In the first half of 2024, the cryptocurrency market experienced many major events. For example, the BTC spot ETF was approved, the ETH ETF is about to be approved, and now there is an expectation for the SOL ETF. At the same time, the global economy has begun to enter a cycle of interest rate cuts. Although it is not clear when the United States will cut interest rates, its inflation has been well contained, which is undoubtedly a big boon to the crypto market. In addition, changes in regulatory policies are still one of the key factors affecting the crypto market. There are differences in the positions of governments on cryptocurrencies, and the adjustment trend of regulatory systems will also become an important variable in determining market trends. In the last quarter that just ended, BTC fell by 16%. The continuous outflow of institutional funds, coupled with the lack of breakthrough technological innovation, has brought certain difficulties to the entire cryptocurrency market. BTC is currently fluctuating and adjusting in the range of 56,000 to 70,000 US dollars, and investors are generally in a wait-and-see state. In such an environment, is now the best time to buy the bottom? Will the cryptocurrency market usher in a new round of bull market in the second half of the year? These issues deserve our in-depth discussion.

1. Timeline of important crypto events this month

Entering July, in addition to the above important project time nodes, the crypto market still needs to pay close attention to:

MT.Gox’s Bitcoin repayment plan in June triggered a market crash, and we need to continue to monitor this development in July;

Pay close attention to the approval process of the Ethereum spot ETF and the approval of the second half of the S-1 document;

Huge unlocking of WLD, SOL, ALT, XAI, ARB and other tokens;

FTX creditors will vote to decide whether to be paid in cash or cryptocurrency;

In terms of mainstream public chains, Cardano will have a Chang mainnet hard fork; HNT has a new subnet proposal; Arbitrums ARB will launch a staking function;

Finally, Jupiter’s JUP will reduce its total supply by 30%, Gala Games’ G token will be rebranded 1:60, and Orion ORN will launch a Lumia brand upgrade.

