Strategy Test 04|OKX and AICoin Research Institute: Funding Arbitrage Strategy

OKX has teamed up with high-quality data platform AICoin to launch a series of classic strategy research, aiming to help users better understand and learn different strategies and avoid blind use through analysis of core dimensions such as data measurements and strategy characteristics.

Funding Rate Arbitrage is a widely used arbitrage strategy in the cryptocurrency market that aims to gain profits by exploiting the difference in funding rates between perpetual contracts and the spot market. The core of funding rate arbitrage lies in exploiting the funding rate mechanism of perpetual contracts. Perpetual contracts are derivative contracts without expiration dates, and the funding rate is used to balance the difference between the contract price and the spot price. The funding rate can be positive or negative, depending on the supply and demand relationship in the market. When the funding rate is positive, longs pay funding fees to shorts; conversely, when the funding rate is negative, shorts pay funding fees to longs.

Arbitrage strategy operation:

• Positive arbitrage: When the funding rate is positive, traders can earn funding income by buying spot and shorting perpetual contracts of equal quantity/amount.

• Reverse arbitrage: When the funding rate is negative, traders can borrow coins to sell spot and go long on perpetual contracts of equal quantity/amount to obtain funding fee income.

This arbitrage strategy typically settles funding fees every 8 hours, but in extreme market conditions, the settlement frequency may be higher to curb excessive speculation.

In the 4th strategy test, we will introduce the funding fee arbitrage strategy and use 3 big data models for testing:

Model 1: Funding arbitrage between BTC and ETH during sideways fluctuations

Model 2: Funding arbitrage between BTC and ETH in a falling market

Model 3: Funding arbitrage between BTC and ETH in a rising market

The operating standards for this period's data test are: the opening condition is that the spread rate is greater than 0.05% and the funding rate is greater than 0; the closing condition is that the spread rate is less than -0.05%.

Funding arbitrage in one sentence: Funding arbitrage is suitable for traders who want to gain returns with relatively low risk in the cryptocurrency market, and it is also suitable for professionals with certain market analysis capabilities and trading experience.

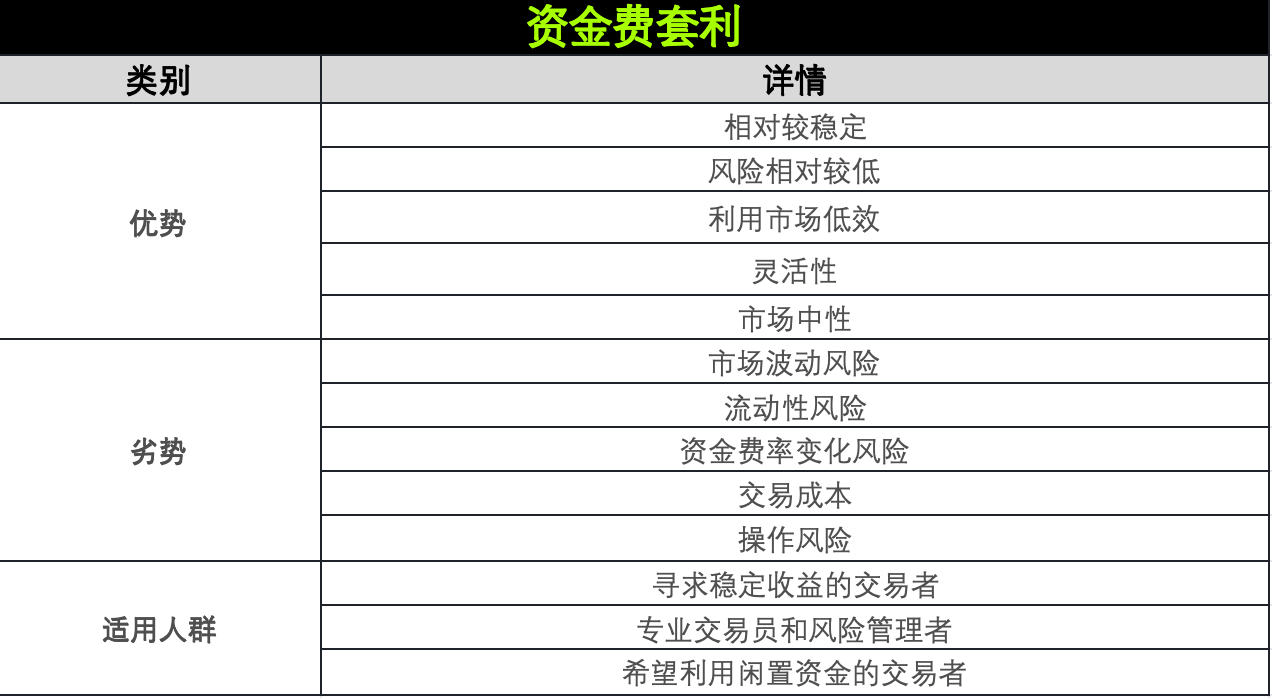

Pros and cons comparison

Specifically, the applicable groups for funding fee arbitrage mainly include the following categories:

1) Traders seeking stable returns: Funding arbitrage is generally considered a relatively low-risk strategy suitable for traders who want to earn income through stable cash flow. Such traders may be cautious about the volatility of the cryptocurrency market and therefore prefer to achieve relatively low-risk returns through arbitrage strategies.

2) Professional traders and risk managers: Since funding arbitrage involves complex market analysis and real-time transaction execution, it usually requires certain market knowledge and experience. Therefore, professional traders and risk managers are the main target groups for this strategy. They can use the differences in funding rates in the market to conduct precise trading operations and thus lock in profits.

3) Traders who want to use idle funds: For traders who hold idle funds (such as USDT), funding arbitrage provides a way to use these funds to obtain additional income. Such traders may be on the sidelines of the current market price, but hope to gain income through arbitrage.

