The divergence between the US CPI and non-farm data in June has caused the market to be unable to reach a consensus on the number of interest rate cuts, and can only wait and see. Nvidias market value once ranked first in the world, becoming the pride of the AI era. However, the US stock market is severely divided, the price-earnings ratio is high, and the bubble has already appeared. The crypto market fell for no reason this month. The selling of old OGs and miners may be the direct cause of the decline, and it also provides new opportunities for subsequent investment.

The latest FOMC meeting in the United States in June came to an end. The meeting decided to maintain the federal funds rate between 5.25% and 5.50%, which was in line with market expectations. However, the overall attitude of this FOMC meeting was dovish, a change from the previous hawkish style. In the wording of the meeting, Powell believed that the current inflation was moderately progressed from the 2% target. Indeed, the latest CPI data in May showed that the US CPI in May increased by 3.3% year-on-year, a slight decrease from the previous value and the expected value of 3.4%; the core CPI in May, excluding food and energy costs, increased by 3.4% year-on-year, lower than the expected 3.5%, and lower than the previous value of 3.6%, the lowest level in more than three years.

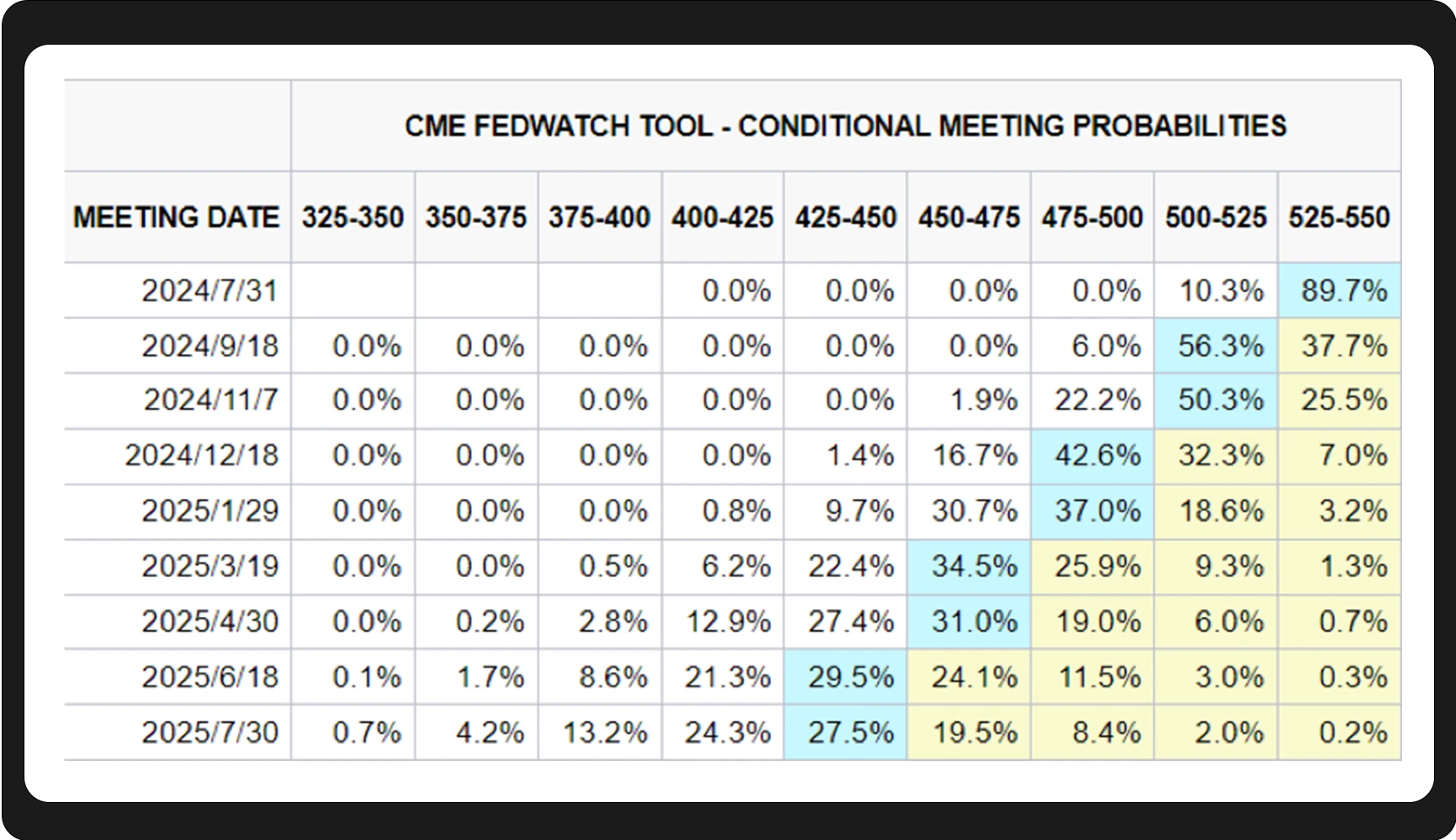

However, despite the good inflation data, the performance of non-farm data casts a shadow on the rate cut. The US non-farm employment in May was 272,000 (expected 185,000, the previous value was 175,000), which was higher than the forecast of Wall Street analysts. This divergence between inflation and employment data has led to the current markets inability to reach a consensus on the timing and number of rate cuts. The FedWatch Tool shows that the probability of the first rate cut in September is currently only 56.3%.

The dot plot shows that 11 members believe that the interest rate will remain above 5% this year, which is equivalent to only one rate cut at most; 8 members believe that it can be reduced to 4.75%-5%, which is equivalent to two rate cuts. Therefore, there is no clear conclusion on the number and magnitude of rate cuts, and we can only wait and see.

From a trading perspective, the market seems to have begun betting on a rate cut by the Federal Reserve. U.S. Treasury yields have been on a downward trend in recent months.

The price of gold has also been trading sideways at a high level, which seems to indicate that the risk appetite of funds is gradually increasing and the attractiveness of safe-haven assets to funds is gradually decreasing.

