Coinbase: Searching for the next crypto catalyst

Original author: David Han

Original translation: Lynn, Mars Finance

At first glance, while on-chain innovation has reached unprecedented levels and is constructive for the sector in the long run, we believe macro factors are likely to play an important role in the short term.

Key Points

While Bitcoin halvings have historically sparked bullish trends, these cyclical upticks are often accompanied by other ecosystem catalysts that provide additional impetus.

A growing talent pool, mature developer tools, and increasing blockchain scalability make a wider range of verticals the catalyst for this cycle, although the channel for inflows of liquidity appears to have shifted from venture financing to spot ETF inflows.

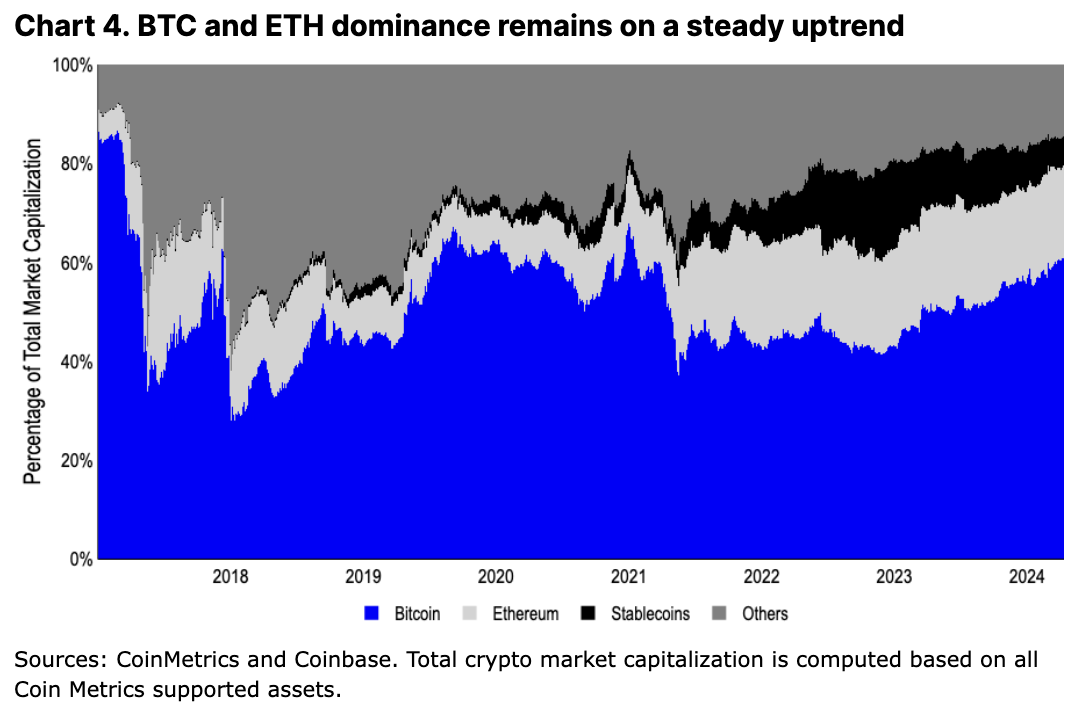

In the short term, we expect Bitcoin’s dominance to remain elevated as the broader macro environment becomes more risk-averse and liquidity injections via ETFs are unlikely to shift to higher beta assets.

In addition to the Bitcoin halving, which we have previously detailed, the market is looking for new catalysts to sustain the Q1 rally sparked by the approval of a spot Bitcoin ETF in the United States. The continued growth in stablecoin issuance and the growth in the total value locked (TVL) in DeFi protocols indicate continued strong on-chain activity. Meanwhile, continued platform innovation at the layer 1 (L1) and layer 2 (L2) levels, coupled with improved wallet tools for a better user experience, form the basis of some of the narratives we believe will be most relevant in the coming months.

