Strategy Testing 03|OKX and AICoin Research Institute: Martingale Strategy

OKX has teamed up with high-quality data platform AICoin to launch a series of classic strategy research, aiming to help users better understand and learn different strategies and avoid blind use through analysis of core dimensions such as data measurements and strategy characteristics.

Martingale strategy, full name Dollar Cost Averaging, referred to as DCA, is a trading method that focuses on position management. The core concept is "loss increase position to pull the average price, profit reset", the main feature is to double the transaction amount after each loss until a victory is achieved. The basic assumption of this strategy is that as long as the capital is large enough, the final victory will make up for all previous losses and bring profits. As a higher-risk strategy, Martingale is suitable for traders who have sufficient capital and can withstand potential huge losses.

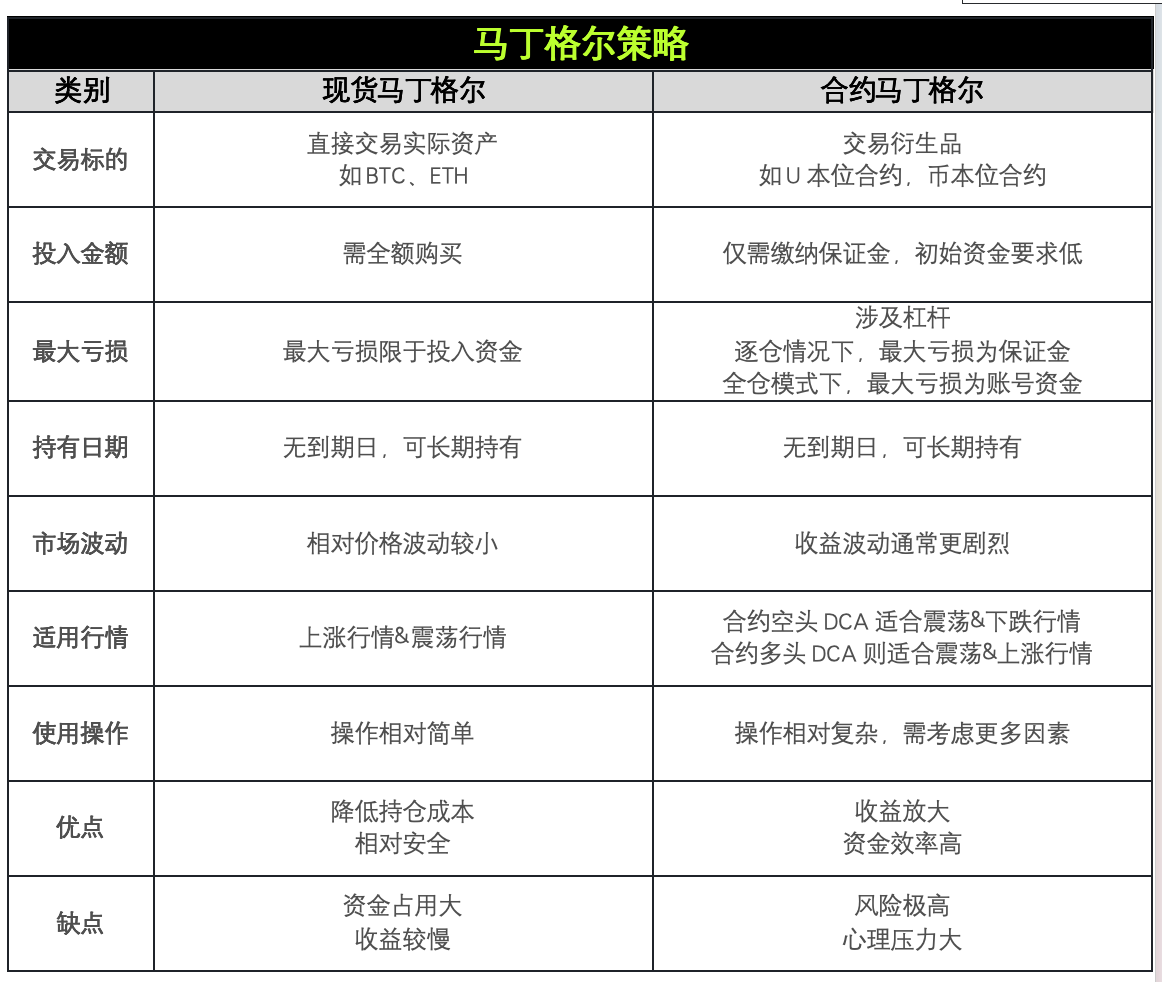

This strategy is mainly divided into two forms of application in the cryptocurrency market: spot martingale and contract martingale.