Now, US inflation seems to be moving in the right direction. The latest US Markit Manufacturing PMI is 51.7 (expected 51.0, previous value 51.3); the GDPNow model of the Federal Reserve Bank of Atlanta shows that the GDP growth rate in the second quarter of 2024 is expected to be 3.0%. Therefore, WealthBee believes that investors do not need to worry too much about the US economy, just wait for inflation to fall and the Fed to cut interest rates.

On June 18, Nvidia (NVDA) stock price rose by 3.51%, and its market value reached 3335.3 billion US dollars, surpassing Microsoft and Apple to become the worlds largest company by market value. It has been less than two weeks since Nvidias market value surpassed Apple on June 5 and became a member of the 3 trillion US dollar market value club. There is no doubt that in this narrative of disruptive AI change, Nvidia has reaped all the dividends and has become the favorite of the era voted by the market with real money.

However, after Nvidia briefly topped the worlds top spot, Huang Renxun began to sell off his shares to cash out, and the stock price fell back. It is now ranked third in the world after Microsoft and Apple.

The Federal Reserve has been slow to cut interest rates, but the U.S. stock market has been able to hit record highs. The powerful momentum brought by AI narratives is leading the U.S. stock market to break the macro cycle and move out of independent market conditions. This month, the Nasdaq and SP 500 continued to hit record highs, while the Dow Jones Industrial Average was trading sideways at a high level.

Since the beginning of the year, the talk of US stock bubble has been going on and even getting louder, but US stocks have been hitting new highs. If WealthBee analyzes the P/E ratio, although the P/E ratio of the SP 500 has been rising over the past year and is close to the 80% percentile of the P/E ratio since the 21st century, it is still much lower than the P/E ratio when the Internet bubble burst around 2002. Therefore, it can be said that the bubble does exist, but it is not that serious.

However, this month, the difference between the return rate and the breadth index of the SP 500 index reached a 30-year extreme, that is, although the index has repeatedly set new highs, the number of rising stocks has continued to decrease. This shows that all market funds are concentrated on large weighted stocks, and small tickets are almost unattended. This phenomenon is not conducive to the overall liquidity of U.S. stocks. Institutional grouping may cause the decline of grouped stocks to cause a plunge in the entire market. Therefore, the current risks of U.S. stocks exist and are obvious. WealthBee believes that it may be necessary to wait until Nvidias second quarter financial report for fiscal year 2025 appears to see whether Nvidia can continue to exceed market expectations. Combined with the changes in expectations for interest rate cuts, the style of U.S. stocks may usher in some changes.

