The market, project, currency and other information, opinions and judgments mentioned in this report are for reference only and do not constitute any investment advice.

Global financial markets were calm in March.

The Nasdaq and Dow Jones indexes hit new rebound highs without any suspense. So far, the Nasdaq has been rising for five consecutive months, indicating that long capital is constantly increasing its tolerance for delaying U.S. interest rate cuts.

There are many factors leading to the delay in interest rate cuts.

The U.S. CPI rebounded slightly from 3.1% to 3.2% month-on-month, and the U.S. manufacturing index PMI rebounded to 50.3%, showing a trend of entering a period of expansion. Japan ended its eight-year period of negative interest rates and raised interest rates for the first time.

The probability of a rate cut in the United States in April has dropped significantly, and the probability of a rate cut in May has also fallen below 50%.

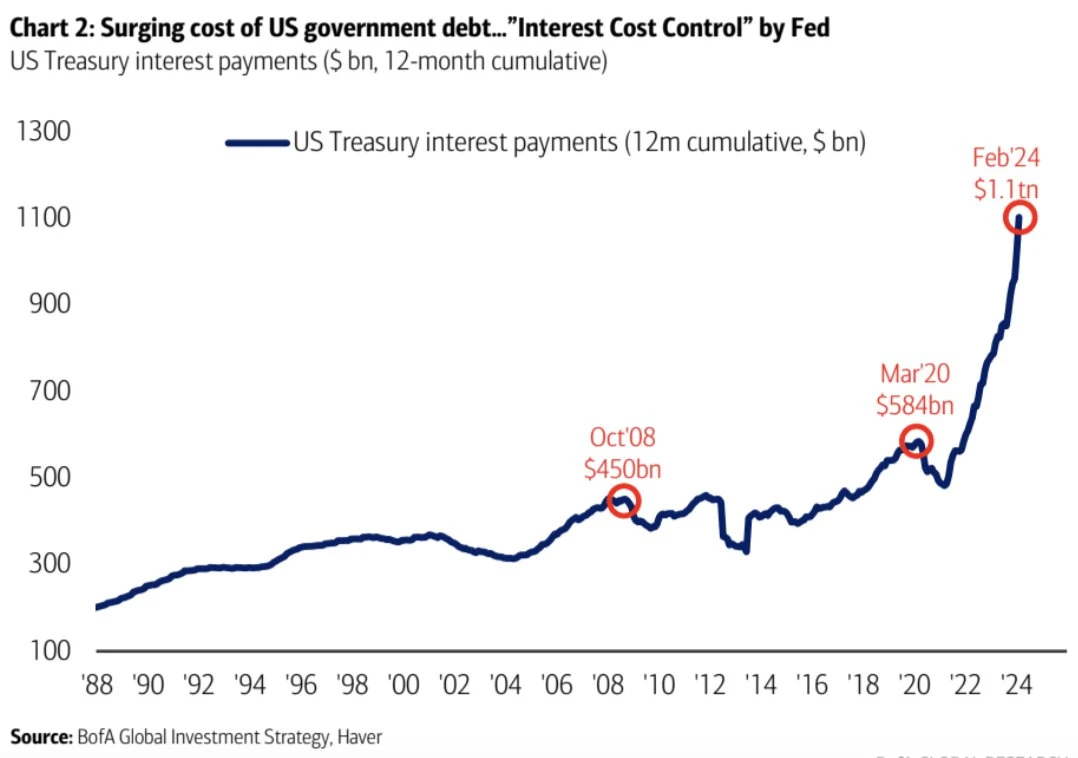

U.S. Treasury interest rate (Chart by Bank of America)

The U.S. dollar index continued to rebound in March, rising to 104.49 by the end of the month.

Gold prices hit all-time highs, BTC prices hit new all-time highs.

The accumulation of capital returning to the United States has simultaneously pushed up the equity and safe-haven markets.

Meanwhile, U.S. government spending on the national debt has reached $1.1 trillion over the past 12 months, doubling since the start of the pandemic. Bank of America noted in its report that if the U.S. government fails to cut interest rates by 150 basis points in the next 12 months, its interest costs will rise to $1.6 trillion. By the end of this year, U.S. debt interest will become the U.S. government’s largest expenditure item.

This is the cost of the additional issuance of U.S. Treasury bonds and the delay in interest rate cuts. It is also one of the underlying reasons why the market is betting that the U.S. government will cut interest rates as soon as possible.

The United States has cut interest rates, macro-finance has entered a period of easing, and the equity market and crypto market have entered a new round of rising cycles.

This is a point that attracts the most attention from global investors and is closely related to the crypto asset market.

The market is currently postponing interest rate cut expectations to the second half of the year. Whether it is the US stock market or the crypto market, some funds have begun to lock in profits and leave the market.

