Last night (23 MAY) the market did not disappoint the markets expectations, and it was lively from 9 pm to the early morning. Before the much-anticipated ETH spot ETF was announced, the price of Ethereum went up all the way to challenge the 4,000-point high, but soon gave up all the gains of the past day at the highest point in a short period of time, and fell to around $3,720. Although the price quickly recovered most of the lost ground, the latest data released by the United States at 21:45 (UTC+ 8) dealt another heavy blow to the risk market. The data showed that the SP Global Composite PMI index in the United States in May recorded 54.4, far exceeding the expected 51.1 and setting a new high in the past two years. The manufacturing and service PMIs also exceeded expectations. After the data was released, the U.S. Treasury yield rose sharply in the short term, with the 10-year yield reaching 4.4980% at one point, and the two-year yield also rose above 4.9% again. Traders also postponed the Feds first rate cut to December, and the futures market cut bets on full-year rate cuts to 34 basis points. The three major indexes all closed lower, with Nvidia bucking the trend and closing up 9.3%, setting a record high and leading the way.

Source: SignalPlus, Economic Calendar

Source: Investing, US May SP Global Composite PMI index exceeded expectations to a two-year high; 10-year Treasury yield

At 4 a.m., as the highlight of the night, the U.S. SEC officially announced the approval of the ETH Spot ETF, but the price of ETH plunged sharply to around $3,500 after the news was released, just as the traditional market motto Buy the rumor, sell the news has been in line with. ETH has risen 29% in the past week, and digital currency commentator Zach Rynes also commented on last nights Move, Everyone who wanted to buy the approval already did. If we delve into the reasons why it did not rise after the good news, it is very important that the so-called approval this time only approved the 19 b-4 applications submitted by 8 institutions (BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galax, Franklin Templeton). The actual trading must wait for Form S-1 to be passed, which may take weeks or months. In addition, it was the SECs Trading Markets department that agreed to approve it, not SEC Chairman Gary Gensler and the other four members. In this regard, Bloombergs ETF analyst James Seyffart believes that it is normal to make decisions in this form of delegation. If the SEC needs to make an official vote for every decision and every document, it is unreasonable. But regardless of how to speculate on this detail, the crypto community has expressed a positive attitude towards this approval, calling it a historic move.

