Introduction: This month, U.S. inflation intensified, but GDP fell short of expectations, triggering market concerns about the stagflation of the U.S. economy; under such concerns, coupled with the impact of geopolitical conflicts, the capital market has experienced a correction this month. U.S. and Japanese stocks have experienced a significant correction, while the situation in Europe is relatively good, indicating that global investors are not worried about the so-called global economic systemic risks; although the crypto market has experienced fluctuations, and the black swan event caused Bitcoin to plunge below $60,000, the crypto market ushered in a historic moment on April 29: the Hong Kong crypto asset ETF was approved, indicating that incremental funds are still continuing to enter and the market outlook is positive.

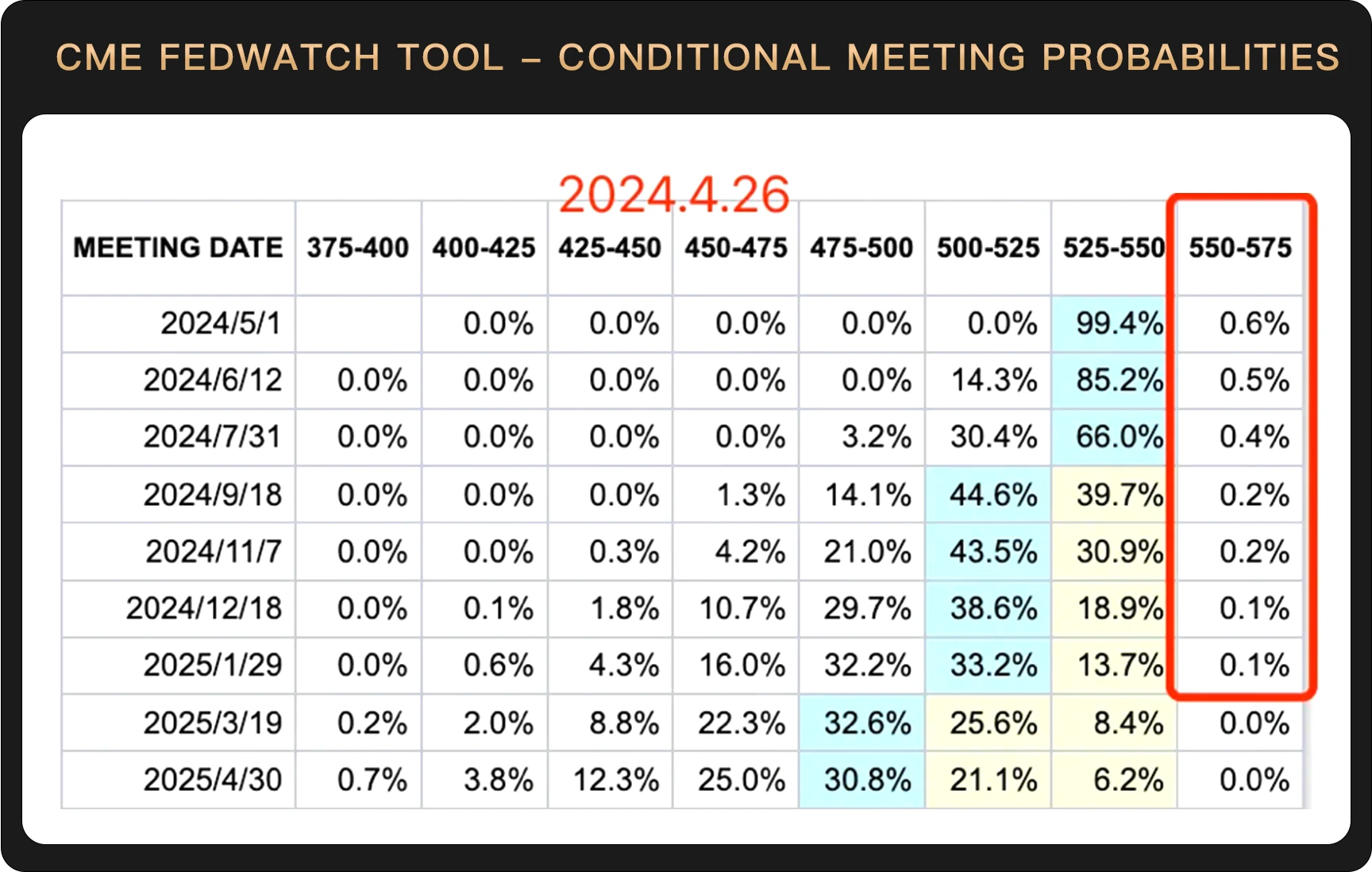

At the beginning of the year, driven by the Feds expectations of rate cuts and the continued decline in the consumer price index (CPI), the market put inflation concerns aside, but since then inflation data has continued to rise and expectations for rate cuts have repeatedly declined. CME FEDWATCH TOOL shows that the market still maintains the expectation of no rate cut in May, and even very few people expect further rate hikes.

Judging from the current data, the United States seems to have entered a state of stagflation - high inflation but low economic growth. The US GDP grew by only 1.6% year-on-year in the first quarter, which was seriously lower than expected; while the core PCE price index grew by 3.7% in the first quarter, which was higher than expected, and this was after excluding energy and food. In other words, even if the impact of the recent rise in international commodity prices is excluded, US inflation is still very serious.

