Background on the AI Revolution

AI Explosive Background

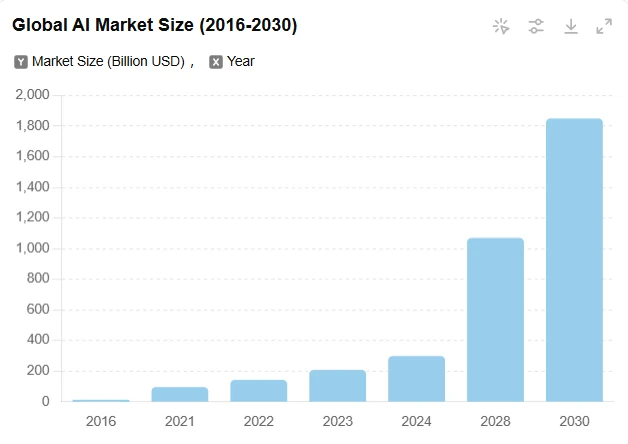

With the booming development of artificial intelligence (AI) technology, we are entering a new data-driven era. Breakthroughs in fields such as deep learning and natural language processing have made AI applications ubiquitous. The birth of ChatGPT in 2022 has detonated the AI industry, followed by a series of AI tools such as Wensheng Video and automatic office, and the application of AI+ has also been put on the agenda. The market value of the AI industry has also soared, and is expected to reach US$185 billion in 2030.

Figure 1 Changes in AI market value

Traditional Internet companies monopolize AI

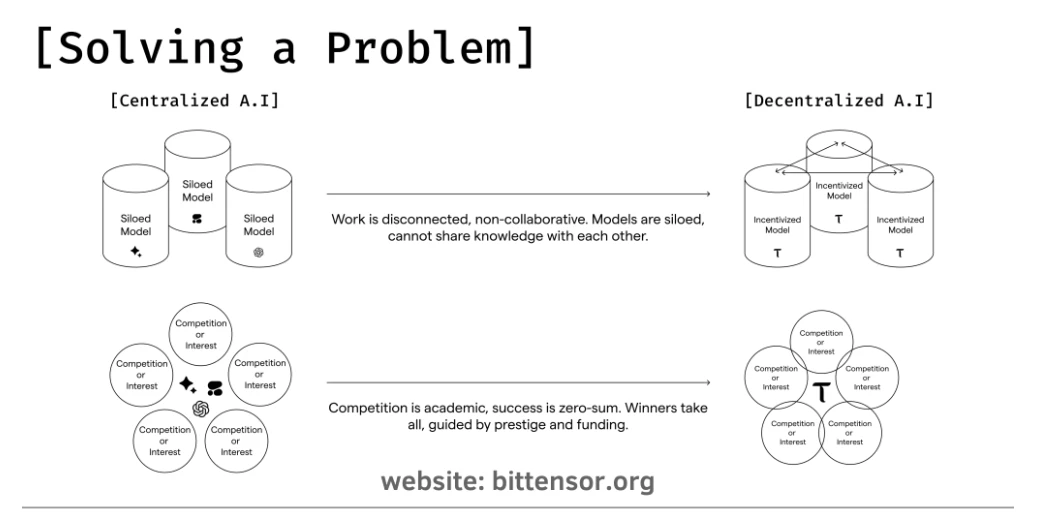

At present, the AI industry is mainly monopolized by companies such as NVIDIA, Microsoft, Google, and OpenAI. Technological progress has also brought a series of challenges such as data concentration and uneven distribution of computing resources. At the same time, the decentralized concept of Web3 provides new possibilities for solving these problems. In the distributed network of Web3, the current AI development pattern will be reshaped.

Web3+AI Current Progress

As the AI industry is booming, a large number of high-quality Web3+AI projects have also emerged. Fetch.ai uses blockchain technology to create a decentralized economy, supports autonomous agents and smart contracts, and is used to optimize the training and application of AI models; Numerai uses blockchain technology and a community of data scientists to predict market trends and motivates model developers through a reward mechanism; Velas builds a high-performance smart contract platform for AI and blockchain, providing faster transaction speeds and higher security. The AI project itself contains three major elements: data, algorithms, and computing power. The Web3+ data and Web3+ computing power tracks are currently developing in full swing, but the Web3+ algorithm direction has always been fighting on its own, and ultimately can only form projects with single-direction applications. Bittensor seized this gap and built an AI algorithm platform with a self-contained screening competition mechanism through the competition and incentive mechanism of the blockchain itself to retain the best AI projects.

