Hunters in the Snow — Pieter Bruegel the Elder

Introduction

Although the market continues to be sluggish, market volatility is gradually decreasing and uncertainty is also weakening. As US ETFs begin to turn to net inflows, the market is expected to rebound in the future, but macro indicators are still the key signals that determine market trends.

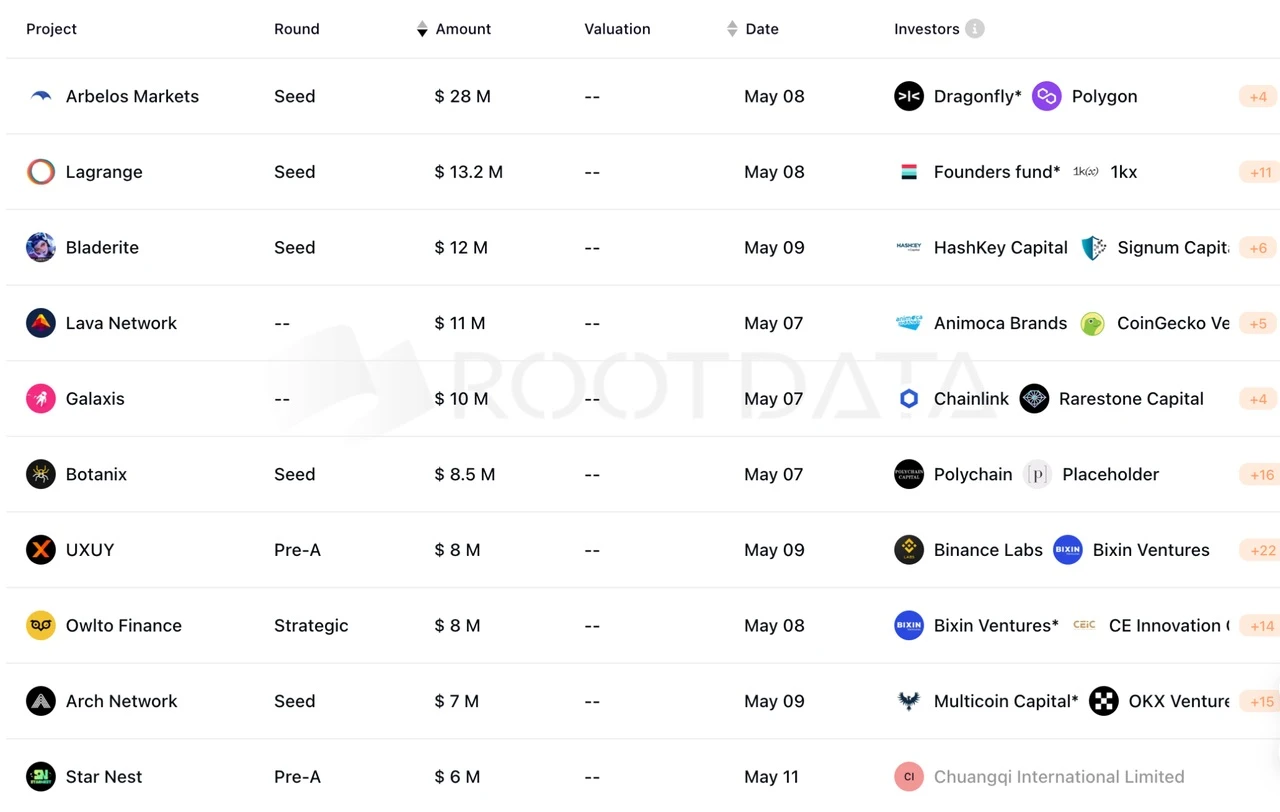

1. Investment and Financing Observation

Last week, there were 41 investment and financing events in the crypto market, up 28.12% from the previous month, with a total capital of US$170 million, up 13.33% from the previous month:

DeFi announced 11 investment and financing deals , among which quantitative trading platform Arbelos Markets completed a $28 million financing led by Dragonfly Capital;

GameFi track announced 5 investment and financing , among which Web3 game developer Seeds Labs completed a $12 million seed round of financing, with Blizzard Fund and others participating;

