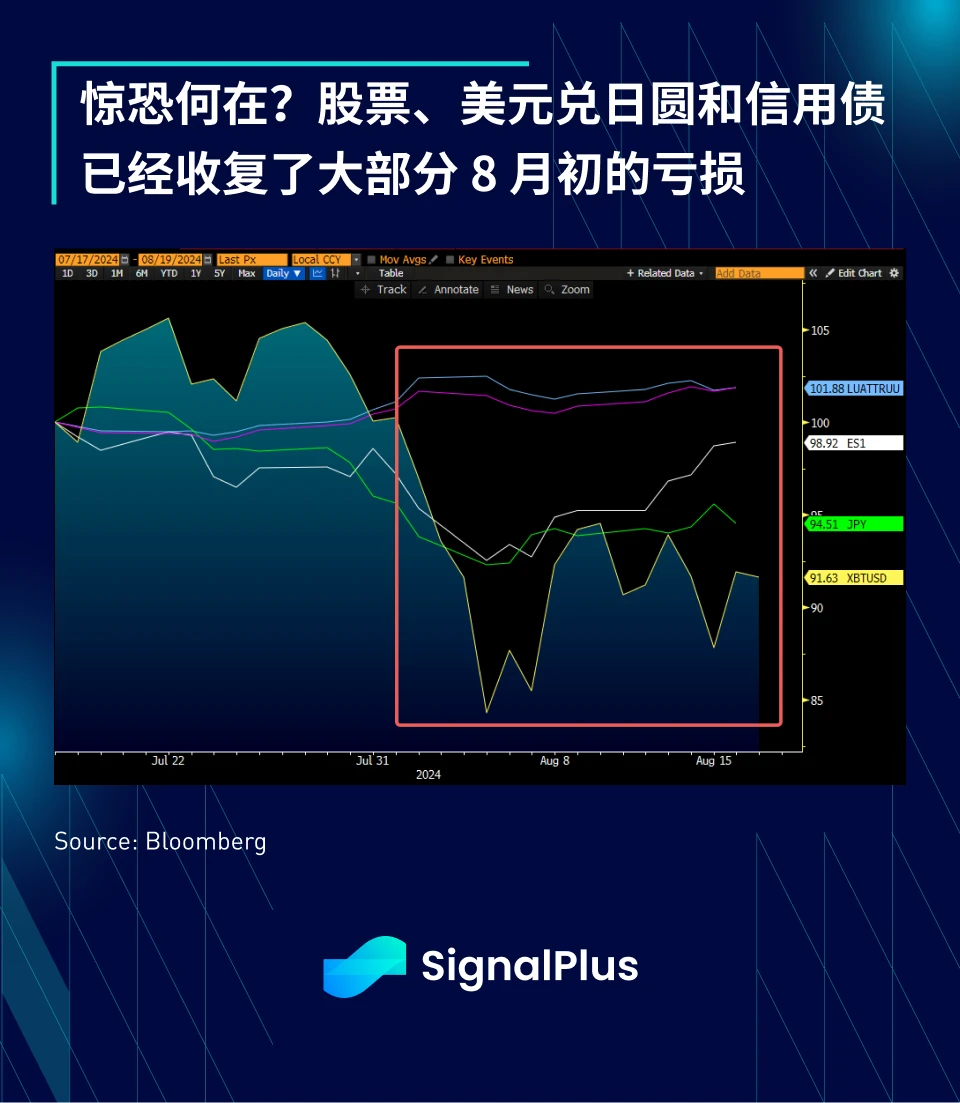

After the turbulence at the beginning of the month, the market entered the second half of the month as if nothing had happened. Due to strong retail sales data, falling unemployment claims and good corporate earnings reports, recession concerns have largely subsided and the market has re-entered the soft landing mode.

