Macroeconomic indicators and current situation

1.1 Geographical location and population size

Hong Kong was once a British colony and is now a special administrative region of China. It is geographically located in southern China, east of the Pearl River Estuary, across the sea from Macau to the west, adjacent to Shenzhen to the north, and to the south of Zhuhai Wanshan Islands. The area includes Hong Kong Island, Kowloon, the New Territories and 262 surrounding islands, with a land area of 1113.76 square meters. kilometers, the sea area is 1641.21 square kilometers, and the total area is 2754.97 square kilometers.

As of the end of 2023, Hong Kong has a total population of 7.5031 million, making it one of the most densely populated regions in the world. Its life expectancy is the first in the world and the human development index is fourth in the world. The majority of Hong Kongs population is of Chinese nationality. According to 2017 statistics, the Chinese population accounts for approximately 91.4% of Hong Kong’s population. Other nationalities mainly include the Philippines (about 190,000, 2.6%), Indonesia (about 170,000, 2.3%) and India (about 33,000, 0.4%).

1.2 Economic structure and characteristics

Hong Kong is ranked 3rd among the first-tier cities in the world by GaWC. Its economy is a free market economic system that is highly dependent on international trade. As the economy with the highest degree of dominance in the global service industry, Hong Kong has financial services, trade and logistics, professional services and other industrial and commercial industries. Support services and tourism are the four traditional main industries of Hong Kongs economy.

As one of the worlds most important financial centers and commercial ports, Hong Kong is characterized by low taxes, minimal government market intervention, and a mature international financial market. Together with New York and London, Hong Kong is known as the Newland Port and is the third largest port in the world. A financial center, it is also an important international trade, shipping center and international innovation and technology center in the world. Hong Kong International Airport is the airport with the largest international cargo volume in 2022, and Hong Kong Port ranks ninth in global container throughput.

In addition, Hong Kong has a very high concentration of wealth and a large wage gap, with 90% of earners receiving 41% of all income. There is one billionaire for every 109,657 people in Hong Kong. It is also the city with the second largest number of billionaires in the world. It is the Asian city with the largest number of billionaires in the world. It is also the city with the highest concentration of ultra-high net worth individuals in the world. City. Despite government efforts to close the growing gap, the median income of the top 10% is 44 times that of the bottom 10%.

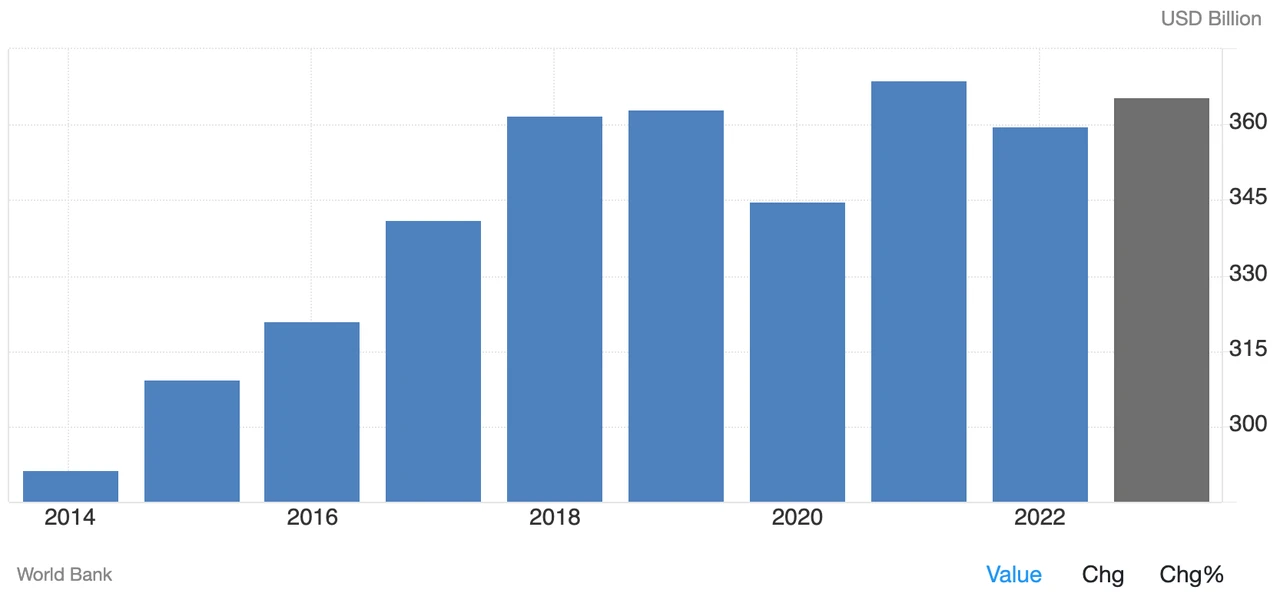

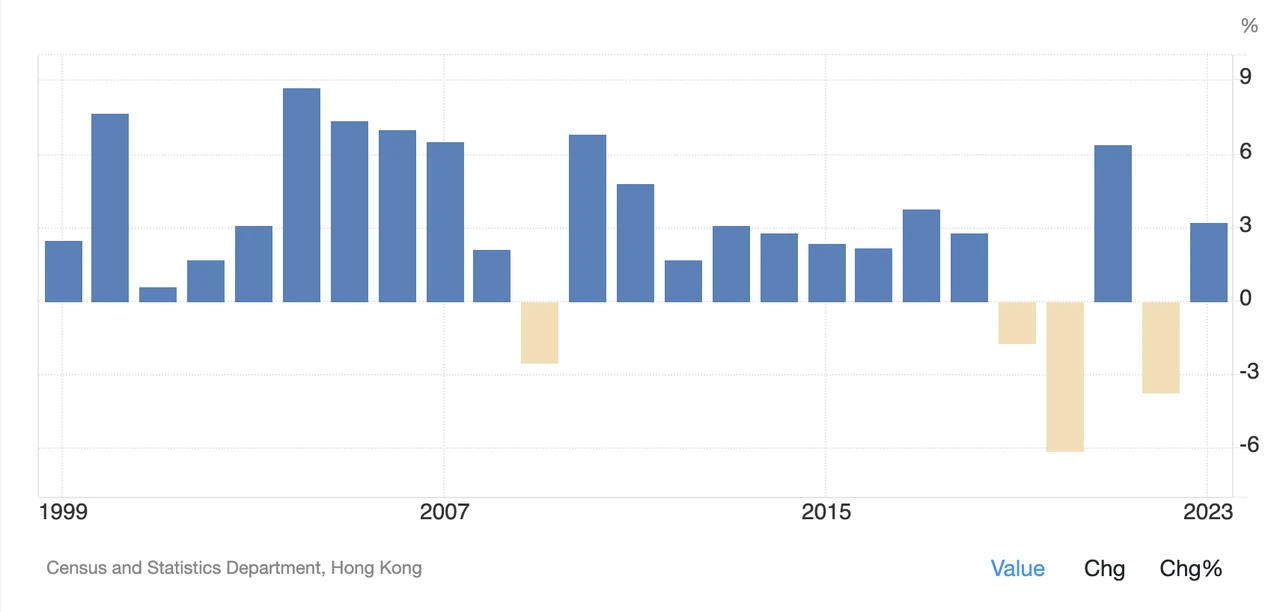

1.3 The latest annual GDP increased by 3.2%

Hong Kong is the 35th largest economy in the world, with a gross domestic product (GDP) of US$359.84 billion in 2022, according to official World Bank data. Hong Kong’s GDP value represents 0.15% of the global economy.

In 2023, according to the preliminary figures of GDP by economic activity in the fourth quarter and full year released by the Census and Statistics Department of the Hong Kong SAR Government, supported by a strong rebound in services exports and fixed investment, as well as significant growth in private consumption, Hong Kongs local GDP increased by 4.3% in real terms in the fourth quarter of 2023 compared with the same period last year. Comparing the whole year of 2023 with 2022, GDP increased by 3.2% in real terms.

