This new column is a sharing of real investment experiences by members of the Odaily editorial department. It does not accept any commercial advertisements and does not constitute investment advice (because our colleagues are very good at losing money) . It aims to expand readers perspectives and enrich their sources of information. You are welcome to join the Odaily community (WeChat @Odaily 2018, Telegram exchange group , X official account ) to communicate and complain.

Recommended by: Asher (X: @Asher_ 0210 )

Introduction : Short-term contracts, long-term ambush of low-market-value cottages, gold farming in blockchain games, and money-grabbing parties

share :

BTC: Short-term correction is expected, and the price may drop to 62500-64000. Open a contract and try to buy below 63000. If the price holds at 62700-62800, add more positions.

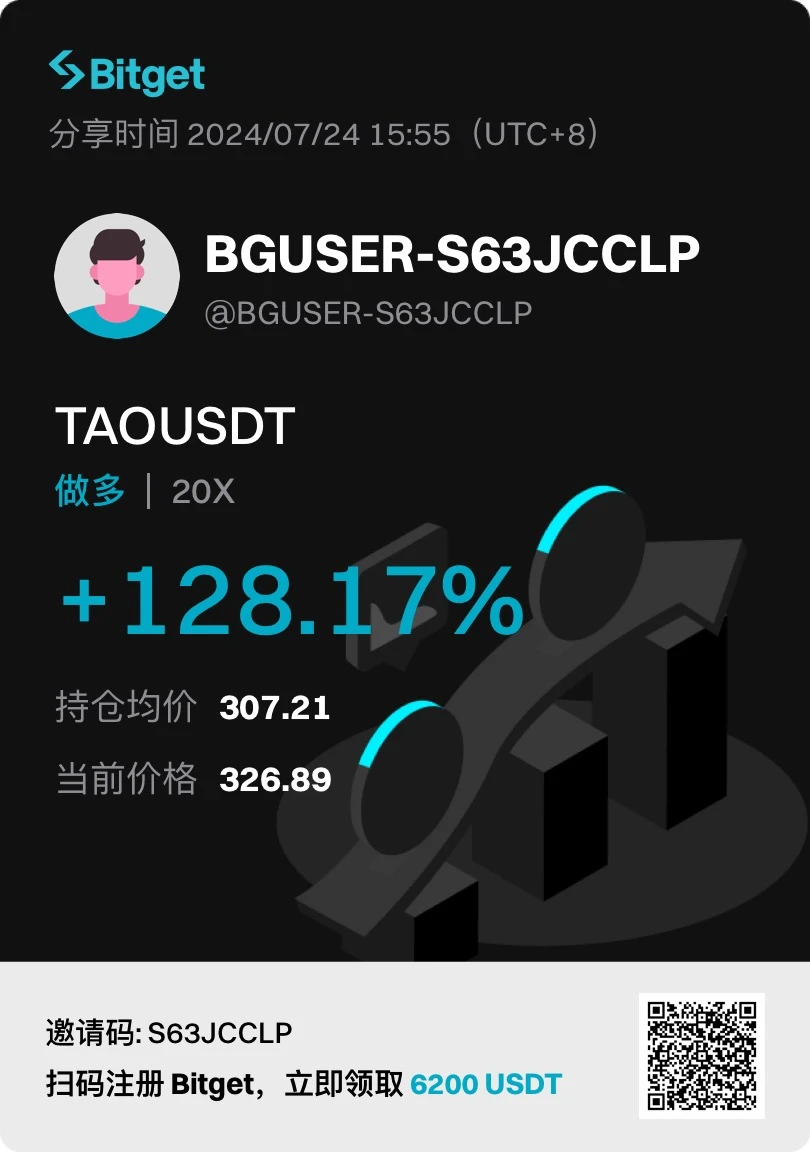

Review of the last altcoin recommendation: TAO tried to go long in the early hours of this morning and rebounded strongly. (BTC still needs to wait for a callback. This is a short-term order. The profit stop is based on feeling, or if you think you have made a lot of money, you can close it.)

This time, the recommended altcoins: If BTC falls back, prepare to continuously increase the positions of PEPE, FLOKI, INJ, and TAO. The positions can be increased when the current price drops by 10%. The ideal scenario is to increase the positions until the price drops by 20%. (Other small-cap altcoins that are ready to ambush will be discussed after the positions of these four currencies are completed.)

Recommender: Nan Zhi (X: @Assassin_Malvo )

Introduction : On-chain player, data analyst, plays everything except NFT

share :

“What does Grayscale selling ETH have to do with my SOL?” I personally predict that the Ethereum ETF will not have too much impact on the broader market. Finally, I have waited for the pullback of SOL and have entered part of it with a small leverage, waiting to buy all of it when MA 55 comes.

The on-chain market is pretty standard, you can play with it or not, start reserving and updating smart money addresses and systems (an article will be published soon, so stay tuned).

Recommender: Vincent (X: @vincent 31515173 )

Introduction : Buy and sell based on your feelings, and quit when you are ahead

Sharing : The ONDO I shared last time has experienced a roller coaster ride in overall returns due to my own greed. Currently, the returns from holding ONDO have returned to zero. I am preparing to continue adding positions, but I need to wait until the overall market rises before making plans. This time I may hold it for a long time, with the goal of getting 1.5 USDT.