crypto market

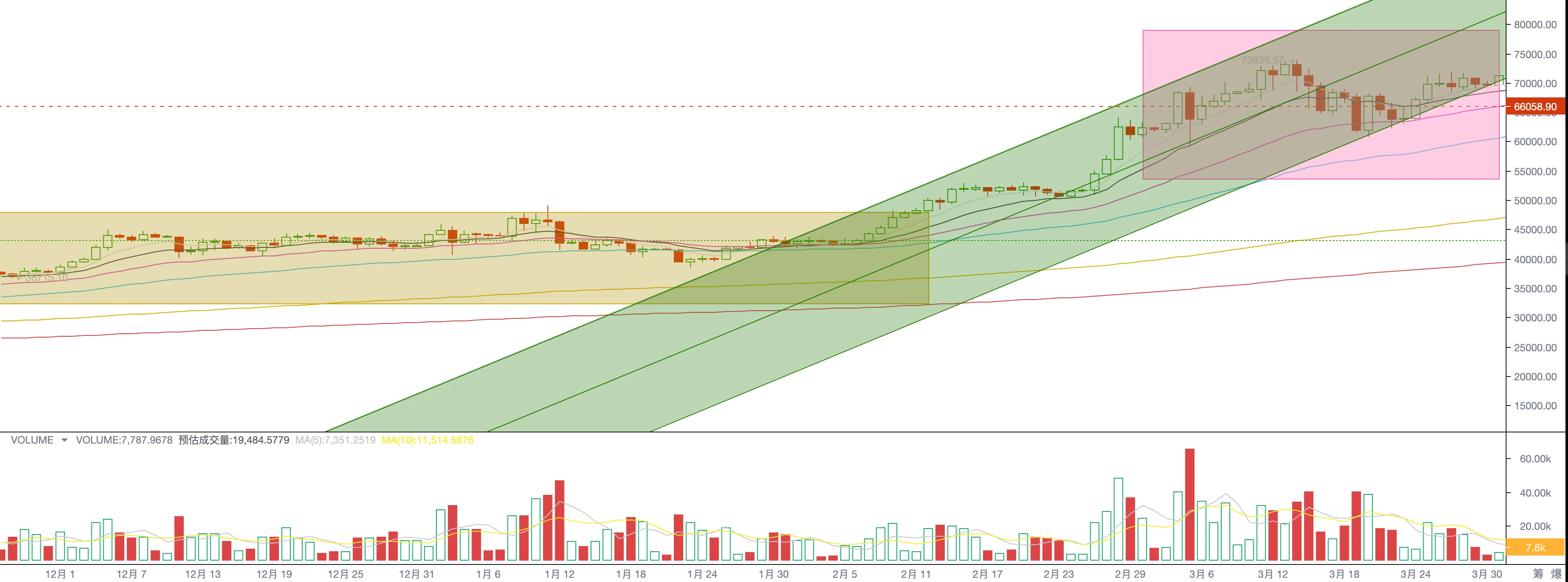

In March, BTC opened at US$61,179 and closed at US$71,289, rising 16.53% for the whole month, with an amplitude of 23.88%, achieving 7 consecutive months of growth, and the trading volume was the highest in July.

Throughout March, BTC remained within the “rising period” ascending channel. March 13 was the turning point of the mid-term trend. On that day, BTC hit a high since the current bull market. After that, the overall volume showed a downward trend. After hitting the bottom of the 30-day moving average on March 20, the volume energy failed to be activated again, indicating that the long and short sides were in a stalemate. As of April 2, when this report was written, BTC had fallen for two consecutive days, and the price once again tested the 30-day moving average, showing a trend of amplification in terms of volume and energy.

BTC’s 7th straight month of gains ties a record. Whether long or short, a lot of unrealized profits have been accumulated. As futures prices rise, the scale of profit-locking sales begins to become one of the focus of the market.

The game between inflow funds and the scale of BTC sales has become the dominant factor affecting BTC prices in the short and medium term.

big sell

We understand the bull market as a market phenomenon in which new participants bring capital to the market to snap up chips against the background of abundant funds, thereby driving existing holders to sell. For long-term BTC investors, a bull market is a time when strong selling can occur.

In this cycle, December 3, 2023 was the all-time high of long-term holdings, when they held a total of 14,916,832 BTC. Since then, as the bull market has gradually started, Changshou has begun a four-year cyclical sell-off, with a total of 897,543 BTC sold as of March 31.

