introduction

Prediction and gambling is an ancient industry that has been running through the entire historical trajectory of human social development. Predictions and bets on future events fascinate everyone and actively participate. Therefore, the prediction and gambling industry came into being. Since ancient times, this industry has attracted much attention due to its lucrativeness and large number of participants, as can be seen from phenomena such as Las Vegas, Macau, and even sports lotteries. Although Web 3 is an emerging industry, many of its industries are highly overlapped with the Web 2 world, so the prediction and gambling industry will inevitably exist in it.

As a leading project in the prediction and gambling industry in the Web 3 world, Polymarket has not only been sought after and widely participated by investors in the industry, but has also successfully crossed the circle and entered the Web 2 society. Since predictions on Polymarket must use their own real money to make investment judgments, in the eyes of some media, Polymarkets prediction results are even more accurate than the answers of experts. Therefore, many media will say when quoting the prediction results: According to the prediction results on Polymarket... For example, the US election is the hottest topic recently, and even domestic media such as Sina News will quote the support results for Trump and Biden on Polymarket. It can be seen that Polymarkets influence has exceeded the encryption field and has a very strong influence in Web 2.

As a project in the prediction and gambling field, Polymarket is very successful. It quickly became the industry leader by increasing the trading liquidity of various markets through the hybrid use of AMM and order books.

Basic information of the project

project team

Shayne Coplan: Founder CEO. Coplan studied computer science at New York University and dropped out to start a business. He was an early follower of Ethereum. In June 2016, he interned at Chronicled in the San Francisco Bay Area and founded Polymarket in June 2020.

Liam Kovatch: Head of Engineering at Polymarket. Former Vice President of the company, CEO of Paradigm Labs, and software engineer at 0x Labs. Graduated from Columbia University with a degree in engineering.

David Rosenberg: Deputy Director of Strategic Operations. Former intern at Silicon Valley Bank, business development manager at foursquare, and strategic director at Snap Inc. Graduated from Cambridge University with a degree in law.

Financing

Polymarket has raised $74 million in three rounds of funding.

Seed round

In October 2020, Polychain Capital and Naval Ravikant led the investment, with 1confirmation and ParaFi, former Coinbase CTO Balaji Srinivasan, Aave founder Stani Kulechov and others participating, with a total investment of US$4 million.

Series A

In 2023, Polychain Capital and Joe Gebbia invested in this round with an amount of US$25 million.

Series B

In May 2024, Founders Fund and existing investors 1confirmation and ParaFi led the investment, with participation from Ethereum co-founder Vitalik Buterin and Dragonfly and Eventbrite co-founder Kevin Hartz, with a total investment of US$45 million.

As a Dapp that only does a single business, the $74 million in financing can reflect its strong market appeal.

Development Strength

Polymarket was established in 2020 by founder Shayne Coplan. Polymarkets development has encountered regulatory obstacles. The key events in the development of the project are shown in the table:

Judging from the key events in the development of Polymarket, although it encountered many obstacles in the process of development, such as sanctions from the Commodity Futures Trading Commission of the United States, and being criticized for sensitive topics when betting on hot topics in the market, Polymarket did not back down, but actively solved the problem. Not only did it successfully deal with the sanctions from the Commodity Futures Trading Commission of the United States, but it also demonstrated excellent emergency public relations capabilities when facing social public opinion crises. In addition, users did not encounter liquidity problems when betting on Polymarket, which fully demonstrated the strong operational and technical strength of the Polymarket team.

Operation Mode

Polymarket belongs to the prediction market track, but essentially still belongs to the category of decentralized exchange (DEX), except that its trading subject is the probability of the topic result being realized.

As a DEX for alternative trading targets, Polymarket deploys smart contracts on Ethereums second-layer Polygon chain, providing liquidity to the market through automated market makers (AMMs) and order book systems. When users choose to provide liquidity for an event, they will receive 2% of the amount of each order as an economic reward, and the closer the liquidity provision price is to the final transaction price, the more rewards they will receive.

Polymarket chose UMAs OP oracle (OO), which consists of three parts: market contract, CTF adapter contract and OO. All external data is accessed by OO, and the oracle is used to ensure the fairness of the prediction results.