Bittensor Development History

Innovative breakthroughs

Bittensor is a decentralized incentivized machine learning network and digital goods marketplace.

Decentralization: Bittensor runs on a distributed network of thousands of computers controlled by different companies and organizations, solving problems such as data centralization.

Fair incentive mechanism: The $TAO tokens provided by the Bittensor network to its subnets are proportional to the contribution ratio of the subnets, and the rewards provided by the subnets to their miners and validators are also proportional to the contribution ratio of the nodes.

Machine learning resources: The decentralized network can provide services to every individual who needs machine learning computing resources.

Diversified digital commodity market: The digital commodity market of the Bittensor network was originally designed specifically for the trading of machine learning models and related data, but thanks to the expansion of the Bittensor network and the Yuma consensus mechanism that does not care about the actual content of the data, it has become a commodity market that can trade any form of data.

development path

Unlike many highly valued VC projects in the current market, Bittensor is a more fair, interesting and meaningful geek project. Its development history does not follow the process of from drawing big pie in the sky to defrauding investment of other projects.

Concept Formation and Project Launch (2021): Bittensor was founded by a group of technology enthusiasts and experts committed to promoting decentralized AI networks. They built the Bittensor blockchain through the Substrate framework to ensure its flexibility and scalability.

Early development and technical verification (2022): The team releases the Alpha version of the network to verify the feasibility of decentralized AI. It also introduces the Yuma consensus, emphasizes the principle of data agnosticism, and maintains user privacy and security.

Network expansion and community building (2023): The team releases the Beta version and introduces a token economic model (TAO) to incentivize network maintenance.

Technological innovation and cross-chain compatibility (2024): The team uses DHT (distributed hash table) integration technology to make data storage and retrieval more efficient. At the same time, the project begins to focus on the promotion and further expansion of subnets and digital goods markets.

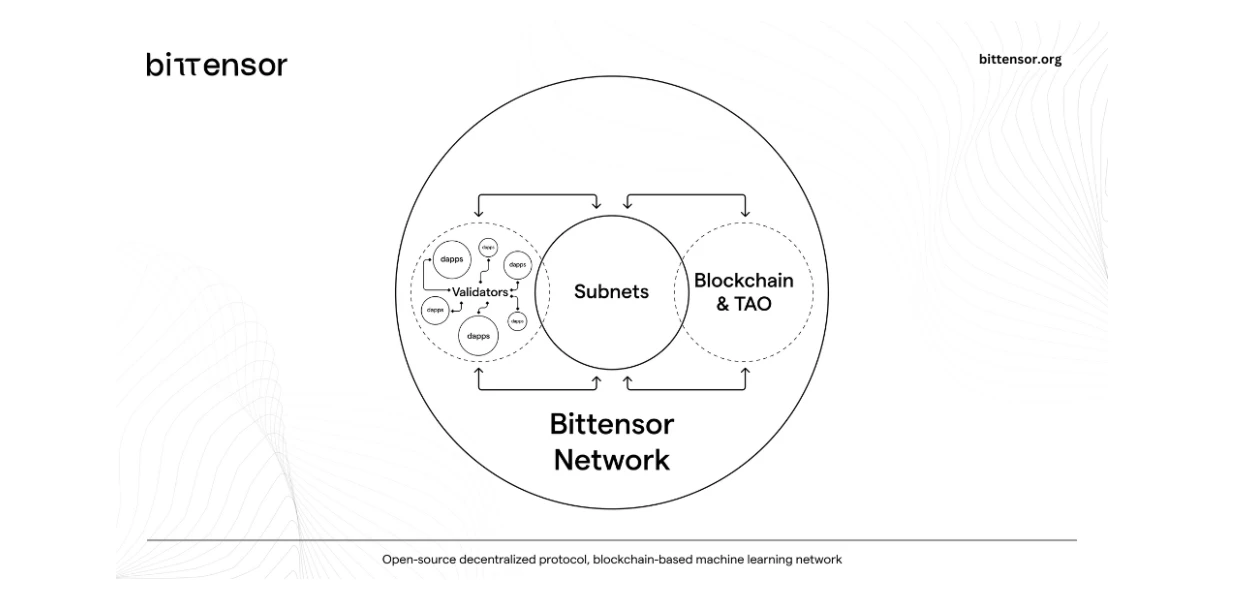

Figure 2 Bittensor network promotional image

In the development history of Bittensor, there have not been many traditional VCs involved, avoiding the risk of centralized control. The project incentivizes nodes and miners through tokens, which also ensures the vitality of the Bittensor network. In essence, Bittensor is an AI computing power and service project driven by GPU miners.

