Original title: Onchain Finance Is Thriving; What’s Next?

Original author: Mario Laul

Release Date:April 15, 2024

Decentralized public blockchain networks have been around for about 15 years, and the crypto assets associated with them are currently experiencing their fourth major market cycle. Over the years, especially since the launch of Ethereum in 2015, we have spent a lot of time and resources to build the theory and develop applications based on these networks. While these networks have made significant progress in financial use cases, other types of applications have struggled, mainly due to the complexity of providing scalable and smooth user experience under the constraints of decentralization, as well as the fragmentation of different ecosystems and standards. However, recent technological advances have made applications both in and outside the blockchain industry not only more feasible, but more necessary than ever.

The early days of blockchain adoption were driven by a rather narrow definition of its core functionality: enabling the secure issuance and tracking of digital assets without reliance on centralized intermediaries such as traditional financial or government institutions. Whether we are talking about blockchain-native fungible tokens such as BTC and ETH, the on-chainization of off-chain assets such as national currencies and traditional securities, or non-fungible tokens (NFTs) representing artworks, game props, or any other type of digital product or collectible, blockchain tracks these assets and allows anyone with an internet connection to trade them globally without touching centralized financial tracks. Given the size and importance of the financial industry, especially in the context of increasing digitization, globalization, and financialization, this alone is enough to prove that blockchain is a revolutionary technology and is enough to attract global attention.

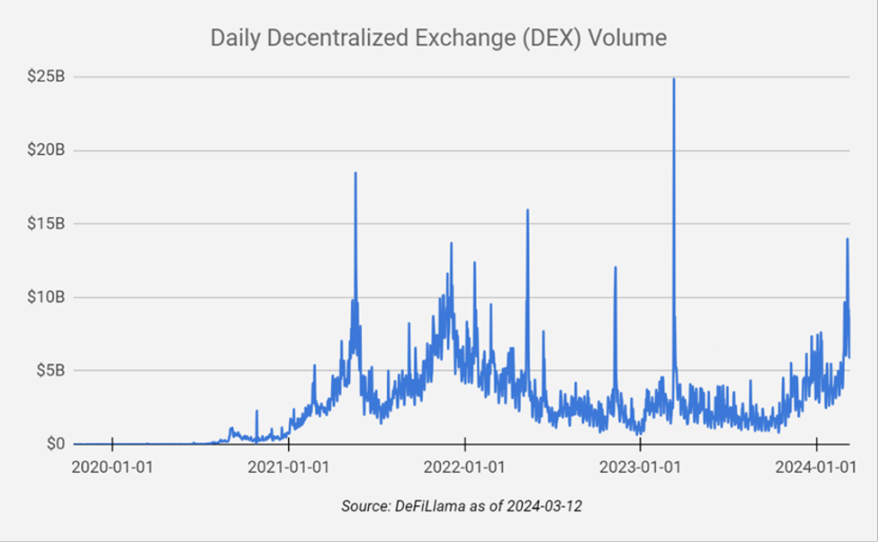

Within this narrow framework, there are currently five blockchain applications with significant product-market fit, in addition to the underlying asset ledgers and the decentralized networks that maintain them: applications for issuing tokens, applications for storing private keys and transferring tokens (wallets), applications for trading tokens (including decentralized exchanges DEX), applications for lending tokens, and applications that give tokens a predictable value relative to traditional fiat currencies (stablecoins). At the time of writing, the number of crypto assets listed on crypto market data aggregator Coingecko has exceeded 13,000, with a total market capitalization of approximately $2.5 trillion and daily trading volume exceeding $10 billion. Nearly half of this value is concentrated in a single asset, BTC, and the vast majority of the other half is distributed among the top 500 assets. However, the long tail of tokens is long and growing, especially after NFTs are also included, which shows how much demand there is for blockchain as a digital asset ledger.