The Infrastructure and Tools track announced 16 investment and financing deals , including cryptography startup Lagrange, which completed a $13 million seed round led by Founders Fund;

One investment and financing was announced in the NFT-related field . Singapore Web3 platform Galaxis completed a $10 million financing;

The DePIN track announced two investment and financing deals , among which Solana ecosystem DePIN project Ambient completed a $2 million seed round of financing, led by Borderless Capital;

Other Web3/crypto applications announced 6 investment and financings , among which Kiosk, a Web3 social application based on Farcaster, completed a $10 million financing, led by Electric Capital;

Judging from the month-on-month data, the number of investment and financing transactions in the cryptocurrency market has increased for two consecutive weeks, and the total scale of funds also rebounded last week. Institutions are still actively raising funds and expanding their layout when the market is cold, and the market is betting on the Bitcoin ecosystem, GameFi and infrastructure. Among VCs, the most active institutions last week were Animoca Brands, Dragonfly, and Solana Foundation, which mainly focused on GameFi and infrastructure.

About Arbelos

Arbelos Markets is a quantitative trading platform whose business focus is to provide these institutional participants with the necessary trading liquidity and act as a counterparty for products such as options and futures.

About Arch Network

Arch Network is a Bitcoin-native application platform that brings smart contract functionality directly to Bitcoin through a novel architecture that utilizes the Rust-based zero-knowledge virtual machine ArchVM and pairs it with a decentralized network of validators, collectively known as the Arch Network.

About UXUY

UXUY is the next-generation decentralized multi-chain trading platform based on the MPC wallet. UXUY actively participates in the construction of the Bitcoin Layer 2 ecosystem, fully integrates into the Bitcoin Lightning Network and Taproot ecosystem, provides users with lightning address DID services, and becomes an important bridge connecting the Bitcoin and Ethereum ecosystems.

2. Industry data

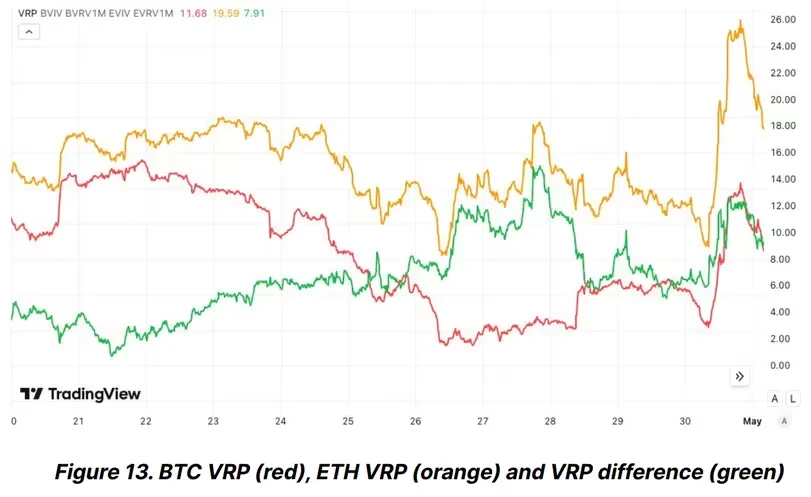

VRP Index shows market stabilization, less uncertainty

Bitfinex analyst tracking data shows that since the BTC halving on April 20, the monthly VRP (volatility risk premium) has plummeted from 15% to 2.5%. Analysts said that the sharp narrowing of VRP indicates that market expectations are being readjusted and have entered a relatively low volatility market environment. Uncertainty has weakened, which can be seen as a positive development by long-term investors. A week ago, Arthur Hayes, former CEO of BitMEX cryptocurrency exchange, wrote that BTC has bottomed out, but the expected rise may be slow.