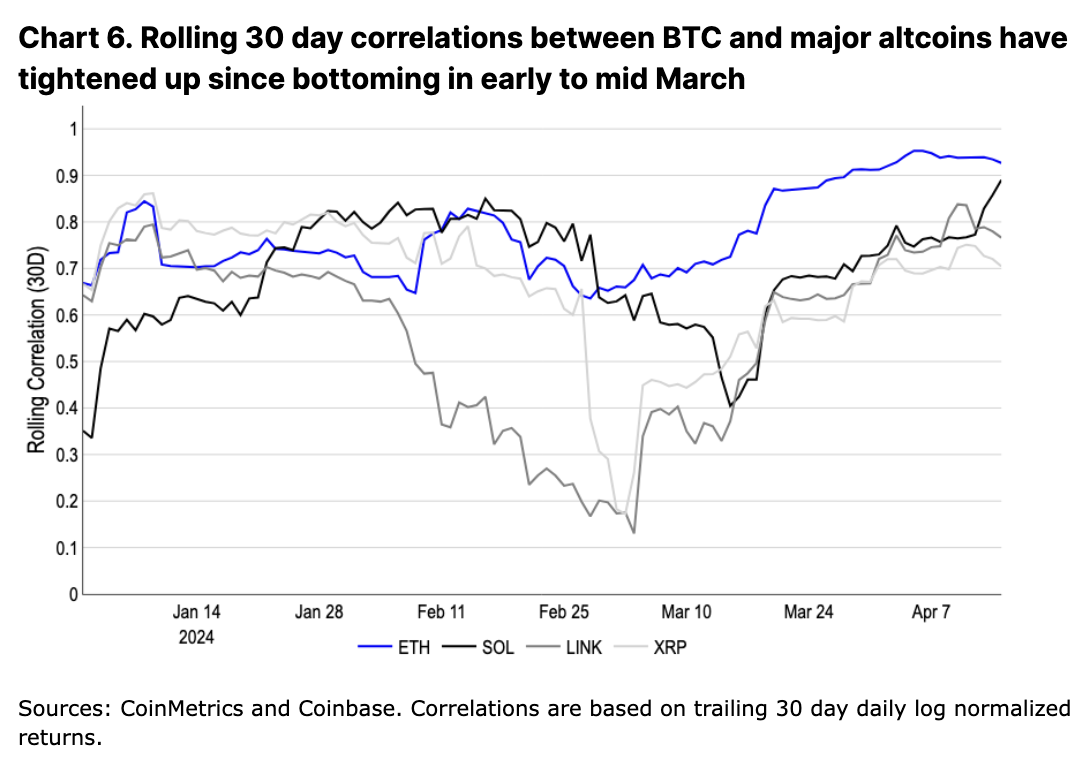

That said, we believe short-term activity is more likely to be driven by macro factors, even though crypto fundamentals remain generally strong. These factors are largely exogenous to crypto and include rising geopolitical tensions, rising long-term interest rates, reflation, and rising national debt. In fact, the recent rise in altcoin correlation with BTC highlights this, indicating BTC's anchoring role in the space, even as BTC solidifies its position as a macro asset.

While cryptocurrencies have historically been largely viewed as a risk-on asset class, we believe Bitcoin’s continued resilience and the approval of spot ETFs has created a polarized investor base (particularly in Bitcoin) — one that views Bitcoin as a purely speculative asset and another that views Bitcoin as “digital gold” and a hedge against geopolitical risk. We believe the growth of the latter camp partially explains the smaller pullbacks we have seen so far in this cycle given the broader macro risks.