Token Economics

The Bittensor network token is TAO, which is similar to BTC in many ways to show respect for Bitcoin. Its total supply is 21 million, and it is halved every four years. TAO tokens are distributed through fair launch when the Bittensor network is launched. There is no pre-mining, so no tokens are reserved for the founding team and VC. Currently, a Bittensor network block is generated approximately every 12 seconds, and each block rewards 1 $TAO token. About 7,200 TAOs are generated every day. These rewards are now distributed to each subnet according to contribution, and then distributed to subnet owners, validators, and miners in the subnet.

Figure 3 Bittensor community promotional image

TAO tokens can be used to purchase and acquire computing resources, data, and AI models on the Bittensor network, and are also credentials for participating in community governance.

Development Status

The total number of Bittensor network accounts is currently over 100,000, of which 80,000 are non-zero accounts.

Figure 4 Changes in the number of Bittensor accounts

In the past year, TAO has risen by dozens of times, with a current market value of US$2.278 billion and a coin price of US$321.

Figure 5 TAO token price changes

Gradually implemented subnet architecture

Bittensor Protocol

The Bittensor Protocol is a decentralized machine learning protocol that supports the exchange of machine learning capabilities and predictions between network participants and facilitates the sharing and collaboration of machine learning models and services in a peer-to-peer manner.

Figure 6 Bittensor protocol

The Bittensor protocol includes network architecture, subtensors, subnet architecture, validator nodes in the subnet ecosystem, miner nodes, etc. The Bittensor network is essentially a group of nodes participating in the protocol, and each node runs the Bittensor client software to interact with other networks; these nodes are managed by subnets, and a survival of the fittest mechanism is adopted. Subnets with poor overall performance will be eliminated by new subnets, and validator and miner nodes with poor performance in each subnet will also be squeezed out. It can be seen that subnets are the most important part of the Bittensor network architecture.

Subnet logic

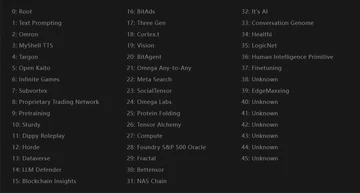

A subnet can be thought of as a piece of independently running code that has unique user incentives and functions, but each subnet maintains the same consensus interface as the Bittensor mainnet. There are three types of subnets: local subnets, testnet subnets, and mainnet subnets. Excluding the root subnet, there are currently 45 subnets, and it is expected that the number of subnets will increase from 32 to 64 between May and July 2024, with 4 new subnets added each week.

Subnet roles and emissions

There are six functional roles in the entire Bittensor network: users, developers, miners, stake validators, subnet owners, and committees. The subnet includes subnet owners, miners, and stake validators.

Subnet owner: The subnet owner is responsible for providing the basic miner and validator code, and can set up unique other incentive mechanisms to allocate miner work incentives.

Miners: Miner nodes are encouraged to iterate servers and mining codes to stay ahead of other miners in the same subnet. Miners with the lowest emissions will be replaced by new miners and need to re-register nodes. It is worth noting that miners can run multiple nodes on multiple subnets.

Validator: Validators are rewarded by measuring the contribution of each subnet and ensuring its correctness. At the same time, TAO tokens can be staked on validator nodes, and validator nodes can obtain 0-18% (adjustable) staking rewards.

Subnet emission is the TAO token distribution mechanism in the Bittensor network that rewards miners and validators. The emission rewards obtained by the subnet are generally designed to be 18% allocated to the subnet owner, 41% to the subnet validator, and 41% to the miner. A subnet contains 256 UDI slots, of which 64 UID slots are allocated to validators and 192 UIDs are allocated to miners. Only the top 64 validators with the largest stake can obtain validator licenses and are considered active validators in the subnet. The stake and performance of the validator determine its status and rewards in the subnet. The performance of the miner is scored through the request and evaluation of the subnet validator, and the miner with poor performance will be replaced by the newly registered miner. Therefore, the more total tokens staked by the validator, the higher the miners computing efficiency, the higher the total emission of the subnet, and the higher the ranking.

