Original author: @Web3 Mario (https://x.com/web3_mario)

Last Monday, I wrote an analysis article about the market and macroeconomics, and found that everyone is quite interested in this topic. I am a science and engineering major, and have been engaged in Web3 product design, operation and RD. I am not a graduate of economics, but I am very interested in the direction of politics and economics, and I have been self-studying. Therefore, I think the reason why everyone likes the content output from my perspective should be more friendly to non-professional enthusiasts, because it contains some explanations of concepts. These are mostly problems I encountered in the learning process. I think it is necessary to explain them in detail to my friends who have experienced the same process as me. In the future, I will continue to output some content on related topics to learn and communicate with everyone. Back to the topic, I saw such a point of view in the comments of friends in the previous article, which roughly means that this kind of analysis article is basically hindsight. Indeed, this is an analysis and outlook of the results. I think this kind of review is still necessary and is a part of learning and improvement, but I also hope to bring you some forward-looking analysis content. Therefore, in this article, let’s talk about a macro indicator that will suddenly become very important in the next month and should affect the price trend of short-term risk assets to a certain extent, the number of people claiming unemployment benefits in the United States at the beginning of the week. This is the most intuitive differential indicator for the US recession trade. Finally, I hope everyone can follow my Twitter, Web3 Mario . I have also recently opened a personal public account, Mario Watching Web3 . Please pay more attention to it. Thank you.

A quick review of the current state of the market: the yen carry trade unwinding is fading, and the US recession trade is taking over

First, let us briefly review the current state of the market. In general, the unwinding of yen carry trades is basically coming to an end, and the focus of market concerns has shifted from the uncertainty of the Bank of Japans interest rate hike to concerns about a hard landing in the United States, the so-called U.S. recession trade.

In the previous article, we have pointed out that the main reason for the huge market fluctuations on Monday was the aggressive interest rate hike by the Bank of Japan. I also said that in the US-Japan alliance, Japan is usually a cooperating party because it does not have complete financial sovereignty. Therefore, this round of liquidation trading came to an end with the press conference held by Shinichi Uchida, deputy governor of the Bank of Japan, at 9:30 am on Wednesday, August 7, Beijing time, to appease the market. He made detailed comments on the rapid rise of the yen, the stock market crash, and the future direction of the central banks monetary policy. The core includes three points:

Recent stock and currency market volatility has had an impact, and if market volatility affects the outlook, the interest rate path will change.

The Bank of Japan will not raise interest rates when the market is unstable, and it needs to firmly implement its loose policy at present.

If the outlook becomes a reality, the degree of easing will be adjusted. The interest rate is not lagging behind the situation, and we are paying attention to the impact of the market on the economy with a sense of urgency.