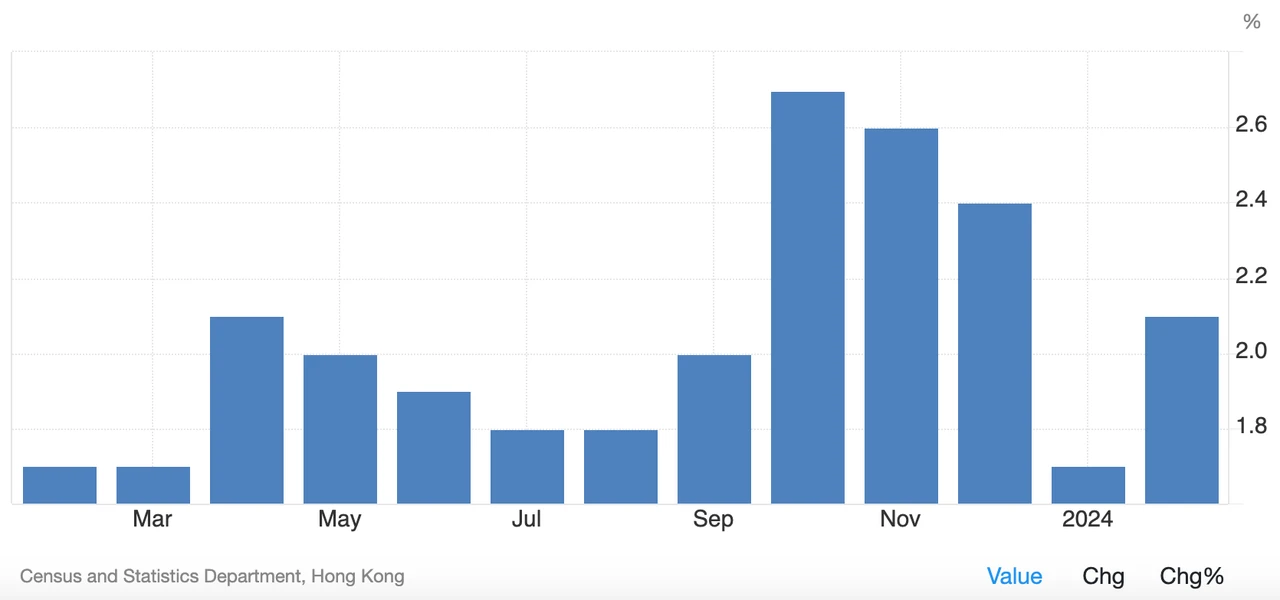

1.4 Inflation rate rose slightly but lower than expected

Hong Kongs annual inflation rate rose to 2.1% in February 2024, slightly below market expectations of 2.2%. Prices for food (2.2%), housing (3%), transportation (2.3%) and other services (3.6%) increased, while prices for clothing and footwear (1.3%) and other goods (1%) eased slow. Costs for electricity, gas and water (-7.8%) and durable goods (-1.4%) continued to fall. Core inflation also increased to 1.2% compared to 0.8% previously.

The Hong Kong government said underlying consumer price inflation remained moderate in the first two months of this year. Although the prices of meals out and takeaways continued to record relatively rapid increases, the prices of basic food items fell year-on-year, and the prices of energy-related items fell further. The price pressure on other major components remained generally under control. While local costs may face some upward pressure as the economy continues to grow, external price pressures should ease further.

1.5 Legal tender in Hong Kong

Hong Kong dollar (HKD) is the legal currency of Hong Kong, formerly known as Hong Kong dollar (unit: yuan), also known as Hong Kong dollar or Hong Kong paper. The currency and fund code is HKD, and the symbol is HK$. The Hong Kong dollar is issued and regulated by the Hong Kong Monetary Authority (HKMA). The currency is pegged to the U.S. dollar (USD) with a narrow floating range, and the Hong Kong dollar is widely used in daily transactions in Hong Kong and is also accepted in neighboring Macau.

2. Current status and characteristics of the encryption market

As a special administrative region of China, Hong Kong has autonomy over many aspects of policy, including the regulation of cryptocurrencies. Unlike China’s total ban on cryptocurrencies, cryptocurrencies are allowed in Hong Kong, and the crypto industry will be explicitly encouraged to settle and develop in Hong Kong starting from 2023, but the requirements must be under regulatory compliance conditions.

At the same time, Hong Kong’s unique cryptocurrency market offers a variety of use cases, not only suitable for local users, but also for foreigners. According to professional analysis, based on Hong Kong’s relatively independent judicial environment and role positioning in the world economy, this may indicate that the Chinese government is reversing the development direction of digital assets, or at least becoming more open to cryptocurrency initiatives.

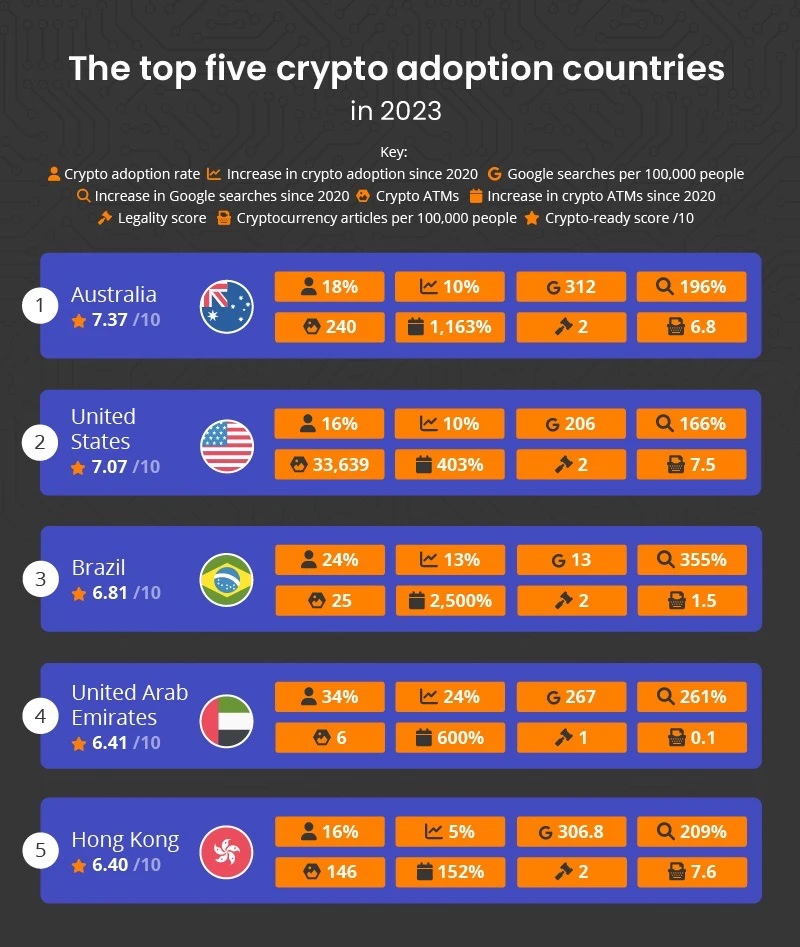

2.1 Cryptocurrency adoption rate ranks 5th in the world

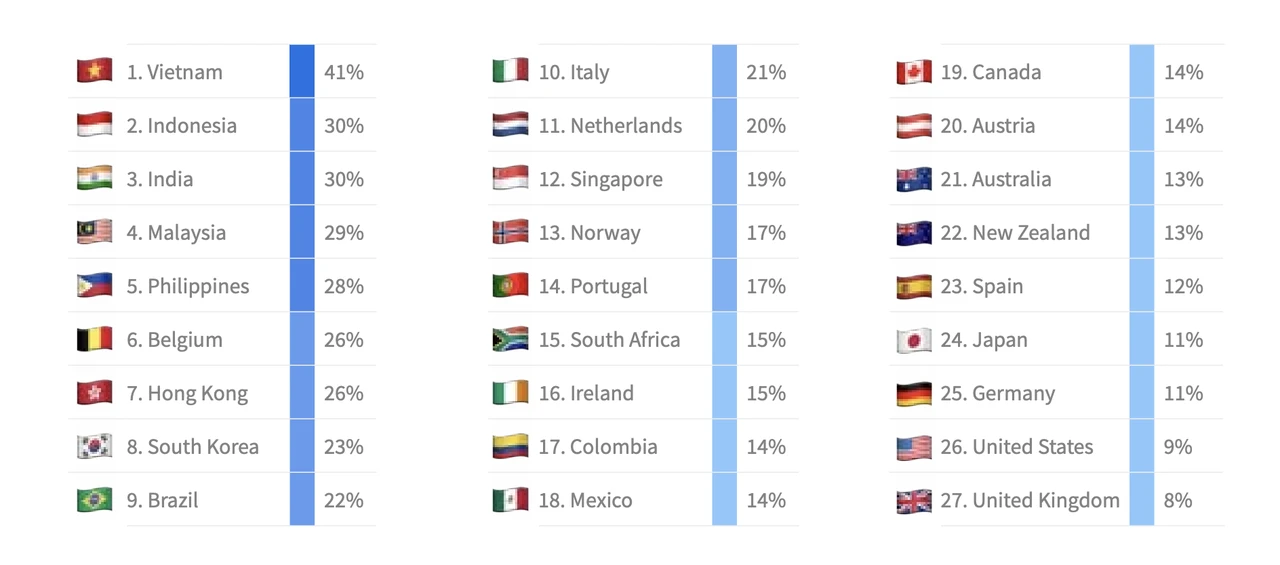

In a cryptocurrency adoption report by Finder, Hong Kong has the highest cryptocurrency adoption rate in Asia, ranking among the top 5 globally. Among them, cryptocurrency adoption in 2022 was 16%, searches for cryptocurrencies increased by 209%, while 7.6 cryptocurrency-related articles were published per 100,000 people, and cryptocurrency ATMs increased by 152%.