Subnet Registration and Retirement

After the subnet is registered, it will enter a 7-day immunity period. The first registration fee is 100 $TAO, and the price will double for the second registration, and the fee will fall back to 100 TAO over time. When all subnet positions are full, when registering a new subnet, a subnet with the lowest emission and not in the immunity period will be deleted to accommodate the new subnet. Therefore, the subnet needs to increase the validator stake and miner efficiency in the UID slot as much as possible to ensure that it will not be deleted after the immunity period.

Figure 7 Subnet Name

Benefiting from the subnet architecture of the Bittensor network, the decentralized AI data network Masa was launched, becoming the first dual-currency reward system in the Bittensor network and attracting US$18 million in financing.

Figure 8 Masa promotion

Consensus and Proof of Stake

The Bittensor network includes multiple consensus mechanisms and proof mechanisms. In traditional decentralized networks, PoW (proof of work) is often used for miner nodes to ensure the miners contribution to the network and to obtain rewards based on their computing power and data processing quality; for validator nodes, the PoV mechanism (proof of verification) is generally adopted to ensure the security and integrity of the network. In the Bittensor network, the original PoI mechanism (proof of intelligence) is used in conjunction with the Yuma consensus to achieve verification and reward distribution.

Intelligence Proof Mechanism

Bittensors PoI mechanism is an original verification and incentive mechanism that proves the contribution of participants through the completion of intelligent computing tasks, thereby ensuring the security of the network, data quality, and efficient use of computing resources.

Miner nodes prove their work by completing intelligent computing tasks, which may include natural language processing, data analysis, machine learning model training, etc.

The tasks are assigned to miners by the validator. After the miners complete the tasks, they return the results to the validator, who then scores them based on the quality of the tasks completed.

Yuma Consensus

Yuma consensus is the core consensus mechanism of the Bittensor network. When the validator obtains a score based on the completion of the task, the score is input into the Yuma consensus algorithm. In the consensus algorithm, validators with a large number of staked TAOs have a higher score. At the same time, the algorithm will filter out the results that deviate from most validators. Finally, the system distributes token rewards based on the comprehensive score.

Figure 9: Consensus algorithm diagram

Data agnostic principle: ensures privacy and security during data processing, that is, nodes do not need to understand the specific content of the data being processed to complete calculations and verifications.

Performance-based rewards: Rewards are distributed based on the performance and contribution of nodes, ensuring efficient and high-quality computing resources and data processing.

MOE Mechanisms Work Together

Bittensor introduces the MOE mechanism in the network, integrating multiple expert-level sub-models in one model architecture. Each expert model has relative advantages when dealing with problems in the corresponding field. Therefore, when new data is introduced into the entire model architecture, different sub-models can work together to obtain better operating results than a single model.

With the cooperation of the Yuma consensus mechanism, validators can also score expert models, rank their capabilities, and allocate token rewards to incentivize model optimization and improvement.