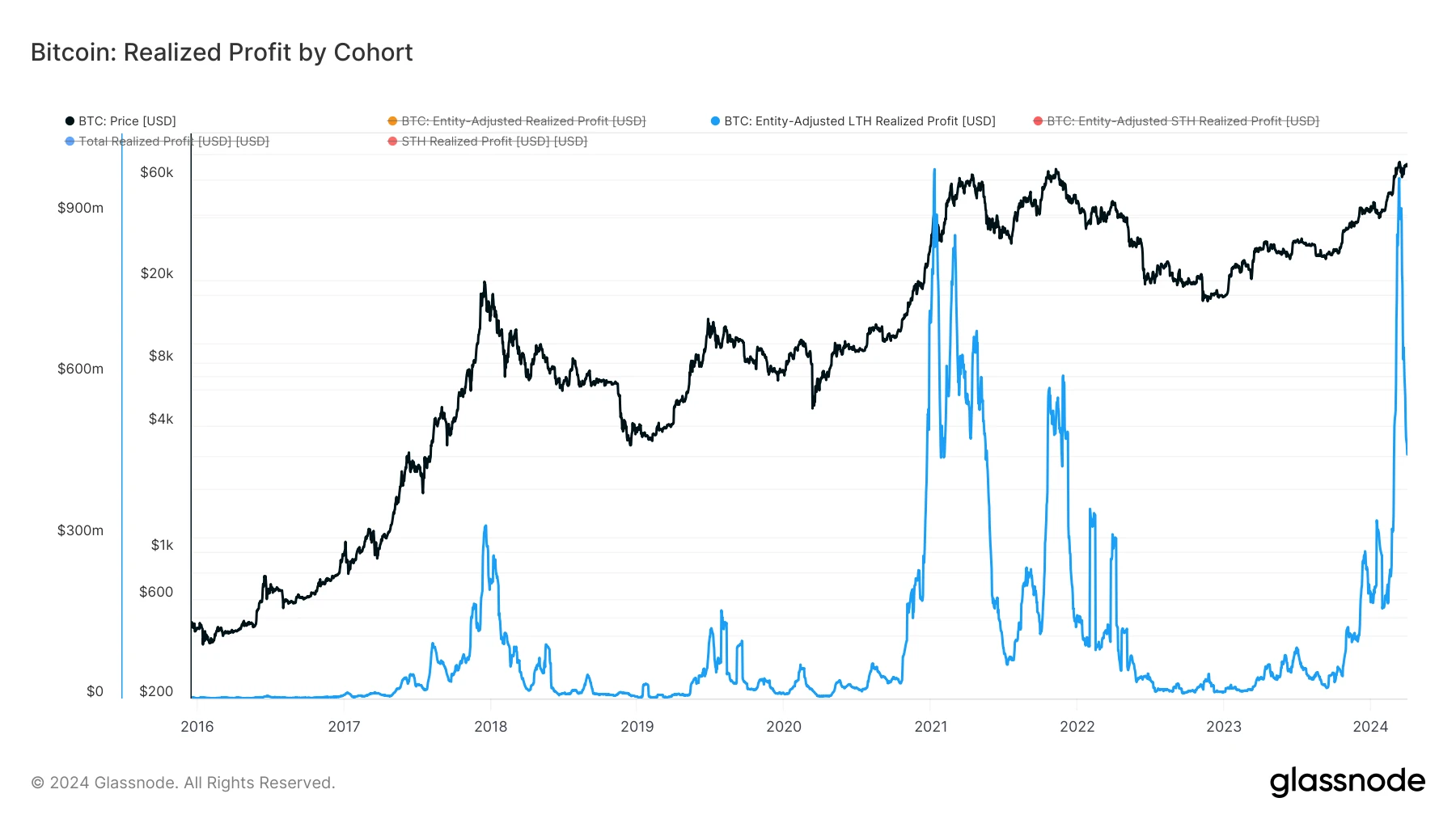

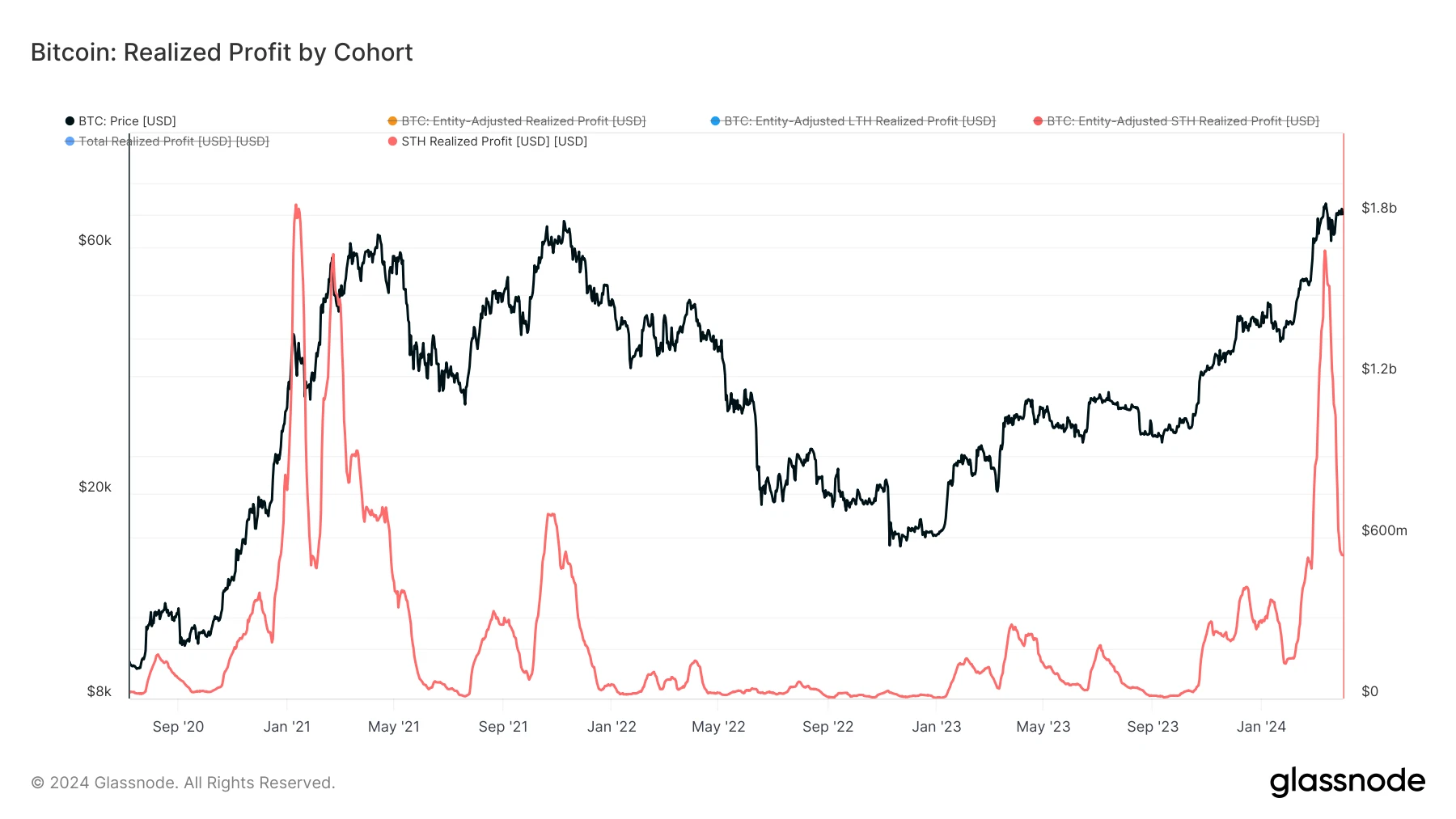

Long-term group selling profits

It starts with the long hand selling and ends with the short hand taking over. The two maintain a dynamic balance.