However, while funding fee arbitrage is a relatively low-risk strategy, there are still some risks that need to be noted:

1) Market volatility risk: The high volatility of the cryptocurrency market may cause sharp price fluctuations, thereby affecting changes in funding rates. Such fluctuations may make arbitrage operations difficult to make a profit, or even lead to losses.

2) Liquidity risk: Liquidity and trading volume may vary between exchanges. Low liquidity may lead to wider bid-ask spreads, increase transaction costs and reduce potential profits. In addition, low liquidity may make transactions difficult to execute, and market orders may result in significant price slippage.

3) Funding rate change risk: Funding rates are not fixed and may fluctuate with changes in market supply and demand. When the direction of the funding rate changes unfavorably, it may be necessary to adjust or close positions in a timely manner to avoid losses.

4) Transaction costs: Arbitrage operations involve multiple transactions, and each transaction incurs a fee. These fees may erode arbitrage profits, especially in the case of frequent transactions.

5) Operational risk: Arbitrage strategies require trading in different markets simultaneously to ensure that orders can be traded at the same quantity and price. Any operational errors or delays may lead to arbitrage failure.

However, although the funding arbitrage strategy is considered to be relatively low-risk, traders still need to conduct sufficient market research and risk management to minimize potential risks and optimize returns. Funding arbitrage has the following advantages:

1) Stable income: Funding arbitrage is a market-neutral strategy that earns funding rates by holding hedge positions. Regardless of market price fluctuations, traders can obtain stable income. This strategy is similar to a money market fund and is suitable for traders who want to obtain a stable cash flow.

2) Lower risk: Compared with high-risk leveraged futures trading, funding arbitrage is less risky because it does not rely on market price predictions, but rather uses differences in funding rates to make profits. This strategy reduces market risk by hedging positions in spot and perpetual contracts.

3) Market Neutral: Funding arbitrage is a market neutral strategy, meaning it can work in bull, bear, or sideways markets. Traders focus on the difference between funding rates rather than overall price movements, which makes the strategy flexible in any market conditions.

4) Exploiting market inefficiencies: This strategy is able to exploit temporary inconsistencies in funding rates in the market and capture additional returns through such short-term inefficiencies that are not achievable through traditional trading.

5) Flexibility: Funding arbitrage strategies allow traders to operate on different cryptocurrencies and stablecoins, providing flexible trading options. In addition, traders can arbitrage through the differences in funding rates between different exchanges, further increasing potential returns.

In general, funding arbitrage has become the preferred strategy for many traders seeking stable returns in the cryptocurrency market due to its stable returns, lower risks, and market neutrality.