Figure 10 Problem Solving Ideas

Subnet Project

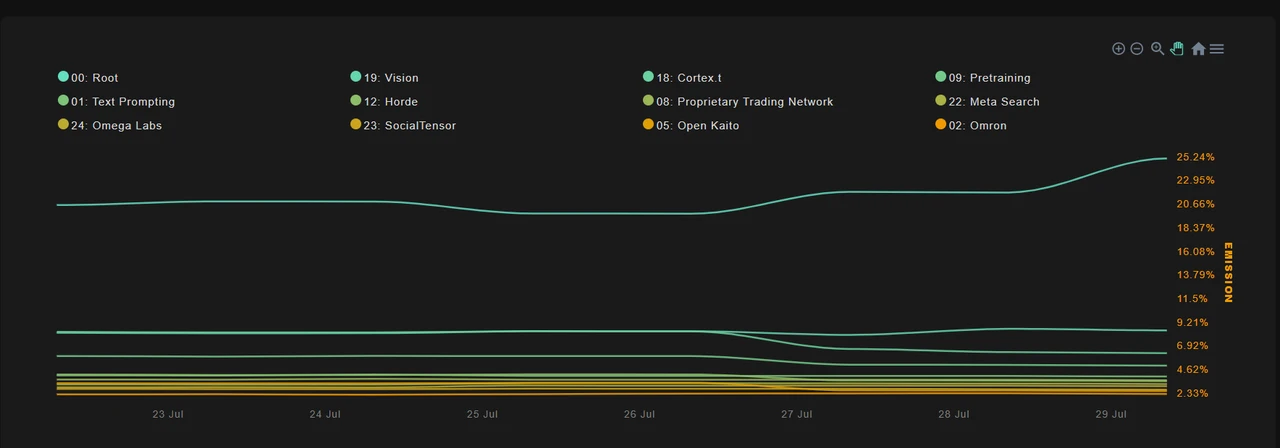

As of the time of writing, the number of Bittensor subnets registered has reached 45, and the number of named subnets is 40. In the past, when the number of subnets was limited, the competition for subnet registration was very fierce, and the registration price was as high as one million US dollars. Currently, Bittensor is gradually opening up more subnet registration quotas. Newly registered subnets may not be as good as subnets with longer running time in terms of stability and model efficacy. However, due to the subnet elimination mechanism introduced by Bittensor, in the long run, it is a process of good coins eliminating bad coins. Subnets with poor model performance and insufficient strength will find it difficult to survive.

Figure 11 Bittensor subnet project details

Excluding the root subnet, subnets 19, 18 and 1 currently receive the most attention; their emissions account for 8.72%, 6.47% and 4.16% respectively.

Subnet 19

Subnet 19 is named Vision and was registered on December 18, 2023. Vision focuses on decentralized image generation and inference; the network provides access to the best open source LLMs, image generation models (including models trained on Subnet 19s dataset), and other miscellaneous models (such as embedding models).

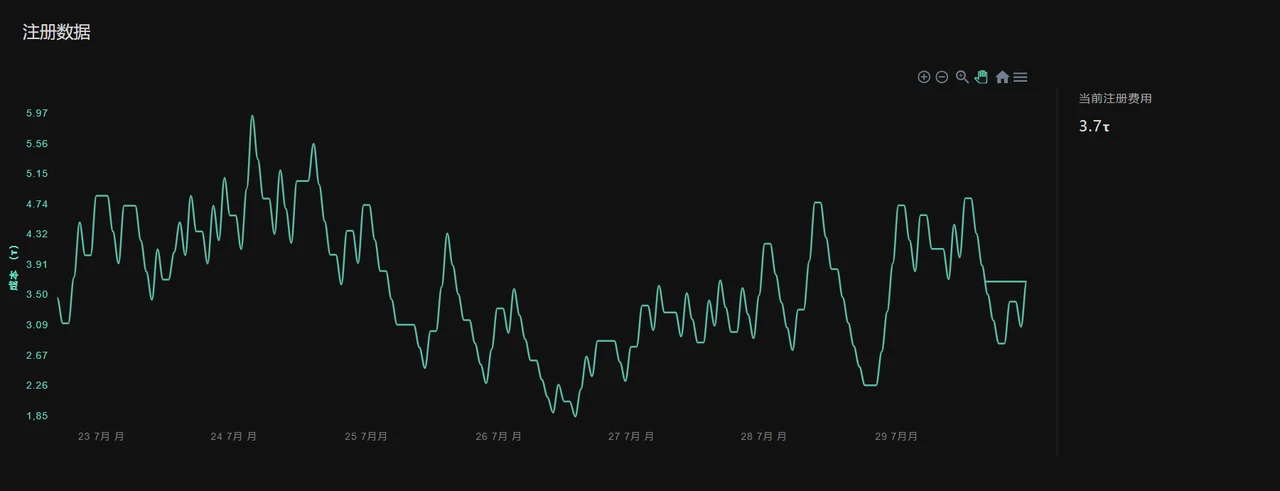

Currently, the registration fee for the Vison subnet slot is 3.7 TAO, the total node income in 24 hours is approximately 627.84 TAO, and nodes worth 64.79 TAO have been recycled in the past 24 hours; if the newly registered nodes can reach the average level, the daily income can reach 2.472 TAO, about 866 US dollars.