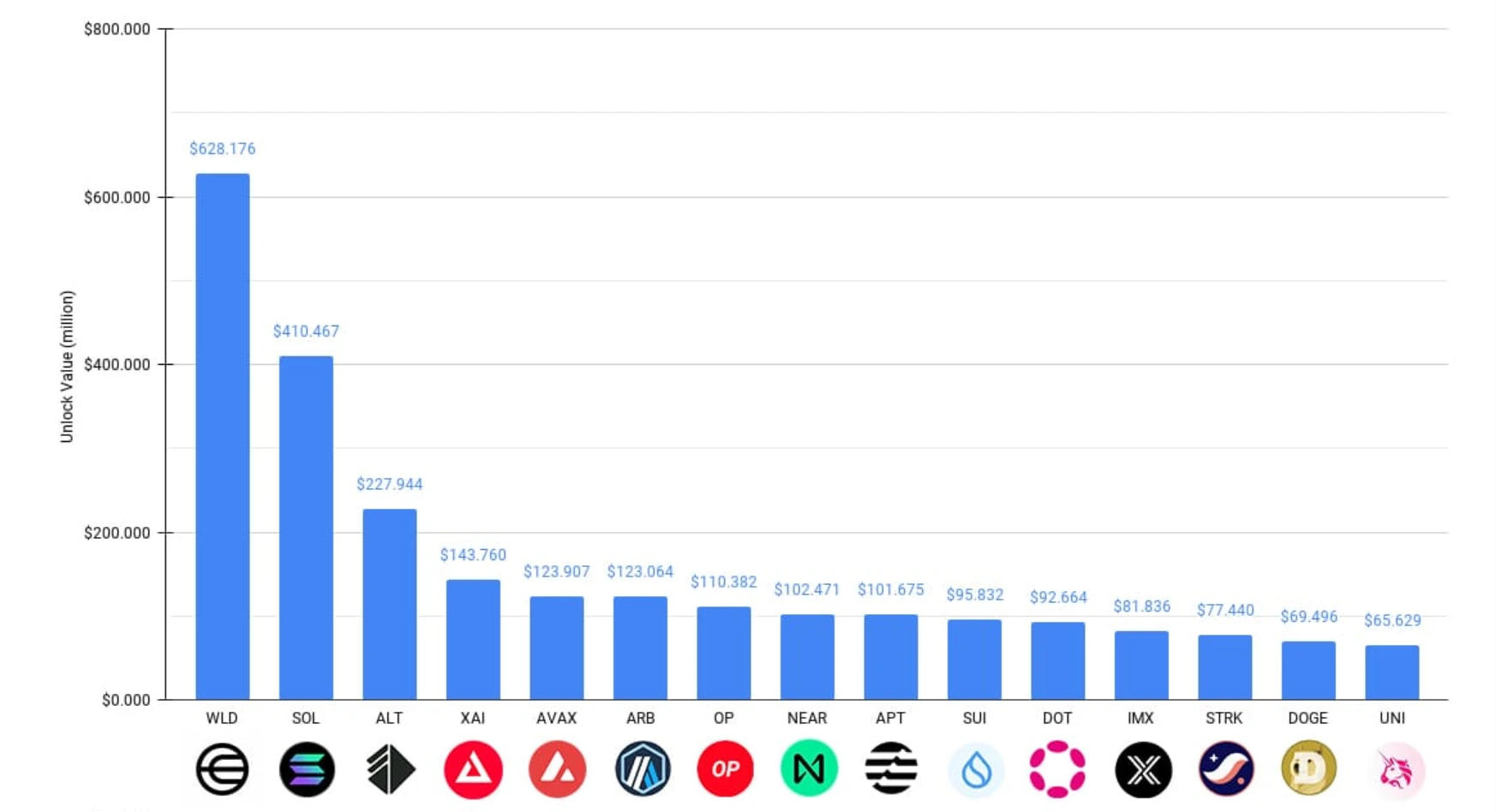

Many tokens are facing large unlocking. The following figure shows the top 15 projects in terms of unlocking volume in July according to @Token_Unlocks:

$WLD has the highest unlocked value this month, exceeding $600 million, and the unlocked scale accounts for 53.36% of the current circulating supply.

$SOL ranks second with over $400 million unlocked. $400 million may seem like a lot, but due to $SOL’s high market cap, the unlocked amount only represents 0.5% of the current circulating supply.

$ALT has seen significant unlocking this month, with nearly 45% of the circulating supply now unlocked.

$XAI also saw high unlocks this month, accounting for 71.59% of its current circulating supply.

Ethereums second-layer $ARB, $OP, and $STRK will unlock 120 million, 110 million, and 70 million US dollars in July.

2. Macro data analysis

After entering July, the focus of macroeconomics is still on when to cut interest rates. Federal Reserve Chairman Powell has long stated that the timing of interest rate cuts will be determined based on two key factors (4+2 indicators) - inflation and unemployment. In the context of major changes in the current international landscape and the profound impact of Sino-US industrial adjustments on the global economy, these changes will not show results in the short term.

The annual rate of core PCE in May released last Friday fell to 2.6%, the lowest in three years, providing confidence support for the interest rate cut in September. However, how the economic data in July and August will perform remains the focus of market attention. The decline in core PCE in May was mainly due to the decline in the prices of three major factors: housing prices, automobiles and crude oil. However, after entering July, the prices of these three factors have rebounded. The expectations for the core PCE data in June are not optimistic, so the smart money in the market has not bet in advance.

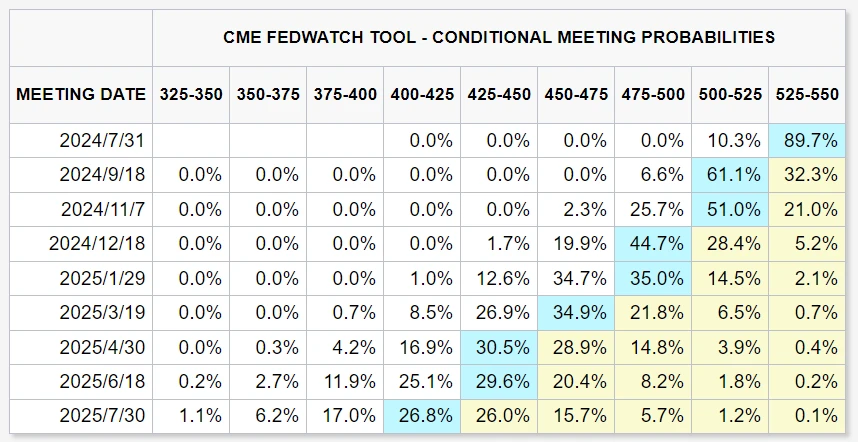

It is worth noting that after the release of the May core PCE data, the Chicago Mercantile Exchange (CME) Fed Watch tool showed that the markets expectations for the Fed to cut interest rates by 25 basis points in September rose to 61%, while the probability of another rate cut in December was 44.7%. Although expectations for rate cuts have risen, the market remains cautious, especially before the release of June data, and the markets attitude towards risky assets such as Bitcoin also reflects this cautious sentiment. Although Bitcoin faces downside risks, its downside is limited in the absence of major negative news.

