Last Friday, the core PCE price index, which the Fed focuses on, recorded a monthly rate of 0.2%, slightly lower than the expected 0.3%, setting a new low since December 2023. After the data was released, U.S. Treasury yields fell for four consecutive days, giving up half of last weeks gains. The ten-year bond fell below 4.5%, now at 4.475%, and the two-year bond was at 4.871%. Risk markets were boosted, with the Dow and SP rising 1.51%/0.8% respectively, and the Nasdaq closing close to flat.

Source: SignalPlus, Economic Calendar

Source: Investing

In terms of digital currencies, according to Glassnode data shown by Leon Waldmann on Twitter, since the approval of the ETH ETF, the proportion of BTC ETH in centralized exchanges has dropped to a record low, and Ethereum worth about $3 B has left centralized exchanges, increasing the possibility of potential short squeezes. BTC broke through the $68,500 resistance level today and began to challenge the next resistance level of $71,500. So far, BTC has hovered around $68,500 for nearly 12 days. If there is no hope of breaking through, it may return to $66,000 for support.

Source: TradingView; Twitter

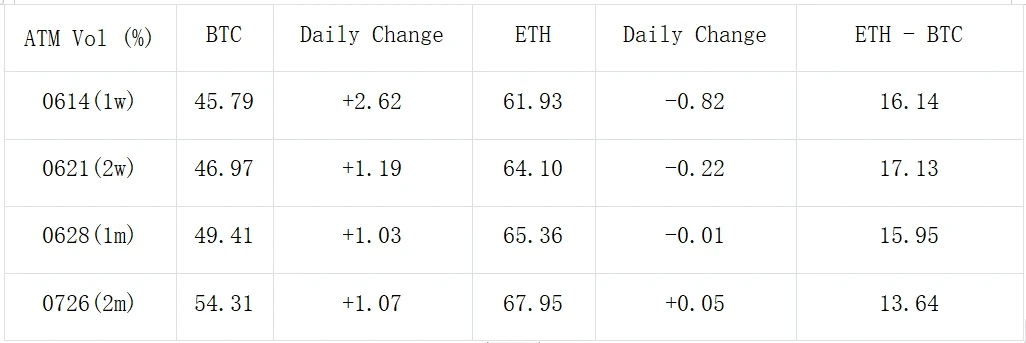

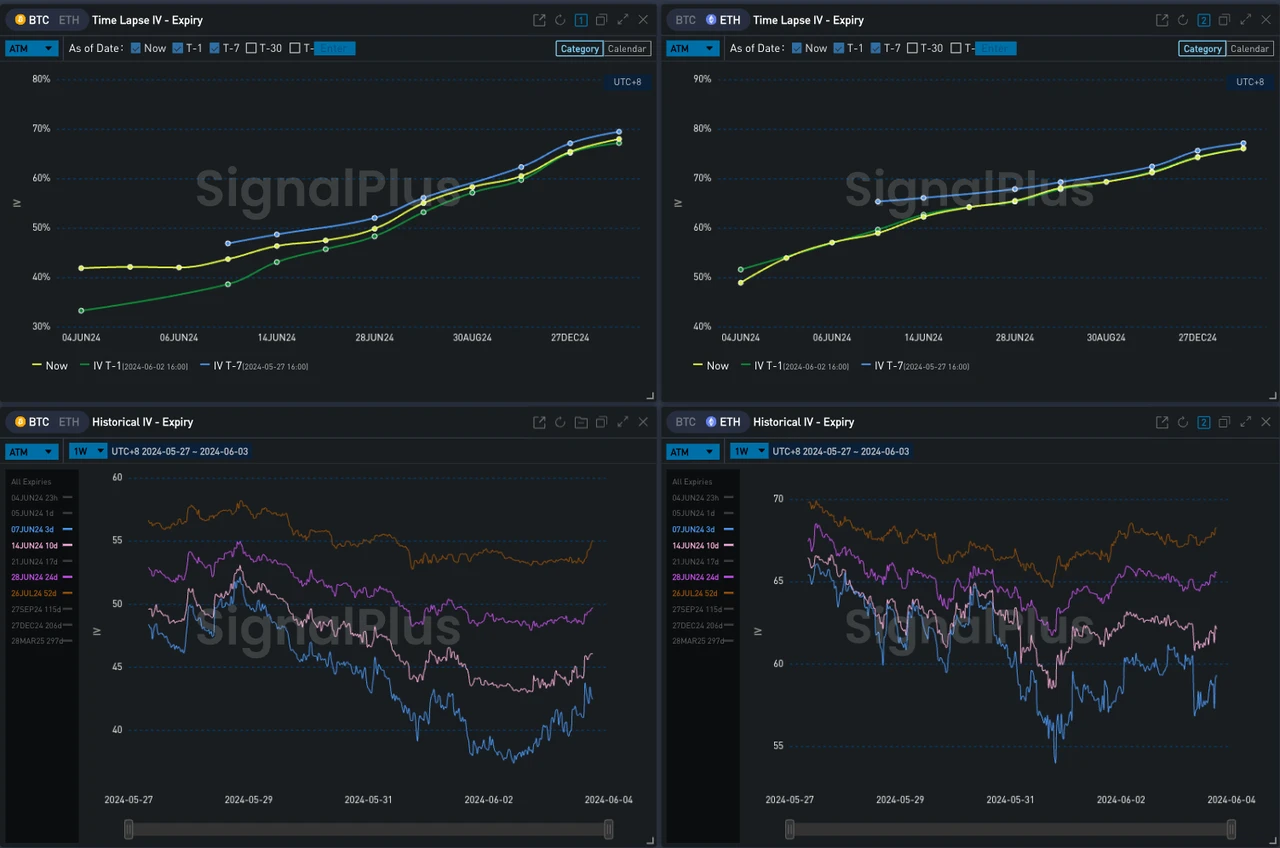

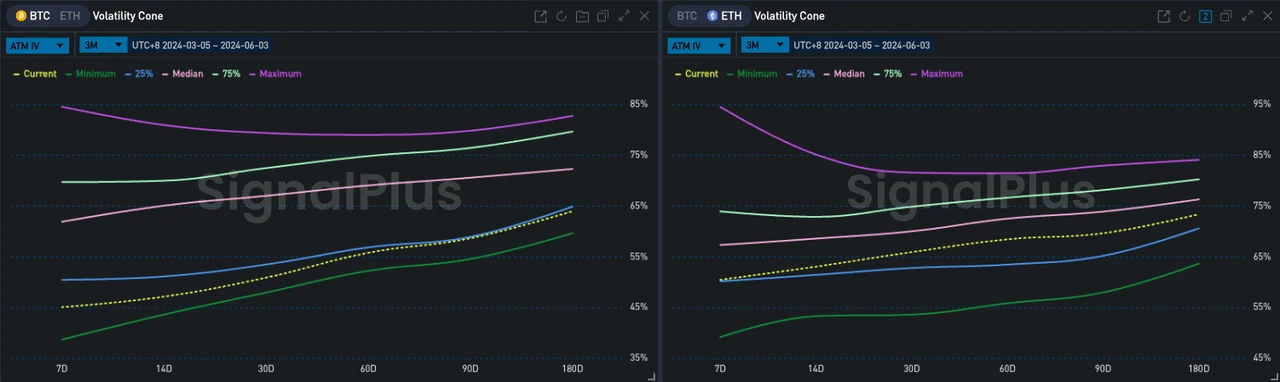

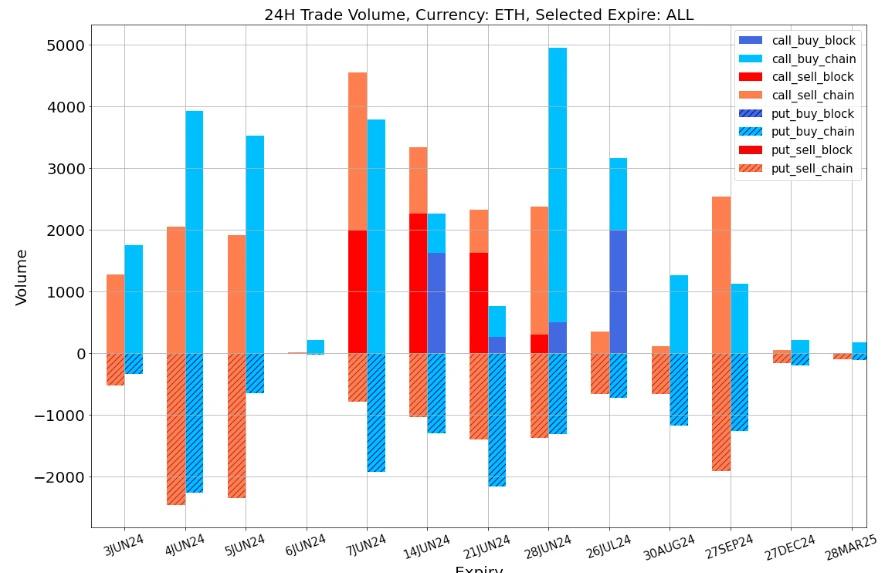