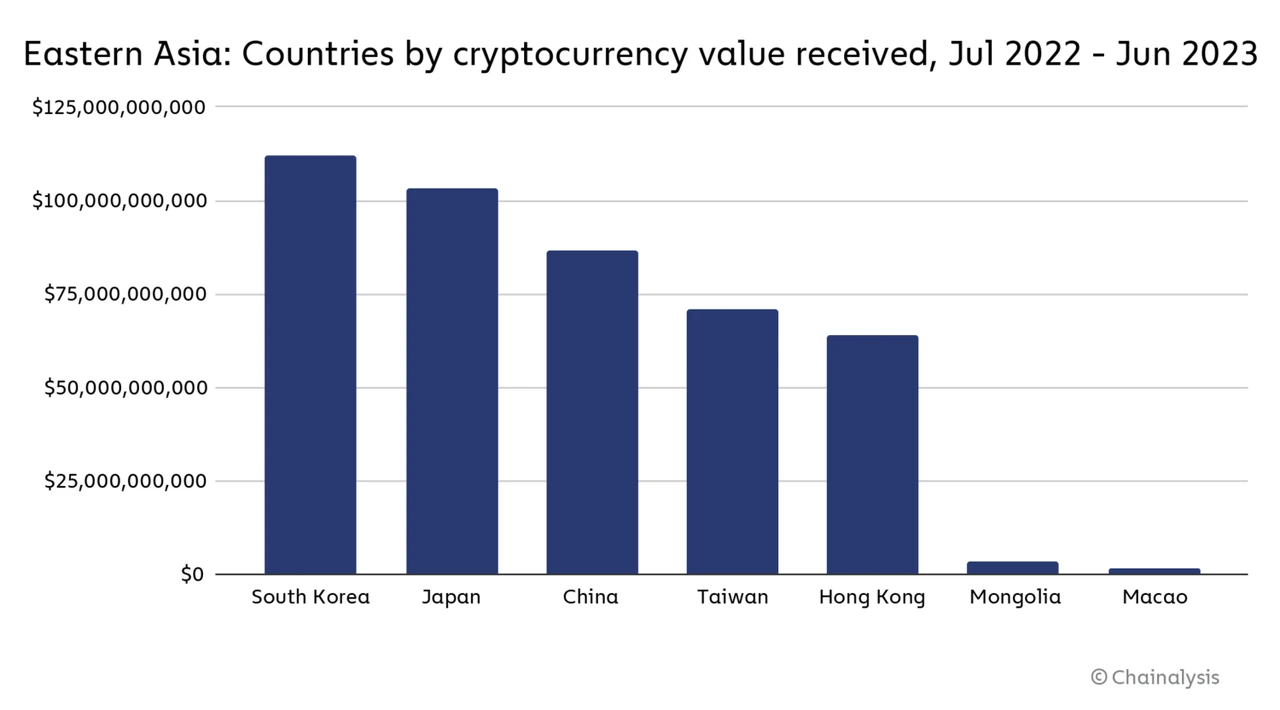

2.2 East Asia ranks 5th in terms of cryptocurrency reception

A report from Chainalysis shows that Hong Kong is a very active cryptocurrency market in terms of raw trading volume, with an estimated $64 billion in cryptocurrency received between July 2022 and June 2023. Although Hong Kongs population accounts for 0.5% of mainland Chinas, it compares favorably with Chinas $864 during the same period.

What’s important is that Hong Kong’s population base and industrial structure more closely replicate its model and framework as one of the world’s top 3 financial centers in the crypto field. This is similar to Singapore and London, but is significantly different from Dubai, Turkey and even the United States. difference.

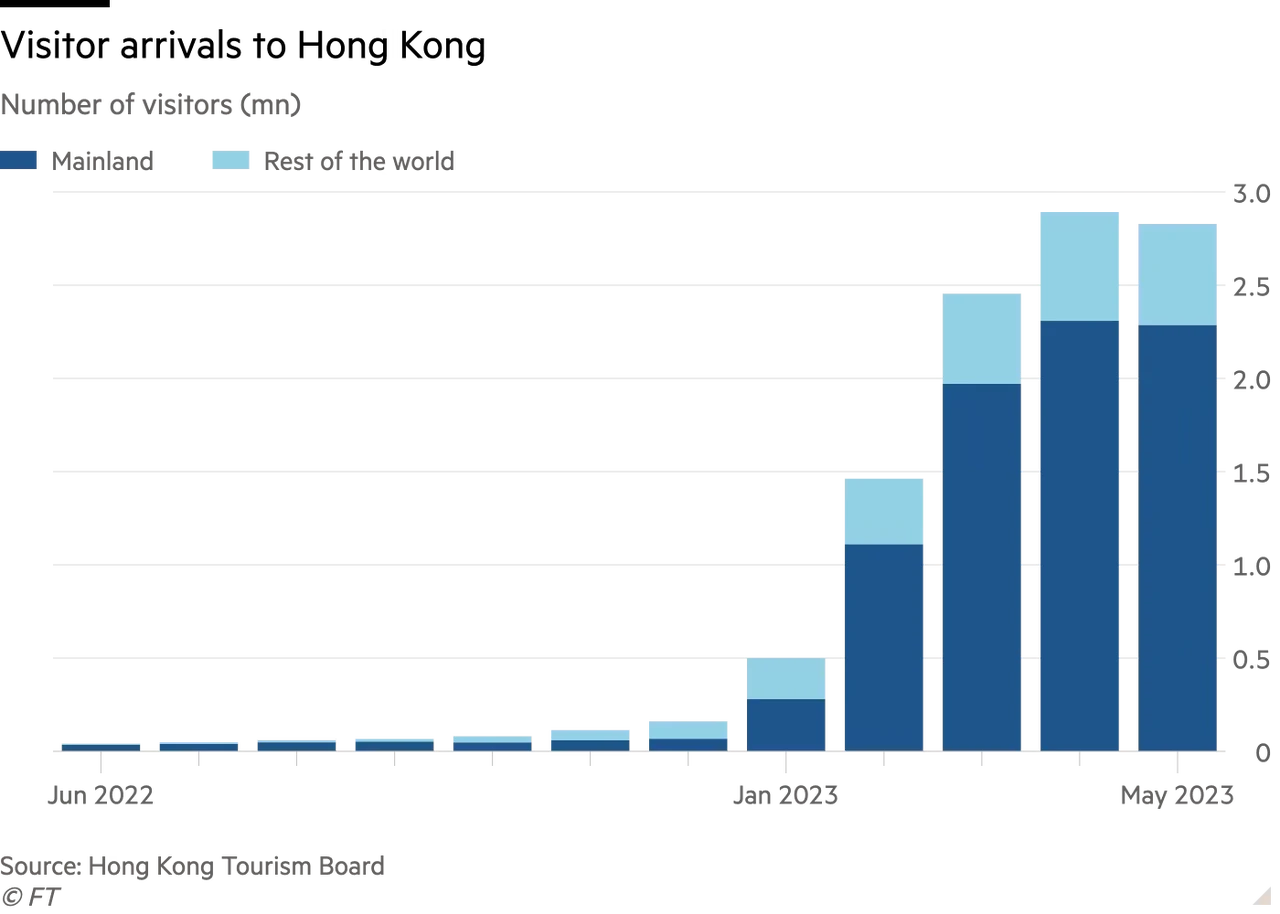

2.3 OTC transactions are growing significantly

Judging from the data on tourists visiting Hong Kong, as the COVID-19 epidemic recedes, the number of tourists visiting Hong Kong began to grow rapidly from the beginning of 2023, with China accounting for about 80%. In addition, the government has created a good business environment and living environment for the encryption industry. According to Hong Kong Crypto physical store data and feedback from practitioners, OTC transactions will increase by approximately 25% in the first half of 2023, and are expected to continue to grow within 2-5 years. substantial growth.

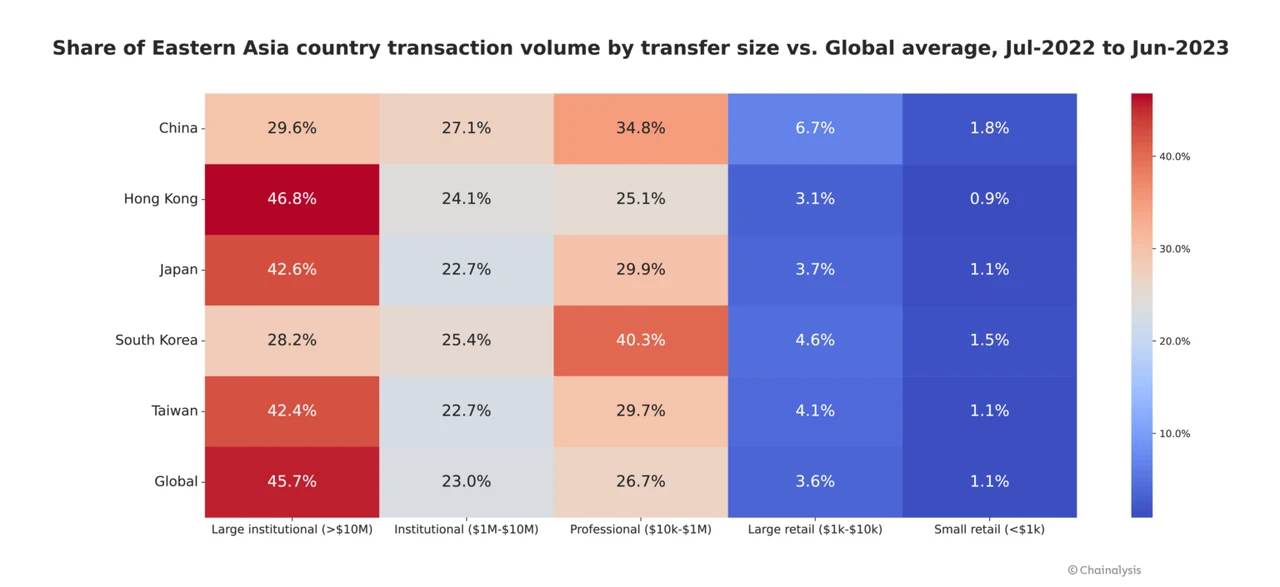

2.4 Proportion of large institutional transactions TOP 1

In terms of transfer scale, large institutional transactions account for a larger share of the transaction volume. Among transfers greater than $10 million, Hong Kong ranks first with 46.8%, higher than the global average of 45.7%; retail transfers Slightly lower than the global average. Much of this is driven by Hong Kongs very active over-the-counter trading market, where over-the-counter or over-the-counter trading desks typically provide large transfers for institutional investors and high-net-worth individuals.