Figure 12 Vison subnet registration fee data

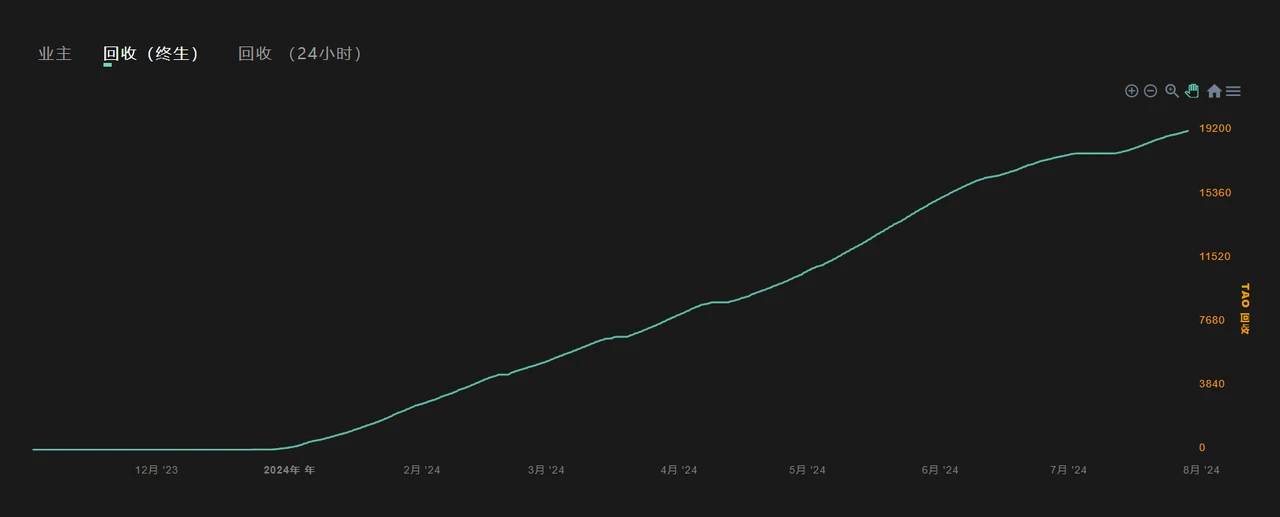

Currently, the total value of Vision subnet recycled nodes is approximately 19,200 TAO.

Figure 13 Vision subnet recovery costs

Subnet 18

Subnet 18 is named Cortex.t and is developed by Corcel. Cortex.t is committed to building a cutting-edge AI platform that provides users with reliable, high-quality text and image responses through APIs.

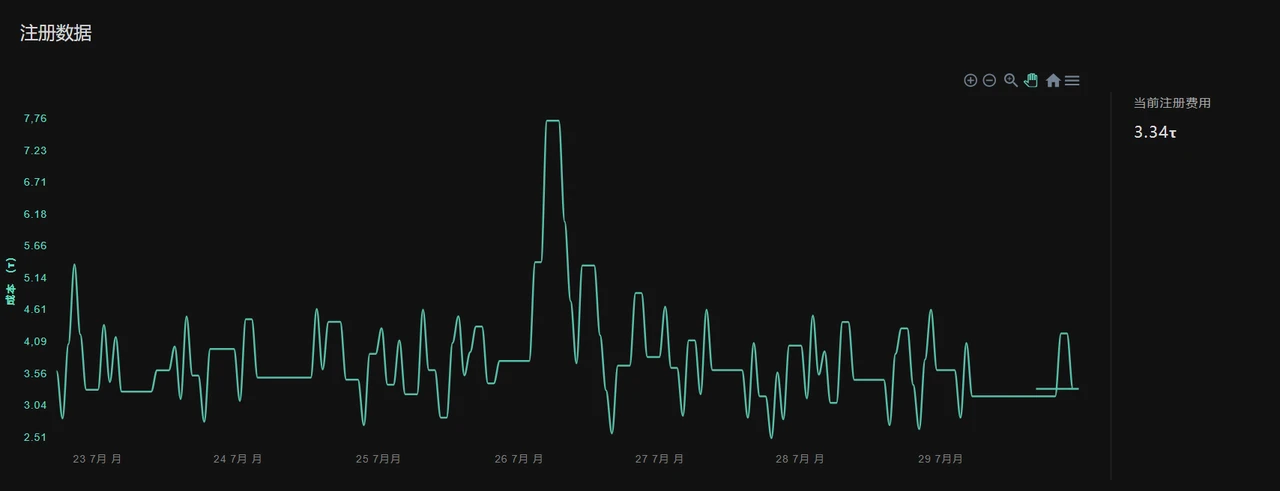

Currently, the registration fee for the Cortex.t subnet slot is 3.34 TAO, the total node income in 24 hours is approximately 457.2 TAO, and nodes worth 106.32 TAO have been recycled in the past 24 hours; if the newly registered nodes can reach the average level, the daily income can reach 1.76 TAO, about US$553.64.