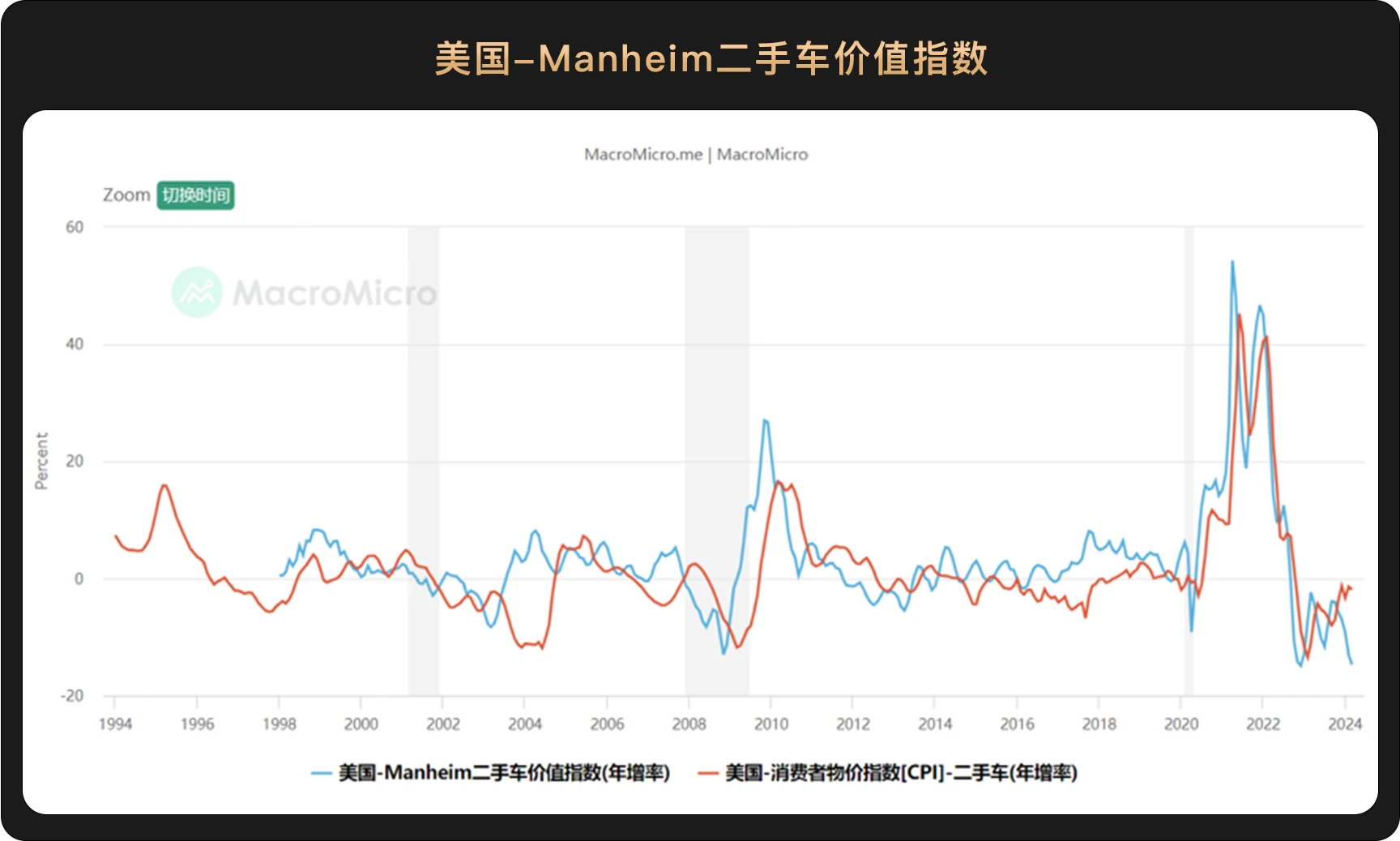

At the beginning of this year, the US economy showed a situation of high growth and low inflation, and the economic narrative of Goldilocks became the mainstream narrative that global investors bet on. In just a few months, the situation has changed from all good to stagflation crisis, and the focus of the United States in the future will be on how to deal with the problem of inflation. At present, a very small number of people in the market have even begun to bet that interest rates will continue to rise, but WealthBee believes that the possibility of further interest rate hikes is not high, and it will only delay the time of interest rate cuts and reduce the number and basis points of interest rate cuts. The current inflation in the United States is affected by multiple factors such as upstream raw material prices, employment and demand. With the influence of factors such as the subsequent rationalization of commodity prices, the rebalancing of the labor market, and the continuation of the downward trend in used car prices, the core inflation in the United States will decline.

At present, the economic situation in the United States is exactly what the Federal Reserve wants to see. There are many ways to untie the wage-inflation spiral, and it is not necessary to choose to continue to raise interest rates, which has a greater impact on the economy. This month, the Japanese yen and Japanese stocks have plunged sharply. In this case, international investors will sell yen and buy back dollars, which may make people suspect that the United States is behind the operation, which is also very helpful in converging the liquidity of the US dollar.

The overall dovish stance of the Fed officials has not released any clear signal of further rate hikes, which may indicate that the United States has certain policy tools to deal with the inflation problem. In short, the US economy is indeed facing the problem of inflationary pressure at this stage, which has caused some concerns in the market, but investors do not need to panic too much about the inflation problem.