Source: TradingView

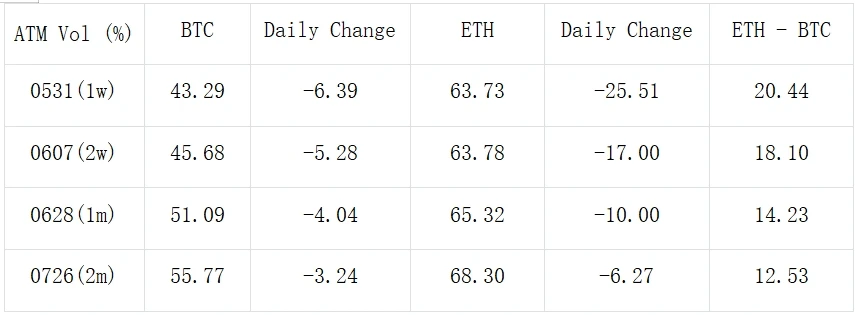

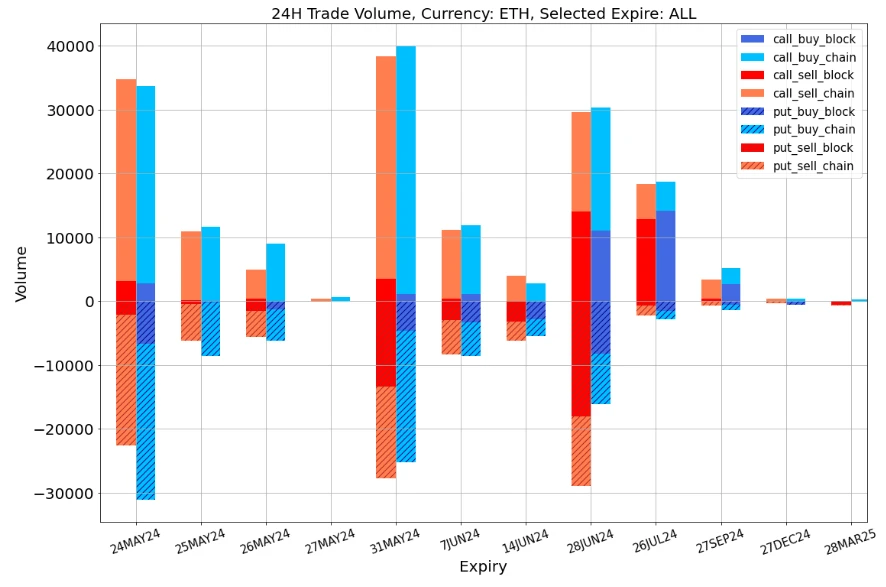

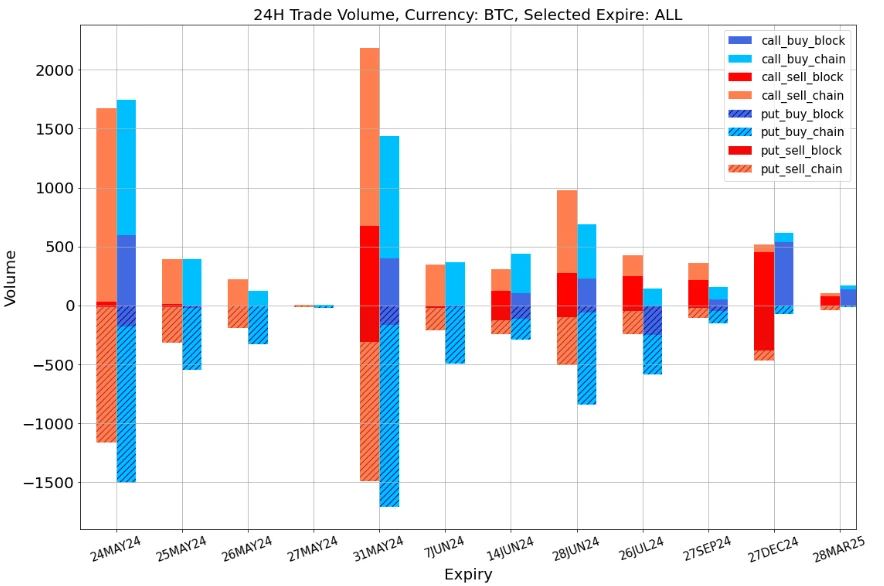

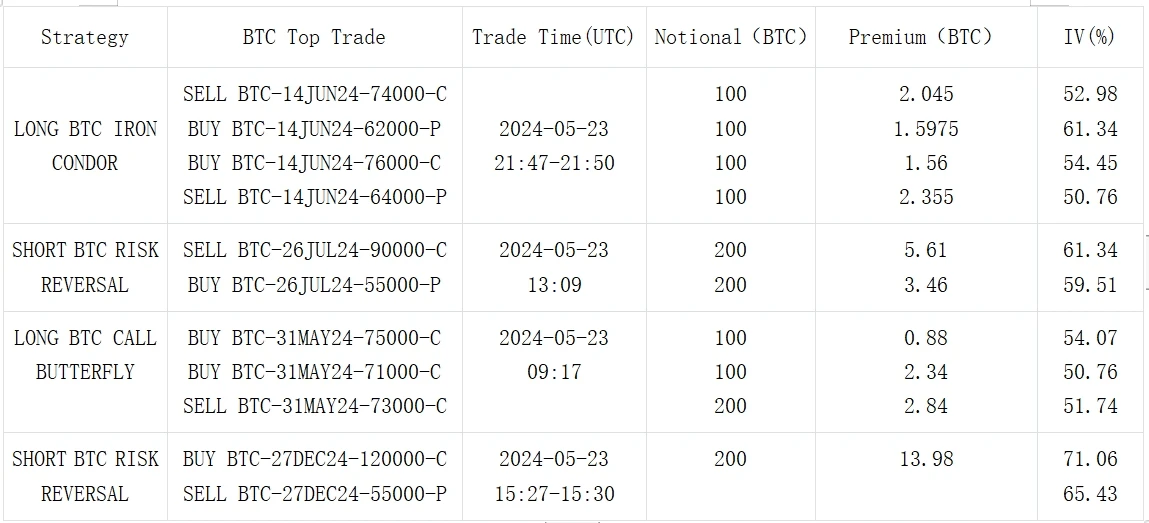

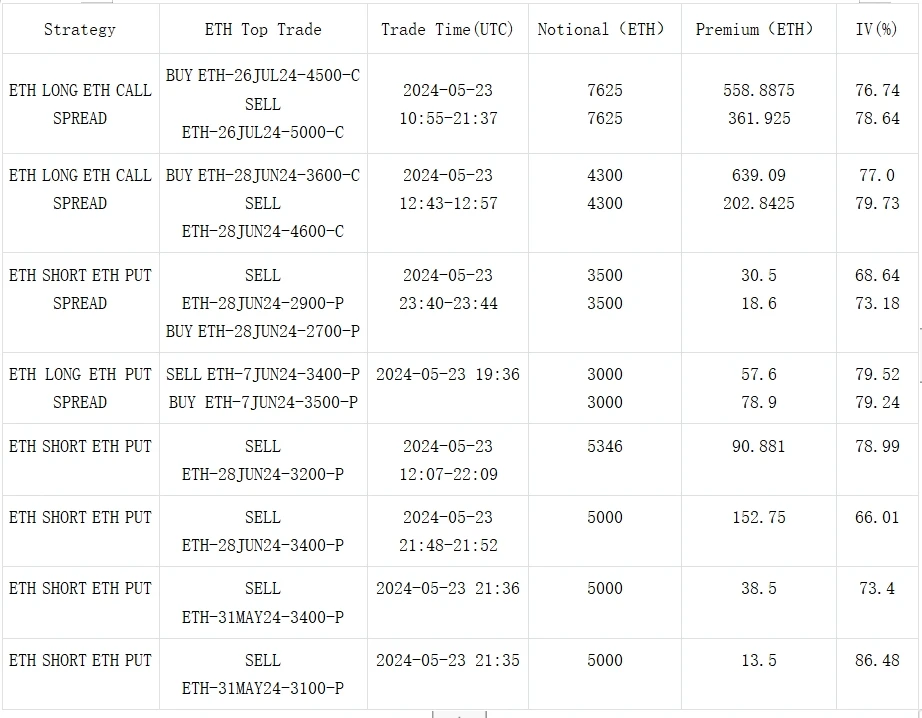

In terms of options, the overall IV levels of BTC and ETH also quickly fell after the ETF was launched, and the curve became steeper, with the average IV level of ETH returning to around 63%. In terms of trading, ETHs bulk Top Trade showed obvious directionality. We observed short puts of 20,000 ETH at the end of May and June, and long call spreads of about 12,000 ETH in two groups at the end of June and July. As mentioned above, the approval of 19 b-4 is only a prelude to victory. It will take several weeks or even months for the S-1 application of ETH spot ETF to be approved. Once TradFis funds really flow into the digital currency market, there will be more real motivation for the price to rise.

Source: Deribit (as of 24 MAY 16: 00 UTC+ 8)

Source: SignalPlus

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com