About VRP (Volatility Risk Premium)

The calculation of VRP data is based on the gap between Volmex’s BTC 30-day implied volatility index (BVIV) and 1-month realized volatility (VBRV);

VRP reflects the tendency for implied volatility (a measure of expectations of price fluctuations) caused by options on an asset to exceed realized volatility over time;

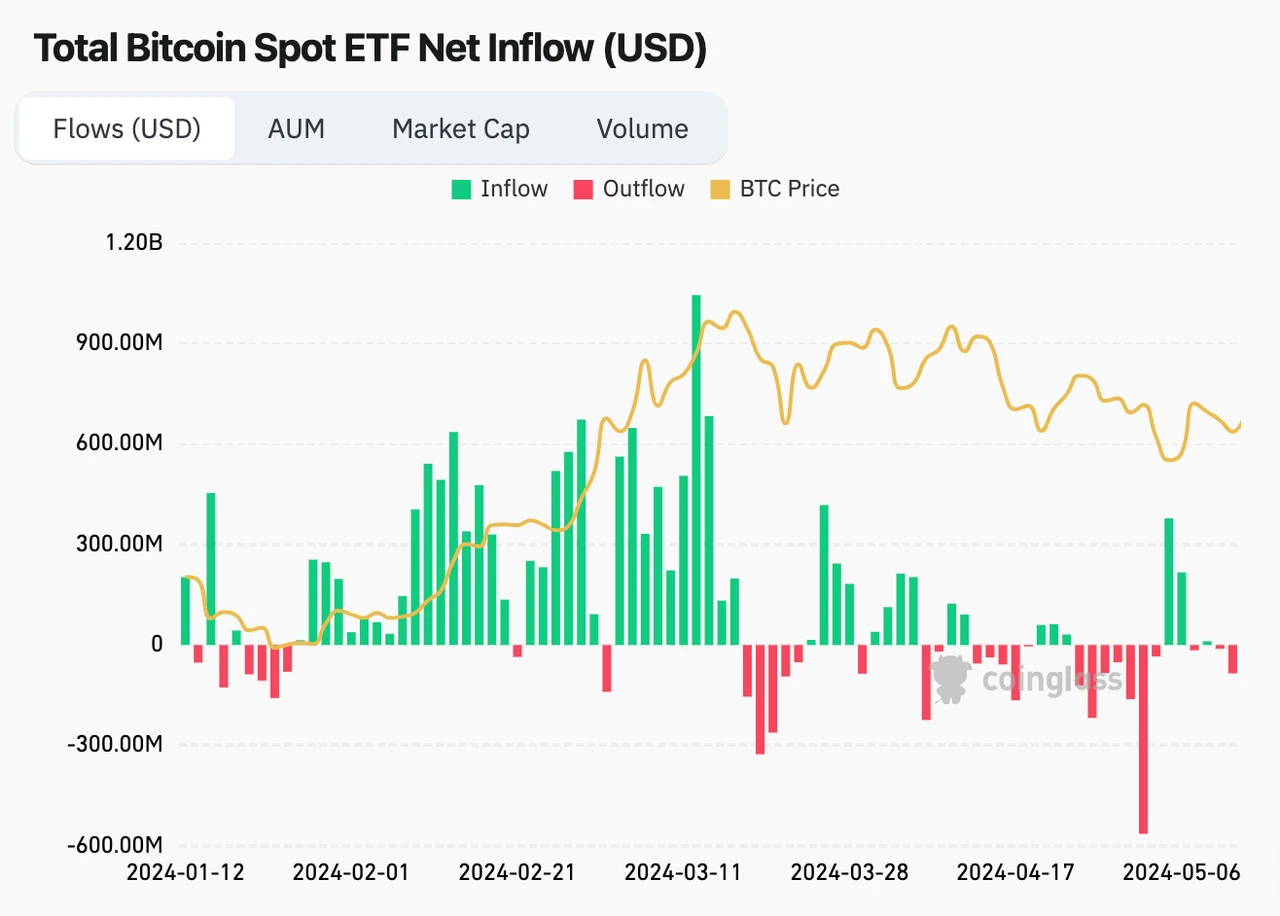

US BTC spot ETFs have net inflows, only GBTC has outflows

According to HOD L1 5 Capital monitoring: Last week, the US BTC spot ETF bought 1,318 BTC, and only GBTC saw capital outflows. As of May 10, global BTC spot ETFs held a total of 949,756 BTC. Since the launch of the BTC spot ETF, GBTC has accumulated a net outflow of US$17.6329 billion, and its asset management scale has dropped to US$17.647 billion.