During the rising period, when the new influx of funds controls the pricing power, the main buying volume drives the price up and achieves balance.

During the rising period, when BTC sells long hands to control the pricing power, the main selling volume drives the price down and achieves balance.

There is also an important sub-group of participants - profit-making short-sellers, which will also become an important reason for pushing prices down during the rising period.

Observing the selling in March, we found that the long and short hands sold at the same frequency.

On February 26, both started large-scale transfers to exchanges and started a big sell-off. Both reached a transfer high on March 12, and the scale of transfers continued to decline thereafter.

The two reached a peak on March 12, and the BTC price began to fall from a high of $73,835.57 the next day, and fell to a March low of $60,771.14 on March 20.

After March 20, bulls used buying power to pull the BTC price back to $71,288.90. However, selling pressure continued to pour in after March 20, and eventually the price collapsed again in the first two trading days of April.

Short-selling group sells for profit

On March 12, the round of selling started by the long and short hands was the first wave of large-scale selling and the peak of profit locking by the two groups after entering the bull market. On that day, the two groups realized a total profit of up to 3 billion. From February 26 to March 31, the company achieved a total profit of US$63.1 billion.

It is worth noting——

During the first half of the big sell-off from February 26 to March 12, BTC was dominated by buying momentum, with the price rising from 51,730.96 to $71,475.93.

In the second half of the big sell-off from March 13 to March 31 (which has not yet ended), BTC was in a period dominated by selling momentum, with the price falling from 73709.99 to a maximum of $60771.74.

Although the selling peak was on March 12, the daily selling volume of long and short hands remained above one billion US dollars until the end of the month.

EMC Labs believes that this continuous and large-scale selling is the fundamental reason for the decline in BTC prices from March to April. This was the first round of big selling after entering the bull market. The sellers had the pricing power, which dampened the enthusiasm of the bulls to do long, causing the price to fall, and thereby locking in a cumulative profit of US$63.1 billion.

During the rising period, whether profit-locking selling will cause the price to fall depends on the balance of game power between the long and short parties. In the early stage of selling, the seller only sells tentatively, and the price will continue to rise. Therefore, the seller continues to increase the scale of selling, which eventually leads to the consumption of ammunition for multiple armies, causing the price to fall. After the decline, due to price reasons, sellers began to reduce the size of their sales, and the power of buyers continued to recover, thus pushing prices up again. The two continue to compete in the rise and fall of prices until the next selling range.

During the entire rising period, similar games often occur several times. After multiple sales, most of the chips entered the short-hand group, and liquidity became increasingly abundant. This made the buyers power finally lose in the long-short game, and the bull market ended.

EMC Labs’ judgment: At present, the selling power is declining significantly, but it is not over yet. While prices are difficult to predict, the first big wave of selling in the bull market is coming to an end. This wave of large-scale selling before the production cut cleared a large number of profit-making chips and raised the cost center of BTC, which will help to increase the price in the next stage.

The bull market gradually unfolds

One of the external factors for the start of this bull market is the inflow of funds caused by the approval of BTC ETF, while the internal factor is the development of technology and the implementation of new applications.

In the February report, we mentioned that the start of a cycle must be based on industrial development. Based on this logic, we set our sights on applying public chain data.