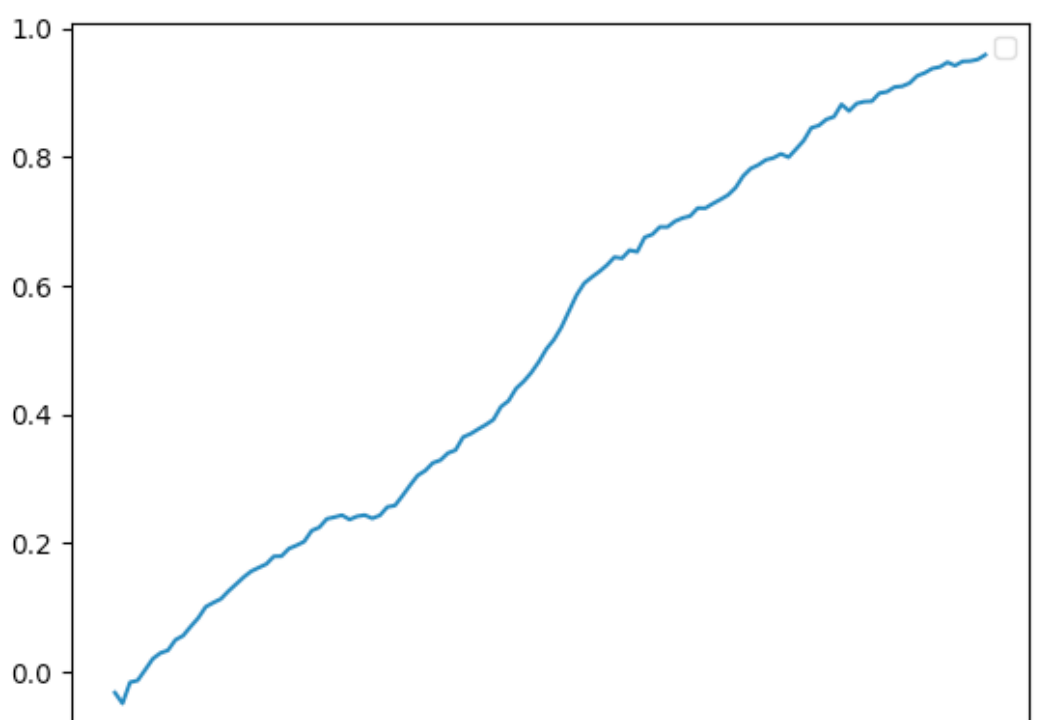

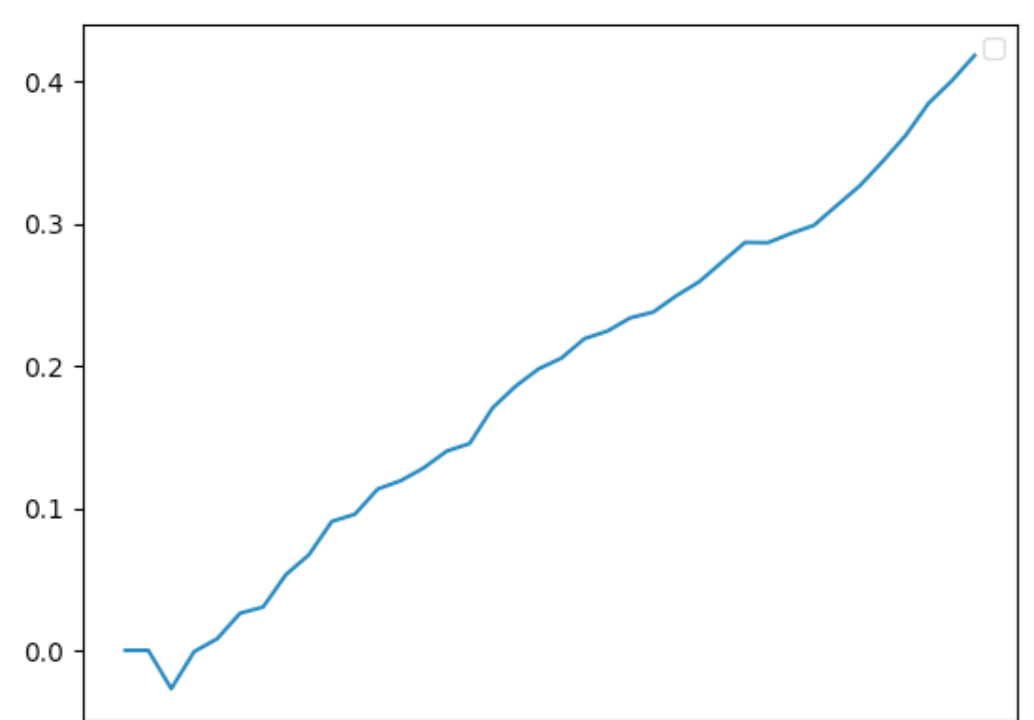

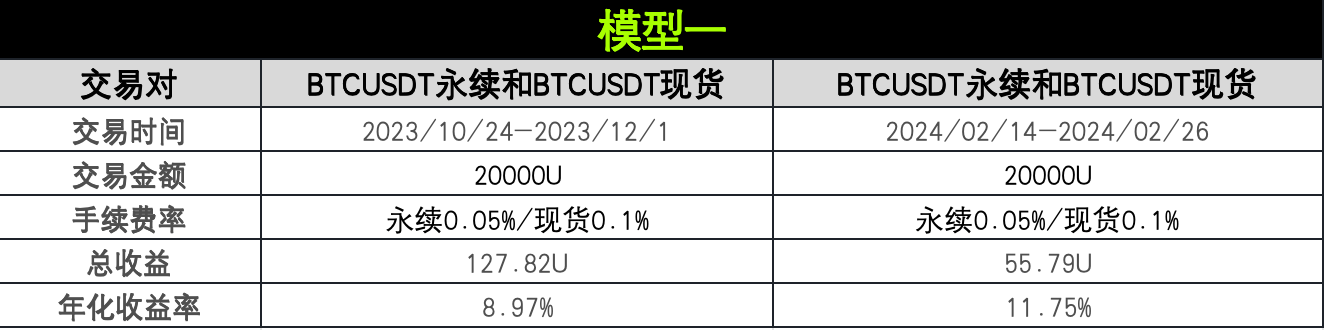

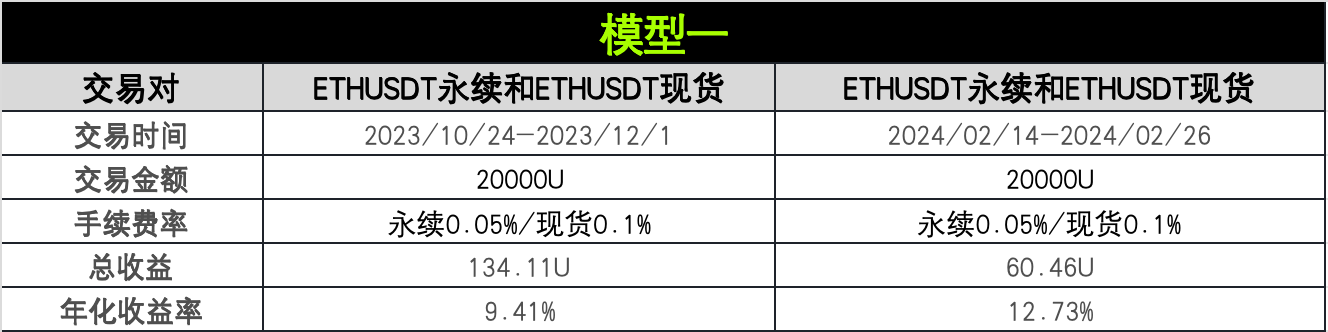

Model 1

The model is: BTC and ETH funding fee arbitrage under sideways fluctuations

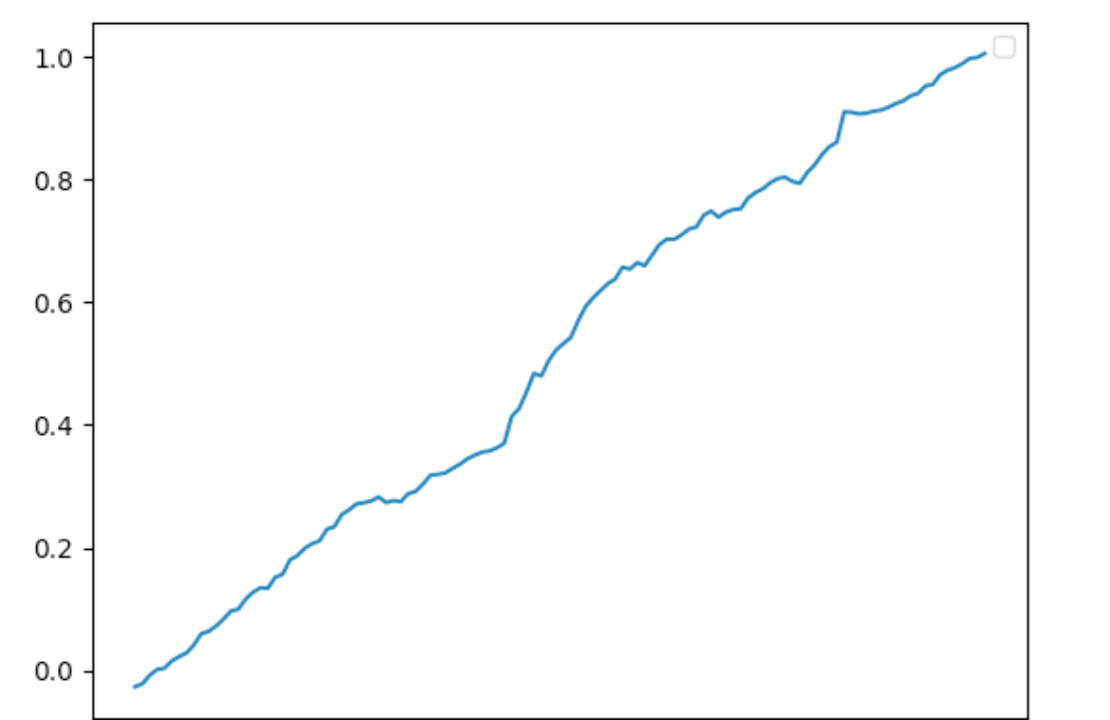

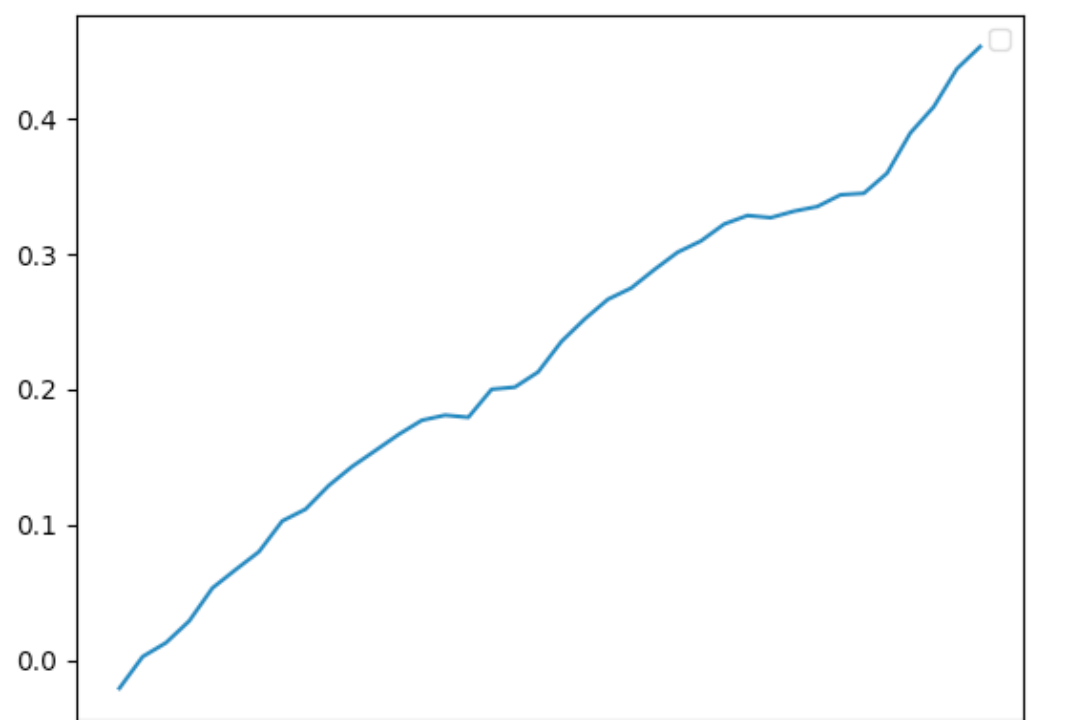

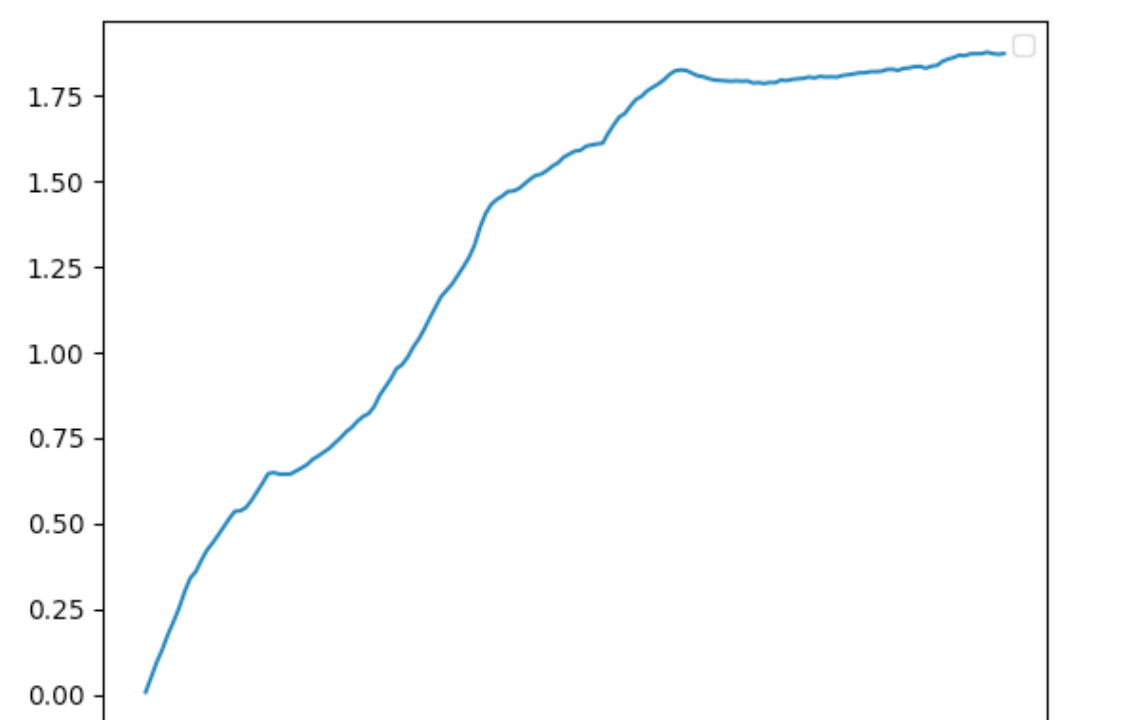

Image 1: BTCUSDT perpetual and BTCUSDT spot funding arbitrage; Source: AICoin

Image 2: BTCUSDT perpetual and BTCUSDT spot funding arbitrage; Source: AICoin

Image 3: ETHUSDT perpetual and ETHUSDT spot funding arbitrage; Source: AICoin

Image 4: ETHUSDT perpetual and ETHUSDT spot funding arbitrage; Source: AICoin

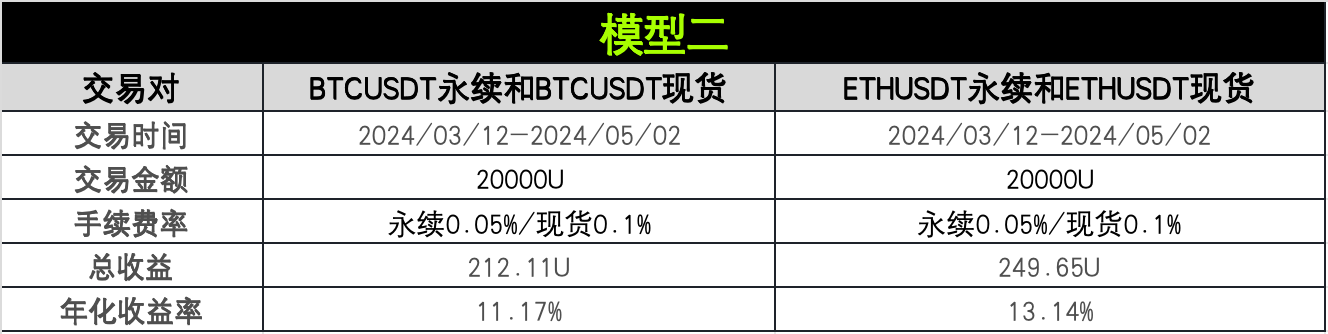

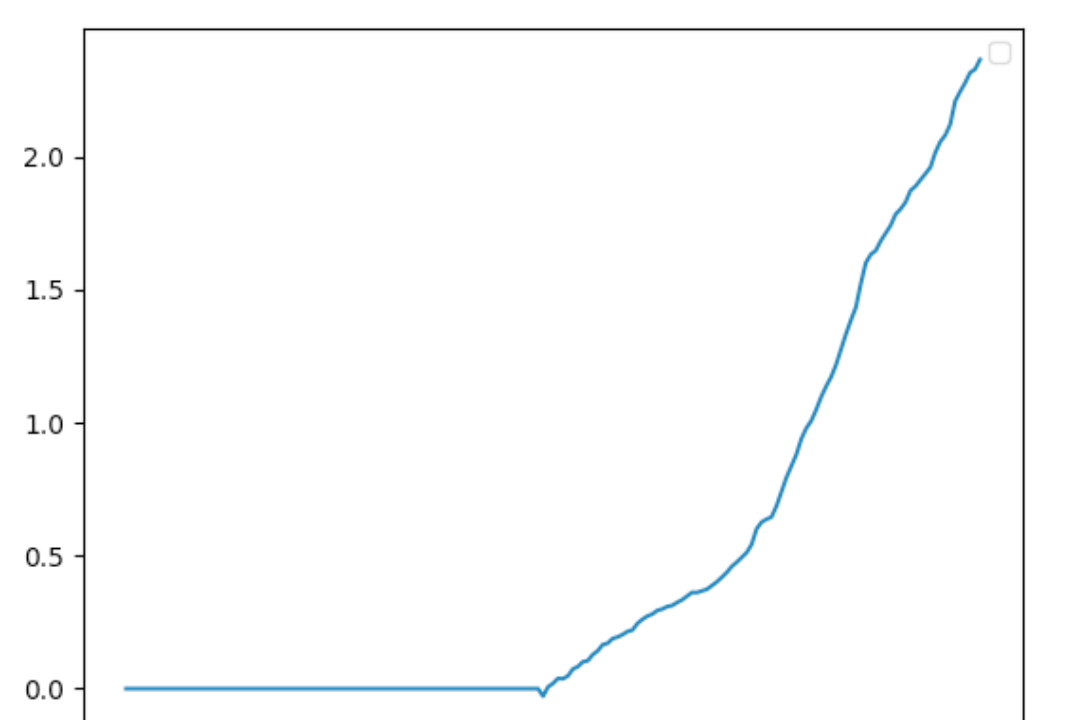

Model 2

The model is: BTC and ETH funding arbitrage in a falling market

Image 5: BTCUSDT perpetual and BTCUSDT spot funding arbitrage; Source: AICoin

Image 6: ETHUSDT perpetual and ETHUSDT spot funding arbitrage; Source: AICoin

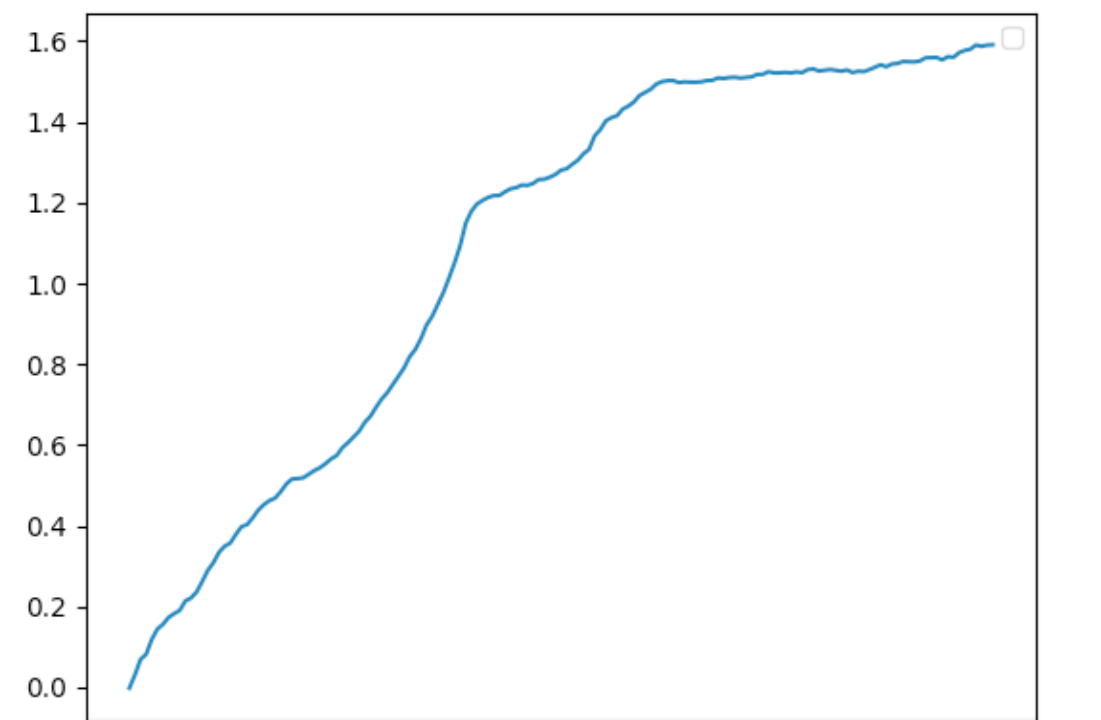

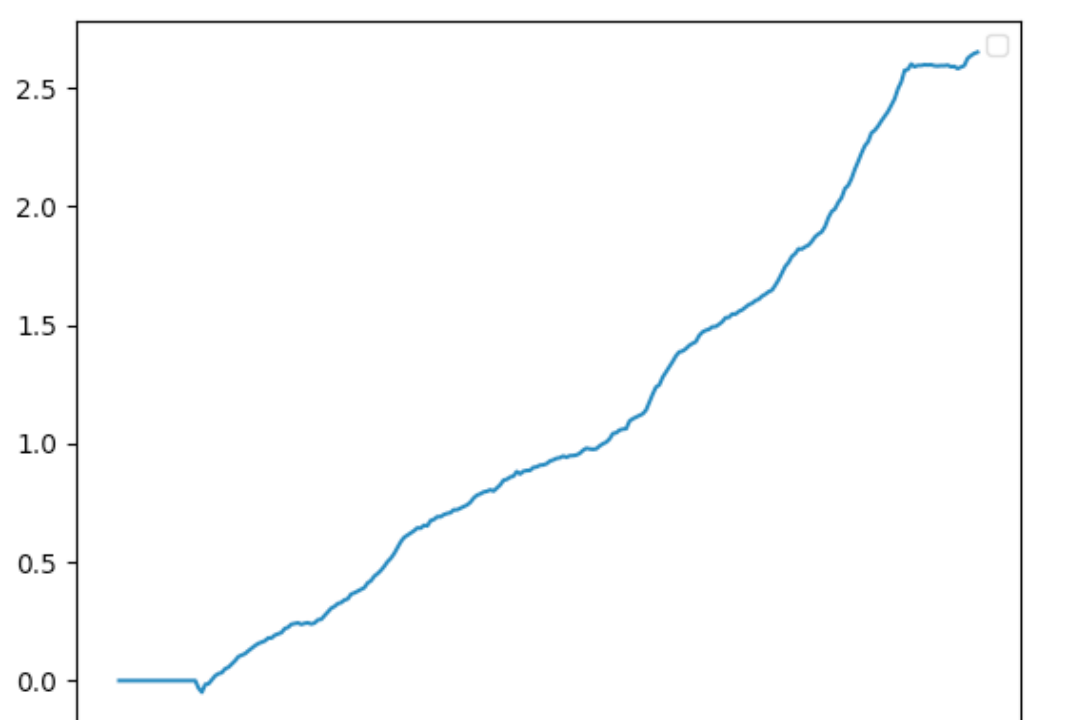

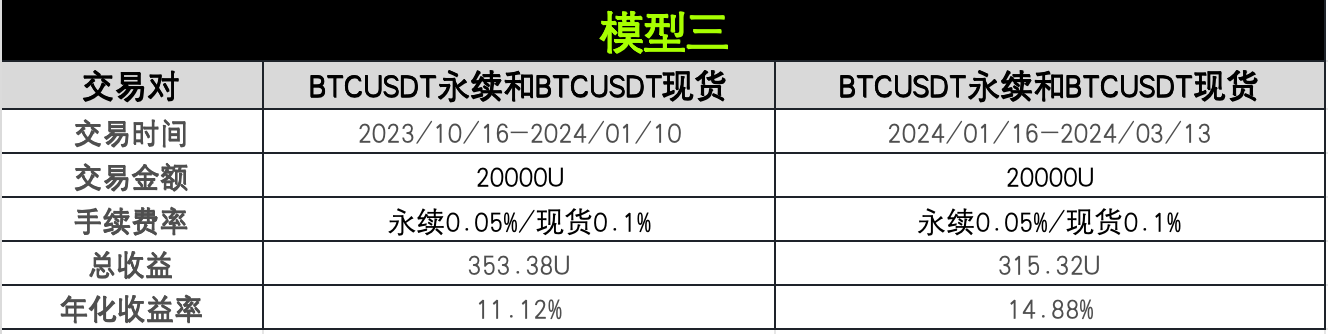

