In the past week, the market has successfully digested the shipments of various whales and successfully hit the pressure level. How will the market perform next? Recently, weak US economic data has raised expectations for interest rate cuts. Fed Chairman Powell has released dovish signals at hearings for two consecutive days, and the US economy has shown signs of fatigue. Ethereum spot ETF is about to land, and Bitcoin has regained its upward momentum this week. After initially bottoming out at $53,000, it has continued to rebound, and the market has once again called for the slogan of copycat carnival. We believe that if Bitcoin can stand firm at the $60,000 mark, it will rebuild market confidence and is expected to return to the high of $70,000 in the short term.

Macro environment

The US unemployment rate has been adjusted significantly

In June, the number of new non-farm payrolls in the United States fell by 12,000 to 206,000, higher than the Bloomberg consensus of 190,000, and the cumulative downward revision from April to May was 110,000; hourly wages fell by 0.1 percentage point to 0.3%, in line with expectations; the unemployment rate rose more than expected to 4.1%. Due to the employment in the service sector, private sector employment performance was weak, while government employment rebounded. The non-farm data in June showed that the momentum of US economic growth in the second quarter may have slowed down to near the potential growth rate, and may continue to weaken in the future.

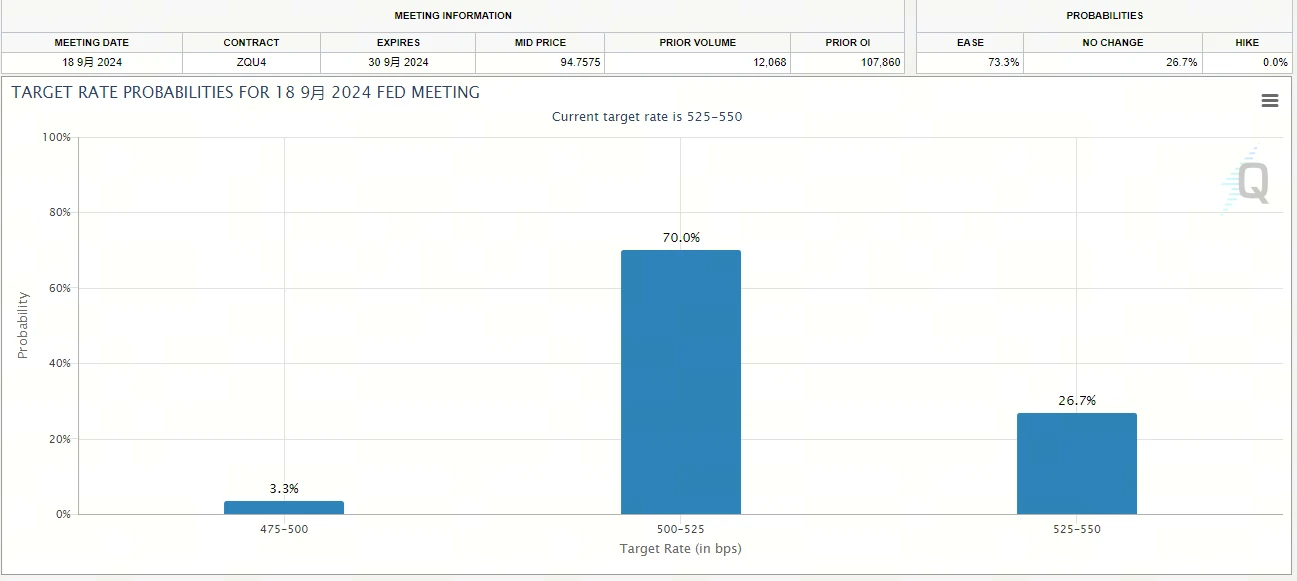

Expectations of a Fed rate cut increase

Timiraos, a mouthpiece of the Federal Reserve, believes that the expectation of a rate cut this time is more credible. Powells reason for cutting interest rates last year seemed untenable when inflation rose in the first quarter and the economy grew steadily. This week, Powell went to Congress to lay the foundation for a rate cut again. If the CPI data does not fluctuate significantly this week, it is highly likely that the rate cut cycle will start in September. The market has already begun to price in the probability of a rate cut in September, which is stable at more than 70%. Traders are betting that September will be the starting point for the rate cut.