Post-halving model

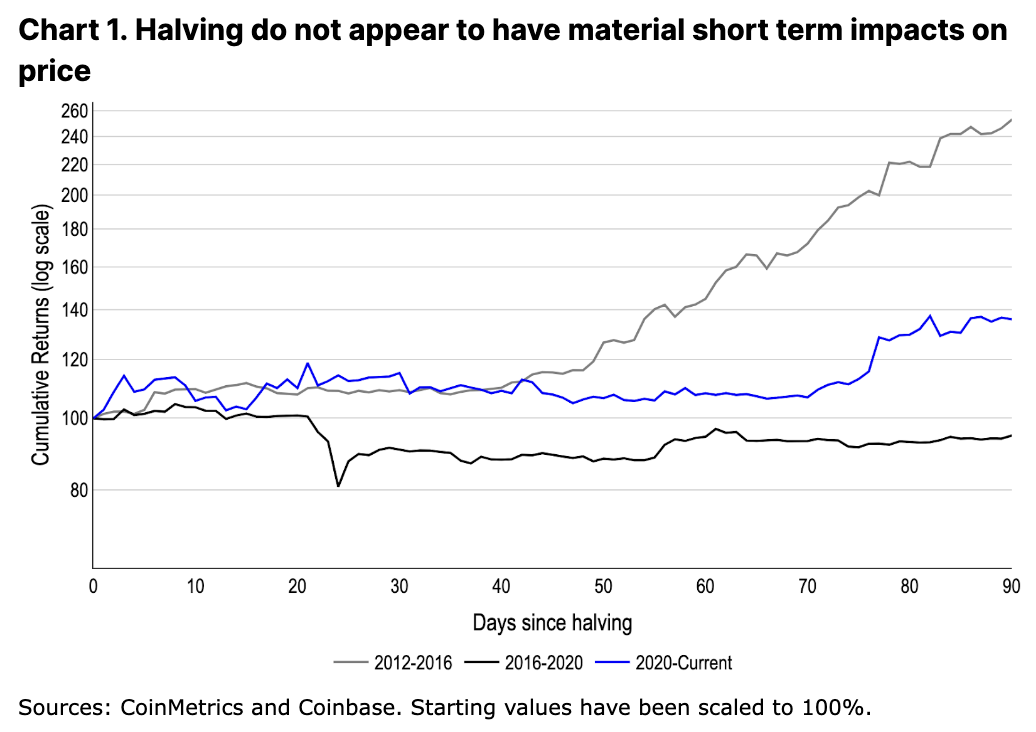

Previous halvings have often been cited as triggering cyclical bullish trends, though the direct impact of the halving appears largely insignificant in the short term. In fact, BTC fell 19% in the month following the 2016 halving, while remaining essentially unchanged in the more than two months following the 2020 halving (see Figure 1). Similarly, we do not expect the upcoming halving to be a transaction-intensive story, though we believe its relevance in flows is therefore overlooked - at $63,000 BTC, the halving equates to a $10.3B reduction in annual BTC issuance, with net inflows of $12.4B to date to US spot BTC ETFs offsetting BTC outflows by a similar amount.