2.5 The proportion of DEX transactions far exceeds the global average

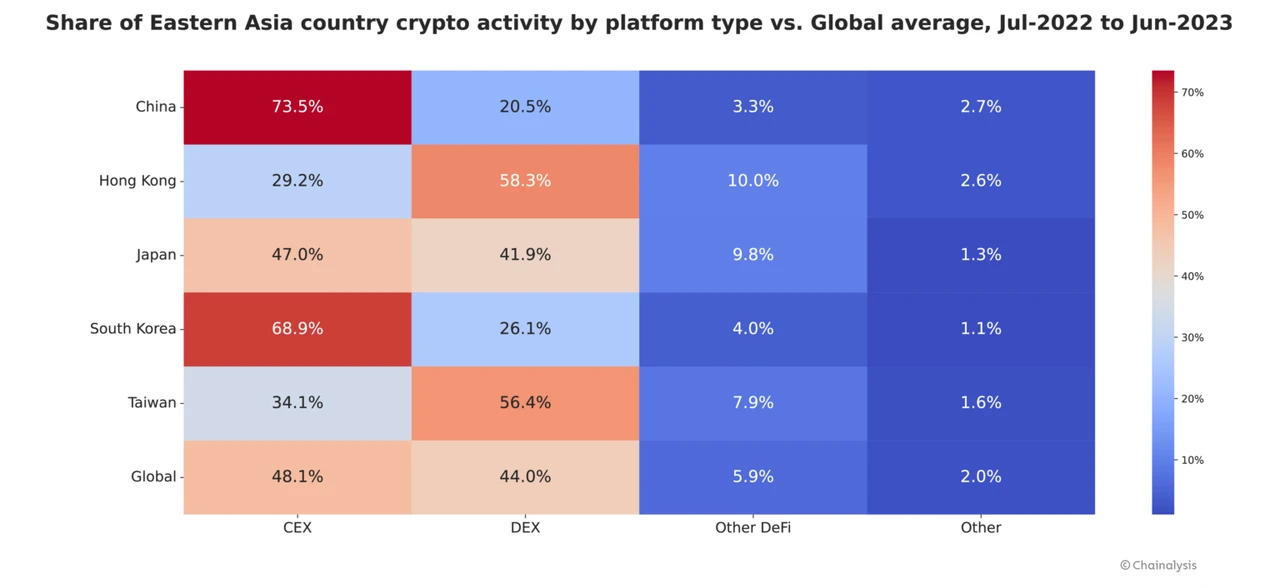

Compared with other regions in East Asia, Hong Kong shows a unique segmentation in the most commonly used encryption platform types, especially in DEX, which accounts for a very high proportion, exceeding Taiwan by 2 percentage points and exceeding the global average by about 14 percentage points. The main reason is that OTC transactions account for a higher proportion of this.

3. Encrypted user characteristics

The exact number of cryptocurrency owners in Hong Kong is difficult to determine, but what is certain is that an increasing number of individuals and companies are involved in cryptocurrency trading, investment and blockchain technology development.

3.1 75% of users pursue short-term gains

According to the 2023 Retail Investor Study conducted by the Investment Council: 75% of virtual asset investors surveyed are pursuing short-term gains. Furthermore, 74% of cryptocurrency investors believe in the enduring trend of virtual assets, while 73% are concerned about missing out on profitable opportunities.

In other words, although investors have good financial knowledge, their financial management behaviors still need to be strengthened. The disconnect between knowledge and practical application highlights the importance of a comprehensive investment strategy approach.

3.2 BTC holding rate 18%, the highest in the world

In a cryptocurrency adoption report by Finder, the top 5 are all in Asia, with Hong Kong residents owning 26% of crypto assets. Considering Hong Kong’s status as a global financial center, this number is not surprising. Surprisingly, in fact, Hong Kong has the highest proportion of Bitcoin owners (18%) and ranks second overall, second only to Vietnam (20%).

3.3 Generation Z is the main group of crypto users

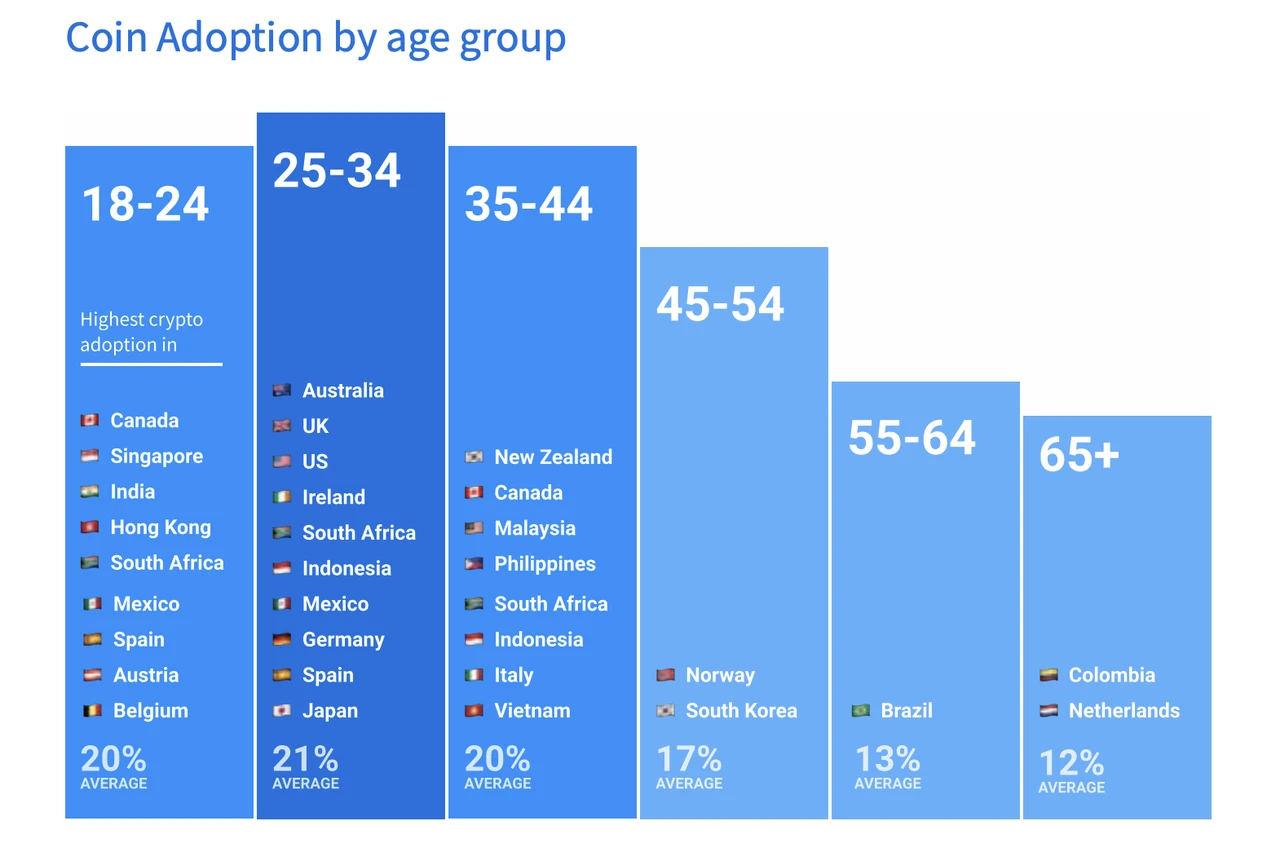

Looking at age groups, 18-24 year olds are the most likely to own cryptocurrencies at 35%, followed by 35-44 year olds at 30%, 25-34 year olds at 28%, and a whopping 23% of those over 65 years old. %, 19% of people aged 55-64, and 16% of people aged 45-54.

Crypto users in Hong Kong are mainly concentrated among Generation Z, with high ownership rates, which is consistent with a study by the University of Hong Kong on Generation Z’s investment preferences. Compared with older age groups, Generation Z in Hong Kong is more aware of the importance of financial management, has a higher deposit rate in banks, and has a higher investment and holding ratio in crypto assets.