Market status and future trends

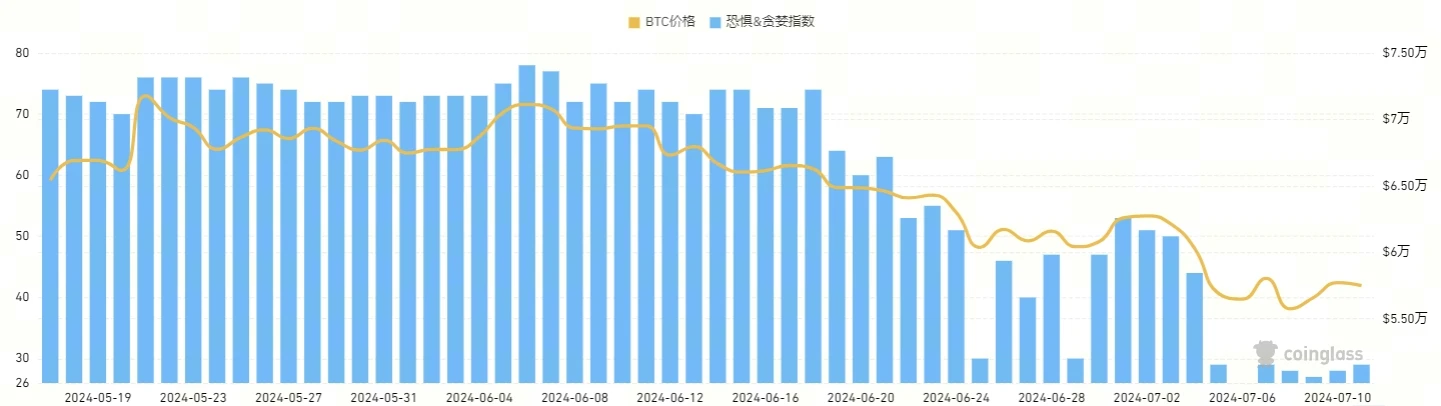

This week, the market selling pressure continued to weaken, and the price of Bitcoin (BTC) showed an upward trend, driving the market to strengthen. On July 15, the Ethereum spot ETF may be launched, and the short-term market sentiment is supported. Affected by this, the Bitcoin panic index gradually improved.

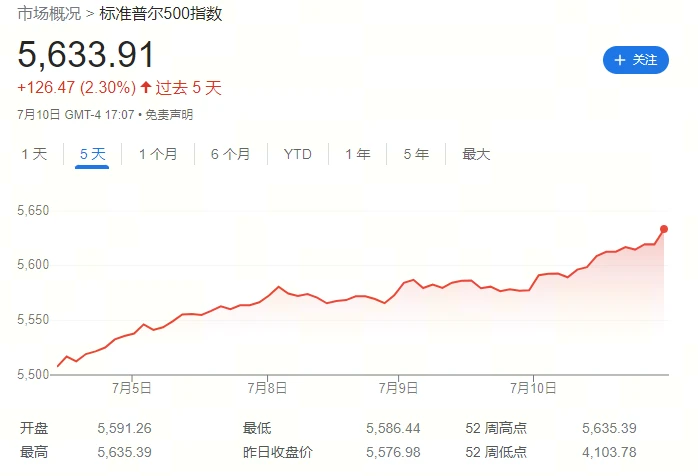

Bitcoin has recently moved in a similar direction to the SP 500, regaining relative strength. As we said last week, as selling pressure eased, there are important buying opportunities in the short term.