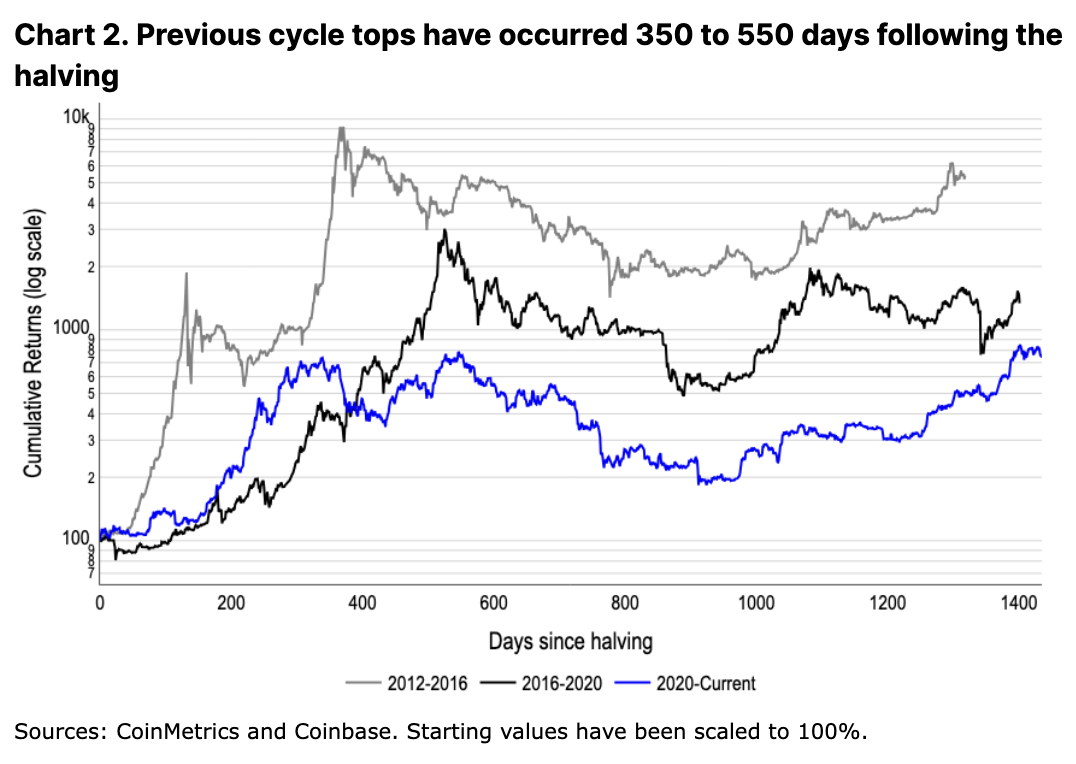

Bitcoin In fact, we believe that increased access to a broader capital base through spot ETFs, coupled with new supply-side dynamics, is constructive for the asset class in the long term. However, if previous cycles are any indication, this may take several months to fully materialize. Post-halving tops occurred between 350 and 550 days after the event (see Figure 2), although this cycle timing has been different. With Bitcoin reaching a new all-time high just over a month before the halving on the back of spot ETF inflows, we expect Bitcoin to deviate further from the prior time trend.

Bitcoin Halvings aren’t just good for Bitcoin, however. Constructive narratives in parallel cryptocurrency verticals often occur after halvings as the industry matures. The initial coin offering (ICO) boom following the 2016 halving carried the market’s euphoria into 2017. Similarly, the 2020 DeFi summer kicked off the rise of decentralized applications (dApps) like Uniswap and Maker, kicking off nearly two years of experimentation in DeFi primitives and other early products.

Sources of Liquidity

The number of cryptocurrency verticals has swelled tenfold today as new tools and use cases emerge. Blockspace has never been cheaper, and the number of on-chain “things to do” has never been greater. Social apps like Farcaster are poised for early adoption, while a host of well-designed blockchain games are starting to come online. Wallet improvements are enabling developers to deploy a more seamless onboarding journey, and DeFi primitives continue to expand into areas like liquidity rehypothecation and novel on-chain derivatives. Meanwhile, tokenization projects across different financial products and jurisdictions are making significant progress, and the overlap between on-chain financialization and off-chain physical assets continues to grow. This is largely driven by the incredible growth in the infrastructure infrastructure built during the bear market.

We believe this may lead to a different pattern this cycle, with more diverse sub-sectors outperforming simultaneously (rather than the industry concentrating on one or two major themes). In particular, in a world of standalone applications (which abstract blockchain components from users) with increasing technical complexity, the differences between tokens and revenue models are becoming greater. This breadth is giving rise to new forms of revenue streams that were not typically available in previous cycles. For example, BonkBot, a Telegram bot that works with the BONK community, regularly generates over $100,000 in fees per day (with a peak single-day fee revenue of $1.4 million).

We further believe that the differentiation between cryptocurrency verticals in this cycle may lead to a more pronounced rotation of capital between sectors. In fact, we have already seen some signs of this through the early focus on artificial intelligence (AI) projects and the subsequent hyperfocus on memecoins and re-hypothecation.