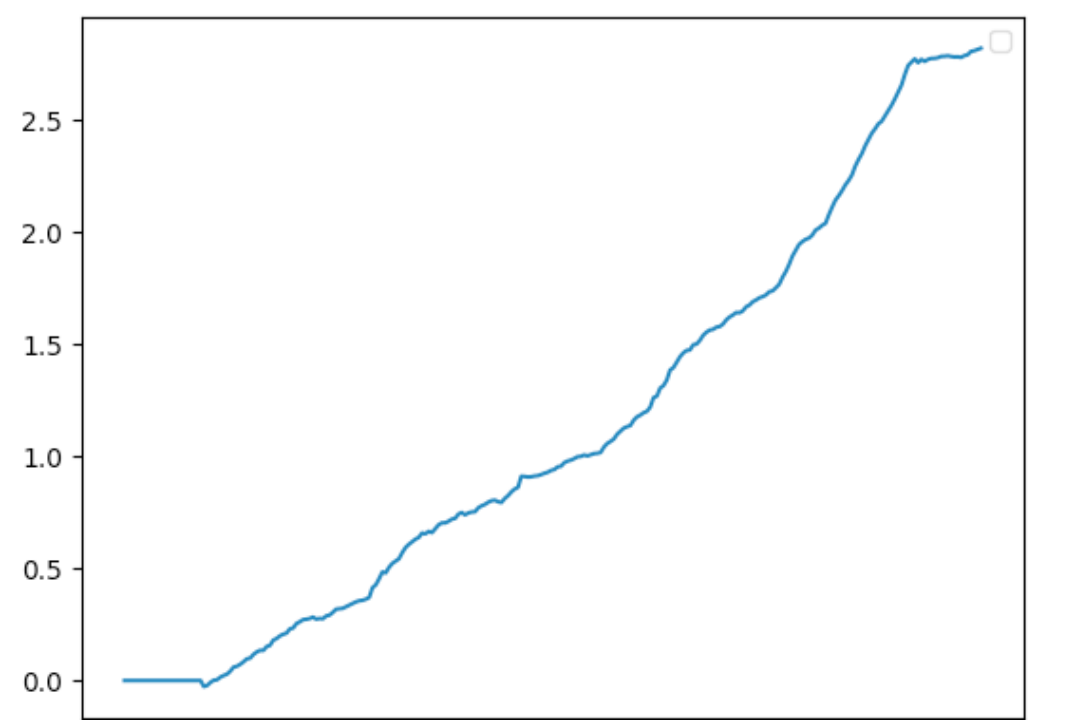

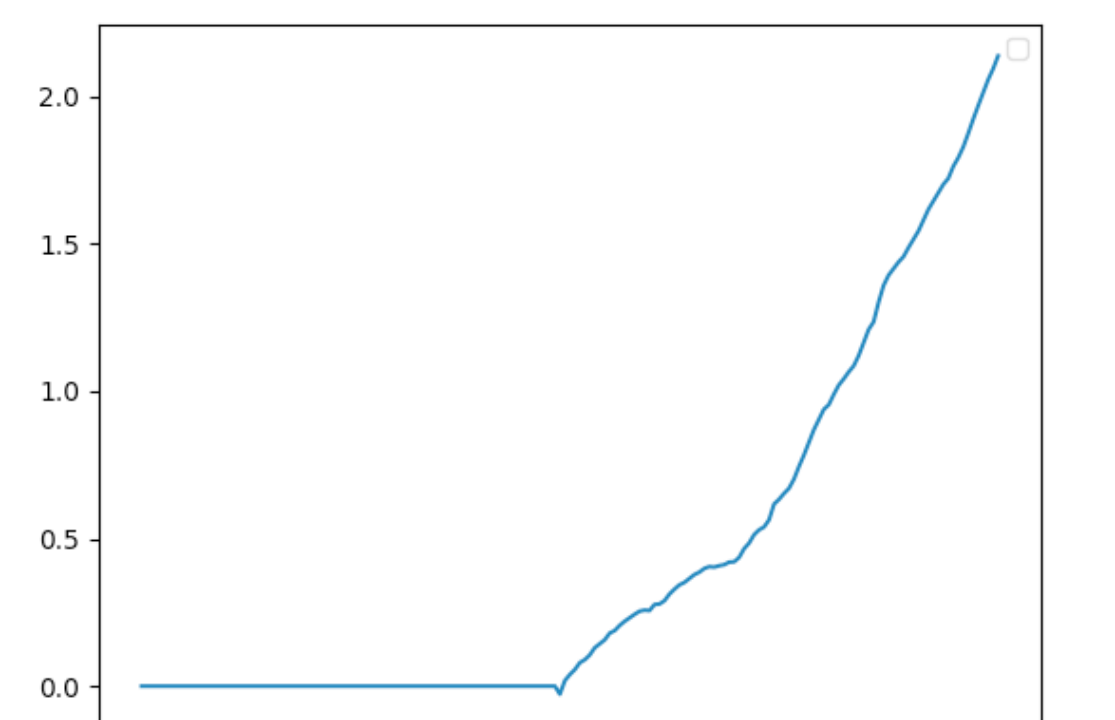

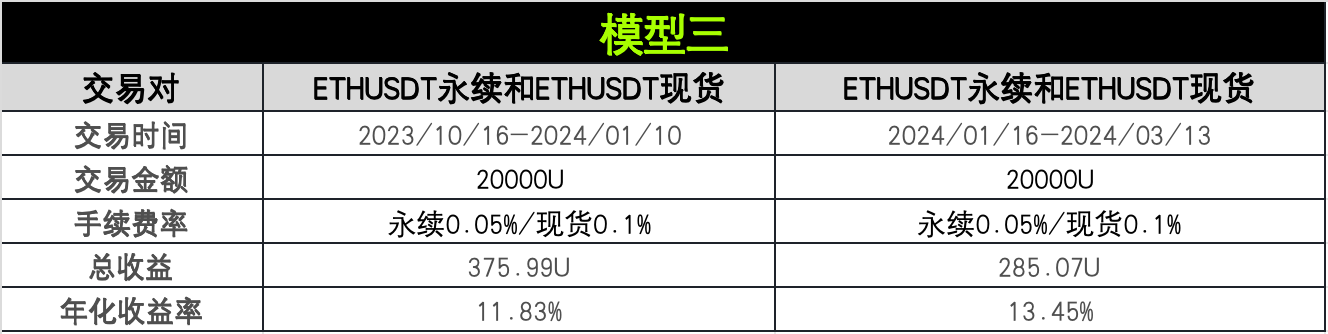

Model 3

The model is: BTC and ETH funding arbitrage in rising market conditions

Image 7: BTCUSDT perpetual and BTCUSDT spot funding arbitrage; Source: AICoin

Image 8: BTCUSDT perpetual and BTCUSDT spot funding arbitrage; Source: AICoin

Image 9: ETHUSDT perpetual and ETHUSDT spot funding arbitrage; Source: AICoin

Image 10: ETHUSDT perpetual and ETHUSDT spot funding arbitrage; Source: AICoin

Analysis and summary

Compare the funding fee arbitrage performance under the three models from different dimensions such as return performance, annualized rate of return, and market adaptability

In terms of performance: Model 3 provides the highest total return and annualized rate of return in the rising market, reflecting that in the bull-dominated market, funding arbitrage can effectively capture price difference opportunities. Model 2 also performs well in the falling market, especially ETH, showing the adaptability of this strategy in different market environments. Model 1 has relatively low returns in the sideways market, reflecting that