After a continuous decline over the past week, the market ushered in a round of selling climax on Monday. So, is now a good time to buy at the bottom? Although the US interest rate cut seems to be imminent, it has not been fulfilled. Combined with the sudden increase in unemployment triggering Sams Law, the market is undergoing a severe test. Over the weekend, Buffetts selling of Apple and the tense situation in the Middle East became the last straw that overwhelmed the market. There was a sell-off that has not been seen in many years in the early Asian trading. The market sentiment has not yet completely stabilized. Investors should be cautious about this wave of decline.

Macro environment

1) The yen rose rapidly and the carry trade collapsed

Yen carry trading is a strategy that uses the price difference of the yen between different markets or financial instruments to arbitrage. Common forms include interest rate arbitrage, currency arbitrage, futures arbitrage and cross-market arbitrage. Investors borrow low-interest yen funds and invest in high-yield assets, or use the price difference between the foreign exchange market and the futures market to buy and sell operations to make profits. This type of transaction usually requires quick decision-making and execution to profit at the moment when the price difference appears.

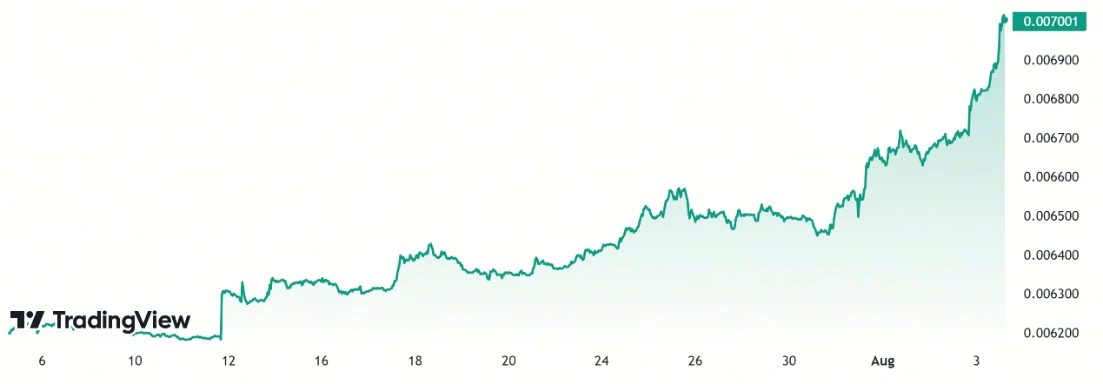

Figure 1: USD/JPY

Source: TradingView

Many traders borrowed yen to buy U.S. dollar assets, and the current huge reversal may form a strong reflexivity. It is estimated that the amount of funds in carry trades is around $4 trillion, and the market continues to inject liquidity from outside.

2) The market starts to panic, and the Fed is expected to intervene

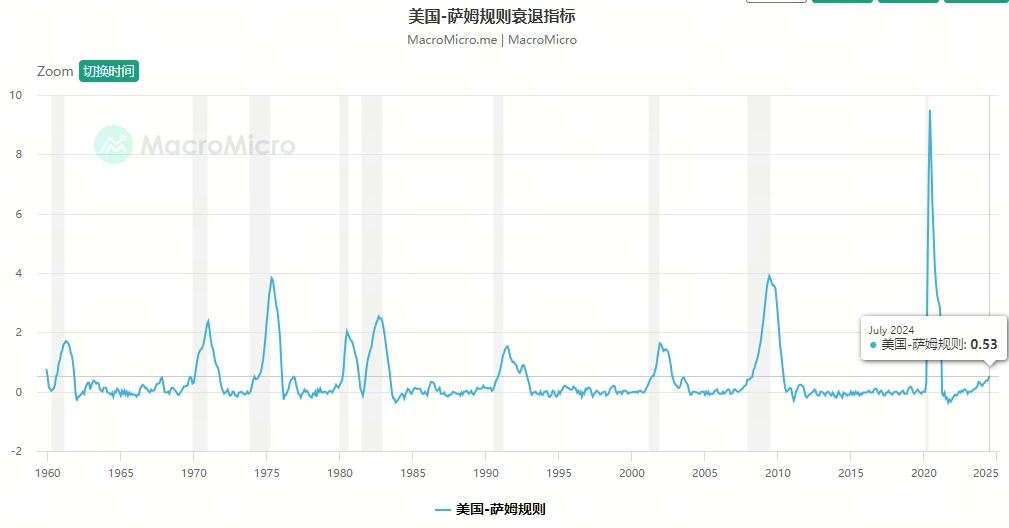

Recently, the market has been affected by the weakening of the US economy, and the price of Bitcoin (BTC) has fallen, and the altcoin market has also fallen. According to the latest non-agricultural unemployment rate calculation, the US unemployment rate has soared by 0.6% from the low point this year. After the unemployment rate has continued to surge beyond expectations for several months, it has finally triggered the Sams Rule that predicts recession based on the unemployment rate.