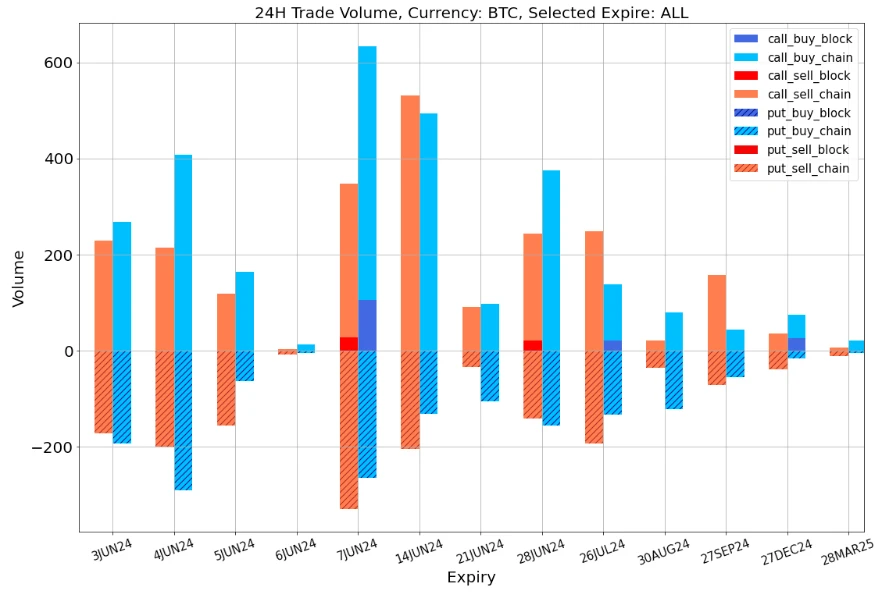

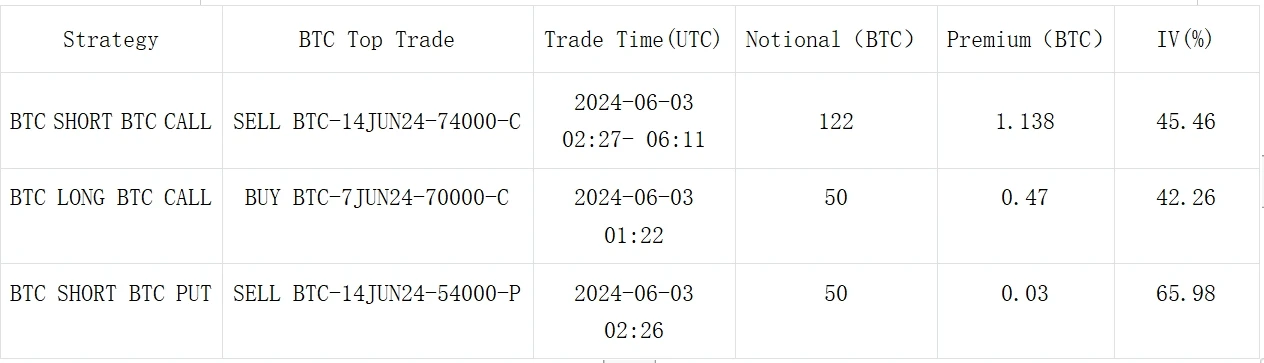

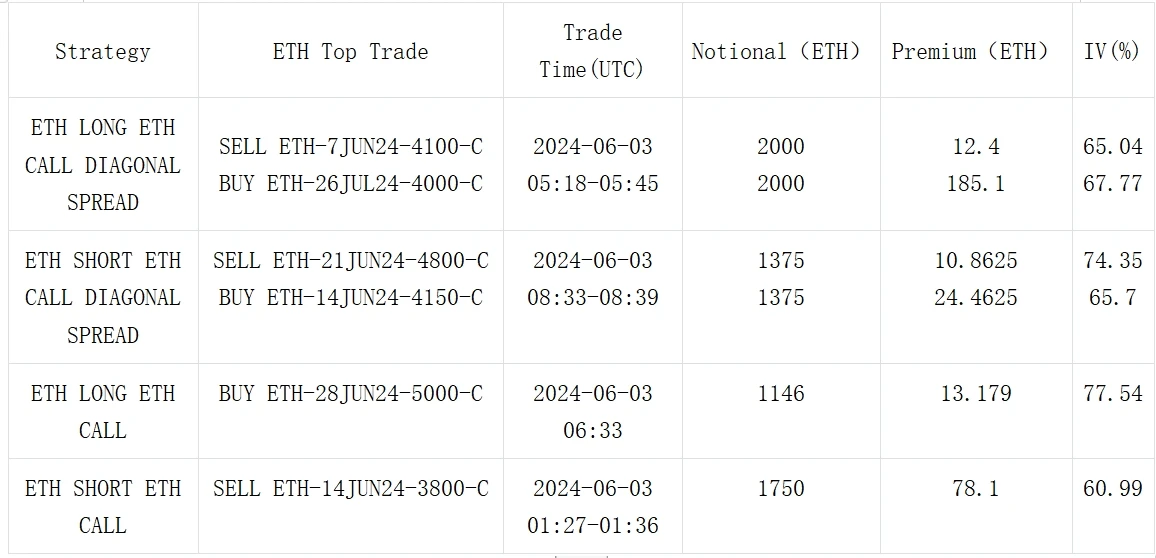

In terms of options, BTCs front-end IV rebounded slightly before entering the working day, but overall it is still at a relative low point below the 25% percentile of the historical three months; ETH is slightly below the historical median, and the term relative curve is steep. Observing the transactions in the past 24 hours, we can also see that the selling pressure of call options in mid-to-early June is strong. On the contrary, Call options in late June and July and later are very popular, which may also be related to the expectation of ETF S-1 approval. The current market consensus is still approval as early as July. At that time, funds will enter the market and the currency price is expected to break upward again. On the other hand, Grayscales Ehereum Trust (ETHE) currently manages funds of up to $ 11 B, so some people are worried that after the ETF is approved for sale, the market will repeat the selling pressure of GBTC at that time.

Source: Deribit (as of 3 JUN 16: 00 UTC+ 8)

Source: SignalPlus, BTC ETH ATM Vols

Source: SignalPlus, BTC ETH 25 dRR

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, BTC transaction overall distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com