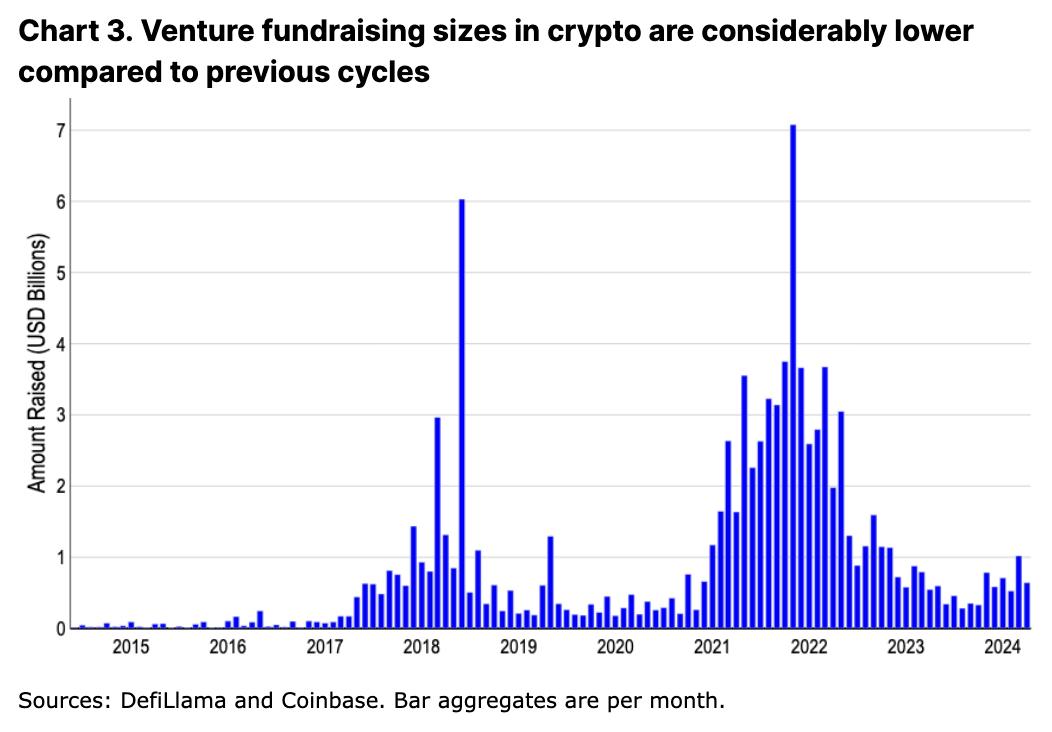

The depressed levels of cryptocurrency fundraising (relative to previous cycles) support this view. It reduces the main source of new liquidity for high-beta assets. Average fundraising in 2024 is still below $1 billion per month, even lower than the level in 2017-18, and about a quarter of the level in 2021-22. The decline in funding is both a byproduct of the severe impact of previous cycles and part of a macro correction. Private markets generally contracted in 2023, with the total amount of funds raised by venture capital funds hitting a 6-year low and down 60% since 2022.

The relative lack of Bitcoin funding raises the question of how to inject liquidity into the space. Spot ETFs are certainly one of the main avenues we have discussed before. They can access a wider pool of capital, from registered investment advisors (RIAs) to potential allocations from other managed funds. For example, BlackRock has laid out plans to include a spot Bitcoin ETF in its Global Allocation Fund. However, these capital inflows are limited to BTC (and possibly ETH in the future) and are unlikely to flow further down the risk curve. Without a major change in this market structure, we believe Bitcoin’s dominance will remain elevated for some time.