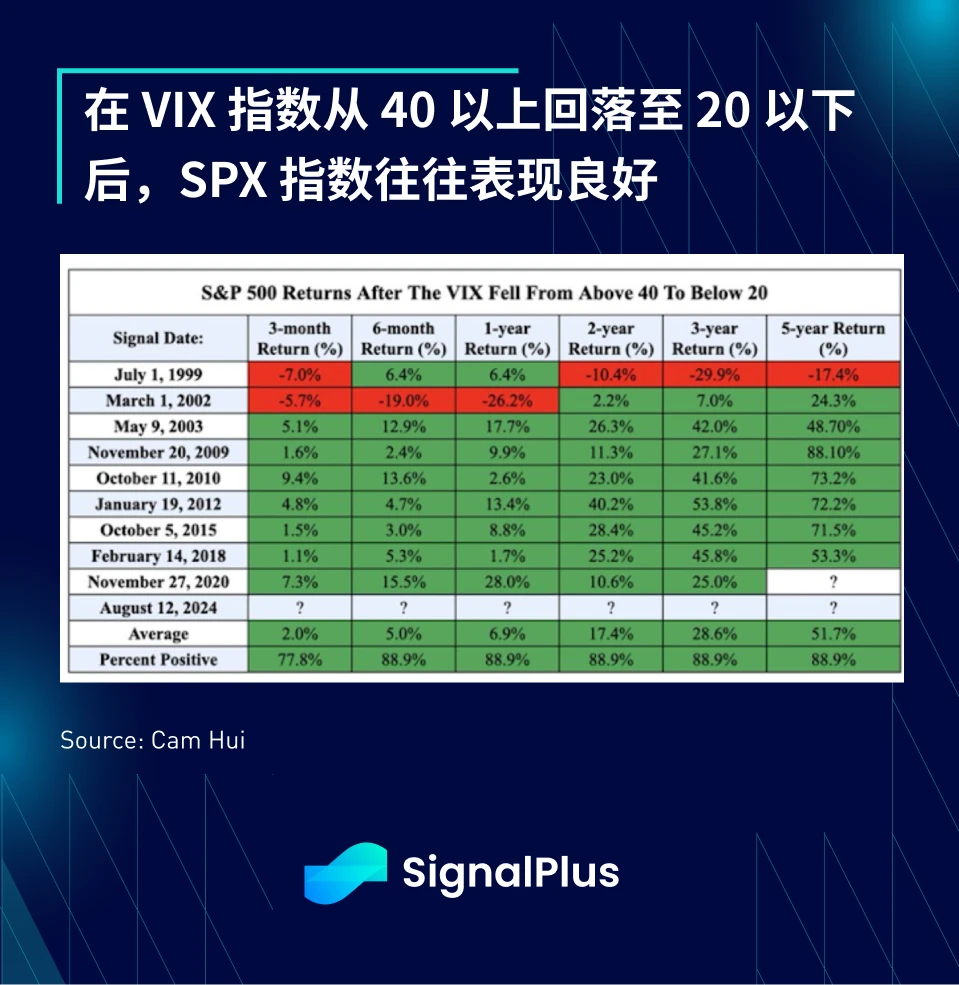

Additionally, the SPX Growth Index outperformed the Value Index by more than 4% this past week, according to Bloomberg data, something that has only happened 31 times in the past 20 years, with more than 70% of those records seeing markets rise in the following week.