In addition, there are many geopolitical conflicts this month, which is also a factor that causes the capital market to be interrupted. From the current point of view, Iran and Israel have actually maintained relative restraint, and there is no sign of further escalation of the conflict. Moreover, in modern society, the possibility of a large-scale war or conflict under the nuclear deterrence of a major power is extremely small, so the impact of geopolitical issues on the financial market is often sudden but short-lived. Even if Russia went to war with Ukraine and NATO, the countrys stock market has now almost recovered all the losses since the war. Therefore, the impact of the war this month is just a sudden variable.

After the U.S. stock market emerged from a five-month bull market, a large-scale adjustment finally occurred - the Nasdaq index hit its 120-day line at its lowest, and Nvidia (NVDA) fell by -10% on April 19.

The current trend of the US stock market reflects more the change in the expectation of interest rate cuts, and geopolitical conflicts are a secondary reason. The valuation of technology stocks is directly related to liquidity, and the postponement of the expectation of interest rate cuts will directly compress the valuation space of technology stocks. This month, UBS downgraded the rating of the six major US technology stocks (Apple AAPL, Amazon AMZN, Alphabet, Meta, Microsoft MSFT, Nvidia NVDA) from overweight to neutral on the grounds that the earnings momentum once enjoyed by the sector is facing a cooling, and the upward momentum is disappearing. However, UBS strategists also said that the downgrade was an acknowledgement of the difficult comparisons and cyclical constraints faced by these stocks, rather than predictions based on valuation expansion or doubts about artificial intelligence.

The reason given by UBS is actually reasonable. After all, under the influence of AI expectations, the valuations of the giants have already reflected future profit expectations in advance. If the giants experience another surge in the future, it can only be that the development of AI has once again exceeded market expectations.

In addition to the United States, the Japanese stock market has also experienced a significant correction this month. The situation in Japan is mainly due to the recent crazy depreciation of the yen, which has caused investors to sell Japanese assets. In addition, the yen and the US dollar have strong synergy, and the delay in the Feds interest rate cut expectations is also one of the important reasons for the recent volatility of the yen.