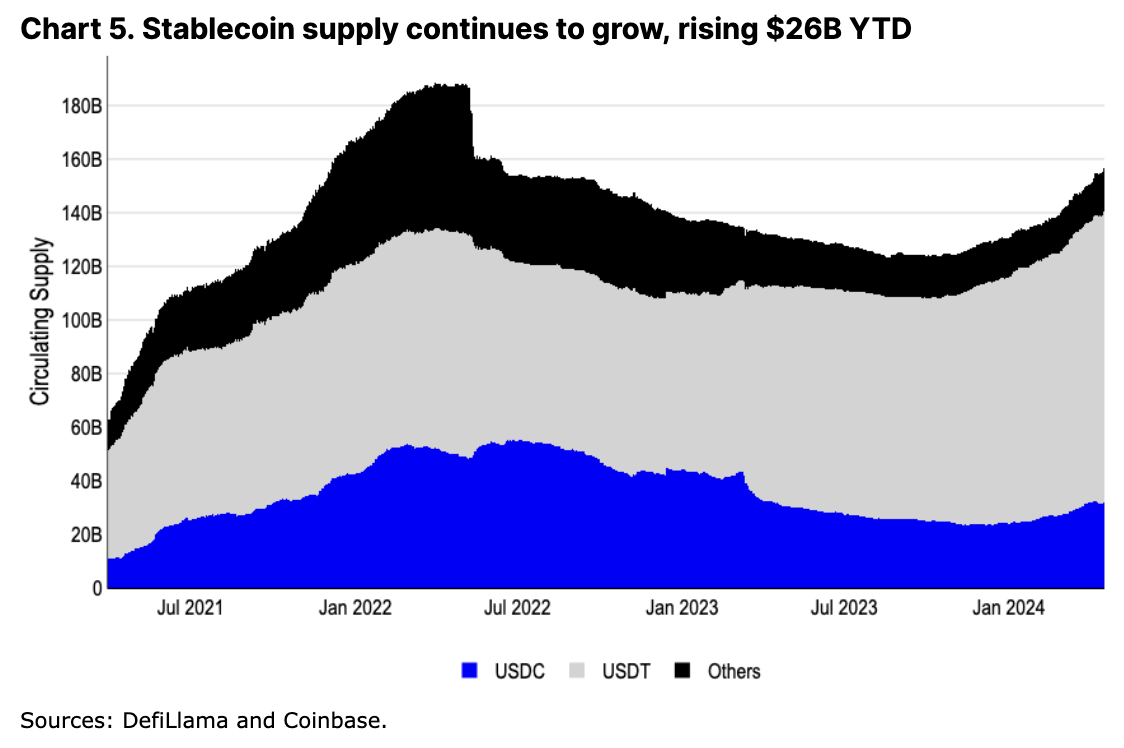

Bitcoin On the other hand, we believe that the main means of injecting liquidity into altcoins (besides leverage) comes from the net growth of stablecoins. Stablecoins participate in the majority of 65% of the $2.6B of daily average trading activity on decentralized exchanges (DEXs), and are further used as trading pairs by many centralized exchanges (CEXs). Although the total stablecoin market capitalization is still below the 2022 peak, the total issuance of USDC and USDT has broken through all-time highs and continues to climb. If we exclude the impact of the now-defunct TerraUSD on the total market capitalization, stablecoins as a whole are actually close to their previous all-time highs.

Macro Thinking about Bitcoin

While we expect the rise of crypto-native catalysts in the future, we believe macro conditions will play a more important role in the near term. In fact, macro tailwinds have been important after previous halvings, and perhaps even more important than crypto-native catalysts. The 2012 halving was primarily impacted by the Fed’s quantitative easing program and the U.S. debt ceiling crisis. Similarly, in 2016, Brexit and a contentious U.S. election likely sparked fiscal concerns in the U.K. and Europe. The COVID-19 pandemic in early 2020 also led to unprecedented levels of stimulus, driving a significant increase in liquidity.

We believe this cycle is no different and today’s macro environment is just as important for Bitcoin and cryptocurrencies more broadly. The recent sharp decline in leverage following the intensification of conflict in the Middle East has reset funding rates to near zero. The ongoing war on the Ukrainian and Russian fronts and tensions in the South China Sea also paint a global picture of uncertainty. We believe the growing importance of global geopolitics within the broader trends of deglobalization and reshoring is likely to be a defining macro feature of this cycle. This is particularly true in a risk-off environment. Following the lack of clarity on market direction, the correlation between Bitcoin and most other cryptocurrencies has consolidated upwards after some decoupling during the Q1’24 rally.