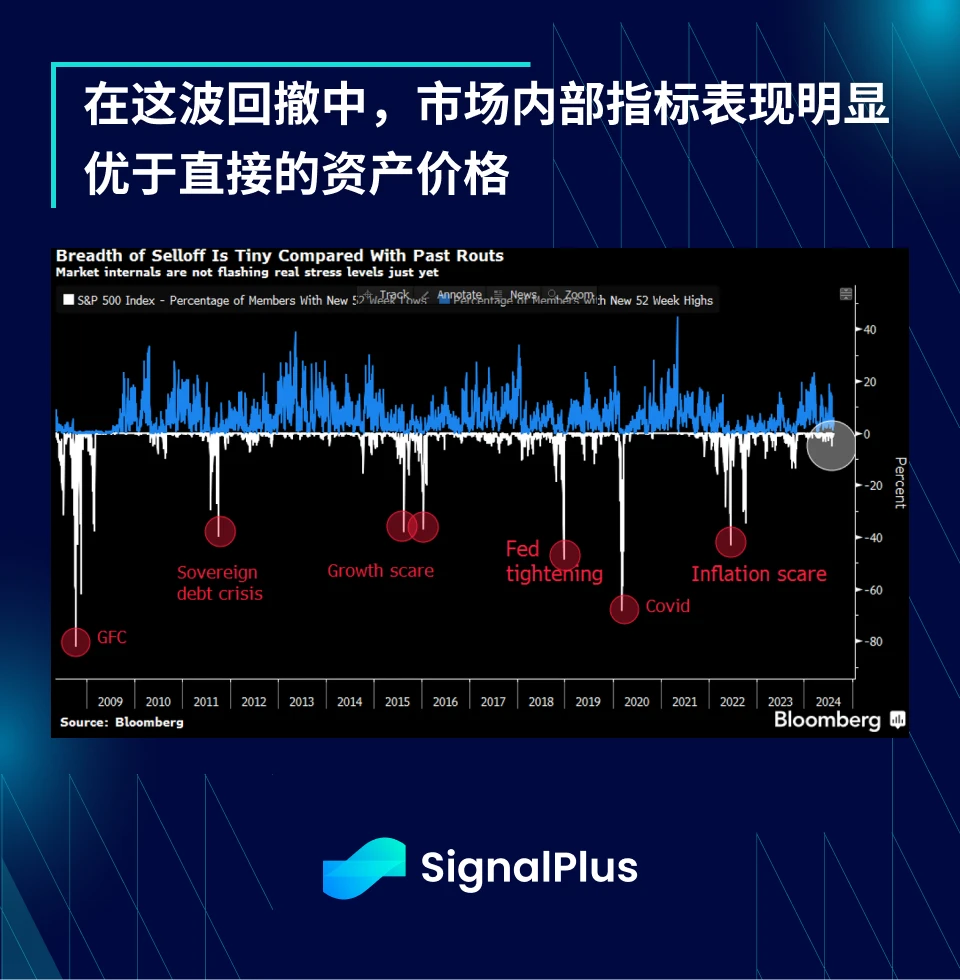

In fact, market internals (measured by stocks reaching new 52-week highs and lows) did not show much panic during this volatility, once again confirming that this sell-off was mainly driven by positioning and profit and loss stops rather than a change in long-term fundamental views.

In addition, Citigroups estimates of market positions confirm that the de-risking behavior in the market in August was mainly led by hedge funds, whose positions were taken over by long-only (LO) funds in the subsequent bargain hunting. If the time frame is extended, this momentary fluctuation of the decline will hardly be noticed on the long-term chart of SPX, and the volatility index (VIX) has fallen back to the range commonly seen this year after a flash of less than a week.

Looking at individual companies, Walmarts earnings report exceeded market expectations and raised its guidance for fiscal 2024, with its stock price rising 7% after the earnings report was released. Other consumer brands such as Home Depot and Starbucks also performed well, further alleviating market concerns about a sharp slowdown in consumer spending.