Judging from the correlation between US ETFs and the market, if the inflow of ETFs continues and begins to increase, it will mean that the market will gradually start to rise. However, considering that the shock selling pressure still exists, the upward trend will most likely rise slowly in the shock.

It is reported that a large part of the early GBTC outflows were related to bankruptcy proceedings (such as Genesis and FTX), profit realization from GBTC discount trading (discounted to 40% of NAV a year ago), and transfers into low-fee products (<0.5% vs. 1.5%).

Hong Kong ETFs show continuous net redemption, liquidity tends to normal

According to SoSo Value data, both Hong Kong ETH and BTC spot ETFs showed net redemptions, with the ETH spot ETF showing net redemptions for three consecutive days:

On May 10, the BTC spot ETF had a net redemption of 99.99 BTC in a single day, with a total of 4,160 BTC held, a single-day transaction volume of US$1.46 million, and a total net asset of US$262 million. ChinaAMC ETF still holds 1,940 BTC and ranks first;

On May 9, the ETH spot ETF had a net redemption of 471.25 ETH in a single day, with a total of 15,630 ETH held, a total daily transaction volume of US$542,000, and a total net asset of approximately US$46.71 million. Bose Hashkey ETF held 6,500 ETH and ranked first;

At present, the liquidity of ETFs in the Hong Kong market will return to normal, and the current flow direction of ETFs will not lead to a structural trend reversal in the market. Investors are advised to use Hong Kong ETFs as tracking indicators to pay attention to trend dynamics, but as leading investment indicators.