The unsatisfactory performance of the stock markets in the United States and Japan has caused some people to worry that the inflation problem in the United States may lead to a global financial crisis. WealthBee believes that it is too early to draw such a conclusion, because except for the United States and Japan, the stock markets of other countries have not seen a significant correction: Frances CAC 40 and Germanys DAX have not seen a sharp correction and are still strong; Indias Mumbai Sensex 30 has also been fluctuating above 70,000 points. The correction of the US stock market this time is most likely just a sudden reaction of the market to changes in expectations and black swan events, and there is no obvious systemic risk.

The trend of the crypto market this month is not satisfactory. The lowest price of BTC has fallen below $60,000, and the lowest price of ETH has fallen below $2,800. Since the price of Bitcoin hit a new high in mid-March, it has entered an adjustment period, which has lasted for one and a half months so far. During this period, black swan events such as geopolitical conflicts and US economic data that fell short of expectations have also made the crypto market, which was not hot, worse. The spike in the middle of April was caused by the geopolitical conflict in the Middle East.

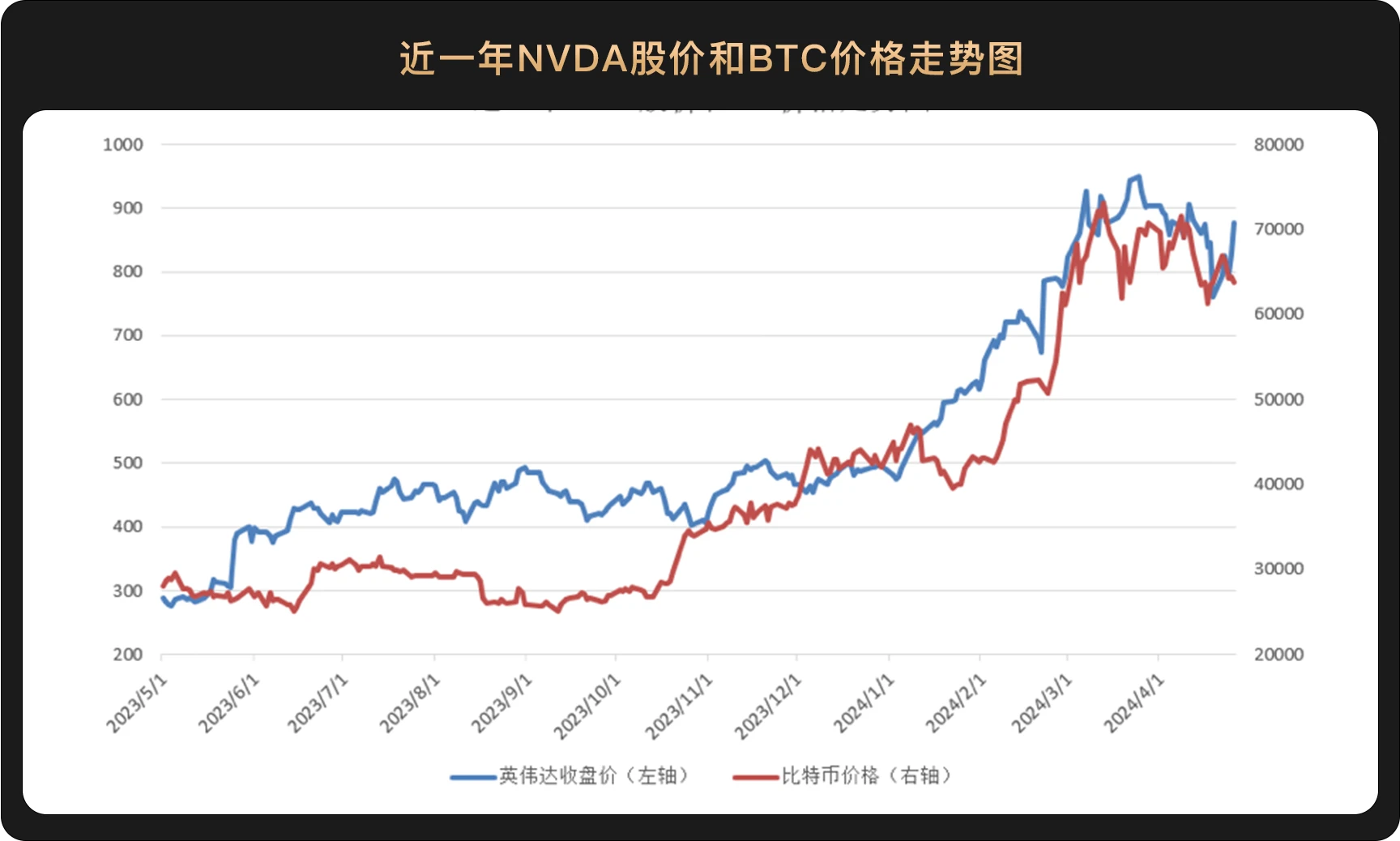

At present, the crypto market has entered a state of strong correlation with the trend of traditional assets - the price of Bitcoin and the share price of Nvidia (NVDA) have shown a surprising correlation in the past year. This strong correlation is very intriguing, and there is currently no recognized explanation.