The main prediction category of Polymarket is the binary prediction market, where users can predict whether an event will or will not occur. Users express their predictions by purchasing shares of yes or no. The results of the predicted event will be connected to the movement of external events in real time through the oracle OO. The CTF adapter will automatically send a request to OO, and the proposer in the UMA system can respond to this request. If there is no dispute, the response will be considered correct and submitted to the CTF adapter after a two-hour challenge period. If the answer is incorrect, or other participants in UMA disagree with the answer, other participants can debate the response as disputers to ensure the correctness of the external data obtained by the oracle OO. When the results of the events that users bet on are revealed, users who predicted correctly will gain benefits, and users who predicted incorrectly will lose the amount of the bet. The price (odds) represents the probability of the current event occurring, and this mechanism encourages users to accurately predict the results. The operating mechanism of the Polymarket protocol is shown in the figure below.

Polymarket protocol operation mechanism

In summary, Polymarket participates in the market through an automated market maker (AMM) or order book system, providing liquidity to participating traders.

Advantages compared with projects on the same track

As a leading project in the decentralized prediction market, Polymarkets main competitors include Augur, Gnosis, and Azuro. In comparison, Polymarket has obvious advantages in the following aspects:

A wider range of targets: Polymarket covers event predictions in multiple fields such as politics, economy, current affairs, sports and entertainment, and can add more flexible prediction targets according to market demand, such as whether the ETH price will reach $3,600 the next day. This flexibility increases investor participation and enthusiasm, and promotes the growth of predicted transaction volume.

Higher acceptance: Polymarket is not only a star project in the Crypto circle, but also widely accepted in the traditional Web 2 world, and its prediction results are often cited by major media. Because making predictions on Polymarket requires investors to pay real money, compared with the subjective predictions of some experts and KOLs, Polymarkets predictions are more professional and reliable, and even some domestic media will quote its prediction results. This shows that Polymarket has a place in the Web 2 world, and its fame and acceptance have become an important moat that is difficult to be copied by other projects.

In summary, Polymarket is significantly superior to other projects in the same field with its wider range of investment targets and higher market acceptance. It is not only popular in the Crypto circle, but also has a place in the Web 2 world, and has the advantage of attracting new users.

Project Model

Dynamic Transaction Fee Model

Polymarkets transaction fees may be adjusted based on market conditions and platform policies. Such adjustments can be based on several factors:

Market demand and trading volume: When market demand and trading volume increase, the platform may adjust the transaction fee rate to optimize revenue and liquidity.

Incentives for liquidity providers: In order to incentivize liquidity providers (LPs) to provide more liquidity, the platform may adjust the fee structure.

Platform operating costs: Polymarket needs to cover its operating costs, including expenditures on technology development, maintenance, security, etc. Therefore, the platform may adjust the transaction fee rate according to changes in operating costs.

In order to maintain transparency, Polymarket usually announces the adjustment of transaction fees in platform announcements or help documents and explains the reasons for the adjustment. Users can learn about the latest transaction fee information through these channels.

Agreement income

Polymarkets protocol revenue = transaction fee income - liquidity reward fees - other operating expenses. At this stage, Polymarket has not disclosed its core financial data to the public.