Issue 03 introduces the Martingale strategy, using 3 big data models to test [spot Martingale and contract Martingale]:

Model 1: Contract DCA and spot DCA in a 5-minute running cycle in an uptrend

Model 2: Contract DCA and spot DCA in a 5-minute cycle during a falling market

Model 3: Contract DCA and Spot DCA under 5-minute sideways fluctuations

This period's data test operation standards:

Long DCA: Open a buy position when the market starts, and cover the position when the market falls. You can cover the position up to 5 times, and set a stop loss line when covering the position for the 5th time. When the market rebounds and rises to the target price, sell it once to gain profit.

Contract DCA: Based on the logic of long DCA, the operation of opening and selling is added. Open and sell when the market starts, and cover the position when the market rises. You can cover the position up to 5 times. Similarly, set a stop loss line when covering the position for the 5th time. When the market pulls back and falls to the target price, make a one-time purchase to obtain profits.

To summarize the spot Martingale and contract Martingale in one sentence: In a sideways and volatile market, contract DCA is more suitable; in a market with a clear upward trend, spot DCA is more suitable, but we need to be wary of risks.

Pros and cons comparison

Both forms of the Martingale strategy follow the same basic principle: increase the size of transactions when losing money, lower the average price, and hope that the final profit will cover the previous losses. However, they differ significantly in specific operations, risk characteristics, and applicable scenarios. The choice of strategy should be dynamically adjusted according to the trader's risk tolerance and market trends, and reasonable risk control measures should be taken to reduce potential losses.

Both spot and contract Martingale are considered to be strategies that focus on position management. The spot Martingale strategy reduces the average cost by doubling the purchase, so we need to be wary of the risk of continued decline; while the contract Martingale strategy amplifies the profit and risk by doubling the opening of positions, so we need to be wary of the risk of liquidation.

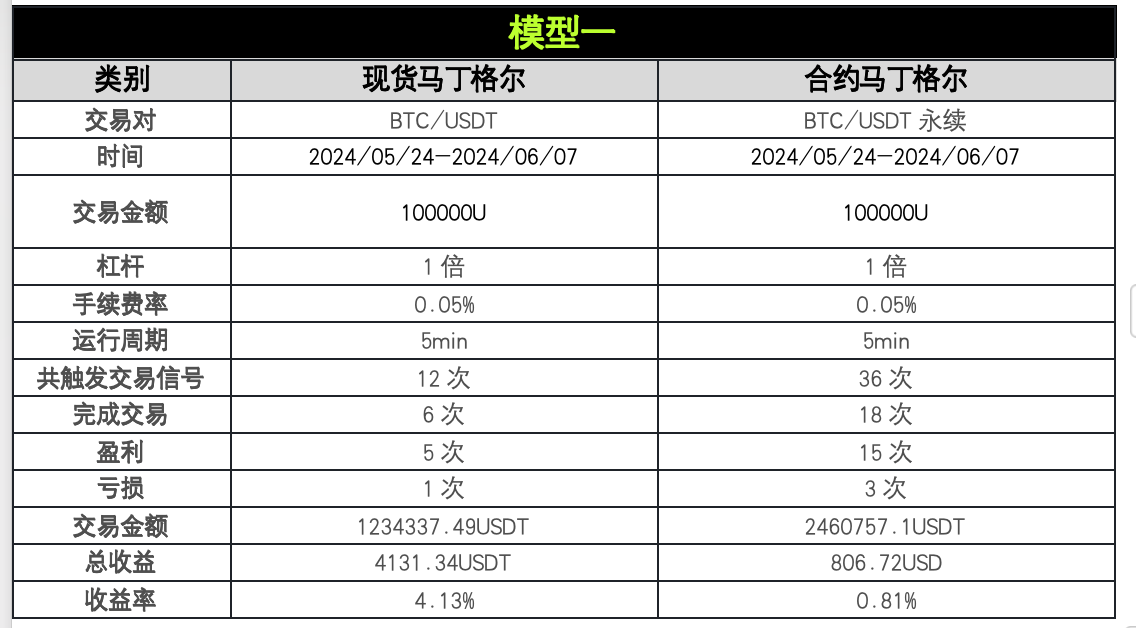

Model 1

The model is: Contract DCA and Spot DCA in a 5-minute operation cycle in an upward market

Image 1: Contract DCA in a 5-minute operation cycle during an upward trend; Source: AICoin