If Bitcoin is indeed regarded as electronic gold by the market consensus, then in theory the trend should be related to gold, and the trend corresponding to geopolitical conflicts should be a surge rather than a downward plunge. From the price trend of gold, it can be seen that gold hit a record high in the days of the conflict between Iran and Israel, fully demonstrating the safe-haven attribute of gold.

This situation may illustrate one point - the current trend of Bitcoin has indeed been tied to the US ETF. Throughout April, ETFs showed a net outflow trend.

This trend of being tied to a countrys assets is not particularly reasonable. Bitcoins most notable decentralized attribute has become a value storage tool that everyone agrees on. No one has the right to issue or destroy Bitcoin. This attribute, which is different from legal tender, has become a breath of fresh air in the era of credit currency. However, at present, ETFs in a single country already have the pricing power of Bitcoin. Although they cannot create or destroy Bitcoin, this is actually a certain deviation from the decentralized attribute.

This trend of being tied to a countrys assets is not particularly reasonable. Bitcoins most notable decentralized attribute has become a value storage tool that everyone agrees on. No one has the right to issue or destroy Bitcoin. This attribute, which is different from legal tender, has become a breath of fresh air in the era of credit currency. However, at present, ETFs in a single country already have the pricing power of Bitcoin. Although they cannot create or destroy Bitcoin, this is actually a certain deviation from the decentralized attribute.