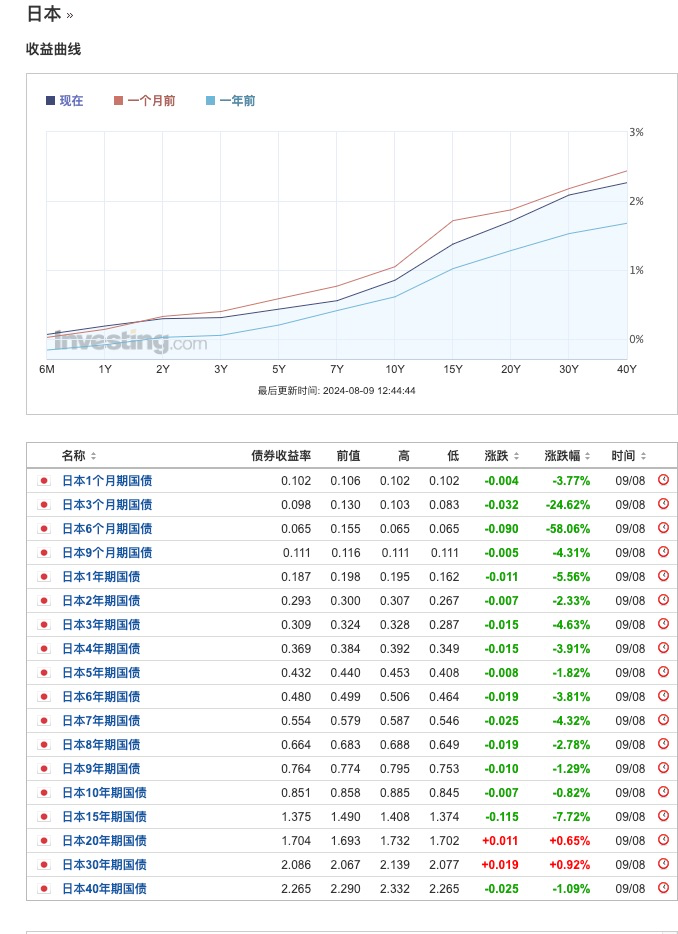

So far, it can be said that the Bank of Japan has temporarily surrendered to the market, that is, it is clear that it will not raise interest rates without affecting the price of risky markets, and will even continue to implement loose policies, which means that there is room for yen carry trades to continue to exist, and with the guarantee of the Bank of Japan, this investment portfolio is equivalent to the government helping to hedge the yen exchange rate risk. Therefore, we can see that after Uchidas speech, the yen-dollar exchange rate has quickly pulled back and plummeted to 146. Of course, the Nikkei index and Japanese government bonds have also seen corresponding upward corrections. It can be said that the current round of yen carry trade liquidation caused by the aggressive interest rate hikes by the Bank of Japan has ended in the short term, and the market is no longer overly panicked about the Bank of Japan continuing to raise interest rates aggressively in the future.

