This new column is a sharing of real investment experiences by members of the Odaily editorial department. It does not accept any commercial advertisements and does not constitute investment advice (because our colleagues are very good at losing money) . It aims to expand readers perspectives and enrich their sources of information. You are welcome to join the Odaily community (WeChat @Odaily 2018, Telegram exchange group , X official account ) to communicate and complain.

Recommender: Nan Zhi (X: @Assassin_Malvo )

Introduction : On-chain player, data analyst, plays everything except NFT

share :

Continue to be bearish on WIF, but the short position has been closed short-term on Monday, waiting for the point.

· SOL demand side: The money-making effect is getting weaker and weaker, which means there is no general incremental capital inflow.

· SOL supply side: Pump’s daily revenue hits a new record high, but the upper limit of the token market value is getting lower and lower. Pump earns hundreds of thousands of SOL per day, and half of it will be sold for USDC. TelegramBot’s daily revenue is also $500,000-1 million SOL, and it is not sure how to deal with it.

I personally bought RUNE (the one on Binance, not Rune). I am preparing to add ETH.

Recommender: Qin Xiaofeng (X: @QinXiaofeng 888 )

Introduction : Option mad dog, Meme taker

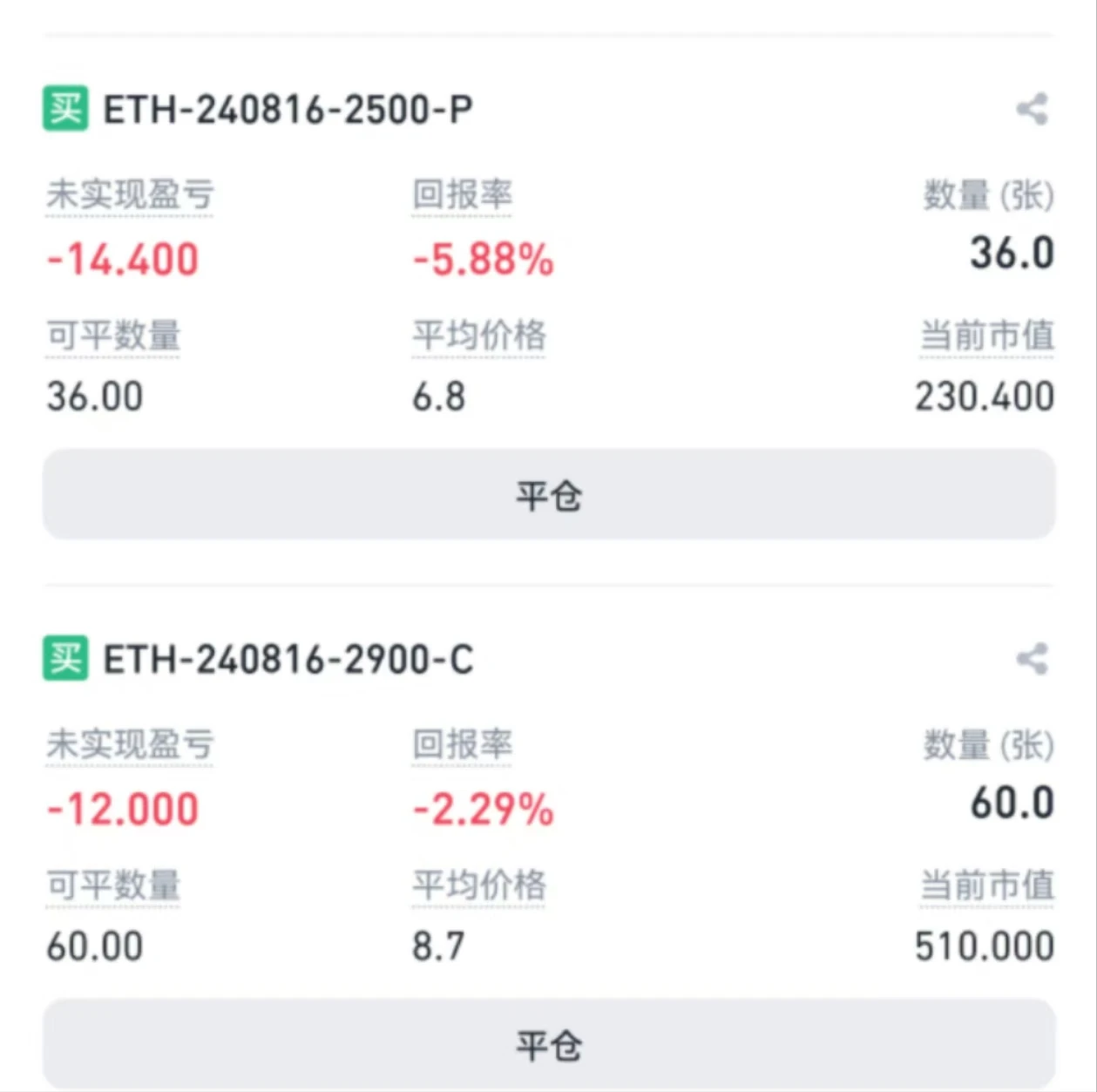

Share : Tonight at 8:30, the US will announce the July CPI, and a big market is coming. Bitcoin and Ethereum have been testing upward since yesterday, but it is still not advisable to bet on one side too optimistically. It is recommended to operate before 8 oclock, open both long and short positions tonight, and open ETH options that expire the day after tomorrow. As shown below:

Recommended by: Wenser (X: @wenser 2010 )

Introduction : Follow the trend of traders, either lose everything or soar

share :

After several months, gm.ai is finally going to be launched. Currently, pre-sale players are losing money. They plan to buy GM tokens at the bottom after they are launched, around 0.08, and try to take a chance on a rebound. If gm.ais products are particularly good, they can be hyped as AI concept coins in the future. After all, the GM meme is still very interesting. Of course, dont get carried away. (You can fool your friends, but dont fool yourself.)

Today I saw a post analyzing Solana Restaking . I feel that Solayer still has some room for growth. It is not ruled out that there will be good fortune. After all, the Solana ecosystem also needs growth points other than Meme. There is nothing wrong with learning from Ethereum.

Previous records

Recommended Reading

Arthur Hayes new article: The Feds Treasury, Yellens Decision, and the Crypto Bull Market Schedule

Uniswap Labs’ latest research: What factors determine Bitcoin price trends?