Figure 14 Cortex.t subnet registration fee data

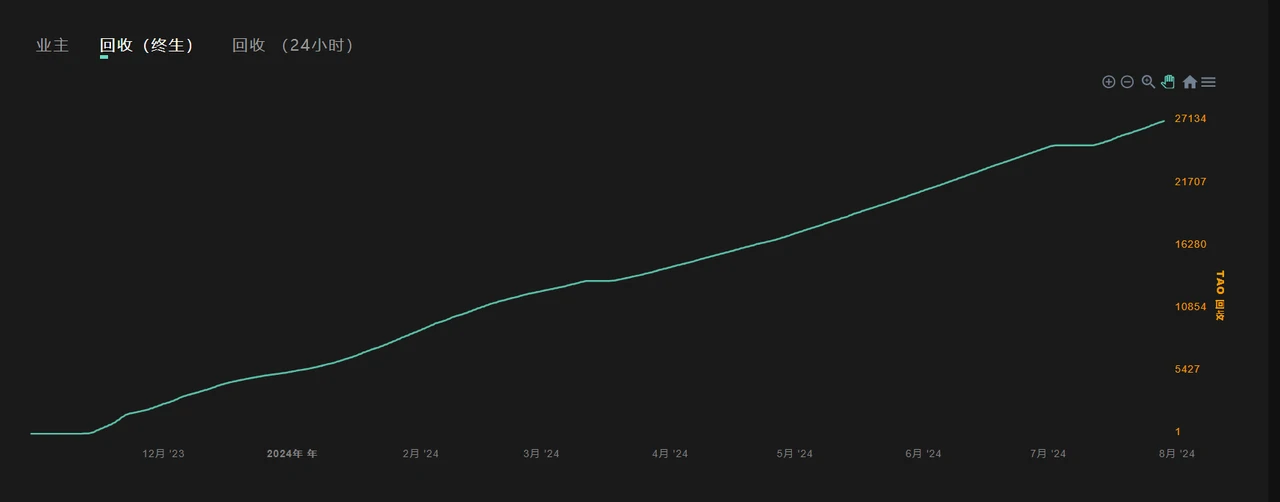

Currently, the total value of Cortex.t subnet recycled nodes is approximately 27,134 TAO.

Figure 15 Cortex.t subnet recycling fee

Subnet 1

Subnet 1 is a decentralized subnet developed by the Opentensor Foundation specifically for text generation. As the first project of the Bittensor subnet, this subnet has been greatly questioned. In March this year, Eric Wall, founder of Taproot Wizards, called Bittensors TAO token a meme coin in the field of AI, and pointed out that Subnet 1 allows hundreds of nodes to obtain similar results through AI when answering text-related questions, which does not improve the effect of solving practical problems.

other

From the perspective of model categories, subnet models 19, 18, and 1 are all generative models. In addition, there are also large data processing models and trading AI models, such as subnet 22 Meta Search, which provides market sentiment by analyzing Twitter data, and subnet 2 Omron, which continuously optimizes staking strategies through deep neural network learning.

From the perspective of profit risk, if the slot can be successfully run for more than a few weeks, the profit will obviously be very considerable. However, if the newly registered node cannot use high-performance graphics cards and optimize the local algorithm, it will be difficult to survive in the competition with other nodes.

future development

From the perspective of popularity, the AI concept itself is no less popular than the Web3 concept, and even a lot of hot money that would have flowed into the Web3 industry has been attracted to the AI industry. Therefore, Web3+AI will be the market center for a long time in the future.

From the perspective of project architecture, Bittensor is not a traditional VC project. The project has increased dozens of times since its launch, and the project has both technical and market support.

From the perspective of technological innovation, Bittensor breaks the situation where Web3+AI projects have been fighting on their own in the past. Its original subnet architecture can also reduce the difficulty of migrating to decentralized networks for many teams with AI technical strength and obtain benefits more quickly. And due to the competitive elimination mechanism, subnet projects must continuously optimize models and increase the amount of pledges to prevent being banned by new subnets.

From a risk perspective, while Bittensor increases the number of subnets, it will inevitably reduce the difficulty of subnet registration, increasing the possibility of inferior projects taking advantage of the situation. At the same time, as the number of subnets increases, the number of TAOs obtained by the originally registered subnets will gradually decrease. If the price of TAO tokens cannot rise with the increase in the number of subnets, the returns will most likely not meet expectations.