Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes many high-quality in-depth analysis contents, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

Bitwise Chief Investment Officer: Who is buying Bitcoin ETFs?

Retail investors hold the majority of outstanding shares in Bitcoin ETFs. Many professional firms own Bitcoin ETFs. The number of large investors in Bitcoin ETFs is surprising. Bitcoin ETFs have been a historic success in terms of ownership breadth. Recent 13 F filings show that Bitcoin ETF allocations are only an initial foray by institutions.

Restarting ICO: Distributed Token Launch (DTL)

VCs never innovated in how they structured their funding rounds; they simply found a way to invest in companies earlier than ever before.

Many projects and their accompanying tokens are facing collapse as the bear market sets in. The collapse of ICOs also brings with it huge scrutiny from the public, institutions and most importantly, regulators.

What we can learn from memecoin: distribution builds community, community builds and demands value, products are built for the community, the community becomes more valuable, investors want to invest in new projects being built in the community and ecosystem, and the initial meme becomes more valuable.

The core focus of DTL is to get tokens and technology into the hands of real users, not just speculators. The latter is inevitable, but where possible, the end user should be the central point. Ideally, no financial capital is used at all. Distributed Token Issuance Decentralization and long-term collaboration occur at the intersection of community and builders, and these two groups should overlap as much as possible. In the crypto space, one of the main motivations is to build a community that is financially incentivized to build a future where products serve their needs rather than rent-seeking monopolies. In order to incentivize this community, they must be prioritized in the fundraising strategy.

We also recommend MIIX Capital: Japanese Crypto Market Research Report .

Meme

The Battle Between Memes and Governance Tokens: Everything is a Meme

Governance tokens are memes with an extra step. Memes are the product of a broken financial system. Memes are testing infrastructure. Memes also serve as fundraising and community building mechanisms. Projects should lean toward fairer launches.

Old money favors Meme, is the next cycle starting?

VanEcks MarketVector recently launched the Meme Index; Franklin Templeton continues to publish articles about Memes. An interesting case is Franklin Templetons promotion of $WIF.

But traditional crypto VCs are still slow to embrace memes. Major memes like $WIF and $PEPE are not found in the portfolios of top VCs.

If they finally give in and decide to invest in memes, this could mark the beginning of the second wave of the meme cycle.

Crazy 70% pullback, data explains the other side of Solana Meme craze

In today’s meme-saturated environment, it is very difficult to maintain a high market value. Most memes have experienced huge retracements.

Pump.fun coupled with multiple memes launched daily on SOL means everyone is glued to their bots and wallet trackers, trying to catch the next winner.

Ethereum

Ethereum’s Innovator’s Dilemma: Valuation and Usage Have Peaked, What Will Happen in the Future?

Ethereum has reached the pinnacle of all crypto assets in terms of valuation, relative usage, and adoption.

The reasons Ethereum succeeded in the past are also the reasons it will fail in the future. There was a time when Ethereum was the only viable smart contract platform for developers. Legitimate use cases (DeFi, NFTs) gave ETH a huge head start. But during this phase, the focus shifted to value accumulation (super stablecoins) and competing with Bitcoin as the default store of value native to the Internet (flipping). The desire to try to be both a smart contract platform and a decentralized super stablecoin added significant friction for marginal users and developers (higher gas costs, congested networks).

The modular blockchain framework provides a set of tradeoffs that blockchains can choose. We are now at a point where the infrastructure that supports blockchains along the tradeoff curve is beginning to emerge. In addition, and more importantly, incentives.

Multi-ecology and cross-chain

Detailed explanation of Berachain: New Meme Paradise or DeFi Utopia?

The Honey Jar or THJ is the core of the Berachain community and was founded by Jani in January 2023. In the bear market, THJ worked hard like any other project, creating countless legendary articles, competitions, podcasts, spaces, NFT casting, etc., gradually building one of the most prolific communities in the crypto space. The core of this community is an NFT collection called Honeycomb, with a total of 16,420 NFTs, which serves as a welfare aggregator for the THJ ecosystem.

Building EVM compatibility and integrating with the existing technology stack is key. Proof of Liquidity (PoL) is a generational experiment in DeFi. The most exciting part of PoL is that it enables any dApp to accelerate its growth in a utilitarian way, a decision made by those who initially provide value or liquidity to the ecosystem, namely BGT holders (ie users).