Image 2: Spot DCA in a 5-minute cycle during an uptrend; Source: AICoin

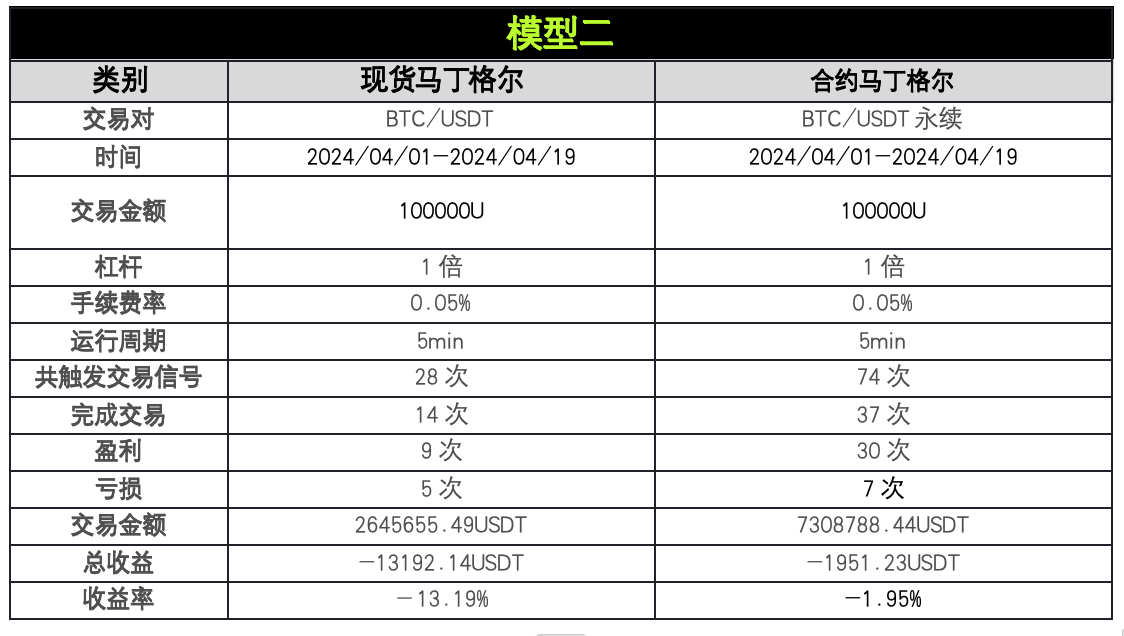

Model 2

The model is: contract DCA and spot DCA in a 5-minute operation cycle in a falling market

Image 3: Contract DCA in a 5-minute operation cycle during a falling market; Source: AICoin

Image 4: Spot DCA in a 5-minute cycle during a falling market; Source: AICoin

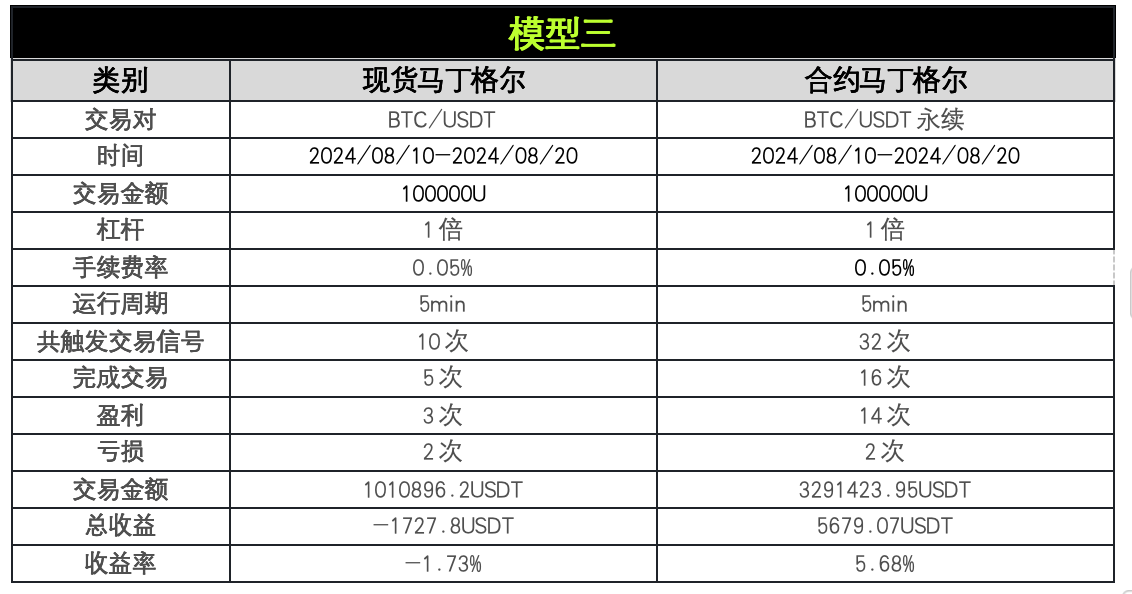

Model 3

The model is: contract DCA and spot DCA under a 5-minute sideways oscillation cycle

Image 5: Contract DCA under a 5-minute sideways fluctuation cycle; Source: AICoin

Image 6: Spot DCA in a 5-minute sideways cycle; Source: AICoin

Analysis and summary

The sudden rise and fall is not conducive to the contract DCA strategy, which is suitable for volatile markets. Among them, the contract short DCA is suitable for volatile & falling markets, and the contract long DCA is suitable for volatile & rising markets. Spot DCA can be obtained in rising markets.