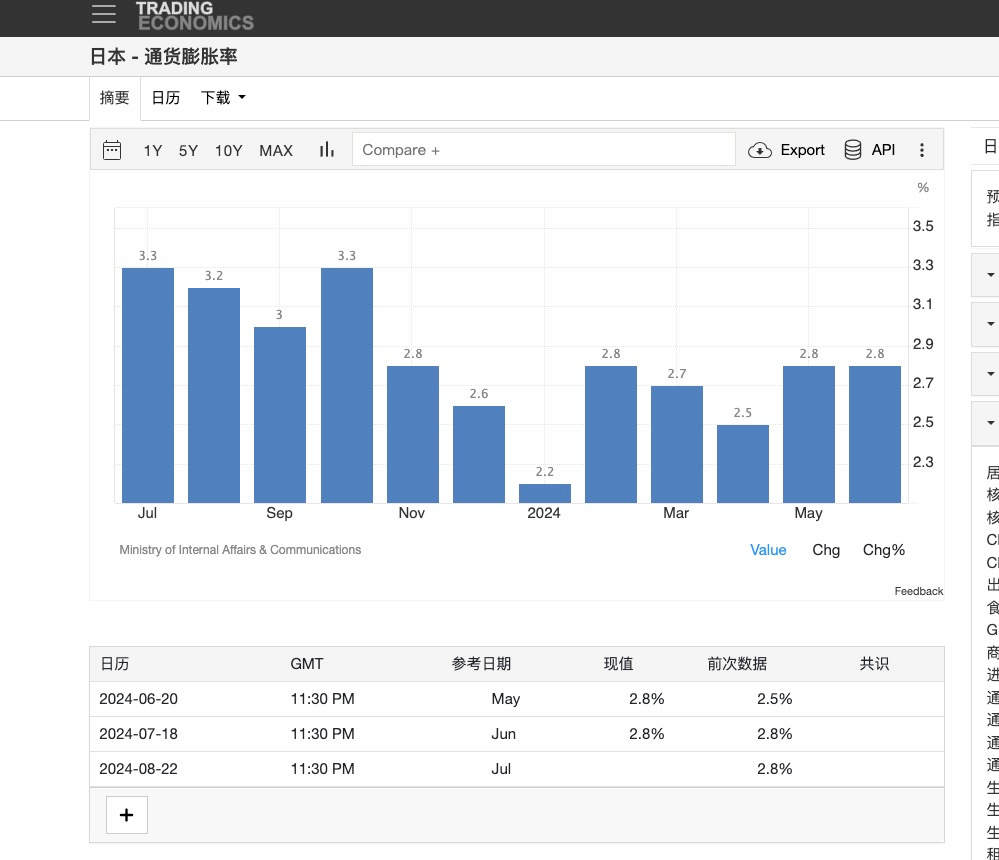

But lets make a simple outlook here. The Bank of Japans path of raising interest rates in the medium and long term has basically been confirmed, but this contradiction has transformed from a short-term contradiction to a medium- and long-term contradiction. The reason is very simple. Lets take a look at Japans current inflation rate, which has reached 2.8%. Considering that the current yield on Japans short-term government bonds has only just begun to rise and is at a relatively low level, the real interest rate in Japanese society is still negative, which means that the loose monetary environment will further push up Japans inflation level. Considering that the current inflation level has exceeded a globally recognized target level of 2%, and Japans wage growth is basically lower than the level of rising inflation, as some of Japans traditional pillar industries, such as automobiles, have been strongly challenged by China and other countries, the job market is not very optimistic. Therefore, inflationary pressure at this time will increase Japans pain index and the Japanese people will be under pressure. Therefore, raising interest rates is basically the only option for the Bank of Japan, but for the sake of global financial stability, the people still need to suffer a little more.