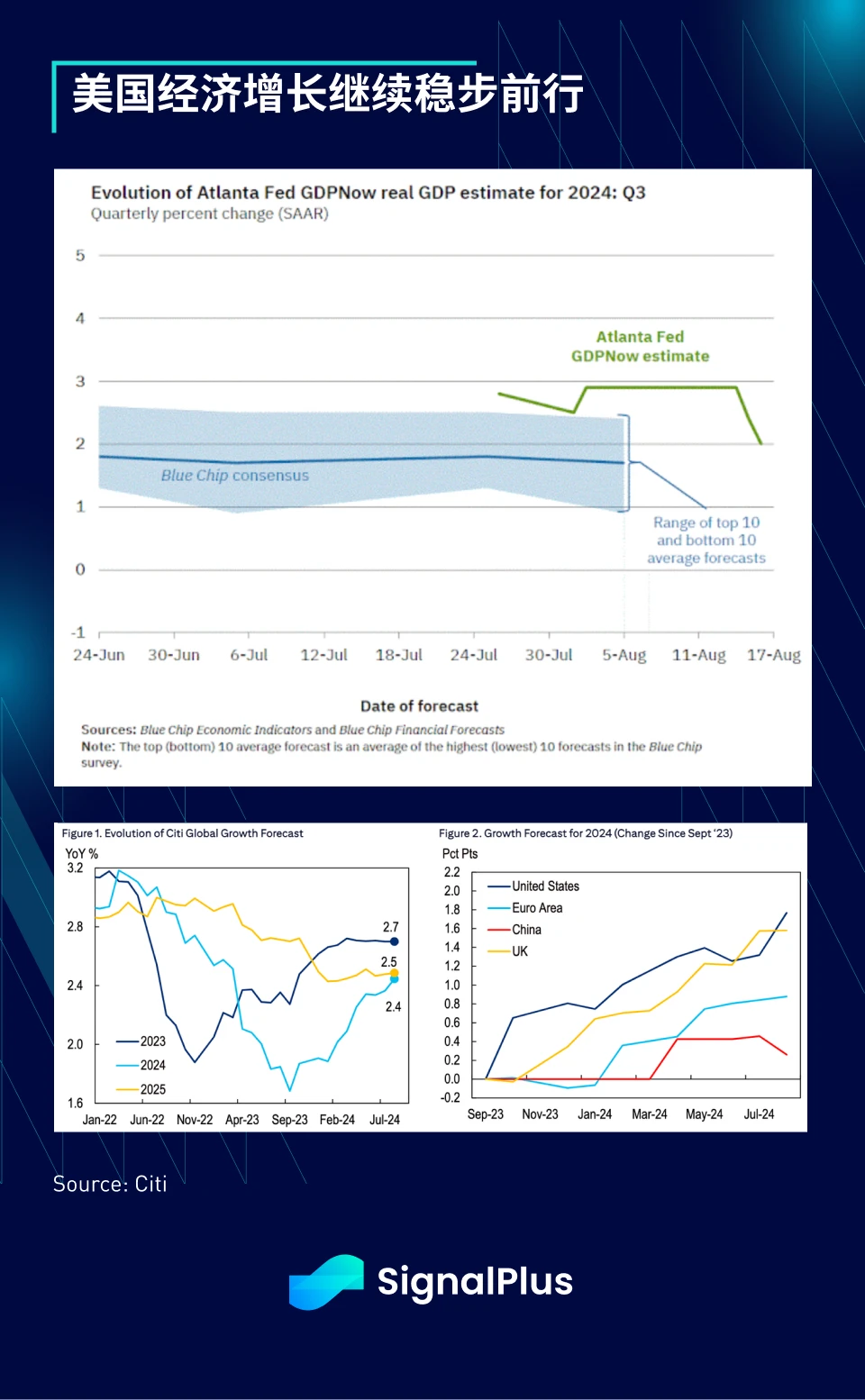

Overall, Q3 GDP growth has been fairly consistent over the past 2 months, with the Atlanta Fed GDPNow model forecasts remaining pretty much in the 2.5% to 3% range. Moreover, Wall Street expects US (and UK) GDP growth to remain the leader in 2024, thanks to the Fed’s support, while 2025 growth is expected to remain at a similar level.

The difference is that compared with July, the markets expectations for the Feds interest rate cuts have changed. The market still expects nearly four interest rate cuts before the end of the year, and the probability of a 50 basis point cut in September is 30%. However, due to the rapid recovery of the market and the continued strong economic data, the Fed is not facing huge dovish pressure like it did two weeks ago, and the market has entered a vacuum period as asset prices return to a state of waiting for more data.