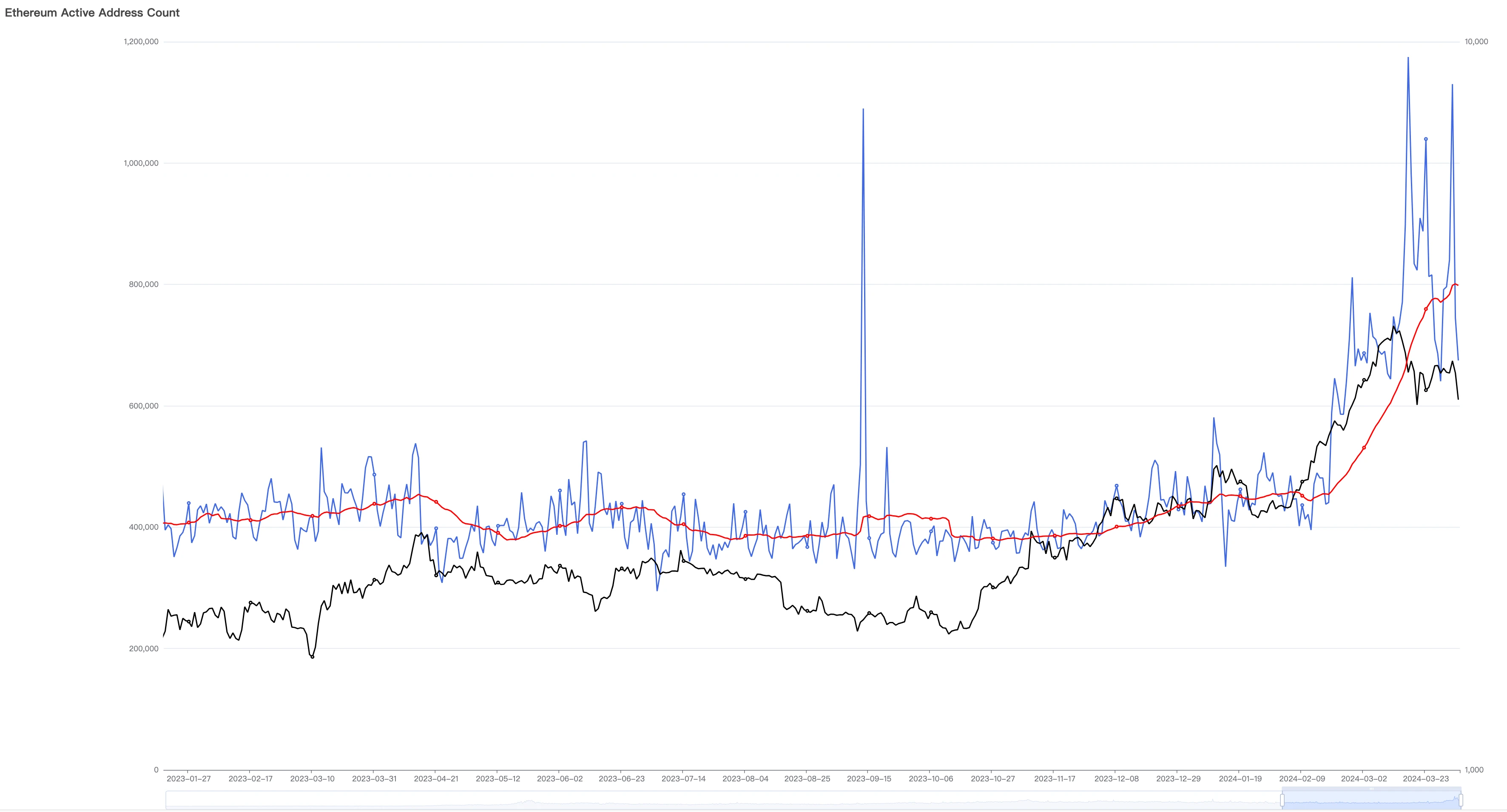

In March, Etherum completed the Cancun upgrade, which effectively reduced the gas fee of Layer 2 and increased the capacity of Layer 1 to a certain extent. We noticed that since February, the daily active users of the Etherum network have increased significantly, from about 400,000 at the beginning of February to 1.13 million at the end of March, an increase of nearly 2 times. For the Etherum community, this is a very bright result and a clear signal that the bull market has started.

Etherum daily active addresses

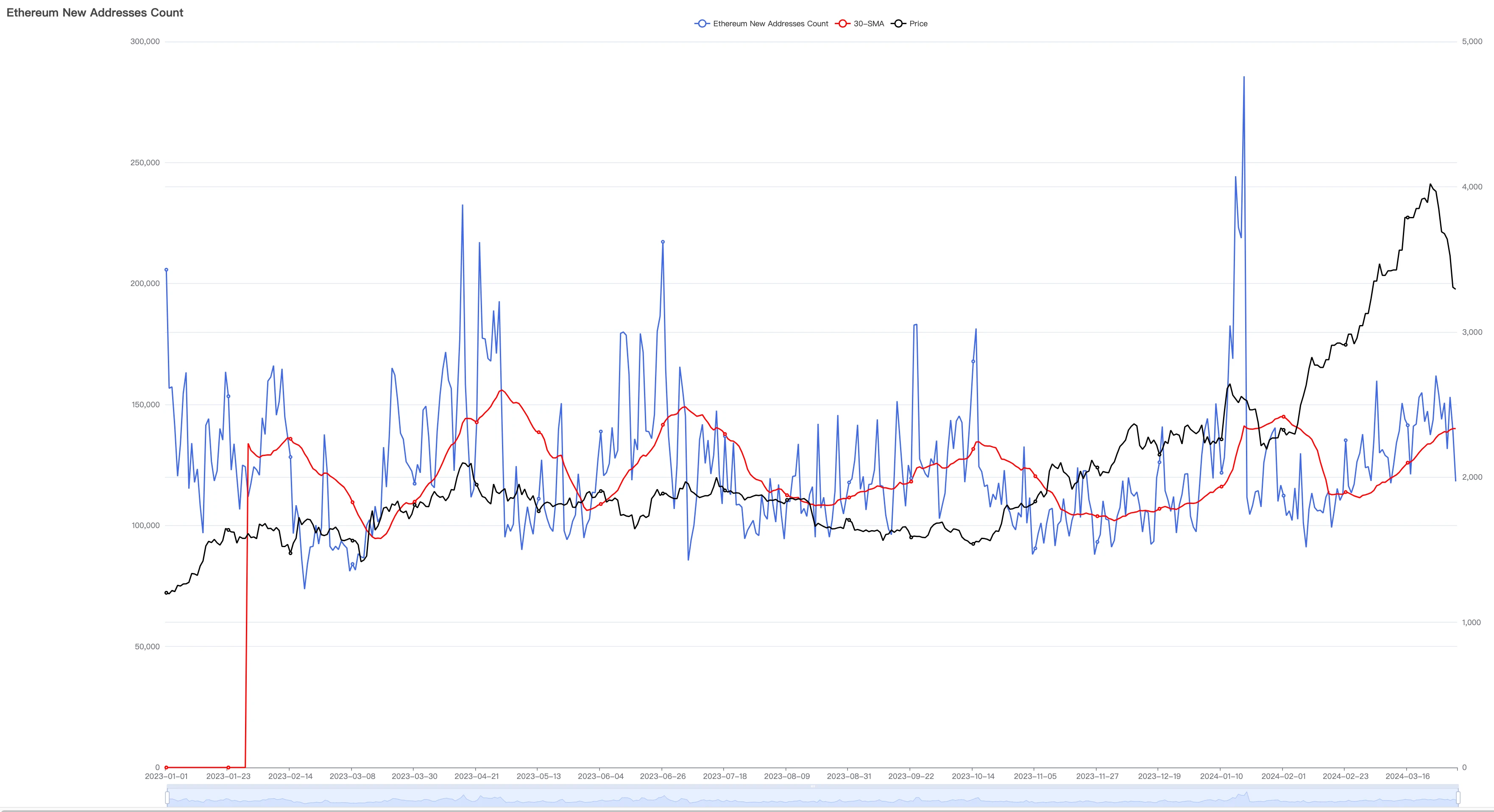

In a bull market, in addition to active existing users, new users will also flood into the market. We monitor this metric by adding new addresses.