3.4 Males account for a higher proportion of crypto users

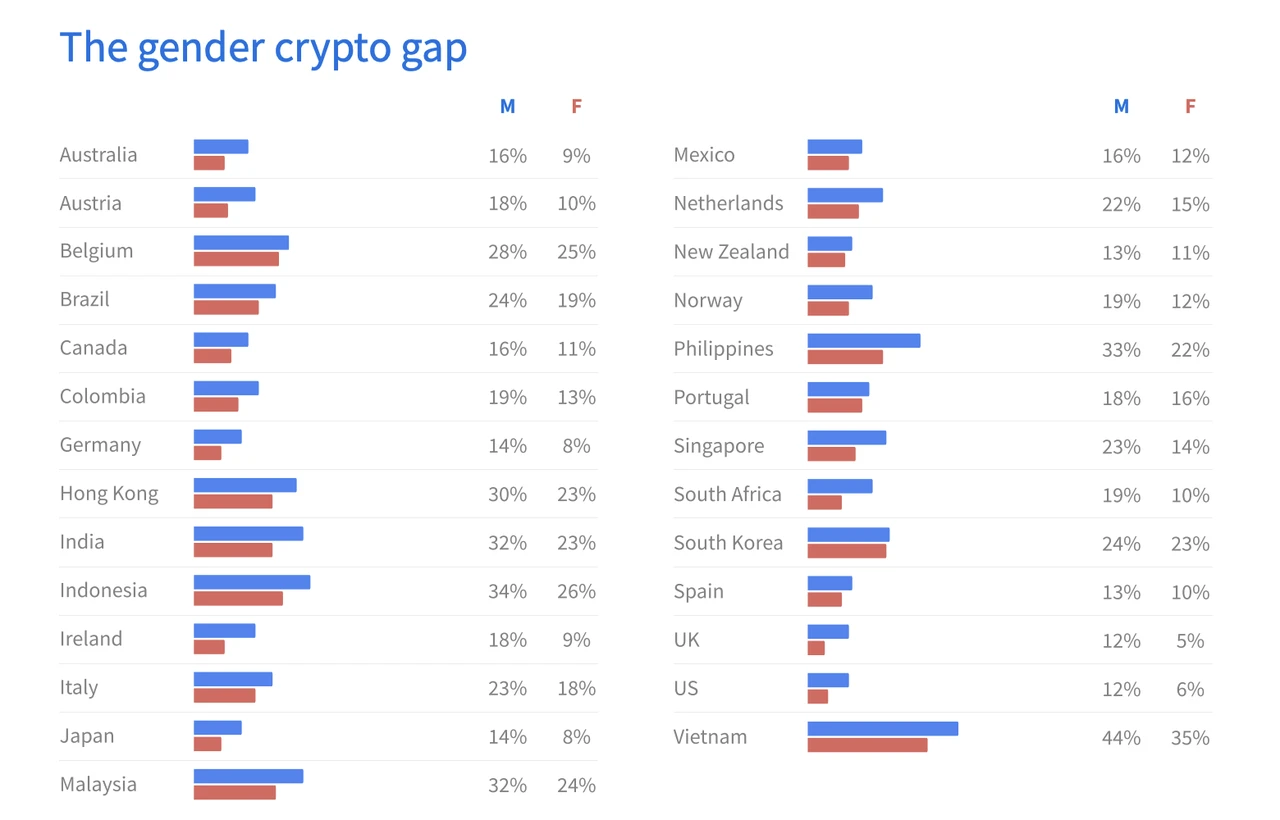

From a gender perspective, Hong Kong is consistent with global trends. There are more men than women among crypto users. 30% of men hold cryptocurrency in Hong Kong, while the proportion of women is 23%. The main reason is that mens income is relatively higher, as well as mens greater interest in encryption and Web3.

4. Current status of CEX in Hong Kong

According to the Hong Kong Securities and Futures Commission, cryptocurrency platforms operating in Hong Kong must submit license applications before the end of March, otherwise they will be required to cease operations.

4.1 CEX that has obtained trading license authorization

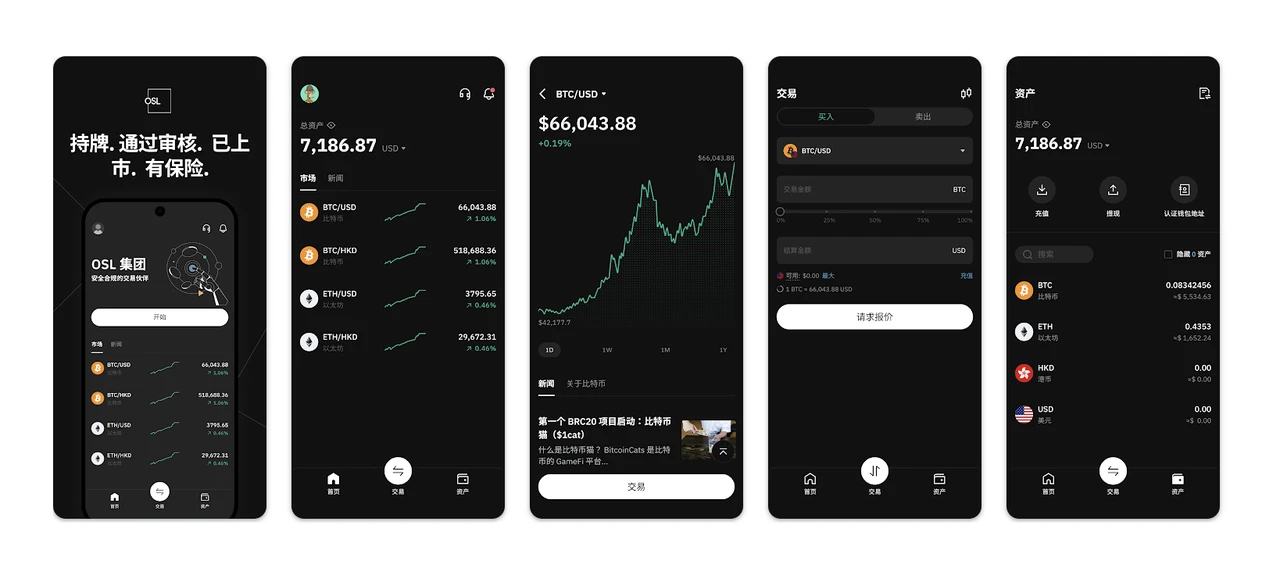

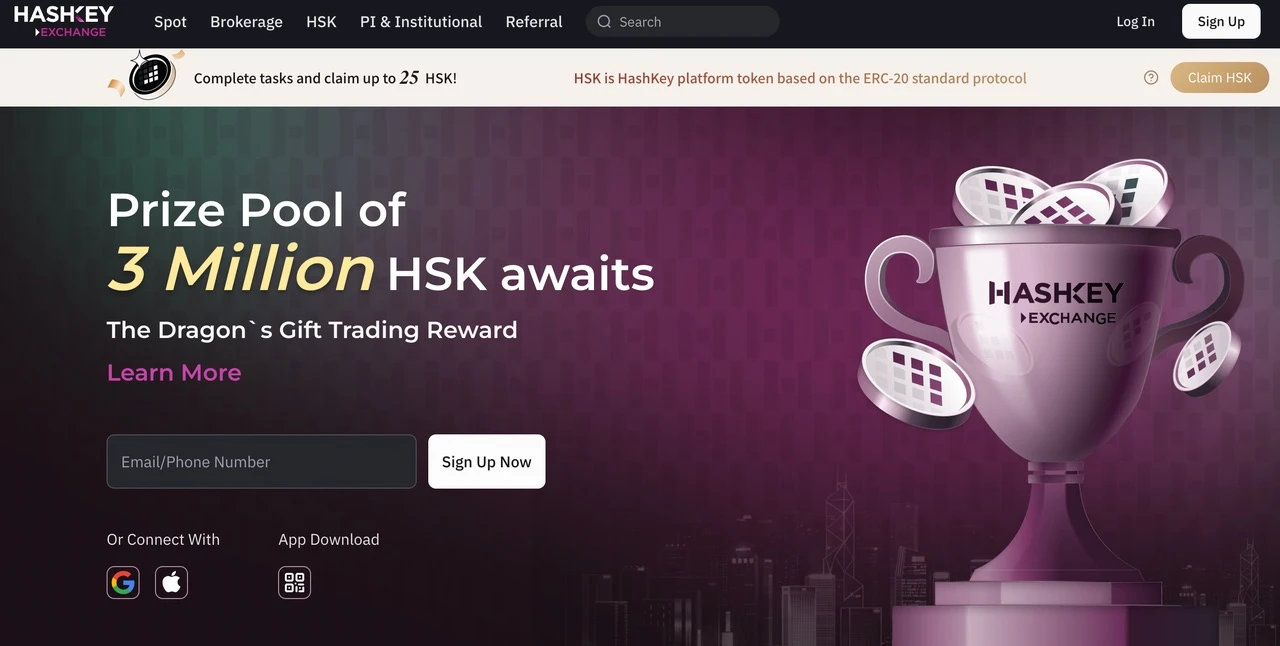

Since the official launch of its licensing system in 2023, the Hong Kong Securities Regulatory Commission website shows: Only OSL and HashKey have obtained cryptocurrency trading license authorization in Hong Kong. As of 2024, the Hong Kong Securities Regulatory Commission has received applications for CEX operating licenses from 22 companies. Applicants Including OKX, Bybit, Bullish, Crypto.com, Huobi HK and Matrixport HK, etc.

OSL focuses on B-side brokerage and trading services

OSL is a Hong Kong-based digital asset brokerage and crypto exchange. Its full name is Olympus Markets Limited. OSL provides institutional and professional investors with over-the-counter trading, custody, prime brokerage business and related SaaS services for encrypted digital assets, and mainly provides services to customers around prime brokerage and API tools. Its application APP has been launched on Apple in Hong Kong. App Store and Google Play Store are online.

BC Technologys interim report for 2023 showed that net losses narrowed from HK$300 million to HK$95 million in the six months to June, with OSLs digital assets and blockchain platform businesses playing a key role in BC Technologys revenue effect.