Operational data

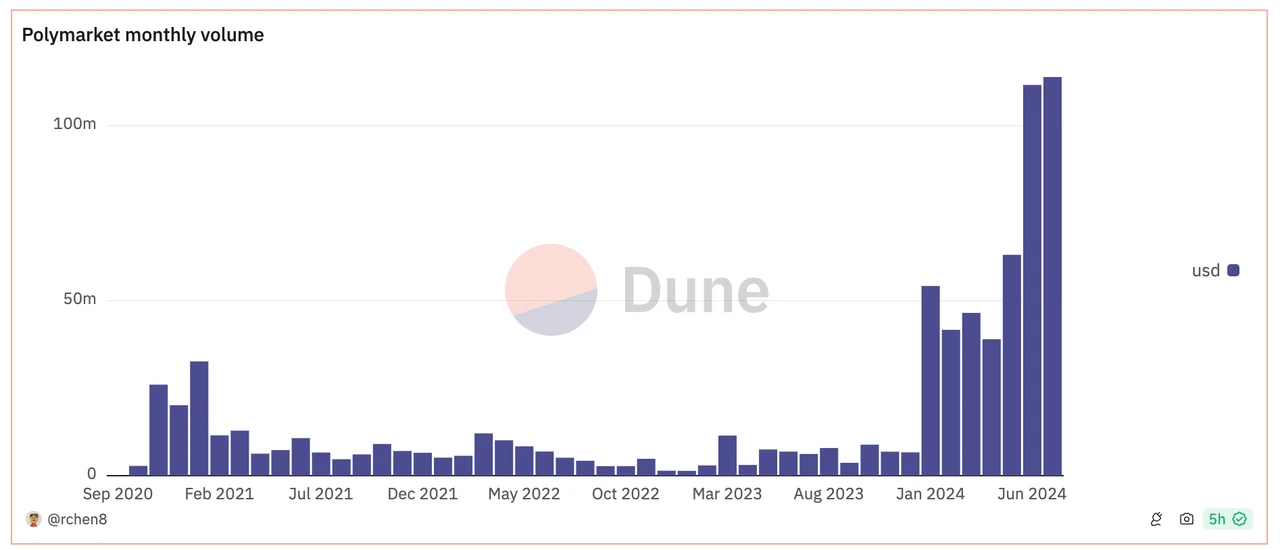

Monthly Trading Volume:

Polymarket monthly trading volume (data source: https://dune.com/rchen8/polymarket)

As shown in the above figure, as the US election gradually heats up, Polymarkets trading volume will maintain a rapid growth trend in 2024. With the continuous hot market events, the project has also entered a stage of rapid development.

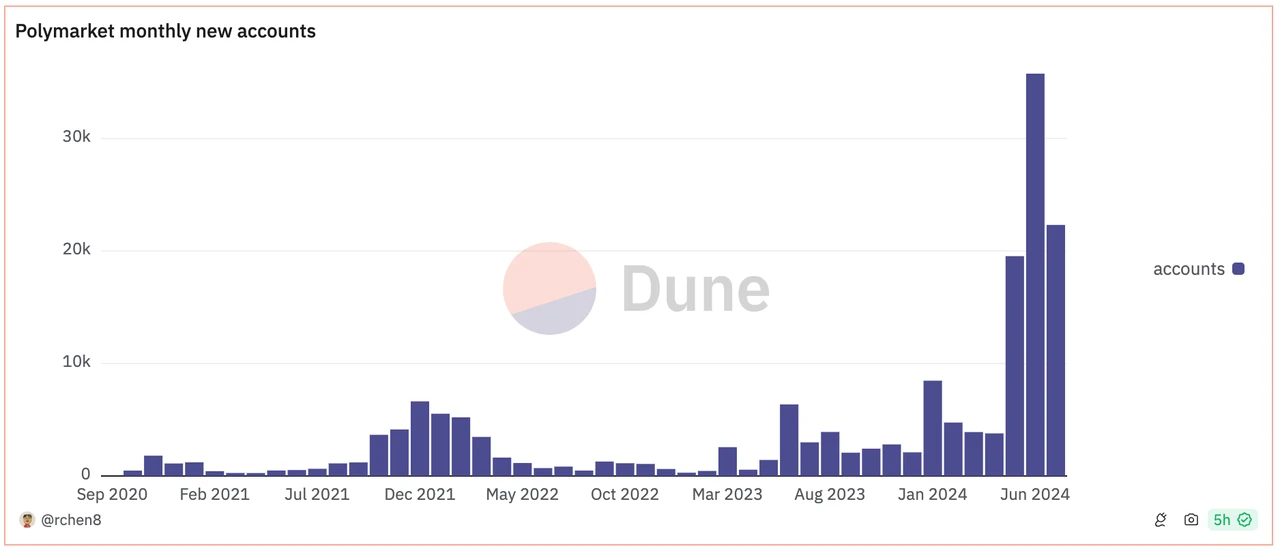

New accounts added per month:

Polymarket monthly new accounts (data source: https://dune.com/rchen8/polymarket)

Polymarkets monthly new accounts have exploded since 2024 and have maintained a high growth trend.

