Bitcoin ended August with a drop of 8.6%, and as September began, the market began to discuss seasonal trends. Statistics show that BTC has fallen an average of 4.5% in the past six Septembers. If this trend continues, BTC may fall to $55,000, but strong support is expected around $54,000.

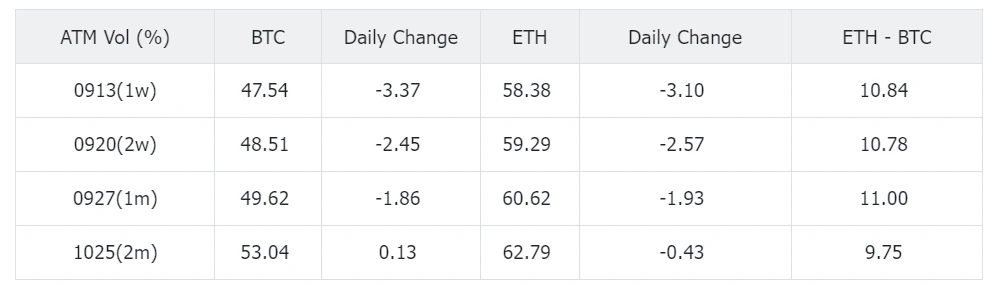

Judging from the local price changes, BTC fell to its lowest point in a week the day before yesterday and was supported around US$57,000. It rebounded to around US$59,000 during the day. The change in implied volatility was negatively correlated with the price. After the price rebounded today, the term structure steepened, and the front end gave up 2-3% of the vol increase, which was slightly lower than the median of the past three months, basically the same as Hourlys RV, and there are not many opportunities in VPR.

Source: Deribit (as of 2 MAY 16: 00 UTC+ 8)

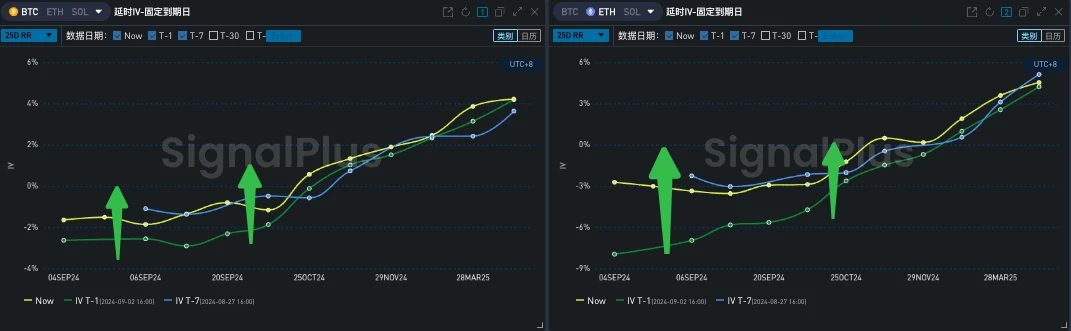

Source: SignalPlus, term structure steepens

From the perspective of Vol Skew, the long-term bullish sentiment maintained a high level, and the positive correlation trend between the mid-to-front-end Risky and the price was significant. However, it was worth noting that the increase in BTC and ETH yesterday was quite different. From a macro perspective, the massive outflow of funds from BTC ETF, the selling pressure implied by the negative Coinbase premium index, and the dilemma of declining profits faced by miners cast a shadow on the market sentiment. From the perspective of Flow, ETHs short-term bullish demand helped push up the Risky premium. Although there are still long-term bullish buys on BTC, the selling on the front-end Top Side Wing caused by this round of price increases has undoubtedly suppressed the increase in its Skew.

Source: SignalPlus, Risky rebound

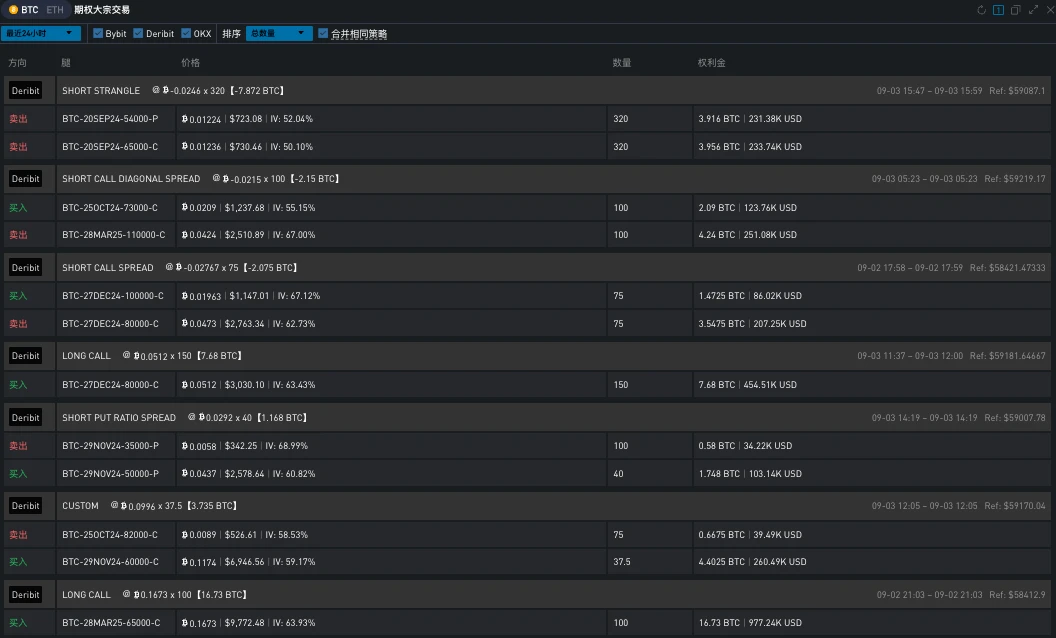

Data Source: Deribit, BTC ETH transaction distribution comparison

Source: SignalPlus, Block Trade

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com