Etherum daily new addresses

Since March, the number of new users on the Etherum network has improved to a certain extent, and the 30-day average user growth has continued to rise, but it has not exceeded last years high point. Since last year, the number of new users on the Etherum network has shown typical wave characteristics and has not yet shown a pulse-like upward trend.

The expansion of the bull market will inevitably be accompanied by the continued rise of Etherum network users. This is worthy of continued observation.

Regarding the data performance of Etherum, we can understand that the bull market has just started, mainly due to the recovery and activity of existing users, while large-scale new users have not yet arrived in droves.

When we look at other application public chains, such as BNB Chain, Avalanche, Polygon, etc., we find that users on the chain are still silent and do not show the vigorous momentum that a bull market should have.

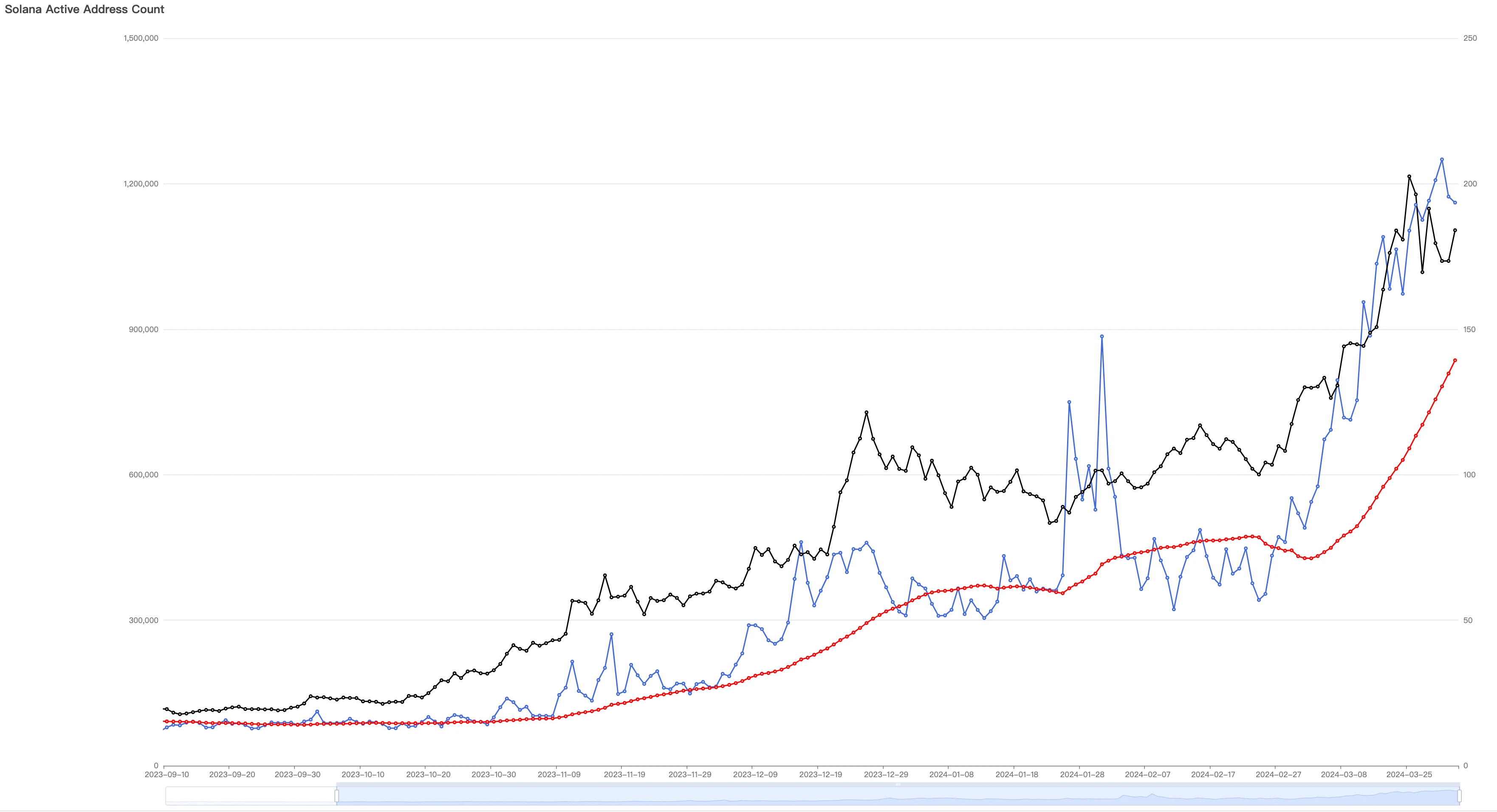

There is only one public chain that far exceeds the performance of Etherum, and this is the gloriously reborn and wildly growing Solana.

Looking at the statistics chart of new Solana users, we can see that it shows a perfect pulse-like growth trend. In 2023, its new users and prices continued to grow slowly. By mid-November, the slope of the growth curve began to increase, from about 300,000 new users per day to about 1.6 million in mid-January, an increase of more than 4 times. Since then, after two new declines in late January and late February, the entire March has been experiencing violent growth, with an increase of nearly 100% in the 30 days from the beginning to the end of the month.