Risks for Berachain are: PoL will only work as intended in an efficient market; similar to LRT, I wonder how much behind-the-scenes trading will happen to get more BGT authorization/emissions; possible concentration of stake around a single LST provider.

GameFi and SocialFi

J Research: In-depth insights into Web3 gaming industry trends in 2024

In the past three years, in terms of market size, the explosive effect has driven the rapid growth of transaction volume, and users account for more than half of the industry; the development process has evolved from rolling Fi to rolling gameplay and playability; in terms of financing and fundraising, a huge amount of funds have poured in to drive the industry blowout; challenges and risks include: sustainable development faces excessive FIization of games and lack of user experience.

New changes in the industry in 2024 include: the gameplay and playability of Web3 games have been improved, and making gold is no longer the only purpose; the types of Web3 games are becoming more and more diverse, and RPG, action, strategy and casual games are the most favored by developers; Web3 game projects are accelerating their evolution towards platformization and ecology; the community ecology of Web3 games may subvert the profit distribution model of the traditional game industry.

A full-chain game entrepreneur from YC: What are the value and problems of full-chain games?

The four value points solved by the chain game are: actual value assets, free transfer of value, stake attributes, and removal of consumption restrictions;

There are three hidden problems: decentralization, durability, and composability.

Deep analysis of Farcaster: How to reinvent SocialFi?

Farcaster is a decentralized social media protocol that provides an open and composable social layer for developers, creators, and ordinary users.

The user level focuses on privacy protection and autonomous control, the protocol level focuses on open source and no permission required, and the product level advocates mini-program level interactivity, directly accessing a variety of services and applications in social media posts through Frames.

Currently, SocialFi has two main directions: financialization - Friend tech; original layer transformation - Farcaster. Farcaster is essentially a transformation of the original layer, which is closer to the concept of Layer. Therefore, it is possible to build financial services based on Layer and derive more and more extensive application scenarios. Farcaster is implemented through a hybrid architecture of on-chain + off-chain. Key information such as user identity and keys are processed on-chain, and content storage, verification and dissemination are processed off-chain.

Farcaster has not issued its own tokens, but it has basically achieved the commonality and attraction of creators, developers, and ordinary people, rather than relying solely on Fi to retain users. A long-term and continuous positive cycle is the key to changing user habits. On the issue of going out of the circle, Farcasters current task is to attract and retain Web3 users on Twitter.

Web3

Delphi Digital: Exploring shared provers, the new frontier of modularity

Shared provers, proof aggregation, and prover marketplaces are changing the zero-knowledge proof landscape.

Shared provers can reduce the proof cost of zk applications and improve proof efficiency.

Chain abstraction is the end game for liquidity fragmentation in cryptocurrencies. It helps to enable massive participation in cryptocurrencies without users having to bear the mental burden of maintaining multiple accounts on multiple chains.

The authors define chain abstraction as: any user-initiated intent on the chain of choice (where liquidity resides) is executed on the chain where the application resides (where the results reside).

