Original title: Lessons From History: A Retrospective on Bitcoin Halvings and Industry Dynamics

Original source: Binance

Original compilation: Kate, Mars Finance

Main takeaways:

The Bitcoin halving, which aims to regulate the supply of new BTC tokens, has historically impacted the tokens supply dynamics, market sentiment, and adoption.

Halvings tend to increase Bitcoins popularity, leading to an increase in price and adoption. They also stimulate discussions related to blockchain technology, the dynamics of the Bitcoin network, and crypto as a distinct asset class.

While historical patterns show BTC prices rising and adoption expanding in the months following the halving event, it’s important to note that the upcoming halving in April 2024 has already been dismissed in several important ways. The proof is unprecedented.

The Bitcoin halving, an event at the heart of the original cryptocurrency’s value proposition, is more than just a footnote in the history of digital finance; this shift has implications for the entire ecosystem, reshaping market dynamics and investor sentiment every time it occurs. . In this article, we take a closer look at the multifaceted impact of the Bitcoin halving on the digital asset industry, revealing its impact beyond short-term price movements. The next halving event is expected to occur in the third week of April, and now that it’s nearing its end, it’s instructive to look at historical data. However, the observed patterns this time around are by no means a guarantee of similar outcomes: the current cycle is unfolding in a unique context and has proven to differ from historical precedent in some important ways.

this is ancient history

Halving is a fundamental mechanism in the Bitcoin protocol designed to regulate the issuance of new coins by regularly reducing mining rewards. This deliberate reduction, designed to curb the rate at which new Bitcoins are created, plays a key role in shaping Bitcoin’s token economics and supply dynamics, reinforcing Bitcoin’s deflationary nature and underpinning Bitcoin’s value proposition . To summarize the basic facts of the Bitcoin halving, check out our video explanation:

Historically, Bitcoin halvings have had a powerful impact on the crypto industry and the broader financial ecosystem. Through the lens of history, tracing the halving events of 2012, 2016, and 2020, we can observe certain recurring patterns in how halvings have affected the crypto world. These events acted as inflection points, catalyzing swings in market sentiment and investor behavior, and interrupting Bitcoin’s evolution as a locomotive of the crypto ecosystem.

150 days later

When dissecting the consequences of halving events, one cannot ignore their impact on Bitcoin’s price and market capitalization. At the heart of the halving mechanism is the principle of scarcity, which attracts investors seeking to issue limited assets, thereby driving up the value of the asset. As supply decreases and demand increases over time, the stage is set, at least in theory, for price increases, which typically materialize gradually over the next few months rather than immediately.

Historically, Bitcoin has experienced significant price increases within 5-6 months after each halving event. For example, in the 150 days after the first three halvings in 2012, 2016, and 2020, Bitcoin prices increased by 999%, 15%, and 24% respectively.

In every four-year period between previous halving events, Bitcoin has reached new all-time highs. In the 2020-2024 cycle, this all-time high was achieved in October 2022, when Bitcoin surpassed the $66,000 mark. What is unique about the upcoming 2024 halving is that for the first time in its history, Bitcoin reached a new all-time high before the halving in early March 2024. Whether this is a warm-up before hitting new highs after the halving, or reaching the coveted highs prematurely, remains to be seen.

The mechanism by which the halving affects prices may be by shaping market sentiment and investor perceptions. In addition to building expectations within the crypto community, halving events drive narratives about the advantages of algorithmic monetary policy and the deflationary properties of digital assets, sparking interest from outside the crypto space and driving new players into the space.

beyond price

In addition to the price-related effects and increased attention (partly through these effects), the halving is also associated with profound, long-term growth in adoption metrics. Bitcoin’s increased popularity both before and after the halving has spurred more newcomers to explore and potentially purchase the digital currency, helping to expand its user base.

Additionally, Bitcoin’s halving prompted miners to reassess the cryptocurrency’s underlying technology and network dynamics as miners undergo a transformation. Discussions around cybersecurity, transaction fees, and scalability solutions are growing. Enhancements in these areas enhance the robustness of the Bitcoin network and increase user and business confidence, thereby creating a conducive environment for Bitcoin adoption. Halvings also tend to reduce miner profit margins, creating additional Bitcoin selling pressure from miners and accelerating the consolidation of mining operations and mining pools.

With each halving event, the need for efficiency and innovation becomes more apparent, driving technological advancements that not only improve the performance of the Bitcoin network but also increase its appeal to a wider audience.

Let’s look at a simple adoption metric – the number of active Bitcoin addresses – using the same 150-day window as the price dynamics. In the first 150 days of each previous halving, the number of new Bitcoin addresses grew: 83% in 2012, 101% in 2016, and 11% in 2020.

The number of addresses holding $100 and above in assets (which is a rough proxy for the number of retail investors) grew by 12% in 2012 and 6% in 2020, and has remained essentially unchanged in the 150 days following the 2020 halving. While these are imperfect indicators that employ dynamics and sentiment (e.g., one person can create multiple wallets), they indicate the directionality and magnitude of trends following past halvings.

Likewise, institutional interest in Bitcoin also tends to spike around halving events, driven by Bitcoin’s ability to serve as a store of value and a potential hedge against inflation. High-profile support from corporate bonds and high-profile investors has further fueled Bitcoin adoption, confirming its legitimacy as an investable asset class. As institutional capital flows into the cryptocurrency market, infrastructure and products emerge, paving the way for widespread cryptocurrency adoption by traditional financial institutions and retail investors.