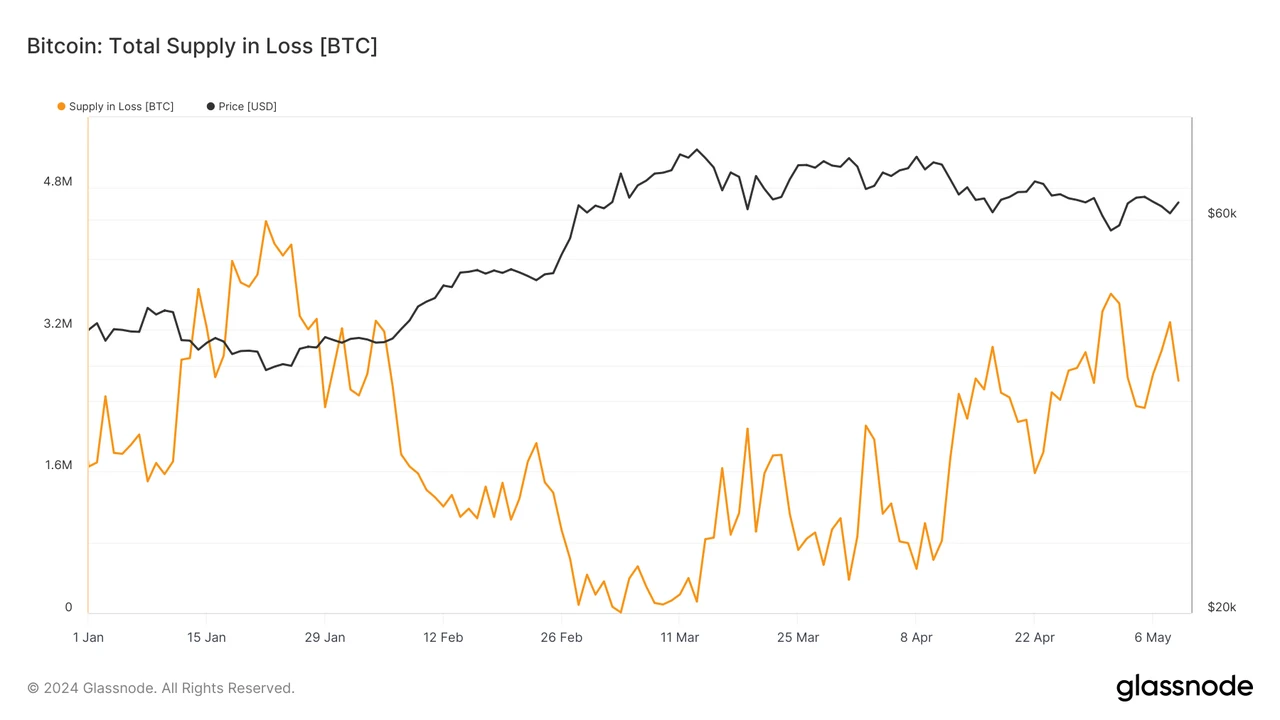

More than 2.6 million BTC are in a loss state, and new adjustments may appear

Glassnode data: As BTC prices fell, as of May 9, more than 2.6 million bitcoins were in a loss-making state, while 86% of the BTC supply was still in a profitable state. This change indicates that many short-term holders are already in a loss-making state, while the previous data on February 28 showed that 99% of the BTC supply was profitable.

Currently, the cost for short-term holders is about 59,800 US dollars. If the price continues to decline, more BTC will be at a loss. The next week may be a swing period for short-term holders. If short-term holders sell off on a certain scale, the market may enter a short-term adjustment.

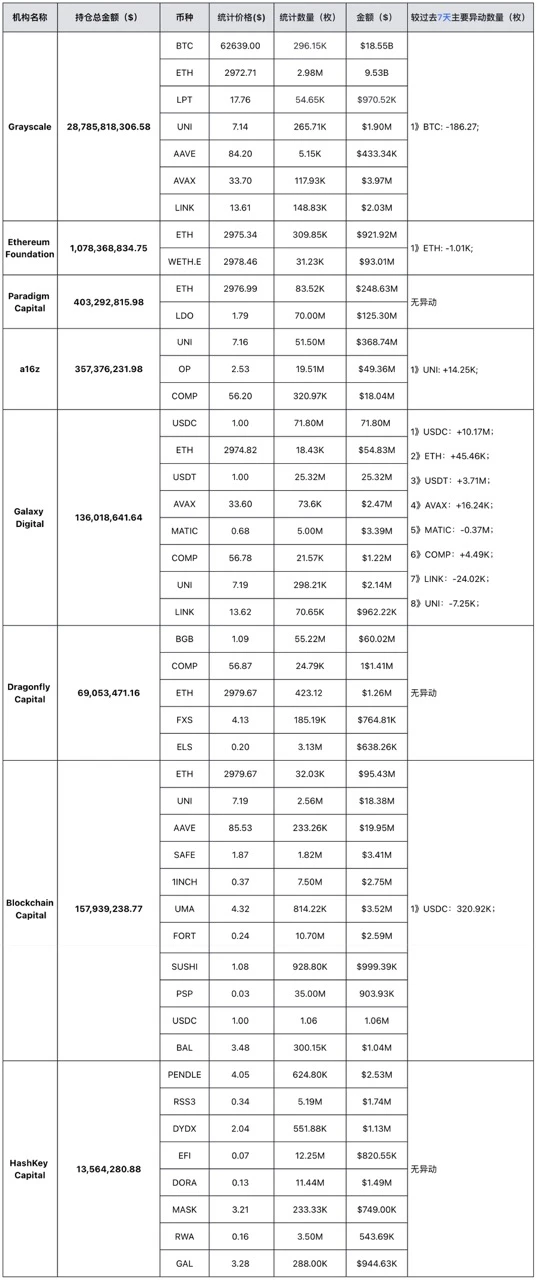

3. VC holdings

Note: The above data comes from https://platform.arkhamintelligence.com/ , statistical time: 17:00 on May 13, 2024 (UTC+ 8).

4. This weeks focus

May 13

Federal Reserve Board Governor Jefferson delivered a speech;

2024 FOMC voting member and Cleveland Fed President Loretta Mester spoke on central bank communication;

BounceBit, the Bitcoin re-staking infrastructure, launched the mainnet and issued BB token airdrops. The Binance Megadrop ended at 8:00 on May 13;

OKX Jumpstart will list Notcoin (NOT), and TON holders can stake TON in exchange for NOT tokens;

Aptos (APT) will unlock approximately 11.31 million tokens at 2:00 on May 13, worth approximately $103 million, accounting for 2.64% of the circulation;

May 14

US PPI for April;

Federal Reserve Governor Lisa Cook spoke;

Federal Reserve Chairman Powell and ECB Board member Knot attended a meeting together and delivered a speech;

A Dutch judge will rule on Tornado Cash developer Alexey Pertsev on May 14.