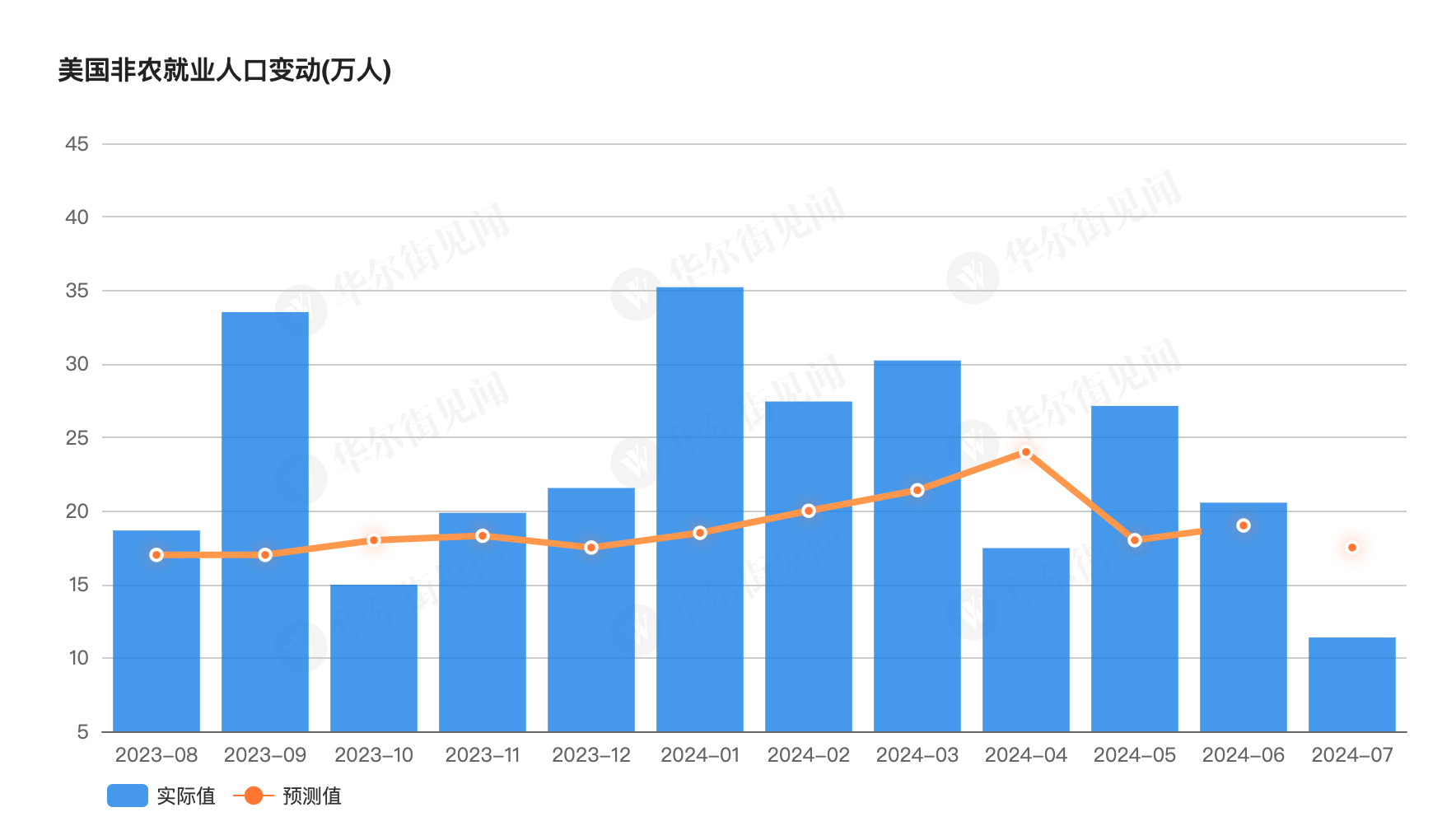

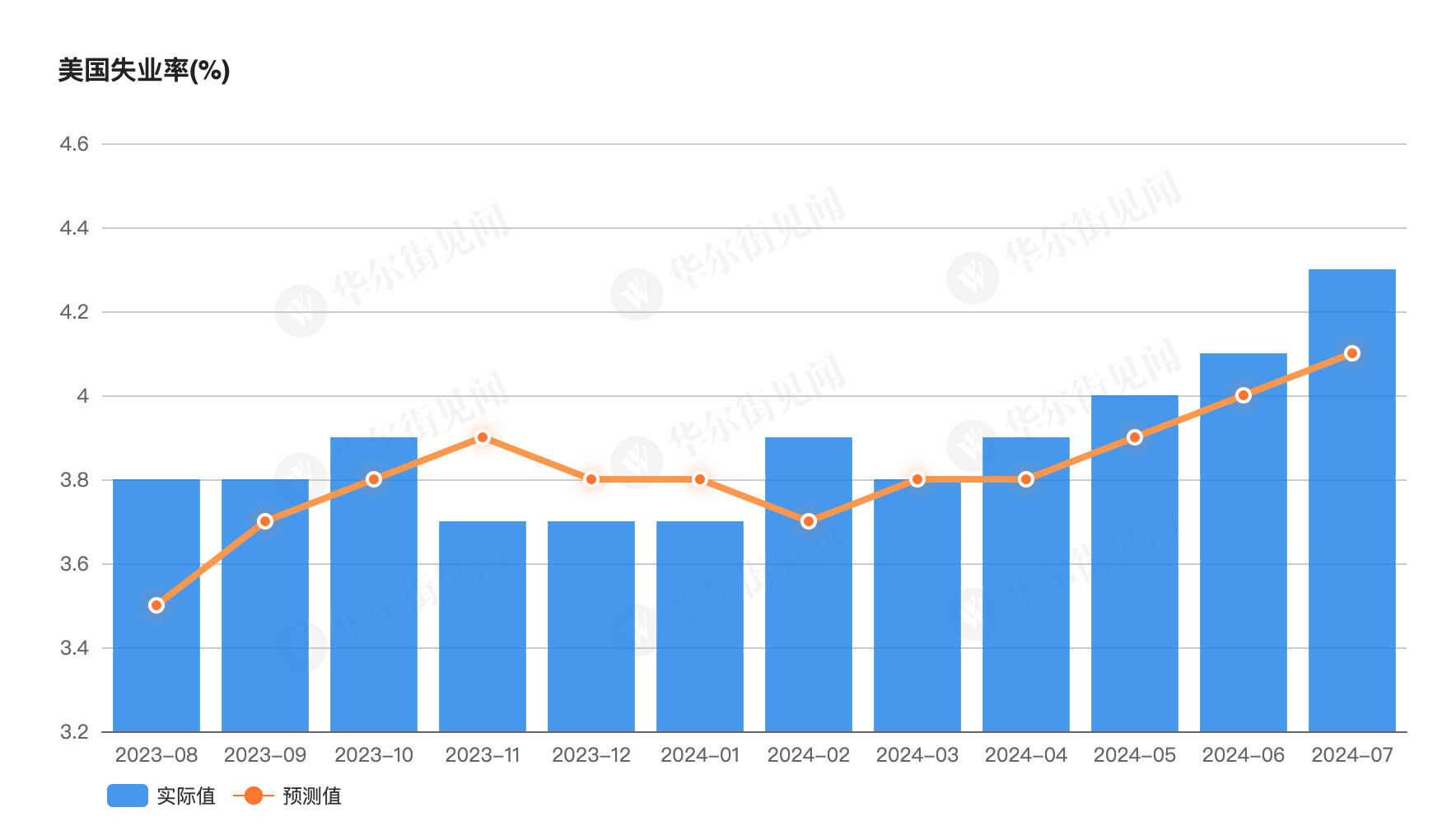

At this point, the focus of market trading has come to the second topic that the market will worry about, that is, the so-called US recession trading. So where did this worry come from? It can be traced back to the two macroeconomic data released by the United States on August 2, the July non-farm employment data and the July unemployment rate. First, the non-farm data was far below expectations, and secondly, the July unemployment rate reached 4.3%, triggering a judgment indicator used to measure whether a country has entered the early stage of an economic recession cycle, the Sam rule.