According to recent statistics, there are about 420 million people around the world who hold crypto tokens, although many of them may have never or rarely interacted with decentralized applications. A report from hardware wallet manufacturer Ledger shows that its Ledger Live software has about 1.5 million monthly active users, while software wallet providers MetaMask and Phantom claim about 30 million and 3.2 million monthly active users, respectively. Combined with daily DEX trading volume of about $5-10 billion, about $3-35 billion in locked value in the on-chain lending market, and a stablecoin market capitalization of about $130 billion, these figures show that the current level of adoption of the above five categories of applications is still low relative to traditional finance and fintech, but still significant. Granted, these figures should be considered in the context of the recent surge in crypto asset prices, but as blockchain regulation becomes more and more complete (the approval of spot Bitcoin ETFs and tailored regulatory frameworks such as Europes MiCA), they may also continue to attract new capital and users, especially in the context of increasing integration with traditional financial assets and institutions.

However, financial applications such as tokens, wallets, DEXs, lending, and stablecoins are just the tip of the iceberg of applications that can be built on general-purpose programmable blockchains. Blockchain adoption should not be measured in the narrow scope of being an enhanced asset ledger, but should be placed in a wider scope, such as being a more general alternative to centralized databases and web application platforms. The number of developers worldwide is now close to about 30 million, but according to Electric Capitals latest Crypto Developer Report, there are still less than 25,000 monthly active developers on public blockchains, of which only about 7,000 are full-time roles. These numbers show that blockchain currently has a considerable gap with traditional software platforms in attracting developers. However, the number of developers with at least 2 years of Crypto development experience has increased for five consecutive years, and the number of contributors in each ecosystem is above 1,000. In addition, Crypto has attracted more than $90 billion in venture capital in the past 6-7 years. While the vast majority of these funds are indeed used to build the underlying blockchain infrastructure and core decentralized financial (DeFi) services (which are called the backbone of the emerging on-chain economy), it can also be seen that capital is also quite interested in non-financial, practical application areas, such as online identity, games, social networks, supply chains, the Internet of Things, and digital governance. So, how successful are these types of applications in the most mature and widely used smart contract blockchains?

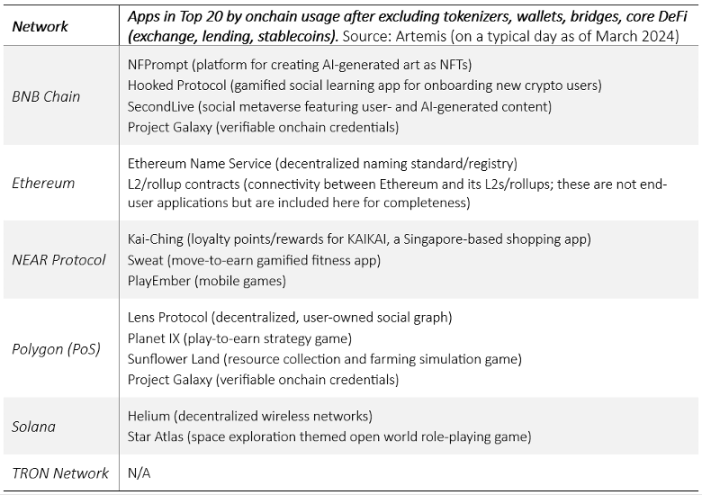

There are three main metrics that provide a glimpse into the market’s interest in specific blockchains and applications: daily active addresses, daily transaction volume, and daily fee expenditures. An important thing to understand before interpreting these metrics is that they can all be easily inflated, so these numbers should only be used as a very rough estimate. According to Artemis, an on-chain data aggregator, six networks have stood out in all three metrics over the past 12 months (each network ranked in the top 6 in at least two metrics): BNB Chain, Ethereum, NEAR Protocol, Polygon (PoS), Solana, and TRON. Four of these networks (BNB, Ethereum, Polygon, TRON) are using the Ethereum Virtual Machine (EVM), and therefore benefit from the tooling versatility and network effects of Solidity (a programming language created specifically for the EVM). Both NEAR and Solana have their own native execution environments, both of which are primarily based on Rust, which, while more complex, has various performance and security advantages over Solidity, and it also has a thriving ecosystem outside the blockchain industry.