This strong performance has enabled the Solana network to surpass the previous bull market and hit record highs in terms of daily new users, daily active users, and daily gas consumption.

This large-scale adoption is the fundamental support for SOL’s price growth to be far ahead among mainstream currencies.

Solana’s daily new addresses

Observing Solana’s daily active addresses, the trend is basically consistent with the new addresses.

Solana daily active user address

Solana of heterogeneous Etherum is considered to be the new carrier of DePin and the public chain supporting the USDC payment narrative.

However, we must see that these adoptions are far from fully unfolded, and the primary use case for the Solana network at the moment is the issuance and hype of the MEME coin. Phenomenal MEME coins such as Bonk, BOME, and WIF have appeared one after another, with daily transaction volume reaching hundreds of millions of dollars. A large number of MEME coins that were born and died completed their lives within a week, but speculators were still happy with it, causing more than 1,000 new MEME coins to be born every day.

Although Solana is launching impressive innovations in the fields of DePin, DEX, Staking, Oracle, RWA, etc., the current wave of large-scale adoption of Solana is still MEME speculation, just like the Etherum ICO frenzy in 2017.

This is worrying.

liquidity

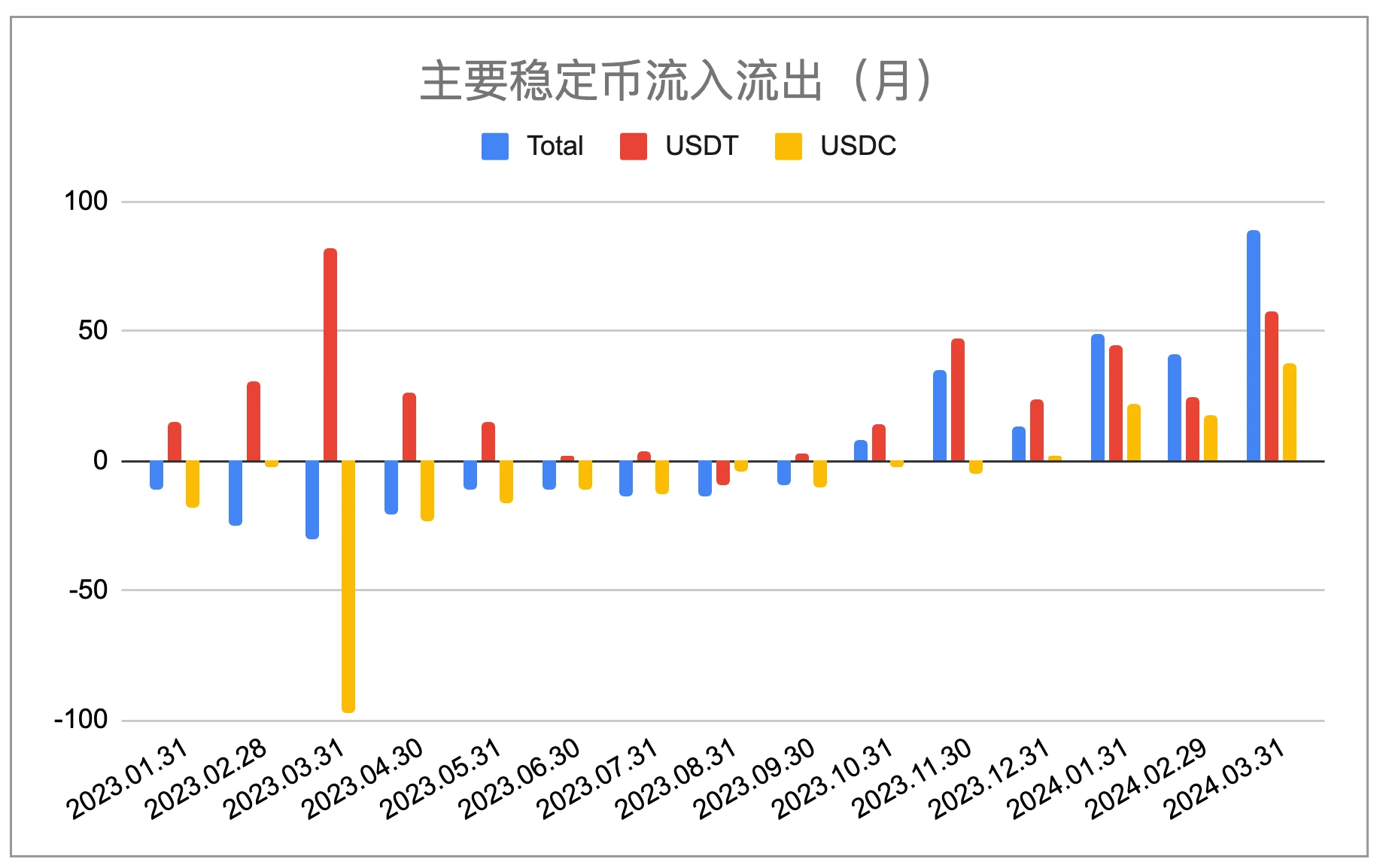

Stablecoin supply trends (EMC Labs statistics)

In previous reports, EMC Labs has repeatedly pointed out that the trend change of stablecoins from outflows to inflows in October 2023 is cyclical. This trend is the main external factor for the start of the bull market, and its cyclical nature will not end in a short time.

Throughout March, stablecoin channels saw a total inflow of $8.9 billion, setting a monthly record for this cycle. This inflow was fundamental support for BTC prices as they hit all-time highs this month, and was one of the takers for selling BTC.