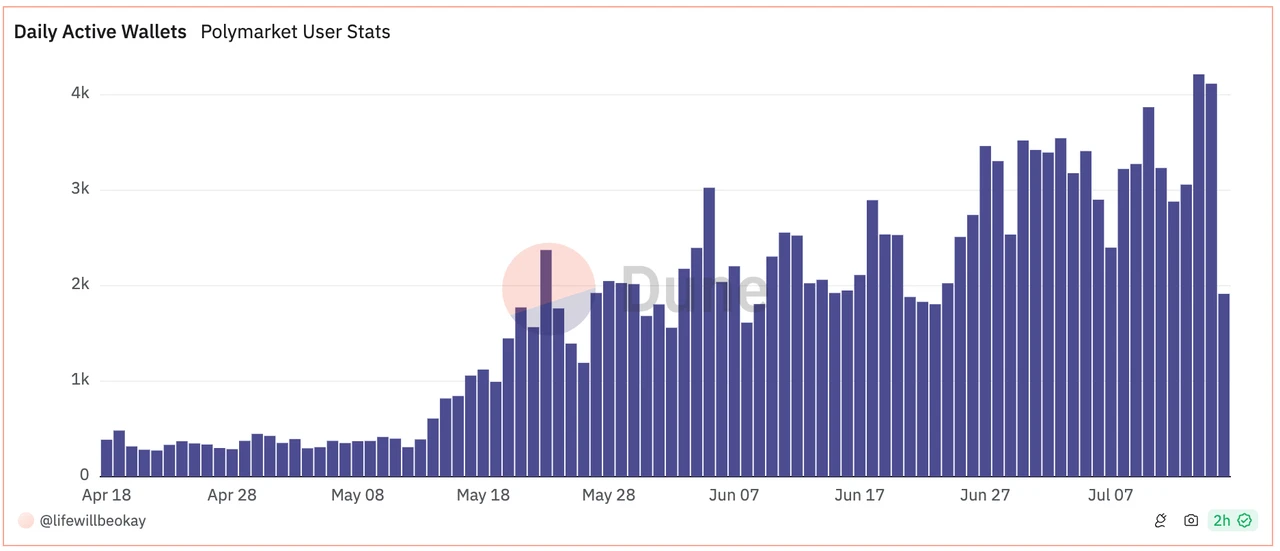

Daily active wallets:

Polymarket daily active wallet number (data source: https://dune.com/lifewillbeokay/polymarket-clob-stats)

The number of daily active wallets on Polymarket is also increasing rapidly, proving that Polymarket’s current data growth is real and reliable.

Project Risks

Insufficient liquidity: Liquidity is a key concern for any trading market. Although Polymarket provides certain liquidity support through AMM and order book systems, it may still face insufficient liquidity for emerging markets or unpopular events. This may cause users to encounter difficulties during the transaction process, affecting the trading experience and potential benefits.

Regulatory risks: Decentralized prediction markets face regulatory uncertainty. Although Polymarket has worked hard to comply with relevant regulations and reached a settlement with the U.S. Commodity Futures Trading Commission, it may still face the risk of legal challenges and regulatory changes in the future. As the market develops and innovates, the policies of regulators may be adjusted, bringing uncertainty to the project.

Summarize

Polymarket is a project based on binary prediction markets. It uses UMAs OP oracle to access external event dynamics in real time. The platform provides liquidity to the market through an automated market maker (AMM) or order book system to ensure liquidity for all prediction projects. Compared with other similar projects, Polymarket has a wider range of investment targets and markets. It is not only popular in the Crypto circle, but also has a place in the Web 2 world.

Although Polymarket provides certain liquidity support through AMM and order book systems, it may still face insufficient liquidity for emerging markets or unpopular events, which may cause users to encounter difficulties in the transaction process. In addition, under the current legal and regulatory environment, decentralized prediction markets face regulatory uncertainty.

All in all, Polymarket provides an attractive option for users who seek to make market predictions in an open and transparent environment. Not only can they participate in the prediction of global events, but they can also experience the innovation brought by blockchain and potentially profit. With the continuous optimization of technology and the expansion of user base, the future of Polymarket is full of unlimited possibilities and has become the preferred platform for event trading.