in the market with limited price fluctuations, there are fewer arbitrage opportunities, which may be because the price volatility is low, the funding rate is relatively stable, and the market participants are more cautious in the sideways market.

In terms of annualized rate of return: Model 2 has outstanding annualized rate of return in the falling market, especially ETH, which shows that in the market dominated by short sellers, funding fee arbitrage can still maintain a high level of return. The annualized rate of return of Model 1 during the sideways fluctuation period is relatively low, showing the impact of the market environment on arbitrage strategies.

In terms of market adaptability: the funding arbitrage strategy can work in different market cycles (up, down, sideways), but the return level and performance are obviously affected by the market environment. Models 2 and 3 perform better than Model 1, indicating that in a market environment with large price fluctuations, the funding arbitrage strategy has greater profit potential.

From the above analysis, the fund management strategy shows strong flexibility and adaptability in different market cycles. In a market dominated by longs or shorts, the strategy can effectively reduce potential risks and maintain stable returns. In a volatile or sideways market, although the benefits are relatively low, it can still provide a certain degree of return stability. Traders should always pay attention to changes in the market environment and adjust the corresponding strategies to maximize returns.

In simple terms, this strategy performs well in all market conditions. In both rising and falling markets, it can provide relatively low risk and stable returns. In volatile markets, it can also provide reliable performance, albeit with lower returns. Traders can maximize their returns by simply adjusting their strategies according to market changes.

OKX & AICoin Funding Arbitrage

Currently, OKX strategy trading provides convenient and diverse strategy products.

Arbitrage generally refers to using hedging or swapping to earn the interest rate difference between different markets with extremely low risk. Common arbitrage trading methods include funding rate arbitrage, spot arbitrage, and period arbitrage.