In fact, Goolsbee, a well-known dove at the Chicago Fed, showed a very cautious and balanced stance in a recent interview, saying that the Fed should not overreact to some recession indicators. Therefore, even if the market is eagerly looking forward to it, Powell may still disappoint the market by taking a more neutral tone at the much-anticipated Jackson Hole meeting. That is, Powell may only express support for the plan to start gradual easing, while downplaying market expectations of a 50 basis point rate cut if the financial situation is easing rapidly. He may also emphasize not to focus on the results of a single non-agricultural employment data, while retaining the option of accelerating the pace of rate cuts if the job market deteriorates rapidly.

We think Powell will proceed very cautiously and there will likely be no major easing policies or messages in the short term.

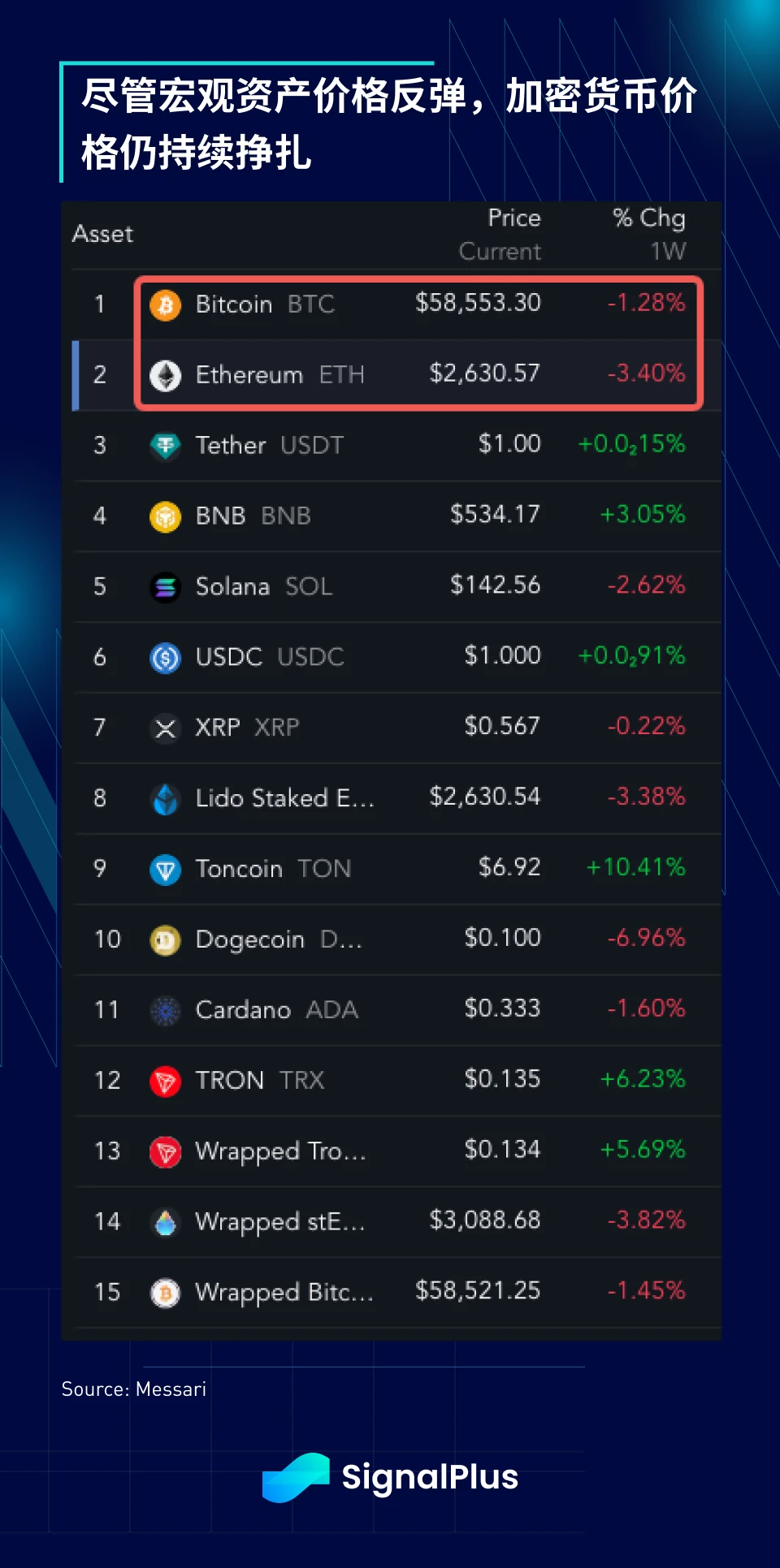

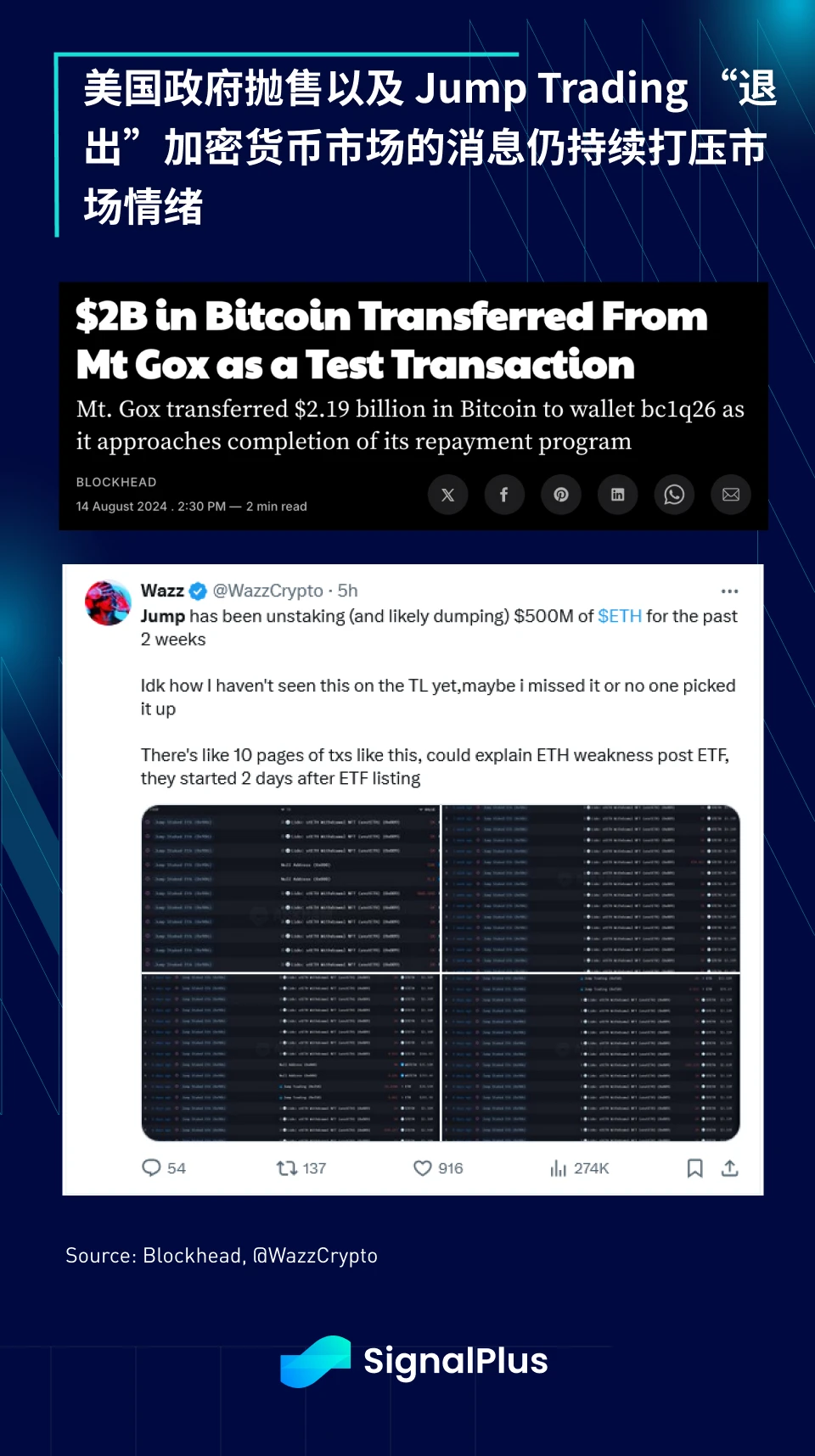

In crypto, the price performance of major currencies continues to lag behind stocks and other risk assets due to market concerns about sell-offs (Mt. Gox) and rumors that Jump Trading is exiting the crypto market. According to reports, Jump Trading continues to transfer assets to centralized exchanges, including withdrawing 17,000 ETH from Lido, possibly in preparation for subsequent liquidation and cashing out.

