Bitcoin just experienced the impact of the macro market last week, and it was around 60,000-61,000 during the weekend. However, in the early morning of Asian time today, BTC fell to below 59,000 without any warning. Looking back at the ups and downs of digital currency prices with macro risk sentiment in recent days, the outflow of ETF funds last Friday was also quite disappointing. Therefore, before the release of inflation data such as CPI this week, traders may adopt more defensive strategies to reduce risk exposure, giving rise to some risk aversion.

Source: TradingView;SignalPlus, Economic Calendar

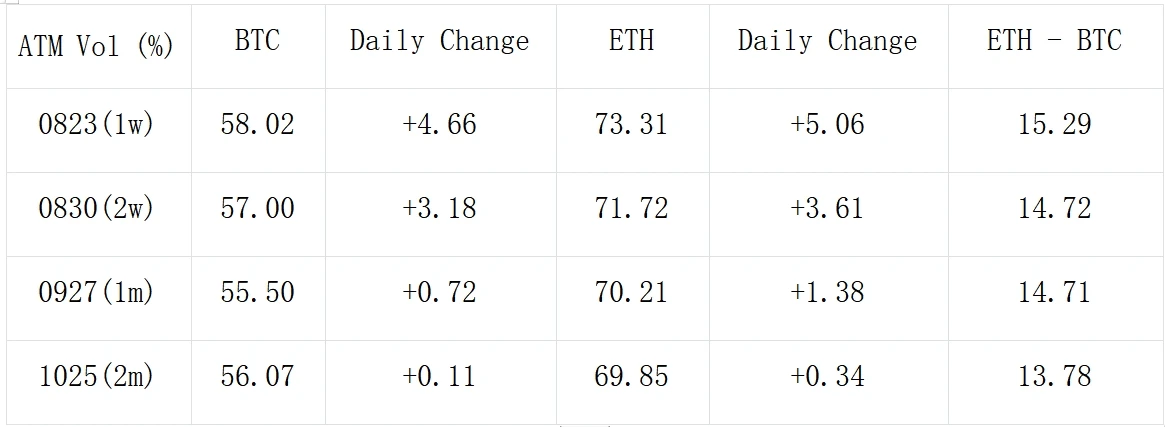

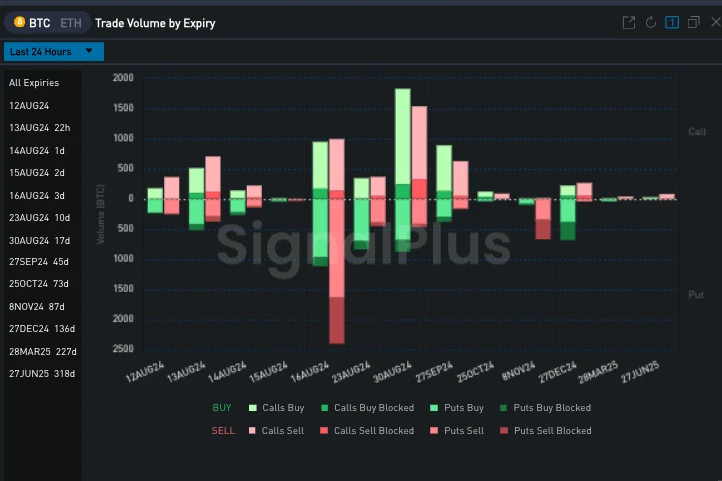

From the perspective of options, the price fluctuations broke the previous short-term tranquility, and the impact of the release of macro data was also amplified, causing the front-end IV to rise sharply and the curve to flatten. Vol Skew also ended the slow rebound of the previous two days, and collapsed again with the short-term price decline, returning to the low point, but from the trading we can see that it was this wave of decline that allowed the trader to seize the opportunity to sell a large number of put options on the Wing that week and gain a higher Vol Preimum.

Source: Deribit (as of 12 AUG 16: 00 UTC+ 8)

Source: SignalPlus

Source: SignalPlus

Source: SignalPlus

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com