On-chain activity for all six networks is concentrated in the top 20 applications, with daily active addresses (inaccurate data) for applications after the top 20 falling to thousands or even hundreds, depending on the network. As of March 2024, on an average day, the top 20 applications account for 70-100% of the three metrics considered, with Tron and NEAR having the highest concentration and Ethereum and Polygon the lowest. Across all networks, the top 20 applications are mainly those related to tokenization, wallets, and DeFi (exchanges, lending, stablecoins), with almost no or very few applications that do not belong to this category (0-4 per network). In addition to bridges for transferring value between different blockchains and NFT trading markets (both of which should be included in the asset transfer and exchange category), the remaining few outliers are usually games or social applications. However, in 5 of all 6 cases, the share of applications in the entire network activity is very low, such as less than 20% for the best data from Polygon, but usually less than 10%. The only exception is Near, but its usage is very concentrated, with two applications Kai-Ching and Sweat accounting for about 75-80% of all on-chain activity, and there are less than 10 applications with more than 1,000 daily active addresses.

All of the above reflects the legacy of blockchain’s early days and reinforces its core value proposition as a digital asset ledger. The common criticism of blockchain’s lack of applications is clearly unfounded, as their primary function is programmable financialization and secure settlement of tokenized value. Asset issuance, wallets, DEXs (or exchanges more broadly), lending protocols, and stablecoins have such a strong product-market fit simply because they are closely related to that purpose. Given the relatively simple business logic and strong positive feedback loops between these five blockchains, it is not surprising that the first generation of leading smart contract blockchains tend to serve mainly this narrow financial use case. And, since the uses of many blockchain applications with non-financial utility are ultimately related to tokenization and financialization, these five financial applications will likely still dominate the main general-purpose blockchains in the long term.

But what does this mean for the more ambitious vision of blockchain as a general application platform? For many years, the two biggest challenges facing the crypto industry have been 1) blockchain scalability (both throughput and cost), and 2) achieving a simple user experience without sacrificing the decentralization and security guarantees of the underlying infrastructure. In terms of scalability, two approaches are currently generally adopted, a more integrated architecture and a more modular architecture. Solana belongs to the former, while Ethereum and its Layer-2 (Rollups) ecosystem demonstrates the latter. In fact, these two approaches are not mutually exclusive, and there is considerable overlap and integration between them. But the more important point is that both approaches are now mature options for scaling blockchains, depending on whether the application in question needs to share state and maximum composability with other applications, or is less concerned with seamless interoperability but seeks to benefit from full sovereignty over its governance and economy.

We have also made significant progress in improving the end-user experience of blockchain applications. Specifically, thanks to the development of technologies such as account abstraction, chain abstraction, proof aggregation, and light client verification, there are now ways to safely remove some of the major user experience barriers that have plagued Crypto for many years, such as having to keep private keys or mnemonics, having to pay transaction fees, account recovery limitations, and over-reliance on third-party data providers, especially in the case of multiple chains. Combined with the increasing number of decentralized data stores, verifiable off-chain computation, and other back-end services used to enhance the functionality of on-chain applications, the current and upcoming application development cycle will prove whether blockchain will become a major player in global financial infrastructure or a more general role. Given the vast number of application scenarios beyond DeFi, these use cases will benefit from greater resilience and better user-centric control of data and transactions, such as online identity and reputation, publishing, gaming, physical infrastructure such as wireless and the Internet of Things (DePin), decentralized science (DeSci), and solving the authenticity problem of growing AI-generated content. These use cases have always been attractive in theory, and now they are becoming feasible in practice.