Arbitrage users need to observe the two markets in real time and place orders at the same time in arbitrage transactions, and the two orders need to be executed at the same time as much as possible to avoid slippage. Therefore, OKX provides this strategy tool to help users improve efficiency and transaction accuracy when arbitrage. When actually arbitrage, users can choose the appropriate arbitrage combination based on the arbitrage order information calculated by the platform. OKX Arbitrage Order Quick Entry: https://www.okx.com/zh-hans/trade-spot-strategy/btc-usdt

How to access more strategy trading on OKX? Users can go to the "Strategy Trading" mode in the "Trading" section through the OKX APP or official website, and then click on the Strategy Square or Create Strategy to start the experience. In addition to creating strategies by yourself, the Strategy Square currently also provides "Quality Strategies" and "Quality Strategies with Strategy Leaders". Users can copy strategies or follow strategies.

OKX strategy trading has multiple core advantages such as easy operation, low fees and security. In terms of operation, OKX provides intelligent parameters to help users set trading parameters more scientifically; and provides graphic and video tutorials to help users quickly get started and master them. In terms of fees, OKX has comprehensively upgraded the fee rate system to significantly reduce user transaction fees. In terms of security, OKX has a security team composed of top global experts who can provide you with bank-level security protection.

How to access AICoin's funding arbitrage strategy? In the left sidebar of the AICoin product, users can find the "Arbitrage Robot" under the "Strategy" option. After clicking into the interface, in the "Arbitrage Opportunities" tab at the top, users can select funding arbitrage strategies such as "Automatic Earning Coins", "Forward Arbitrage" or "Reverse Arbitrage"

Disclaimer

This article is for reference only and represents the author's views only, not the position of OKX. This article is not intended to provide (i) trading advice or trading recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/trading professionals for your specific situation. Please be responsible for understanding and complying with local applicable laws and regulations.