In addition, changes in the international economic environment cannot be ignored. The industrial adjustments between China and the United States are having a profound impact on the global economic landscape, and this process may take a long time to fully manifest its results. This adjustment has had an important impact on the global supply chain, trade relations and investment flows, and the market needs to keep an eye on it.

Economic data in the coming months will have a key impact on market expectations and the Feds policy decisions. Investors need to pay close attention to the upcoming data, while considering changes in the international economic environment and market sentiment to make more informed investment decisions.

Since March, altcoins have been adjusting for more than three months, and Bitcoin has also come out of a clear M-top pattern. The election debate on June 27, the PCE data on June 28, and the launch of the Ethereum spot ETF on July 2, which we had high hopes for, did not bring the expected benefits to the market. Although the PCE indicator is beneficial to US stocks and risk markets, the markets digestion and interpretation of these data have become more hesitant due to the impact of the US election. The rapid rise and fall in the short term further highlights the markets disagreement and uncertainty about the future direction.

3. Key factors of the macro market

The cryptocurrency market has been facing the influence of many key factors. The correlation between the US stock market and cryptocurrencies in the past cycle is self-evident. In the context of the global economy entering a cycle of interest rate cuts, the overall performance of risky assets will also be key. At the same time, the strong US dollar, which has remained near its highest level in the past 30 years, will also put some pressure on the crypto market. A strong dollar will make cryptocurrencies denominated in US dollars relatively more expensive, and will also reduce investors risk appetite to a certain extent. When faced with high interest rates, investors are more likely to choose to deposit funds in banks to earn interest, which will affect market liquidity.

In addition, the approval and listing of the most popular Ethereum spot ETF will inject new momentum into Ethereum and the entire crypto ecosystem. There is also the US election in the second half of the year, and the impact of political factors on market sentiment is also very important. The interweaving of various factors will jointly determine the direction of the crypto market in the second half of 2024.

On Tuesday morning, Eastern Time, Federal Reserve Chairman Powell said at a central bank forum hosted by the European Central Bank that the Fed has made considerable progress in controlling inflation, but hopes to see more progress before having the confidence to start cutting interest rates. The forum also attracted the participation of European Central Bank President Lagarde and the President of the Central Bank of Brazil.

Powell expressed satisfaction with the inflation control results over the past year: We have made considerable progress in bringing inflation back to target levels. The latest inflation data show that we are back on track to cool inflation. But he stressed that too fast policy adjustments could undermine the inflation control results, while too slow policy adjustments could hinder economic recovery and expansion. Powell pointed out that the Fed needs to find a delicate balance between controlling inflation and avoiding a deterioration in the labor market.

When talking about the labor market, Powell said that the U.S. unemployment rate remains at a low level of 4% and the labor market is gradually cooling down. Powell expects inflation to be in the lower middle of the 2%-3% range in the next year, but he expressed concern about higher service sector inflation, especially the part related to wages.

Although market expectations for a rate cut in September have risen, Powell declined to give a specific time. When asked if a rate cut in September was possible, Powell said: Im not going to set any specific date right now. This statement shows that the Fed remains cautious about rate cuts and that future policies will continue to be data-driven.

Powell also mentioned that fiscal policy is the responsibility of politicians and that debt sustainability should be the focus in the future. Boosted by Powells speech, the Nasdaq index turned positive, the SP 500 index erased early losses, U.S. Treasury yields extended their declines, and the dollar index fell back to intraday lows. Traders in the swap market continue to expect the Federal Reserve to cut interest rates nearly twice this year.

Potential impact of the election on US markets

The main factor that may trigger political and economic fluctuations in the United States is still the election. As voters expectations of the election of Trump and Biden change, the market is also betting on the different impacts and expectations brought about by the election of different candidates. If the market stirs up a storm of Trump market, and it is expected that he will implement large-scale loose policies and inject a large amount of funds into the stock market after his election, then capital will flow into the risk market in advance, triggering a sharp rise.

Market participants are concerned about the uncertainty brought about by the election, not only because of the huge differences in policies among different candidates, but also because of their potential impact on the economy. Trumps policies tend to be large-scale fiscal stimulus and tax cuts, which may be seen as positive for the stock market. In contrast, Biden is more focused on infrastructure investment and social welfare, which are also likely to promote economic growth, but the market remains cautious about his possible tax policies.

If expectations of Trumps victory increase, the market may reflect this expectation in advance, with funds quickly flowing into stocks and other risky assets, pushing up market prices. However, this situation also brings potential risks, including uncertainty in policy implementation and long-term economic impact. The market will continue to closely monitor the development of the election and assess the possibility of each candidates victory and the impact of their policies on the economy.

