Yesterday (30 MAY), the cooling of US economic data re-boosted the markets confidence in interest rate cuts. The actual GDP was revised down to 1.3% (previous value was 1.6%), the lowest since the first quarter of 2023. Both inflation data and consumer spending fell slightly, and the existing home sales index fell sharply by -7.7%, the lowest since February 2021. After the data was released, US bonds gave up all the gains of the previous day. The current two-year/ten-year bonds are 4.948%/4.561% respectively.

Source: SignalPlus, Economic Calendar

Source: Investing

In terms of digital currencies, as the closing day of this month, BTC and ETH closed at 68201.52 (+ 0.62%)/3731.97 (0.12%) respectively. Looking back at yesterdays market, the release of US economic data boosted the price of the currency, pushing BTC to briefly break through $69,000, but the price soon fell back to around $68,000 after the peak. Judging from the recent trend, $69,000 seems to have turned from a support level to a key resistance level.

Source: TradingView

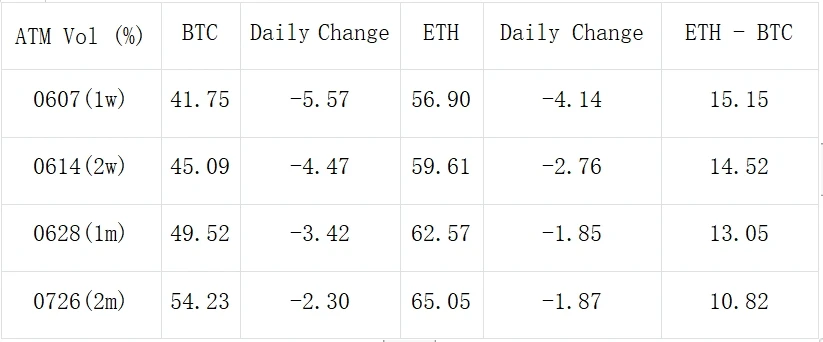

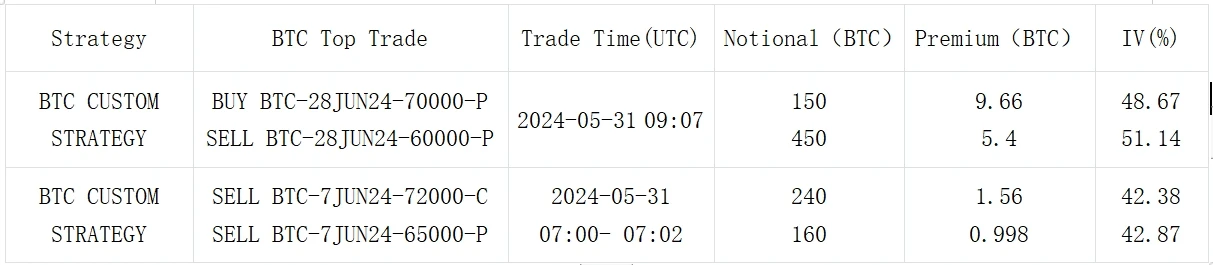

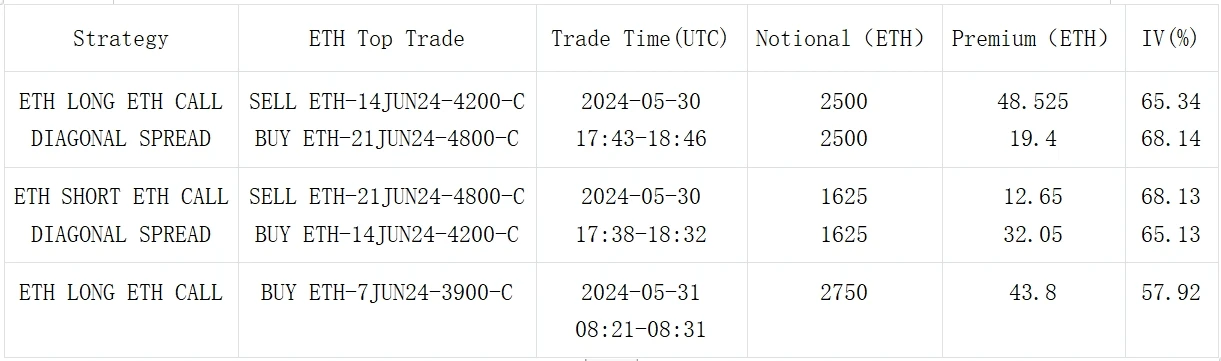

In terms of options, the implied volatility has obviously steepened downward, and the BTC front-end has dropped by about 4-5% again. The ATM IV within 1 month has returned to below 50%. ETHs IV is also falling overall, but it is still 10% + Vol higher than BTC in all terms. The approval date of ETF S-1 is still unknown. The market generally believes that it will be passed in July at the earliest. The transaction of ETH in the past 24 hours reflects a more obvious trend, which is reflected in the large number of call option positions in mid-to-late July and the bearish selling represented by 3000-P at the end of the month.

Source: Deribit (as of 2 MAY 16: 00 UTC+ 8)

Source: SignalPlus, Implied volatility continues to decline

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com