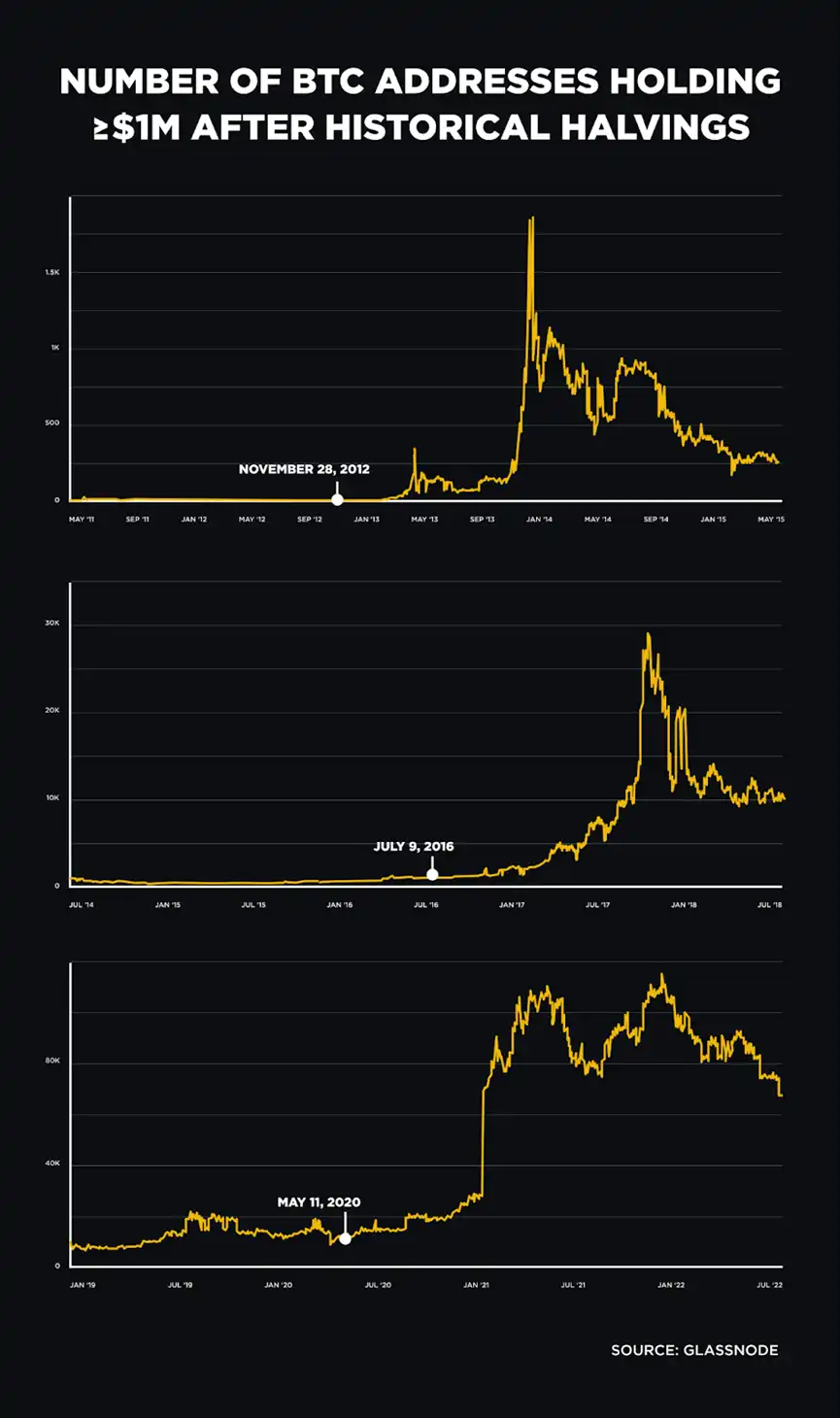

For example, the number of wallets holding more than $1 million, which can be considered an indicator of professional or institutional investment activity, increased by thousands of percentage points in 2012, by 10% in 2016, and by 43% in 2020.

Whats next?

The next Bitcoin halving will occur in April, against a backdrop of strong inflows into the Bitcoin industry and centralized exchanges like Binance, as well as a boom in institutional participation fueled by the approval of a spot Bitcoin ETF in the United States.

Coupled with a surge in second-layer solutions and DeFi activity that enhances the network’s real utility, this setup is starting to be very beneficial for the Bitcoin ecosystem and the broader crypto space.

However, it is important to remember that while the backdrop surrounding the 2024 halving is auspicious, there is no guarantee that its dynamics and impact will mirror previous halving events. Each halving represents a unique point in Bitcoin’s development, affected by changing market conditions, technological advances, and regulatory developments. So while there is optimism about the transformative potential of the 2024 halving, caution requires acknowledging the inherent unpredictability of market dynamics and the need for vigilance when navigating the ever-changing landscape of digital assets.

Each Bitcoin halving represents a fundamental shift in the crypto industry, with profound consequences for adoption and market evolution. In addition to its direct impact on price and investor sentiment, the Bitcoin halving has also promoted interest and awareness of Bitcoin, institutional participation and technological innovation, laying the foundation for the continued growth and maturity of digital finance. As we navigate the ever-evolving crypto landscape, the significance of the Bitcoin halving is a testament to our industry’s enduring strength and resilience.