HashKey native compliant encryption CEX

HashKey Exchange is a cryptocurrency exchange based in Hong Kong. It is licensed by the Hong Kong Securities and Futures Commission and is one of the platforms operating legally in the region. HashKey Exchange provides users with a platform to buy, sell and trade various cryptocurrencies, providing services such as spot trading, derivatives trading and custody solutions. It aims to provide a safe, compliant environment for cryptocurrency trading in Hong Kong and beyond. ,

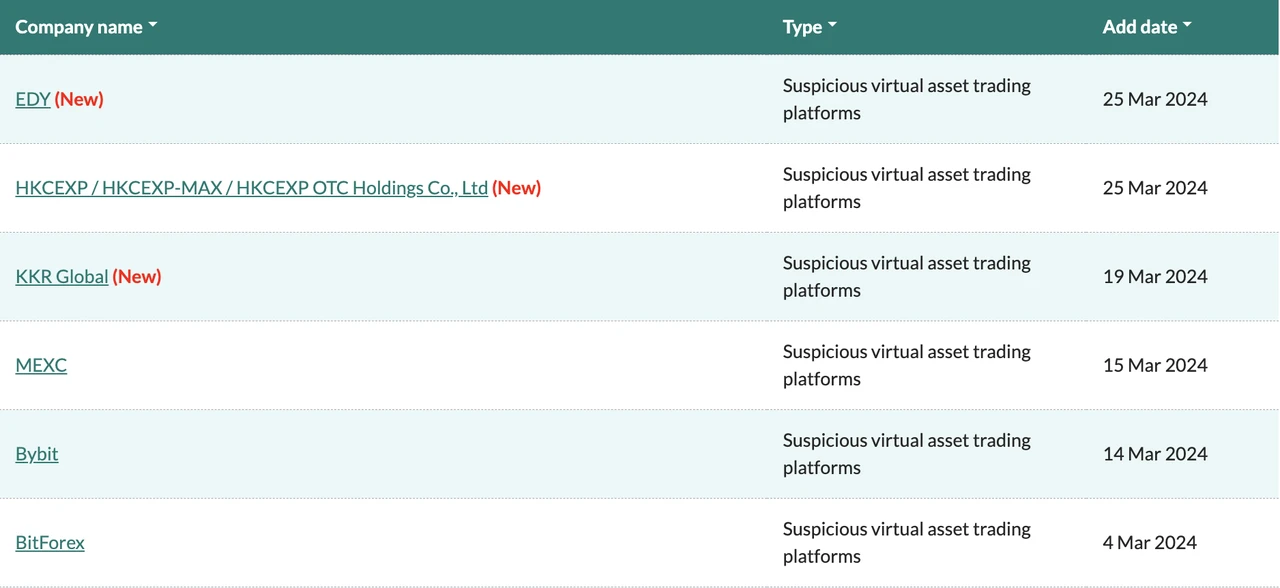

4.2 CEX listed as suspicious

The Hong Kong Securities Regulatory Commission mainly publicizes CEXs whose operating entities have no licenses and are believed to be or have targeted Hong Kong investors, or claim to be connected to Hong Kong. There are currently 23 CEX information listed, including MEXC and Bybit.

4.3 Other CEX used by users

In addition to OSL and HashKey, which are already compliant, there are actually multiple CEXs used by Hong Kong users in crypto asset custody and trading, and most of these CEXs are actively applying for corresponding licenses.

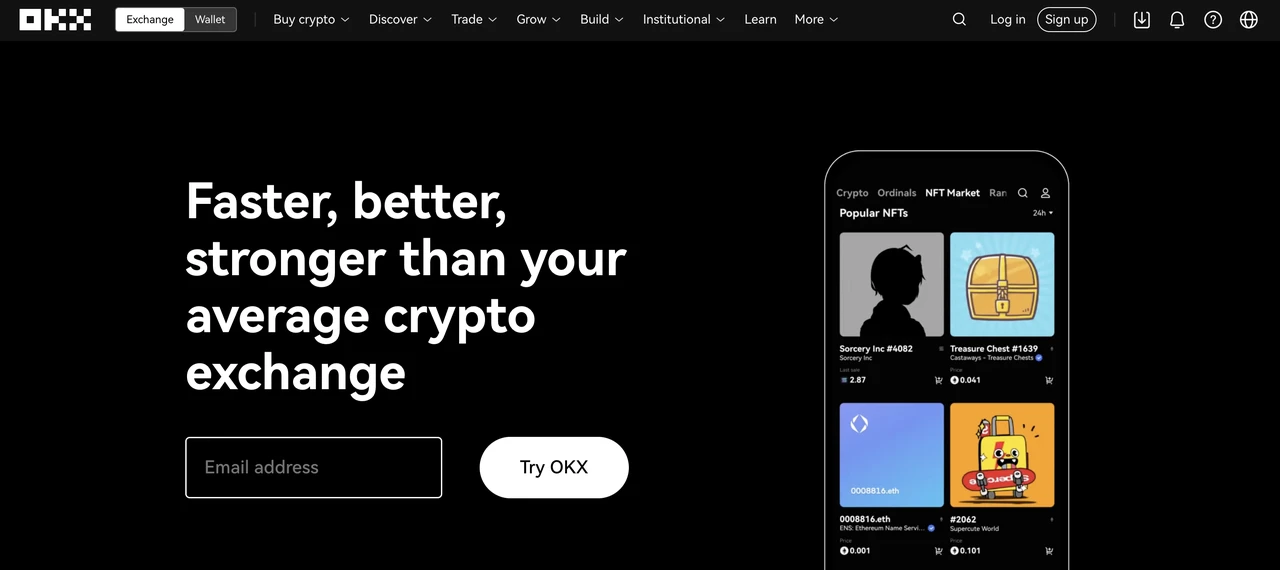

OKX

OKX has started applying for a Hong Kong encryption license in 2022, and has established a dedicated team of more than 20 people to be responsible for the Hong Kong compliance process. The team members are all from SFC, SEC, international law firms or licensed financial institutions.

Currently, OKX has established a Hong Kong entity to launch virtual asset services in Hong Kong, and plans to apply for a virtual asset service provider in accordance with the Anti-Money Laundering and Counter-Terrorism Financing (Amendment) Ordinance 2022 (the Ordinance will take effect on June 1, 2023) license, and apply for Type 1 and Type 7 licenses under the Securities and Futures Ordinance.

Bitget

Bitget hired Hong Kong lawyers and compliance professionals at the end of 2022 to further understand all relevant Hong Kong policies, and is preparing to apply for a Hong Kong virtual asset trading platform license.

Huobi Global

Justin Sun said in an interview with Bloomberg that Huobi Global has applied for a cryptocurrency trading license in Hong Kong and will be able to expand its services and products to Hong Kong customers to provide a wider range of cryptocurrency trading and investment options. Currently, Huobi has launched a new exchange Huobi HK in Hong Kong, providing spot trading and virtual asset custody services.

Gate.io

Gate.io’s Hippo Financial Services hasgetObtained a Hong Kong virtual asset custody license and was allowed to provide virtual asset custody services in Hong Kong. Gate has also obtained a Hong Kong Trust and Company Service Provider (TCSP) license to provide custody solutions covering a range of digital assets in Hong Kong. Currently, its parent company Gate Group is applying for a new cryptocurrency license in Hong Kong and launching Gate HK, a new platform designed for the Hong Kong market.

BitMart

In May 2023, BitMart announced that its trading platform BitMart Hong Kong in Hong Kong was officially launched to continue to provide services to Hong Kong institutional investors and retail investors. Currently, BitMart Hong Kong supports spot trading of virtual assets such as Bitcoin, Ethereum and LTC.

4. Hong Kong’s Web3 project

As a financial center, Hong Kong is vigorously promoting the implementation, compliance, and introduction of resources and talents in the Web3 and encryption industries. However, due to natural limitations, there are not many Web3 projects in Hong Kong, and some of them will use their technologies. The team or marketing team is outsourced to Shenzhen or Kuala Lumpur.

MAMORI

Mamori is a smart contract audit system based on the Web3 algorithm. It mainly focuses on zero-day economic vulnerabilities and MEV, and solves the problems of scalability, automation, vulnerability detection relevance and performance in the field of Web3 security. Their goal is to apply interdisciplinary techniques and protect against unknown unknown vulnerabilities. To achieve this goal, they use algorithm parsing technology to build smart contract sequences, leverage reproducible stateful computing technology, and integrate innovative, customizable algorithm feedback mechanisms.

Ladder

Ladder is a decentralized automated market maker protocol (AMM) that specializes in providing instant exchange of NFTs using liquidity pools. Although Ladder is primarily geared towards the GameFi space, they support all major token standards, including ERC-721, ERC-1155, ERC-3525, ERC-20, and more.

Yuliverse

Yuliverse is a blockchain-based play-to-earn game that combines elements of GameFi and SocialFi with its NFTs and cryptocurrencies, ARGs and ARTs. It provides players with a gaming experience with a make money on demand mechanism. The game is designed to promote social engagement and interaction, providing players with opportunities to explore the real world and connect with local businesses. By completing tasks and challenges, players can earn two native tokens, which play an important role in the Yuliverse ecosystem.

Conflux Network

Conflux is a high-performance Layer 1 blockchain designed for dapps that require massive speed while ensuring decentralization. Conflux’s tree graph structure can confirm multiple blocks at the same time. This parallel processing of blocks and transactions reduces confirmation time and greatly improves transaction throughput. As a compliant and permissionless public chain in China, Conflux is building a borderless transaction and technology ecosystem for globally minded crypto projects, expanding from China to North America, Russia, Latin America, Europe, Africa and the rest of the world .