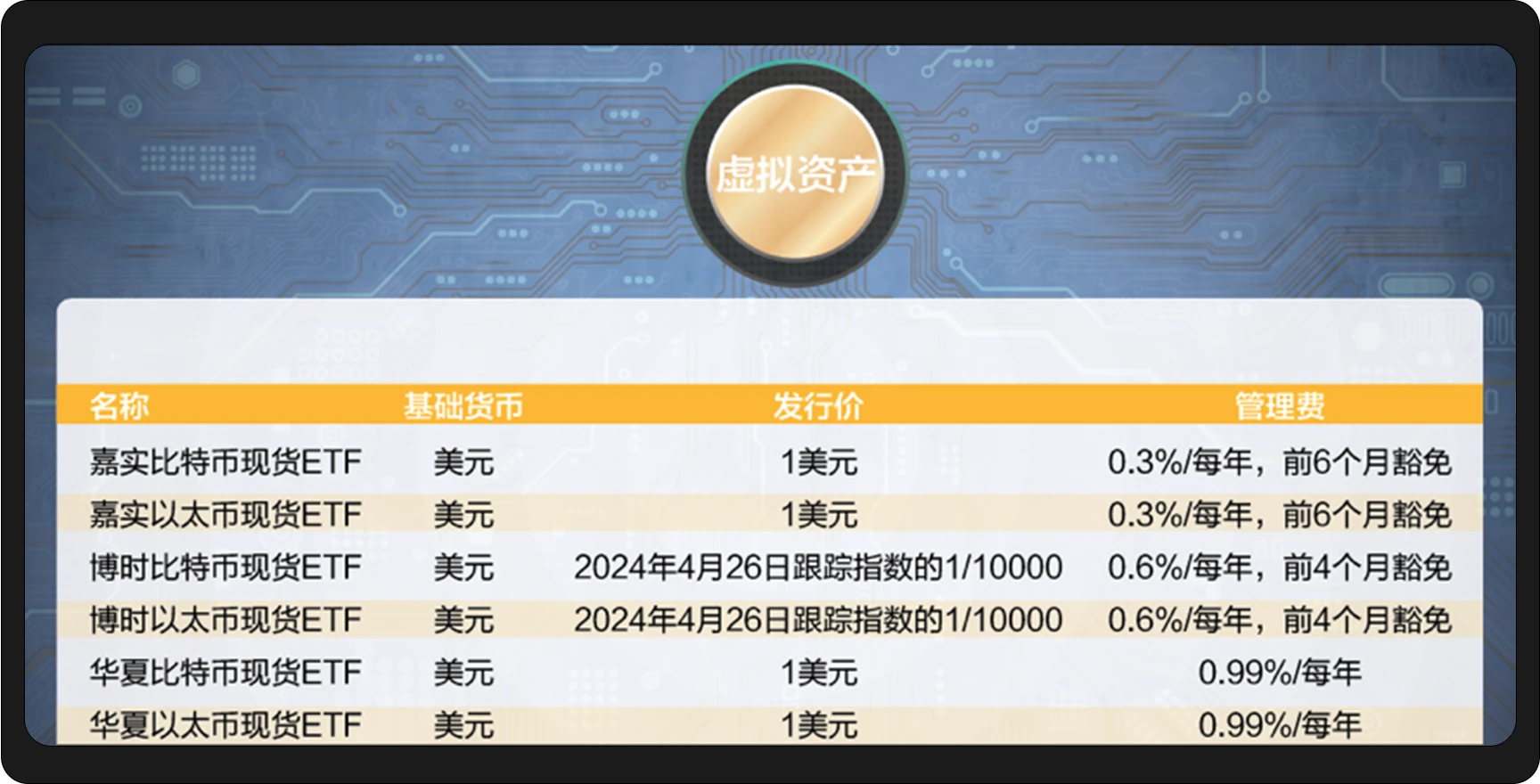

Fortunately, following the United States, Hong Kong also officially approved 6 virtual asset spot ETFs on April 29, including 3 Bitcoin ETFs and 3 Ethereum ETFs. These ETF products differ in product fee structure, transaction efficiency, and issuance strategy, providing investors with diverse choices, and are ahead of the United States in terms of category. The United States has not yet approved Ethereum spot ETFs. Institutions predict that with the growing market interest in these innovative ETFs, these six ETFs will bring $1 billion in incremental funds to the crypto market.

The latest news also shows that Australia will launch a Bitcoin ETF by the end of this year.

This multi-point ETF listing is somewhat similar to the early mining farms and mining machines distributed around the world, which can fully maintain the decentralized nature of Bitcoin in the secondary market - no institution or country has the right to price Bitcoin alone.

Therefore, as more and more institutions in more countries or regions list Bitcoin spot ETFs, the holdings of whales will become more and more dispersed. At that time, in the secondary market, the pricing power of Bitcoin will also show decentralized characteristics, and may return to the value essence of electronic gold.

Conclusion: In April, the hawkish remarks of the Federal Reserve and the geopolitical conflicts in the Middle East brought volatility to the capital market, but the strategic stability among nuclear powers provided a certain degree of protection for the market. In terms of inflation suppression strategy, the Federal Reserve is actively responding to potential financial risks. Although the US and Japanese stock markets have experienced a correction, the global capital market has not yet shown signs of a widespread financial crisis.

At this critical moment, financial innovation initiatives in the Asian market, especially in Hong Kong, China, are particularly important. The approval and upcoming listing of the Hong Kong Bitcoin ETF not only marks a major step forward for the Asian financial market in the field of cryptocurrency, but may also become a new detonation point for the global capital market. This progress not only provides investors with new asset allocation options, but may also drive the cryptocurrency market towards a more mature and standardized direction, heralding the birth of new investment opportunities and market trends, and also promoting the decentralization of Bitcoin pricing power in the secondary market.

Copyright Statement: If you need to reprint, please add our assistant on WeChat (WeChat ID: hir 3 po) for communication. We reserve the right to pursue legal liability for any unauthorized reprint or plagiarism.

Disclaimer: The market is risky and investment should be cautious. Please strictly abide by the local laws and regulations when considering any opinions, views or conclusions in this article. The above content does not constitute any investment advice.