The contract DCA strategy has shown strong adaptability in different market environments, especially in the sideways and volatile market. Spot DCA performs well in rising markets, but performs poorly in sideways and falling markets. Contract DCA gains profits through more frequent transactions and higher winning rates, but it may also bring higher risks. Spot DCA has a lower trading frequency and may be more suitable for long-term traders or risk-averse traders.

In general, when their scaling parameters are set to 1, they behave very similarly to grids. But when the scaling parameters are set to 2 (or more), they can lead to a sharp increase in capital requirements and cause great psychological pressure on traders. In particular, contract martingales, due to leverage, have more significant risks and can lead to liquidation.

Specifically:

Choose a strategy based on your risk tolerance

High risk tolerance: Consider contract DCA, especially in a sideways market.

Low risk tolerance: Spot DCA can be chosen, especially in a market with a clear upward trend.

Combined with market trends

Upward trend: Both strategies can be considered, but be careful to stop profit in time.

Downtrend: Use with caution, you may need to adjust your strategy or wait and see for the time being.

Sideways fluctuations: Contract DCA may have more advantages.

Dynamic Adjustment

Adjust strategies flexibly according to market changes and don't stick to a single model.

Risk Management

Set a stop loss point, control the amount of funds for a single transaction, and diversify transactions to reduce risks.

Combination strategy

Consider combining contract DCA and spot DCA to balance risk and reward.

Continuous learning and optimization

Regularly backtest and evaluate strategy effectiveness, and continuously optimize trading strategies based on new market data.

Focus on external factors

In addition to technical analysis, we should also pay attention to external factors such as macroeconomics and industry news that may affect the market.

By using these strategies and adjusting them to suit your personal circumstances and market conditions, traders can better manage risk and increase their chances of making a profit. However, always keep in mind that the cryptocurrency market is highly volatile and traders should only invest money they can afford to lose.

OKX&AICoin Martingale Strategy

Currently, OKX Strategy Trading provides convenient and diverse strategy products. OKX spot version and contract version of Martingale strategy are optimized to a greater extent in combination with the habits and characteristics of crypto users. Two different creation modes are set for users with different experience: manual creation and smart creation.

Manual creation is for traders to set parameters based on their personal judgment of the market. This is mainly suitable for traders with rich trading experience and strong capital strength. Ordinary users are recommended to use the intelligent creation mode. Intelligent creation is for users to set the transaction amount and buying rhythm based on their personal risk preferences by selecting the parameters recommended by the OKX system.

It is worth mentioning that the parameters recommended by the system are calculated based on historical market conditions and asset fluctuations with the help of OKX backend algorithms. They are authoritative to a certain extent and can provide traders with reliable trading references. In addition, drawing on the practice of stratifying traders in traditional securities trading, the intelligent creation model controls risks as much as possible, and recommends parameters of different risk levels to users based on the three levels of conservative, balanced and aggressive, in combination with the user's asset status and tolerance.

How to access more strategy trading on OKX? Users can go to the "Strategy Trading" mode in the "Trading" section through the OKX APP or official website, and then click on the Strategy Square or Create Strategy to start the experience. In addition to creating strategies by yourself, the Strategy Square currently also provides "Quality Strategies" and "Quality Strategies with Strategy Leaders". Users can copy strategies or follow strategies.

OKX strategy trading has multiple core advantages such as easy operation, low fees and security. In terms of operation, OKX provides intelligent parameters to help users set trading parameters more scientifically; and provides graphic and video tutorials to help users quickly get started and master them. In terms of fees, OKX has comprehensively upgraded the fee rate system to significantly reduce user transaction fees. In terms of security, OKX has a security team composed of top global experts who can provide you with bank-level security protection.

How to access AICoin's DCA strategy?

All-currency DCA strategy: Users can find the "All-currency DCA" option in the "Strategy" option on the left sidebar of the AICoin product. Click here, and on this interface there is the all-currency DCA strategy recommended by AICoin based on the current market conditions.

Spot DCA strategy: Users can find the "Spot DCA" option in the "Market" option on the left sidebar of the AICoin product. Click here, and on this interface, AICoin will recommend a spot DCA strategy based on the current user-selected trading pair.

Contract DCA strategy: Users can find the "Custom Indicator/Backtest/Real Trading" option in the "Market" option on the left sidebar of the AICoin product. Click here and search for "Contract DCA" in "Community Indicator" to find the code of the fixed investment strategy.

Disclaimer

This article is for reference only and represents the author's views only, not the position of OKX. This article is not intended to provide (i) trading advice or trading recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/trading professionals for your specific situation. Please be responsible for understanding and complying with local applicable laws and regulations.