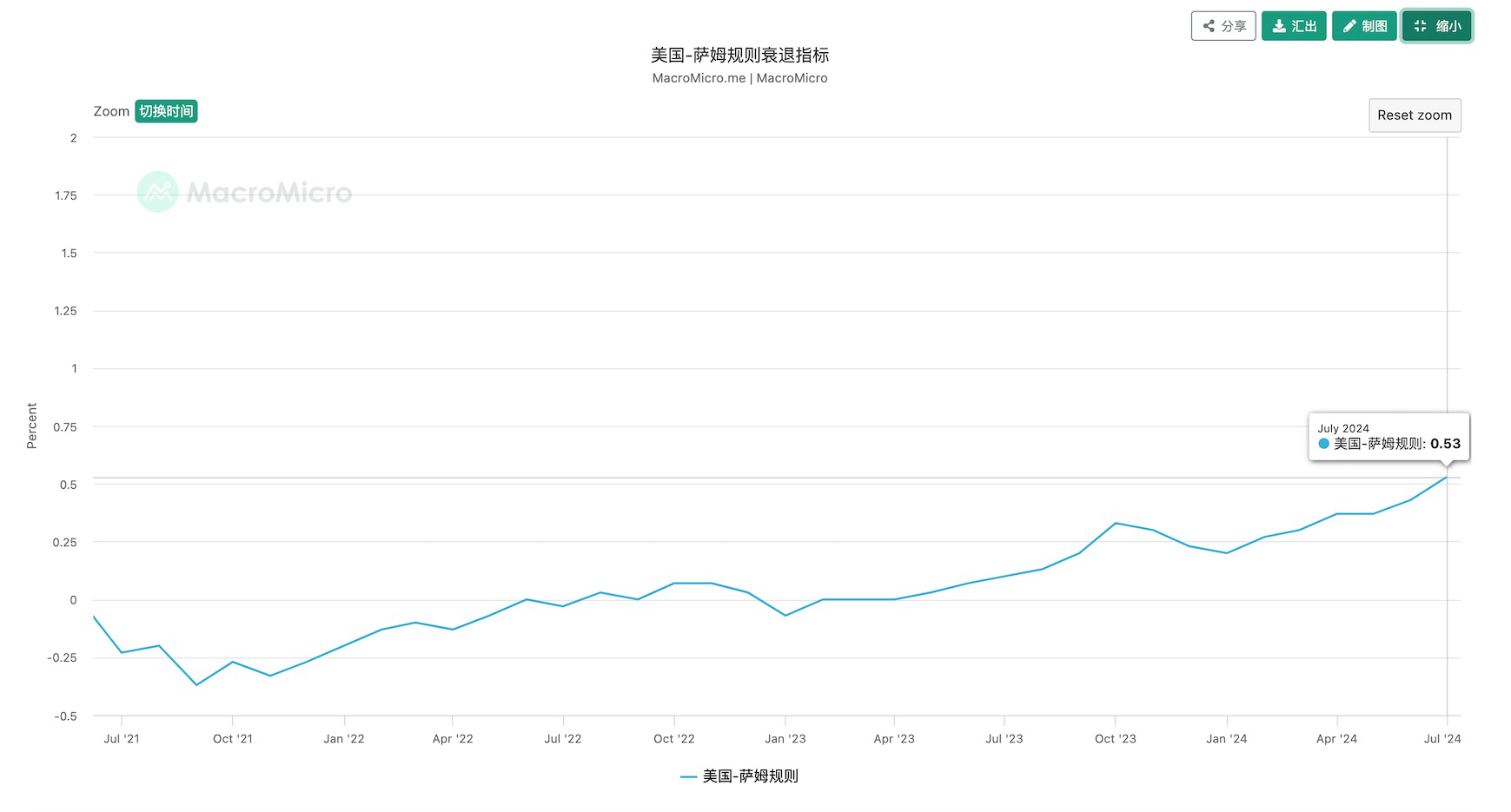

Here is a brief introduction to how the Sam Rule recession indicator is calculated. It was proposed by Federal Reserve economist Claudia Sahm. Sahm found that when the moving average of the US unemployment rate for three months minus the low point of the unemployment rate in the previous year exceeds 0.5%, it means that the economy is experiencing a recession, and every recession in the past has met this situation, so this indicator is named the Sam Rule recession indicator. The US unemployment rate in July just brought the Sam Rule indicator to 0.53%, officially entering its recession period. This has caused some concerns in the market.

Of course, we see that after reaching the goal, the effectiveness of the Sam Rule began to be widely discussed by bigwigs, including Nomura and other institutions, and even the originator of the Sam Rule, Claudia Sahm, in an interview on August 6, believed that considering the changes in the current US job market, the Sam Rule has become ineffective and cannot prove that the US economy has fallen into recession. Regardless, this also shows that this indicator has attracted widespread attention from the market. Especially for some big capital, risk is more important than return, so it is very normal to make more cautious adjustments to the market at this time. This means that for some time to come, the observation of whether the United States is in recession will continue and become more critical, which leads to the theme of this article, the leading indicator of the US recession trade in the next month: the number of Americans claiming unemployment benefits at the beginning of the week.

The number of Americans claiming unemployment benefits at the beginning of the week will become an important indicator of recession differential assessment in the next month

Why has this indicator become important? This stems from an interpretation of the higher unemployment rate in July. Some people believe that the reason for the poor employment data in July is that the United States was affected by Hurricane Beryl, which lasted from June 28, 2024 to July 9, 2024. Objective factors such as damage to infrastructure caused short-term fluctuations in the job market. Therefore, the poor employment data in July is not representative, so the employment data in August is particularly critical, because the employment data in August determines whether this argument can be broken.

However, considering the release date of US macro data, the August non-farm payrolls and unemployment rate will not be released until the first Friday of September, which is September 6. Therefore, within this month, the market needs to find some other testimonies to predict the results of September in advance. The most critical of these testimonies is the number of people claiming unemployment benefits at the beginning of the week in the United States. Of course, we also need to pay attention to the speeches of some FED officials.

The reason why it is necessary to remind everyone to pay attention is that this indicator has not been particularly important in the past. It is just because the market has been mainly engaged in recession trading in recent times, and the number of people claiming unemployment benefits at the beginning of the week can be observed as a differential data of the monthly unemployment rate. Usually, people who claim unemployment benefits for the first time mean that they are unemployed for the first time, so it can well reflect the changes in the employment market this month.

The indicator is released every Thursday at 8:30 p.m. Beijing time. A specific observation standard is that when the public data is lower than expected, it means that the job market remains strong this week, the probability of recession becomes smaller, and the risk asset market is more likely to rise. When the data is higher than expected, it means that more people will start to lose their jobs this week, the probability of recession will increase, and the risk asset market is more likely to fall.

Of course, no matter what, the investment strategy at this stage still needs to be relatively conservative, and controlling leverage is the most important. Wait until the market gives a clearer trend signal before increasing investment. After all, making money is a long-term thing, and there is no rush. Finally, I hope everyone can follow my Twitter, Web3 Mario . I have also recently opened a personal public account, Ma Xiaoao Watching Web3 . Please pay more attention to it. Thank you.