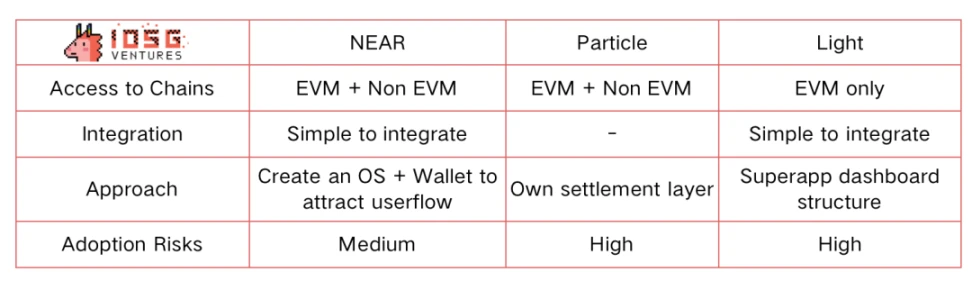

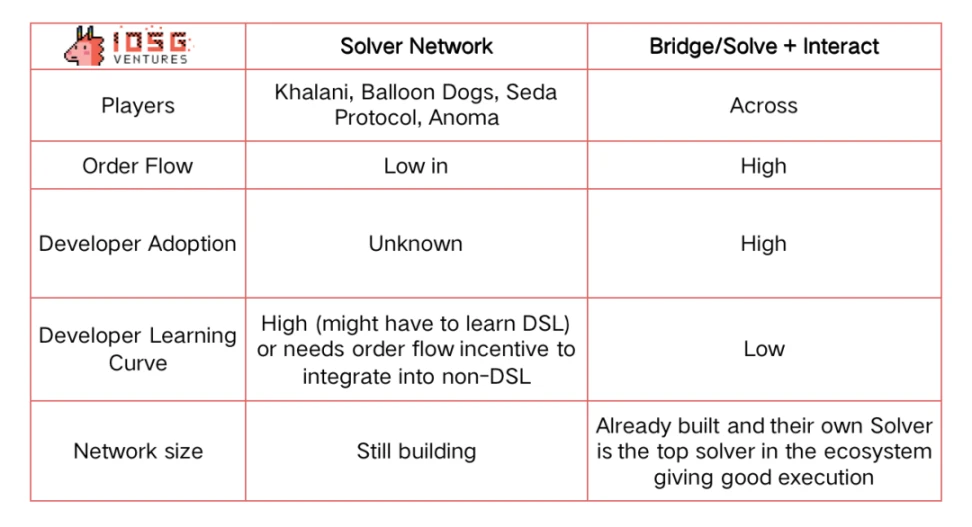

Interactive player

Communications Layer Players

Participants in the full-stack framework include: CAKE, DappOS, and Aarc.

Overview of the FHE track: 25 projects worth watching

Homomorphic Encryption (HE) was first proposed in 1978 to solve the problem of processing data without touching the data.

The difference between ZKP and FHE is that ZKP can prove the authenticity and reliability of data to the other party without revealing the real data, and it also plays a very important role in reducing costs in L2. What FHE wants to do is to be computable invisible. Its application scenarios are broad, not just Web3 and blockchain. It is aimed at any privacy data in the entire Internet system, whether it is advertising, personalized recommendations, AI, games, on-chain transactions, MEV protection, block space auctions, on-chain voting, anti-sybil attacks, machine learning, medical care, finance, natural language processing, etc.

Hot Topics of the Week

In the past week, OpenAI released its latest flagship model GPT 4o , and ChatGPT entered a new stage of human-computer interaction; Roaring Kitty, the protagonist of the GameStop retail investor vs. Wall Street incident, returned to X, and related meme coins soared, and GameStop triggered six circuit breakers in the U.S. stock market that day;

In addition, in terms of policy and macro markets, the U.S. House of Representatives will vote en masse on the crypto market structure bill FIT 21 ; the Court of Appeal ruled that Coinbase cannot force the U.S. SEC to formulate new rules for the crypto industry ; Federal Reserve Board member Bowman: states and the federal government need to cooperate in the field of stablecoins ; a Dutch court found Tornado Cash developer Alexey Pertsev guilty of money laundering;

In terms of opinions and opinions, Elon Musk compared the operation of the Federal Reserve to the rules of Monopoly, where banks will not go bankrupt and can print money indefinitely; Former PayPal President: All companies will eventually use the Bitcoin Lightning Network to settle transactions; Galaxy Partner: Crypto payments have great potential and stablecoins will be everywhere; Ripple CEO clarified: He is not attacking Tether; Vitalik proposed a new proposal for Ethereum, aiming to make multi-dimensional Gas pricing more concrete; Bankless: The ultimate destination of Bitcoin L2 is ZK-Rollups;

In terms of institutions, large companies and leading projects, CME plans to launch Bitcoin spot trading; Morgan Stanley disclosed that it has invested nearly $270 million in Grayscale GBTC, becoming one of the largest holders; Guotai Junan International launched a virtual asset spot ETF structured product in Hong Kong; Maker founder: will launch a stablecoin PureDai that is loyal to the original vision of the protocol in addition to NewStable. PureDai will have its own governance token with an initial supply of 2 billion; Binance launched a liquidity docking plan to connect projects with market makers; BounceBit mainnet was launched, launching node staking and delegation, BounceClub and other new features; Jupiters third round of LFG voting will be held on May 22, and will implement multiple changes such as Blind Voting; Lens launched infrastructure Lens Network; DRIFT opened token airdrop applications;

On the security front, pump.fun got hacked ... well, another week of ups and downs.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~