The circulation scale of stablecoins has not yet reached the high point of the last bull market, and the scale and rate of subsequent inflows need to be paid close attention to.

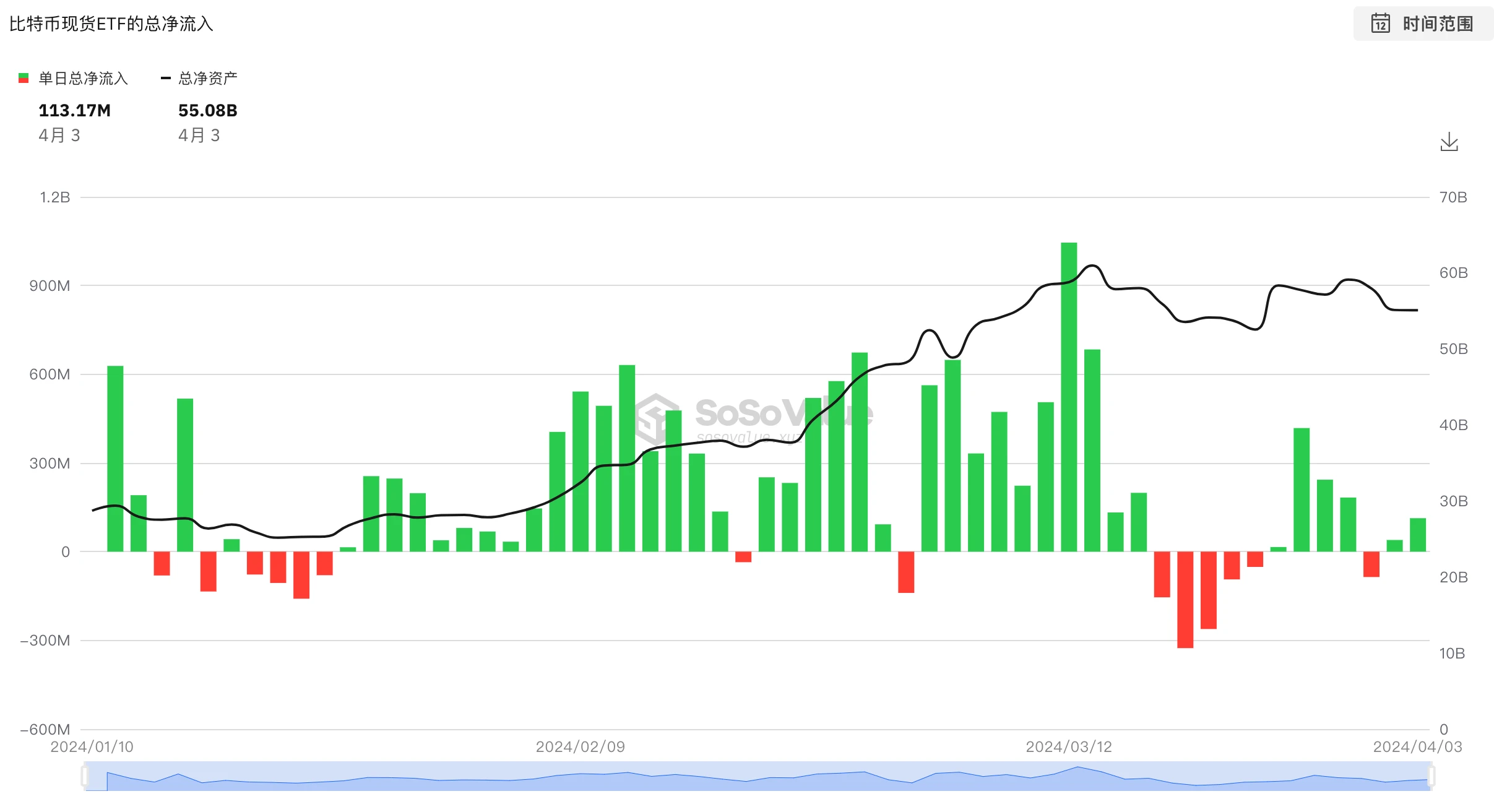

Since the United States approved 11 BTC ETFs in January this year, funds from this channel have also become one of the important factors affecting the market.

Observing the data, we can see that the BTC ETF did not experience large-scale outflows during this round of major selling adjustments, and only recorded small outflows from March 18 to March 22.

11 Support BTC ETF inflow and outflow statistics (SosoValue)

Based on the inflow and outflow analysis of BTC ETF, we judge that the funds in this channel have only reduced positions in a short period of time, and the scale is around 10 US dollars. This amount of funds is still small compared with the locked-in profits of US$63.1 billion, so it is not the fundamental reason for this round of adjustment.

Funds in the BTC ETF channel continue to flow in, which is one of the important supports for the subsequent recovery and new highs of BTC prices.

Conclusion

In this report, we analyze the phenomenon of long-term investors and short-term profit makers starting the first round of the new cycle after the price of BTC broke through a new high.

The sell-off helped sellers lock in $61 billion in profits, causing BTC prices to drop around 17%.

Based on the market structure, we judge that this kind of selling is a normal phenomenon during the market rise; based on the capital inflow of stablecoins and ETF channels and the adoption of application chains, we judge that there will be recurrences in the market outlook, but this round of crypto bull market is taking shape. To unfold in sequence, long-term investors should actively go long on the basis of caution.

about Us

EMC Labs (Emergence Labs) was founded in April 2023 by crypto asset investors and data scientists. Focusing on blockchain industry research and Crypto secondary market investment, with industry foresight, insight and data mining as its core competitiveness, it is committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and encrypted assets as Blessings to humanity.

For more information please visit:https://www.emc.fund