In general, the US election is not only a political game, but also a major event that affects the global market. Investors need to remain vigilant and adjust their strategies in a timely manner to cope with possible drastic fluctuations and changes in the market.

4. Focus on the sector

ETH Ecosystem

Key targets: ETH, ENS, LDO, SSV, ETHFI

The ETF Store predicts that the Ethereum spot ETF may be launched in the week of July 15. Once the ETH spot ETF is approved and launched by the SEC, it will definitely have a significant repair on the market sentiment. The approval of the Ethereum ETF, like the Bitcoin ETF, means that more institutional investors can enter the market more conveniently, pushing up the price of the currency. By then, the Ethereum ecosystem will also rise as a whole. You can focus on Ethereums own son ENS, as well as the leading staking project LDO, and the re-staking leader ETHFI. In the second half of the year, we can also look forward to the technological innovation brought by the parallel EVM: continue to pay attention to the new developments of Fuel, Monad, Berachain, and the application of Sei on the game chain.

SOL Ecosystem

Key targets: SOL, JUP, HNT

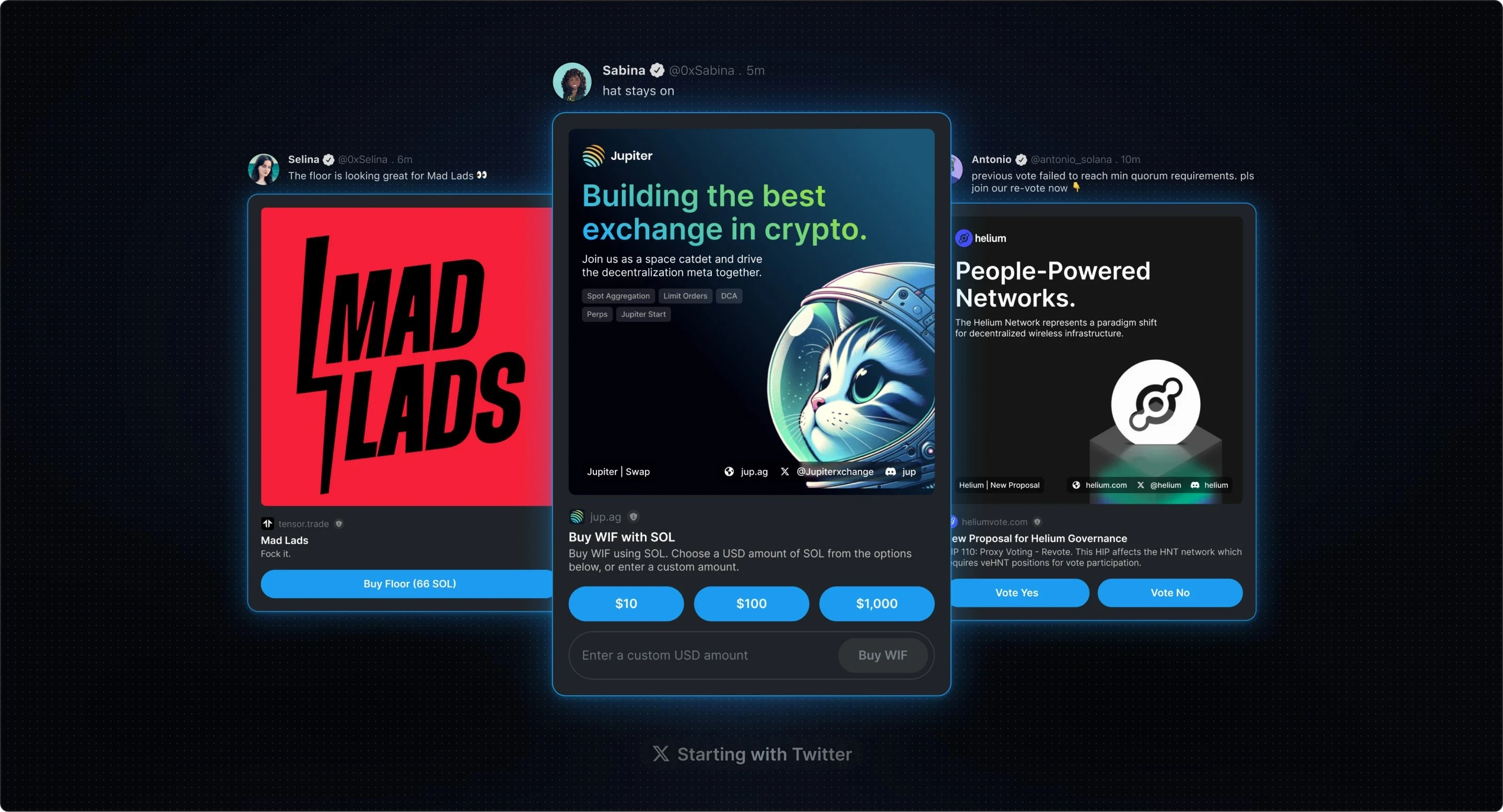

On June 28, asset management giant VanEck submitted Solana ETF (VanEck SolanaTrust) application documents to the SEC. Subsequently, 21 Shares also submitted the S-1 document of Solana ETF, which attracted great attention from the market. Solana has also recently launched the powerful Blinks, which converts various interactive operations on Solana into a button on Twitter, such as Mint, Swap, etc. By linking social media accounts, you can follow the transaction of popular assets on the chain with one click, opening up the imagination space for a variety of application scenarios. The high-speed information requirements of early Meme tokens may be met by Blinks, further opening up the Meme market. At present, a series of protocols such as two wallets Phantom and Backpack, DEX Jupiter, and NFT platform Tensor already support Blinks.

This month Helium will also announce a new sub-network proposal, so you can keep an eye on the HNT trend. In addition, Solanas ecosystem re-staking LST liquidity aggregation protocol Sanctum is also about to airdrop. It has previously announced the token economy of its token $CLOUD, 10% of which will be used for airdrops. Currently, the TVL exceeds $800 million, making it the fifth largest project in the Solana ecosystem TVL, and it is worth paying attention to.

AI Section

Key targets: RNDR, AKT

The continued large-scale investment of capital has promoted the development of AI technology and also driven the encryption sector of AI concepts. It is expected that the markets continued preference for artificial intelligence will continue to benefit the decentralized GPU market such as Render and Akash. In July, there will be new progress in the merger of AGIX, FET, and OCEAN.

MEME Section

Key targets: PEPE, BONK, WIF, TRUMP