In addition to the US stock market, the Asia-Pacific market performed well again this month, with the Mumbai SENSEX approaching 80,000 points and the Taiwan Weighted Index hitting a record high. Although the yen exchange rate fell below 160, the Nikkei 225 remained strong, trading sideways at a high level.

The U.S. stock market hit a new high, but the crypto market fell for no reason. This month, despite no obvious macroeconomic negatives, the crypto market continued to fall, with Bitcoin falling below $58,500 and Ethereum falling to around $3,240.

In fact, the macroeconomic situation in June was not bad, and the Feds speech has turned dovish. However, the fluctuations in the financial market are often inexplicable. HOD L1 5 Capital monitoring data shows that the US spot Bitcoin ETF still had a net inflow of 9,281 BTC in June. The Bitcoin spot ETF showed a net inflow, but the market trend was contrary to the behavior of large institutions.

At present, the direct cause of the market decline is still the selling of old OGs and miners (taking miners and whales as an example, they have sold $4.1 billion). As for why the concentrated selling during this period, it is most likely that it is gathered together for no reason.

From another perspective, the emergence of a large number of financial instruments in the Bitcoin market has also greatly increased market volatility. Since the emergence of Bitcoin contract trading in 2017, more and more complex financial derivatives have been born. If there were no contract trading, everyone would trade spot freely in the market, then the entire market would be neutral except for the increase in supply caused by miners producing new Bitcoins. The emergence of contracts has led to naked short selling in the market, resulting in the emergence of a large number of paper BTC, thereby increasing the supply of the market and exacerbating the volatility of Bitcoin prices. The interweaving of financial instruments such as spot, contracts, and options has made the volatility of the entire Bitcoin market more and more chaotic, and the simple and beautiful classical era of Bitcoin is gone forever.

Since there is no obvious risk, a decline is most likely a good time to add positions, and the selling by whales also gives other investors an opportunity to get in at a low price.

Moreover, the increasing diversification of financial instruments is the key path for the crypto market to gradually move towards the publics vision. Just this month, the crypto market ushered in two important pieces of information. First, the arrival of the Ethereum spot ETF is faster than expected, and it may be approved as early as early July. Bloomberg ETF analyst Eric Balchunas expects that the Ethereum spot ETF will be approved as early as July 2.

In addition, on June 27, Matthew Sigel, head of digital asset research at VanEck, said that he had applied to the SEC for the Solana ETF and said it might be launched in 2025.

From Bitcoin to Ethereum, and then from Ethereum to Solana, crypto assets are being accepted by traditional markets at a rate beyond expectations, and the incremental funds generated by then will probably be immeasurable.

Although the US CPI data for June showed that inflation cooled more than expected, the strong performance of non-farm data complicated the markets expectations for the Feds interest rate cut. In addition, the divergence between CPI and non-farm data and the interest rate cut measures that have already begun in Europe have further exacerbated the differentiation of global monetary policies. In the stock market, the sharp fluctuations in Nvidias market value and the large and small caps of US stocks reflect the markets differentiation in the prospects of AI technology, and also expose the increase in market concentration.

The sharp drop in the price of Bitcoin in the cryptocurrency market this month to below $60,000 and the decoupling from the trend of the U.S. stock market may be related to the selling behavior of miners and long-term holders. The increased volatility in the market may be partly due to the emergence of complex financial derivatives related to Bitcoin. Nevertheless, the launch of spot ETFs is seen as a stabilizer of the market, providing investors with hedging tools. In particular, the Ethereum spot ETF, which is expected to be launched in early July, will bring new vitality and stability to the market. Despite the uncertainty in the macroeconomic and traditional financial markets, the crypto asset market has shown its independence and resilience, and is expected to play an increasingly important role in a diversified portfolio and provide investors with new growth opportunities.