Element

Element is a multi-chain aggregation NFT market that aims to build a community-driven integrated market with the best trading experience and the lowest entry threshold. Element provides partners with exclusive pages, collection certification, and launchpad services to facilitate project development and engagement. Element has been developing its presence in the Hong Kong market for a long time, and the headquarters of many consumer goods multinational companies have the need to issue NFTs.

The Sandbox

Founded in 2012, The Sandbox is one of the leading Metaverse concept projects. It is a decentralized, community-driven gaming ecosystem where players can create NFTs, upload them to the in-game market and transfer them into the game. . The project has been financed twice, with a total financing amount of US$95.1 million. The main investors are SoftBank Vision Fund, Animoca Brands, Bluepool Capital, Polygon Labs, Liberty City Ventures, Samsung Nex, etc.

5. Crypto Venture Capital in Hong Kong

Although Hong Kong is lagging behind on Web3 policy, it is still one of the strongest cities in Asia in terms of foundation. Many giant projects in the encryption field started in Hong Kong. In recent years, many new blockchain start-ups and crypto investment institutions have been born in Hong Kong. The potential of Hong Kong to incubate Web3 projects is evident. Among them, investment institutions rely on their own industrial resources to provide customers, resource introduction, technical support, etc. for enterprises or project parties. Its importance to strategic implementation and industry development is self-evident.

Cyberport

Cyberport is managed by the Hong Kong SAR Government and is Hong Kong’s digital technology center and incubator. It has more than 2,000 members, including 900 on-site and nearly 1,100 off-site startups and technology companies. Cyberport is committed to promoting Hong Kong’s digital economy, nurturing talents, promoting youth entrepreneurship, supporting start-ups, and promoting industry collaboration for digital transformation.

HASHKEY Capital

HashKey Capital is headquartered in Hong Kong and has branches in Singapore, Japan, the United States and other places. It is a leading blockchain investment company in Hong Kong with an asset management scale of over US$1 billion. As one of the largest and most influential blockchain investment institutions in Asia, and the earliest institutional investor in Ethereum, it mainly invests in blockchain technology, digital assets and cryptocurrency-related projects.

HashKey Capital provides funding, strategic guidance and support to promising blockchain startups and projects, as well as advisory services to institutional investors seeking exposure in the blockchain and crypto markets, in advancing the blockchain ecosystem. play an important role in innovation and growth.

Amber Group

Amber Group is the industrys leading digital financial technology platform, a well-known transaction service provider, and a well-known institutional investor in the primary market. Based on the rapid development of the business and the resource background of the founding team, Amber has successively received large-scale financing from top investment institutions, including Temasek, Sequoia China, Pantera Capital, Tiger Global Management, Fenbushi Capital US, etc.

Amber Groups investment projects include public chain NEARProtocol, decentralized pledge protocol StaderLabs, decentralized pledge protocol SSV.Network, algorithmic stablecoin project Sperax, Aurora native lending protocol Aurigami, lightweight public chain Mina, and Japanese blockchain games Startup company doublejump.tokyo, Web3 infrastructure company EthSign, etc.

IOSG Ventures

IOSGVentures is an investment and research company focusing on the blockchain/encryption field, covering multiple blockchain verticals such as infrastructure, DeFi, GameFi and SocialFi. According to the official website, when making investments, it focuses on the breakthrough and innovation of the project, the ambition and resilience of the founder and team, operational excellence and delivery capabilities, and a focus on community building.

IOSG mainly focuses on investing in Layer 1 projects and has become one of the major investors in Polkadot and NearProtocol. It has invested in many well-known projects. Projects invested in the Defi field include 0x, 1inch.exchange, DeFiAlliance, etc., and in the Layer-1 field, there are Conflux, Cosmos, MinaProtocol, etc.

Animoca Brands

Animoca Brands, a Deloitte Tech Fast winner, a Fortune Crypto 40 company and one of the Financial Times Asia Pacific Fast Growth Companies of 2023, uses blockchain to deliver digital products to consumers around the world. property rights to help build an open virtual universe. Animoca Brands is one of the most active investors in Web3, making over 400 Web3 investments directly or through Animoca Ventures, including Yuga Labs, Axie Infinity, Polygon, Consensys, Magic Eden, Fireblocks, OpenSea, Dapper Labs, Yield Guild Games wait.

C Capital

C Capital is a global asset management company that manages private equity funds, private credit funds and blockchain hedge funds. It was co-founded in 2017 by Hong Kong real estate tycoon Adrian Cheng, Clive Ng and Ben Cheng. Its BlockchainMarketFund is a discretionary long/short hedge fund focused on investing in the blockchain field, providing investors with a range of cryptocurrency trading strategies through technical analysis, fundamental analysis and on-chain analysis and evaluation.

CCapital has invested in more than 60 companies so far, covering the consumer, technology and blockchain fields. Its investments in the blockchain and digital asset fields include Ethereum infrastructure development company ConsenSys, financial services platform Matrixport, NFT virtual fashion brand RTFKT, and AnimocaBrands wait.

Everest Ventures Group

Everest Ventures Group, referred to as EVG, is a blockchain investment bank and incubator spun off from Hong Kong private equity/venture capital fund Huiyou Capital. It aims to promote the large-scale application of digital assets and blockchain technology. EVG focuses on financial technology, DeFi infrastructure, NFT, GameFi, Web3 and the Metaverse.

EVG’s investment portfolio includes blockchain game and NFT developer AnimocaBrands, decentralized metaverse TheSandbox, public chain Flow, crypto exchange Kraken and many other well-known projects. In addition to investment and financing business, EVG will also set up many companies to do GameFi, film and television NFT and other businesses, and it will have more plans in the metaverse in the future.

GBV Capital

GBVCapital is an investment institution under GenesisBlock. It is a venture fund focusing on Asian blockchain technology and digital assets. It mainly operates cryptocurrency over-the-counter trading business in Hong Kong. The GBV team supports full-stack engagement with projects and aims to facilitate project development through marketing, transactional functions, product and strategy-focused team members who provide assistance when needed.

Since its establishment in 2020, GBV has invested in more than 70 companies, covering multiple vertical fields, including Layer 2 public chain BobaNetwork, Layer 2 money market protocol zkLend, DeFi startup Arch, crypto options trading platform SignalPlus, and P2E shooting games. CantinaRoyale, Web3 creator collaboration platform Joyn, etc.

Newman Capital

Newman Capital is a full-stack venture capital firm focused on technology investments in private equity, blockchain startups, and art and collectibles investments. Its focus areas include core infrastructure, decentralized finance, social and gaming.

According to the official website, Newman’s team has supported more than 60 projects, in addition to well-known encryption projects such as NFT unicorn YugaLabs, crypto exchange Kraken, Ethereum expansion and infrastructure development platform Polygon and DapperLabs in the blockchain/web3 field. , also participated in early investments in well-known Internet technology companies such as Reddit, SpaceX and EpicGames.

MindWorks Capital

MindWorks Capital is headquartered in Hong Kong, with offices in Beijing, Shanghai and Jakarta. Its investment territory radiates to Greater China and Southeast Asia. It is a venture capital company that conducts early-stage and seed investments.

MindWorks Capital manages capital from university endowments, global asset managers, funds of funds, family offices and Asias leading new economy entrepreneurs. It has invested in 33 projects so far, including a number of start-ups in the blockchain field, such as YGGSEA, a subsidiary of the chain gaming association YGG, the encryption exchange Zipmex, the on-chain data monitoring platform PARSIQ, the composite asset protocol StarfishFinance, etc.

6. Crypto market regulatory framework

The Hong Kong Financial Services and the Treasury Bureau (Treasury Bureau) officially released the Policy Declaration on the Development of Virtual Assets in Hong Kong on October 31, 2022, which provides guidance on public participation in virtual asset transactions, property rights protection and stability of tokenized assets. The development of currency and other aspects demonstrate the Hong Kong governments open, inclusive and innovative attitude. The Hong Kong government has also personally participated in three experimental projects: NFT issuance, green debt tokenization, and digital Hong Kong dollars to test the technical benefits brought by virtual assets and try to further apply relevant technologies to the financial market.

In recent years, the virtual asset industry has been turbulent, with various innovative technologies and applications emerging one after another. Regulatory authorities in various jurisdictions around the world are also following closely, hoping to standardize the development of the industry and find new development engines for the local economy. The Hong Kong Securities and Futures Commission (SFC), Treasury Bureau, Monetary Authority (HKMA) and other agencies have issued a number of statements, circulars, position papers, and legislative consultations from different regulatory perspectives. and other documents to gradually build Hong Kong’s regulatory framework for virtual assets.

6.1 Regulatory bodies and division of labor

Hong Kongs financial supervision work mainly consists of the Financial Services and the Treasury Bureau (Treasury Bureau), the Hong Kong Monetary Authority (HKMA), the Securities and Futures Commission (SFC) and the Insurance Authority (IA).

The Ministry of Finance, which plays an administrative role in financial regulation and can formulate financial policies and submit legislative proposals;

The Hong Kong Monetary Authority is mainly responsible for maintaining the stability of the financial system and banking industry, and managing the Exchange Fund to maintain the stability of the Hong Kong dollar;

The Securities and Futures Commission, which is responsible for overseeing and promoting the development of the securities and futures markets and may issue licenses for regulated activities;

The Insurance Regulatory Bureau supervises the insurance industry, protects the interests of policyholders, and promotes the stable development of the insurance industry;

In addition, the Hong Kong Association of Banks, the Hong Kong Stock Exchange, and the Hong Kong Federation of Insurance Companies serve as industry self-regulatory bodies for the banking, securities, and insurance industries respectively to conduct industry supervision. Such a multi-level regulatory system can greatly stimulate the creativity and enthusiasm of the financial market while controlling financial risks, thus promoting the stable development of special economic zones.