High-quality track

1) Bitcoin L2

Hot Spot: UNISAT New Product Release

UniSat announced a major update to its Swap product on July 7. Most of the engineering for the Swap module has been completed, and the remaining work mainly involves assisting other index compilers to effectively identify and calculate records related to the Swap module. The team has also expanded Bitcoin through FractalBitcoins approach. The team is very confident about delivering FractalBitcoin in September. On FractalBitcoin, the official will provide a swap product called FractalSwap, which has the same functions as the mainnet swap module to ensure that projects on FractalBitcoin have good liquidity from the beginning. In subsequent iterations, BTC and other mainnet assets can also exist as brc-20 wrapped assets on FractalBitcoin, providing greater flexibility.

Next market trend

The emergence of inscriptions is the first opportunity in history to earn profits by mining Bitcoins for transaction fees instead of relying on fixed block rewards, which is of great significance to maintaining the Bitcoin ecosystem. If the unemployment rate cools down this week, it can be expected that Bitcoin L2 may continue to outperform Bitcoin.

2) Ethereum track

Hot topic: Ethereum spot ETF is about to be approved

An Illinois court has ruled that Ethereum is a commodity, clearing the way for the approval of an Ethereum spot ETF. The market believes that the ETH spot ETF may be approved by the SEC on July 15, and there may be significant gains by lurking in the Ethereum ecosystem.

Specific currency list

Uni (Uniswap): Uniswap is a decentralized trading protocol that enables cryptocurrency trading through automated liquidity providers (AMMs) without the need for traditional centralized exchanges.

LDO (Lido): Lido is a decentralized Ethereum 2.0 staking service that allows users to stake ETH to Ethereum 2.0’s Beacon chain and receive stETH tokens pegged 1:1 to ETH.

Ethena (ENA): Ethena is a synthetic dollar and internet native yield platform built on the Ethereum blockchain. It provides stable synthetic USDe through a Delta neutral hedging process.

User attention

1) Popular Tokens on Twitter

$IO

IO.NET is an open source, cross-platform network communication library for high-performance asynchronous network programming on the .NET platform. It provides a concise and powerful way to handle network communications, supports protocols such as TCP, UDP, and Unix domain sockets, and is suitable for building various network applications and services.

On July 5, @maid_crypto said on the X platform: “IO insider trading has transferred 2.5 million IO.”

IO.NET official @TheAntiApe clarified: This FUD is indeed a misunderstanding: 1. The contract is the IO Season 3 airdrop contract from streamflow. The 2.5 million IO community rewards and the remaining GPU rewards are separate contracts, so this contract shows a total of 2.5 million. 2. The link sent by @maid_crypto filters transactions with more than 10,000 tokens. If you cancel the filter, you can see all small amounts of the contract.

$SD

Stader is a non-custodial smart contract-based staking platform designed to make it easy for you to discover and use staking solutions. Stader is building critical staking middleware infrastructure for multiple PoS networks to serve retail crypto users, exchanges, and custodians. Moreover, Stader’s mission is to simplify staking and provide the best risk-adjusted returns to delegators. We envision a future where our staking-based DeFi cornerstone will unleash a whole new world of staking derivatives.

Some major exchanges have already included it in the coin listing process.

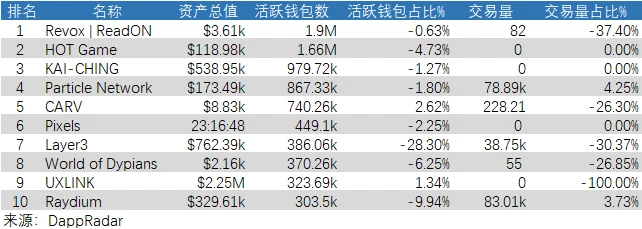

2) Popular DApps

Layer 3

Layer 3 is a protocol that creates a liquid attention market across EVM, Solana, and Cosmos. Since launch, Layer 3 has facilitated 96 million interactions and issued L3 tokens. Users holding L3 can participate in governance and staking. The initial airdrop will take place in the summer of 2024, with a total supply of 300 million, an initial airdrop of 5%, and a community allocation of 51%. The Layer 3 Foundation will release token economics and distribution schedules. Governance allows holders to manage the protocol, with 51% of the supply dedicated to the community.