Figure 2: Sams Rule Recession Indicator

Source: MacroMicro

We need to pay close attention to the Feds next move. It is rumored that the Fed will hold an emergency meeting on Monday to discuss interest rates after the Japanese stock market crash.

Figure 3: Fear and Greed Index

Source: Coinglass

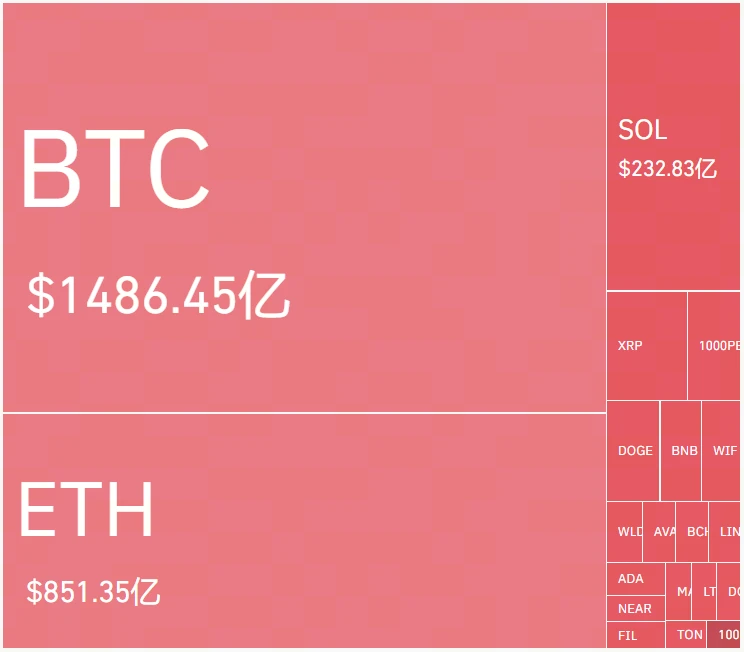

The selling appears to have been sparked by a “time-triggered” algorithm that triggered sell orders at 10 a.m. ET (after the U.S. market opened) every day for the past seven trading days. The algorithm was still running over the weekend, which may have led to high-frequency trading (HFT)-driven selling and shorting, forcing leveraged long investors to admit defeat.

Figure 4: Liquidation heat map (24 hours)

Source: Coinglass official website

After leveraged bulls encounter the explosive gold coin blockade, the market may collect chips in the short term and enter an upward trend.

High-quality track

In the current market environment, investors should carefully select investment targets and pay close attention to the macro environment and market trends so as to make wise investment decisions at the appropriate time.

1) On-chain Gold (XAUT)

Fundamentals: Physical gold collateral

Tether Gold (XAUt) is a digital asset that represents ownership of physical gold held in a vault.

Stable value

The value of XAUt is tied to actual gold, with each XAUt representing a certain amount of gold. This makes XAUt perform well during market panics.

Transparency and security

XAUt uses blockchain technology to ensure transaction transparency and security. Each transaction is recorded on the blockchain, which is traceable and verifiable, reducing potential fraud and risks.

Convenience

XAUt can be traded quickly and cheaply around the world. Compared to traditional gold trading, XAUt transactions are faster and are not restricted by geography or time.

2) TRON (TRX)

Transaction volume surpasses Ethereum

According to blockchain analysis on X Lookonchain, the number of transactions on the Tron network has exceeded 8 billion. This is four times that of Ethereum (ETH).

Stable profit

TRX expects to achieve an overall protocol revenue of $700-800 million this year, with an annual protocol deflation rate of 6%. In an unstable bear market, TRX will be a more stable token.

Summarize

Mondays sell-off caused a surge in risk aversion in the crypto market, considering the collapse of the yen carry trade and the high-frequency trading sell-off that may be caused by the intensification of market panic. The current on-chain stabilization may depend on the strong intervention of the Federal Reserve and the restoration of market sentiment. We believe that in a high-risk market, holding or buying on-chain gold (XAUt) and TRON (TRX) as high-quality tracks will be able to better avoid the risk of further market declines.