By the way, the conversation between Elon Musk and Trump did not discuss cryptocurrencies much, which may have disappointed some listeners who expected to hear more supportive (i.e. pump and dump) remarks.

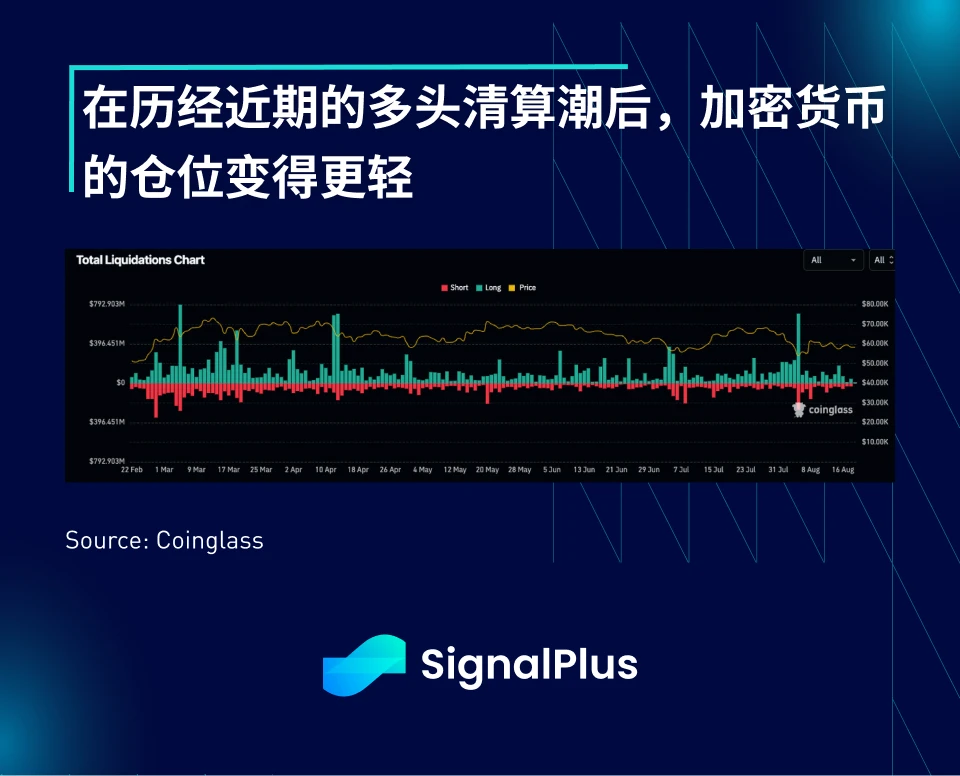

We expect cryptocurrency prices to face challenges until September, after which continued improvement in macro sentiment has the opportunity to push cryptocurrency prices higher, especially considering the light positions in the market after recent long liquidations and the Federal Reserve is finally about to start taking interest rate cuts.

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com