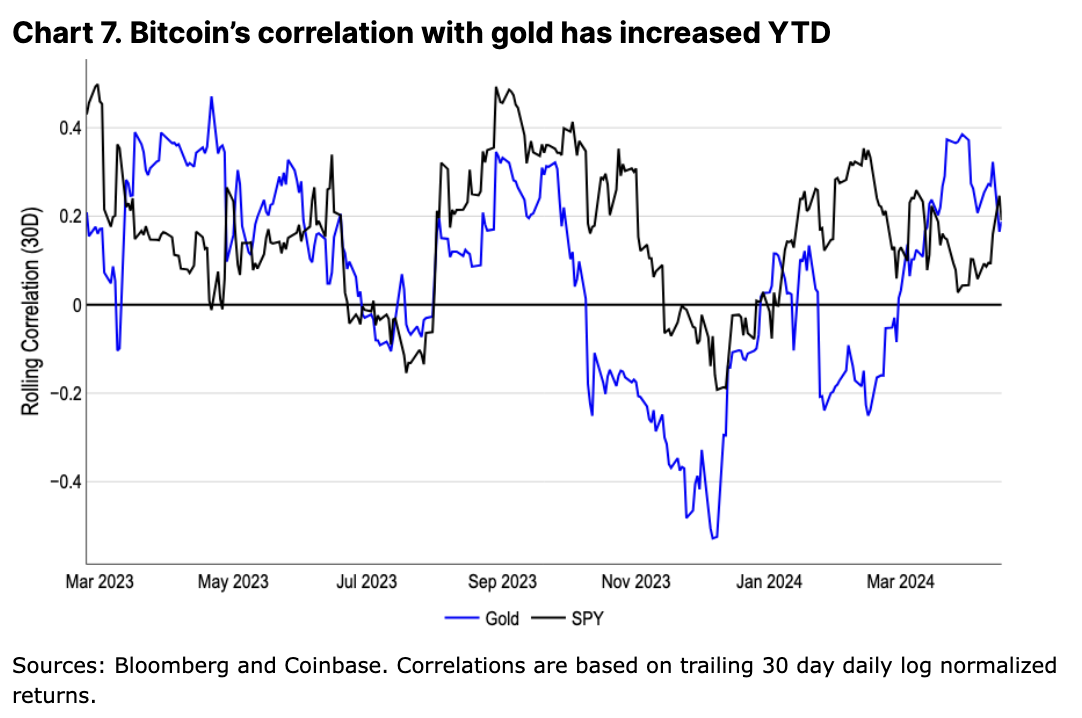

Bitcoin’s rising correlation with gold in March and April, driven by concerns about rising inflation, also suggests Bitcoin’s growing position as a sensitive macro asset in the absence of crypto-specific catalysts such as spot ETF approvals. This behavior is promising given Bitcoin’s claim to being a store of value, although we believe this claim has actually been reinforced by the recent bear market.

Bitcoin saw strong bids during the uncertainty surrounding the US debt ceiling in January 2023 and the ensuing regional banking crisis in March of that year. Compressed price appreciation (like that experienced over the past 6 months) can distort this signal somewhat by introducing an element of speculation and excitement. Nonetheless, we continue to believe that Bitcoin’s value as a geopolitical hedge has led to more aggressive dip buying thus far, with maximum retracements limited to 18% (compared to retracements of 30%+ in previous cycles).

Additionally, rising US national debt levels are another topic of concern for Bitcoin supporters. The Congressional Budget Office predicts that $870 B will be spent on repaying the national debt in 2024, up from $658 B recorded in 2023. Of course, we think this is worrying and is driving the bond yield curve inversion - as US Treasuries need to be refinanced, long-term higher interest rates may be fiscally unsustainable.

That said, even with the accelerating pace of the US debt burden, it is possible that the US could grow its way out of debt (or balance the budget by reducing spending or raising taxes, although this seems unlikely in the short to mid-term with the upcoming elections). Stronger-than-expected GDP growth and high employment figures could increase overall tax revenues. While we believe that the current growth rate cannot fully offset the increased debt burden, it is also impossible to fully discount it. Risks such as geopolitics, inflation, and national debt combine to form the macro backdrop for this cycle.

in conclusion

All else being equal, the Bitcoin halving is an inherently constructive event, though we believe the macro environment and tangential breakouts in the crypto vertical have historically played a significant role in catalyzing cyclical bull runs. While this process has historically taken several months, it varies from cycle to cycle - and we believe changing market structure may lead to some uniqueness in this cycle as major ETFs inflow and venture capital investment decline.

We further believe that the last cycle solidified Bitcoin’s sensitivity to global liquidity following the COVID-19-induced stimulus. However, global liquidity no longer appears to be increasing at the same magnitude and has taken a back seat to more substantial instability both domestically and abroad. In light of this, we believe the upcoming cycle will focus on testing Bitcoin’s store of value narrative, supported by more broadly dispersed crypto catalysts across different verticals.