For the regulation of crypto-assets and the crypto industry, there is no separate regulatory agency in Hong Kong, but several financial regulators have issued guidance documents on this topic, including the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA) .

6.2 Regulatory progress timeline

In September 2017, the Statement on Initial Coin Offerings was released. ICOs need to apply for a license from the Hong Kong Securities and Futures Commission;

In December 2017, the Circular to Licensed Corporations and Registered Institutions Regarding Bitcoin Futures Contracts and Cryptocurrency-Related Investment Products was issued;

In November 2019, Hong Kong began to regulate cryptocurrency exchanges, requiring CEXs to obtain licenses in order to provide corresponding services to investors;

In June 2022, an announcement Warning Investors to Pay Attention to NFT Risks was issued, mentioning that most NFTs are intended to represent their related assets;

In October 2022, the Treasury Bureau issued the Hong Kong Virtual Asset Development Policy Statement expressing Hong Kongs open and inclusive attitude towards virtual assets;

In December 2022, the Hong Kong Legislative Council passed the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance 2022;

In January 2023, the Crypto-Assets and Stablecoins Discussion Paper was released requiring that stablecoins should fully support and allow face value redemption;

In February 2023, the Hong Kong Securities and Futures Commission released a consultation paper on proposed regulatory requirements for virtual asset trading platform operators;

In May 2023, the Guidelines on Combating Money Laundering and Terrorist Financing were released;

In June 2023, the virtual asset service provider (VASP) licensing system will be implemented;

In August 2023, the Hong Kong government announced that listed exchanges could sell to retail investors;

In January 2024, the Strategic Focus from 2024 to 2026 was released, stating that encryption-centered technological innovation will be a development focus;

6.3 Classification of financial licenses

There are ten types of financial licenses issued by the Hong Kong Securities and Futures Commission:

License No. 1, securities trading, provides customers with stocks, stock options, bond trading and brokerage services, and is also able to provide mutual funds, unit trust fund placement and underwriting securities;

License No. 2, futures contract trading, providing customers with index or commodity futures trading and brokerage services;

License No. 3, leveraged foreign exchange trading, providing customers with foreign exchange trading services;

License No. 4, securities investment consulting, providing clients with securities investment advice and research and analysis reports;

License No. 5, futures contract investment consulting, providing customers with investment opinions and research analysis reports on futures contracts.

License No. 6, institutional finance consulting, approved to serve as sponsor for clients initial public offerings and provide advice on company listing compliance and other matters;

License No. 7, automated trading, providing customers with electronic trading platform services for order matching operations;

License No. 8, guaranteed financing, providing customers with stock pledge financing services;

License No. 9, asset management, providing customers with discretionary fund management and securities and futures contract investment management services;

License 10, Credit Rating, allows the rating of corporate, bond and sovereign credit;

The most critical of these licenses are No. 1 and No. 7 licenses (for securities trading and provision of automated trading services respectively), which are necessary conditions for the implementation of compliant exchanges. License No. 9 is also the focus of the market. The difference is that it can host users. Funding is a necessary condition for private placement or public placement. The exchange does not currently need to change its license. Currently, OSL and HashKey have obtained licenses No. 1 and 7, and Huobi Technology has obtained license No. 9.

6.4 Requirements and guarantees for CEX operations

Regarding the operation of the CEX platform, according to the document requirements published by the Hong Kong Securities Regulatory Commission, the following are the following:

CEX platform operators must maintain a paid-up share capital of no less than HK$5 million at all times (i.e., the minimum amount of paid-up share capital);

The platform operator should beneficially possess fully liquid assets in Hong Kong at all times, such as cash, deposits, treasury bills and certificates of deposit (but not virtual assets), the amount of which should be equal to the platform operator’s actual assets calculated on a continuing basis for at least 12 months. operating expenses;

Platform operators should establish and implement strict internal control measures and governance procedures in terms of private key management to ensure that all encryption seeds and private keys are securely generated, stored and backed up. Seeds and private keys are stored in Hong Kong;

6.5 ETF policies and regulatory requirements

On December 22, 2023, the Hong Kong Monetary Authority and the Securities and Futures Commission jointly issued the updated Joint Circular on Virtual Asset-related Activities of Intermediaries, expressing their readiness to accept applications for virtual asset spot ETFs and futures ETFs, and proposed Regulatory requirements:

On the same day, the China Securities Regulatory Commission issued the Circular on Funds Recognized by the China Securities Regulatory Commission for Investment in Virtual Assets (ETF Circular). The ETF Circular replaces the circular on virtual asset futures ETFs issued by the China Securities Regulatory Commission on October 31, 2022, and proposes new regulatory requirements for virtual asset ETFs (including futures ETFs and spot ETFs):

Manager qualifications: ETF managers should have good regulatory compliance records; have at least one competent employee with experience in virtual asset and related product management; and hold an upgraded No. 9 license;

Underlying assets: ETFs may only invest (directly or indirectly) in assets tradable by retail users on licensed exchanges in Hong Kong;

Investment strategy: ETFs do not allow leverage at the fund level;

Subscription and redemption: The China Securities Regulatory Commission allows subscription and redemption in two ways: cash (in-cash) or in-kind (in-kind);

Custody arrangements: Assets held by ETFs need to be hosted on licensed exchanges in Hong Kong or financial institutions and their subsidiaries recognized by the Hong Kong Monetary Authority;

6.6 Stable currency issuance regulatory legislation

Stablecoins are linked to the value of specific assets (such as legal tender, gold, etc.), with small price fluctuations, and play the role of currency in the crypto market. The Hong Kong government is very concerned about the development of stable currencies and is actively promoting relevant legislation:

Plan to introduce new legislation rather than amend existing legislation (e.g. the Payment Systems and Stored Value Facilities Ordinance (Chapter 584 of the Laws of Hong Kong) or the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Chapter 615 of the Laws of Hong Kong)) ;

The proposed regulatory regime for stablecoins would only apply to fiat-referenced stablecoins (FRS), which are cryptographically protected digital forms of value that maintain a relatively stable value with one or more fiat currencies;

To issue FRS in Hong Kong, to issue Hong Kong dollar-linked FRS in any region, or to actively promote the issuance of FRS to the Hong Kong public, an FRS issuer license is required;

The main licensing conditions and regulatory requirements that FRS issuers need to meet include: requirements related to reserve assets and stabilization mechanisms, redemption of FRS at face value in the reference currency, and the need to obtain approval from the Monetary Authority before any new business;

Only FRS issued by FRS issuers licensed by the HKMA can be sold to retail investors, and all other types of FRS can only be sold to professional investors;

Judging from relevant policy documents issued by institutional departments, the main regulatory focus is anti-money laundering and investor protection. It draws on traditional financial supervision ideas and complies with the supervisory principle of same business, same risk, same rules to prevent legal financial activities from becoming a tool for criminal activities such as money laundering and terrorist financing, protect investors to the greatest extent, and reduce the risk of non-compliance of trading platforms. Even illegal activities and allowing investors to invest in targets that are not in line with their risk tolerance have caused huge asset losses to investors.

7. Summary

Hong Kong has been in the blockchain industry for a long time. Since the launch of the “Financial Finance Competition” in 2018 to encourage local companies to participate in the development of blockchain and other technology fields, Hong Kong has more than 600 financial technology companies, including mobile payment, In the fields of cross-border financial management, wealth and investment management, compliance technology, and crypto-asset trading, we also launched crypto-asset ETFs and continued to hold multiple large-scale blockchain industry summits.

With the rise of blockchain technology, as a traditional global financial center, Hong Kong is actively exploring how to maintain its position in the world of Web3, giving full play to its unique advantages as a financial center, and has become a leader in blockchain and digital assets. As a hot spot in the field, more and more companies choose to set up institutions or branches in Hong Kong.

Hong Kongs financial industry is characterized by a strong regulatory framework, sound infrastructure and openness to foreign investment. This is also reflected in the encryption industry, and the corresponding regulatory policies have become increasingly clear. By establishing a clear regulatory framework, we can create an environment conducive to digital asset activities and take advantage of the opportunities brought by the growing digital asset market to create a broader The financial technology ecosystem continues to empower.

In the turbulent environment of the crypto market, Hong Kong’s unique status and governance environment give it great potential to become the axis of the Chinese market. With the further promotion and implementation of policies, the eyes of the Chinese market, the Asia-Pacific market, and the global market are converging. Hong Kong, its advantages as a financial center are also being amplified and released in the crypto field. We have reason to believe that Hong Kong’s position in the crypto market will become increasingly important and become the hub and core of motivation for the crypto industry.

Note: All the above opinions are for reference only and do not serve as investment advice. If you have any objections, please contact us for correction.

Follow and join the MIIX Captial community to learn more cutting-edge information:

Twitter :https://twitter.com/MIIXCapital_CN;

Telegram :https://t.me/MIIXCapitalcn;

Join the MIIX Capital team:hr@miixcapital.com

Positions currently recruiting: Investment Research Analyst/Operations Manager/Visual Designer