MEME manufacturer Pump.fun has surpassed Ethereum in daily revenue. As the market fails and the altcoin plummets, investors are looking for solace in MEME. We can choose projects that have entered the public eye and have a strong community consensus as investment targets, such as PEPE, to avoid a sharp decline in assets too quickly. MEME is a product driven by emotions, and any exciting news will become a catalyst for the rise. A large, active and actively involved community will always be the backing of MEME. The WIF and BONK communities have done a good job in this regard. If you want to choose an investment target in the Solana ecosystem MEME, I believe WIF and BONK will be the first choice for many people. In the US election that has not yet ended in the second half of the year, TRUMP also has many band opportunities. In general, the risks and randomness of participating in MEME projects are too high, and investment should be cautious.

GameFi and SocialFi Sections

Focus on: TON, RON

TON has been very resilient in this round of correction, and the monthly return rate is still positive, which is a very impressive performance. In July, Telegram mini-program games Hamster and Catizen will also issue tokens, and you can focus on their trends and performance. In addition, the game public chain Ronin will upgrade to Goda this month. After the hard fork, validators can get rewards by generating blocks every day, and the upgradeability of smart contracts has been introduced. REP-0014 proposes to implement Ethereums EIP-1559 to transfer gas fees to the Ronin treasury. You can pay attention to whether the treasury funds will be used to repurchase RON.

V. Conclusion

BTC fell below 58,000 again, and the market was very pessimistic. At present, BTC computing power has dropped to the lowest level since December 2022. Multiple indicators: miner reserves, exchange reserves, miner position index (MPI), etc. also show that the market may have bottomed out, miners are more willing to hold positions, and cash-out behavior has been reduced. At this stage, miners are less likely to sell BTC. All of these mean that market sentiment and expectations are improving to a certain extent. Bitcoin is looking for new upward momentum to lay the foundation for a subsequent rebound. This momentum may come from the official interest rate cut in the United States, the emergence of new breakthrough technologies in the market, or the dust has settled on the election, and crypto advocate Trump has introduced more market-friendly policies. By then, long-term wait-and-see investors will enter the market again and re-drive capital inflows.

In general, the crypto market still has strong rebound momentum in the second half of 2024. We should pay attention to the multiple changes in policies, fundamentals, innovation and market sentiment in real time. This article does not serve as any investment advice. Risk control is also the most important thing we always talk about. If a losing position makes you feel bad, its simple: exit quickly, because you will always have the opportunity to enter the market again (Paul Tudor Jones). When the market is not good, it is best for us not to linger, exit and wait and see, patiently wait for the next opportunity, and avoid excessive trading caused by emotions.