May 15

US April CPI;

U.S. retail sales monthly rate in April;

BNB Chain will take a snapshot of the second season airdrop alliance plan at 8:00 on May 15 (UTC+8);

opBNB testnet nodes must be upgraded to the latest version before the hard fork on May 15;

Starknet (STRK) will unlock 64 million STRK at 8:00 on May 15, worth about 77 million US dollars, accounting for 8.79% of the circulation;

CyberConnect (CYBER) will unlock 886,000 CYBER at 14:00 on May 15, worth approximately $6.84 million, accounting for 4.13% of the circulation;

Aevo (AEVO) will unlock approximately 827 million AEVO at 15:59 on May 15, worth approximately $1 billion, accounting for 752.36% of the circulation;

May 16

Initial jobless claims in the U.S. this week;

Federal Reserve Board Governor Bowman delivered a speech;

Federal Reserve Board Governor Barr testifies before the Senate Banking Committee;

Alpaca Finance’s PYTH airdrop distribution program will end on May 16;

Arbitrum (ARB) will unlock approximately 92.65 million ARB at 21:00 on May 16, worth approximately US$92.57 million, accounting for 3.49% of the circulation;

May 17

2024 FOMC voting member and Cleveland Fed President Loretta Mester spoke on the economic outlook;

Atlanta Fed President Bostic, a 2024 FOMC voting member, spoke on the economic outlook;

Chinas State Council Information Office held a press conference on the operation of the national economy;

A Nigerian court has postponed the tax evasion hearing of Binance executives until May 17.

WikiEXPO held the offline event WIKI FINANCE EXPO HONG KONG 2024 at Sky 100 in Hong Kong;

LayerZeros Self-Reporting of Witch Activity will close on May 17 at 19:59:59;

ApeCoin (APE) will unlock about 15.6 million pieces at 8:00 on May 17, worth about 19 million US dollars, accounting for 2.48% of the circulation;

Immutable (IMX) will unlock approximately 25.53 million IMX at 8:00 on May 17, worth approximately US$57.95 million, accounting for 1.75% of the circulation;

May 18

2024 FOMC voting member and San Francisco Fed President Mary Daly delivered a speech;

Nym (NYM) will unlock approximately 3.02 million tokens at 8:00 on May 18, worth approximately $470,000, accounting for 0.39% of the circulation;

Manta Network (MANTA) will unlock approximately 6.67 million tokens at 17:30 on May 18, worth approximately US$11 million, accounting for 2.66% of the circulation;

5 Conclusion

Last week, the crypto market continued to fluctuate, with market activity less than 30% of the previous peak, but market expectations are set to start a slow upward trend; in addition, the number of investment and financing deals and the total size of funds are both on the rise, with funds continuing to flow into DeFi, GameFi, infrastructure construction, and other Web3/crypto application areas, reflecting investors recognition of the long-term value of these areas and their optimistic expectations for the future development of the industry.

This week, the US PPI and CPI data for April were released. Since the Federal Reserve has not given up the option of raising interest rates in terms of inflation control and management, the market needs clearer directional instructions to focus on the main direction of capital flows in the future. APT, IMX, ARB, STRK and AEVO are all facing large-scale token unlocking, especially AEVO, which unlocks tokens equivalent to about US$1 billion, which will bring great uncertainty to the market. However, if the US inflation data is controllable, the entire crypto market will most likely begin a slow and volatile recovery phase.

From a medium- to long-term perspective, the infrastructure construction and technological innovation of the crypto industry have laid a solid foundation for the steady growth and mature development of the industry. Therefore, for investors, maintaining strategic patience and focusing on the long-term value and development potential of the industry will be the key to future success.

Note: All the above opinions are for reference only and are not investment advice. If you disagree, please contact us for correction.

Follow and join the MIIX Captial community to learn more cutting-edge information

Website: https://www.miixcapital.com

Twitter CN: https://twitter.com/MIIXCapital_CN

Telegram CN: https://t.me/MIIXCapitalcn

Join MIIX Capital: hr@miixcapital.com

Recruiting positions: Investment Research Analyst/Operation Manager/Visual Designer